Mobile Artificial Intelligence (AI) Market by Application (Smartphones, Cameras, Drones, Automotive, AR/VR, Robotics, Smart Boards, and PCS), Technology Node (10nm, 20 to 28nm, 7nm and Others), and Geography - Global Forecast to 2023

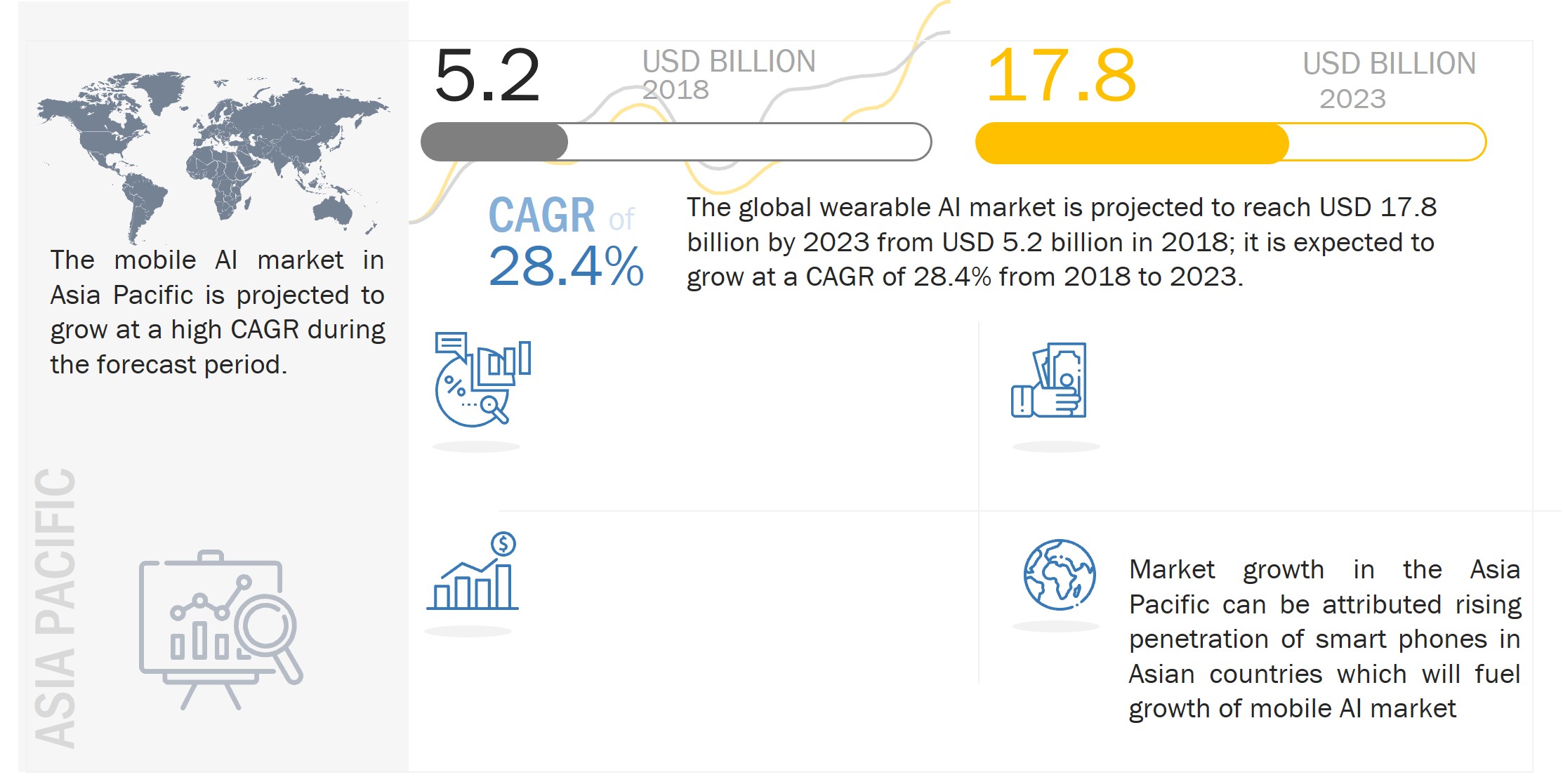

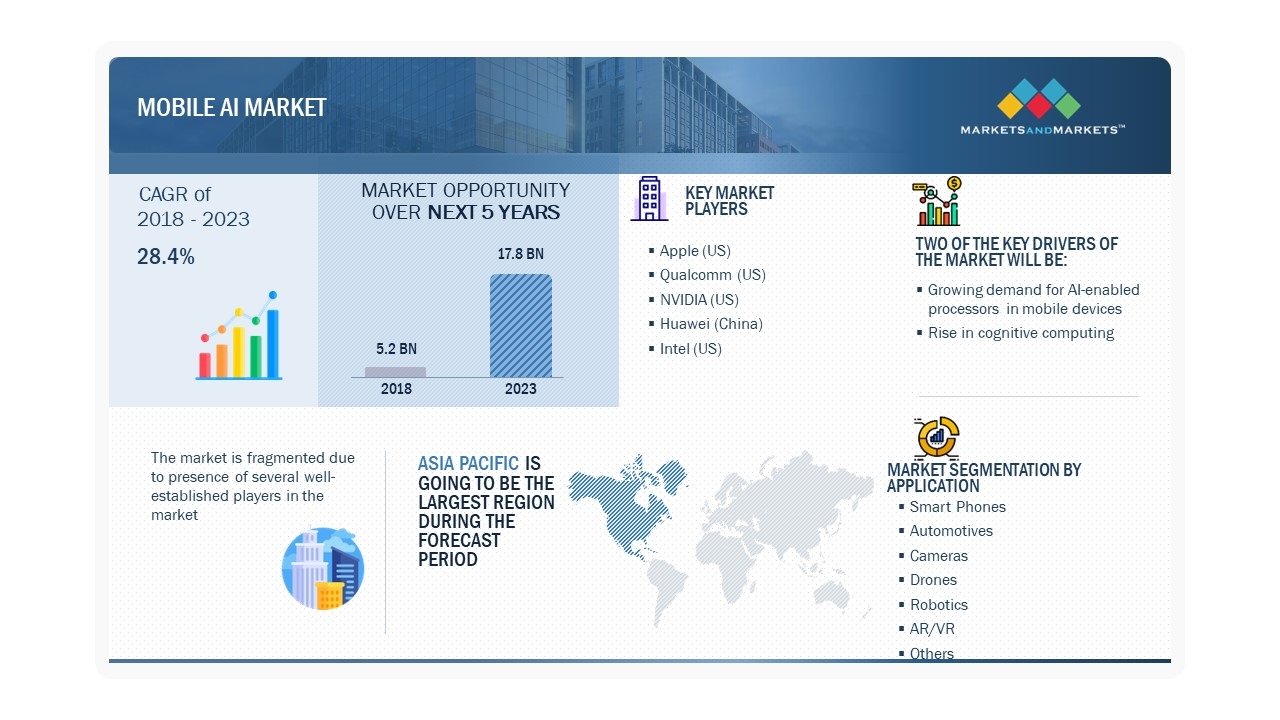

The global mobile artificial intelligence (AI) market size was valued at USD 5.2 billion in 2018 to USD 17.8 billion by 2023; at a CAGR of 28.4% from 2018 to 2023.

Mobile AI (on-device AI) is the ability to process data on devices using neural processing units (NPUs) without involving the Internet or the cloud. On-device AI uses dedicated AI chipsets and provides several benefits, such as high performance, better reliability, and improved privacy & security to deliver automated personalized services and experiences.

Mobile Artificial Intelligence (AI) Market Forecast to 2023

To know about the assumptions considered for the study, Request for Free Sample Report

The use of the Mobile Artificial Intelligence (AI) Market has been mainly prevalent across automotive, smartphones, drones, and robotics. Increasing demand for real-time speech and voice recognition and analysis, as well as technical advancements in smartphone image recognition, is driving the market for smartphone AI processors. The majority of AI processors have an additional inbuilt Neural Processing Unit (NPU) that can handle significant amounts of parallel processing, uses low power, and is capable of cognitive tasks.

There is a rapid increase in the use of drones due to various reasons; some of which are increased venture funding, a rise in the demand for drone-generated data for commercial applications, as well as rapid technological advancements. Next-generation drones are likely to be powered by artificial intelligence (AI), which will allow drones and other machines to make decisions and operate independently without any human intervention. Drones consist of a range of cameras and sensors feeding data into small chips called a vision processing unit (VPUs). VPU is a processor used in drones, along with advanced algorithms. These processors boost the use of drones for machine vision applications, such as object detection, gesture mode, safe landing, 3D mapping, and contextual awareness.

Mobile Artificial Intelligence (AI) Market Dynamics:

Driver: Growing demand for AI-capable processors in mobile devices

In the past years, cloud-based complex AI algorithms could not accomplish tasks on computers, mobile phones, and other devices.

This limitation became a roadblock for rapid adoption of AI in consumer devices. It has led to tier-one semiconductor hardware manufacturers, including smartphone vendors, increasingly focusing on exploring application processor designs and frameworks that will fetch AI on the device rather than on the cloud. Connectivity in mobile devices experiences high latency, network congestion in densely populated areas, and increased levels of signal collision due to oversaturated use of available spectrums/increasing traffic in available spectrums.

On-device processors can help mobile equipment compute data in real-time with minimum latency (much lower compared to cloud). This low latency attribute is a critical design aspect for drones, augmented reality solutions, cameras, and autonomous and semiautonomous cars, as they require running deep learning algorithms in real-time for making quick decisions. Any delay stemming from latency in the communication can result in disastrous or fatal outcomes. At the moment in the market, Apple (US) and Google (US) are using AI capable processors in their flagship smartphone products. However, with the increased use of AI in autonomous cars, drones, and other mobile devices, more players are expected to enter this market during the forecast period.

Restraint: Limited number of AI experts

AI is a complex system, and for developing, managing, and implementing AI systems, companies require personnel with certain skill sets. For instance, people dealing with AI systems should also be aware of technologies such as cognitive computing, ML and machine intelligence, deep learning, and image recognition.

In addition, integrating AI solutions with existing systems is a difficult task, which requires extensive data processing to replicate the behavior of a human brain. Even minor errors can translate into system failure or malfunctioning of a solution, which can drastically affect the outcome and desired result.

Professional services of data scientists and developers are needed to customize an existing ML-enabled AI service. Due to AI being a technology still in the early stages of its life cycle, a workforce possessing in-depth knowledge of this technology is limited. The impact of this restraining factor will likely remain high during the initial years of the forecast period

Opportunity: Growing demand for edge computing in IoT

Edge computing technology is used to move data processing close to the source of data rather than limiting the processing power in cloud/data centers.

The combination of IoT and edge computing can reduce latencies and increase the penetration of AI in industries. Self-driving cars, robotics, and predictive maintenance are expected to leverage AI edge computing significantly during the forecast period. Service robots in industries and homes can use AI technologies such speech and voice recognition, computer vision, and more sophisticated analytics tools.

Moreover, the use of edge computing in motion detectors, video surveillance, environmental sensors, and other security and monitoring devices can further enhance levels of automation in security and monitoring processes. In industries, predictive maintenance is also an area where edge AI can enhance IoT systems' latency and overall performance. Edge computing and AI can together reduce maintenance time and costs in the road transportation, railways, and aerospace industries.

Challenge: Unreliability of AI algorithms in mobile apps

AI is implemented through machine learning using a computer to run specific software that can be trained. Machine learning can help systems process data with the help of algorithms and identify specific features from that dataset.

However, a concern associated with such systems is that it is unclear as to what is going on inside algorithms; internal workings remain inaccessible and unlike humans, the answers provided by these systems are uncontextualized. In July 2017, researchers at the Facebook AI Research (FAIR) lab found that the chatbot they created had deviated from their predefined script and were communicating in a language they created, which humans could not understand.

While one of the important goals of current research is to improve AI-to-human communication, the possibility that an AI system can create its own unique language that humans cannot understand could be a setback. Several scientists and tech influencers, such as Stephen Hawking, Elon Musk, Bill Gates, and Steve Wozniak, have indeed raised concerns about future AI technology leading to unintended consequences.

Mobile Artificial Intelligence (AI) Market Segment Insights

Based on application, AR/VR, to hold grow at the highest CAGR during the forecast period

Based on application, the mobile AI market has been segmented into smartphones, automotive, cameras, drones, robotics, AR/VR, and others (smart boards and PCs). Virtual Reality (VR) and Augmented Reality (AR) are rapidly evolving technologies. AR and VR would provide smarter, more relevant, and personalized experience when coupled with AI.

By technology node, 10 NM node to hold the highest market share of the mobile AI market in Europe during the forecast period

The market for 10 NM node is expected to hold the largest share of the mobile AI market in Europe during the forecast period. The main factor driving the demand for 10nm nodes is the increasing use of 10nm technology nodes in new, high-end smartphones; advancements in 10nm technology node manufacturing afford more power-efficient processors, better battery life, and performance for smartphones.

Mobile Artificial Intelligence (AI) Market Regional Insights:

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period

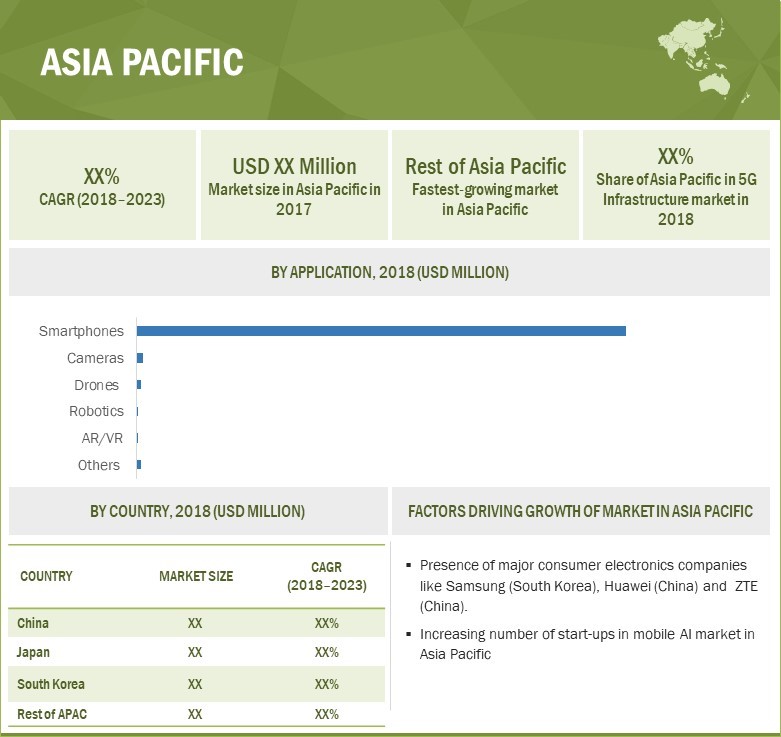

The market in Asia Pacific is projected to grow at the highest CAGR during the forecast period. A large number of manufacturing companies, along with the strong presence of automobile, electronics, and semiconductor companies in China and Japan, is driving the growth of the mobile AI market in Asia Pacific.

Applications such as smartphones, industrial robots, and automotive have huge potential in APAC. With the growing penetration of smartphones in countries such as China, Japan, India, and South Korea, the adoption of AI processor-enabled smartphones in the Asia Pacific is expected to increase in the coming years. Asia Pacific is also one of the largest markets for smartphones, surveillance cameras, and wearable devices, which are integrated with vision processing units to accelerate AI tasks.

Mobile Artificial Intelligence (AI) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

In the Asia Pacific region, countries such as China, South Korea, and Japan are estimated to witness significant growth in the mobile AI market during the forecast period. China is among the highest spenders on the manufacturing sector in the Asia Pacific. The manufacturing sector in China is growing rapidly, resulting in the introduction of new robotics and big data technologies. In addition, China, being a global manufacturing hub, holds immense potential for the automotive industry. These factors are expected to fuel the growth of the AI market in China as AI is increasingly being used in the country’s automotive and transportation sectors. Major industries driving the growth of the AI market in Japan include information and communication technology, manufacturing, automotive, machinery, and robotics.

The North America region held the largest share of the mobile AI market in 2018

North America held the largest share of the mobile AI market and is expected to hold second dominant position by 2023. The factors responsible for the growth of the mobile AI market in the North America include the increasing number of and growing dependency on IoT devices, the rising need for faster device processing, and high latency due to network congestion.

High government funding and a strong technical base also contribute to the market's growth in this region. The markets for consumer drones and surveillance cameras, which use vision processing units, in North America are likely to grow significantly in the near future. Moreover, North America is home to prominent mobile AI technology vendors, such as IBM (US), Microsoft (US), and Google (US), and hardware providers, such as NVIDIA (US), Qualcomm (US), and Intel (US).

Key Market Players in Mobile Artificial Intelligence (AI) Industry

Some of the Major players in the mobile AI market are Apple (US), Qualcomm (US), NVIDIA (US), Huawei (China) and Intel (US). These players have adopted various growth strategies such as Product launches and developments, partnerships, agreements, and collaborations further to expand their presence in the mobile AI market.

Apple (US) implements artificial intelligence (AI) and machine learning technologies in consumer and enterprise-level devices. The company has added various features, such as security and social networking, to its devices. The aforementioned devices highlight a trend where artificial intelligence (AI) is moving toward end devices instead of relying more on cloud services. This, as a result, has created opportunities for chip suppliers to bring robust chips and graphics processing units (GPUs) and other solutions, such as accelerators and vision processing units (VPUs), to the market. Apple mainly focuses on product launches and acquisitions to maintain its competitive position in the mobile AI market.

Qualcomm (US) is continuously growing in the mobile AI market. The company has R&D centers in various locations worldwide. Its robust R&D capabilities enabled it to develop a strong patent portfolio. Qualcomm focuses on organic and inorganic strategies, such as product launches, partnerships, and collaborations to grow in the market. The company’s Snapdragon mobile platform has accelerated the migration of intelligence from the cloud to edge devices in key device categories, including mobile, IoT, and automotive.

Mobile Artificial Intelligence (AI) Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2015–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD, million) |

|

Segments covered |

By Technology-Node, By Application |

|

Geographies covered |

North America, Europe, APAC, RoW |

|

Companies covered |

Apple (US), NVIDIA (US), Huawei (China), Samsung Electronics (South Korea), Qualcomm (US), Intel (US), IBM (US), Microsoft (US), MediaTek (Taiwan), and Google (US) |

The research report categorizes the mobile artificial intelligence (AI) market into the following segments and sub-segments:

- Market, by Application

- Smartphones

- Cameras

- Drones

- Automotive

- Robotics

- Augmented Reality (AR)/ Virtual reality (VR)

- Others (Smart Boards and PCs)

Market, by Technology Node

- 20–28nm

- 10nm

- 7nm and Others (12nm and 14nm)

Market, by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of APAC (RoAPAC)

-

Rest of the World (RoW)

- South America

- Middle East & Africa

Mobile Artificial Intelligence (AI) Market Highlights:

Recent Developments in Mobile Artificial Intelligence (AI) Industry

- In October 2021, Microsoft launched Microsoft AI Innovate, a program for nurturing and scaling start-ups leveraging Artificial Intelligence (AI). Microsoft AI Innovate is a 10-week initiative that will support start-ups in India leveraging AI technologies, helping them scale operations, drive innovation, and build industry expertise.

- In September 2021, Honor and Microsoft announced an expansion of an ongoing partnership between the two companies, under which they will collaborate on Microsoft cloud adoption, personal and mobile computing, as well as other technologies. As per the partnership, Honor will adopt AI speech and AI translation services based on Microsoft Azure. These services support Honor's Smart Assistant YOYO, collaborative office, smart travel, life services, smart translation, and other applications.

- In May 2021, Graphcore (UK) added three new North American partners — solution provider powerhouse Trace3, high-performance computing system integrator Applied Data Systems in the United States, and solution provider Images et Technologie in Canada. At the same time, three channel partners based in Europe — 2CRSi, BIOS IT and Boston Limited- are expanding its Graphcore reselling efforts to North America.

- Key Benefits of the Report/Reason to Buy:

- Target Audience: Manufacturers of mobile AI chips, original equipment manufacturers, Research organizations

Frequently Asked Questions (FAQs):

What is the current size of the mobile AI market?

The mobile AI market is projected to grow from USD 5.2 billion in 2018 to USD 17.8 billion by 2023; at a CAGR of 28.4% from 2018 to 2023.

Who are the winners in the mobile AI market?

Apple (US), Qualcomm (US), NVIDIA (US), Huawei (China), and Intel (US)

What are some of the technological advancements in the market?

Edge computing: The edge computing technique moves data processing close to the source of data rather than limiting the processing power in cloud/data centers. The combination of IoT and edge computing can reduce latencies and increase the penetration of AI in industries. Self-driving cars, robotics, and predictive maintenance are expected to leverage AI edge computing significantly during the forecast period. Edge computing and AI can together reduce maintenance time and costs in the road transportation, railways and aerospace industries. Machine learning-based predictive maintenance monitoring systems are already used in existing rail roads to monitor the tracks' condition and rolling stock. AI-based predictive maintenance systems are expected to reduce maintenance costs in the future significantly.

What are the factors driving the growth of the market?

The growth of the Mobile Artificial Intelligence (AI) market is driven by growing demand for AI-enabled processors in mobile devices, the rise in cognitive computing, and the growing number of AI applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in Mobile AI Market

4.2 Market, By Technology Node (Million Units)

4.3 Market, By Application (Million Units)

4.4 Market in APAC, By Application and Country (Million Units)

4.5 Market, By Region (Million Units)

5 Market Overview (Page No. - 32)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Growing Demand for AI-Capable Processors in Mobile Devices

5.1.1.2 Rise of Cognitive Computing

5.1.1.3 Growing Number of AI Applications

5.1.2 Restraints

5.1.2.1 Premium Pricing of AI Processors

5.1.2.2 Limited Number of AI Experts

5.1.3 Opportunities

5.1.3.1 Dedicated Low-Cost AI Chips for Camera and Vision Applications in Mobile Devices

5.1.3.2 Growing Demand for Edge Computing in Iot

5.1.4 Challenges

5.1.4.1 Unreliability of AI Algorithms in Mobile Apps

5.1.4.2 Creating Models and Mechanisms of AI

6 Mobile AI Market, By Application (Page No. - 37)

6.1 Introduction

6.2 Smartphones

6.3 Cameras

6.4 Drones

6.5 Robotics

6.6 Automotive

6.7 AR/VR

6.8 Others

7 Mobile AI Market, By Technology Node (Page No. - 49)

7.1 Introduction

7.2 20–28nm

7.3 10nm

7.4 7nm and Others

8 Mobile AI Market, By Region (Page No. - 54)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Rest of Europe (RoE)

8.4 Asia Pacific (APAC)

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 Rest of APAC

8.5 Rest of the World (RoW)

8.5.1 Middle East & Africa (MEA)

8.5.2 South America

9 Competitive Landscape (Page No. - 73)

9.1 Overview

9.2 Ranking Analysis

9.3 Competitive Situations and Trends

9.3.1 Product Launches and Developments

9.3.2 Agreements, Partnerships, Collaborations, and Contracts

9.3.3 Mergers & Acquisitions

10 Company Profiles (Page No. - 79)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1 Key Players

10.1.1 Nvidia

10.1.2 Intel

10.1.3 Microsoft

10.1.4 IBM

10.1.5 Qualcomm

10.1.6 Apple

10.1.7 Huawei (Hisilicon)

10.1.8 Alphabet (Google)

10.1.9 Samsung

10.1.10 Mediatek

10.2 Other Companies

10.2.1 Graphcore

10.2.2 Cerebras Systems

10.2.3 Cambricon Technology

10.2.4 Deephi Tech.

10.2.5 Shanghai Thinkforce Electronic Technology Co., Ltd. (Thinkforce)

10.2.6 Sambanova Systems

10.2.7 Rockchip (Fuzhou Rockchip Electronics Co., Ltd.)

10.2.8 Thinci

10.2.9 Kneron

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 112)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (46 Tables)

Table 1 Mobile AI Market, By Application, 2017–2023 (Million Units)

Table 2 Market, By Application, 2017–2023 (USD Million)

Table 3 Market for Smartphones, By Region, 2017–2023 (Million Units)

Table 4 Market for Smartphones, By Region, 2017–2023 (USD Million)

Table 5 Market for Cameras, By Region, 2017–2023 (Million Units)

Table 6 Market for Cameras, By Region, 2017–2023 (USD Million)

Table 7 Market for Drones, By Region, 2017–2023 (Million Units)

Table 8 Market for Drones, By Region, 2017–2023 (USD Million)

Table 9 Mobile AI Market for Robotics, By Region, 2017–2023 (Million Units)

Table 10 Market for Robotics, By Region, 2017–2023 (USD Million)

Table 11 Market for Automotive, By Region, 2017–2023 (Million Units)

Table 12 Market for Automotive, By Region, 2017–2023 (USD Million)

Table 13 Market for AR/VR, By Region, 2017–2023 (Million Units)

Table 14 Market for AR/VR, By Region, 2017–2023 (USD Million)

Table 15 Market for Others, By Region, 2017–2023 (Million Units)

Table 16 Market for Others, By Region, 2017–2023 (USD Million)

Table 17 Mobile AI Market, By Technology Node, 2017–2023 (Million Units)

Table 18 Market for 20–28nm Nodes, By Geography, 2017–2023 (Million Units)

Table 19 Market for 10nm Nodes, By Region, 2017–2023 (Million Units)

Table 20 Market for 7nm and Other Nodes, By Geography, 2017–2023 (Million Units)

Table 21 Mobile AI Market, By Region, 2017–2023 (Million Units)

Table 22 Market, By Region, 2017–2023 (USD Million)

Table 23 Market in North America, By Application, 2017–2023 (Million Units)

Table 24 Market in North America, By Application, 2017–2023 (USD Million)

Table 25 Market in North America, By Technology Node, 2017–2023 (Million Units)

Table 26 Market in North America, By Country, 2017–2023 (Million Units)

Table 27 Market in North America, By Country, 2017–2023 (USD Million)

Table 28 Market in Europe, By Application, 2017–2023 (Million Units)

Table 29 Market in Europe, By Application, 2017–2023 (USD Million)

Table 30 Mobile AI Market in Europe, By Technology Node, 2017–2023 (Million Units)

Table 31 Market in Europe, By Country, 2017–2023 (Million Units)

Table 32 Market in Europe, By Country, 2017–2023 (USD Million)

Table 33 Market in APAC, By Application, 2017–2023 (Million Units)

Table 34 Market in APAC, By Application, 2017–2023 (USD Million)

Table 35 Market in APAC, By Technology Node, 2017–2023 (Million Units)

Table 36 Market in APAC, By Country, 2017–2023 (Million Units)

Table 37 Market in APAC, By Country, 2017–2023 (USD Million)

Table 38 Mobile AI Market in RoW, By Application, 2017–2023 (Million Units)

Table 39 Market in RoW, By Application, 2017–2023 (USD Million)

Table 40 Market in RoW, By Technology Node, 2017–2023 (Million Units)

Table 41 Market in RoW, By Region, 2017–2023 (Million Units)

Table 42 Market in RoW, By Region, 2017–2023 (USD Million)

Table 43 Ranking of Top 5 Players in Market, 2017

Table 44 Product Launches and Developments (2017–2018)

Table 45 Agreements, Partnerships, Collaborations, and Contracts (2016–2018)

Table 46 Mergers & Acquisitions (2016 and 2017)

List of Figures (35 Figures)

Figure 1 Markets Covered

Figure 2 Research Flow

Figure 3 Mobile AI Market: Research Design

Figure 4 Data Triangulation

Figure 5 Mobile AI Market (2017–2023)

Figure 6 Smartphones to Hold Largest Share of Market Throughout Forecast Period

Figure 7 Market, By Technology Node, 2018–2023 (Million Units)

Figure 8 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 9 Market in APAC to Grow at Highest CAGR Between 2018 and 2023

Figure 10 10nm Technology Node to Hold Largest Size of Market Throughout Forecast Period

Figure 11 Smartphones to Hold Largest Share of Market Throughout Forecast Period

Figure 12 Smartphones to Hold Largest Share of Market in APAC in 2018

Figure 13 Market in China to Grow at Highest CAGR During Forecast Period

Figure 14 Growing Demand for AI-Capable Processors in Mobile Devices in Market

Figure 15 Market for Smartphones in APAC to Grow at Highest CAGR During Forecast Period

Figure 16 Market for Drones in APAC to Grow at Highest CAGR Between 2018 and 2023

Figure 17 Europe to Hold Largest Size of Market for Automotive Throughout Forecast Period

Figure 18 APAC to Lead Mobile AI Market for AR/VR Throughout Forecast Period

Figure 19 Market, By Technology Node (Million Units)

Figure 20 Market for 7nm and Other Nodes, By Geography (Million Units)

Figure 21 Market, By Geography

Figure 22 Snapshot of Mobile AI Market in North America

Figure 23 Snapshot of Market in Europe

Figure 24 Snapshot of Market in APAC

Figure 25 Companies Mostly Adopted Product Launches and Developments as Their Key Growth Strategies Between 2015 and 2018

Figure 26 Nvidia Corporation: Company Snapshot

Figure 27 Intel: Company Snapshot

Figure 28 Microsoft: Company Snapshot

Figure 29 IBM: Company Snapshot

Figure 30 Company Snapshot: Qualcomm

Figure 31 Company Snapshot: Apple

Figure 32 Huawei: Company Snapshot

Figure 33 Alphabet: Company Snapshot

Figure 34 Samsung: Company Snapshot

Figure 35 Mediatek: Company Snapshot

Growth opportunities and latent adjacency in Mobile Artificial Intelligence (AI) Market