Molecular Quality Controls Market Product (Independent Control, Instrument Specific Control (PCR, DNA Sequencing), Application (Infectious Disease Diagnostics), Analyte type, End User (Hospitals, Diagnostic Lab), Region- Global Forecast to 2028

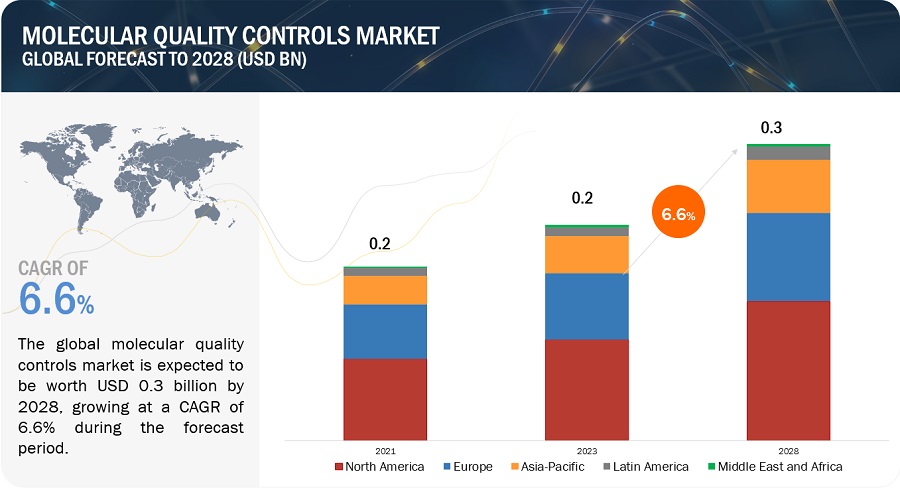

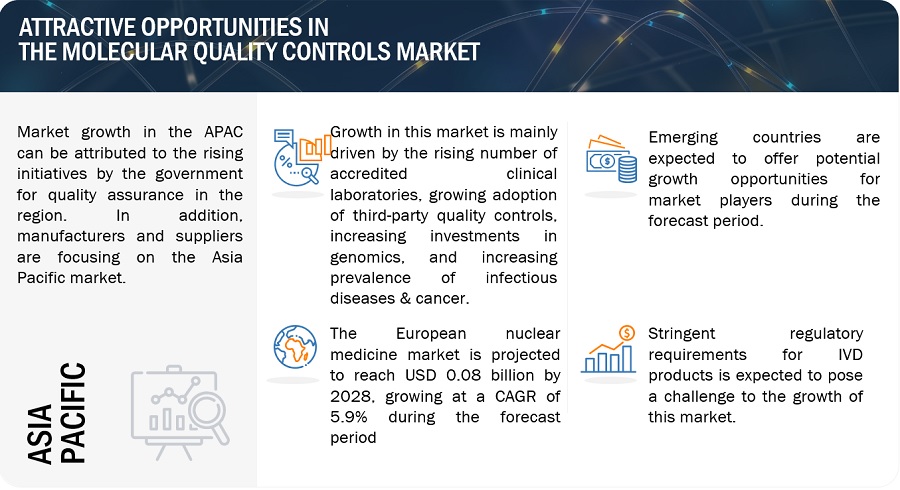

The global molecular quality controls market in terms of revenue was estimated to be worth $0.2 billion in 2023 and is poised to reach $0.3 billion by 2028, growing at a CAGR of 6.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is primarily driven by the increasing number of accredited clinical laboratories, growing adoption of third-party quality controls, and increasing government funding for genomic projects. Rising demand for multi-analyte controls and growth opportunities in emerging countries are expected to offer opportunities for market players during the forecast period.

On the other hand, the additional costs involved in the quality control process and budget constraints in hospitals and laboratories, are expected to restrain the market growth to some extent in the coming years.

Global Molecular Quality Controls Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Molecular Quality Controls Market Dynamics

Driver: Growing preference for personalized medicines

Genomics has played a key role in the emergence of personalized medicine. Personalized medicine provides tailored treatments and prevention procedures to suit each individual’s condition for optimal results. This field of medicine offers the most promising approach to tackle diseases that have not been well-known for responding effectively to the existing treatments or cures. As per the Personalized Medicine report published in the PMC (Personalized Medicine Coalition):

- In 2022, FDA’s Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities (NMEs), among these two NMEs were therapeutic products and others were diagnostic agents. 12 of the 35 new therapeutic molecular entities approved by the US FDA and 5 new cell-based therapies were personalized medicine.

The cost of genome sequencing has dropped dramatically in the last six years, approximately a million-fold. The Human Genome Project was completed by thousands of researchers in 13 years and cost USD 2.7 billion (Source: WIRED, September 2022). According to a blog published in Sequencing in 2022, due to the growing interest in DNA sequencing numerous bioinformatics companies are focused on creating new technologies, sequencers, and consumables aiming to offer genetic testing at affordable costs.

Restraint: Budgetary constraints in clinical laboratories

Setting up a QC process in a clinical laboratory requires significant investments. Laboratories also need to maintain dedicated personnel to manage the QC system. Moreover, QC procedures incur similar costs, regardless of the volume of tests performed. Hence, the cost of adopting QC procedures is very high for clinical laboratories working with low volumes of diagnostic tests. This, coupled with budgetary constraints in many hospitals and laboratories in developed and developing economies, is expected to result in the lower adoption of QC practices.

Opportunity: Rising demand for multi-analyte controls

Technological advancements have led to the development of a new range of multi-analyte and multi-instrument controls. These innovative controls consolidate multiple instrument-specific controls into a single control, thereby enabling clinical laboratories to cut down costs. In addition, these controls save the time involved in separate QC procedures for each individual analyte. A number of multi-analyte controls are available in the market, such as the Amplicheck Series (BD Company), AcroMetrix Series (Thermo Fisher Scientific), Seraseq Controls (SeraCare), and Introl Series (Maine Molecular Quality Controls). These controls help laboratories to perform quality control for multiple parameters, including cardiac and tumor markers and DNA/RNA of multiple infectious disease-causing agents in a single run.

Challenge: Stringent regulatory requirements for IVD products

Regulatory and legal requirements applied to IVD (including molecular diagnostics) in the US and European countries are becoming more stringent. In the US, IVD products are defined under 21 CFR 809 and regulated under guidelines like medical devices. The FDA released new FDA guidance documents. Under US federal regulations, device manufacturers must submit a 510 (k) application for any further modifications to a device. New applications may require software updates or new software installation in an existing device or any other changes made to these devices. In the past few years, the FDA requirements, particularly with regard to 510(k) notifications, have increased, requiring more data and details than earlier. This change, resulting in unpredictable premarket submission requirements, is extremely unfavorable for IVD manufacturers that require 510(k) clearance.

Molecular Quality Controls Market Ecosystem Map

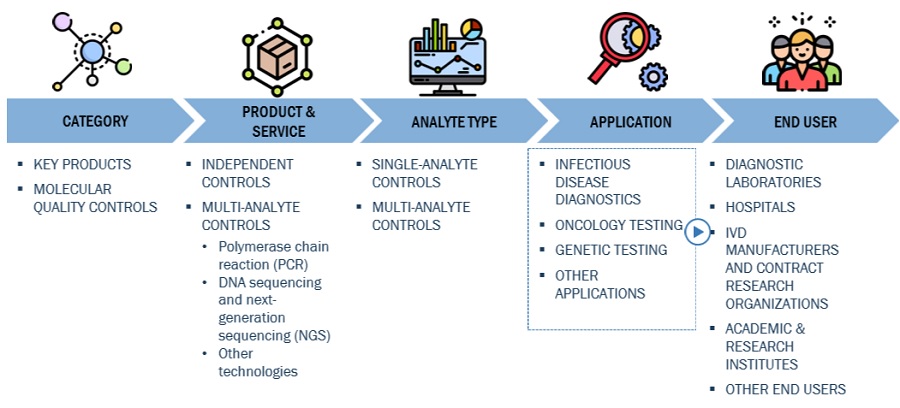

The independent controls segment of the Molecular Quality Controls Industry has accounted for the highest market share during the forecast period

On the basis of product, the molecular quality controls market is segmented into instrument specific controls and independent controls. The independent controls segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the longer shelf-life and reduced cost of operation.

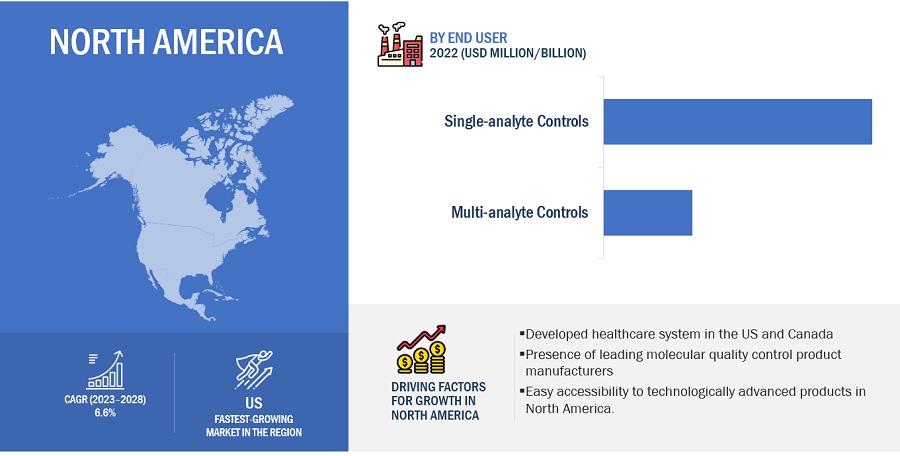

The single-analyte controls has accounted for the highest share of the Molecular Quality Controls Industry during the forecast period.

Based on analyte type, the molecular quality controls market is segmented into multi-analyte controls and single-analyte controls. Single-analyte controls accounted for the highest share of the market in 2022. The large share of this segment can be attributed to the low risk of cross-reactivity and the significant use of singleplex assays in hospitals.

The infectious disease diagnostic segment accounted for the highest share of the Molecular Quality Controls Industry in 2022

On the basis of application, the molecular quality controls market is segmented into genetic testing, oncology testing, infectious disease diagnostics, and other applications (including microbiology, tissue typing, DNA fingerprinting, cardiovascular disease testing and neurology disease testing). The infectious disease diagnostics segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the development of advanced assays for different infectious diseases.

The diagnostic laboratories segment accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on end users, the molecular quality controls market is segmented into diagnostic laboratories, hospitals, IVD manufacturers & CROs, academic & research institutes, and other end users (blood banks, local public health laboratories, home health agencies, and nursing homes). The diagnostic laboratories segment accounted for the largest share of the market in 2022. This can be attributed to the increasing number of accredited diagnostic laboratories worldwide and the growing number of laboratory tests performed in diagnostic laboratories.

North America accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on region, the molecular quality controls market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2022. The large share of this regional segment is mainly due to the developed healthcare system in the US and Canada and the presence of many leading molecular quality control product manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), Anchor Molecular (US), Thermo Fisher Scientific, Inc. (US), Randox Laboratories Ltd. (UK), LGC Limited (UK), Abbott Laboratories (US), Fortress Diagnostics (UK), SERO AS (Norway), Anchor Molecular (US), Vircell S.L. (Spain), Ortho Clinical Diagnostics, Inc. (US), QuidelOrthoCorporation (US), Sun Diagnostics, LLC (US), Seegene Inc. (South Korea), ZeptoMetrix, LLC (US), Qnostics (UK), Bio-Techne Corporation (US), Microbiologics, Inc. (US), Steck LLC (US), Helena Laboratories Corporation (US), Microbix Biosystems Inc. (Canada), Molbio Diagnostics Pvt. Ltd. (India), SpeeDx Pty. Ltd. (Australia), Maine Molecular Quality Controls, Inc. (US), and Grifols, S.A. (Spain).

Scope of the Molecular Quality Controls Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.2 billion |

|

Projected Revenue by 2028 |

$0.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.6% |

|

Market Driver |

Growing preference for personalized medicines |

|

Market Opportunity |

Rising demand for multi-analyte controls |

This study categorizes the global molecular quality controls market to forecast revenue and analyze trends in each of the following submarkets

By Product

- INDEPENDENT CONTROLS

-

INSTRUMENT-SPECIFIC CONTROLS

- POLYMERASE CHAIN REACTION (PCR)

- DNA SEQUENCING & NGS

- OTHER TECHNOLOGIES

By Analyte Type

- SINGLE-ANALYTE CONTROLS

- MULTI-ANALYTE CONTROLS

By Application

- INFECTIOUS DISEASE DIAGNOSTICS

- ONCOLOGY TESTING

- GENETIC TESTING

- OTHER APPLICATIONS

By End User

- DIAGNOSTIC LABORATORIES

- HOSPITALS

- IVD MANUFACTURERS & CONTRACT RESEARCH ORGANIZATIONS

- ACADEMIC & RESEARCH INSTITUTES

- OTHER END USERS

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of APAC (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Molecular Quality Controls Industry

- In 2023, Thermo Fisher Scientific (US) acquired The Binding Site Group to expands the company’s existing specialty diagnostics portfolio with the addition of pioneering innovation in diagnostics and monitoring for multiple myeloma.

- In 2022, Microbiologics Inc. (US) acquired the Cryologics (US) to extend the company’s capacity to serve quality control microbiologists dedicated to the safety of pharmaceutical and personal care products.

- In 2021, LGC SeraCare expanded its line of SARS-CoV-2 molecular quality solutions to include AccuPlex SARS-CoV-2 Variant Panel 1.

- In 2020, Roche entered a 15-year non-exclusive partnership with Illumina to broaden the adoption of NGS-based testing in oncology.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global molecular quality controls market?

The global molecular quality controls market boasts a total revenue value of $0.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global molecular quality controls market?

The global molecular quality controls market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $0.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

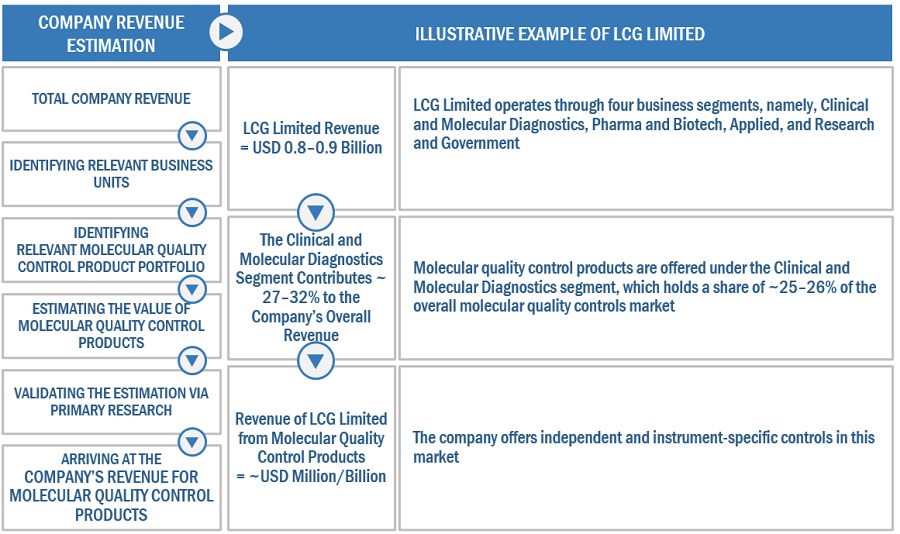

This study involved three major activities in estimating the size of the molecular quality controls market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the Clinical and Laboratory Standards Institute (CLSI), World Health Organization (WHO), Clinical Laboratory Improvement Amendments (CLIA), National Accreditation Board for Testing and Calibration Laboratories (NABL), Centers for Disease Control and Prevention (CDC), Organisation for Economic Co-operation and Development (OECD), Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), European Medicines Agency (EMA), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the molecular quality controls market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the smart pills market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

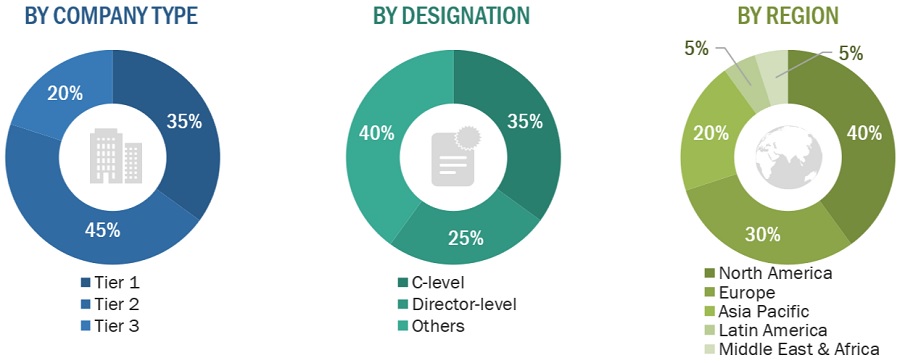

Breakdown of Primary Interviews

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the molecular quality controls market and to estimate the size of various other dependent submarkets in the overall molecular quality controls market.

The research methodology used to estimate the market size includes the following details:

- The market value of molecular quality controls for infectious disease diagnostics, oncology testing, and genetic testing applications have been extracted from the repository and validated through secondary and primary research.

- The market shares of the infectious disease diagnostics, oncology testing, and genetic testing applications in the global molecular quality controls market were derived and added up to reach the market value.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions, and other segments of the molecular quality controls market. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Molecular quality control is a quality control material made up of synthetic or biological components (such as whole blood, serum, plasma, urine, and spinal fluid sourced from human or animal origin) that can be used to evaluate and monitor analytical processes during molecular testing procedures for clinical diagnostics and research applications. The focus of these quality controls is to test the molecular diagnostic products in order to identify defects and report them to management authorities.

Key Stakeholders

- Molecular quality control manufacturers, vendors, and distributors

- Manufacturers and distributors of molecular diagnostic instruments and assays

- Group purchasing organizations (GPOs)

- Original equipment manufacturers (OEMs)

- Diagnostic laboratories

- Hospitals and clinics

- Contract research organizations (CROs)

- IVD manufacturers and distributors

- Blood banks

- Research institutes and government organizations

- Market research and consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists

Report Objectives

- To define, describe, segment, and forecast the global molecular quality controls market by product, analyte type, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall molecular quality controls market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the market segments in five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies2 in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as product launches, partnerships, collaborations, mergers, and acquisitions are the principal growth strategies adopted by market players in this period

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molecular Quality Controls Market

Nice share thanks for the details in quality control