MEA Cloud Computing Market by Offering (Service Model (laaS, PaaS, and SaaS)), Deployment Mode (Public Cloud, Private Cloud, and Hybrid Cloud), Vertical (BFSI, Energy and Utilities, and Manufacturing) and Region - Forecast to 2028

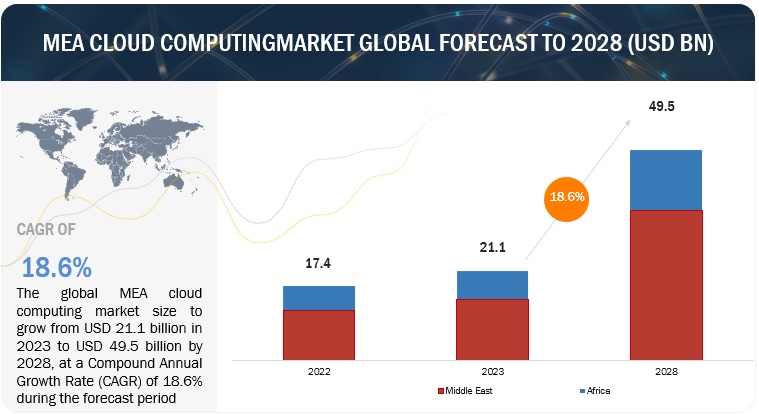

[314 Pages Report] The MEA Cloud Computing Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.6 % during the forecast period, to reach USD 49.5 billion by 2028 from USD 21.1 billion in 2023. Cloud providers were offering advanced AI and machine learning services, making it easier for MEA organizations to leverage these technologies for insights and automation in various industries, including healthcare, finance, and manufacturing.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

MEA Cloud Computing Market Dynamics

Drivers: Growing Demand for Scalability and Flexibility

The increasing demand for scalability and flexibility in IT infrastructure is a key driver in the cloud computing market. Organizations across industries are leveraging cloud solutions to easily scale their computing resources up or down based on demand, optimizing costs and enhancing operational efficiency. This scalability also enables businesses to adapt quickly to changing market conditions, ensuring they can meet customer needs effectively. The MEA cloud computing market is driven by the increasing adoption of digital transformation initiatives across various industries in the region. Organizations are recognizing the need to modernize their IT infrastructure and leverage cloud services to enhance agility, scalability, and cost-efficiency.

Restraints: Security and Data Privacy Concerns

Security and data privacy concerns represent a significant restraint in the cloud computing market. Organizations worry about the safety of their sensitive data when migrating to the cloud, especially given the rising number of cyber threats and data breaches. Compliance with data protection regulations such as GDPR and HIPAA adds complexity and cost to cloud adoption, making it crucial for cloud service providers to continually enhance their security measures.

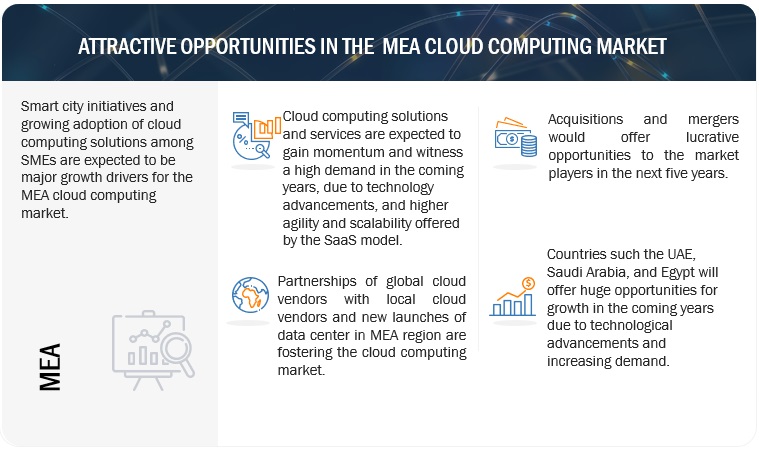

Opportunities: Integration of Emerging Technologies

The cloud computing market presents a significant opportunity in the integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Cloud platforms provide the necessary infrastructure and tools for businesses to harness the potential of these technologies. By leveraging the cloud's computational power and scalability, organizations can process vast amounts of data, extract valuable insights, and automate processes. This integration enhances decision-making, enables the development of innovative products and services, and drives competitive advantage. As businesses recognize the transformative potential of AI, ML, and IoT, cloud providers that offer robust support for these technologies are well-positioned to capture a growing market share.

Challenges: Vendor Lock-In and Interoperability

Vendor lock-in and interoperability challenges represent formidable obstacles in the cloud computing landscape. Once an organization commits to a specific cloud service provider, migrating to another platform can be a complex and costly endeavor. This lock-in can limit an organization's flexibility and bargaining power, potentially leading to higher costs in the long run. Additionally, ensuring seamless integration and data portability across different cloud environments, including public, private, and hybrid clouds, is a complex task. To address this challenge, industry stakeholders must work towards standardization and the adoption of open-source technologies that promote interoperability. Organizations should also carefully evaluate their cloud strategies to minimize vendor lock-in risks and maintain the flexibility to adapt to changing business needs and technology trends.

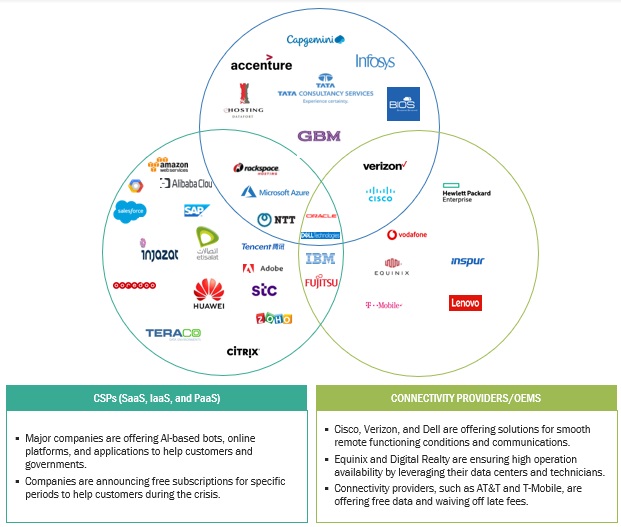

MEA Cloud Computing Market Ecosystem

By IaaS ,Storage and warehouse segment to hold the largest market size during the forecast period

Storage and warehouse services in Infrastructure as a Service (IaaS) cloud computing refer to the scalable and on-demand provisioning of virtualized storage resources and data warehouses in the cloud. IaaS providers offer users the flexibility to store, manage, and retrieve data without the need to invest in physical hardware. These services encompass various storage options, such as block, object, and file storage, as well as data warehousing solutions designed for efficient data analysis and reporting.

By deployment mode , public cloud cloud segment to hold the largest market size during the forecast period

A public cloud in the context of cloud computing refers to a shared IT infrastructure and computing resources provided by a third-party cloud service provider. These resources are accessible to the general public or a wide range of customers via the internet. Public clouds offer advantages such as scalability, flexibility, and cost-efficiency, as they enable organizations to access and pay for computing services as needed, eliminating the need for them to own and manage physical infrastructure. Users can deploy, operate, and oversee applications, storage, and other IT assets within a highly scalable and virtualized environment. This makes public clouds a popular choice for businesses aiming to harness cloud technology for tasks like hosting websites and applications or managing data storage and analysis.

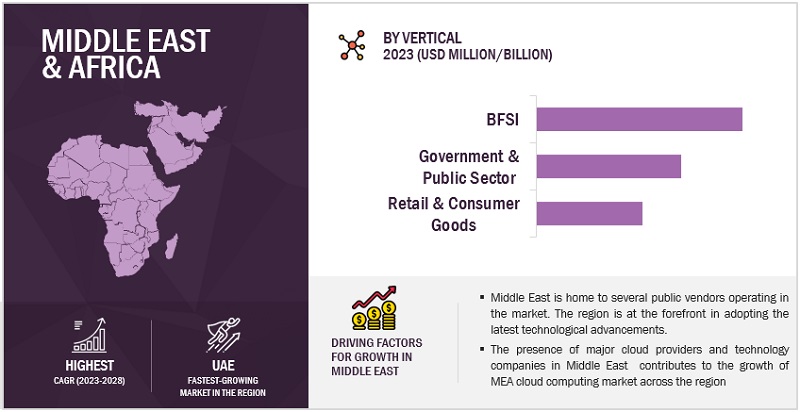

Middle East to grow at the highest CAGR during the forecast period

The Middle East has been experiencing significant growth in the field of cloud computing in recent years. This growth can be attributed to various factors, including increased adoption of digital technologies, government initiatives to promote cloud adoption, and a growing startup ecosystem. Several countries in the Middle East have launched initiatives to promote cloud adoption. For example, the United Arab Emirates (UAE) launched the "UAE Cloud First Policy" to encourage government entities to prioritize cloud solutions. Similarly, Saudi Arabia has its "Cloud-First" strategy, aiming to accelerate the adoption of cloud services across government agencies. Major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have established data centers or availability zones in the Middle East region. These data centers improve the availability and latency of cloud services, making it more attractive for businesses in the region to migrate to the cloud. The Middle East, based on countries such as Saudi Arabia, UAE, Qatar, Israel, Turkey and other countries (Oman, Kuwait, and Bahrain).

Key Market Players

The MEA cloud computing market is dominated by companies such as Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Offering (Service Model), Deployment Model, Verticals, and Region |

|

Regions covered |

Middle East and Africa |

|

Companies covered |

Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE). |

This research report categorizes the MEA cloud computing market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Offering:

-

Service Model

- IaaS

- PaaS

- SaaS

Based on the IaaS application:

- Computation

- Storage and warehousing

- Recovery & backup

- Others

Based on the PaaS application:

- Data management

- Application development & platforms

- Analytics and reporting

- Integration and orchestration

- Application testing and quality

- Others

Based on the SaaS application:

- Customer relationship management

- Enterprise resource management

- Human capital management

- Others content management

- Collaboration and productivity suites

- Supply chain management

- Others

Based on the Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on the vertical:

- BFSI

- Telecommunications

- IT and ITeS

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Other Verticals

Based on regions:

-

Middle East

- Saudi Arabia

- UAE

- Qatar

- Israel

- Turkey

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Egypt

- Nigeria

- Rest of Africa

Recent Developments

- In May 2023, Microsoft announced a suite of new AI solutions and enhancements to Microsoft Cloud for Nonprofit. These advancements are specifically crafted to revolutionize the nonprofit industry, redefining how fundraisers engage with donors, manage campaigns, and optimize operations.

- In May 2023, SAP collaborated with IBM and announced that IBM Watson technology would be embedded into SAP solutions to offer new AI-driven insights and automation. It also helps to fuel innovation and create more efficient and effective user experiences across SAP solution portfolios.

- In September 2022,At Dreamforce, Salesforce introduced Salesforce Customer 360 to provide companies with powerful automation and intelligence technologies to drive efficient growth and deliver personalized customer experiences.

- In September 2022, IBM announced the general availability of IBM LinuxONE Bare Metal Servers. With this new solution, the LinuxONE platform may now be deployed in an off-premises Infrastructure as a Service (IaaS) model while enjoying all the advantages, including core consolidation, resultant software license savings, and decreased energy consumption to support sustainability goals.

- In September 2022, A new feature from Google Cloud allows users to significantly reduce the cold start time of Cloud Run and Cloud Functions. This is named startup CPU boost for Cloud Run and Cloud Functions 2nd gen.

Frequently Asked Questions (FAQ):

What is the projected market value of the MEA cloud computing market?

The MEA cloud computing market size is expected to grow from USD 21.1 billion in 2023 to USD 49.5 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 18.6% during the forecast period.

Which region has the highest market share in the MEA cloud computing market?

Middle East region has the higher market share in the MEA cloud computing market.

Which service model is expected to witness high adoption in the coming years?

IaaS is expected to witness the highest rate adoption in five years, as large enterprises are investing more in this service model.

Which are the major vendors in the MEA cloud computing market?

Microsoft, IBM, Google, AWS, Alibaba Cloud, Oracle, Salesforce, and SAP are major vendors in MEA cloud computing market.

What are some of the drivers in MEA cloud computing market?

The embracing of cloud computing solutions across the Middle East and Africa .

Business expansion by market leaders in the Middle East and Africa to cater to untapped clientele

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

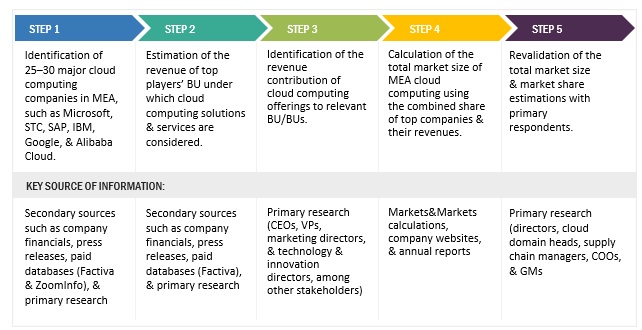

The study involved 4 major activities to estimate the current market size of MEA cloud computing. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, The Software Alliance, CCA, MENA Cloud Alliance, International Trade Administration (ITA), Telecommunications Industry Association, United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), Arab Information and Communication Technology Organization (AICTO) to identify and collect information useful for this technical, market-oriented, and commercial study of the MEA cloud computing market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing MEA cloud computing solutions. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

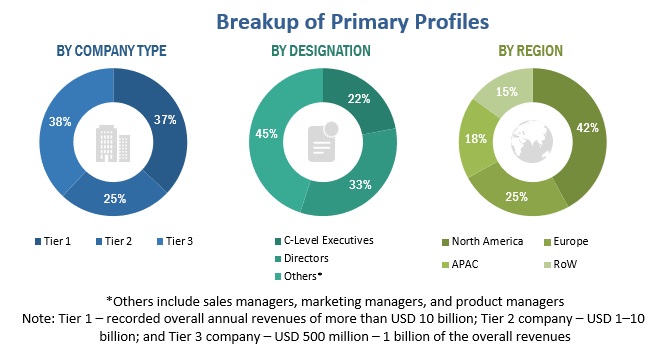

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MEA cloud computing market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the MEA cloud computing market.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the MEA cloud computing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Bottom-Up Approach

In the bottom-up approach, the adoption rate of MEA cloud computing solutions among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of MEA cloud computing solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the MEA cloud computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major MEA cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall MEA cloud computing market size and segments’ size were determined and confirmed using the study.

Definition

Cloud computing refers to the delivery of computing services, including but not limited to servers, storage, databases, networking, software, analytics, and intelligence, over the internet (the cloud) to offer faster innovation, flexible resources, and economies of scale. Cloud services can be provisioned and scaled up or down on-demand, allowing businesses and individuals to access and utilize computing resources without the need to invest in and maintain physical infrastructure.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Third-party providers

- Consultants/Consultancies/Advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information Technology (IT) infrastructure providers

- System Integrators (SIs)

- Support service providers

- Government and standardization bodies

- Data center providers

- Regional associations

- Independent software vendors

- Value-added resellers and distributors

Report Objectives

- To describe and forecast the MEA cloud computing market based on offering, deployment mode , verticals, and regions

- To forecast the market size of regional segments: Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel,and Rest of Middle East) and Africa (South Africa, Egypt, Nigeria and Rest of Africa)

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MEA Cloud Computing Market