Lithium-ion Battery Recycling Market by Source (Automotive, Non-automotive), Battery Chemistry, Battery Components, Recycling Process (Hydrometallurgical Process, Pyrometallurgy Process, Physical/ Mechanical Process), and Region - Global Forecast to 2031

Lithium-ion Battery Recycling Market

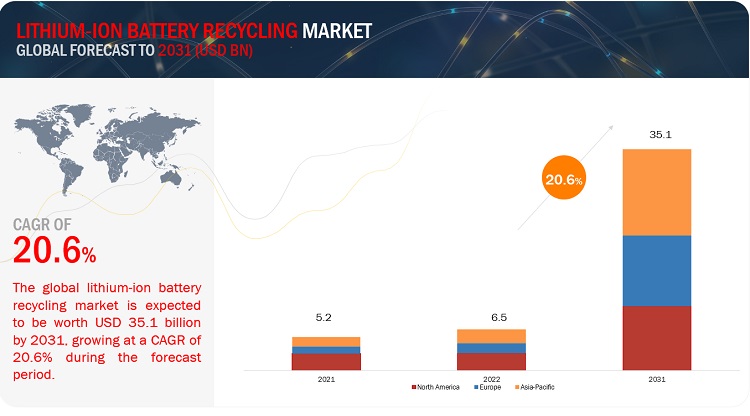

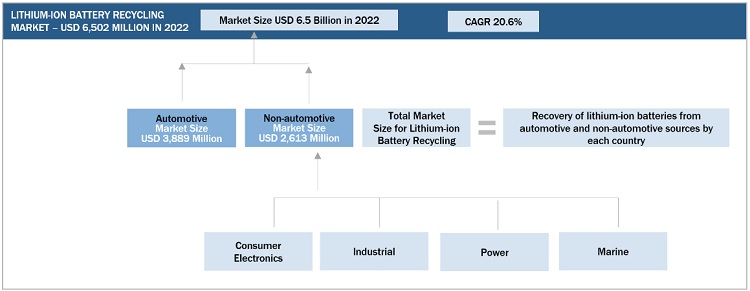

The lithium-ion battery recycling market was valued at USD 6.5 billion in 2022 and is projected to reach USD 35.1 billion by 2031, growing at a cagr 20.6% from 2022 to 2031. The market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period. Rising investments in the development of electric vehicles and subsidies to encourage battery recycling are expected to drive the growth of the market in the upcoming years.

Attractive Opportunities in the Lithium-Ion Battery Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium-ion Battery Recycling Market Dynamics

Driver: Increase in demand for electric vehicles

Electric vehicles , adoption of lithium-ion batteries is increasing The use of electric vehicles is increasing as a result of various factors such as energy efficiency, pollution reduction, and consumer uptake that are driving up the adoption of lithium-ion batteries. The development of advanced battery technologies and minimal maintenance requirements for these lithium-ion batteries are other factors contributing to the growth of the electric vehicles. Hence, it is anticipated that the market for lithium-ion battery recycling would continue to expand as a result of the growing use of lithium-ion batteries.

Restraint: Safety issues related to the storage and transportation of spent batteries

Acids and heavy metals such as mercury and lead are among the hazardous chemicals found in spent batteries. They posses a residual charge that may accidentally discharge, causing damage to property and people. Owing to these issues, state or federal governments restrict the transportation and storage of expended batteries.

Opportunity: Subsidies to encourage battery recycling

Battery recycling is mandatory in North America and Europe. Grants and subsidies are available for battery recycling businesses through development grant programs in some countries in Europe and North America. For instance, in the US, Florida has special project grant funding for which recycling initiatives are eligible; and Texas offers regional solid waste grants for recycling efforts through public-private partnerships. However, such grants and subsidies that make business ventures in this field economically viable are not provided to market players in all regions. In the coming years, provisions to provide grants and subsidies in other regions are expected to provide opportunities for battery recyclers.

Challenge: High cost of recycling and dearth of technologies

As per the Centre for Energy Economics (CEE), the rate of recovery of lithium from all applications worldwide is only 1-3%. Various companies such as Umicore (Belgium), Guangdong Brunp Recycling Technology Co., Ltd. (China), and Toxco (US), among others are developing advanced technologies to extract lithium from spent lithium-based batteries. However, the market players face a number of challenges in terms of battery recycling such as the high cost of recycling, lack of adequate storage systems for the collection of used batteries, and the dearth of technologies for recycling, among other challenges.

Lithium-Ion Battery Recycling Market Ecosystem

Prominent companies in this market include well-established, financially stable recyclers of lithium-ion batteries. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Umicore (Belgium), Glencore (Switzerland), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), and RecycLiCo Battery Materials Inc. (Canada).

Based on source, the industrial segment accounted for the second largest non-automotive lithium-ion battery recycling market

The industrial segment held the second largest non-automotive share of the global lithium-ion battery recycling industry in 2021. Rising environmental concerns and resource depletion have stimulated the recycling of spent lithium-ion batteries. Recycling lithium-ion batteries offers economic benefits such as reduced dependence for the supply of raw materials on countries having reserves of lithium and copper.

Based on battery chemistry, the lithium-nickel manganese cobalt (Li-NMC) segment is projected to lead the automotive lithium-ion battery recycling market during the forecast period

The lithium-nickel manganese cobalt segment accounted for the largest share of the market in 2021 owing to its major application in e-mobility. The market for Li-NMC battery recycling is increasing due to the exponential rise in the sales of electric vehicles, which is expected to result in a significant volume of end-of-life Li-NMCs.

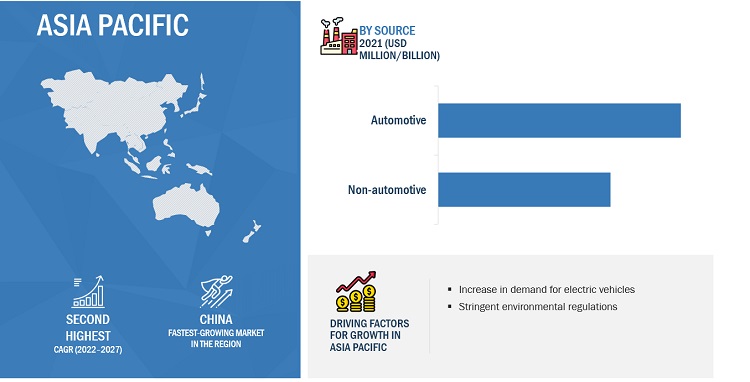

Based on region, Asia Pacific accounted for the second largest share of the global lithium-ion battery recycling market in 2022

Rising demand for vehicles and environmental regulations are leading to the growth of Asia Pacific market. The increasing pollution levels in emerging economies such as China and India is among the factors which is driving the Asia Pacific market.

To know about the assumptions considered for the study, download the pdf brochure

Lithium-ion Battery Recycling Market Players

American Battery Technology Company (US), ACCUREC Recycling GmbH (Germany), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), Ecobat (US), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Redwood Materials Inc. (US), RecycLiCo Battery Materials Inc. (Canada), Stena Recycling (Sweden), TES (Singapore), The International Metals Reclamation Company (US), and Umicore (Belgium), and others are among the major players leading the market through their innovative offerings, enhanced recycling capacities, and efficient distribution channels.

Lithium-ion Battery Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 6.5 billion |

|

Revenue Forecast in 2031 |

USD 35.1 billion |

|

CAGR |

20.6% |

|

Market Size Available for Years |

2017 to 2031 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2031 |

|

Forecast Units |

Value (USD Million), Volume (Units) |

|

Segments Covered |

Source, Battery Chemistry, Battery Component, recycling process, and Region |

|

Geographies Covered |

Europe, Asia Pacific, and North America |

|

Companies Covered |

The major market players include American Battery Technology Company (US), ACCUREC Recycling GmbH (Germany), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), Ecobat (US), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Redwood Materials Inc. (US), RecycLiCo Battery Materials Inc. (Canada), Stena Recycling (Sweden), TES (Singapore), The International Metals Reclamation Company (US), and Umicore (Belgium), and others |

This research report categorizes the lithium-ion battery recycling market based on source, battery chemistry, and region.

Based on source, the lithium-ion battery recycling market has been segmented as follows:

- Automotive

- Non-automotive

Based on battery component, the lithium-ion battery recycling market has been segmented as follows:

- Active Material

- Non-active Material

Based on recycling process, the lithium-ion battery recycling market has been segmented as follows:

- Hydrometallurgical Process

- Pyrometallurgical Process

- Physical/Mechanical

Based on battery chemistry, the lithium-ion battery recycling market has been segmented as follows:

- Lithium-nickel Manganese Cobalt (Li-NMC)

- Lithium-iron Phosphate (LFP)

- Lithium-manganese Oxide (LMO)

- Lithium-titanate Oxide (LTO)

- Lithium-nickel Cobalt Aluminum Oxide (NCA)

Based on the region, the lithium-ion battery recycling market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- UK

- France

- Sweden

- Norway

- Netherlands

- Rest of Europe

-

North America

- US

- Canada

- Mexico

Recent Developments

- In February 2023, Contemporary Amperex Technology Co., Limited, Mercedes-Benz, and GEM Co., Ltd. signed a memorandum of understanding for the recycling of cobalt, nickel, manganese, and lithium metals from spent EV batteries of Mercedes-Benz and remanufacture them into battery cathode materials.

- In September 2022, Fortum founded Fortum Batterie Recycling GmbH in Germany to provide safe and sustainable electric vehicle (EV) battery recycling in central Europe.

- In May 2022, Li-Cycle Corp. received an investment of USD 200 million from Glencore to support its upcoming recycling plants.

Frequently Asked Questions (FAQ):

What is the key driver and opportunity for lithium-ion battery recycling market?

Stringent local and state government regulations and EPA guidelines is the major driver and opportunity.

Which region is expected to hold the highest market share in the lithium-ion battery recycling market?

The lithium-ion battery recycling market in Asia Pacific is estimated to hold the highest market share, showcasing strong demand for electric vehicles, plug-in motor vehicles and stringent environmental regulations.

What is the major source of lithium-ion batteries for recycling?

The automotive segment with increasing number of electric vehicles is the major source of lithium-ion batteries for recycling.

Who are the major recyclers of lithium-ion batteries?

The key recyclers operating in the market include Umicore (Belgium), Glencore (Switzerland), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), and RecycLiCo Battery Materials Inc. (Canada).

What is the total CAGR expected to record for the lithium-ion battery recycling market during 2022-2031?

The market is expected to record a CAGR of 20.6% from 2022-2031 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size of lithium-ion battery recycling. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of lithium-ion battery recycling through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

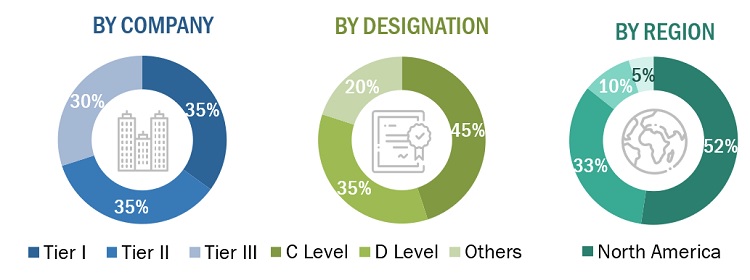

The lithium-ion battery recycling market comprises several stakeholders, such as such as battery suppliers, processors, recycling companies, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the lithium-ion battery recycling industry. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lithium-ion battery recycling market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the lithium-ion battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Lithium-Ion Battery Recycling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Lithium-Ion Battery Recycling Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive and non-automotive sources.

Market definition

Lithium-ion battery recycling refers to the reuse and reprocessing of spent lithium-ion batteries to reduce their disposal as municipal solid waste or material waste. Lithium-ion battery recycling is important not only for the recovery of valuable materials and metals but also for efficient waste management.

Key Stakeholders

- Governments and research organizations

- Battery manufacturers

- Electric vehicle manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

- Lithium-ion battery recycling manufacturers/traders

Report Objectives:

- To analyze and forecast the market size of lithium-ion battery recycling in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global lithium-ion battery recycling market on the basis of source and recovered products.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on three major regions: North America, Europe, and Asia Pacific, along with their respective key countries.

- To track and analyze the competitive developments, such as expansion, merger & acquisition, new technology development, and contract & agreement, in the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the lithium-ion battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium-ion Battery Recycling Market