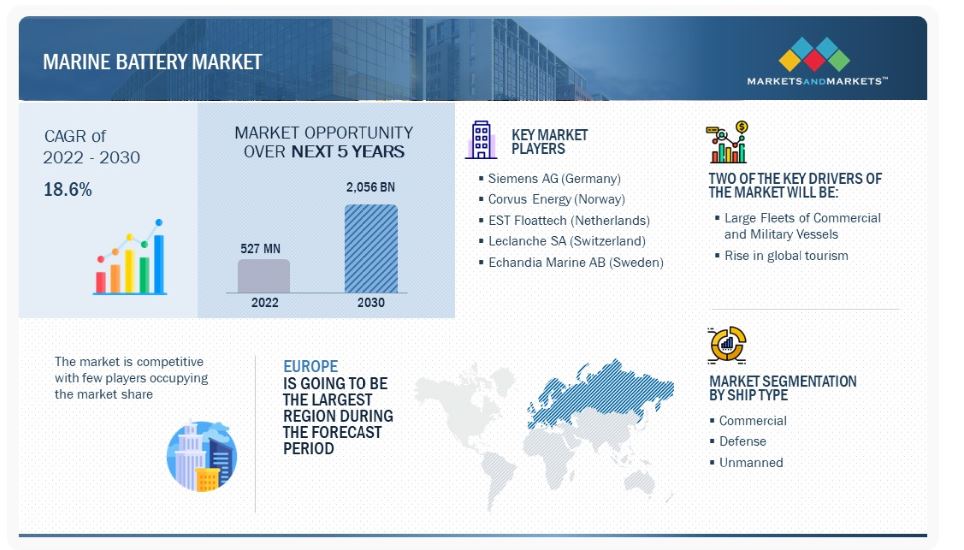

Marine Battery Market by Battery Type (Lithium, Lead Acid, Nickel Cadmium, Sodium Ion, Others), Ship Type, Sales Channel, Battery Function, Nominal Capacity, Propulsion Type, Ship Power, Battery Design, Energy Density and Region - Global Forecast to 2030

The Marine Battery Market size is projected to grow from USD 527 Million in 2022 to USD 2,056 Million by 2030, at a CAGR of 18.6% from 2022 to 2030. The key factor driving the growth of the worldwide Marine Battery Industry is the increase in global commercial trade and the spike in hybrid and fully-electric marine vessels. Additionally, the demand for advanced marine battery onboard vessels with higher specific energy density and low operational costs is driving the adoption of marine battery that can meet the requirements of sustainable marine transportation, while providing quick and hazard-proof rechargeable battery systems.

Marine Battery Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Battery Market Dynamics

Driver:Implementation of sulfur 2020 rule

As per the International Maritime Organization’s (IMO) MARPOL convention for preventing pollution from ships, the sulfur content in the fuel used by ships needs to be reduced from 3.5% to 0.5% from January 2020. This rule was in response to the increased environmental and health-related concerns raised by various governments and environmental organizations globally. In adherence to this rule, ship operators need to install exhaust cleaning systems or scrubbers on ships that clean emissions before they are released into the atmosphere. They also need to switch from high-sulfur fuel oil (HSFO) to very low-sulfur fuel oil (VLSFO) or use LNG-based fuel. The rule has encouraged ship manufacturers to adopt battery-driven hybrid or electric propulsion.

According to an article by Drewry Shipping Consultants Ltd. (UK) in August 2018, the cost of installing a scrubber on a ship varies from USD 2 million to USD 6 million. Very large crude carriers can consume up to 60–70 metric tons of fuel a day. The price difference in switching from HSFO to VLSFO is approximately USD 238.5 higher per metric ton. As of July 2019, 4% of all vessels have been fitted with scrubbers and are ready for operation. Battery-driven propulsion engines could save shipowners from using expensive fuel and installing scrubbers. Electric propulsion systems installed on ships have a huge market potential as they reduce emissions, fuel consumption, along with the overall cost of operations. Depending on the size of vessels and the amount of electrification carried out, operators can reduce annual fuel costs by 3–5% in a hybrid setup and 80–100% in a fully electric setup. On average, maintenance costs can be reduced by up to 50% with an electric propulsion system.

Restraint : Limited range and capacity of fully electric ships

Limited travel distance and capacity are major restraints of fully electric ships. On average, these ships can?travel 80?km on a single?charge.

The Ellen ferry, the largest fully electric passenger vessel operating in Denmark, can undergo a round trip of 22 nautical miles. A huge limitation regarding electric ships is their short range. Hybrid ships can elevate this constraint to an extent by installing diesel generators that can charge the batteries and propel the ship in times of extra power requirement or when the batteries are depleted. However, this does not solve the problem of zero-emission shipping.

The capacity in terms of deadweight tonnage that fully electric ships can carry is also limited. China’s first fully electric cargo ship can travel 80 kilometers and carry 2,200 tons of cargo. A large container ship can carry approximately 200,000 container loads of cargo. The engine itself weighs approximately 2,300 tons. There is a vast gap between the engine capacity of a diesel ship and an electric ship when it comes to the amount of cargo it can haul. It is also challenging to bridge the gap with the current battery technology.

Opportunity: Hybrid propulsion technology for large ships

Currently, hybrid propulsion technology is suitable for small vessels, such as ferries and cruise ships. With the development of marine electric-propulsion technology and alternate fuels, such as fuel cells, manufacturers have a huge opportunity to work on electric propulsion systems for larger ships.

In UK, shipbuilder Ferguson Marine (UK)built the USD 14 million diesel-electric hybrid ferry, the Catriona, for CalMac to use on its Clyde and Hebridean routes. Catriona’s hybrid system works by combining diesel power with electric battery power. A Smarter Journey, a report published by Siemens and Bellona (Norway) in June 2018, gave further weight to the hybrid argument, claiming that around 70% of the 180-strong Norwegian ferry fleet could be converted to a battery or hybrid propulsion, 84% to all-electric, and 43% to some form of hybrid technology. In June 2019, Leclanché SA entered into a partnership with Comau (Italy), a leading player in advanced industrial automation products and solutions, to build the world’s first automated manufacturing lines for lithium-ion battery modules for transport applications. This partnership is expected to help Leclanché SA produce energy storage solutions for e-transport and e-marine applications at an industrial scale. This would help the company secure a position as a key provider of energy storage solutions to the sizeable and fast-growing electric and hybrid mass transport market.

Challenge: Inadequate charging infrastructure

Inadequate charging infrastructure at ports is a major challenge for the marine battery market. It is more challenging for large ships to power their systems or store energy than for small ships. Large ships require several cables to receive a regular power supply. It is neither time-efficient nor effective to connect 15-20 heavy cables, especially for ships that are berthed for a short period of time. Additional infrastructure onshore (port side) and onboard ships are required for vessels. Electrical power available from onshore grids is not adapted to the requirements of vessels in terms of voltage, frequency, and earthing.

Electric vessels would require high-voltage superchargers to ensure an adequate turn-around time. However, superchargers place high demands on local power grids, and most cannot supply such power in the required timeframe. As a result, the initial deployments of fully electric ferries require adequate storage capacity to enable a faster turn-around.

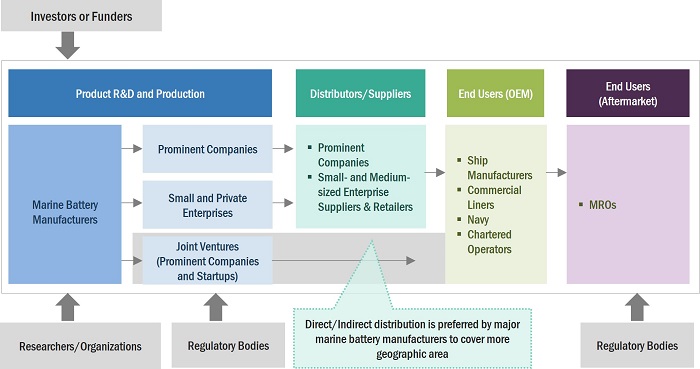

Marine Battery Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Marine Battery. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. The prominent companies are Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France) and Shift Clean Energy (Canada). Commercial Passenger vessel operators, cargo operators, oil tanker operators, private cruise liners, global naval forces, MROs, and chartered operators are some of the leading consumers of Marine Battery.

Commercial Segment to dominate market share during the forecast period

Based on Ship Type, the Marine Battery market has been segmented into commercial, defense and unmanned vessels. One of the primary factors propelling this segment is the increased global tourism. The need to design safe battery systems with high energy capacity, minimum volume, high performance, and improved life is driving this segment.

Fuel-Cells to have the highest CAGR for Marine Battery during the forecast period

Based on Battery Type, the Marine Battery market has been segmented into Lithium, Lead-Acid, Nickel-Cadmium, Sodium-ion, and Fuel-Cells. Hydrogen fuel cell technology is a critical zero-emission propulsion option for a wide range of medium- and heavy-duty applications. According to Ballard (Canada), a major fuel-cell producer, the first fuel cells are already beginning to demonstrate their worth at sea and in ports, already powering several smaller vessels and port handling equipment.

>500 WH/kg segment to witness higher demand during the forecast period

Based on Energy Density, the marine battery market has been classified into < 100WH/Kg, 100-500 WH/Kg and > 500 WH/Kg. Batteries over 500 WH/kg capacity fall in the category of high performance. Lithium-ion, sodium-ion, LFP, and solid-state batteries fall in this category. They are integrated into systems above the capacity of 50 KW/hr. These systems are generally used for propulsion. Lithium-ion batteries have a larger energy density than other systems, sometimes above 500 WH/kg.

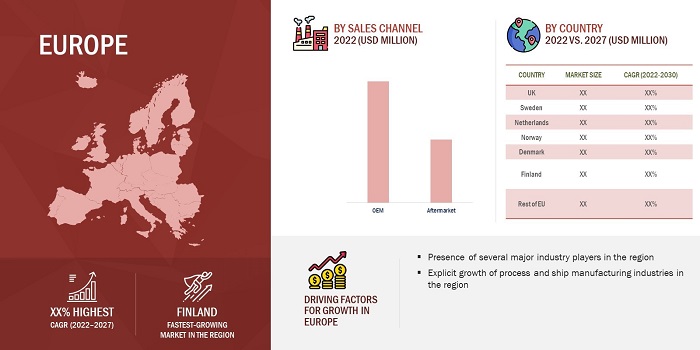

OEM to acquire the largest market share during the forecast period

Based on Sales Channel, the Marine Battery market has been classified into OEM and Aftermarket. The ongoing fleet expansion programs of several end users, such as cargo and freight operators and global naval force, drive the OEM segment of the market. Several inland and sea-faring vessel operators are adopting hybrid and fully-electric propulsion systems that lower their operational costs as well as result in lesser environmental degradation.

Europe is projected to witness the highest market share during the forecast period

Europe leads the marine battery market due presence of big players, OEMs, and component manufacturers which are some of the factors expected to boost the growth of the marine battery market in the region. These players continuously invest in R&D to develop Marine Battery with improved efficiency and reliability. Additionally, the growing demand for higher specific energy and energy density in marine batteries for civil & commercial applications and their increasing utility in the defense sector for carrying out persistent transport and surveillance activities are additional factors influencing the growth of the European Marine Battery market. Key manufacturers and suppliers of Marine Battery in this region include Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France).

Marine Battery Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Marine Battery Companies include Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France), Shift Clean Energy (Canada), Echandia Marine AB (Sweden), and EST Floattech (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Growth Rate |

18.6% |

|

Estimated Market Size in 2022 |

USD 527 Million |

|

Projected Market Size in 2030 |

USD 2,056 Million

|

|

Market size available for years |

2018-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Ship Type, By Battery Function, By Nominal Capacity, By Propulsion Type, By Ship Power, By Battery Design, By Battery Type, By Sales Channel, By Energy Density, By Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Rest of the World |

|

Companies Covered |

Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France), Shift Clean Energy (Canada), Echandia Marine AB (Sweden), EST Floattech (Netherlands), Sensata Technolgies Inc. (US), Powertech Systems (France), Lifeline Batteries (US) amongst others. |

Marine Battery Market Highlights

This research report categorizes the Marine Battery market based on Ship Type, Battery Function, Nominal Capacity, Propulsion Type, Ship Power, Battery Design, Battery Type, Sales Channel, Energy Density, and Region.

|

Aspect |

Details |

|

Marine Battery Market, By Ship Type |

|

|

Marine Battery Market, By Battery Function |

|

|

Marine Battery Market, By Nominal Capacity |

|

|

Marine Battery Market, By Propulsion Type |

|

|

Marine Battery Market, By Ship Power |

|

|

Marine Battery Market, By Battery Design |

|

|

Marine Battery Market, By Battery Type |

|

|

Marine Battery Market, By Sales Channel |

|

|

Marine Battery Market, By Energy Density |

|

|

Marine Battery Market, By Region |

|

Recent Developments

- In January 2023, Leclanché SA was selected as the battery technology provider for two hybrid vessels for Stena RoRo and Brittany Ferries. Each battery system has a capacity of 11.3 MWh. The RoPax (roll-on/roll-off passenger) ferries will be the largest hybrid vessels worldwide.

- In August 2022, Corvus Energy announced an order from Ulstein Power & Control to deliver energy storage systems for two Construction Service Operation Vessels (CSOVs) to be built for Norwegian shipowner Olympic.

- In December 2022, Shift Clean Energy (Shift) announced that it has entered into a Channel Partner Agreement with Billion Electric, a prominent and experienced provider of power electronics and network communication technology, utilizing Shift’s PwrSwäp technology. As a result of this partnership, Billion Electric now has the exclusive rights to distribute energy storage solutions of Shift in Taiwan.

- In August 2021, Spear Power Systems entered into an agreement to be acquired by Sensata Technologies, Inc. Spear Power Systems develops next-generation scalable lithium-ion battery storage systems for demanding land, sea, and air applications. The acquisition of Spear Power Systems advances Sensata’s electrification portfolio and strategy into new clean energy markets.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Marine Battery market?

The Marine Battery market is being driven by end-user fleet modernization initiatives, as well as an expanding order book and the delivery of new-generation marine vessels.

What are the key sustainability strategies adopted by leading players operating in the Marine Battery market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Marine Battery market. The major players include Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France), Shift Clean Energy (Canada), Echandia Marine AB (Sweden), EST Floattech (Netherlands), Sensata Technologies Inc. (US), Furukawa Battery Co. Ltd. (Japan), Lithium Werks (US), Kokam Co. Ltd. (South Korea). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Marine Battery market?

Some of the major emerging technologies and use cases disrupting the market include solid state batteries and fuel-cell technologies, that have relatively higher energy carrying capacities, with enhanced safety and can power vessels for larger maritime distances and operations.

Who are the key players and innovators in the ecosystem of the Marine Battery market?

The key players in the Marine Battery market include Corvus Energy (Norway), Leclanché S.A. (Switzerland), Siemens AG (Germany), Saft SA (France), Shift Clean Energy (Canada), Echandia Marine AB (Sweden), EST Floattech (Netherlands), Sensata Technologies Inc. (US), Furukawa Battery Co. Ltd. (Japan), Lithium Werks (US), Kokam Co. Ltd. (South Korea) to name a few.

Which region is expected to hold the highest market share in the Marine Battery market?

The Marine Battery market in Europe is projected to hold the highest market share during the forecast period due to the presence of several large Marine Battery manufacturers in the region, as well as the presence of major shipyards and inland and sea-faring vessel operators in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

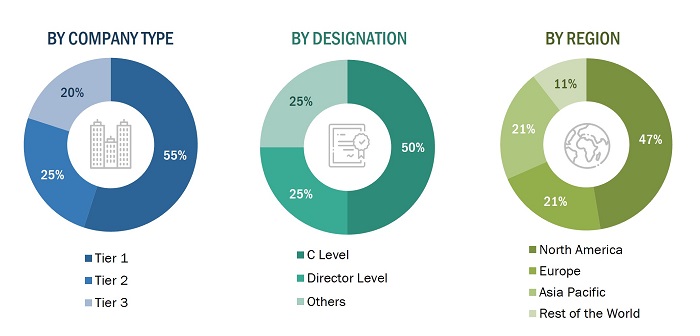

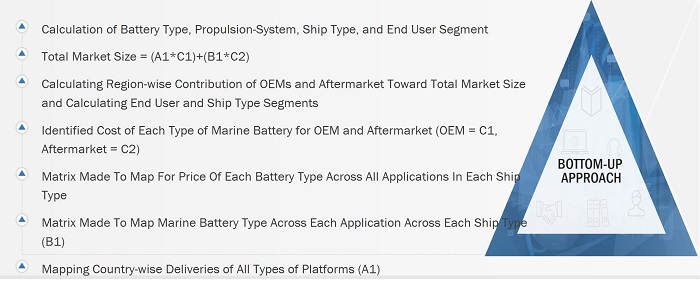

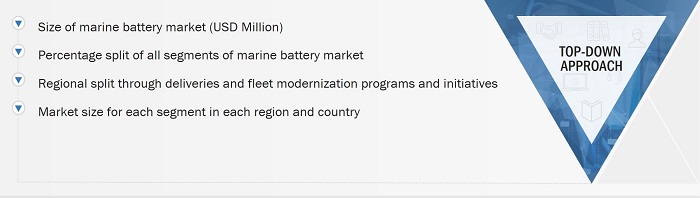

The study involved four major activities in estimating the current market size for the Marine Battery market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Marine Battery market comprises several stakeholders, such as raw material providers, Marine Battery manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in battery chemistries and safe battery systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Marine Battery market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the Marine Battery market from the demand for such systems and components by end users in each country, and the average cost of battery systems was multiplied by the new ship deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market Size Estimation Methodology: Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Marine Battery market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Marine Battery market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, and Rest of the World along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

The Impact of Growing Use of Electric Ships on the Marine Battery Market

- Increased demand for high-capacity batteries: Electric ships require high-capacity batteries to provide the energy needed to power the vessel. This demand for high-capacity batteries is likely to drive the growth of the marine battery market, as companies seek to develop and produce batteries that can meet the energy demands of electric ships.

- Advancements in battery technology: The growing demand for marine batteries is likely to drive advancements in battery technology. As companies seek to develop batteries that can meet the energy demands of electric ships, we can expect to see new battery technologies and improvements to existing technologies.

- Development of charging infrastructure: The growing use of electric ships is likely to drive the development of charging infrastructure in ports and other locations where ships dock. This infrastructure will be needed to charge the batteries of electric ships, and it may present new business opportunities for companies in the marine battery market.

- Competition from other energy storage technologies: While marine batteries are likely to play a significant role in the electrification of ships, they may face competition from other energy storage technologies, such as hydrogen fuel cells. Companies in the marine battery market will need to continue to innovate and improve their products to stay competitive in this rapidly evolving market.

Future Growth Opportunities for the Electric Ships Industry

- Increasing environmental regulations: As environmental regulations become more stringent, companies are turning to electric ships as a way to reduce their emissions and comply with regulations. This is likely to drive demand for electric ships in the future, as companies seek to reduce their environmental impact.

- Advancements in battery technology: Advancements in battery technology are likely to make electric ships more efficient and cost-effective. As battery technology improves, we can expect to see electric ships with longer ranges, faster charging times, and reduced operating costs.

- Cost competitiveness: The cost of electric ships is expected to decrease as the industry grows and economies of scale are achieved. This will make electric ships more cost-competitive with traditional fossil fuel-powered vessels and further drive demand for electric ships.

- Expansion of e-commerce and logistics: The expansion of e-commerce and logistics is likely to drive demand for electric ships in the future. Electric ships can be used for cargo transportation and shipping, and their efficiency and low emissions make them an attractive option for companies in these industries.

- Government incentives and funding: Governments around the world are offering incentives and funding to encourage the development and adoption of electric ships. This support is likely to drive growth in the electric ships industry as companies seek to take advantage of these incentives and funding opportunities.

Innovators in Electric Ship Technology

- ABB

- Corvus Energy

- BAE Systems

- Wärtsilä

- MAN Energy Solutions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine Battery Market

Writing my bachelors degree within valuation. The company I am valuing is Corvus Energy, this report would to huge help.