Mass Notification System Market by Offering (Software, Hardware (Fire Alarm System, Visual Alert Devices, Sirens), Services), Communication, Application (Critical Event Management, Public Safety & Warning), Vertical and Region - Global Forecast to 2029

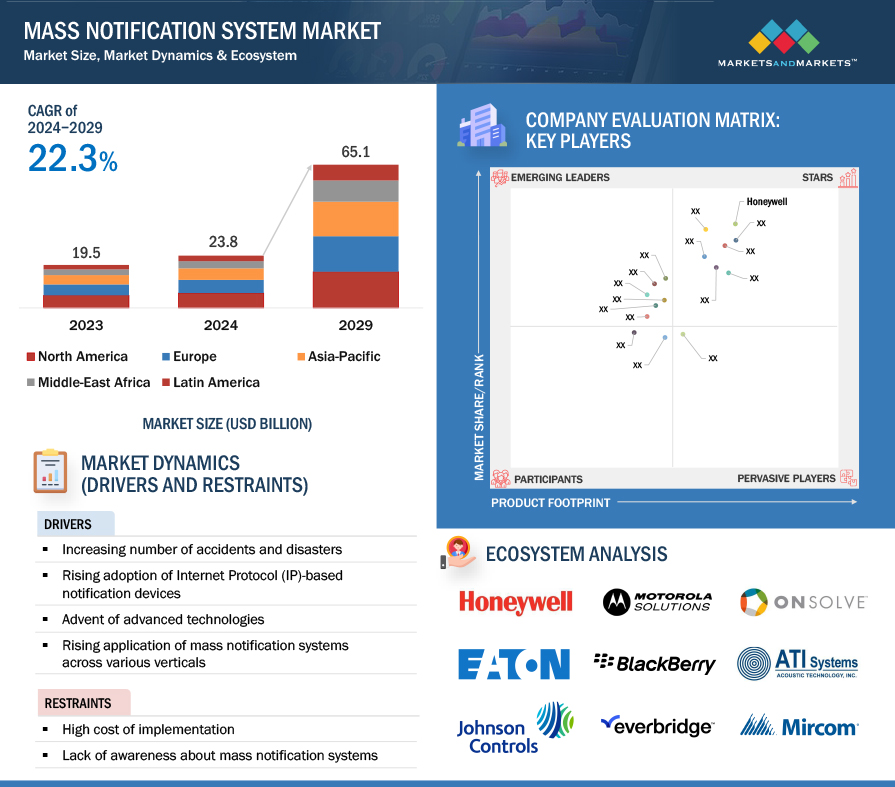

[426 Pages Report] The global market for mass notification system is projected to grow from USD 23.8 billion in 2024 to USD 65.1 billion by 2029, at a CAGR of 22.3% during the forecast period. A mass notification system stands as a sophisticated communication solution that transcends basic alerting mechanisms by leveraging state-of-the-art technology to efficiently inform and direct individuals to safety. It comprises a comprehensive framework encompassing inputs, monitoring capabilities, and outputs tailored to detect hazards, oversee incidents, and provide directives during critical situations. Its application spans from individual facilities to expansive complexes such as corporate campuses, manufacturing plants, or entire urban areas. Addressing a wide array of risks, it mitigates threats ranging from security breaches and workplace incidents to environmental hazards like chemical leaks and natural disasters such as storms and earthquakes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing of technologies such as AI & ML to revolutionize security and emergency response capabilities

The integration of artificial intelligence (AI) and machine learning (ML) technologies within mass notification systems emerges as a pivotal driver propelling market expansion. This integration revolutionizes security and emergency response capabilities, catalyzing organizational development and response efficiency enhancements. By harnessing predictive analytics and recommendation systems, AI and ML empower these platforms to deliver heightened security through diverse inputs for predictive insights and recommendations. Consequently, this integration augments existing emergency notification systems, amplifying their effectiveness and contributing significantly to the burgeoning growth of the mass notification system market.

Restraint: Growing implementation cost associated with the mass notification system

The high implementation costs associated with mass notification systems pose a notable constraint on market expansion, particularly impacting small and medium enterprises (SMEs). Despite their pivotal role in enhancing public safety and communication effectiveness, the considerable initial investment required for setup and integration serves as a significant deterrent for potential buyers. Expenses spanning hardware acquisition to ongoing maintenance further compound this financial challenge, hindering adoption momentum and decision-making timelines. To mitigate this restraint, stakeholders can explore avenues for cost optimization, including the development of budget-friendly solutions and flexible pricing structures. Strategic communication of the value proposition, alongside collaborative partnerships among industry peers and relevant stakeholders, can also facilitate the adoption of these systems. Addressing this business constraint is pivotal for unlocking broader market penetration and ensuring widespread public safety enhancement across sectors.

Opportunity: Growing demand of real time alert system to enhance risk mitigation efforts

The burgeoning need for real-time notification and alert systems is driven by the imperative for swift and accurate information dissemination across diverse industries. In today's hyper-competitive landscape, timely communication is pivotal for informed decision-making and maintaining operational agility. Whether in finance, healthcare, supply chain management, or emergency response, instantaneous alerts facilitate rapid response to critical events, thereby enhancing organizational efficiency and risk mitigation efforts. These systems capitalize on cutting-edge technologies such as artificial intelligence, machine learning, and the Internet of Things to deliver tailored and actionable notifications. As enterprises seek to gain a competitive edge and consumers demand seamless experiences, the demand for robust, scalable, and customizable notification solutions continues to soar. The ability to receive real-time updates empowers businesses to proactively address challenges and capitalize on emerging opportunities in an increasingly interconnected and dynamic market environment.

Challenge: Ensuring the reliability and accuracy of mass notification systems

Ensuring the reliability and accuracy of mass notification systems presents a formidable challenge. Technical hurdles such as network congestion, hardware malfunctions, and software errors can disrupt the seamless dissemination of critical information to a wide audience. Maintaining accuracy adds another layer of complexity, necessitating robust mechanisms to filter out misinformation and ensure the relevance and credibility of notifications. Furthermore, the use of diverse communication channels—ranging from SMS and email to social media platforms introduces additional challenges in maintaining consistency and accuracy across different mediums. Overcoming these obstacles requires rigorous testing, ongoing monitoring, and swift response protocols to mitigate risks and preserve user trust, particularly in high-stakes scenarios such as emergency situations or disaster management. The ability to navigate these challenges effectively is essential for ensuring the effectiveness and reliability of mass notification systems in safeguarding public safety and welfare.

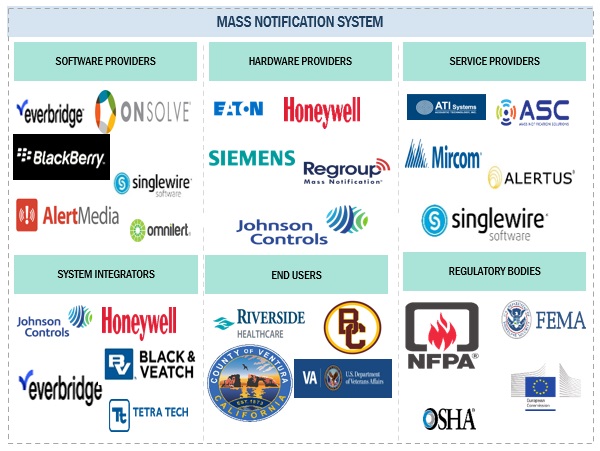

Mass Notification System Market Ecosystem

By application, public safety & warning to account for the largest market size during the forecast period.

In terms of application, the public safety & warning is expected to dominate the market size during the forecast period. The adoption of mass notification systems for public safety & warning represents a significant advancement in enhancing community security. These systems facilitate the rapid dissemination of critical information through various channels such as text messages, emails, and sirens, ensuring comprehensive coverage. Customization of alerts based on specific regions and incident types enhances their relevance and effectiveness. Leveraging advanced AI technology, the system enables precise targeting, thereby contributing to efficient incident management. Users have the ability to personalize their notification preferences, ensuring the receipt of pertinent updates. Real-time monitoring of alerts and responses enhances situational awareness, further strengthening emergency preparedness, streamlining response coordination, and safeguarding communities. With its capability to swiftly reach a large audience and provide crucial insights, the mass notification system emerges as a pivotal asset in contemporary public safety strategies.

Based on channel by communication, by channel to account for the largest market size during the forecast period.

Digital communication has emerged as a pivotal channel within the mass notification system market, revolutionizing how organizations disseminate information. Leveraging email, SMS, social media, and mobile apps, digital platforms ensure swift and widespread message delivery during emergencies or critical events. This real-time capability enhances situational awareness and facilitates rapid response coordination, crucial for safety and crisis management. Furthermore, digital communication offers versatility, allowing tailored messaging to specific groups or individuals, optimizing relevance and engagement. As technology evolves, integrating AI and IoT, digital channels will continue to shape the mass notification landscape, offering seamless, efficient, and scalable communication solutions.

By offering, software to account for the largest market size during the forecast period.

The integration of mass notification system software represents a significant breakthrough in emergency communication protocols. This software fundamentally reshapes the process of generating, customizing, and distributing alerts, ensuring swift and precise information dissemination. Its seamless compatibility with diverse communication channels extends the reach of critical messages, while its advanced functionalities, including real-time updates and AI-driven insights, augment responsiveness and decision-making capabilities. Characterized by an intuitive user interface, the software streamlines alert management and accommodates recipient preferences efficiently. This adoption heralds a transformative era in emergency preparedness and response, empowering organizations to swiftly confront threats, emergencies, and crises. As technology progresses, Mass Notification System software emerges as a cornerstone of effective communication, serving as a crucial tool in safeguarding lives and fortifying community resilience.

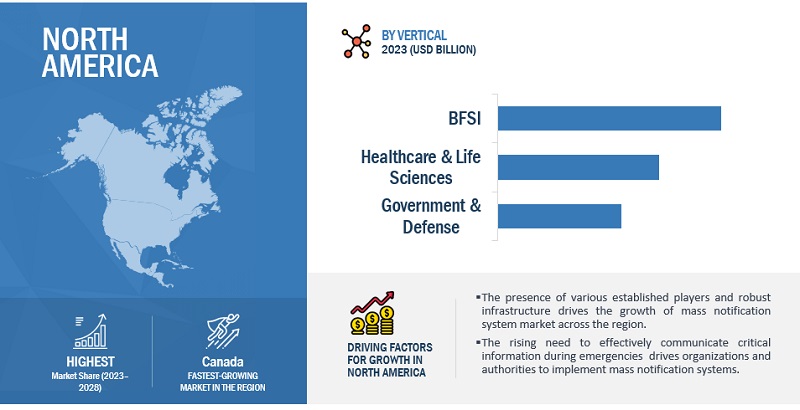

North America to account for the largest market size during the forecast period.

The forecast period anticipates North America to emerge as the largest market for Mass Notification Systems, reflecting a significant evolution in emergency management practices within the region. Propelled by technological advancements, these systems have transitioned from basic alerts to sophisticated networks seamlessly integrating multiple communication channels. Their adoption has surged as businesses recognize their pivotal role in ensuring employee safety, facilitating public outreach, and managing crises effectively. Equipped with features such as real-time updates, AI-driven insights, and tailored targeting, mass notification systems empower organizations to navigate diverse challenges with agility. This growing awareness of their benefits, coupled with their adaptability across various industries, fuels their expansion throughout North America, solidifying their status as indispensable tools for emergency communication and incident management.

Key Market Players

The Mass Notification System vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgrades, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for mass notification system are Siemens AG (Germany), Everbridge (US), Honeywell (US), Eaton (Ireland), Motorola Solutions (US), Blackberry (Canada), Johnson Controls (Ireland), Singlewire Software (US), OnSolve (US), AlertMedia (US), Alertus Technologies (US), F24 (Germany), HipLink (US), American Signal Corporation (US), ATI Systems (US), Finalsite (US), Omnilert (US), Regroup Mass Notification (US), Mircom (Canada), Konexus (US), Netpresenter (Netherlands), Iluminr (US), CrisisGo (US), Omnigo (US), Ruvna (US), Klaxon Technologies (UK), Crises Control (UK), ICEsoft Technologies (Canada), Squadcast (US), Pocketstop (US), Preparis (US), HQE Systems (US), Veoci (US), Text-Em-All (US), and DialMyCalls (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering, Communication Channel, Facility Type Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Siemens AG (Germany), Everbridge (US), Honeywell (US), Eaton (Ireland), Motorola Solutions (US), Blackberry (Canada), Johnson Controls (Ireland), Singlewire Software (US), OnSolve (US), AlertMedia (US), Alertus Technologies (US), F24 (Germany), HipLink (US), American Signal Corporation (US), ATI Systems (US), Finalsite (US), Omnilert (US), Regroup Mass Notification (US), Mircom (Canada), Konexus (US), Netpresenter (Netherlands), Illumina (US), CrisisGo (US), Omnigo (US), Ruvna (US), Klaxon Technologies (UK), Crises Control (UK), ICEsoft Technologies (Canada), Squadcast (US), Pocketstop (US), Preparis (US), HQE Systems (US), Veoci (US), Text-Em-All (US), and DialMyCalls (US) |

This research report categorizes the Mass Notification System market based on Offering, Communication, Application, Vertical, and Region.

By Offering:

-

Software

-

By Type

- In-building

- Wide Area Notification

- Distributed Recipient

-

By Integration

- Standalone

- Integrated

-

By Deployment

- On-premises

- Cloud

-

By Type

-

Hardware

- Fire Alarm Systems

- Public Address Systems (Loud-speakers/Speaker Array)

- Duress Buttons

- Electronic Messaging Displays

- Visual Alert Devices

- Sirens

-

Services

-

Professional Services

- Consulting and Planning Services

- Training and Support Services

-

Managed Services

- Managed Alert Creation and Delivery

- 24/7 Monitoring and Response

- Emergency Event Coordination

- Dedicated Emergency Response Teams

- Content Creation and Management

-

Professional Services

By Communication Channel:

-

Text Based Communication

- SMS alerts

- Email notifications

-

Voice Communication

- Phone call alerts

- PA system announcements

-

Digital Communication

- Mobile app notifications

- Desktop alerts

- Audio-Visual alerts

By Facility Type

-

Indoor Facilties

- Office buildings

- Shopping malls

- Others

-

Outdoor Facilities

- Parks

- Open-air venues

- Others

By Application:

-

Critical Event Management

- Incident Response

- Emergency Notification

- Real-Time Visibility

- Event Detection and Monitoring

- Others (incident collaboration, and incident coordination)

-

Public Safety and Warning

- Public Safety Drills and Exercises

- Government and Law Enforcement Updates

- Traffic and Transportation Alerts

- Evacuation Notices

- Public Health Notifications

- Amber Alerts and Missing Person Notifications

- Others (Severe Weather Warnings, Public Infrastructure Alerts)

-

Business Continuity & Disaster Management

- Emergency Response Plans and Workflows

- Business Continuity Activation

- Employee Safety and Accountability

- Supply Chain and Vendor Communication

- Facility and Asset Management

- Customer Communication and Service Updates

- Others (Resource Allocation and Mobilization)

-

Reporting & Analytics

- Recipient Behavior Analysis

- System Performance Analytics

- Emergency Response Analytics

- Others (Risk Assessment and Mitigation)

- Other Applications

By Vertical:

-

BFSI

- Banks

- Financial institutions

- Others

-

Retail & eCommerce

- Retail chains

- E-commerce platforms

- Others

-

Transportation and Logistics

- Airports

- Ports

- Public transportation hubs

- Others

-

Government & Defense

- Emergency services (police, fire, medical)

- Municipalities and local government

- Federal agencies

- Others

-

Healthcare & Life Sciences

- Hospitals and medical facilities

- Healthcare networks

- Others

-

Telecom

- Telecommunication companies

- Data centers

- Others

-

Energy & Utilities

- Power plants

- Oil and gas facilities

- Others

-

Manufacturing

- Factories

- Manufacturing facilities

- Others

- IT/ITeS

-

Media & Entertainment

- Stadiums and arenas

- Theme parks

- Theaters

- Others

-

Education

- K-12 schools

- Colleges and universities

- Educational districts

- Others

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- South Korea

- ANZ

- Japan

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- Israel

- Egypt

- UAE

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Development

- In March 2024, The state of California partnered with Motorola Solutions to strengthen its disaster preparedness and response capabilities. Through this partnership, California will utilize Rave Prepare, a solution provided by Motorola Solutions, to gather additional opt-in information.

- In February 2024, Everbridge announced that it would enter into a definitive agreement to be acquired by Thoma Bravo.

- In July 2023, Johnson Controls to expand OpenBlue digital buildings capabilities through acquisition of workplace management software leader FM:Systems.

- In June 2023, Everbridge announced that the dual-island Caribbean nation of Trinidad and Tobago, has deployed the company’s public alerting software to help keep residents and visitors safe and informed in the event of an emergency.

- In February 2023, Singlewire Software acquired Visitor Aware to bolsters safety and communication solutions by adding visitor and student management capabilities to its InformaCast software, enhancing emergency preparedness and operational efficiency.

Frequently Asked Questions (FAQ):

What constitutes a Mass Notification System?

A mass notification system is a communication platform designed to swiftly disseminate crucial information to a large audience or specific groups. Leveraging diverse channels like text messages, emails, voice calls, and social media, it ensures the rapid delivery of critical alerts, notifications, and emergency messages, thereby bolstering public safety and facilitating information sharing across various contexts.

Which countries are encompassed within the European region?

The report encompasses an analysis of the UK, Germany, France, Spain, and Italy within the European region.

What are the primary sectors embracing Mass Notification System software and services?

Key sectors adopting Mass Notification Systems and services comprise BFSI (Banking, Financial Services, and Insurance), Retail & E-commerce, Transportation and Logistics, Government & Defense, Healthcare & Life Sciences, Telecommunications, Energy & Utilities, Manufacturing, IT/ITeS, Media & Entertainment, Education, and other industries such as mining, travel & hospitality.

What are the main factors driving the growth of the Mass Notification System market?

The primary drivers fostering market growth for Mass Notification Systems include the increased utilization of such systems across various verticals for incident response, the introduction of advanced technologies, the growing adoption of Internet Protocol (IP)-based notification devices, and the rising occurrences of accidents and disasters.

Who are the key vendors in the market for Mass Notification System?

The key vendors in the global Mass Notification System market include Siemens AG (Germany), Everbridge (US), Honeywell (US), Eaton (Ireland), Motorola Solutions (US), Blackberry (Canada), Johnson Controls (Ireland), Singlewire Software (US), OnSolve (US), AlertMedia (US), Alertus Technologies (US), F24 (Germany), HipLink (US), American Signal Corporation (US), ATI Systems (US), Finalsite (US), Omnilert (US), Regroup Mass Notification (US), Mircom (Canada), Konexus (US), Netpresenter (Netherlands), Iluminr (US), CrisisGo (US), Omnigo (US), Ruvna (US), Klaxon Technologies (UK), Crises Control (UK), ICEsoft Technologies (Canada), Squadcast (US), Pocketstop (US), Preparis (US), HQE Systems (US), Veoci (US), Text-Em-All (US), and DialMyCalls (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

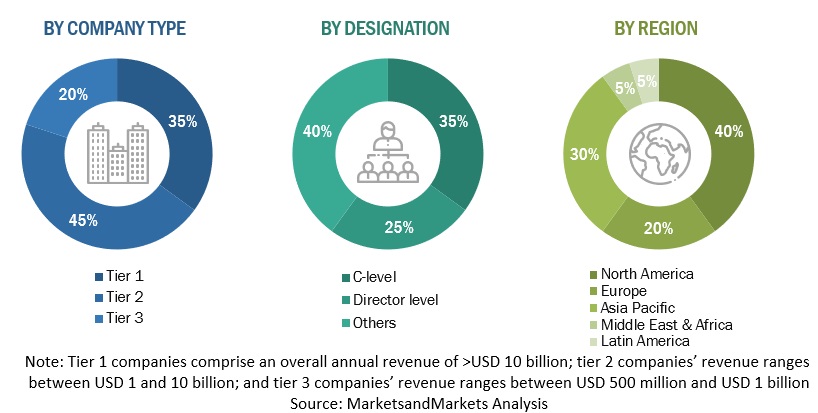

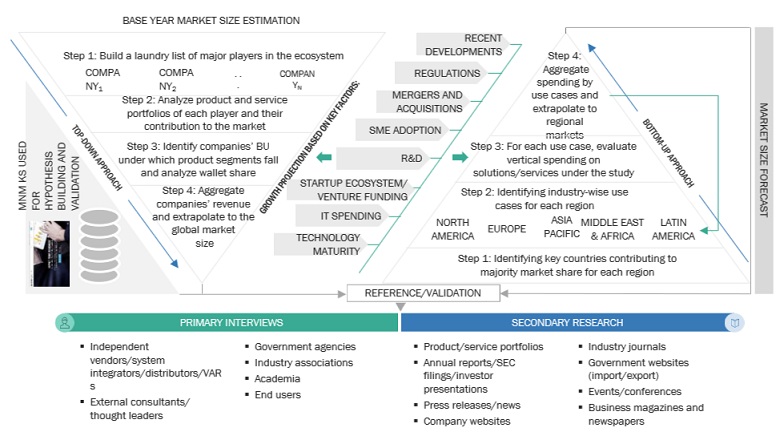

The research methodology for the global Mass Notification System market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering mass notification system offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the mass notification system market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing Mass Notification System offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the mass notification system market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global mass notification system market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering mass notification system. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, cloud types, organization sizes, and verticals. The aggregate of all the companies' revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of mass notification system software, hardware, and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of mass notification system software, hardware, and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Mass Notification System software, hardware, and service based on some of the key use cases. These factors for the mass notification system tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Everbridge, a mass notification system (MNS) is a vital solution that enables prompt and precise delivery of notifications to individuals or groups, irrespective of their location. It serves as a comprehensive platform, swiftly disseminating emergency messages through various communication channels like voice calls, SMS, push notifications, desktop alerts, and social media. By utilizing visual intelligence and user-friendly interfaces, MNS ensures that the right message reaches the intended recipients during critical events, regardless of the devices they use or their physical whereabouts. This system plays a pivotal role in protecting people, securing operations, and safeguarding the reputation of organizations by facilitating timely and accurate communication.

As per Blackberry, mass notification systems (MNS) are primarily focused on enhancing situational awareness. These systems have the capability to send messages through multiple channels simultaneously, aiming to maximize outreach during critical events. One of their key design features is the ability to remain operational even when other communication channels are unavailable or compromised. The main purpose of MNS is to ensure that important messages reach the intended recipients promptly and reliably, enabling organizations to stay informed and respond effectively during emergencies and critical situations.

Key Stakeholders

- Mass notification system vendors

- Mass notification solution vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Distributors and Value-added Resellers (VARs)

- Independent Software Vendors (ISV)

- Cloud Service Providers

- Technology providers

Report Objectives

- To define, describe, and predict the mass notification system market by offering (software, hardware, and services), communication, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall mass notification system market

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the mass notification system market

- To analyze the impact of the recession on the mass notification system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for Mass Notification System

- Further breakup of the European market for Mass Notification System

- Further breakup of the Asia Pacific market for Mass Notification System

- Further breakup of the Latin American market for Mass Notification System

- Further breakup of the Middle East & Africa market for Mass Notification System

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mass Notification System Market