Liquid Biopsy Market Size by Product (Assay Kits, Instruments), Circulating Biomarkers (CTC, ctDNA), Technology (NGS, PCR), Application (Cancer (Lung, Breast), Non-Cancer), Sample Type (Blood), End User (Reference Lab, Hospitals) - Global Forecast to 2027

The global size of liquid biopsy market in terms of revenue was estimated to be worth USD 4.3 billion in 2022 and is poised to reach USD 10.0 billion by 2027, growing at a CAGR of 18.3% from 2022 to 2027. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Market is driven by the rising incidence and prevalence of cancer and the increasing preference for non-invasive treatment procedures.

Attractive Opportunities in the Liquid Biopsy Market

To know about the assumptions considered for the study, Request for Free Sample Report

Liquid Biopsy Market Dynamics

Driver: Cancer awareness initiatives undertaken by global health organizations

In the past decade, governments in various countries and global health organizations have undertaken several initiatives to spread awareness about cancer. For instance, the WHO’s National Cancer Control program is a public health program that aims to reduce the number of cancer deaths and improve the quality of life of cancer patients. Similarly, the National Breast and Cervical Cancer Early Detection Program (NBCCEDP), initiated by the US Centers for Diseases and Prevention (CDC) in 1991, provides breast cancer screening and diagnosis for uninsured and low-income patients in the US every year. In 2020, this program provided breast cancer screening and diagnostic services to 260,143 women. This program also provided cervical cancer screening and diagnostic services to 116,562 women in the same year.

Restraint: The lower sensitivity of certain liquid biopsies

Detecting ctDNA in liquid biopsies is technically challenging because the levels of ctDNA of any given cancer mutation may be very low in the plasma of a cancer patient, especially after treatment or surgery. ctDNA is not necessarily applicable to all cancers; some tumor types are bad ctDNA shedders (e.g., gliomas and sarcomas), which acts as an obstacle for ctDNA profiling. The reason for low ctDNA levels is unclear but is thought to be associated with tumor vascularity, location (e.g., bone lesions), or the blood-brain barrier.

Opportunity: Growth opportunities in emerging countries

Developing economies such as India, China, South Korea, Brazil, Turkey, Russia, and South Africa are expected to offer potential growth opportunities for major players operating in the liquid biopsy market. This can be attributed to the higher cancer prevalence, large patient population, improving healthcare infrastructure, increasing disposable income, and growing medical tourism in these countries. In addition to the factors mentioned above, the Asia Pacific region has emerged as an adaptive and business-friendly hub due to relatively less stringent regulations and data requirements.

Challenge: Unclear reimbursement scenario

Limited reimbursement (non-coverage for panel-based tests) restricts the uptake of liquid biopsy testing. The NCD guidelines proved advantageous for approval of Foundation One’s genomic profiling assay, but may work against other liquind biopsy companies developing NGS-panel tests under the LDT scenario. If multigene NGS tests have not secured FDA approval or reimbursement coverage, it is up to Medicare administrative contractors (MACs) to approve coverage when a company seeks a local coverage determination (LCD). However, we find that most MACs lean toward the NCD to decide, and this is likely to create an unfavourable situation for liquid biopsy companies.

Assay kits segment accounted for the largest share of the liquid biopsy market

Assay kits play a crucial part in the detection of cancer tumor cells or tumor DNA using liquid biopsy. Liquid biopsy assays are cost-effective and minimally invasive procedures that aid in monitoring patients throughout and after treatment and screening. The availability of a wide range of reagents and kits, easy accessibility to a wide range of assays, and the rising prevalence of cancer are other major factors driving the growth of the liquid biopsy assay kits market.

Cancer application segment accounted for the largest share of liquid biopsy market during the forecast period

Globally, the prevalence of cancer has increased significantly over the last few years. Cancer, the leading cause of death globally, accounted for 10 million deaths in 2020. The use of liquid biopsy products has been particularly significant in understanding cancer signatures and developing customized therapies. Liquid biopsy is one of the many emerging technologies developed to address the growing cancer prevalence.

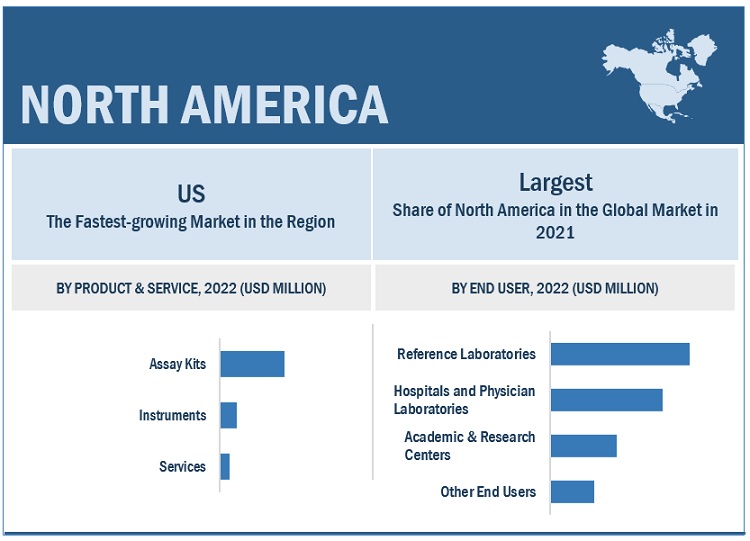

Reference laboratories segment to dominate the liquid biopsy market

Reference laboratories are independent private laboratories that receive samples for analysis from various small and large hospitals, private practitioners, and clinical research sites. In India, there are more than 20,000 clinical laboratories, although very few of these are NABL-accredited. Moreover, hospitals increasingly outsource diagnostic tests to these laboratories to reduce costs and limit technical issues in managing laboratories.

North America is the largest regional market for liquid biopsy market

Growth in the developed markets of North America is primarily driven by the high adoption of advanced technologies like NGS, increasing number of research studies for the discovery & development of novel cancer biomarkers, presence of many pharmaceutical & liquind biopsy companies, rising funding and investments from public & private organizations, and the increasing use of biomarkers in patient stratification and drug development processes.

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the global Liquid Biopsy Market are

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Myriad Genetics, Inc. (US)

- QIAGEN N.V. (Netherlands)

- Thermo Fisher Scientific, Inc. (US)

- Guardant Health, Inc. (US)

Liquid Biopsy Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

USD 4.3 billion |

|

Projected Revenue by 2027 |

USD 10 billion |

|

Revenue Rate |

CAGR of 18.3% From 2022 to 2027 |

|

Market Driver |

Cancer awareness initiatives undertaken by global health organizations |

|

Market Opportunity |

Growth opportunities in emerging countries |

This report categorizes the liquid biopsy market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Assay Kits

- Instruments

- Services

By Circulating Biomarkers

- Circulating Tumor Cells

- Circulating Tumor DNA (ctDNA)

- Cell-free DNA (cfDNA)

- Extracellular Vesicles (EVS)

- Other Circulating Biomarkers

By Application

- Cancer Application

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma

- Other Cancers

- Non-cancer Applications

- Non-invasive Prenatal Testing (NIPT)

- Organ Transplantation

- Infectious Disease Testing

By Technology

- Multi-gene Parallel Analysis using NGS

- Single-gene Analysis using PCR Microarrays

By Clinical Application

- Early Cancer Screening

- Therapy Selection

- Treatment Monitoring

- Recurrence Monitoring

By End User

- Reference Laboratories

- Hospitals and Physician Laboratories

- Academic & Research Centers

- Other End Users

By Sample Type

- Blood

- Other Sample Types

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In August 2022, Thermo Fisher Scientific Inc. (US) launched the first NGS-based tests to support both DNA and RNA input. The Ion Torrent Oncomine Myeloid MRD Assays (RUO) provide comprehensive and highly sensitive myeloid measurable residual (MDR) assessments from blood and bone marrow samples.

- In May 2022, QIAGEN N.V. (Netherlands) launched the therascreen EGFR Plus RGQ PCR Kit, a new in vitro diagnostic test for sensitive EGFR mutation analysis.

- In June 2021, Guardant Health, Inc. (US) launched its Guardant360 Response test that detects changes in circulating tumor DNA (ctDNA) levels.

- In October 2020, F. Hoffmann-La Roche Ltd. (Switzerland) received the US FDA approval of expanded claims for the cobas EGFR Mutation Test v2 to be used as a companion diagnostic (CDx) for a broader group of therapies to treat non-small cell lung cancer (NSCLC).

- In March 2020, Biocept, Inc. (US) entered into an agreement with a second California-based independent physician association (IPA) to provide its Target Selector liquid biopsy assay services to physicians and patients in the network.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the liquid biopsy market?

The liquid biopsy market boasts a total revenue value of $10.0 billion by 2027.

What is the estimated growth rate (CAGR) of the liquid biopsy market?

The global liquid biopsy market has an estimated compound annual growth rate (CAGR) of 18.3% and a revenue size in the region of $4.3 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 LIQUID BIOPSY MARKET

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 1 LIQUID BIOPSY MARKET: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key data from primary sources

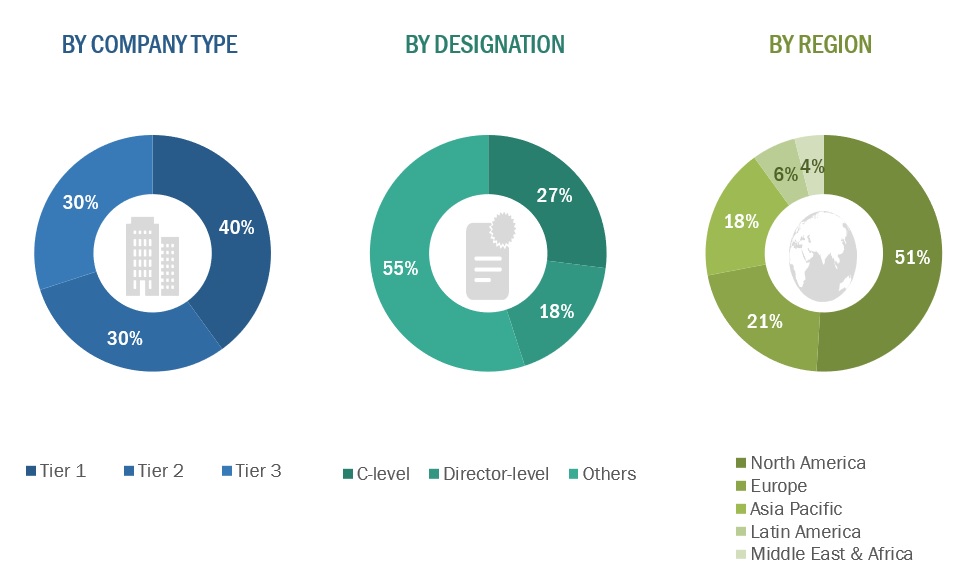

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primary interviews

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.3.1.2 Approach 2: Presentations of companies and primary interviews

2.3.1.3 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE

2.6 STUDY ASSUMPTIONS

2.7 GROWTH RATE ASSUMPTIONS

2.8 RISK ASSESSMENT

2.8.1 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 8 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY CIRCULATING BIOMARKER, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 BIOPSY DEVICES MARKET, BY CLINICAL APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY SAMPLE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 MARKET OVERVIEW

FIGURE 16 RISING INCIDENCE OF CANCER TO DRIVE GROWTH IN LIQUID BIOPSY MARKET

4.2 MARKET SHARE, BY PRODUCT & SERVICE, 2022 VS. 2027

FIGURE 17 ASSAY KITS TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 MARKET SHARE, BY CIRCULATING BIOMARKER, 2022 VS. 2027

FIGURE 18 CIRCULATING TUMOR CELLS TO CONTINUE TO DOMINATE MARKET IN 2027

4.4 MARKET SHARE, BY CLINICAL APPLICATION, 2022 VS. 2027

FIGURE 19 THERAPY SELECTION SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.5 MARKET SHARE, BY TECHNOLOGY, 2022 VS. 2027

FIGURE 20 MULTI-GENE PARALLEL ANALYSIS USING NGS SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2027

4.6 MARKET SHARE, BY APPLICATION, 2022 VS. 2027

FIGURE 21 CANCER APPLICATIONS TO LEAD MARKET IN 2027

4.7 MARKET SHARE, BY SAMPLE TYPE, 2022 VS. 2027

FIGURE 22 BLOOD TYPE SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2027

4.8 MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 23 REFERENCE LABORATORIES TO DRIVE MARKET GROWTH IN 2027

4.9 BIOPSY DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 24 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising incidence and prevalence of cancer

TABLE 1 NUMBER OF PREVALENT CANCER CASES WORLDWIDE IN 2020, BY TYPE OF CANCER

5.2.1.2 Cancer awareness initiatives undertaken by global health organizations

5.2.1.3 Increasing preference for non-invasive treatment procedures

5.2.2 RESTRAINTS

5.2.2.1 Lower sensitivity of certain liquid biopsy procedures

5.2.3 OPPORTUNITIES

5.2.3.1 Growing significance of companion diagnostics

5.2.3.2 Growth opportunities in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Unclear reimbursement scenario

5.3 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICES OF KEY PLAYERS, BY PRODUCT

TABLE 3 AVERAGE SELLING PRICE TREND

5.4 PATENT ANALYSIS

FIGURE 26 PATENT ANALYSIS OF LIQUID BIOPSY

TABLE 4 PATENT ANALYSIS

5.5 VALUE CHAIN ANALYSIS

FIGURE 27 MAJOR VALUE ADDITION DURING MANUFACTURING & ASSEMBLY PHASE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 28 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM ANALYSIS OF MARKET

FIGURE 29 MARKET: ECOSYSTEM ANALYSIS

5.7.1 MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 THREAT FROM SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 NORTH AMERICA

5.9.2.1 US

5.9.2.2 Canada

5.9.3 EUROPE

5.9.4 ASIA PACIFIC

5.9.4.1 China

5.9.4.2 Japan

5.9.5 LATIN AMERICA

5.9.5.1 Brazil

5.9.5.2 Mexico

5.9.6 MIDDLE EAST

5.9.7 AFRICA

5.10 TECHNOLOGY ANALYSIS

5.11 PESTLE ANALYSIS

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

5.12.1.1 Export scenario for liquid biopsy

TABLE 11 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2017–2021 (USD MILLION)

5.12.1.2 Import scenario for liquid biopsy

TABLE 12 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 13 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2017–2021 (TONS)

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.14.1 REVENUE SHIFT & REVENUE POCKETS FOR LIQUID BIOPSY PRODUCT MANUFACTURERS

FIGURE 30 REVENUE SHIFT FOR MARKET

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LIQUID BIOPSY PRODUCTS & SERVICES

TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LIQUID BIOPSY PRODUCTS & SERVICES

5.15.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR LIQUID BIOPSY PRODUCTS & SERVICES

TABLE 16 KEY BUYING CRITERIA FOR LIQUID BIOPSY PRODUCTS & SERVICES

5.16 CASE STUDY ANALYSIS

5.16.1 CASE STUDY 1

5.16.2 CASE STUDY 2

6 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE (Page No. - 90)

6.1 INTRODUCTION

TABLE 17 BIOPSY DEVICES MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

6.2 ASSAY KITS

6.2.1 RECURRENT REQUIREMENT AND PURCHASES OF ASSAY KITS TO DRIVE GROWTH

TABLE 18 KEY PRODUCTS IN ASSAY KITS MARKET

TABLE 19 LIQUID BIOPSY ASSAY KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 LATEST ADVANCEMENTS IN PCR TECHNOLOGIES TO ENSURE MARKET GROWTH

TABLE 20 KEY PRODUCTS IN INSTRUMENTS MARKET

TABLE 21 LIQUID BIOPSY INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SERVICES

6.4.1 INCREASING NUMBER OF LIQUID BIOPSY-BASED SERVICE DEVELOPMENTS TO SUPPORT MARKET GROWTH

TABLE 22 LIQUID BIOPSY SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER (Page No. - 96)

7.1 INTRODUCTION

TABLE 23 BIOPSY DEVICES MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

7.2 CIRCULATING TUMOR CELLS (CTC)

7.2.1 EASY COLLECTION AND PERSISTENT ASSESSMENT & ANALYSIS OF OVERALL TUMOR BURDEN TO DRIVE DEMAND

TABLE 24 MARKET FOR CIRCULATING TUMOR CELLS, BY REGION, 2020–2027 (USD MILLION)

7.3 CIRCULATING TUMOR DNA (CTDNA)

7.3.1 ABILITY OF CTDNA ANALYSIS TO SIGNIFICANTLY IMPROVE TUMOR DIAGNOSIS TO DRIVE MARKET

TABLE 25 MARKET FOR CIRCULATING TUMOR DNA, BY REGION, 2020–2027 (USD MILLION)

7.4 CELL-FREE DNA (CFDNA)

7.4.1 GROWING APPLICATION OF CFDNA IN PRENATAL SCREENING TO DRIVE GROWTH

TABLE 26 MARKET FOR CELL-FREE DNA, BY REGION, 2020–2027 (USD MILLION)

7.5 EXTRACELLULAR VESICLES (EVS)

7.5.1 ABILITY TO REMAIN STABLE IN BLOOD CIRCULATION OVER OTHER ANALYTES TO ENSURE CONSISTENT GROWTH IN MARKET

TABLE 27 LIQUID BIOPSY - MARKET FOR EXTRACELLULAR VESICLES, BY REGION, 2020–2027 (USD MILLION)

7.6 OTHER CIRCULATING BIOMARKERS

TABLE 28 LIQUID BIOPSY - MARKET FOR OTHER CIRCULATING BIOMARKERS, BY REGION, 2020–2027 (USD MILLION)

8 LIQUID BIOPSY MARKET, BY TECHNOLOGY (Page No. - 102)

8.1 INTRODUCTION

TABLE 29 BIOPSY DEVICES MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

8.2 MULTI-GENE PARALLEL ANALYSIS USING NGS

8.2.1 HIGH SENSITIVITY AND ECONOMICAL BENEFITS TO DRIVE GROWTH

TABLE 30 MARKET FOR MULTI-GENE PARALLEL ANALYSIS USING NGS, BY REGION, 2020–2027 (USD MILLION)

8.3 SINGLE-GENE ANALYSIS USING PCR MICROARRAYS

8.3.1 COST BENEFITS OF PCR TECHNOLOGY TO DRIVE ADOPTION

TABLE 31 MARKET FOR SINGLE-GENE ANALYSIS USING PCR MICROARRAYS, BY REGION, 2020–2027 (USD MILLION)

9 LIQUID BIOPSY MARKET, BY APPLICATION (Page No. - 106)

9.1 INTRODUCTION

TABLE 32 BIOPSY DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 CANCER APPLICATIONS

TABLE 33 GLOBAL CANCER INCIDENCE, 2020 VS. 2040 (MILLION)

TABLE 34 LIQUID BIOPSY - MARKET FOR CANCER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 LIQUID BIOPSY - MARKET FOR CANCER APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

9.2.1 LUNG CANCER

9.2.1.1 Growing prevalence of lung cancer to propel market growth

TABLE 36 GLOBAL LUNG CANCER INCIDENCE, 2020 VS. 2040

TABLE 37 LIQUID BIOPSY - MARKET FOR LUNG CANCER, BY REGION, 2020–2027 (USD MILLION)

9.2.2 BREAST CANCER

9.2.2.1 Increasing government funding for breast cancer research to spur growth

TABLE 38 GLOBAL BREAST CANCER INCIDENCE, 2020 VS. 2040

TABLE 39 LIQUID BIOPSY - MARKET FOR BREAST CANCER, BY REGION, 2020–2027 (USD MILLION)

9.2.3 COLORECTAL CANCER

9.2.3.1 Rising prevalence of colorectal cancer to propel market

TABLE 40 GLOBAL COLORECTAL CANCER INCIDENCE, 2020 VS. 2040

TABLE 41 LIQUID BIOPSY - MARKET FOR COLORECTAL CANCER, BY REGION, 2020–2027 (USD MILLION)

9.2.4 PROSTATE CANCER

9.2.4.1 Growing number of prostate cancer patients to support market growth

TABLE 42 GLOBAL PROSTATE CANCER INCIDENCE, 2020 VS. 2040

TABLE 43 LIQUID BIOPSY - MARKET FOR PROSTATE CANCER, BY REGION, 2020–2027 (USD MILLION)

9.2.5 MELANOMA

9.2.5.1 Growing need for early diagnosis of genetically mutated tumors to drive market growth

TABLE 44 GLOBAL MELANOMA INCIDENCE, 2020 VS. 2040

TABLE 45 LIQUID BIOPSY - MARKET FOR MELANOMA, BY REGION, 2020–2027 (USD MILLION)

9.2.6 OTHER CANCERS

TABLE 46 GLOBAL INCIDENCE OF OTHER CANCERS, 2020

TABLE 47 LIQUID BIOPSY - MARKET FOR OTHER CANCERS, BY REGION, 2020–2027 (USD MILLION)

9.3 NON-CANCER APPLICATIONS

TABLE 48 LIQUID BIOPSY - MARKET FOR NON-CANCER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 LIQUID BIOPSY - MARKET FOR NON-CANCER APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

9.3.1 NON-INVASIVE PRENATAL TESTING (NIPT)

9.3.1.1 Growing demand for NIPT in high-risk pregnancies to drive growth

TABLE 50 LIQUID BIOPSY - MARKET FOR NIPT, BY REGION, 2020–2027 (USD MILLION)

9.3.2 ORGAN TRANSPLANTATIONS

9.3.2.1 Need for early detection of rejection to improve survival chances to drive growth

TABLE 51 LIQUID BIOPSY - MARKET FOR ORGAN TRANSPLANTATIONS, BY REGION, 2020–2027 (USD MILLION)

9.3.3 INFECTIOUS DISEASE TESTING

9.3.3.1 Potential to reliably identify a wide variety of infections to drive adoption

TABLE 52 LIQUID BIOPSY - MARKET FOR INFECTIOUS DISEASE TESTING, BY REGION, 2020–2027 (USD MILLION)

10 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION (Page No. - 122)

10.1 INTRODUCTION

TABLE 53 BIOPSY DEVICES MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

10.2 THERAPY SELECTION

10.2.1 GROWING PREFERENCE DUE TO NON-INVASIVENESS OF LIQUID BIOPSY TESTS TO DRIVE GROWTH

TABLE 54 MARKET FOR THERAPY SELECTION, BY REGION, 2020–2027 (USD MILLION)

10.3 TREATMENT MONITORING

10.3.1 ABILITY TO QUANTITATIVELY CALCULATE CONCENTRATIONS OF CANCER-RELATED MUTATIONS TO FUEL DEMAND

TABLE 55 MARKET FOR TREATMENT MONITORING, BY REGION, 2020–2027 (USD MILLION)

10.4 RECURRENCE MONITORING

10.4.1 ABILITY TO DETECT CANCER MUTATIONS THROUGH CTDNA TO DRIVE GROWTH

TABLE 56 MARKET FOR RECURRENCE MONITORING, BY REGION, 2020–2027 (USD MILLION)

10.5 EARLY CANCER SCREENING

10.5.1 POTENTIAL OF LIQUID BIOPSY TO DETECT CANCER IN EARLY STAGES TO DRIVE MARKET

TABLE 57 LIQUID BIOPSY - MARKET FOR EARLY CANCER SCREENING, BY REGION, 2020–2027 (USD MILLION)

11 LIQUID BIOPSY MARKET, BY SAMPLE TYPE (Page No. - 128)

11.1 INTRODUCTION

TABLE 58 BIOPSY DEVICES MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 59 LIQUID BIOPSY SAMPLES AND APPLICATIONS

11.2 BLOOD

11.2.1 SIMPLE AND NON-INVASIVE NATURE TO DRIVE MARKET GROWTH

TABLE 60 LIQUID BIOPSY - MARKET FOR BLOOD SAMPLES, BY REGION, 2020–2027 (USD MILLION)

11.3 OTHER SAMPLE TYPES

TABLE 61 LIQUID BIOPSY - MARKET FOR OTHER SAMPLE TYPES, BY REGION, 2020–2027 (USD MILLION)

12 LIQUID BIOPSY MARKET, BY END USER (Page No. - 132)

12.1 INTRODUCTION

TABLE 62 BIOPSY DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2 REFERENCE LABORATORIES

12.2.1 INCREASING OUTSOURCING OF LIQUID BIOPSY TESTS TO REFERENCE LABORATORIES TO DRIVE GROWTH

TABLE 63 LIQUID BIOPSY - MARKET FOR REFERENCE LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

12.3 HOSPITALS AND PHYSICIAN LABORATORIES

12.3.1 GROWING NUMBER OF HOSPITALS WORLDWIDE TO BOOST GROWTH

TABLE 64 LIQUID BIOPSY - MARKET FOR HOSPITALS AND PHYSICIAN LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

12.4 ACADEMIC & RESEARCH CENTERS

12.4.1 GROWING FOCUS OF RESEARCH FOR DEVELOPMENT OF INNOVATIVE LIQUID BIOPSY TESTS TO FUEL GROWTH

TABLE 65 LIQUID BIOPSY - MARKET FOR ACADEMIC & RESEARCH CENTERS, BY REGION, 2020–2027 (USD MILLION)

12.5 OTHER END USERS

TABLE 66 LIQUID BIOPSY - MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

13 LIQUID BIOPSY MARKET, BY REGION (Page No. - 137)

13.1 INTRODUCTION

TABLE 67 BIOPSY DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

13.2 NORTH AMERICA

TABLE 68 NORTH AMERICA: NUMBER OF NEW CANCER CASES, BY TYPE OF CANCER, 2020

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: LIQUID BIOPSY - MARKET, BY END USER, 2020–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Increasing prevalence of cancer to drive growth

TABLE 77 US: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 78 US: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 79 US: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 80 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 US: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 US: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 83 US: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Availability of various cancer screening programs to drive growth

TABLE 84 CANADA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 85 CANADA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 87 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 CANADA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 CANADA: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 90 CANADA: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3 EUROPE

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 EUROPE: BIOPSY DEVICES MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 98 EUROPE: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Favorable government health policies to support market growth

TABLE 99 GERMANY: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 105 GERMANY: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Increasing number of diagnostic laboratories to propel market growth

TABLE 106 UK: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 107 UK: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 108 UK: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 109 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 UK: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 111 UK: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 112 UK: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Rising R&D expenditure to drive market growth

TABLE 113 FRANCE: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 119 FRANCE: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Growing research on discovery of novel circulating cancer biomarkers to drive market growth

TABLE 120 ITALY: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 121 ITALY: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 122 ITALY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 123 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 124 ITALY: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 125 ITALY: BIOPSY DEVICES MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 126 ITALY: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.5 SPAIN

13.3.5.1 Growing focus on personalized medicine to support market growth

TABLE 127 SPAIN: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 128 SPAIN: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 129 SPAIN: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 130 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 131 SPAIN: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 132 SPAIN: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.6 REST OF EUROPE

TABLE 134 REST OF EUROPE: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 140 REST OF EUROPE: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Growing public access to advanced healthcare facilities to drive market

TABLE 149 CHINA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 150 CHINA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 151 CHINA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 152 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 153 CHINA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 154 CHINA: BIOPSY DEVICES MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 155 CHINA: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.2 JAPAN

13.4.2.1 Universal healthcare reimbursement policy to fuel growth

TABLE 156 JAPAN: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 159 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 160 JAPAN: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 JAPAN: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 162 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Increasing private & public investments in healthcare system to boost market

TABLE 163 INDIA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 164 INDIA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 165 INDIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 166 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 167 INDIA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 168 INDIA: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 169 INDIA: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.4 REST OF ASIA PACIFIC

TABLE 170 REST OF ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.5 LATIN AMERICA

13.5.1 INCREASING PRIVATE & PUBLIC INVESTMENTS TO DRIVE MARKET

TABLE 177 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 182 LATIN AMERICA: BIOPSY DEVICES MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

13.6 MIDDLE EAST & AFRICA

13.6.1 INCREASING FUNDING IN RESEARCH TO DRIVE MARKET GROWTH

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY CIRCULATING BIOMARKER, 2020–2027 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY CLINICAL APPLICATION, 2020–2027 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY SAMPLE TYPE, 2020–2027 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: LIQUID BIOPSY MARKET, BY END USER, 2020–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 195)

14.1 OVERVIEW

14.2 STRATEGIES OF KEY PLAYERS

14.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN LIQUID BIOPSY MARKET

TABLE 191 OVERVIEW OF STRATEGIES DEPLOYED BY KEY LIQUID BIOPSY COMPANIES

14.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 35 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN MARKET

14.4 MARKET SHARE ANALYSIS

14.4.1 GLOBAL MARKET

FIGURE 36 MARKET SHARE, BY KEY PLAYER (2021)

TABLE 192 MARKET SHARE: DEGREE OF COMPETITION

14.5 COMPANY EVALUATION QUADRANT

14.5.1 LIST OF EVALUATED VENDORS

14.5.2 STARS

14.5.3 EMERGING LEADERS

14.5.4 PERVASIVE PLAYERS

14.5.5 PARTICIPANTS

FIGURE 37 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

14.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

14.6.1 PROGRESSIVE LIQUID BIOPSY COMPANIES

14.6.2 STARTING BLOCKS

14.6.3 RESPONSIVE LIQUID BIOPSY COMPANIES

14.6.4 DYNAMIC LIQUID BIOPSY COMPANIES

FIGURE 38 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

14.7 COMPETITIVE BENCHMARKING

14.7.1 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

FIGURE 39 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS IN LIQUID BIOPSY MARKET

TABLE 193 MARKET: COMPANY GEOGRAPHICAL FOOTPRINT

TABLE 194 MARKET: COMPANY PRODUCT & SERVICE FOOTPRINT

TABLE 195 MARKET: DETAILED LIST OF KEY START-UPS/SMES

14.8 COMPETITIVE SCENARIO

14.8.1 PRODUCT LAUNCHES & APPROVALS

TABLE 196 KEY PRODUCT LAUNCHES & APPROVALS

14.8.2 DEALS

TABLE 197 KEY DEALS

15 COMPANY PROFILES (Page No. - 208)

(Business overview, Products offered, Recent Developments, MNM view)*

15.1 KEY PLAYERS

15.1.1 QIAGEN N.V.

TABLE 198 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 40 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

15.1.2 F. HOFFMANN-LA ROCHE AG

TABLE 199 F. HOFFMANN-LA ROCHE AG: BUSINESS OVERVIEW

FIGURE 41 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT (2021)

15.1.3 MYRIAD GENETICS, INC.

TABLE 200 MYRIAD GENETICS, INC.: BUSINESS OVERVIEW

FIGURE 42 MYRIAD GENETICS, INC.: COMPANY SNAPSHOT (2021)

15.1.4 THERMO FISHER SCIENTIFIC, INC.

TABLE 201 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 43 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

15.1.5 GUARDANT HEALTH, INC.

TABLE 202 GUARDANT HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 44 GUARDANT HEALTH, INC.: COMPANY SNAPSHOT (2021)

15.1.6 BIO-RAD LABORATORIES, INC.

TABLE 203 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 45 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

15.1.7 ILLUMINA, INC.

TABLE 204 ILLUMINA, INC.: BUSINESS OVERVIEW

FIGURE 46 ILLUMINA, INC.: COMPANY SNAPSHOT (2021)

15.1.8 EXACT SCIENCES CORPORATION

TABLE 205 EXACT SCIENCES CORPORATION: BUSINESS OVERVIEW

FIGURE 47 EXACT SCIENCES CORPORATION: COMPANY SNAPSHOT (2021)

15.1.9 SYSMEX INOSTICS (SUBSIDIARY OF SYSMEX CORPORATION)

TABLE 206 SYSMEX INOSTICS: BUSINESS OVERVIEW

FIGURE 48 SYSMEX CORPORATION: COMPANY SNAPSHOT (2021)

15.1.10 BIOCEPT, INC.

TABLE 207 BIOCEPT, INC.: BUSINESS OVERVIEW

FIGURE 49 BIOCEPT, INC.: COMPANY SNAPSHOT (2021)

15.1.11 MDXHEALTH

TABLE 208 MDXHEALTH: BUSINESS OVERVIEW

FIGURE 50 MDXHEALTH: COMPANY SNAPSHOT (2021)

15.2 OTHER PLAYERS

15.2.1 NEOGENOMICS, INC.

15.2.2 EPIGENOMICS AG

15.2.3 ANGLE PLC

15.2.4 MENARINI-SILICON BIOSYSTEMS

15.2.5 VORTEX BIOSCIENCES, INC.

15.2.6 EXOSOME DIAGNOSTICS, INC.

15.2.7 MEDGENOME INC.

15.2.8 AGENA BIOSCIENCE, INC.

15.2.9 PERSONAL GENOME DIAGNOSTICS, INC.

15.2.10 FREENOME HOLDINGS, INC.

15.2.11 STRAND LIFE SCIENCES

15.2.12 LUNGLIFE AI, INC.

15.2.13 LUCENCE HEALTH INC.

15.2.14 ANPAC BIO-MEDICAL SCIENCE CO., LTD.

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted liquid biopsy companies.

16 APPENDIX (Page No. - 263)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the liquid biopsy market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the liquid biopsy market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the liquid biopsy market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global liquid biopsy market by product & service, circulating biomarkers, technology, application, clinical application, sample type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall liquid biopsy market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the liquid biopsy market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Liquid biopsy market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the liquid biopsy market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Liquid Biopsy Market

Which of the end user segment is expected to hold the major share of the global Liquid Biopsy Market?

What will be the global market value for Liquid Biopsy Market in 2029?