Military Lighting Market by Product (LED, Non-LED), Type (Internal Lighting, External Lighting, Others), End Use (Ground, Marine, Airborne), and Region - Global Forecast to 2027

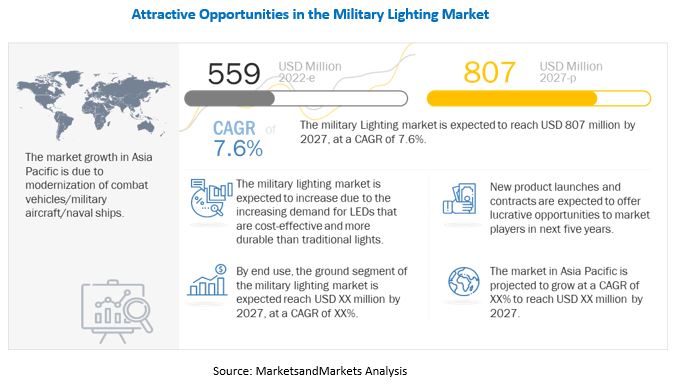

[203 Pages Report] The military lighting market is projected to grow from USD 559 million in 2022 to USD 807 million by 2027, at a CAGR of 7.6% from 2022 to 2027.

Military lighting products include the ones installed in military shelters, military airports/airfields, and soldier lights, such as combat helmet lighting. Lights in military shelters generally consist of gooseneck and task/drop lights. The number of lights installed depends on the shelter type, and, generally, hard shelters have double the number of lights of soft shelters as the accommodation capacity for hard shelters is double that of soft shelters.

Airport lights are used to guide aircraft during take-off and landing. In the early 1990s, lighting was developed for runway edges and then taxiway edges. It expanded to centerline lighting, touchdown zone lighting, and approach light systems. Taxiway guidance signage became illuminated, and runway guard light systems were established.

Lights used in military airports can be segmented based on type and position. Runway lighting systems, taxiway light systems, EALS, and apron lights are the various forms of lights considered under types. Whereas the categories of light by position include in-pavement/inset lights, elevated airfields, and precision approach path indicator (PAPI). Armed forces also use solar LED helipads to improve the operational efficiency of their systems.

Various players such as Astronics Corp. (US), Honeywell International (US), Raytheon Technologies (US), Glamox (Norway), and Orion Energy Systems (US) among others, are prominent players operating in the military lighting market.

To know about the assumptions considered for the study, Request for Free Sample Report

Military lighting Market Dynamics:

Driver: Modernization and upgrade of military vehicles, aircraft, naval ships

Governments around the world are investing heavily in modernizing their armed forces in terms of weapon capabilities and equipment. Most countries are focusing on modernizing the helmet lighting systems of their soldiers along with the lighting systems of armored vehicles. The improved lighting systems would be better suited for covert operations and would be equipped with night vision capabilities. This requirement of line fitting and retrofitting advanced LEDs in naval, airborne, and ground applications is expected to drive the military lighting industry across the globe. In June 2020, Orion Energy Systems received a contract worth USD 1.3 million from the US government for a retrofit project.

Restraint: Short-to-medium-term impact on lighting component supply due to US–China trade conflict

The US-China trade conflict started in March 2018. Being the two largest economic powers in world, the trade conflict between these two countries has substantially transformed the trading dynamics across globe, specifically in the defense electronics vertical, as China is one of the largest producers of electronics whereas the US is the largest consumer of the same. Thus, the profitability of several lighting product manufacturers across globe have been influenced negatively. Though the effect of this trade conflict between the US and China is short-to-medium term, it has more widespread effect on other developing economies, including Brazil, Indonesia, and India.

Opportunity: Compatibilityof LEDs with military, navy, air force operations

The high cost incurred on the development of radar systems is one of the major factors hindering the growth of the radar systems market and thus, affecting the military lightings market. Since radar is one of Low temperatures present a challenge to fluorescent lamps and can affect their operation; LEDs are ideal for operations in low-temperature settings. LEDs operate well in cold settings such as outdoor winter settings, freezer rooms, and grocery store coolers. Temperature ranges can be below zero degrees Fahrenheit to over 100 degrees Fahrenheit. Also, LEDs can be combined in any shape to produce highly efficient illumination. Individual LEDs can be dimmed, resulting in dynamic control of light, color, and distribution. These functionalities of LEDs offer an opportunity for the military lighting market to grow.

Challenges: Existing defense backlog

Boeing (US) and Airbus (France) constitute the largest market share of military orders among all other manufacturers. These companies receive the greatest number of military orders; however, their manufacturing capacities are limited, thereby creating a large backlog of military deliveries. Due to COVID-19, 2020 was a very challenging year, and 2021 was the year of recovery for these companies.

Military lighting Market Ecosystem:

The key stakeholders in the military lighting market ecosystem include companies which provide platforms and soldier systems. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Interior lighting segment to grow at fastest rate in military lighting market

Growing use of map and chart lights while maintaining night vision to see outside the aircraft is driving the demand for effective cockpit lights. Additionally, there are glare shield lights to flood light the instrument panel, dome lights, floor lights, emergency lights, and oxygen mask lights. New aircraft and retrofits use LEDs in the cockpit to increase reliability and reduce lifecycle costs. These solid-state parts consume less power and have no coiled filaments, which can weaken from vibration and temperature extremes.

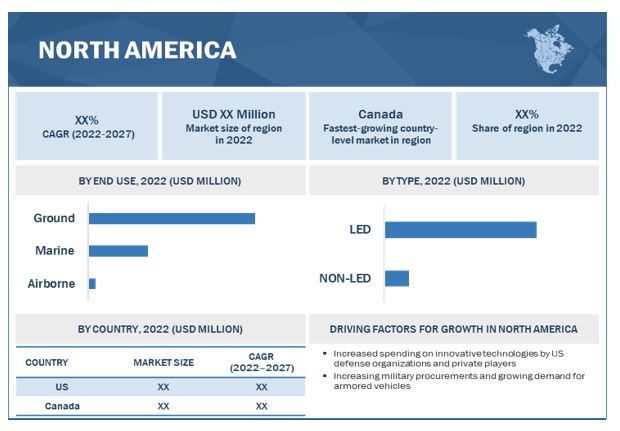

In terms of value, North America led the military lighting market

The US and Canada are expected to invest in the modernization and upgrade programs of their military capabilities to build an army that is capable of asymmetric warfare. Hence, the market for military lightings in North America is projected to witness significant growth during the forecast period. Astronics Corp. (US), Honeywell International (US), Raytheon Technologies (US), Glamox (Norway), and Orion Energy Systems (US) are the leading manufacturers of military lightings in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Military Lighting Companies - Key Market Players

The military lighting companies are dominated by a few globally established players such as Astronics Corp. (US), Honeywell International (US), Raytheon Technologies (US), Glamox (Norway), and Orion Energy Systems (US). The players are mostly engaged in new product launches & developments and having a strong global presence will enhance their position in the military lighting market. These players are primarily focusing on entering new markets by launching technologically advanced and cost-effective platforms and infrastructure. Apart from new product launches & developments, these players also adopted the partnerships contracts, & agreements strategy.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Type, End Use |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

Astronics Corp. (US), Honeywell International (US), Raytheon Technologies (US), Glamox (Norway), and Orion Energy Systems (US) among others |

This research report categorizes the Military lighting Market based on Product, Type, End Use, and Region.

By Product

- Interior Lighting

- Exterior Lighting

- Others

By Type

- LED

- Non-LED

By End Use

- Ground

- Marine

- Airborne

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In June 2022, Rheinmetall BAE Systems Land (RBSL) and Rheinmetall Land Systeme (RSL) together awarded a contract worth USD 4.4 million contract to Oxley Group. According to the contract, the company will provide LEDs for the British Army’s new Boxer vehicles.

- In May 2022, Astronics Corporation announced a strategic agreement with LG Display to provide market-leading OLED display technologies to the aviation sector. Through this partnership, Astronics has access to a wide range of OLED displays from LG Display, as well as technical assistance for development and integration from LG Display engineering resources.

- In January 2022, Anglia Components strengthened its partnership with MARL International by becoming MARL’s Master Distributor for the UK and Ireland. As a Master Distributor, Anglia will not only maintain a sizable inventory of basic items for customers and other resellers but will also provide support for clients who need customized goods.

- In September 2021, Babcock International Group has awarded the contract to Consolite Technology Ltd (UK) to provide the General and Navigation Lighting System for the Type 31 General Purpose Frigates. The agreement covers all general lighting, including internal compartment lighting and external lighting for all weather decks.

- In April 2021, Glamox and Norwegian business Luminell Group entered an agreement to acquire 100% of Luminell’s shares. Luminell has a solid reputation as a premium developer and supplier of floodlights, searchlights, and lighting controllers in the marine and offshore lighting sector.

Frequently Asked Questions (FAQs):

What is the current size of the military lighting market?

The global military lighting market size is projected to grow from USD 559 million in 2022 to USD 807 million by 2027, at a CAGR of 5.5% from 2022 to 2027.

Who are the winners in the military lighting market?

Astronics Corp. (US), Honeywell International (US), Raytheon Technologies (US), Glamox (Norway), and Orion Energy Systems (US) are some of the winners in the market.

What are some of the technological advancements in the market?

VISIBLE light communication and solar lighting systems are some of the technological advancements in the military lighting market.

What are the factors driving the growth of the market?

The military lighting market is being driven by factors such as rising demand for advanced military fleets across globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

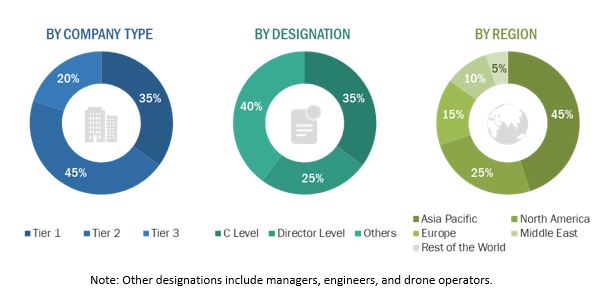

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the military lighting market. Primary sources included industry experts from the core and related industries as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess prospects for the growth of the market during the forecast period.

Secondary Research

The share of companies in the military lighting market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the military lighting market included financial statements of companies offering and developing military lighting products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the military lighting market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the military lighting market through secondary research. Several primary interviews were conducted with market experts from both, the demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific, and the Middle East and Rest of the World. This primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

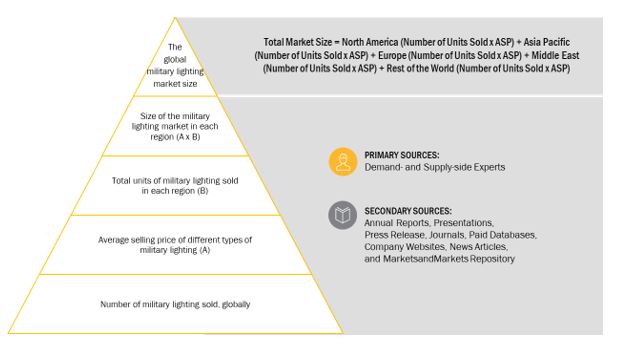

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the military lighting market.

The research methodology that was used to estimate the size of the military lighting market includes the following details.

Key players in the military lighting market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders such as chief executive officers, directors, and marketing executives of the leading companies operating in the military lighting market.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the military lighting market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Data Triangulation

After arriving at the overall size of the military lighting market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the size of the military lighting market based on product, type, end use, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of military lighting by different countries to track the market size of military lighting

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the military lighting market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market analysis of additional countries (subject to the data availability)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Lighting Market