LNG Storage Tank Market by Type (Self-Supporting, Non-Self-Supporting), Material (Steel, 9% Nickel Steel, Aluminum Alloy), Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) - Global Forecast to 2027

Updated on : April 01, 2024

LNG Storage Tank Market

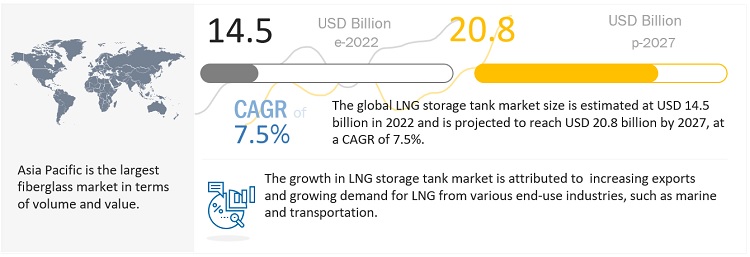

The global LNG storage tank market was valued at USD 14.5 billion in 2022 and is projected to reach USD 20.8 billion by 2027, growing at 7.5% cagr from 2022 to 2027. Liquefied natural gas (LNG) storage tanks are specialized types of storage tanks, used for LNG storage. These tanks are generally found in-ground, above ground, and in LNG carriers or vehicles. They are made in various configurations, such as horizontal, vertical, double-walled, and insulated. LNG storage tanks are constructed with thermal insulation to reduce evaporation, prevent heat transfer, and protect structures from cryogenic temperatures.

Attractive Opportunities in the LNG Storage Tank Market

Note e-estimated; p-projected.

To know about the assumptions considered for the study, Request for Free Sample Report

LNG Storage Tank Market Dynamics

Increased number of floating storage and regasification units to drive the demand for LNG storage tanks

A floating storage and regasification unit is a key component of the LNG value chain, forming the interface between LNG carriers and local gas suppliers. Floating storage and regasification units (FSRUs) are a flexible alternative to conventional onshore LNG terminals. In 2021 the overall LNG fleet increased by 10% from 2020. According to International Gas Union, the global LNG carrier fleet consisted of 641 active vessels as of end-of-April 2022, including 45 FSRUs and five floating storage units (FSUs). The demand for floating storage and regasification units is more in regions that have a high demand for LNG and a lack of an established pipeline network. Fast-growing economies in some regions, including Asia Pacific, the Middle East, and Africa, are expected to drive the growth of new floating storage and regasification units in the near future, which, in turn, is expected to drive the demand for LNG storage tanks.

High installation cost of LNG storage tanks is a major restrain for the LNG storage tank market

A major raw material used for the manufacturing of the LNG storage tank is nickel steel (9%). The fluctuating prices of nickel steel act as a restraint to market growth. The nickel steel prices have been fluctuating continuously due to Indonesia’s ban on the export of nickel, which was effective from January 2020. Indonesia is the largest global producer and exporter of nickel, followed by the Philippines, accounting for over 20% of nickel export, globally. Owing to the announcement of the ban, there was a sudden surge in nickel prices, which resulted in an increase in the production cost of LNG storage tanks. Moreover, the US imposed 25% tariffs on steel production in China, in 2018. This was one of the reasons which led to a trade war between the US and China, resulting in the rise in prices of steel, that is the most used raw material for manufacturing LNG storage tanks.

Growing opportunities in marine transport is the an opportunity to LNG storage tank market to grow

In 2020, the International Maritime organization decided to implement a 0.50% sulfur cap decision to reduce the harmful effects of marine fuel on the environment. This gave rise to LNG as a marine fuel. LNG emits zero sulfur oxide and zero particulate matter, unlike other fuels, and is noncorrosive and non-toxic. LNG will lead to long-term, cost-effective solutions as a conventional marine fuel. Wartsila (Finland), a global leader in the marine industry, has developed and converted oil-run engines to LNG-powered engines.

LNG storage tanks are being increasingly used for intermodal freight transportation. Intermodal facilities include depots, container yards, cargo, and storage tanks, which provide more options for marine transportation and many oil & gas companies, which will boost the LNG storage tank market.

One of the major restraint for LNG storage tank market is LNG leakage and boil-off gas

LNG is stored and transported in storage tanks as a cryogenic liquid. Even though the tanks are insulated, there is still heat ingress into the tanks from the surroundings. This increases the temperature, causing the liquid to evaporate and thus creating boil-off gas. Managing the boil-off gas is very necessary to prevent the tank from being over-pressurized and avoid health and safety risks to the surroundings. There are also explosion hazards in case of leakage of gas from the tank. Thus, leakage and boiling of gas are key challenges in the LNG storage tank market.

Another key challenge is that a lot of players are involved in the LNG value chain—EPC (Engineering, Procurement, and Construction) contractors, suppliers, vendors, stakeholders, and end users, which gives rise to potential problem areas, such as delayed supply, and increase in cost.

To know about the assumptions considered for the study, download the pdf brochure

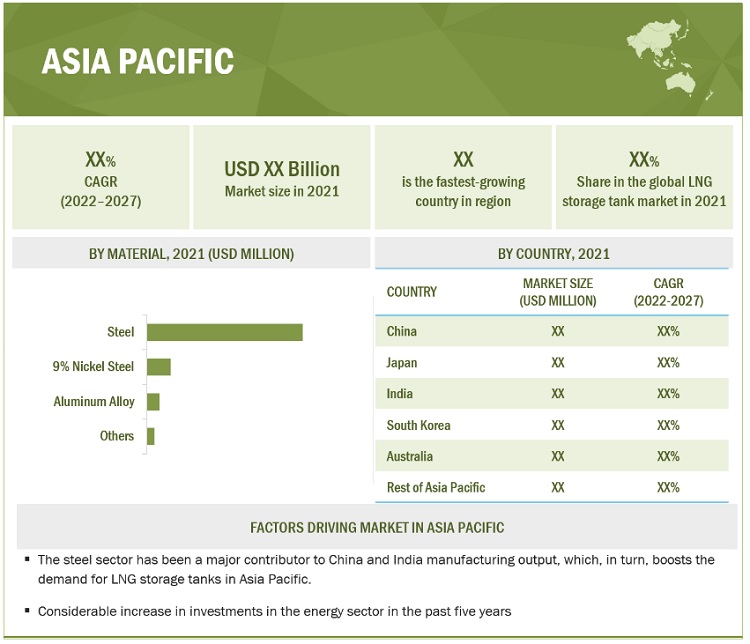

Asia Pacific held the largest market share in the LNG storage tank market

Asia Pacific is projected to be the fastest-growing market for LNG storage tanks, owing to a considerable increase in investments in the energy sector in the past five years, creating a high demand for small-scale LNG, which, in turn, will drive the demand for LNG storage tanks in the region. Furthermore, the growing import of small-scale LNG coupled with the growth in the Asia Pacific steel and metal manufacturing sector has been driven mainly by the domestic availability of raw materials (for instance, iron ore) and cost-effective labor. The steel sector has been a major contributor to India’s manufacturing output, which, in turn, boosts the demand for LNG storage tanks in Asia Pacific.

LNG Storage Tank Market Players

The key players in the global LNG storage tank market are:

- Linde Plc (Ireland)

- McDermott International Inc. (US)

- Wartsila (Finland)

- IHI Corporation (Japan)

- Air Water Inc. (Japan)

- Cimc Enric (China)

- Chart Industries (US)

- Isisan A.S (Turkey)

- Cryolor (France)

- Inox (India)

- Carbon Energy Group (US)

- TransTech Energy Llc. (US)

- Others

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the LNG storage tank industry. The study includes an in-depth competitive analysis of these key players in the LNG storage tank market, with their company profiles, recent developments, and key market strategies.

LNG Storage Tank Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Million square meter) |

|

Segments |

Type, Material type, and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

Linde Plc (Ireland), McDermott International Inc. (US), Wartsila (Finland), IHI Corporation (Japan), Air Water Inc. (Japan), Cimc Enric (China), Chart Industries (US), Isisan A.S (Turkey), Cryolor (France), Inox (India), Carbon Energy Group (US), and TransTech Energy Llc. (US). |

This research report categorizes the LNG storage tank market based on type, material type, and region.

By Type:

- Self-Supportive

- Non-Self-Supportive

By Material Type:

- Steel

- 9% Nickel Steel

- Aluminum Alloy

- Others (7% nickel steel, concrete)

By Region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments

- In May 2022, Chart Industries completed the acquisition of Cryogenic Service Center AB (CSC). This acquisition helped the company to expand its geographical footprint along with extended service capabilities for transportable tanks, and LNG fueling stations.

- In January 2022, CIMC ENRIC acquired Lindenau Full tank service Inc., which is an established tank service company having expertise in cryogenic, gas, and chemical tanks, and tank trailers. This acquisition will help the company to expand its network in Europe. It will provide timely after-sales services and capabilities, particularly in energy and chemical logistics.

- In September 2021, Wartsila was planning to collaborate with Hudong-Zhonghua Shipbuilding (HZS) and ABS to develop a future-proof, flexible LNG carrier vessel concept (LNGC).

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the LNG storage tank market?

High demand from power, energy, and other end-use industries.

Which is the fastest-growing region-level market for LNG storage tank?

APAC is the fastest-growing LNG storage tank market due to the presence of major LNG storage tank manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of LNG storage tank?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of LNG storage tanks.

What are the challenges in the LNG storage tank market?

LNG leakage is the major challenge in the LNG storage tank market. .

Which type of LNG storage tanks holds the largest market share?

Self-supporting tanks in terms of value hold the largest share.

How is the LNG storage tank market aligned?

The market is growing at a significant pace. It is a potential market and many manufacturers are planning business strategies to expand their business.

Who are the major manufacturers?

Linde PLC (Ireland), McDermott International Inc. (US), Wartsila (Finland), IHI Corporation (Japan), Air Water Inc. (Japan), CIMC ENRIC (China), Chart Industries (US), ISISAN A.S. (Turkey), DowAksa (Turkey), and Cryolor (France) are some of the key players in the LNG storage tank market.

What are the major material type of LNG storage tank?

The major material typesare steel, 9% nickel steel, aluminum alloy, and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves two major activities in estimating the current size of the LNG storage tank market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The LNG storage tank market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side is characterized by developments in the LNG storage tank market. The supply side is characterized by market consolidation activities undertaken by the manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

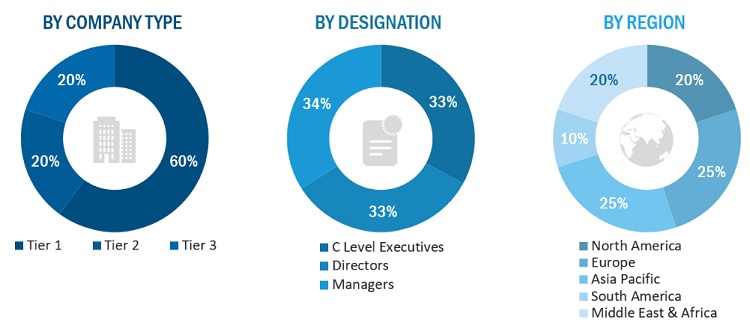

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total LNG storage tank market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall LNG storage tank market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply side.

Report Objectives

- To analyze and forecast the global LNG storage tank market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type, and material type

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC LNG storage tank market

- Further breakdown of Rest of European LNG storage tank market

- Further breakdown of Rest of North American LNG storage tank market

- Further breakdown of Rest of MEA LNG storage tank market

- Further breakdown of Rest of South American LNG storage tank market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LNG Storage Tank Market