Managed Services Market by Service Type (Managed Security Service, Managed Network Service, and Managed IT Infrastructure and Data Center Service), Deployment Type (On-premises and Cloud) Vertical and Region - Global Forecast to 2028

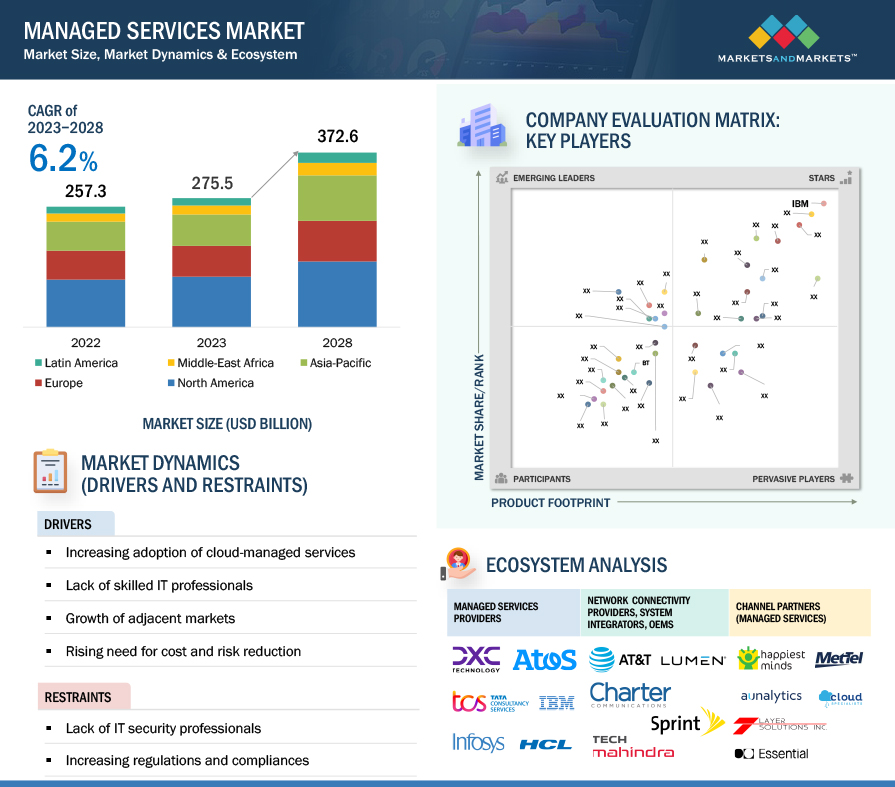

[368 Pages Report] The managed services market size is expected to grow from USD 275.5 billion in 2023 to USD 372.6 billion by 2028 at a compound annual growth rate (CAGR) of 6.2% during the forecast period. The future of the managed services market is poised for continued expansion and evolution. With technology becoming increasingly intricate and businesses focusing on agility, the demand for specialized external support will persist. Cloud computing, cybersecurity, data management, and remote work solutions are expected to dominate the market as organizations seek scalable and secure services. As artificial intelligence and automation advance, MSPs are likely to integrate these technologies to enhance service efficiency. The growing reliance on IoT devices drives demand for managed IoT services, ensuring seamless management and security. Hybrid work models require robust remote workforce support, fueling the need for managed services. As the market matures, competition will intensify, leading to innovation in service offerings, pricing models, and customization. The future of managed services lies in the convergence of cutting-edge technology, adaptable solutions, and strategic partnerships, enabling businesses to streamline operations, enhance cybersecurity, and navigate the complexities of the digital age.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Managed Services Market Dynamics

Driver: Increasing adoption of cloud-managed services contributes to market growth

The increasing adoption of cloud-managed services will fuel substantial growth in the managed services market. As businesses increasingly shift their IT infrastructure to cloud-based solutions, they encounter complexities in managing and optimizing these environments effectively. Increased adoption of cloud services presents a prime opportunity for managed service providers (MSPs) to step in and offer their specialized expertise. Managed service providers can provide diverse services, including cloud migration support, ongoing infrastructure management, security and compliance measures, performance monitoring, and cost optimization. Outsourcing these tasks to MSPs allows organizations to focus on their core business functions, leverage advanced technologies, and achieve greater operational efficiency.

Moreover, as the cloud computing landscape evolves, businesses seek customized and scalable solutions tailored to their needs. MSPs can cater to these demands, delivering flexible services that adapt to dynamic business requirements. This level of personalized support further drives the demand for managed services. With the growing importance of data security and compliance, businesses rely on MSPs to implement robust security measures and ensure data integrity within their cloud environments. As cloud-managed services become increasingly vital for companies, the managed services market will witness significant expansion, presenting new opportunities for providers to innovate and deliver value-added solutions to their clients.

Restraint: Lack of IT security professionals may inhibit market growth

The lack of IT security professionals significantly restraints the growth of the managed services market. As the digital landscape expands and cyber threats become more sophisticated, businesses are increasingly concerned about safeguarding sensitive data and systems. However, the shortage of skilled IT security experts hampers organizations’ ability to effectively manage and protect their infrastructure. This talent shortage makes it challenging for managed service providers (MSPs) to offer comprehensive cybersecurity solutions to their clients. The demand for MSPs with specialized expertise in security services surpasses the available supply, resulting in limited capabilities to address the evolving threat landscape adequately.

Moreover, as businesses recognize the importance of data privacy and compliance with industry regulations, the need for robust security services becomes even more critical. The lack of qualified IT security professionals inhibits MSPs from delivering the security assurance required by clients, potentially making businesses hesitant to outsource their IT security to third-party providers. Overall, the scarcity of IT security professionals creates a significant challenge for MSPs and can restrain the managed services market’s growth, especially in cybersecurity offerings.

Opportunity: Changing work environments

The changing work environment presents significant opportunities for the managed services market. With the rise of remote work and distributed teams, businesses increasingly require flexible and scalable IT solutions. Managed service providers (MSPs) can cater to this demand by offering cloud-based services, collaboration tools, and secure remote access solutions. As organizations adapt to hybrid work models, MSPs can efficiently provide specialized support to manage diverse IT environments. They offer endpoint security, network monitoring, and data management services to ensure seamless operations regardless of employees’ locations. The changing work landscape also demands enhanced cybersecurity measures to protect sensitive data from potential breaches. MSPs can deliver robust security solutions and regular vulnerability assessments to safeguard businesses against evolving threats.

The need for continuous technical support and 24/7 monitoring also creates opportunities for MSPs to offer round-the-clock services, ensuring uninterrupted business operations. Overall, the evolving work environment opens doors for MSPs to provide tailored solutions that address the specific challenges and opportunities arising from remote and hybrid work arrangements, contributing to the growth and expansion of the managed services market.

Challenge: Increased competition can lead to pricing pressures

Increasing competition in the managed services market presents various challenges. While the growing number of providers can lead to pricing pressures and a need for differentiation, it also stimulates innovation and improved service offerings. As providers strive to stand out in a crowded market, they are driven to develop unique solutions, cater to specific industries, and enhance customer experiences. The competitive landscape encourages MSPs to invest in research and development, staying at the forefront of technological advancements. Increased R&D fosters the creation of cutting-edge services and drives the adoption of new technologies among businesses.

Moreover, competition compels MSPs to focus on building strong client relationships, offering customized solutions that align with individual business needs. Enhanced customer support, proactive monitoring, and personalized attention are critical in gaining a competitive edge. In the face of increasing competition, MSPs can leverage collaboration and strategic partnerships to expand service portfolios and access a broader customer base. Organic and inorganic strategies adopted by vendors bolster their position in the market and enable them to offer comprehensive, end-to-end solutions, tapping into new growth opportunities. While increasing competition poses challenges, it catalyzes positive change, driving innovation, specialization, and improved customer-centric offerings in the managed services market.

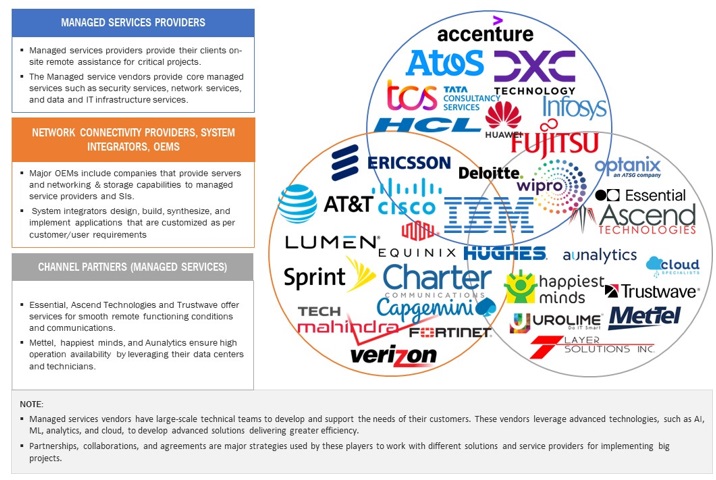

Managed Services Market Ecosystem

Prominent companies in this market are responsible for delivering managed services to end users via various deployment models. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), and Cisco (US). The section highlights the market’s key players, including connectivity providers, OEMs, solutions providers, services providers and consultants, integrators, and MSPs. The chapter describes the companies offering services and solutions in the managed services market, the latest company developments related to the recession, and MarketsandMarkets’ analysis of these vendors. It further highlights the unique differentiation points of each company and its expertise in the market.

Based on vertical, BFSI vertical is expected to hold the largest market share during the forecast period.

Based on the vertical, the managed services market is segmented into BFSI, IT & telecom, manufacturing, retail & consumer goods, healthcare & life science, energy & utilities, government, media & entertainment, and other verticals. Among the verticals, the BFSI segment is expected to hold the largest market share during the forecast period. Managed services play a crucial role in the banking, financial services, and insurance (BFSI) industry by offering specialized outsourced support and expertise to address the industry’s unique challenges and needs. In a rapidly evolving landscape marked by stringent regulations, complex technological advancements, and growing customer expectations, managed services enhance operational efficiency, security, and customer experience.

The managed services enable financial institutions to offload non-core functions such as IT infrastructure management, cybersecurity, data analytics, and compliance to experienced third-party providers. Managed services allow BFSI companies to focus on their core competencies, such as delivering financial products and services, while benefiting from specialized expertise in areas crucial for maintaining operational resilience.

The BFSI sector faces numerous cybersecurity threats due to the sensitive nature of financial data. Managed security services offer proactive monitoring, threat detection, and incident response, minimizing the risk of breaches and ensuring regulatory compliance, such as GDPR or HIPAA. Furthermore, managed services help streamline IT operations by providing round-the-clock support, system maintenance, and updates. Additionally, managed services aid in adopting emerging technologies such as artificial intelligence, machine learning, and blockchain, which can enhance customer engagement, risk assessment, and fraud prevention. For the BFSI industry, customer experience is paramount. Managed services can assist in developing and maintaining user-friendly digital platforms, ensuring smooth transactions, quick query resolutions, and personalized financial advice.

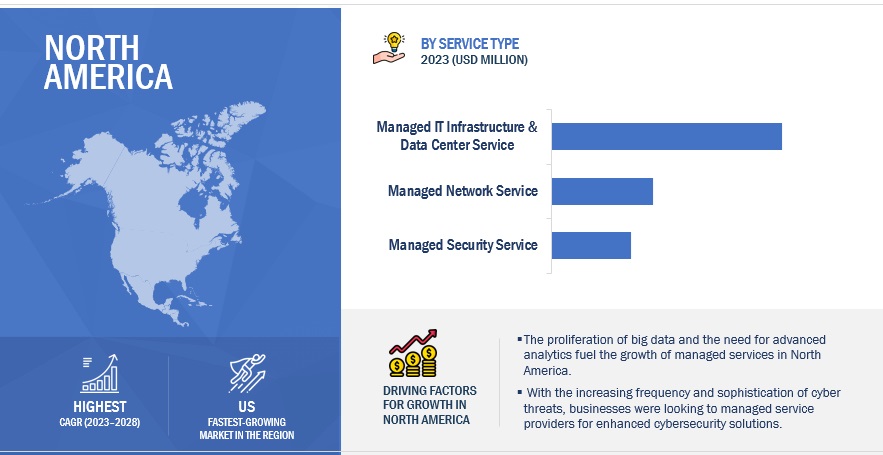

The US market is projected to contribute the largest share of the managed services market in North America.

North America is expected to lead the managed services market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the managed services market, and the trend is expected to continue until 2028. Managed services play a significant role in the United States, offering valuable support and solutions to businesses of all sizes and industries. Companies can streamline their processes, reduce costs, and focus on their core competencies by outsourcing their IT management and operations to specialized service providers. One prominent example of managed services in the US is the healthcare sector. Managing IT infrastructure and complying with stringent regulations in the healthcare industry can be highly complex and resource-intensive. Many healthcare providers and organizations have turned to managed service providers (MSPs) to handle critical IT tasks effectively. MSPs in this domain offer various services, including electronic health record (EHR) management, data backup and recovery, cybersecurity, and compliance support.

Key Market Players

The managed services market is dominated by a few globally established players such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), and Verizon (US) among others, are the key vendors that secured managed services contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the managed services market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Service Types, Managed Security Service, Managed Network Service, Managed IT Infrastructure and Data Center Service, Managed Communication and Collaboration Service, Managed Mobility Service, Managed Information Service, Verticals, Deployment Types, And Regions |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the significant managed services market vendors are IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericsson (Sweden), and GTT Communications (US)NTT Communications (Japan), and Digital Reality (US) |

This research report categorizes the managed services market based on service types: managed security service, network service, IT infrastructure and data center service, communication and collaboration service, mobility service, information service, verticals, deployment types, and regions.

Based on the Service Type:

- Managed Security Service

- Managed Network Service

- Managed IT Infrastructure & Data Center Service

- Managed Communication & Collaboration Service

- Managed Mobility Service

- Managed Information Service

Based on the Managed Security Service:

- Managed Identify & Access Management

- Managed Antivirus/Antimalware

- Managed Firewall

- Managed Risk And Compliance Management

- Managed Vulnerability Management

- Managed Security Information & Event Management

- Managed Intrusion Detection Systems/ Intrusion Prevention Systems

- Managed Unified Threat Management

- Managed Encryption

- Other Managed Security Services

Based on the Managed Network Service:

- Managed LAN

- Managed Wi-Fi

- Managed VPN

- Managed WAN

- network monitoring

- Other Managed Network Security

Based on the Managed IT Infrastructure & Data Center Service:

- Managed Print Services

- Server Management

- Storage Management

- Other Managed IT Infrastructure & Data Center Services

Based on the Managed Communication & Collaboration Service:

- Managed VoIP

- Managed UCaaS,

- Other Managed Communication & Collaboration Services

Based on the Managed Mobility Service:

- Device Life Cycle Management

- Application Management

Based on the Managed Information Service:

- Business Process Management

- Managed Operational Support Systems/ Business Support Systems

Based on the Deployment Type:

- On-premises

- Cloud

Based on the Vertical:

- BFSI

- IT & telecom

- Manufacturing

- Retail & Consumer Goods

- Healthcare & Life Science

- Energy & Utilities

- Government

- Media & Entertainment

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2023, Fujitsu launched Managed Security Services (MSS), a suite of security solutions that help organizations protect their data, systems, and applications from cyber threats. Fujitsu’s MSS can help organizations detect and respond to cyber threats in real-time. MSS includes using a combination of security tools and human expertise to identify and investigate threats and take appropriate action to mitigate them. Fujitsu’s MSS can help organizations monitor their security environment 24/7. MSS also includes monitoring for suspicious activity and compliance with security regulations.

- In March 2022, IBM launched Unified Key Orchestrator, an innovative multi-cloud solution, as a part of IBM Cloud Hyper Protect Crypto Services, which are offered as managed services.

- In June 2021, with Cisco, AT&T Business introduced Webex Calling with AT&T – Enterprise to Cisco’s Unified Communications Manager – Cloud (UCMC), helping businesses optimize operations and accelerate digital transformation in nearly any environment.

Frequently Asked Questions (FAQ):

What are managed services?

According to IBM, managed IT services are computer-based processes outsourced to a third-party contractor. The Contractor, or the Managed Services Provider (MSP), is responsible for providing IT services and equipment. The company pays a set fee for these services. It is an alternative to the break/fix or on-demand outsourcing arrangements where a contractor only provides services when specifically requested by the company.

According to Capgemini, managed service is a practice of delivering services and continuously taking full responsibility for the regular management, maintenance, and support of IT functions and processes. It is an alternative to on-demand outsourcing models like projects, where the service provider performs on-demand services and bills the customer only for the work done.

How many MSPs are there in US?

Around 40,000 MSPs are there in US.

Who are vital clients adopting managed services?

Key clients adopting the managed services market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

Which are the key vendors exploring managed services?

Some of the significant managed services vendors are IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericsson (Sweden), and GTT Communications (US).

What is the total CAGR expected to be recorded for the managed services market from 2023 to 2028?

The market is expected to record a CAGR of 6.2% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

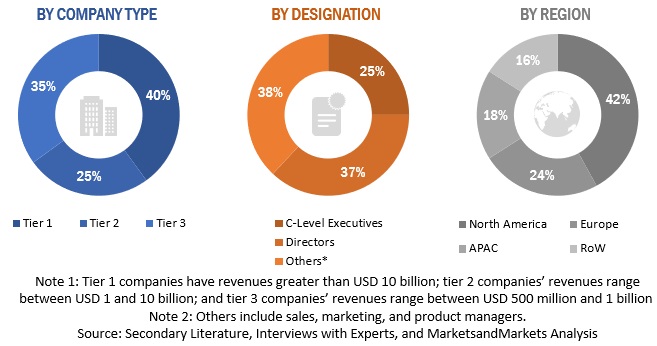

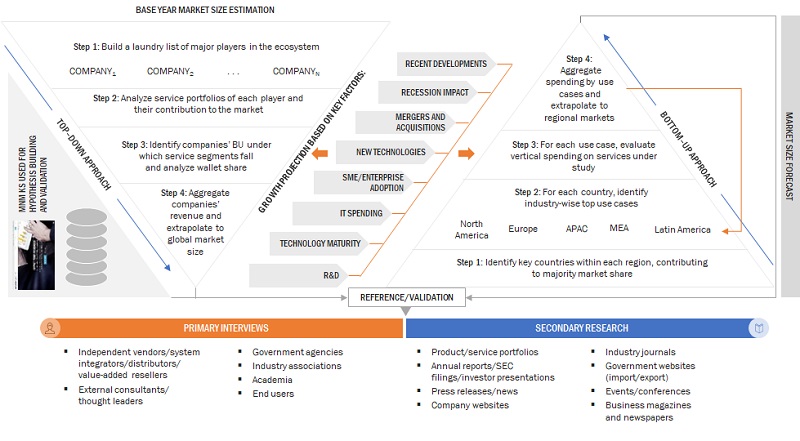

This research study involved extensive secondary sources, directories, and paid databases to identify and collect information useful for this technical, market-oriented, and commercial study of the managed services market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology in developing this report on the managed services market.

Secondary Research

The market size of companies offering managed services was derived based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from managed services vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, service type, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using managed services, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall managed services market.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

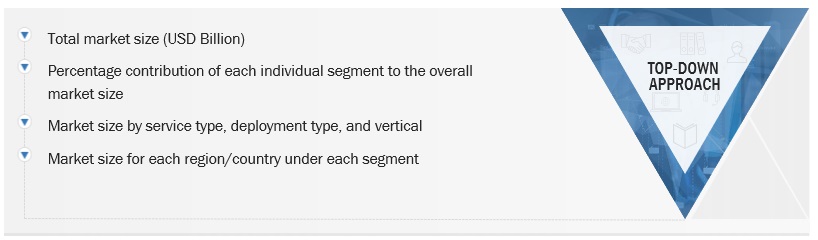

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the managed services market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of Managed Services Market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the managed services market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of Managed Services Market

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The data was triangulated by studying various factors and trends from government agencies’ demand and supply sides.

Market Definition

Managed services refer to outsourcing specific business functions or processes to third-party providers, known as Managed Services Providers (MSPs). These providers assume responsibility for the outsourced services’ ongoing management, monitoring, and optimization. Managed services cover many areas, including IT infrastructure management, cybersecurity, cloud computing, network monitoring, data storage, help desk support, and more. The primary goal of managed services is to allow organizations to offload non-core activities and focus on their core competencies while leveraging the expertise of specialized external partners. This model provides businesses access to skilled professionals, advanced technologies, and industry best practices without significant investment in personnel, infrastructure, and training. Managed services are typically offered on a subscription or contractual basis, providing businesses with predictable costs and scalable solutions that adapt to changing needs and technological advancements.

Key Stakeholders

- Global managed services providers

- Cloud Service Providers (CSPs)

- Independent Software Vendors (ISVs)

- System integrators

- Value-Added Resellers (VARs)

- Managed Service Providers (MSPs)

- Chief Financial Officers (CFOs)

- Information Technology (IT) directors

- Small and Medium-sized Enterprises (SMEs)

- IT strategy consultants

- Managed services consulting vendors

- Technology partners

- Research organizations

- Enterprise users

- Technology providers

Report Objectives

- To define, describe, and forecast the managed services market based on service types: managed security service, network service, IT infrastructure and data center service, communication and collaboration service, mobility service, information service, verticals, deployment types, and regions.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for prominent players

- To comprehensively analyze the core competencies of key players

- To track and analyze the impact of the recession and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the managed services market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Services Market

Interested in managed services market

Interested in IT area of MSP market

Market size of IT managed services market

Market growth of managed security services in Latin America and Colombia

Interested in MSP market

Understanding the market forecasts in USA in MSP domain

Interested in managed services market

Market sizing and growth in different segments for IMS

Understanding the market growth and dynamics of managed services market

Interested in managed services market

Understanding the market trends in MSP market

Understanding of the managed services and their technologies

Interested in market size and growth in managed services market

Interested in healthcare area of managed services market

Interested in Managed Security Services, Managed Network Services, Managed IT Infrastructure and Data Center Services

Understanding the IT services forecast

Understanding the various players in tech services market in MSP domain

Interested in Managed Services market in North

Interested in healthcare area of managed services market

Market size and segmentation of managed services market

Interested in managed services market in Russia

Interested in IT area of MSP market

Understanding the market size of managed services market in APAC

Interested in MSP market

Interested in Mananaged services special emphasis on Networking/RMM; Security; Mobility

Understanding the secure managed file transfer market

Market segmentation of managed services market

Interested in MSP market

Interested in MSP market

Interested in managed services market

Interested in market size, growth, segments of Managed Services Market

Interested in healthcare area of managed services market

Understanding the market segmentation of managed market

Market size of managed services in UK

Interested in managed services market

Interested in Managed Services market in Asia

Interested in market sizing and segmentation of Managed Services Market

Market segmentation of managed services market

Interested in reseller/service provider channel market

Understanding the RAN managed services market size

Interested in Security Managed Services and related markets

Market size and segmentation of managed services market

Interested in IT area of MSP market

Interested in food sector in managed services

Market segmentation of managed services market

Interested in managed services market

Interested in managed services market

Understanding the telecom market