Loyalty Management Market by Offering (Solution (Customer Retention, Customer Loyalty, Channel Loyalty), and Services), Operator, Vertical (BFSI, Aviation, Automobile, Media, Retail & Consumer Goods, Hospitality) & Region - Global Forecast to 2029

[275 Pages Report] The loyalty management market size is projected to grow from USD 11.4 billion in 2024 to USD 25.4 billion by 2029 at a CAGR of 17.3% during the forecast period. The rise of subscription-based business models across various industries has fueled demand for loyalty programs tailored to recurring revenue streams. Loyalty management solutions support subscription loyalty initiatives by incentivizing ongoing engagement, reducing churn, and maximizing customer lifetime value.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Loyalty Management Market Dynamics

Driver: Integration of gamification into loyalty programs

With reward-seeking behavior, a competitive spirit, and the innate fear of missing out fueling its popularity, gamification captivates experience-driven customers, fostering prolonged engagement and community-building within loyalty programs. By infusing playful and interactive elements such as challenges, prizes, and competitions, businesses create immersive experiences that resonate with customers, resulting in increased brand interactions and frequent purchases. Gamification not only deepens customer engagement but also cultivates loyalty by incentivizing desirable behaviors and providing a sense of accomplishment through rewards and badges. Consequently, businesses harness the power of gamification to bolster brand loyalty, drive advocacy, and collect vital customer data, thereby propelling growth in the loyalty management market.

Restraint: Stringent government regulations

Regional regulations are affecting loyalty program liability modeling. Various regulations, including the Credit Card Act and the Durbin Amendment of 2010, compel the banking sector to restructure its reward program portfolio. For instance, in January 2018, Ontario's Protecting Rewards Points Act came into force and changed the loyalty program and reward point process in Ontario and Quebec, Canada.

With the implementation of the General Data Protection Regulations (GDPR) in May 2018, it is imperative that companies understand how these regulations affect their business policies. Loyalty management programs are the most effective way of gathering consumer data. The significant factors that affect a company’s loyalty program under GDPR are the definition of personal data, consent, partners, business communication, and information withdrawal. With the threat of major penalties to the revenue of companies in the case of non-compliance, following effective data protection policies is paramount when it comes to compliance.

Opportunity: Surging investments in customer success startup platforms

With significant growth in online shopping, direct-to-consumer startups are continuously looking for creative ways to reward customers by launching new loyalty programs. By investing in customer success early in their lifecycle, startups are broadening their capabilities (not payroll), decrease customer churn, and building stronger customer relationships. For instance, in March 2020, Loyalty Prime, a Germany-based enterprise loyalty program Software-as-a-Service (SaaS) platform provider, received EUR 5 million in Series B funding led by Hi Inov with participation from existing investors, and The SaaSgarage (Alexander Bruehl). Loyalty Prime intended to use the funds to develop its enterprise SaaS platform. The increased funding for these startups is leding to the development of more solutions and tools to address customer-related challenges. Investments by such firms are expected to continue shortly and are expected to bolster the growth of the loyalty management platforms market.

Challenge: Rapidly changing trends and diverse consumer preferences

Companies face a critical challenge in fostering brand loyalty amidst rapidly changing trends and diverse consumer preferences. Failure to adapt to these dynamics can diminish customer loyalty and market relevance. A key obstacle is the biased approach to business planning, where companies overlook the importance of understanding and catering to evolving consumer needs. Inadequate staff training further exacerbates this challenge, as unprepared employees struggle to meet the expectations of savvy consumers. Recognizing the pivotal role of staff in shaping customer experiences, organizations must prioritize comprehensive training programs to equip employees with the skills and knowledge necessary to deliver exceptional service. Additionally, maintaining consistent engagement with employees is essential in cultivating a workforce that serves as ambassadors for brand loyalty. Overcoming these hurdles demands a proactive approach that prioritizes consumer insights, employee development, and a commitment to delivering exceptional customer experiences.

Ecosystem Of Loyalty Management Market

The channel loyalty solution segment is expected to register the highest CAGR in the loyalty management market during the forecast period.

Channel loyalty refers to the level of dedication and commitment demonstrated by customers toward a specific distribution or sales channel utilized for their purchases. It serves as a vital metric for businesses, indicating the strength of the bond between customers and the chosen distribution channel. Factors influencing channel loyalty may include convenience, brand reputation, quality of customer service, pricing, and the overall shopping experience provided by the channel.

BI WORLDWIDE India a global leader and India’s foremost in providing tech-enabled loyalty and engagement solutions, effectively manages channel loyalty programs for its dealers, wins prestigious Dragons of Asia Awards 2023, in Kuala Lumpur, Malaysia and has been lauded and recognised for innovative and results-driven loyalty and engagement programs for clients across industries.

The B2B operator segment is expected to hold the largest market size during the forecast.

By implementing B2B loyalty programs, operators can strengthen partnerships, enhance customer retention, and drive sustainable growth within the B2B ecosystem. Due to multiple industry standards, B2B companies have limited product offerings, making B2B loyalty programs a strong differentiator for similarly manufactured and regulated products. Hence, an effective loyalty management solution for B2B operators helps them understand the ideal customer profile and cater to the on-site experience of customer needs. B2B loyalty management solutions can also deliver loyalty programs that speed up the claim’s verification process. For instance, sales reps can upload invoices, receipts, warranty registrations, and others to the loyalty program. This, in turn, will authenticate claims faster, and participants will experience faster rewards.

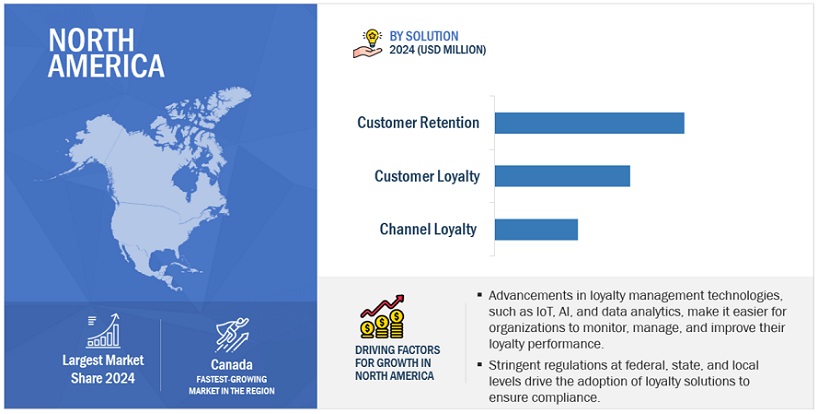

Based on region, North America is expected to hold the second largest market size during the forecast.

North America, encompassing countries like the US and Canada, boasts well-developed infrastructures that fuel a significant demand for loyalty management solutions. Contributions from leading nations such as the US and Canada primarily drive the loyalty management market in North America. These countries' robust economies facilitate substantial investments in cutting-edge technologies, further enhancing their market dominance. The stringent regulatory frameworks upheld by the US and Canadian governments are a crucial catalyst for the loyalty management market's growth. Furthermore, these nations have integrated cutting-edge technologies such as machine learning (ML) and artificial intelligence (AI), contributing to the proficiency of organizations within their economies in the loyalty management sphere. This region boasts the highest uptake of loyalty management solutions, attributed to technological innovations and the prevalence of diverse retailers offering a broad spectrum of loyalty programs. Loyalty management serves as a strategic framework enterprises employ to entice and sustain customer loyalty, thereby augmenting the company's or organization's overall value proposition and fostering enduring, mutually beneficial relationships between customers and businesses. Some major loyalty management companies, such as Oracle, ICF International Inc., Epsilon, Bond Brand Loyalty, Kobie Marketing, and Maritz Motivation, are headquartered in North America.

Market Players:

The major vendors in this market include Epsilon (US), Oracle (US), Comarch (Poland), ICF Next (US), Bond Brand Loyalty (Canada), Merkle (US), Capillary (Singapore), Jakala (Italy), Kobie (US), Giift Management (Singapore). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the loyalty management market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering, Solution, Services, Operator, Vertical and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

The major players in the loyalty management market are Epsilon (US), Oracle (US), Comarch (Poland), ICF Next (US), Bond Brand Loyalty (Canada), Merkle (US), Capillary (Singapore), Jakala (Italy), Kobie (US), Giift Management (Singapore), Maritz Motivation (US), Cheetah Digital (US), Collinson (UK), Loyalty One (Canada), Punchh (US), Ebbo (US), Preferred Patron (US), Loopy Loyalty (China), Paystone (UK), LoyLogic (Switzerland), Ascenda (Singapore), Loyalty Juggernaut (US), Gratifii (Australia), SAP SE (Germany), Annex Cloud (US), Apex Loyalty (US), Sumup (UK), Kangaroo (Canada), Smile.io (Canada), SessionM (US), LoyaltyLion (UK), Yotpo (US), SailPlay (US), and Zinrelo (US). |

This research report categorizes the loyalty management market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solution

- Services

Based on Solution:

- Health Safety Management

-

Customer Retention

- Subscription Management Software

- Campaign Management Tools

- Predictive Analytics Platforms

- Customer Engagement Platforms (CEPS)

-

Customer Loyalty

- Tiered Loyalty Program Management

- Loyalty Program Management

- Personalized Reward Engines

-

Channel Loyalty

- Omnichannel Loyalty Management Platforms

- Mobile App Development Tools

- Partner Relationship Management (PRM) Tools

- Point-Of-Sale (POS) Integration

Based on Operator:

- Business-to-Business

- Business-to-Customer

Based on Vertical:

- BFSI

- Aviation

- Automotive

- Media & Entertainment

- Retail & Consumer Goods

- Hospitality

- Telecom

- Healthcare

- Oil & Gas

- Other Vertical

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordic

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2024, Epsilon launched the next generation of its retail media platform. Epsilon Retail Media applied AI and person-first identity in the ad server, unlocking opportunities to drive stronger outcomes with shoppers on retailers’ properties, across the open web or in tandem.

- In May 2023, Bond Brand Loyalty announced a strategic investment in its business from Colorado-based private equity firm, Mountaingate Capital. The announcement followed a substantial period of growth for Bond and reflected the potential for further expansion in both reach and offerings to serve clients better.

- In April 2023, Capillary Technologies acquired Brierley to expand its portfolio.

- In January 2023, Giift acquired a strategic majority interest in InTouch, a loyalty solutions provider based in Indonesia.

Frequently Asked Questions (FAQ):

What is loyalty management?

Loyalty management refers to the strategic process of designing, implementing, and overseeing programs and initiatives aimed at fostering long-term relationships and repeat business with customers. At its core, loyalty management involves understanding customer needs, preferences, and behaviors, and then using this information to develop targeted strategies that incentivize ongoing engagement and loyalty.

What is the market size of the loyalty management market?

The loyalty management market size is projected to grow from USD 11.4 billion in 2024 to USD 25.4 billion by 2029 at a CAGR of 17.3% during the forecast period.

What are the major drivers in the loyalty management market?

The major drivers in the loyalty management market are growing focus on reducing customer churn rates, integration of gamification into loyalty programs, companies strategically investing in loyalty programs amidst recession and inflation, emergence of loyalty management mobile applications, and demand for advanced solutions to monitor customer scores and enhance customer engagement.

Who are the key players operating in the loyalty management market?

The key vendors operating in the loyalty management market include Epsilon (US), Oracle (US), Comarch (Poland), ICF Next (US), Bond Brand Loyalty (Canada), Merkle (US), Capillary (Singapore), Jakala (Italy), Kobie (US), Giift Management (Singapore), Maritz Motivation (US), Cheetah Digital (US), Collinson (UK), Loyalty One (Canada), Punchh (US), Ebbo (US), Preferred Patron (US), Loopy Loyalty (China), Paystone (UK), LoyLogic (Switzerland), Ascenda (Singapore), Loyalty Juggernaut (US), Gratifii (Australia), SAP SE (Germany), Annex Cloud (US), Apex Loyalty (US), Sumup (UK), Kangaroo (Canada), Smile.io (Canada), SessionM (US), LoyaltyLion (UK), Yotpo (US), SailPlay (US), and Zinrelo (US).

What are the opportunities for new market entrants in the loyalty management market?

Newcomers in the loyalty management market have ample opportunities. They can innovate with personalized experiences, advanced analytics, and seamless integration to meet rising demand. Focusing on niche markets like e-commerce or hospitality, or forging partnerships, can help carve a competitive edge. By leveraging emerging tech and strategic alliances, newcomers can swiftly establish themselves in this dynamic landscape. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

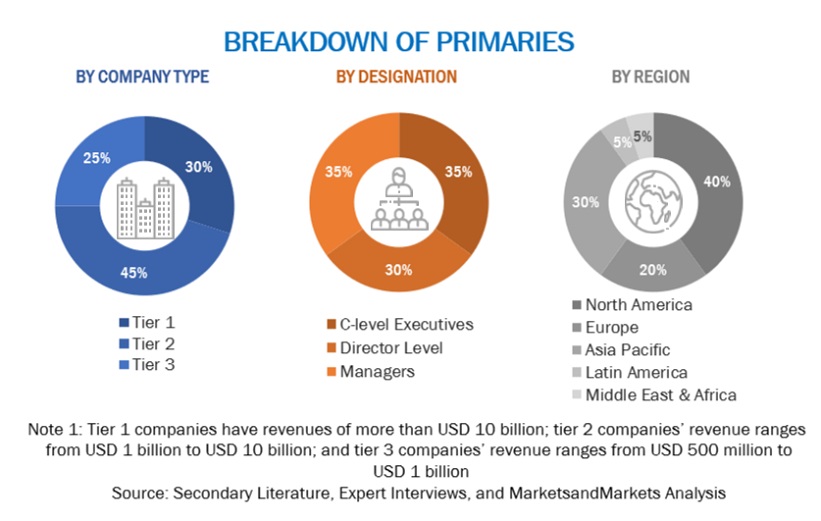

The research study involved four major activities in estimating the loyalty management market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering loyalty management to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Secondary research was used to obtain critical information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the loyalty management market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use loyalty management, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of loyalty management solution and services, which is expected to affect the overall loyalty management market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the loyalty management market, as well as other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the critical market area have been considered.

- Tracking the recent and upcoming developments in the loyalty management market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakdown of the scope of work carried out by major companies.

- Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the loyalty management market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The loyalty management market size has been validated using top-down and bottom-up approaches.

Market Definition

Loyalty management is a software-based solution and sometimes an outsourced service available in the current market space to assist organizations with superior quality customer account management, incentive distribution management, employee recognition, employee performance management, and channel partner management.

Stakeholders

- System Integrators

- Value-added Resellers

- Cloud Service Providers

- Software Developers

- Application Developers

- Customer Loyalty Solution Vendors

- Channel Loyalty Solution Vendors

- Customer Analytics Solution Vendors

- Distributors and Resellers of Loyalty Management Solutions

Report Objectives

- To determine and forecast the global loyalty management market by offering, solution, services, operator, vertical, and region from 2024 to 2029, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the loyalty management market.

- Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall loyalty management market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the loyalty management market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Loyalty Management Market