Mass Flow Controller Market by Material Type (Stainless Steel, Exotic Alloys, Bronze, Brass), Flow Rate (Low, Medium, High), Media Type (Gas, Liquid, Vapor), End User Industry (Semiconductor, Chemical, Pharmaceutical), Region – Global Forecast to 2028

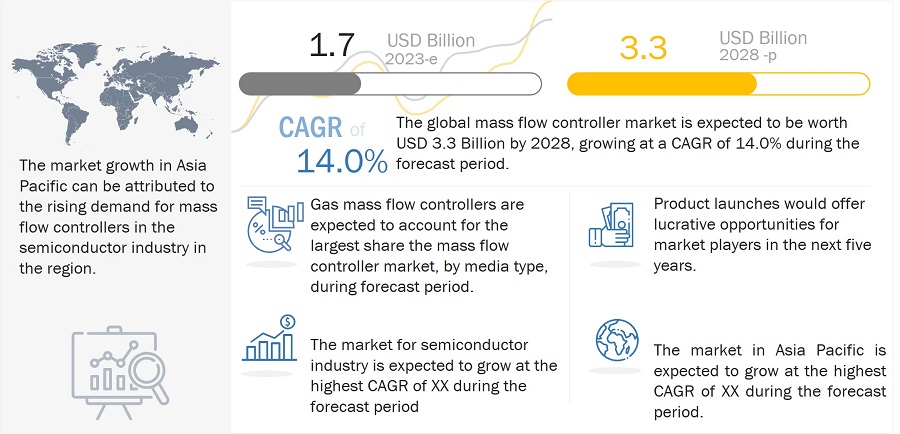

[199 Pages Report] The mass flow controller market size is expected to grow from USD 1.7 billion in 2023 to USD 3.3 billion by 2028, at a CAGR of 14.0%.

The factor which drives growth of mass flow controller is increase in use of mass flow controller in various industries such as semiconductor, medical, etc. The application of mass flow controller in medical devices like ventilation devices. Rapid development in industrial electronics products which tends to growth of mass flow controller industry.

Mass Flow Controller Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing use of mass flow controllers by semiconductor manufacturers

The mass flow controller is an important equipment in semiconductor manufacturing. The quality and efficiency of a mass flow controller play a major role in the success or failure of the semiconductor manufacturing process. Mass flow controllers are used in the semiconductors industry for various applications, such as wafer cleaning, layer deposition, thin film deposition, physical vapor deposition, chemical vapor deposition, vacuum sputtering, plasma coating and etching, surface treatment, thermal spraying and painting, and semiconductor chip making, Mass flow controllers are used to measure and control the flow of gases and liquids used in above-mentioned processes. The semiconductor industry has no substitute for a mass flow controller. Therefore, the constant demand for mass flow controllers in the semiconductor industry drives market growth.

Restraint: High initial cost and physical restraints of mass flow controllers

Mass flow controllers have several advantages and disadvantages. Factors such as pricing, integrated technology, the application for which they are installed, the material of construction, and the principle of operation make them more suitable for some applications and unsuitable for others. For instance, Coriolis mass flow controllers are more expensive than other flow controllers. Also, most Coriolis mass flow controllers have in-line sizes above four inches and have difficulty measuring gas flow due to the gas's low density. Similarly, ultrasonic mass flow controllers have disadvantages, such as errors in measurement due to deposits, and Doppler meters are affected by changes in sound velocity due to temperature, density, and concentration. Thus, the high initial cost and technical constraint of mass flow controllers restrain the growth of this market.

Opportunity: Increasing use of mass flow controllers in space applications

Critical medical fluids in space stations require flow controllers with low flow rates and high accuracy and sustainability in zero-gravity conditions. Mass flow controllers fulfill these requirements and are used in space applications. Industry players manufacturing such niche products have to follow various international standards. As a result, a limited number of industry players manufacture flow controllers for space applications. However, this application can create a huge opportunity for mass flow controller manufacturers owing to lower competition and higher billing rates. Accurate control and measurement of propellant flow to a thruster is one of the most fundamental requirements for operating electric propulsion systems, whether in the laboratory or on a flight spacecraft. Hence, the electric propulsion community must have a common understanding of typical flow control and measurement methods. This is expected to provide ample opportunities for the providers of mass flow controllers.

Challenge: Media dependency in calibration of mass flow controllers

Scheduled calibration is an essential maintenance activity for mass flow controllers. This activity is required to ensure the reliable and efficient functioning of these controllers. The media of mass flow controllers can be nitrogen, oxygen, helium, and many different gases or liquids. Mass flow controllers are calibrated by comparing their measurements against a flow measurement reference. The controller under the test is connected in series with the flow reference device to measure the same flow; later, the flow measurements from both devices, i.e., the reference device and mass flow controller under test, are compared. Such calibration activities incur an additional maintenance cost for mass flow controllers. As these calibrations differ for each gas or liquid, the operating cost of mass flow controllers increases significantly.

Exotic alloy to hold largest market share in year 2022.

Exotic alloy accounted for largest market share in year 2022. A mass flow controller requires enough strength to withstand internal stress generated by containing and controlling the fluid/gas under pressure. Corrosion is a metal breakdown due to an attack by various chemical reactions. Alloys, such as nickel, titanium, and nickel-aluminum-bronze, are used for manufacturing mass flow controllers to achieve desired specifications for different end users.

Low flow rate mass flow controller to exhibit highest market share during the forecast period.

Low flow rate to hold largest market share in year 2022. High precision and stability to drive demand for mass flow controllers with low flow rate. In semiconductor chip manufacturing, it is essential to control the flow of deposition media at a very low flow rate for the doping process. Many companies are investing in its development due to the significant growth of the market for mass flow controllers with low flow rates.

Gas mass flow controller to grow at highest CAGR during the forecast period 2023-2028.

Gas mass flow controllers accounted for the largest market share of in 2022. Gas mass flow controllers are used for applications in laboratory, industrial processes, and hazardous locations. A gas mass flow controller is an instrument used to measure and control the flow of gases. These controllers are built, tested, and calibrated for specific operating conditions.

Pharmaceutical Industry to grow at highest CAGR during the forecast period 2023-2028.

The market for the pharmaceutical industry is expected to grow at the highest CAGR during the forecast period. Advancements in mass flow controller technology have enabled manufacturers in healthcare, medical, and pharmaceutical industries to improve their manufacturing capabilities by maximizing uptime, reducing the overall cost of equipment ownership, and lowering the maintenance cost.

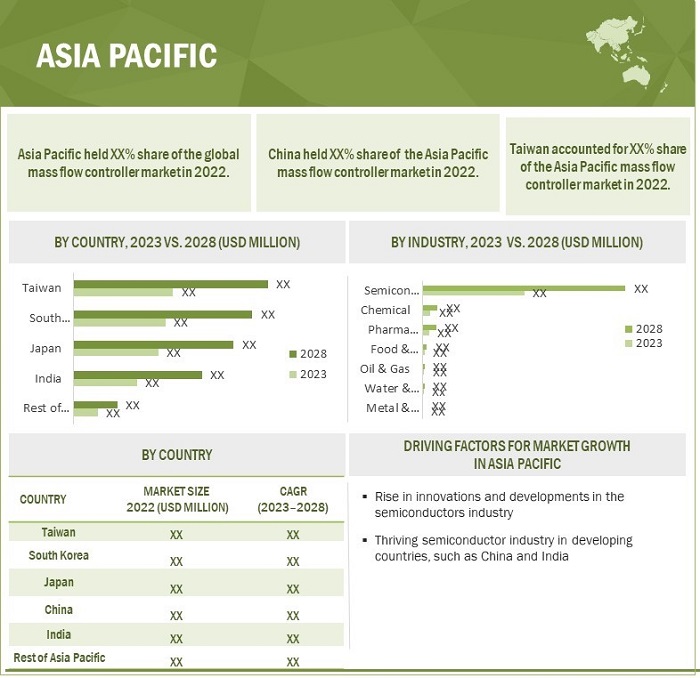

The mass flow controller market in Asia Pacific to grow at highest CAGR during the forecast period

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Due to surging technological advancements in medical and healthcare devices, the market of mass flow controllers is expected to grow in the emerging countries of India, China, and Japan. Mass flow controller manufacturers to exhibit opportunities in Asia Pacific with growing semiconductor industry.

Mass Flow Controller Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The mass flow controller companies such as Brook instrument (US), Bronkhorst (Netherland), Christian Bürkert GmbH & Co. KG (Germany), MKS instrument (US), Sierra Instrument (US), HORIBA, Ltd (Japan), Sensirion AG (Switzerland), Teledyne Hastings Instruments (US), Alicat Scientific (US), and Parker Hannifin (US) are some of the key players of mass flow controller market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for providing market size |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) in million/ billion |

|

Segments covered |

Material type, flow rate, media type and end-user industry |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Brooks Instrument (US), Bronkhorst (Netherland), Christian Bürkert GmbH & Co. KG (Germany), MKS Instruments (US), Sierra Instruments (US), HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), Teledyne Hastings Instruments (US), Alicat Scientific (US), Parker Hannifin Corp (US) are some of the key players in the mass flow controller market. A total of 25 players are covered. |

Mass Flow Controller Market Highlights

The mass flow controller market study has been segmented by material type, flow rate, media type, end-user industry, and region.

|

Aspect |

Details |

|

By Material Type:

|

|

|

By Flow rate: |

|

|

By Media Type: |

|

|

By End-User Industry |

|

|

By Region |

|

Recent Developments

- In February 2022, Sierra Instruments launched a new industrial thermal mass flow meter and controller for biopharmaceutical and food & beverage applications. Engineers in the biopharmaceutical industry require precise control of the gases in bioreactors. Sierra’s RedyIndustrial thermal mass flow meter delivers optimized microbial growth that ensures accurate mixing and distribution of biomass.

- In June 2022, Sensirion AG expanded its product range by adding two mass flow controllers to its SFC5500 series. These mass flow controllers are suitable for analytical, medical, and industrial applications.

- In April 2022, Bronkhorst launched the FLEXI-FLOW series, combining fast and stable chip sensors with reliable and accurate bypass technology. These multifunctional mass flow controllers are designed to measure multiple parameters, including flow and temperature.

Frequently Asked Questions (FAQ):

Which are the major companies in the mass flow controller market? What are their major strategies to strengthen their market presence?

The major companies in the mass flow controller market are – Brook instrument (US), Bronkhorst (Netherland), Christian Bürkert GmbH & Co. KG (Germany), MKS instrument (US), Sierra Instrument (US), HORIBA, Ltd (Japan), Sensirion AG (Switzerland), Teledyne Hastings Instruments (US), Alicat Scientific (US), and Parker Hannifin (US). The major strategies adopted by these players is product launches.

Which is the potential market for mass flow controller in terms of the region?

The Asia Pacific region is expected to grow significantly due to the growing manufacturing activities of various industries, including semiconductors, chemical, etc.

What are the opportunities for new market entrants?

There are moderate opportunities in the mass flow controller market for start-up companies. These companies can provide mass flow controller solutions to rapidly growing energy & power, automotive, and oil & gas industries. However, the presence of established players with broad product portfolios catered to different industries intensifies the market competition.

What are the drivers and opportunities for the mass flow controller market?

Factors such as Emerging applications of mass flow controllers in pharmaceutical and medical devices industries, increasing use of mass flow controllers in space applications to create lucrative opportunities in the mass flow controller market.

Who are the major consumers of mass flow controller that are expected to drive the growth of the market in the next 5 years?

The major consumers for Semiconductor, Chemical, Oil & gas, Food & Beverages, Pharmaceuticals, Metal & Mining and Water & Wastewater are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

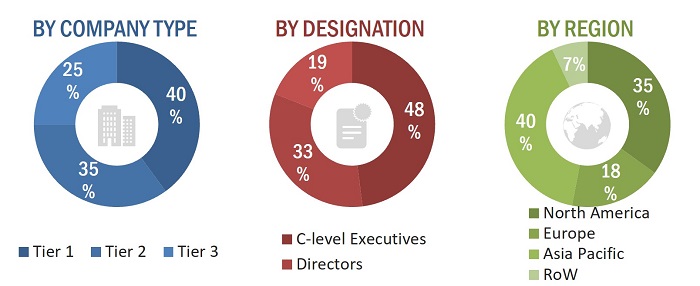

The study involves major activities for estimating the current size of the mass flow controller market. Exhaustive secondary research was carried out to collect information on the market. The next step involves the validation of these findings, assumptions, and sizing with industry experts, identified in the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, mass flow controller-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various industry respondents from both supply and demand sides of the mass flow controller market have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects.

Key players in the mass flow controller market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

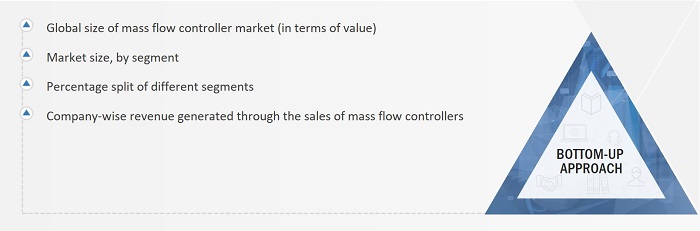

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the mass flow controller market.

- Information related to revenues obtained from key manufacturers and providers of mass flow controllers has been studied and analyzed to estimate the global size of the mass flow controller market.

- The mass flow controller market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

- Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the mass flow controller market, have been studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category of the mass flow controller market have been identified through secondary research and duly verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders (KOLs) of all major companies developing the mass flow controller have been conducted to validate the market split based on material type, flow rate, media type, end-user industry, and region.

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering mass flow controllers in a specific country or region and the type of mass flow controllers offered by these players.

The top-down approach has been used to estimate and validate the total size of the mass flow controller market.

- Information related to revenues obtained from key manufacturers and providers of mass flow controllers has been studied and analyzed to estimate the global size of the mass flow controller market.

- The mass flow controller market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

- Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the mass flow controller market, have been studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category of the mass flow controller market have been identified through secondary research and duly verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders (KOLs) of all major companies developing the mass flow controller have been conducted to validate the market split based on type, sales channel, end-user industry, and region.

- Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering mass flow controllers in a specific country or region and the type of mass flow controllers offered by these players.

Data Triangulation

After arriving at the overall mass flow controller market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the mass flow controller market, in terms of value, by material type, flow rate, media type, end-user industry, and region.

- To forecast the market size, in terms of value, by region—North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding market dynamics, namely, drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To provide a detailed overview of the value chain of the mass flow controller ecosystem

- To analyze probable impact of recession on the market in future

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total mass flow controller market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders.

- To analyze the major growth strategies such as product launches adopted by the key market players to enhance their position in the mass flow controller market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the mass flow controller market report.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mass Flow Controller Market

I want to understand the competitive scenario and market players share for especially for Semiconductor application. Do you have anything related to the same?

My current focus is on MFC for low flow applications. Have you covered it in your report? With which granularity?

Mass flow controller is a pretty big market.

I have more interest to know about the mass flow controller market in North America and its penetration. Kindly provide me same executive summary on the same

Dose this report covers mass flow sensors? As we are interested to know about latest technology in mass flow sensor and major companies in the European market.

our company is open for mass flow controls applications across the industries, hence we would like to know overall industry behavior for MFC. What all is included in this report for mentioned industries?