Low Light Imaging Market by Technology (CMOS and CCD), Application (Photography, Monitoring, Inspection & Detection, and Security & Surveillance), Vertical (Automotive, Consumer Electronics, Medical & Lifesciences) and Region - Global Forecast to 2027

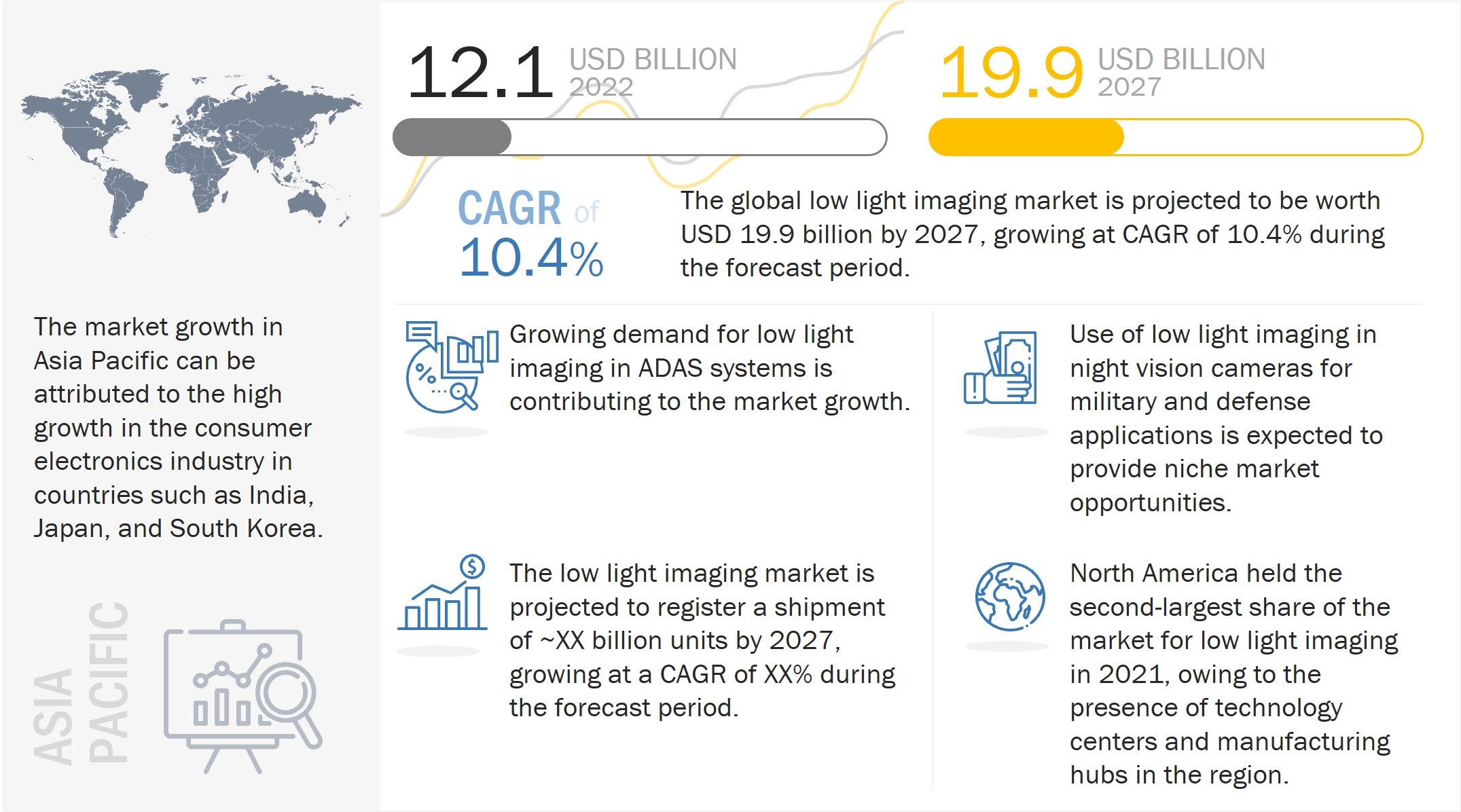

[215 Pages Report] The low light imaging market size is expected to grow from USD 12.1 billion in 2022 to USD 19.9 billion by 2027, at a CAGR of 10.4% during the forecasted period.

The integration of low light imaging sensors into cameras of smartphones and tablets, increasing deployment of advanced driver-assistance systems (ADASs) in automobiles, and growing use of low light image sensors in advanced medical imaging applications are the few drivers for pertaining the growth of low light imaging market.

Low Light Imaging Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Low Light Imaging Market Dynamics

DRIVERS : Integration of low light imaging sensors into cameras of smartphones and tablets

The increasing use of smartphones and tablets equipped with multiple cameras is one of the key factors contributing to the growth of the low light imaging industry . As the importance of cameras and image quality in smartphones is increasing, OEMs are focusing on developing image sensors with smaller footprints and enhanced functionalities such as low light visibility and high-quality pixels. Camera specifications have become a prime focus of smartphone buyers worldwide, and companies are increasingly launching camera-centric smartphones. Smartphone manufacturers such as Samsung Electronics, Co., Ltd. (South Korea), Xiaomi Corporation (China), Apple Inc. (US), Motorola, Inc. (US), Google (US), LG Electronics Inc. (South Korea), One Plus Technology Co., Ltd. (China), Huawei Technologies Co., Ltd. (China), Realme (China), Guangdong OPPO Mobile Telecommunications Corp., Ltd, (China), and Vivo Communication Technology Co. Ltd. (China) are launching smartphones with marketing campaigns emphasizing camera features. Besides, despite the pandemic crisis, consumers continued to upgrade to premium smartphones, fueling the growth of the low light imaging market.

RESTRAINT : Declining demand for digital still cameras

Smartphone photography has dramatically improved, such that many individuals no longer carry or purchase a digital still camera. Modern smartphones take readily sufficient photographs for the average user, while professionals and photo enthusiasts obtain superior results with high-end cameras and lenses. According to the Camera & Imaging Products Association (CIPA), a Japan-based industry association, global digital still camera shipments decreased by 93% between 2011 and 2021. The sharp decline was mostly caused by decreased sales of digital still cameras with built-in lenses, which casual photographers relied on until smartphone photography became more popular. Thus, the demand for low light imaging for applications in digital still cameras has declined significantly, affecting the market growth.

OPPORTUNITIES : Rising innovations and advancements in light imaging sensors

Emerging imaging technologies such as organic photodetectors, SWIR image sensors, event-based vision, hyperspectral imaging, and flexible detectors have enhanced the working of image sensors in low light imaging applications. The benefits of these emerging technologies include decreased cost, increased dynamic range, improved temporal resolution, spatially variable sensitivity, high-resolution global shutters, reduced unwanted scattering influence, and flexibility. With the increasing demand for the latest features in cameras of smartphones and the growing adoption of these technologies, the market is likely to witness substantial growth in the coming years. For instance, in February 2022, STMicroelectronics N.V. launched the market’s first 0.5 MP depth image sensor named VD55H1. The innovative VD55H1 3D depth sensor reinforces ST’s leadership in Time-of-Flight and complements its full range of depth-sensing technologies

CHALLENGES : Short time-to-market of smartphones

Most digital cameras with low light imaging sensors are marketed in the consumer market, which is extremely competitive due to the constantly shortened time-to-market for new and improved versions. Because of the continuously shortening product lifecycles, product lines must be constantly improved. As a result, reducing development time is a significant challenge, given that the company that is the first to market the new or improved version can gain a significant competitive advantage.

Low Light Imaging Market Ecosystem

Monitoring, inspection & detection to hold the second largest share in low light imaging market in 2021

Automotive and medical and life sciences are the major verticals wherein low light imaging cameras are used for monitoring, inspection, and detection applications. In the automotive industry, manufacturers are launching cars having multiple cameras to enhance safety and convenience. The cameras need to perform efficiently in all lighting conditions, which has resulted in an increased demand for low light imaging sensors in the automotive industry. Rising demand for low light imaging cameras and growing adoption of LiDAR technology in the automotive industry are the major factors accelerating the growth of the low light imaging market for the monitoring, inspection, and detection application.

Automotive segment to hold the second largest segment in low light imaging market in 2021

In the automotive vertical, low light image sensors find applications in advanced driver assistance system, or ADAS, such as side view/rear view, forward ADAS, in-cabin ADAS, and camera mirror systems. The most common use of cameras in cars today is rear-, side-, and forward-viewing systems. For ensuring safety and security, the cameras in cars need to operate efficiently in all lighting conditions; this requirement from the automotive vertical has generated the demand for cameras having a low light imaging feature. The rising demand for ADAS in the automotive vertical is likely to boost the growth of the low light imaging market.

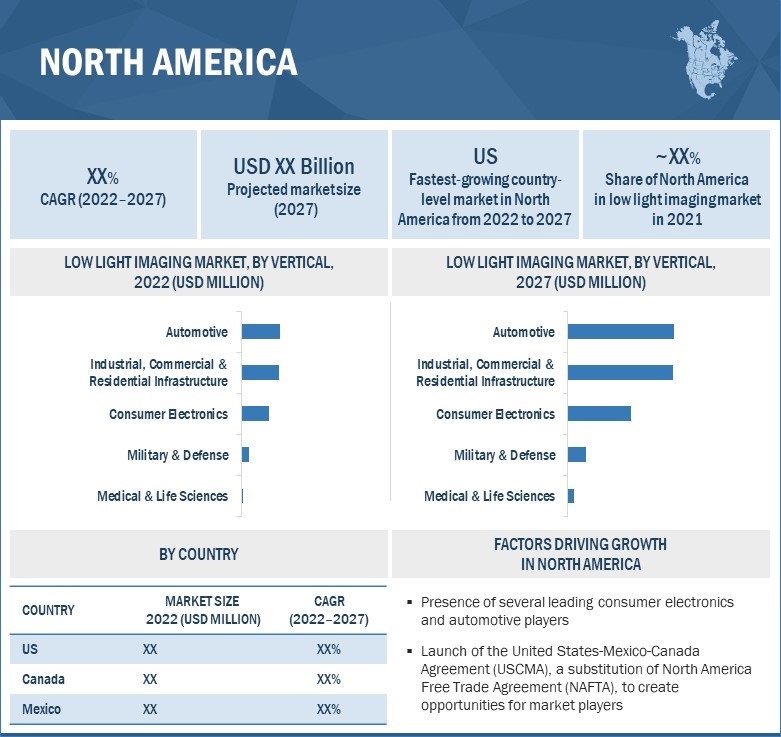

North America is expected to hold the second largest market of low light imaging during forecasted period

The growth of the low light imaging market in North America is due to the growing number of technological innovations in field of imaging technology for various application areas such as medical, life sciences, electronics, and automotive. The increasing demand for image sensors for consumer electronics, industrial, automotive, healthcare, and security & surveillance applications is expected to support market growth in North America. The low light imaging market in North America is driven by the presence of key industry players in the region such as OMNIVISION, On Semiconductor, and Teledyne Technologies Incorporated. Several leading consumer electronics, as well as automotive, industry players are based in the region.

Low Light Imaging Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Low Light Imaging Market :

The low light imaging companies such as Sony Group (Japan), Samsung Electronics Co., Ltd. (South Korea), OMNIVISION Technologies (US), STMicroelectronics N.V. (Switzerland), ON Semiconductor Corporation (US), Panasonic Holdings Corporation (Japan), Canon Inc. (Japan), PixArt Imaging Inc. (Taiwan), Hamamatsu Photonics K.K. (Japan), and Teledyne Technologies Incorporated (US), among others.

Low-Light Imaging Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 12.1 Billion |

| Projected Market Size | USD 19.9 Billion |

| Growth Rate | 10.4% At a CAGR |

|

Market size availability for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Million Units) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Integration of low light imaging sensors into cameras of smartphones and tablets |

| Key Market Opportunity | Rising innovations and advancements in light imaging sensors |

| Largest Growing Region | North America |

| Largest Market Share Segment | Automotive segment |

| Highest CAGR Segment | USB-based/Portable segment |

The study categorizes the low light imaging market based on technology, application, vertical, and region at the global level.

|

Aspect |

Details |

|

By Technology |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Low Light Imaging Industry

- In May 2022, STMicroelectronics N.V. unveiled a second-generation automotive global-shutter image sensor, VB56G4A, which simplifies driver monitoring system (DMS) design.

- In July 2021, Samsung Electronics Co., Ltd. expanded its automotive portfolio by introducing ISOCELL Auto 4AC, an automotive image sensor with advanced 120-dB high dynamic range (HDR) and LED flicker mitigation (LFM) system, designed specifically for surround-view monitors (SVM) or rear-view cameras (RVC) in high-definition resolution (1280 x 960). This new sensor is the company’s first imaging solution designed specifically for automotive applications.

Frequently Asked Questions (FAQ’s)

What is the total CAGR expected to be recorded for the low light imaging market during forecasted?

The global low light imaging market is forecasted to reach USD 19.9 billion in 2027, growing at a CAGR of 10.4% from 2022–2027. This growth attributed by the surging demand of smartphones with high quality cameras.

What are some of the technology trends of low light imaging market?

The recent trends of the low light imaging market include autonomous driving systems, 3D sensing, LiDAR in automotive application.

What is the different technology type covered in low light imaging market?

The CMOS and CCD technology-based low light imaging are covered in the report.

Which region will lead the low light imaging market in the future?

Asia Pacific is expected to lead the low light imaging market during the forecast period. Owing to increasing penetration of industrial, commercial, and residential infrastructure applications, and rise in number of smart phones manufacturing companies are expected to boost the market for low light imaging in this region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 LOW LIGHT IMAGING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 LOW LIGHT IMAGING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 PROCESS FLOW: LOW LIGHT IMAGING MARKET SIZE ESTIMATION

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 LOW LIGHT IMAGING MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 LOW LIGHT IMAGING MARKET: TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.2.3.1 Specific factors considered while estimating and forecasting market size

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 LOW LIGHT IMAGING MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 7 CMOS TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SIZE IN 2027

FIGURE 8 PHOTOGRAPHY APPLICATION TO HOLD LARGEST SIZE OF LOW LIGHT IMAGING MARKET BY 2027

FIGURE 9 CONSUMER ELECTRONICS VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC CAPTURED LARGEST SHARE OF LOW LIGHT IMAGING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR LOW LIGHT IMAGING MARKET PLAYERS

FIGURE 11 INCREASING ADOPTION OF LOW LIGHT IMAGING PRODUCTS IN ASIA PACIFIC TO DRIVE MARKET GROWTH

4.2 LOW LIGHT IMAGING MARKET, BY TECHNOLOGY

FIGURE 12 CMOS TECHNOLOGY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.3 LOW LIGHT IMAGING MARKET, BY APPLICATION

FIGURE 13 MONITORING, INSPECTION & DETECTION APPLICATION TO EXHIBIT HIGHEST CAGR IN LOW LIGHT IMAGING MARKET DURING FORECAST PERIOD

4.4 LOW LIGHT IMAGING MARKET, BY VERTICAL

FIGURE 14 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR IN LOW LIGHT IMAGING MARKET DURING FORECAST PERIOD

4.5 LOW LIGHT IMAGING MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO HOLD LARGEST SHARE OF LOW LIGHT IMAGING MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 LOW LIGHT IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Integration of low light imaging sensors into cameras of smartphones and tablets

5.2.1.2 Increasing deployment of advanced driver-assistance systems (ADAS) in automobiles

5.2.1.3 Growing use of low light image sensors in advanced medical imaging applications

FIGURE 17 ANALYSIS OF IMPACT OF DRIVERS ON LOW LIGHT IMAGING MARKET

5.2.2 RESTRAINTS

5.2.2.1 Declining demand for digital still cameras

FIGURE 18 GLOBAL SHIPMENTS OF DIGITAL STILL CAMERAS, 2011–2021

FIGURE 19 ANALYSIS OF IMPACT OF RESTRAINTS ON LOW LIGHT IMAGING MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Rising innovations and advancements in light imaging sensors

FIGURE 20 ANALYSIS OF IMPACT OF OPPORTUNITIES ON LOW LIGHT IMAGING MARKET

5.2.4 CHALLENGES

5.2.4.1 Short time-to-market of smartphones

FIGURE 21 ANALYSIS OF IMPACT OF CHALLENGES ON LOW LIGHT IMAGING MARKET

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 22 LOW LIGHT IMAGING MARKET: SUPPLY CHAIN ANALYSIS

TABLE 1 LOW LIGHT IMAGING MARKET: ECOSYSTEM ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 LOW LIGHT IMAGING MARKET: ECOSYSTEM ANALYSIS

5.5 AVERAGE SELLING PRICE ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS OFFERED BY KEY PLAYERS

FIGURE 24 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS OFFERED BY KEY PLAYERS

TABLE 2 AVERAGE SELLING PRICE OF CMOS IMAGE SENSORS OFFERED BY KEY PLAYERS (USD)

5.5.2 AVERAGE SELLING PRICE TREND

TABLE 3 AVERAGE SELLING PRICE OF LOW LIGHT IMAGING PRODUCTS, BY INDUSTRY (USD)

FIGURE 25 AVERAGE SELLING PRICE OF LOW LIGHT IMAGING PRODUCTS, BY INDUSTRY

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 26 REVENUE SHIFTS FOR LOW LIGHT IMAGING MARKET

5.7 TECHNOLOGY TRENDS

5.7.1 LIDAR TECHNOLOGY

5.7.2 THERMAL IMAGING TECHNOLOGY

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 LOW LIGHT IMAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 LOW LIGHT IMAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

5.9.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.1 CASE STUDY ANALYSIS

5.10.1 ONSEMI PYTHON SERIES OF CMOS IMAGE SENSORS USED IN CAMERA SYSTEMS DURING MARS 2020 MISSION

5.10.2 LABSPHERE, INC. DEPLOYED HIGH-END IMAGE SENSORS IN ITS SPHERE UNIFORM LIGHT SOURCE SYSTEMS

5.10.3 IMAGE SENSOR-ENABLED VISION SYSTEMS USED TO INSPECT HEAD-UP DISPLAYS (HUDS) DEPLOYED IN JET PLANES

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

TABLE 7 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.11.2 EXPORT SCENARIO

TABLE 8 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 30 NUMBER OF PATENTS RELATED TO LOW LIGHT IMAGING PRODUCTS, 2012–2022

TABLE 9 LIST OF SOME PATENTS PERTAINING TO LOW LIGHT IMAGING MARKET, 2020–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 LOW LIGHT IMAGING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TARIFF ANALYSIS

TABLE 11 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY US

TABLE 12 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY CHINA

TABLE 13 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY JAPAN

5.15 STANDARDS AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 GOVERNMENT REGULATIONS

5.15.2.1 Canada

5.15.2.2 US

5.15.2.3 Europe

5.15.2.4 India

6 LOW LIGHT IMAGING MARKET, BY TECHNOLOGY (Page No. - 75)

6.1 INTRODUCTION

FIGURE 31 LOW LIGHT IMAGING MARKET, BY TECHNOLOGY

FIGURE 32 CMOS TECHNOLOGY TO CONTINUE TO DOMINATE LOW LIGHT IMAGING MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 20 MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNIT)

TABLE 21 MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNIT)

6.2 COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR (CMOS)

6.2.1 HIGH DEMAND FOR LOW LIGHT PHOTOGRAPHY APPLICATIONS TO BOOST GROWTH OF CMOS IMAGING MARKET

6.3 CHARGE-COUPLED DEVICE (CCD)

6.3.1 ADVANTAGES OF CMOS OVER CCD TECHNOLOGY TO RESULT IN DECLINE IN DEMAND FOR CCD TECHNOLOGY-BASED LOW LIGHT IMAGING DEVICES

7 LOW LIGHT IMAGING MARKET, BY APPLICATION (Page No. - 80)

7.1 INTRODUCTION

FIGURE 33 LOW LIGHT IMAGING MARKET, BY APPLICATION

FIGURE 34 MONITORING, INSPECTION, AND DETECTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.2 PHOTOGRAPHY

7.2.1 HIGH DEMAND FROM CONSUMER ELECTRONICS VERTICAL TO DRIVE MARKET

7.3 MONITORING, INSPECTION & DETECTION

7.3.1 USED BY AUTOMOTIVE, MEDICAL, AND LIFE SCIENCES VERTICALS

7.4 SECURITY & SURVEILLANCE

7.4.1 DEMAND FROM INDUSTRIAL, COMMERCIAL, AND RESIDENTIAL END USERS TO BOOST MARKET

8 LOW LIGHT IMAGING MARKET, BY VERTICAL (Page No. - 84)

8.1 INTRODUCTION

FIGURE 35 LOW LIGHT IMAGING MARKET, BY VERTICAL

FIGURE 36 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST SIZE OF LOW LIGHT IMAGING MARKET DURING FORECAST PERIOD

TABLE 26 LOW LIGHT IMAGING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 28 MARKET, BY VERTICAL, 2018–2021 (MILLION UNIT)

TABLE 29 MARKET, BY VERTICAL, 2022–2027 (MILLION UNIT)

8.2 CONSUMER ELECTRONICS

8.2.1 SMARTPHONE SEGMENT TO DOMINATE LOW LIGHT IMAGING MARKET FOR CONSUMER ELECTRONICS VERTICAL DURING 2022–2027

TABLE 30 CONSUMER ELECTRONICS: LOW LIGHT IMAGING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 CONSUMER ELECTRONICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 CONSUMER ELECTRONICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 CONSUMER ELECTRONICS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 35 CONSUMER ELECTRONICS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 36 CONSUMER ELECTRONICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 37 CONSUMER ELECTRONICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 CONSUMER ELECTRONICS: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 CONSUMER ELECTRONICS: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

8.3 AUTOMOTIVE

8.3.1 ACCELERATED ADOPTION OF ADAS TO AUGMENT DEMAND FOR LOW LIGHT IMAGING DEVICES

TABLE 40 AUTOMOTIVE: LOW LIGHT IMAGING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 AUTOMOTIVE: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 AUTOMOTIVE: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 44 AUTOMOTIVE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 AUTOMOTIVE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 AUTOMOTIVE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 AUTOMOTIVE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 AUTOMOTIVE: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 AUTOMOTIVE: LMARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

8.4 MEDICAL & LIFE SCIENCES

8.4.1 ENDOSCOPES AND CATHETERS AMONG KEY MEDICAL APPLICATIONS

TABLE 50 MEDICAL & LIFE SCIENCES: LOW LIGHT IMAGING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MEDICAL & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 MEDICAL & LIFE SCIENCES: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 53 MEDICAL & LIFE SCIENCES: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 MEDICAL & LIFE SCIENCES: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MEDICAL & LIFE SCIENCES: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 MEDICAL & LIFE SCIENCES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 MEDICAL & LIFE SCIENCES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 MEDICAL & LIFE SCIENCES: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MEDICAL & LIFE SCIENCES: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

8.5 MILITARY & DEFENSE

8.5.1 SECURITY AND SURVEILLANCE APPLICATION TO DOMINATE LOW LIGHT IMAGING MARKET FOR MILITARY & DEFENSE DURING 2022–2027

TABLE 60 MILITARY & DEFENSE: LOW LIGHT IMAGING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MILITARY & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MILITARY & DEFENSE: MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MILITARY & DEFENSE: MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

8.6 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE

8.6.1 GROWING SECURITY CONCERNS TO DRIVE DEMAND FOR LOW LIGHT IMAGING SOLUTIONS

TABLE 70 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: LOW LIGHT IMAGING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: LOW LIGHT IMAGING MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: LOW LIGHT IMAGING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: LOW LIGHT IMAGING MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 LOW LIGHT IMAGING MARKET FOR COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 INDUSTRIAL, COMMERCIAL & RESIDENTIAL INFRASTRUCTURE: LOW LIGHT IMAGING MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

9 LOW LIGHT IMAGING MARKET, BY REGION (Page No. - 105)

9.1 INTRODUCTION

FIGURE 37 LOW LIGHT IMAGING MARKET TO WITNESS HIGHEST CAGR IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 80 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: LOW LIGHT IMAGING MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: LOW LIGHT IMAGING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US to dominate market in North America during forecast period

TABLE 86 US: LOW LIGHT IMAGING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 87 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Focus on improving security to boost demand for low light image sensors

TABLE 88 CANADA: LOW LIGHT IMAGING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 89 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Fastest-growing country-level market in North America

TABLE 90 MEXICO: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 91 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 39 EUROPE: LOW LIGHT IMAGING MARKET SNAPSHOT

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Demand from automotive vertical to accelerate market growth

TABLE 96 UK: LOW LIGHT IMAGING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 97 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Automotive vertical significant contributor to market in Germany

TABLE 98 GERMANY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Industrial, commercial, and residential infrastructure and automotive verticals to dominate market in France

TABLE 100 FRANCE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 101 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 High demand for ADAS to lead to significant growth in low light imaging market

TABLE 102 ITALY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 103 ITALY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.5 REST OF EUROPE

TABLE 104 REST OF EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: LOW LIGHT IMAGING MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Presence of manufacturing plants of several leading consumer electronics companies to favor market

TABLE 110 CHINA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 111 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Surging requirement for ADAS to drive market growth

TABLE 112 JAPAN: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Penetration of smartphones to foster market growth

TABLE 114 INDIA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 115 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 116 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 117 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 118 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 120 REST OF THE WORLD: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 121 REST OF THE WORLD: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Demand from automobile producers in Brazil to strengthen market

TABLE 122 SOUTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 123 SOUTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Surging adoption of video surveillance cameras to boost market

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 133)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 126 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2021

TABLE 127 LOW LIGHT IMAGING MARKET: MARKET SHARE ANALYSIS (2021)

10.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 41 FIVE-YEAR REVENUE ANALYSIS OF TOP FOUR PLAYERS IN LOW LIGHT IMAGING MARKET, 2017–2021

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 42 LOW LIGHT IMAGING MARKET: COMPANY EVALUATION QUADRANT, 2021

10.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT

TABLE 128 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 129 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN LOW LIGHT IMAGING MARKET

TABLE 130 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (TECHNOLOGY FOOTPRINT)

TABLE 131 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (VERTICAL FOOTPRINT)

TABLE 132 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (REGIONAL FOOTPRINT)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 43 LOW LIGHT IMAGING MARKET: STARTUP/SME EVALUATION MATRIX, 2021

10.7 COMPANY FOOTPRINT

TABLE 133 COMPANY FOOTPRINT

TABLE 134 COMPANY TECHNOLOGY FOOTPRINT

TABLE 135 COMPANY VERTICAL FOOTPRINT

TABLE 136 COMPANY REGIONAL FOOTPRINT

10.8 COMPETITIVE SCENARIOS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 137 LOW LIGHT IMAGING MARKET: PRODUCT LAUNCHES, 2019–2022

10.8.2 DEALS

TABLE 138 LOW LIGHT IMAGING MARKET: DEALS, MARCH 2019–MAY 2022

11 COMPANY PROFILES (Page No. - 155)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 SONY

TABLE 139 SONY: COMPANY OVERVIEW

FIGURE 44 SONY: COMPANY SNAPSHOT

11.1.2 SAMSUNG ELECTRONICS

TABLE 140 SAMSUNG ELECTRONICS: COMPANY OVERVIEW

FIGURE 45 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

11.1.3 STMICROELECTRONICS

TABLE 141 STMICROELECTRONICS: COMPANY OVERVIEW

FIGURE 46 STMICROELECTRONICS: COMPANY SNAPSHOT

11.1.4 OMNIVSION TECHNOLOGIES

TABLE 142 OMNIVISION: COMPANY OVERVIEW

11.1.5 ON SEMICONDUCTOR

TABLE 143 ON SEMICONDUCTOR: COMPANY OVERVIEW

FIGURE 47 ON SEMICONDUCTOR: COMPANY SNAPSHOT

11.1.6 CANON INC.

TABLE 144 CANON INC.: COMPANY OVERVIEW

FIGURE 48 CANON INC.: COMPANY SNAPSHOT

11.1.7 HAMAMATSU PHOTONICS

TABLE 145 HAMAMATSU PHOTONICS: COMPANY OVERVIEW

FIGURE 49 HAMAMATSU PHOTONICS: COMPANY SNAPSHOT

11.1.8 PANASONIC HOLDINGS CORPORATION

TABLE 146 PANASONIC: COMPANY OVERVIEW

FIGURE 50 PANASONIC: COMPANY SNAPSHOT

11.1.9 TELEDYNE TECHNOLOGIES

TABLE 147 TELEDYNE TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 51 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

11.1.10 PIXART IMAGING

TABLE 148 PIXART IMAGING: COMPANY OVERVIEW

FIGURE 52 PIXART IMAGING: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 AMS OSRAM AG

11.2.2 SHARP CORPORATION

11.2.3 PHOTONIS TECHNOLOGIES SAS

11.2.4 NEW IMAGING TECHNOLOGIES

11.2.5 RUIXIN MICROELECTRONICS CO., LTD.

11.2.6 PIXELPLUS

11.2.7 GALAXYCORE

11.2.8 HIMAX TECHNOLOGIES

11.2.9 LIGHT

11.2.10 COREPHOTONICS

11.2.11 GIGAJOT TECHNOLOGY

11.2.12 CISTA SYSTEM

11.2.13 CLAIRPIXEL CO., LTD.

11.2.14 TRIEYE LTD

11.2.15 NEWSIGHT IMAGING

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 201)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 CAMERA MODULES MARKET, BY PIXEL

12.3.1 UP TO 7 MP

12.3.1.1 Rising deployment of secondary cameras in smartphones to provide opportunities for market growth

12.3.2 8 TO 13 MP

12.3.2.1 Innovations and advancements in image sensors to propel market growth

12.3.3 ABOVE 13 MP

12.3.3.1 Increasing demand for high-quality and high-resolution images by end users to accelerate market growth

TABLE 149 CAMERA MODULES MARKET, BY PIXEL, 2017–2020 (USD MILLION)

TABLE 150 CAMERA MODULES MARKET, BY PIXEL, 2021–2026 (USD MILLION)

12.4 CAMERA MODULES MARKET, BY APPLICATION

TABLE 151 CAMERA MODULES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 152 CAMERA MODULES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.1 CONSUMER ELECTRONICS

12.4.1.1 Constant technological advancements leading to shorter replacement cycles of consumer electronics

12.4.2 AUTOMOTIVE

12.4.2.1 Technological breakthroughs in automotive to spur market growth

12.4.3 HEALTHCARE

12.4.3.1 Use of medical imaging systems in healthcare industry to augment market growth

12.4.4 INDUSTRIAL

12.4.4.1 Digitalization across industries bolsters growth of camera modules market

12.4.5 SECURITY AND SURVEILLANCE

12.4.5.1 Rising security concerns to boost utilization of security cameras

12.4.6 AEROSPACE & DEFENSE

12.4.6.1 Effective use of camera modules in aerospace and defense applications ensures smooth performance

12.5 CAMERA MODULES MARKET, BY REGION

TABLE 153 CAMERA MODULES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 154 CAMERA MODULES MARKET, BY REGION, 2021–2026 (USD MILLION)

12.5.1 NORTH AMERICA

12.5.2 EUROPE

12.5.3 ASIA PACIFIC

12.5.4 REST OF THE WORLD

13 APPENDIX (Page No. - 209)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

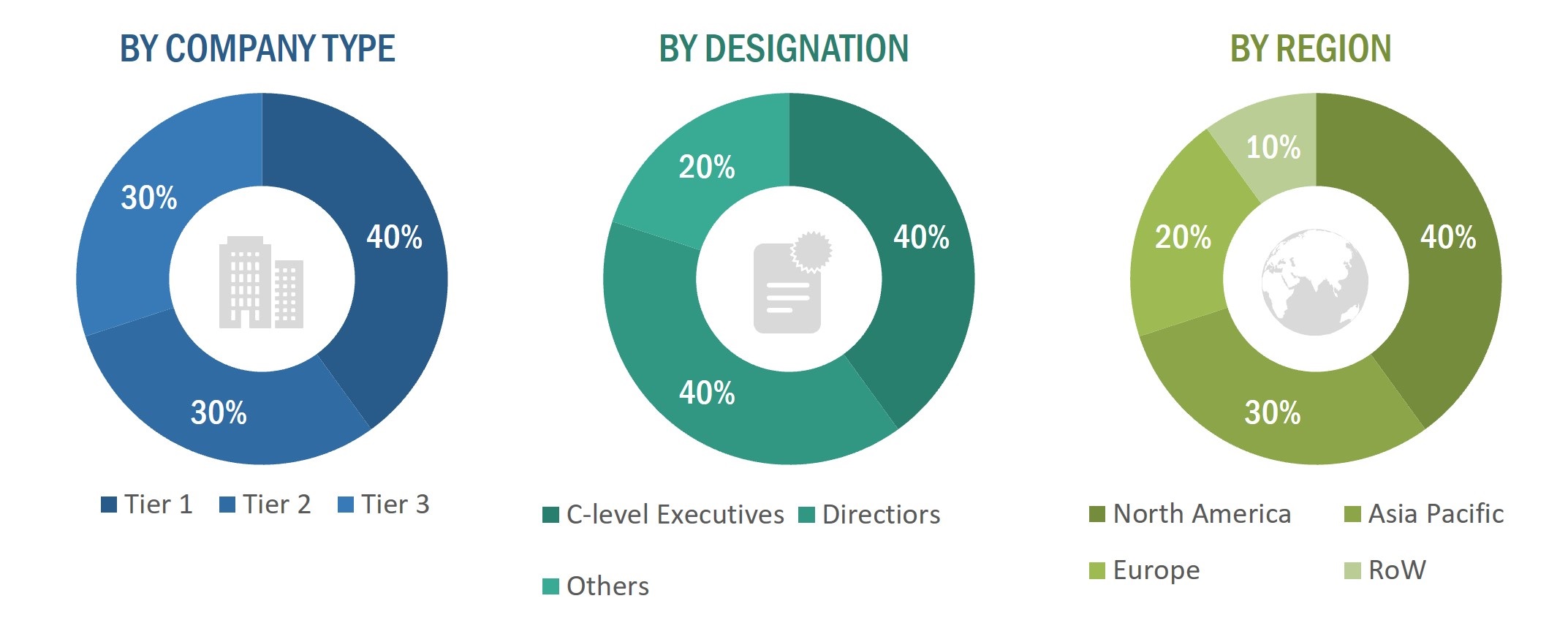

The study involved four major activities in estimating the current size of the low light imaging market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the low light imaging market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Digital Imaging Association, Indian Radiological & Imaging Association (IRIA), Others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall low light imaging market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the present scenario of the low light imaging market through secondary research. Several primary interviews have been conducted with market experts from both the demand (adopters of low light imaging sensors used for various systems and its applications) and supply (sensor manufacturers, integrators, and distributors) sides across 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% and 75% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

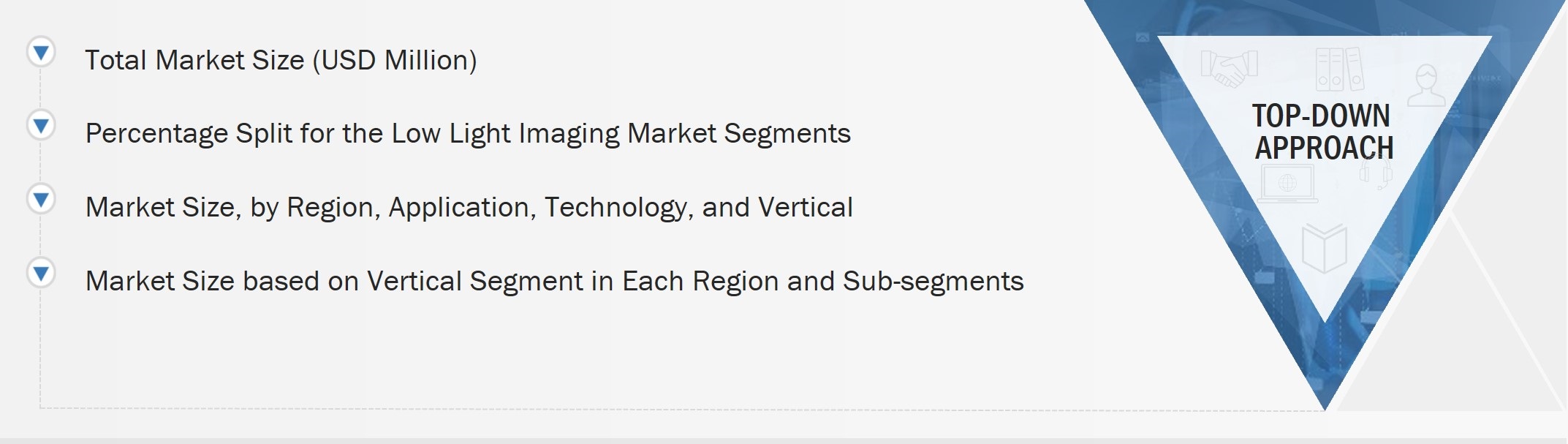

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the low light imaging market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the low light imaging market.

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of sizes of segments of the low light imaging market, the market size obtained by implementing the bottom-up approach has been used in the top-down approach. This has been later confirmed with primary respondents across different geographies.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the size of various market segments.

- The market share of each company has been estimated to verify revenue shares used in the bottom-up approach earlier.

- The sizes of the overall parent and peer markets (Image Sensor market and thermal and IR imaging market) and each individual market have been determined and confirmed in this study with the help of a data triangulation procedure and validation of data through primary interviews.

Global Low Light Imaging Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the low light imaging market size, by technology, application, and vertical, in terms of value and volume

- To describe and forecast the low light imaging market size, in terms of value and volume, with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the low light imaging market

- To provide a detailed overview of the supply chain of the low light imaging market and its ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the low light imaging market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, partnerships, expansions, and collaborations, undertaken in the low light imaging market

Available Customizations

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Additional country level analysis of low light imaging market

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Low Light Imaging Market