Milking Automation Market by Offering (Milk Meters, Pulsators, Milk Point Controllers, Milk Clusters, Smart Cameras, Software, Services), Farm Size (Small, Medium, Large), Species (Dairy Cattle, Goat, Sheep), Region - Global Forecast to 2027

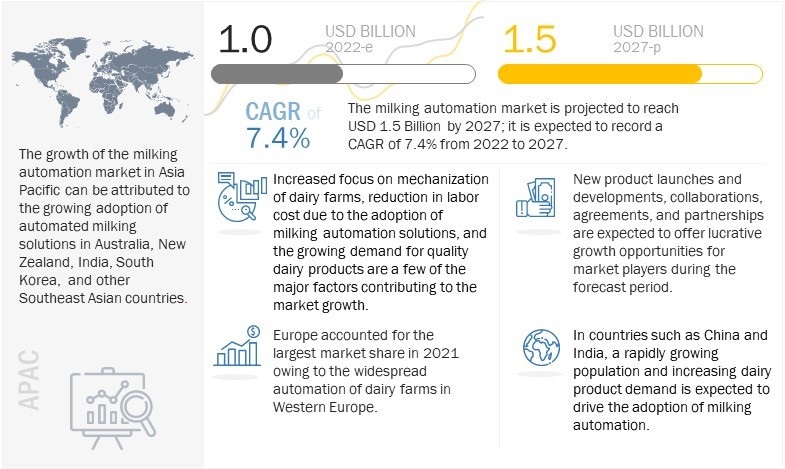

[169 Pages Report] The global milking automation market size is estimated to be USD 1.0 Billion in 2022 and is projected to reach USD 1.5 Billion by 2027, at a CAGR of 7.4% during the forecast period.

Some of the major factors contributing to the growth of market includes reduced labor costs due to automation in dairy farms, rising farm consolidation with increasing average herd size, government policies and incentive programs supporting livestock farm mechanization, and increasing demand for quality dairy products.

Milking Automation Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Milking Automation Market Dynamics

Drivers: Rising adoption of automated milking equipment owing to increasing average herd size

The consolidation of dairy farms, mainly in developed regions, has driven the adoption of milking automation solutions. The increasing average herd size of dairy cows, particularly in countries such as the Netherlands, Australia, New Zealand, and the US, has led to the installation of a large number of milking points and the integration of additional electronic components, such as milk analyzers, sensors, and smart pulsators, on dairy farms.

In most advanced dairy-producing regions, the increase in average herd size and difficulty retaining staff have threatened the industry's long-term viability. These issues are resolved by adopting technologically advanced milking equipment and the automation of milking parlors.

In the last decade, the number of dairy farms has reduced significantly owing to the increased average herd size, and the milk yield per cow has increased due to the adoption of automated solutions. According to Dairy Australia, the number of dairy farms declined by approximately 57% between 2002 and 2021. However, during this period, the average milking herd size increased by almost 50%, that is, from around 200 heads to 295 heads.

With the increasing herd size, managing milking operations manually has become extremely difficult. Dairy farmers increasingly use automation and electronic milk meters to reduce labor requirements and improve milking management. Automating milking operations can replace repetitive tasks, improve measurement accuracy and frequency, and enable better farm decisions.

The use of milking automation devices, such as smart milk meters, pulsators, and milk point controllers, can maximize herd performance and milking productivity, maintain the health and well-being of farm animals, reduce labor costs, and ensure high profitability and sustainability.

Restraints: Availability of plant-based alternative products for dairy milk

Dairy milk production has raised concerns about animal welfare and the environment, which is driving consumers to seek alternatives. This will hamper global dairy milk production, thereby impeding the growth of the milking automation industry.

According to Univar Solutions (US), in 2020, the demand for plant-based milk is growing by more than 10% yearly, while dairy milk is growing at a rate of 3% annually. Plant, grain, and nut milk currently comprise over 10% of the total milk market. Milk substitutes have already seized market share and now make up 13% of retail milk sales in the US, in which almond milk has the greatest share among the substitutes.

Several factors including nutritional values, lactose intolerance, milk allergies, and taste and environmental impact encourage consumers to look for substitutes. Compared to cow's milk, plant-based milk often has lower calorie and saturated fat levels while offering similar nutritional advantages. Plant milk is an excellent alternative for anyone with milk allergies or lactose intolerance. The success of the American dairy milk category is threatened by consumers' declining dairy milk intake.

Opportunities: Gradual transition of small- and medium-scale dairy farms from manual milking to mechanized milking solutions

The adoption rate of milking automation systems in developing countries is relatively low, mainly due to high installation costs and limited awareness among farmers about the benefits of milking automation systems.

However, the growing demand for milk and dairy products, increasing per capita income of farmers in developing countries, rising herd size, and growing focus of governments on dairy farming and agriculture industries are expected to create a surge in demand for advanced milking solutions in developing countries in the coming years.

Governments of different developing countries have facilitated the integration of AI, robotics, and IoT technologies with conventional milking systems and are running various initiatives to promote the adoption of automated milking solutions, creating growth opportunities for market players in the region. For instance, governments of countries such as Indonesia, South Korea, India, and Columbia support dairy farmers by providing incentives and subsidies for automating their dairy farms.

Challenges: Lack of skills and limited understanding of technology among farmers in developing regions

The limited awareness about the benefits of milking automation solutions among farmers is expected to significantly impede market growth. Due to the lack of skills required to handle large volumes of data and use advanced and sophisticated tools in farmers, milking automation solutions are adopted very slowly in many regions globally.

Other factors hamper milking solutions adoption in dairy farms are the high cost involved in automating farms, the lack of technical knowledge, and reluctance toward using new technology owing to limited skillset and understanding. In addition, since the milking system operates 24/7, technical support is essential.

Due to breakdowns during milking activity, the herd and delicate sensors are at risk of being damaged, incurring additional repair costs. Market players are likely to witness this challenge for a considerable period owing to the poor economic condition of many countries and the lack of infrastructure and awareness about the benefits of automated milking equipment.

Dairy cattle segment continues to hold largest share for milking automation market during the forecast period

The dairy cattle will lead the market during the forecast period. When compared with other dairy animals, cattle have several advantages, including ease of milking, large udder size, higher ability to store milk, and milk yield. Because of these advantages, majority of the dairy farmers prefer dairy cattle over other milking animals, as a result, most companies in the market design milking systems specialized for dairy cattle only.

The world's milk production is dominated by cattle milk. India, Brazil, China, and Pakistan are the four countries with the most dairy cattle, and the United States and India produce the most cow milk. There is a decline in cow milk production in developed countries, along with a decrease in dairy operations and animals, but productivity per cow is increasing.

In developing countries, both the number and production of lactating cows are on the rise, but their animals have lower milk yields and shorter lactation periods. Climate (high ambient temperature, humidity), low-quality feed, low levels of nutritional supplement intake, the low genetic potential for milk production in multipurpose animals (used for both milking and farming), as well as high disease incidences are just a few of the factors contributing to poor animal performance in small-scale dairy systems in developing countries.

Hardware segment to account for the largest market share of milking automation market between 2022 and 2027

Based on offering, the market has been segmented into hardware, software, and services. The hardware segment has been further subsegmented into milk meters, milking clusters milk point controllers, pulsators, smart feeding robots (TMR/PMR-based feeding robots), smart camera-based facial recognition systems (biometric ID), and other hardware components such as automated weighing, and sorting systems.

Milking automation solutions are increasingly being adopted as automated hardware and systems are becoming more popular. Dairy farms across the world are increasingly installing mechanized milking solutions such as pipeline milking systems and milking machines on dairy parlors. With the help of milking automation hardware components such as milk meters, pulsators, milking clusters, milk point controllers, milk analyzers, and sensors, dairy farm owners can reduce labor costs and increase milk yield per ruminant. Moreover, the increasing awareness about the quality of milk is expected to fuel the demand for milk metering solutions for dairy farming during the forecast period.

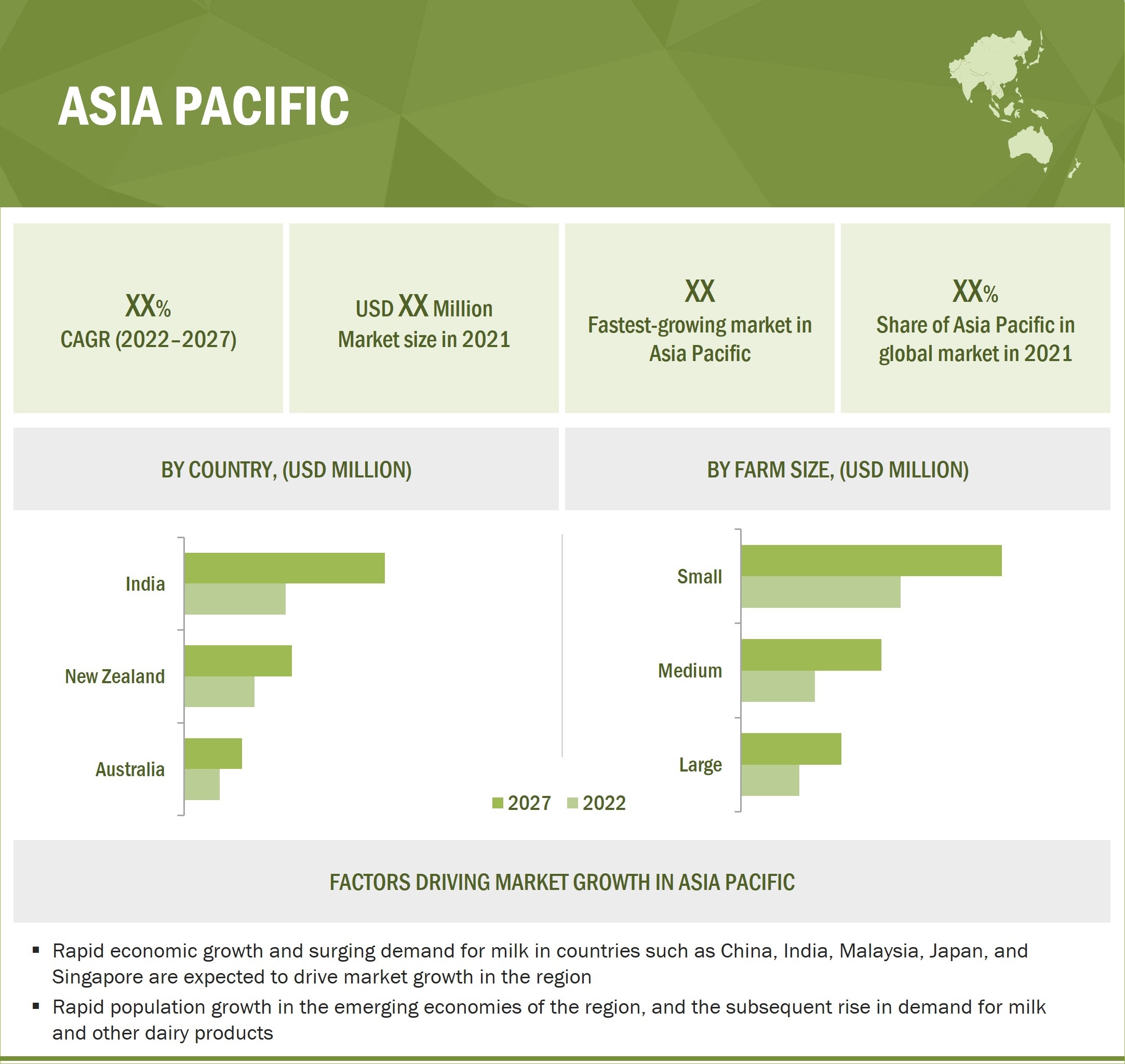

Asia Pacific is likely to be the fastest growing market between 2022 and 2027.

Milking Automation Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Source: FAOstat, the Korea Dairy Beef Cattle Association, Asia-Pacific Dairy Association (APDA), Japan Dairy Industry Association, Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

Asia Pacific is expected to witness the highest growth rate for milking automation market during the forecast period. Rapid economic growth and surging demand for milk in countries such as China, India, Malaysia, Japan, and Singapore are expected to drive market growth in the region.

This increased demand for milk products has triggered the adoption of automated milking systems on dairy farms in this region. Furthermore, automated milking rotaries (AMRs) reduce the amount of manual labor required in the milking process on dairy farms, thereby reducing labor costs. With rapid industrialization, milk consumers are becoming aware of the quality and the type of dairy products they are consuming. Hence, dairy farm owners are adopting automated milking systems for increasing production to meet the growing demand for milk.

Key Market Players in Milking Automation Market

Major milking automation companies are DeLaval (Sweden), Afimilk Ltd. (Israel), GEA Group (Germany), Nedap N.V. (Netherlands), and Allflex Livestock Intelligence (US).

Milking Automation Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 1.0 Billion |

| Market Size Value in 2027 | USD 1.5 Billion |

| Growth Rate | CAGR of 7.4% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

|

| Key Market Driver | Rising adoption of automated milking equipment owing to increasing average herd size |

| Key Market Opportunity | Gradual transition of small- and medium-scale dairy farms from manual milking to mechanized milking solutions |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Dairy Cattle |

Milking Automation Market Highlights

This research report categorizes the market, by offering, farm size, species, and region available at the regional and global level

|

Aspect |

Details |

|

Based on Offering:

|

|

|

Based on Farm Size: |

|

|

Based on Species: |

|

|

Based on the Region: |

|

Recent Developments in Milking Automation Industry

- In August 2022, DeLaval launched the E-series rotary milking system to meet the needs of North American dairy producers. The E300 and E500 models are equipped with new-generation rotary systems.

- In October 2021, BouMatic acquired SAC Group. The acquisition enabled BouMatic to strengthen its market and enhance its product portfolio related to milking solutions.

- In July 2021, GEA Group launched the newer versions of the DairyRobot R9500 milking robot and the DairyProQ automatic milking system. Adopting these solutions facilitates an increased number of milking cycles and reduces costs by up to 35%.

- In May 2021, Nedap N.V. partnered with Waikato to develop and manufacture advanced dairy products. Waikato provides integrated identification, monitoring, and automation solutions through its smart CowTraQ collars and TracHQ platform driven by Nedap’s integrated platform.

- In July 2020, DeLaval acquired milkrite | InterPuls from Avon Rubber to improve its milking point product portfolio for dairy farms.

Key Questions Addressed by the Report

Who are the key players in the milking automation market? What are the major growth strategies they had taken to strengthen their position in the market?

Major companies operating in the milking automation market includes DeLaval (Sweden), Afimilk Ltd. (Israel), GEA Group (Germany), Nedap N.V. (Netherlands), Allflex Livestock Intelligence (US), BouMatic (US), Waikato Milking Systems (New Zealand), Dairymaster (Ireland), and BECO Dairy Automation Inc. (US). They offer advanced milking automation solutions in several countries to meet their customers' needs. These players competed in the market through product launches and developments, acquisitions, collaborations, partnerships, and agreements.

What are the new opportunities for emerging players in milking automation value chain?

The growing demand for milk and dairy products, increasing per capita income of farmers in developing countries, rising herd size, and growing focus of governments on dairy farming and agriculture industries are expected to create a surge in the adoption of mechanized milking solutions in small-to-medium dairy farms.

Which Region to offer lucrative growth for milking automation Market By 2027?

It is expected that Europe will lead the milking automation market due to the presence of large dairy farms and high labor wages in the region. In contrast, the Asia Pacific region is expected to see the highest growth rate between 2022 and 2027.

How is competitive landscape for milking automation market?

The milking automation market is consolidated with the presence of a substantial number of global and regional market players. In 2021, DeLaval (Sweden), Afimilk Ltd. (Israel), GEA Group (Germany), Nedap N.V. (Netherlands), Waikato Milking Systems (New Zealand), and Allflex Livestock Intelligence (US) were the major players in the milking automation market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

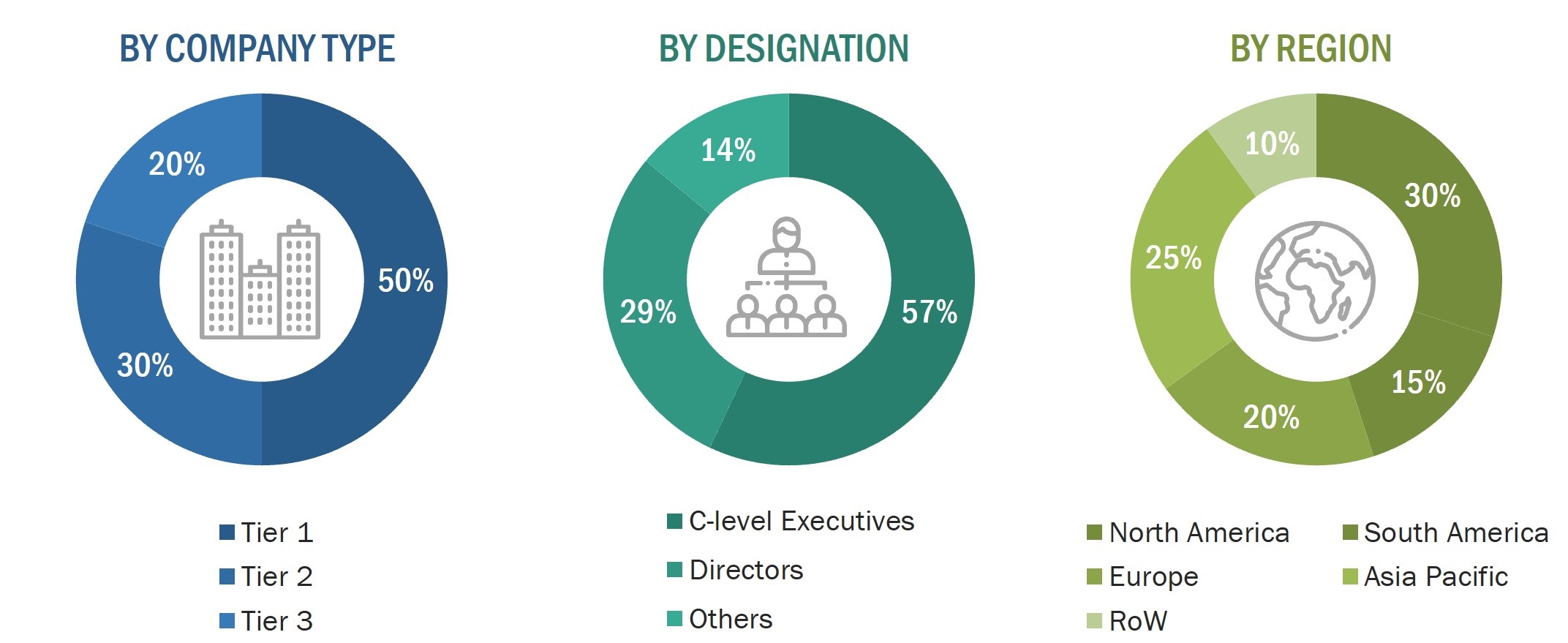

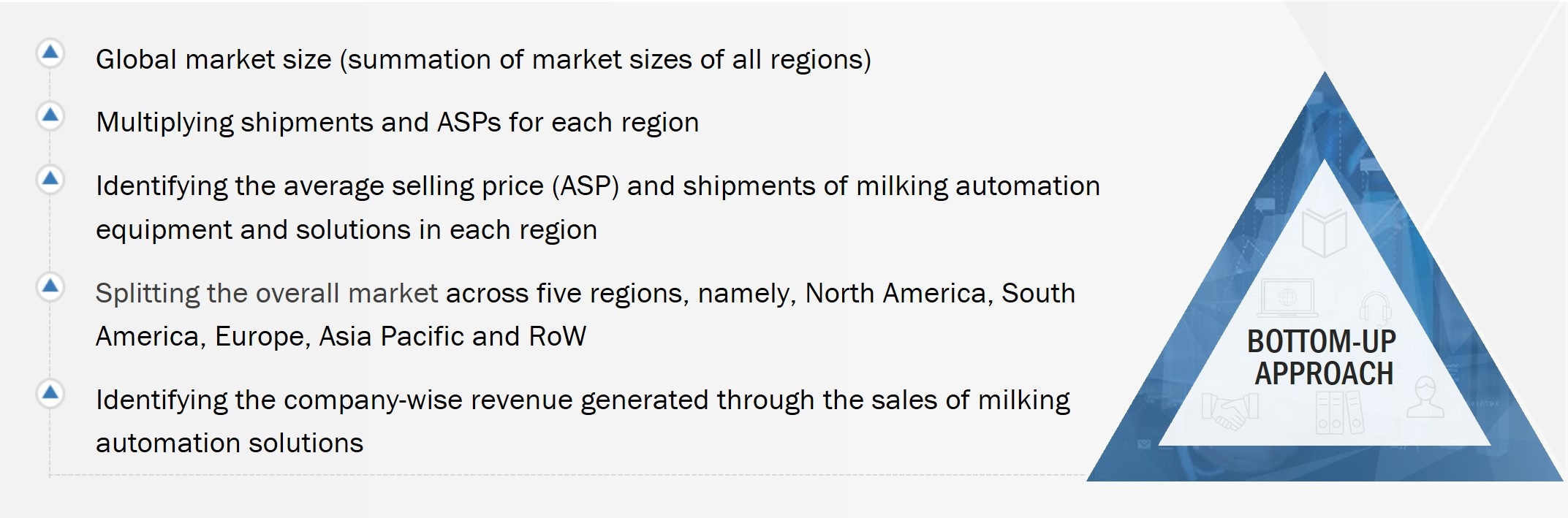

The study involved four major activities for estimating the size of the milking automation market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the milking automation market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the milking automation market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of milking automation, the value chain of the milking automation ecosystem, the total pool of key players, market classification and segmentation according to the industry trends, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after understanding and analyzing the milking market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand-side and supply-side vendors across the 5 major regions—North America, South America, Europe, Asia Pacific, and Rest of the World (Africa and the Middle East). Approximately 15% of the primary interviews were conducted with the demand side and 85% with the supply side. This primary data was collected mainly through telephonic interviews, which consist of 90% of total primary interviews; however, questionaries and emails were also used to collect the data.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the milking automation market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Initially, the focus was on top-line investments and spending in the ecosystem. Furthermore, the segment-level splits and significant developments in the market have been considered

- Information related to the market revenue generated by the key market players in the milking automation market has been determined

- Building and developing the information related to market revenue offered by the key players in the milking automation ecosystem

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of milking automation systems and providers of related software and services.

- Estimating the geographic split using secondary sources based on various factors such as the number of OEMs in a specific country or region, the role of leading players based in this country or region in the market for the development of new and innovative products, and adoption and penetration rates of hardware components, level of services offered, and types of software implemented in a particular country or region.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Milking Automation Market Size: Bottom-Up Approach

Global Milking Automation Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, analyze, and forecast the milking automation market, by offering, farm size, and species, in terms of value

- To forecast the market size for various segments with respect to five main regions – North America, South America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW) -- in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the milking automation market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the milking automation market landscape

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape

- To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To analyze competitive developments by players in the milking automation market, such as contracts, product launches/developments, expansions, and research and development (R&D) activities.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Milking Automation Market