Molecular Diagnostics Market Size by Product & Service (Reagents, Kits), Test Type (Lab, PoC), Sample Type (Blood, Urine), Technology (PCR, INAAT), Application (Infectious, Oncology), End User (Diagnostic Labs, Hospitals), Region - Global Forecast to 2028

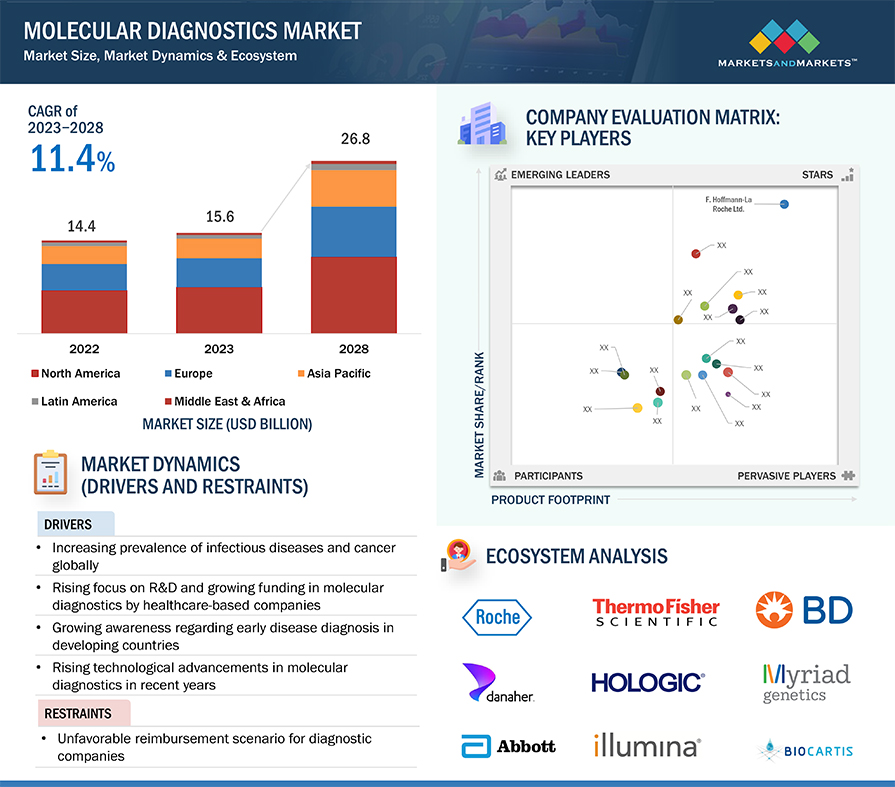

The size of global molecular diagnostics market in terms of revenue was estimated to be worth $15.6 billion in 2023 and is poised to reach $26.8 billion by 2028, growing at a CAGR of 11.4% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Market growth is largely driven by the increasing prevalence of infectious diseases and cancer and the growing funding for R&D in molecular diagnostics. On the other hand, the unfavorable reimbursement scenario and the high cost of instruments may restrain the growth of this market to a certain extent.

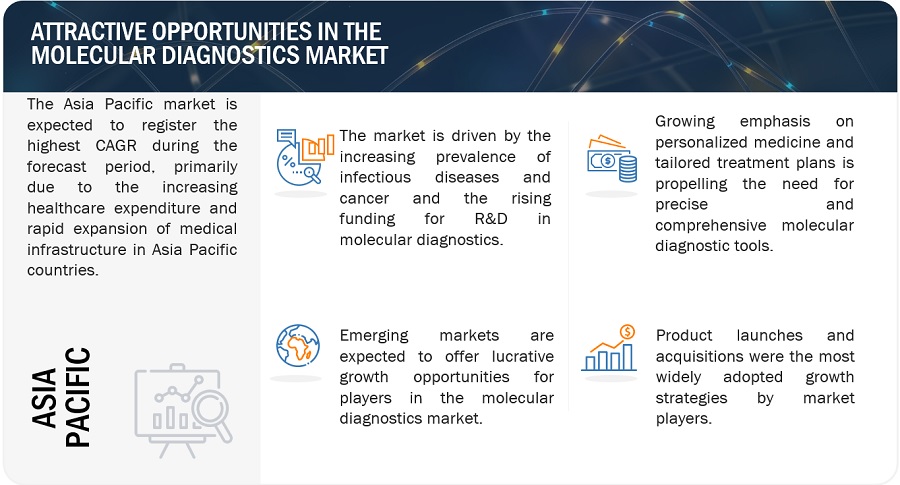

Attractive Opportunities in the Molecular Diagnostics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Molecular Diagnostics Market Dynamics

DRIVER: Rising technological advancements in molecular diagnostics in recent years

In recent years, several new technologies have been introduced in the market. Shotgun metagenomic next-generation sequencing is a comprehensive genomics-based test that identifies every known microorganism present in a patient’s sample. Each sample is screened for about 40,000 microorganisms—including bacteria, viruses, parasites, and fungi. The MSI Analysis System detects microsatellite instability (MSI), a form of genomic instability linked to a dominant hereditary cancer called Lynch Syndrome. Sample preparation methods have improved in the field of molecular diagnostics. NANOPEC can help decrease the probability of receiving the wrong diagnosis because the fluorescent signal is too weak or the biomarker concentration is too low. Such technological advancements by various key players will increase the adoption of molecular diagnostics, thus driving market growth in the coming years.

OPPORTUNITY: Growing significance of companion diagnostics in drug development process

Companion diagnostics include tests or assays intended to assist healthcare providers in making treatment decisions for patients based on the best response to therapy. The co-development of companion diagnostics with therapeutic products can significantly alter the drug development process and commercialize drug candidates by yielding safer drugs with enhanced therapeutic efficacy quickly and cost-effectively. With an increase in the demand for high-priced specialist therapies and safer drugs, the market for companion diagnostics is expected to grow at a robust rate. This growing importance of companion diagnostics also provides growth opportunities for the market. The growing availability of such advanced and efficient companion diagnostic tests is expected to support the growth of the market in the coming years.

RESTRAINT: Unfavorable reimbursement scenario for diagnostic companies

Inadequate reimbursements are a major factor restraining the growth of the market. A major challenge faced by most diagnostic companies face in commercializing their tests is getting Medicare and private health insurers to pay for them. In the US, Medicare revised its reimbursement mechanism for some IVD tests, including molecular tests, in 2021. Some of these molecular pathology tests do not have their own Healthcare Common Procedure Coding System (HCPCS) codes and are instead billed using unlisted codes. In such cases, Medicare Administrative Contractors (MACs) establish a payment amount for their local jurisdictions. Medicare does not currently provide genetic testing coverage for individuals without a personal history of cancer (Source: American Society of Clinical Oncology). These factors are expected to affect the US molecular testing market adversely.

CHALLENGE: Operational barriers and shortage of skills across major markets

Clinical laboratories across major markets are still evolving; technicians face operational challenges in ensuring effective sample procurement, storage, and transportation, especially while adopting novel technologies such as NGS and lab-on-a-chip PCR devices. Laboratory spaces also need to be reconfigured to conduct specific molecular diagnostic tests used for pathogen detection to avoid cross-contamination and ensure efficient time management. This results in considerable cost escalations in maintaining and operating advanced molecular diagnostic instruments, particularly those capable of handling a single sample type.

Furthermore, due to the rapid mutation of microbes and the increasing outbreak of epidemics, clinical laboratories need to adopt innovative technologies capable of rapid sample diagnosis. However, the shortage of skilled and technically knowledgeable laboratory technicians to operate advanced molecular diagnostic products has hindered their overall adoption, particularly in emerging markets.

Molecular Diagnostics Ecosystem/Market Map

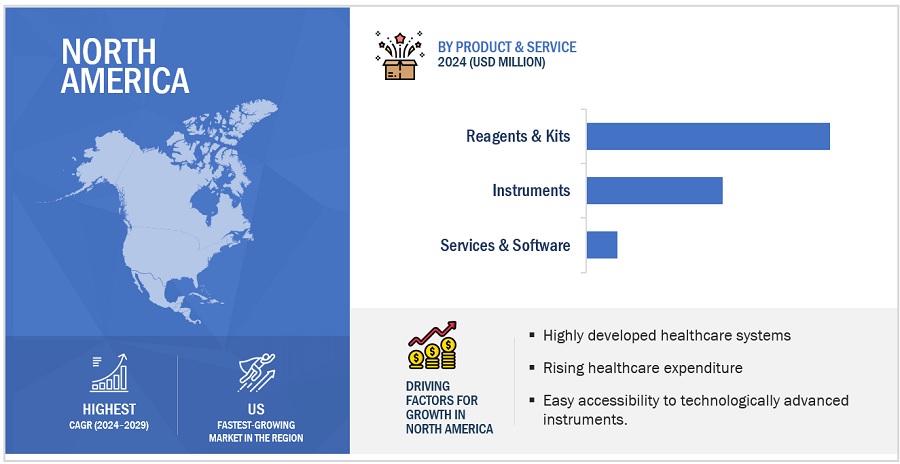

Reagents & kits segment accounted for the largest share of the molecular diagnostics industry in 2022, by product & service

The molecular diagnostics market is categorized into reagents & kits, instruments, and services & software based on product & service. The reagents & kits segment emerged as the dominant force in the market in 2022. The recurring cost associated with the frequent requirement of reagents & kits is a significant factor contributing to the market's growth. Furthermore, technological advancements in molecular diagnostics continuously drive the development of new and improved reagents and kits. The availability of advanced reagents and kits that offer enhanced performance and reliability fosters their widespread adoption and contributes to the segment's growth.

Lab tests segment accounted for the largest share in the molecular diagnostics industry in 2022, by test type

The global molecular diagnostics market is categorized into lab tests and PoC tests based on test type. In 2022, the lab tests segment held the largest share in the market, categorized by test type. The growth of this segment can be attributed to factors such as the growing demand for automation in laboratory settings and the increasing incidence of various infectious diseases.

Lab tests generally have higher sensitivity and specificity compared to PoC tests. The controlled laboratory environment allows for more accurate and precise measurements, reducing the chances of false-negative or false-positive results. This is particularly crucial in infectious disease diagnostics where accuracy is paramount for appropriate treatment and containment measures. Another advantage of lab tests is the ability to process a large volume of samples simultaneously. Automated platforms and high-throughput systems in laboratories can handle a high sample throughput, enabling efficient testing for infectious diseases. Such factors are expected to fuel the growth of this segment.

Blood, serum, and plasma, urine, and other sample types segment accounted for the largest share in the molecular diagnostics industry in 2022, by sample type

Based on sample type, the molecular diagnostics market has been segmented into blood, serum, and plasma, urine, and other sample types. In 2022, the blood, serum, and plasma segment accounted for the largest share of the market. These sample types provide a rich and diverse pool of molecular diagnostic information. They contain circulating DNA, RNA, proteins, and other biomarkers that carry valuable insights into various diseases and conditions. This wealth of information enables healthcare professionals to make accurate diagnoses, monitor disease progression, and personalize treatment decisions.

North America accounted for the largest share of the molecular diagnostics industry in 2022

The molecular diagnostics market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading contributor, claiming the largest portion of the market share in the molecular diagnostics industry. North America has been at the forefront of technological advancements in the field of molecular diagnostics. The region has a robust infrastructure for R&D, which has led to the rapid adoption of innovative diagnostic techniques and platforms. Also, North America houses several major companies operating in the molecular diagnostics sector. These companies have significant expertise, resources, and established distribution networks, which contribute to the region's market dominance. Examples of prominent molecular diagnostics companies in North America include Hologic, Inc. (US), PerkinElmer, Inc. (US), Abbott Laboratories (US), and Thermo Fisher Scientific Inc. (US).

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are Danaher (US), F. Hoffmann-La Roche Ltd. (Switzerland), Hologic, Inc. (US), Abbott Laboratories (US), Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), bioMérieux (France), and QIAGEN (Netherlands). The market leadership of these players stems from their comprehensive product portfolios and expansive global footprint. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the Molecular Diagnostics Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$15.6 billion |

|

Projected Revenue Size by 2028 |

$26.8 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 11.4% |

|

Market Driver |

Rising technological advancements in molecular diagnostics in recent years |

|

Market Opportunity |

Growing significance of companion diagnostics in drug development process |

This report categorizes the molecular diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Reagents & Kits

- Instruments

- Services & Software

By Test Type

- Lab Tests

- PoC Tests

By Sample Type

- Blood, Serum, and Plasma

- Urine

- Other Sample Types

By Technology

- Polymerase Chain Reaction

- Isothermal Nucleic Acid Amplification Technology

- DNA Sequencing & Next- generation Sequencing

- In Situ Hybridization

- DNA Microarrays

- Other Technologies

By Application

-

Infectious Disease Diagnostics

- Hepatitis

- HIV

- CT/NG

- HAI

- HPV

- Tuberculosis

- Influenza

- Other Infectious Diseases

-

Oncology Testing

- Breast Cancer

- Colorectal Cancer

- Lung Cancer

- Prostate Cancer

- Other Cancers

- Genetic Testing

- Other Applications

- COVID-19

By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Molecular Diagnostics Industry

- In February 2023, Thermo Fisher Scientific Inc. (US) acquired Binding Site Group (UK), a global leader in specialty diagnostics, to expand Thermo Fisher’s existing specialty diagnostics portfolio with the addition of pioneering innovation in diagnostics and monitoring for multiple myeloma.

- In October 2022, F. Hoffmann-La Roche Ltd. (Switzerland) received 510(k) clearance from the US FDA for the cobas SARS-CoV-2 Qualitative PCR test for use on the fully automated cobas 6800 and cobas 8800 Systems.

- In May 2022, F. Hoffmann-La Roche Ltd. (Switzerland) partnered with Global Fund to support low- and middle-income countries in strengthening critical diagnostics infrastructure.

- In December 2021, Hologic, Inc. (US) launched Panther Trax for high-volume molecular testing.

- In March 2021, Abbott Laboratories (US) received Emergency Use Authorization (EUA) from the FDA for a laboratory PCR assay, Alinity m Resp-4-Plex molecular assay, that detects and differentiates between SARS-COV-2, flu A, flu B, and RSV in one test.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global molecular diagnostics market?

The global molecular diagnostics market boasts a total revenue value of $26.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global molecular diagnostics market?

The global molecular diagnostics market has an estimated compound annual growth rate (CAGR) of 11.4% and a revenue size in the region of $15.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

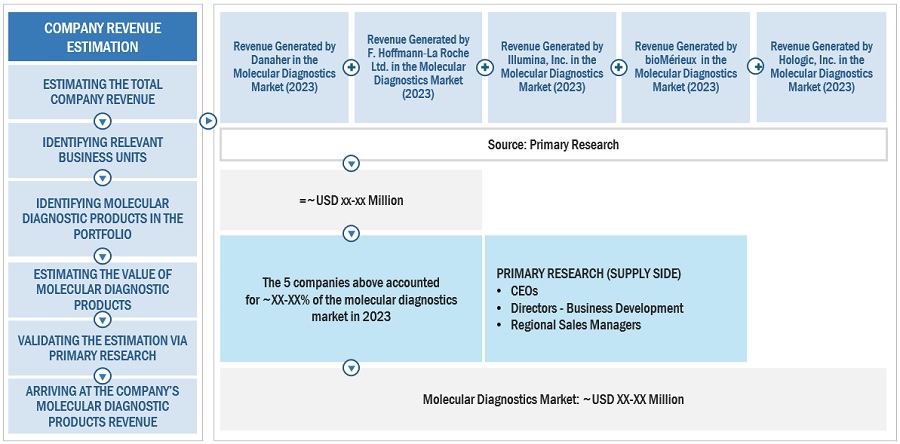

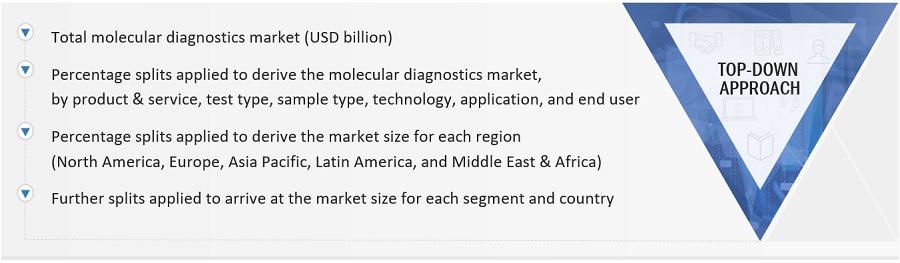

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, agreements and partnerships of the leading players, the competitive landscape of the molecular diagnostics market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

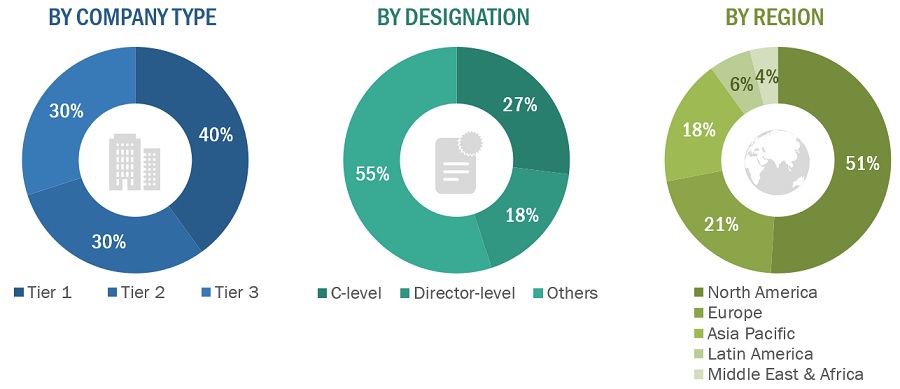

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Abbott |

Marketing Manager |

|

F. Hoffmann-La Roche Ltd |

Senior Product Manager |

|

Danaher |

Marketing Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the molecular diagnostics market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the molecular diagnostics market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Molecular Diagnostics Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Molecular Diagnostics market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Molecular diagnostics is a technique that identifies and analyzes nucleic acids or proteins at a molecular level. This technique assesses the genetic makeup of an individual to identify a predisposition to any particular disease or condition and diagnose it.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global molecular diagnostics market, by product & service, test type, sample type, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall molecular diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the molecular diagnostics market

Company profiles

- Additional five company profiles of players operating in the molecular diagnostics market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the molecular diagnostics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molecular Diagnostics Market

• Due to covid, there was an increase in the demand for immunodiagnostics and molecular testing, which was regarded as the gold standard for diagnosing infectious diseases, leading to the increased sales of related consumables and kits. During the pandemic era, revenue growth for key players was majorly driven by the sales of COVID-19 diagnostic tests. The dominant model of laboratory testing throughout the world remains the centralized laboratory that uses automated analytical testing methods to detect target analytes. This trend is well established in clinical chemistry and haematology disciplines and is now extending to other areas, including immunoassays and molecular diagnostics. Reagents & kits segment accounted for the largest share in the IVD market and Oncology segment is expected to witness the fastest growth in the forecast period. With 30,000+ partners, technologies, and use-cases as the primary levers, we have deep understanding of IVD ecosystem. We offer more than 2X coverage throughout the IVD curve as compared to our competitors.

•The molecular diagnostics market is segmented into lab tests and PoC tests by test type. The lab tests segment accounted for the largest share of the molecular diagnostics market in 2021. Factors such as the increasing need for automation and the rising incidence of various infectious diseases are driving the growth of this segment. •Molecular diagnostic reagents include disease-specific kits and general reagents used during infectious disease diagnosis and pathogen screening. Laboratory technicians utilize specific disease diagnostic kits for earlier and more accurate identification of specific pathogen strains in a patient sample. General reagents are key components of a majority of conventional molecular diagnostic procedures. • Companies are now launching rapid kits and reagents to detect the novel coronavirus, which is further fueling the growth of this market segment. Regional authorities have also been actively engaged in providing emergency approvals for the use of these kits. In September 2020, Danaher Corporation (US) received Emergency Use Authorization (EUA) from the US Food & Drug Administration (FDA) for its Xpert Xpress SARS-CoV-2/Flu/RSV, a rapid molecular diagnostic test for the qualitative detection of the viruses causing COVID-19, Flu A, Flu B, and RSV infections from a single patient sample. In March 2020, QIAGEN N.V. (Netherlands) received FDA approval for its QIAstat-Dx test kit to detect coronavirus.