More Electric Aircraft Market by Aircraft Type (Fixed Wing, Rotary Wing), Application (Power Generation, Power Distribution, Power Conversion, Energy Storage), Aircraft System, Component, End User, and Region – Global Forecast to 2027

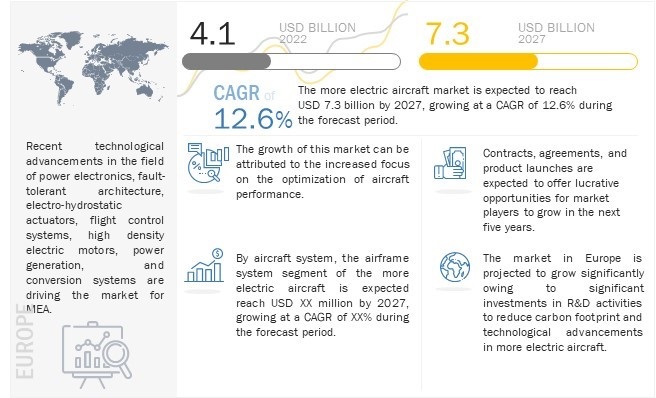

The More Electric Aircraft Market size is expected to grow at a compound annual growth rate (CAGR) of 12.6% during the forecast period, reaching USD 7.3 billion by 2027 from USD 4.1 billion in 2022. The concept of MEA involves using electric power for non-propulsive systems instead of pneumatic and hydraulic power sources, driven by the aviation industry's increasing environmental concerns. Recent technical developments in power electronics, fault-tolerant architecture, electro-hydrostatic actuators, flight control systems, and high-density electric motors have enabled the rise of the more electric aircraft era. The adoption of this concept is crucial for unlocking gains in aircraft weight, fuel consumption, total life cycle costs, carbon neutrality, maintainability, and reliability. High-density battery solutions and optimized aircraft performance are driving the growth of the more electric aircraft industry, as airplane OEMs collaborate with their suppliers to develop new power-dense electrically-intensive designs.

This report provides a detailed study of the MEA market based on application, component, aircraft system, aircraft type, end-user, and region. It offers a complete overview of each market segment and the market size analysis. There has been a rapid rise in research activities for the development of commercially viable electric aircraft. The main driver for these research activities and the introduction of technologically advanced aircraft (more electric aircraft, hybrid electric aircraft, and fully electric aircraft) is the advantages of aircraft electrification, such as reduced aircraft weight, fuel consumption, and carbon emission.

Major manufacturers of aircraft electrical components are based in the US, the UK, Germany, China, and Japan. Europe and North America are prime distributors and component manufacturers markets, as major aircraft electrification developments are being undertaken in these regions. Some players operating in the market are AMETEK (US), Safran (France), Astronics Corporation (US), Amphenol Corporation (US), Honeywell International, Inc (US), Meggitt (UK), and Thales Group (France). These More Electric Aircraft Companies have well-equipped strong distribution networks across the North American, European, Asia Pacific, Middle East & African, and Latin American regions.

More Electric Aircraft Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

More Electric Aircraft Market Dynamics:

Driver: Advancement of high-density battery solutions for more electric aircraft

More electric aircraft are developing different prototypes, from delivery drones to passenger aircraft. However, more electric aircraft are still lacking due to a suitable batteries. Batteries play a pivotal role in the success and wide adoption of MEA. Lithium-ion is a developing battery technology offering a potential solution for aircraft propulsion. Key industry players, such as GE Aviation, Honeywell, and BAE Systems, have invested in developing new lithium-based batteries with high power density. Presently, battery technologies are in the development stage and can supply power to small passenger aircraft traveling short distances. Advanced applications in aircraft tend to consume more power, needing batteries with high-power storage and improved safety features. Despite the potential of lithium-ion batteries, various manufacturers of energy storage systems in Japan, China, South Korea, the US, and Europe believe that the performance of lithium-ion batteries can be improved significantly. Therefore, significant research funding is being undertaken to improve the performance of lithium-ion batteries and develop other related battery technologies.

According to Tesla CEO Elon Musk, the development of an aircraft battery with a power density of 400 Wh/kg will rapidly boost the electrification of aircraft. Solid-state batteries are an innovative solution for the aviation industry and are expected to be adopted for the operation of various aircraft electrical systems by 2030. Magnesium-based, lithium-based, and sodium-ion solid-state batteries offer various advantages, including long lifecycles and increased energy density. The development of these batteries is expected to boost the more electric aircraft market over the forecast period.

Leading More Electric Aircraft companies such as Airbus and Boeing use li-ion batteries in various non-propulsive aircraft systems as they are lightweight and meet required safety standards. Significant potential in emerging markets and adoption by leading MEA companies such as Boeing and Airbus are creating a positive environment for the growth of the market for Li-ion batteries. Li-ion battery packs are fitted with battery management systems (BMS) that enable them to perform functions such as monitoring, equalization, protection & alarm, display, state of charge estimation, intelligent communication, and healthy management of batteries. Companies manufacturing aircraft-specific li-ion batteries include Aero Lithium Batteries (US), Sichuan Changhong Battery Co., Ltd. (China), and EAGLEPICHER TECHNOLOGIES (US), among others.

Restraint: Huge amount of investment and longer clearance period

Every component or product manufactured for the aviation industry requires thorough R&D. Manufacturers must invest heavily in R&D on enhanced electrical components and systems for aircraft. Aircraft manufacturers and OEMs need high initial capital to set up machinery and upgrade manufacturing capabilities, skilled workforce, state-of-the-art technical equipment, and integration platforms. Furthermore, the manufactured components need approval from various authorities before they are installed on board an aircraft. It is not easy to obtain approval for replacing conventional systems with electric systems in an aircraft. For instance, in the U.S., the Federal Aviation Administration (FAA) insists on using conventional systems in certain aircraft classes. The approval process can be tedious and time-consuming, consisting of various tests and procedures. Toyota Motor Corporation invested USD 394 million in the aerospace business Joby Aviation in January 2020, building an all-electric aircraft with vertical take-off and landing capabilities. Multiple partners contributed a total of USD 720 million to Joby Aviation. The significant capital need for MEA technology makes getting finance difficult for new market players. Thus, high capital requirements and longer clearance period act as major restraints for the growth of the more electric aircraft market.

Opportunity: Emergence of alternative power sources for electric power generation

Companies in the aviation industry are striving to reduce aircraft emissions by using fuel cells to provide electrical generation onboard aircraft. Fuel cells can transform chemical energy from a fuel into electricity through a chemical reaction. The adoption of aircraft electrification with fuel cells can save fuel through the efficient generation of electricity. Electric power from fuel cells can be used for aircraft brakes, during landing and taxiing on the ground, or when the main engines are not operational. Research activities have been undertaken on a possible aircraft architecture wherein a fuel cell power unit is used to replace the aircraft’s auxiliary power unit (APU). The APU provides most of the power required for subsystems in flight and on the ground. However, these units consume significant amounts of fuel. Using fuel cells instead of APUs to power aircraft subsystems and satisfy all major loads can help reduce fuel consumption. Solid oxide fuel cells (SOFC) and proton exchange membrane fuel cells (PMFC) are widely used to power aircraft systems. These fuel cells provide low internal resistance and long-term durability. They can operate at high temperatures and provide high-quality waste heat, generating additional electric power, thus improving the system's efficiency.

Challenge: Thermal management in electrical systems

More electric aircraft are replacing pneumatic and hydraulic power with electric power. The replaced electrical components need high electric input. Hence the electric power required in MEA is much higher than that in a conventional aircraft. For instance, the overall electrical power generation of Boeing 787 is above 1MW, while a conventional aircraft uses less than 0.25MW. All power management, generation, distribution, and conversion levels in an aircraft electrical system generate heat and require effective thermal management. An aircraft's use of electrical systems to optimize its performance has a collateral increased heating effect and therefore required an efficient thermal management solution. Batteries, capacitors, and other components of electrical systems need efficient thermal management to deliver high power effectively. Thermal management systems need to provide high heat absorbing capacity concerning heat generated by electrical systems. Furthermore, the complex electrical systems that include bipolar transistors, Variable Speed Constant Frequency (VSCF) systems, and converters in aircraft generate a large amount of heat which poses a challenge in thermal management. In order to have an efficient, more electric aircraft system, there is a need for optimized power conversion, distribution, and thermal management systems, which is a major challenge for aircraft manufacturers.

Based on aircraft system, the more electric aircraft market size is segmented into propulsion and airframe systems. The electrification of various propulsion and airframe systems allows air transportation to cut carbon emissions and operational expenses. This is projected to lead to greater adoption of electric aircraft in the future years. The airframe system remains to be the dominating segment during the forecasted period.

Based on component, the more electric aircraft market share is segmented into engines, batteries, fuel cells, solar cells, generators, actuators, electric pumps, power electronics, distribution devices, valves, and landing gear. The generators segment is projected to grow from USD 967 million in 2022 to USD 1,690 million by 2027, at a CAGR of 11.8% during the forecast period.

Based on the solution, the more electric aircraft market report is segmented into fixed-wing and rotary-wing. The increasing awareness of the development of emission-less air transport is a major factor driving the market. Several governing bodies, such as ICAO and the European Commission, have started implementing aircraft emissions and noise pollution regulations. These bodies are announcing plans for emission-less air transport. The fixed-wing segment is the largest growing segment of more electric aircraft type during the forecasted period.

Regional Insights:

More Electric Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

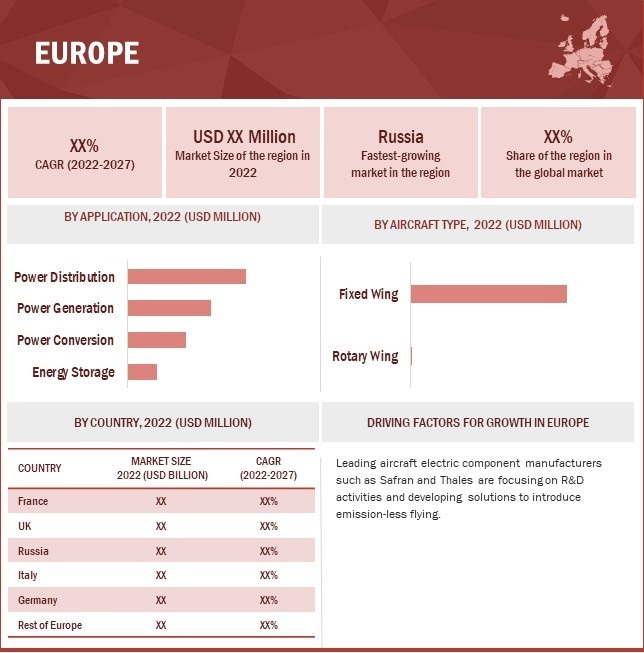

The Europe region is projected to Grow at the highest CAGR during the forecast period

For the regional market analysis, Europe includes the UK, France, Germany, Russia, Italy, and the rest of Europe. The European aviation sector aims to incorporate new modern materials with enhanced mechanical qualities in aircraft, such as gamma-titanium aluminides and single crystals; these sophisticated engines assist aircraft in minimizing fuel consumption, carbon emissions, and noise. Government agencies such as the European Union Aviation Safety Agency (EASA), the European Defence Agency (EDA), the UK Civil Aviation Authority (CAA), and the European Air Transport Command are critical in ensuring transportation safety and addressing issues such as carbon emissions and noise pollution. Rolls-Royce (UK), Safran Group (France), GKN Aerospace (UK), Airbus (Netherlands), Thales Group (France), and Turbomeca (France) are among Europe's leading electric aircraft manufacturers. These aircraft manufacturers focus on many aircraft electrification schemes, likely to boost the regional market. During the projected period, moving electric aircraft development projects, airline mergers, and increased air traffic will likely drive market expansion in this region.

The North American region held the second major share of the More Electric Aircraft Systems Market in 2021

The major countries considered under this region are the US and Canada. The US is estimated to lead the more electric market in North America in 2021. The growth of the market in this region can be attributed to the presence of several large aircraft electrical systems manufacturers such as Raytheon Technologies Corporation (US) and Astronics Corporation (US), and Honeywell International, Inc (US). These players continuously invest in R&D to develop more aircraft electrical systems with improved efficiency and reliability. They are also focused on developing more electric aircraft systems rather than using hydraulics in aircraft. The aviation aerospace sector in the North American region is also growing steadily. This has created a significant demand for more electric aircraft. The market's growth is also driven by rapid growth in aircraft manufacturing, technological advancements, and travel and tourism.

Top More Electric Aircraft Companies - Key Market Players:

The more electric aircraft companies are dominated by a few globally established players such as Honeywell International Inc. (Us), General Electric (US), Raytheon Technologies Corporation (US), Safran S.A. (France), and Thales Group (France). This is also supported by their growth rates, which are remarkably close to the market's. These businesses provide their goods, solutions, and services to a variety of aircraft manufacturers. These top players' products and services are critical in both civil and military applications.

SAFRAN S.A.

Safran S.A. is the global leader in more electric aircraft. The company's well-established distribution network and brand value are critical to its success. Safran engages in three business segments: aircraft propulsion, aircraft equipment/defense/aerosystems, and aircraft interiors. The corporation is a prominent participant in the electric aircraft market, with operations in Europe, the Middle East, Asia & Oceania, North America, and Africa.

HONEYWELL INTERNATIONAL, INC.

International, Inc. is another leading player in the electric aircraft market. The company has undergone a partnership to strengthen its global presence. Honeywell is in the Americas, Europe, the Middle East & Africa, and Asia Pacific. In November 2018, Honeywell received a contract worth USD 1,036.0 million from the US Air Force to provide logistics support for secondary and ground-based auxiliary power systems for multiple aircraft types.

RAYTHEON TECHNOLOGIES CORPORATION

Raytheon Technologies Corporation is ranked third in the more electric aircraft market. Raytheon Technologies was formed after the merger of Raytheon Company and the United Technologies Corporation. The company focuses on inorganic strategies. For example, in April 2020, Raytheon Technologies Corporation announced the successful completion of the all-stock ‘merger of equals transaction between Raytheon Company and United Technologies Corporation.

Scope of the More Electric Aircraft Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

By component, application, aircraft system, aircraft type, end-user, and region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies Covered |

Honeywell International Inc. (Us), General Electric (US), Raytheon Technologies Corporation (US), Safran S.A. (France), Thales Group (France), and others |

More Electric Aircraft Market Highlights

This research report categorizes the more electric aircraft market based on component, application, aircraft system, aircraft type, end-user, and region

|

Report Metric |

Details |

|

More Electric Aircraft Market, By Component |

|

|

More Electric Aircraft Market, By Application |

|

|

More Electric Aircraft Market, By Solution |

|

|

More Electric Aircraft Market, By Aircraft Type |

|

|

More Electric Aircraft Market, By End-User |

|

|

More Electric Aircraft Market, By Region |

|

Recent Developments

- In April 2022, Safran Electrical & Power, a subsidiary of Safran SA, and AURA AERO (France), a digital and environmentally friendly aircraft manufacturer, signed a collaboration agreement to cooperate on the architecture and electric propulsion systems of two aircraft: the INTEGRAL E training aircraft and the ERA (Electric Regional Aircraft). The INTEGRAL E is already projected to get around 60 orders. The first flight is scheduled for 2022, with deliveries beginning in 2023.

- In April 2022, GE Aviation chose BAE Systems to supply energy management solutions for its newly announced hybrid electric technology demonstrator program. BAE Systems will develop, test, and deliver energy management components for megawatt-class electric aircraft as part of the NASA research project.

- In January 2022, As part of the US Air Force's ongoing modernization efforts to keep the B-52 bomber flying into the 2050s, Boeing selected Collins Aerospace, a subsidiary of Raytheon Technologies, to upgrade the aircraft with a new electric power generation system (EPGS). Collins will supply a modern EPGS derived from industry-leading commercial technology. The new EPGS will upgrade the B-52's current 70-year-old system with more efficient technology requiring less engine power. This will contribute to the Air Force's goal of a 30% improvement in fuel efficiency for the B-52 and a reduction in carbon dioxide emissions.

Frequently Asked Questions (FAQs):

What is the current size of the more electric aircraft market?

The more electric aircraft market is projected to grow from USD 4.1 Billion in 2022 and reach USD 7.3 Billion by 2027, at a CAGR of 12.6% during the forecast period.

Who are the winners in the more electric aircraft market?

Honeywell International Inc. (Us), General Electric (US), Raytheon Technologies Corporation (US), Safran S.A. (France), and Thales Group (France).

What are some of the technological advancements in the market?

The next advancement in lithium batteries is the lithium-sulfur battery (Li-S), a rechargeable battery recognized for its high specific energy. Li-S is lightweight due to the low atomic weight of lithium and the moderate atomic weight of sulfur, which is approximately the same as the density of water. Li-S batteries are meant for long and high-altitude unmanned solar-powered aircraft.

3D printing, also known as additive manufacturing (AM), is a process employed for layer-by-layer manufacturing of a component by using 3D design data obtained from a computer. This process enables designers to develop superior-quality components. It also leads to production feasibility and low production cost of components. 3D printing enables the production of different types of aerostructure components at different sites, simplifying the manufacturing supply chain and ensuring safe and economical warehousing of manufactured components. It also reduces manufacturing turnaround time from months to weeks and enables manufacturers of components to carry out innovations in their product designs.

What are the factors driving the growth of the market?

The evolution of the aviation industry has also led to the technological advancements of various system components, such as generators, rectifiers, actuators, linkages, and raw materials. The market for more electric aircraft is growing as more aircraft subsystems are electrically powered to enhance the overall efficiency of aircraft and reduce emissions. Moreover, market growth may lead to more electric technology advancement, and becoming an important driver for more electric aircraft architecture are among the key trends driving the market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MORE ELECTRIC AIRCRAFT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 MORE ELECTRIC AIRCRAFT MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 MORE ELECTRIC AIRCRAFT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Insights from industry experts

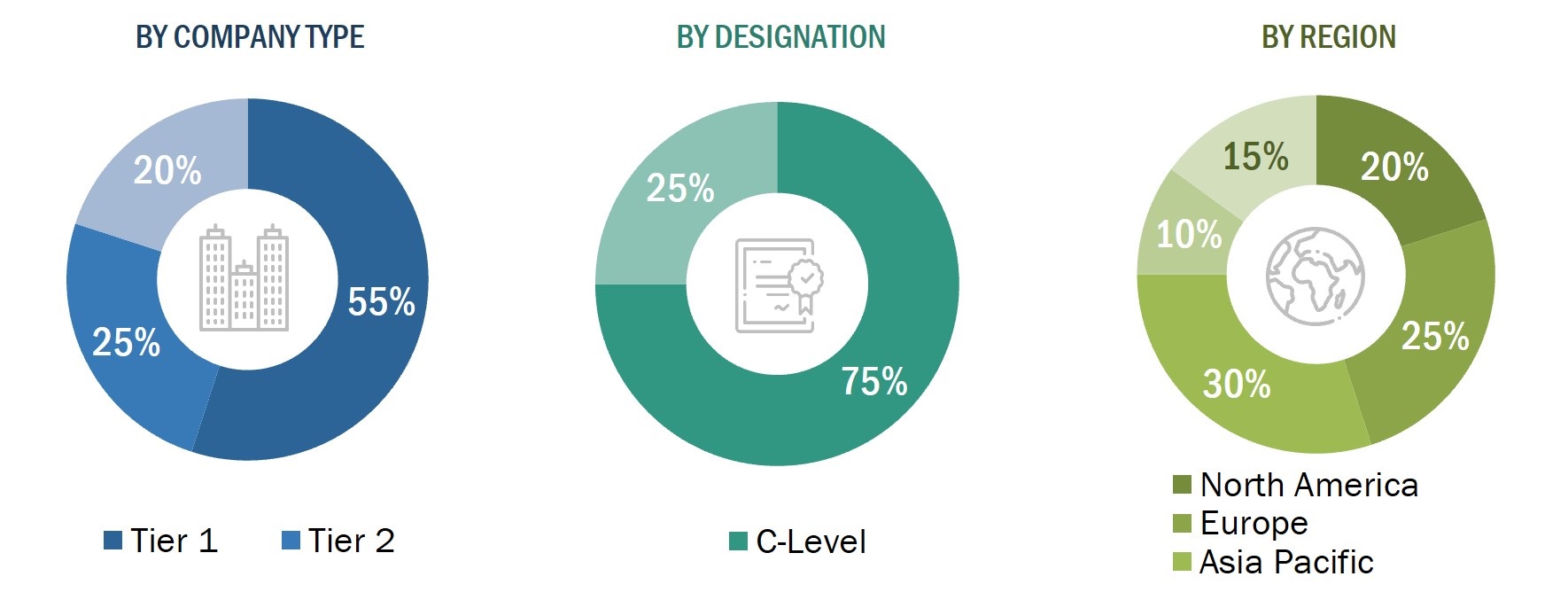

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Growing trend of more electric technology

2.2.2.2 Increasing demand for new commercial aircraft

2.2.2.3 Surging demand for cleaner and quieter aircraft

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Increasing adoption of electrical systems in aircraft

2.2.3.2 Emergence of alternative power sources for generation of electric power

2.3 MARKET SIZE ESTIMATION

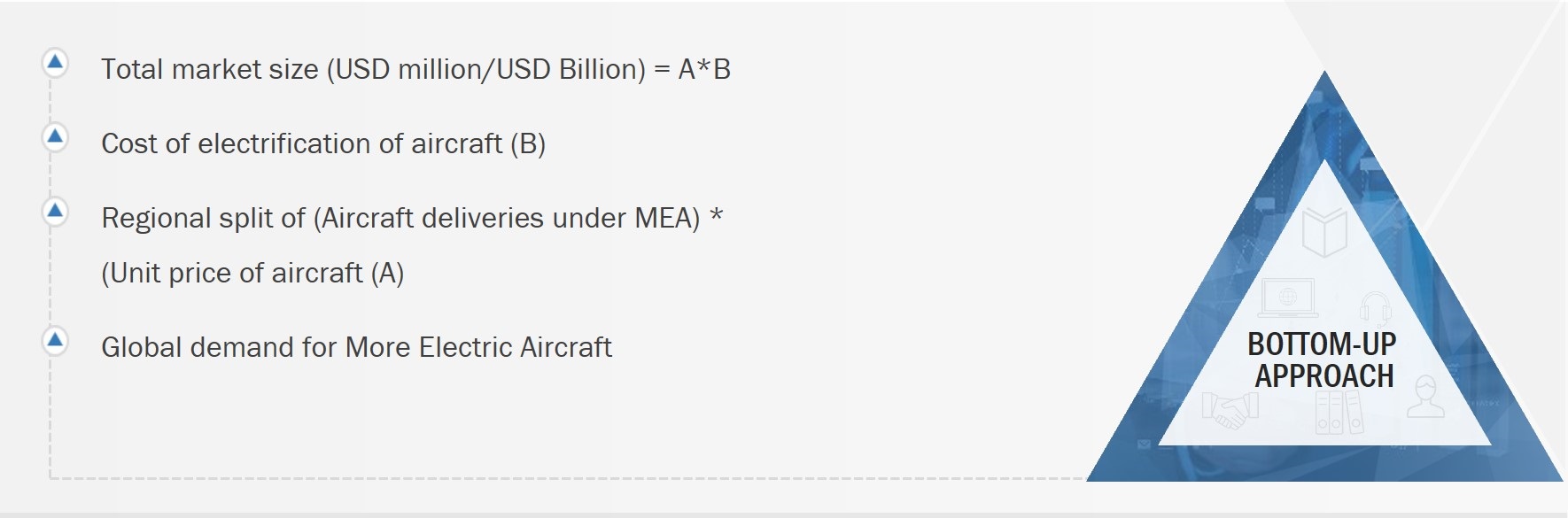

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market size estimation

2.3.1.2 More electric aircraft market research methodology

FIGURE 4 RESEARCH METHODOLOGY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 9 GENERATORS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MORE ELECTRIC AIRCRAFT MARKET DURING FORECAST PERIOD

FIGURE 10 POWER DISTRIBUTION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MEA MARKET FROM 2022 TO 2027

FIGURE 11 CIVIL SEGMENT TO LEAD MEA MARKET DURING FORECAST PERIOD

FIGURE 12 EUROPE ACCOUNTED FOR LARGEST SHARE OF MORE ELECTRIC AIRCRAFT MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE OPPORTUNITIES FOR MORE ELECTRIC AIRCRAFT MARKET PLAYERS

FIGURE 13 TECHNOLOGICAL ADVANCEMENTS IN POWER ELECTRONICS TO DRIVE MARKET

4.2 MORE ELECTRIC AIRCRAFT MARKET, BY APPLICATION

FIGURE 14 POWER DISTRIBUTION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MORE ELECTRIC AIRCRAFT MARKET DURING FORECAST PERIOD

4.3 MORE ELECTRIC AIRCRAFT MARKET, BY END USER

FIGURE 15 CIVIL SEGMENT TO LEAD MORE ELECTRIC AIRCRAFT MARKET DURING FORECAST PERIOD

4.4 MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE

FIGURE 16 FIXED WING SEGMENT TO ACCOUNT FOR LARGER SHARE OF MORE ELECTRIC AIRCRAFT MARKET DURING FORECAST PERIOD

4.5 MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT SYSTEM

FIGURE 17 PROPULSION SYSTEM SEGMENT TO REGISTER HIGHER CAGR IN MORE ELECTRIC AIRCRAFT MARKET DURING FORECAST PERIOD

4.6 MORE ELECTRIC AIRCRAFT MARKET, KEY COUNTRIES

FIGURE 18 MORE ELECTRIC AIRCRAFT MARKET IN SOUTH AFRICA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MORE ELECTRIC AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advancement of high-density battery solutions for more electric aircraft

5.2.1.2 Optimized aircraft performance using more electric technology

5.2.1.3 Decrease in operational and maintenance costs in more electric aircraft

5.2.1.4 Reduced emission and aircraft noise

5.2.2 RESTRAINTS

5.2.2.1 Huge amount of investment and longer clearance period

5.2.2.2 High voltage and thermal issues of aircraft electrical systems

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of alternative power sources for electric power generation

5.2.3.2 Development of advanced power electronics components

5.2.4 CHALLENGES

5.2.4.1 Thermal management in electrical systems

5.2.4.2 Reliability of electrical systems in harsh environments

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MORE ELECTRIC AIRCRAFT MARKET

FIGURE 20 REVENUE SHIFTS IN MEA MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

5.5 MORE ELECTRIC AIRCRAFT MARKET ECOSYSTEM

5.5.1 PROMINENT More Electric Aircraft COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END-USERS

FIGURE 22 MEA MARKET ECOSYSTEM MAP

TABLE 2 MORE ELECTRIC AIRCRAFT MARKET ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 TURBOGENERATORS FOR POWERING ELECTRIC MOTORS AND BATTERIES

5.6.2 ELECTRIC ACTUATORS

5.6.3 FLY-BY-WIRE

5.7 USE CASE ANALYSIS

5.7.1 USE CASE: MORE ELECTRIC ARCHITECTURE

5.7.2 USE CASE: AUXILIARY POWER UNIT

5.8 PRICING ANALYSIS

FIGURE 23 PRICING ANALYSIS OF MORE ELECTRIC AIRCRAFT MARKET, BY APPLICATION (USD THOUSAND)

5.9 MORE ELECTRIC AIRCRAFT, BY AIRCRAFT TYPE

TABLE 3 MORE ELECTRIC AIRCRAFT, BY AIRCRAFT TYPE, VOLUME DATA

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MORE ELECTRIC AIRCRAFT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 MORE ELECTRIC AIRCRAFT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MORE ELECTRIC AIRCRAFT

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER (%)

5.11.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR MORE ELECTRIC AIRCRAFT

TABLE 6 KEY BUYING CRITERIA FOR MORE ELECTRIC AIRCRAFT

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.1.1 Federal Aviation Administration (FAA) guidelines for electric motors in aircraft

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 EUROPEAN UNION (EU) ECODESIGN REGULATION

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 TRADE DATA ANALYSIS

TABLE 12 TRADE DATA TABLE FOR MORE ELECTRIC AIRCRAFT MARKET

5.14 KEY CONFERENCES AND EVENTS

TABLE 13 MORE ELECTRIC MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 INDUSTRY TRENDS (Page No. - 88)

6.1 INTRODUCTION

FIGURE 27 AIRCRAFT ELECTRICAL POWER DEMAND, 2010–2050

6.2 TECHNOLOGY TRENDS

6.2.1 PENETRATION OF ELECTRICAL SYSTEMS, BY AIRCRAFT TYPE

TABLE 14 PENETRATION OF ELECTRICAL SYSTEMS, BY AIRCRAFT TYPE

6.2.2 SHIFT FROM HYDRAULIC TO ELECTRIC LANDING GEAR

6.2.3 ELECTRICAL AND ELECTRONIC TECHNOLOGIES USED IN MORE ELECTRIC AIRCRAFT

6.2.3.1 Machine technologies for more electric aircraft

6.2.3.2 Power electronics

6.2.3.3 Energy management

6.2.4 ADVANCED BATTERIES

TABLE 15 TYPES OF ADVANCED AIRCRAFT BATTERIES: COMPARATIVE STUDY

6.2.4.1 Lithium-sulfur (Li-S)

6.2.5 ELECTRIC MOTOR-DRIVEN SMART PUMPS

6.2.6 3D PRINTING

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 SUSTAINABLE AVIATION FLUID

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2020–2022

7 MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT SYSTEM (Page No. - 96)

7.1 INTRODUCTION

FIGURE 29 MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 17 MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 18 MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

7.2 PROPULSION SYSTEM

TABLE 19 PROPULSION SYSTEM: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 20 PROPULSION SYSTEM: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.1 FUEL MANAGEMENT SYSTEM

7.2.1.1 Helps reduce fuel usage

7.2.2 THRUST REVERSER SYSTEM

7.2.2.1 Helps in reducing break wear

7.3 AIRFRAME SYSTEM

TABLE 21 AIRFRAME SYSTEM: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 22 AIRFRAME SYSTEM: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.1 ENVIRONMENTAL CONTROL SYSTEM

7.3.1.1 Ensures comfort in travel for long haul routes

7.3.2 ACCESSORY DRIVE SYSTEM

7.3.2.1 Helps aircraft operators reduce weight and increase power transmission capabilities

7.3.3 POWER MANAGEMENT SYSTEM

7.3.3.1 Aids in increasing energy efficiency in aircraft

7.3.4 CABIN INTERIOR SYSTEM

7.3.4.1 Helps enhance customer experience

7.3.5 FLIGHT CONTROL SYSTEM

7.3.5.1 Consists of necessary operating mechanisms to control aircraft's direction

8 MORE ELECTRIC AIRCRAFT MARKET, BY COMPONENT (Page No. - 101)

8.1 INTRODUCTION

FIGURE 30 MORE ELECTRIC AIRCRAFT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 23 MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 24 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

8.2 ENGINES

8.2.1 NO-BLEED ENGINE ARCHITECTURE PRESENT IN MORE ELECTRIC AIRCRAFT

8.3 BATTERIES

8.3.1 LITHIUM-SULFUR AND LITHIUM TITANATE BATTERIES—FUTURE OF AIRCRAFT BATTERIES

8.3.2 NICKEL-BASED BATTERIES

8.3.2.1 High capacity and quick charging capabilities drive usage

8.3.3 LEAD-ACID-BASED BATTERIES

8.3.3.1 Increasing usage due to low cost and low maintenance

8.3.4 LITHIUM-BASED BATTERIES

8.3.4.1 Wide-scale adoption in futuristic applications that require high energy density and low weight

8.4 FUEL CELLS

8.4.1 INCREASED EFFICIENCY OF FUEL CELLS REDUCES FUEL LOAD ON AIRCRAFT

8.5 SOLAR CELLS

8.5.1 AIRPLANES EQUIPPED WITH SOLAR CELLS CAN FLY WITHOUT LIQUID FUEL

8.6 GENERATORS

8.6.1 KEY PLAYERS DEVELOPING ADVANCED GENERATORS THAT REQUIRE LOW MAINTENANCE AND REDUCE COSTS OF OPERATION

TABLE 25 GENERATORS: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 26 GENERATORS: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.6.2 STARTER GENERATOR

8.6.2.1 Acts as parallel electrical power supply unit

8.6.3 AUXILIARY POWER UNIT (APU)

8.6.3.1 Essential as back-up electrical supply for aircraft

8.6.4 VARIABLE SPEED CONSTANT FREQUENCY (VSCF) GENERATOR

8.6.4.1 Provides more flexible electrical system architecture

8.7 ACTUATORS

8.7.1 HELP IN ACHIEVING PHYSICAL MOVEMENT THROUGH CONVERSION OF ELECTRICAL ENERGY

TABLE 27 ACTUATORS: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 28 ACTUATORS: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.7.2 ELECTRIC

8.7.2.1 Increasing emphasis on electrification of aircraft components

8.7.3 HYBRID ELECTRIC

8.7.3.1 Efficiency, precision, and low weight drive demand for hybrid electric actuators

TABLE 29 HYBRID ELECTRIC: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 30 HYBRID ELECTRIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.7.3.2 Electro-hydrostatic actuators (EHA)

8.7.3.3 Electro-mechanical actuators (EMA)

8.7.3.4 Electrical-backup hydraulic actuators

8.8 ELECTRIC PUMPS

8.8.1 ADOPTION OF ELECTRIC PUMPS INCREASING FOR NEXT-GENERATION AIRCRAFT

8.9 POWER ELECTRONICS

8.9.1 FOCUS ON REDUCING AIRCRAFT WEIGHT TO STIMULATE DEMAND FOR POWER ELECTRONICS

TABLE 31 POWER ELECTRONICS: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 32 POWER ELECTRONICS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.9.2 RECTIFIERS

8.9.2.1 Convert 120V AC power generated by engines or APU generators to 28V DC power

8.9.3 INVERTERS

8.9.3.1 Convert DC into AC

8.9.4 CONVERTERS

8.9.4.1 Provide high-quality DC electrical power for aerospace networks

8.1 DISTRIBUTION DEVICES

8.10.1 NEED FOR DISTRIBUTION OF ELECTRICITY WITH MINIMAL LEAKAGE OF POWER TO DRIVE DEMAND FOR DISTRIBUTION DEVICES

TABLE 33 DISTRIBUTION DEVICES: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 34 DISTRIBUTION DEVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.10.2 WIRES & CABLES

8.10.2.1 Shift toward more electric aircraft to increase demand for wires and cables

8.10.3 CONNECTORS & CONNECTOR ACCESSORIES

8.10.3.1 Increased demand for well-connected wiring systems to boost demand for connectors and connector accessories

8.10.4 BUSBARS

8.10.4.1 Growing electrification of aircraft components to induce demand for busbars

8.11 VALVES

8.11.1 REGULATE GAS LEVELS IN MEA ENGINES

8.12 LANDING GEAR

8.12.1 SAVE FUSELAGE FROM DRAGGING ON GROUND UPON LANDING

9 MORE ELECTRIC AIRCRAFT MARKET, BY APPLICATION (Page No. - 112)

9.1 INTRODUCTION

FIGURE 31 MEA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 35 MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 36 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 POWER GENERATION

9.2.1 ELECTRIC POWER GENERATORS HELP REDUCE EMISSIONS

9.3 POWER DISTRIBUTION

9.3.1 ELECTRIC POWER DISTRIBUTION SYSTEMS DETECT VOLTAGE AND FACILITATE PROMPT LOAD SHUT-OFF

9.4 POWER CONVERSION

9.4.1 MEA ARCHITECTURE HELPS INCREASE OPERATIONAL EFFICIENCY AND ACHIEVE WEIGHT REDUCTION

9.5 ENERGY STORAGE

9.5.1 INCREASE IN USE OF ADVANCED BATTERY AND FUEL CELL SYSTEMS TO BOOST DEMAND FOR ENERGY STORAGE DEVICES

10 MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE (Page No. - 116)

10.1 INTRODUCTION

FIGURE 32 MEA MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 37 MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 38 MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

10.2 FIXED WING

10.2.1 ME ARCHITECTURE IMPROVES FUEL CONSUMPTION AND RELIABILITY AND REDUCES MAINTENANCE COST IN FIXED-WING AIRCRAFT

TABLE 39 FIXED WING: MORE ELECTRIC AIRCRAFT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 40 FIXED WING: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 NARROW-BODY AIRCRAFT (NBA)

10.2.2.1 Advancements in hydraulic and pneumatic aircraft systems to propel demand for narrow-body aircraft

10.2.3 WIDE-BODY AIRCRAFT (WBA)

10.2.3.1 Post COVID-19 increase in passenger travel to raise demand for wide-body aircraft

10.2.4 REGIONAL AIRCRAFT

10.2.4.1 Increase in air passenger traffic to fuel demand for regional transport aircraft

10.2.5 FIGHTER JETS

10.2.5.1 Increasing military budgets to lead to heightened procurement of fighter jets

10.3 ROTARY WING

10.3.1 FANS IN ROTARY WING AIRCRAFT POWERED BY DISTRIBUTED ELECTRIC SYSTEMS USING CONVENTIONAL GAS TURBINE ENGINES

TABLE 41 ROTARY WING: MEA MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 42 ROTARY WING: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 MEDIUM HELICOPTERS

10.3.2.1 Used in corporate and civil applications to commute long distances to avoid road traffic

10.3.3 HEAVY HELICOPTERS

10.3.3.1 Designed to transport troops, vehicles, and supplies from ships to shore

11 MORE ELECTRIC AIRCRAFT MARKET, BY END-USER (Page No. - 121)

11.1 INTRODUCTION

FIGURE 33 MORE ELECTRIC AIRCRAFT MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 43 MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 44 MARKET, BY END-USER, 2022–2027 (USD MILLION)

11.2 CIVIL

11.2.1 FOCUS ON REDUCING EMISSIONS TO PROPEL GROWTH OF CIVIL MEA MARKET

11.3 MILITARY

11.3.1 INCREASE IN DEFENSE BUDGET ALLOCATION FOR MILITARY EQUIPMENT TO DRIVE MARKET

12 MORE ELECTRIC AIRCRAFT MARKET, BY REGION (Page No. - 124)

12.1 INTRODUCTION

FIGURE 34 EUROPE ACCOUNTED FOR LARGEST SHARE OF MORE ELECTRIC AIRCRAFT MARKET IN 2021

TABLE 45 MEA MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 46 MEA MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 35 NORTH AMERICA: MORE ELECTRIC AIRCRAFT MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Presence of leading OEMs to drive market

TABLE 57 US: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 58 US: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 59 US: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 60 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 US: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 62 US: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 63 US: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 64 US: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increasing R&D activities to fuel adoption of more electric aircraft

TABLE 65 CANADA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 66 CANADA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 67 CANADA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 68 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 69 CANADA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 70 CANADA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 71 CANADA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 72 CANADA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 36 EUROPE: MORE ELECTRIC AIRCRAFT MARKET SNAPSHOT

TABLE 73 EUROPE: MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

12.3.2.1 Presence of aircraft OEMs and aircraft electric component manufacturers to foster market growth

TABLE 83 UK: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 84 UK: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 85 UK: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 86 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 UK: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 88 UK: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 89 UK: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 90 UK: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 High investments in aerospace industry to fuel market

TABLE 91 FRANCE: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 94 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Developments in electric propulsion technologies to drive market

TABLE 99 GERMANY: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Presence of OEMs expected to support market

TABLE 107 RUSSIA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 108 RUSSIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 109 RUSSIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 110 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 111 RUSSIA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 112 RUSSIA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 113 RUSSIA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 114 RUSSIA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 High demand for electric components from more electric aircraft manufacturers to augment market growth

TABLE 115 ITALY: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 116 ITALY: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 117 ITALY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 118 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 ITALY: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 120 ITALY: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 121 ITALY: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 122 ITALY: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 123 REST OF EUROPE: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 126 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 REST OF EUROPE: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 128 REST OF EUROPE: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MORE ELECTRIC AIRCRAFT MARKET SNAPSHOT

TABLE 131 ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Growing domestic aviation market to provide opportunities for players

TABLE 141 CHINA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 142 CHINA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 143 CHINA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 144 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 CHINA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 146 CHINA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 147 CHINA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 148 CHINA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Improving domestic capabilities of aerospace industry to spur market growth

TABLE 149 INDIA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 150 INDIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 151 INDIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 152 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 153 INDIA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 154 INDIA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 155 INDIA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 156 INDIA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increasing in-house development of aircraft to boost market growth

TABLE 157 JAPAN: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 159 JAPAN: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 160 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 JAPAN: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 162 JAPAN: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 163 JAPAN: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Presence of aircraft electric component manufacturers to support market expansion

TABLE 165 SOUTH KOREA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 166 SOUTH KOREA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 167 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 168 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 169 SOUTH KOREA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 170 SOUTH KOREA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 171 SOUTH KOREA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 172 SOUTH KOREA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4.6 AUSTRALIA

12.4.6.1 Penetration of more electric technology in Australia to favor market growth

TABLE 173 AUSTRALIA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 174 AUSTRALIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 175 AUSTRALIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 176 AUSTRALIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 177 AUSTRALIA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 178 AUSTRALIA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 179 AUSTRALIA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 180 AUSTRALIA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

TABLE 181 REST OF ASIA PACIFIC: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 38 MIDDLE EAST & AFRICA: MORE ELECTRIC AIRCRAFT MARKET SNAPSHOT

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 UAE

12.5.2.1 Presence of leading global airlines to drive market

TABLE 199 UAE: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 200 UAE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 201 UAE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 202 UAE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 203 UAE: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 204 UAE: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 205 UAE: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 206 UAE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Significant growth in advanced power electronics to push market

TABLE 207 SAUDI ARABIA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 208 SAUDI ARABIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 209 SAUDI ARABIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 210 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 211 SAUDI ARABIA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 212 SAUDI ARABIA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 213 SAUDI ARABIA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 214 SAUDI ARABIA: MAE MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.5.4 ISRAEL

12.5.4.1 Presence of electric propulsion system manufacturers to accelerate market growth

TABLE 215 ISRAEL: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 216 ISRAEL: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 217 ISRAEL: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 218 ISRAEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 219 ISRAEL: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 220 ISRAEL: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 221 ISRAEL: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 222 ISRAEL: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.5.5 SOUTH AFRICA

12.5.5.1 Aircraft electrification in South Africa to induce market growth

TABLE 223 SOUTH AFRICA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 224 SOUTH AFRICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 225 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 227 SOUTH AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 229 SOUTH AFRICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 230 SOUTH AFRICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 231 REST OF THE MIDDLE EAST & AFRICA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 232 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 233 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 234 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 235 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 236 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 237 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 238 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 39 LATIN AMERICA: MORE ELECTRIC AIRCRAFT MARKET SNAPSHOT

TABLE 239 LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 240 LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 241 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 243 LATIN AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 244 LATIN AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 248 LATIN AMERICA: MAE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Presence of leading airlines to encourage market growth

TABLE 249 BRAZIL: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 250 BRAZIL: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 251 BRAZIL: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 252 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 253 BRAZIL: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 254 BRAZIL: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 255 BRAZIL: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 256 BRAZIL: MORE ELECTRIC AIRCRAFT MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Business jet companies to generate demand for more electric aircraft

TABLE 257 MEXICO: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 258 MEXICO: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 259 MEXICO: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 260 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 261 MEXICO: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 262 MEXICO: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 263 MEXICO: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 264 MEXICO: MARKET, BY END-USER, 2022–2027 (USD MILLION)

12.6.4 REST OF LATIN AMERICA

TABLE 265 REST OF LATIN AMERICA: MORE ELECTRIC AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2019–2021 (USD MILLION)

TABLE 266 REST OF LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 267 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 268 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 269 REST OF LATIN AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2019–2021 (USD MILLION)

TABLE 270 REST OF LATIN AMERICA: MARKET, BY AIRCRAFT SYSTEM, 2022–2027 (USD MILLION)

TABLE 271 REST OF LATIN AMERICA: MARKET, BY END-USER, 2019–2021 (USD MILLION)

TABLE 272 REST OF LATIN AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

This research study on the more electric aircraft market involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources considered included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the market and assess its growth prospects.

Secondary Research

The ranking analysis of companies in the more electric aircraft market was determined using secondary data from paid and unpaid sources and analyzing the product portfolios and service offerings of major More Electric Aircraft companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources for this research study included financial statements of MEA companies offering aircraft electric components for all technology stages, such as more electric aircraft, hybrid electric aircraft, and fully electric aircraft, along with various trade, business, and professional associations. The secondary data was collected and analyzed to determine the market's overall size, which primary respondents validated.

Primary Research

Through secondary research, extensive primary research was conducted after obtaining information about the more electric aircraft market's current scenario. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

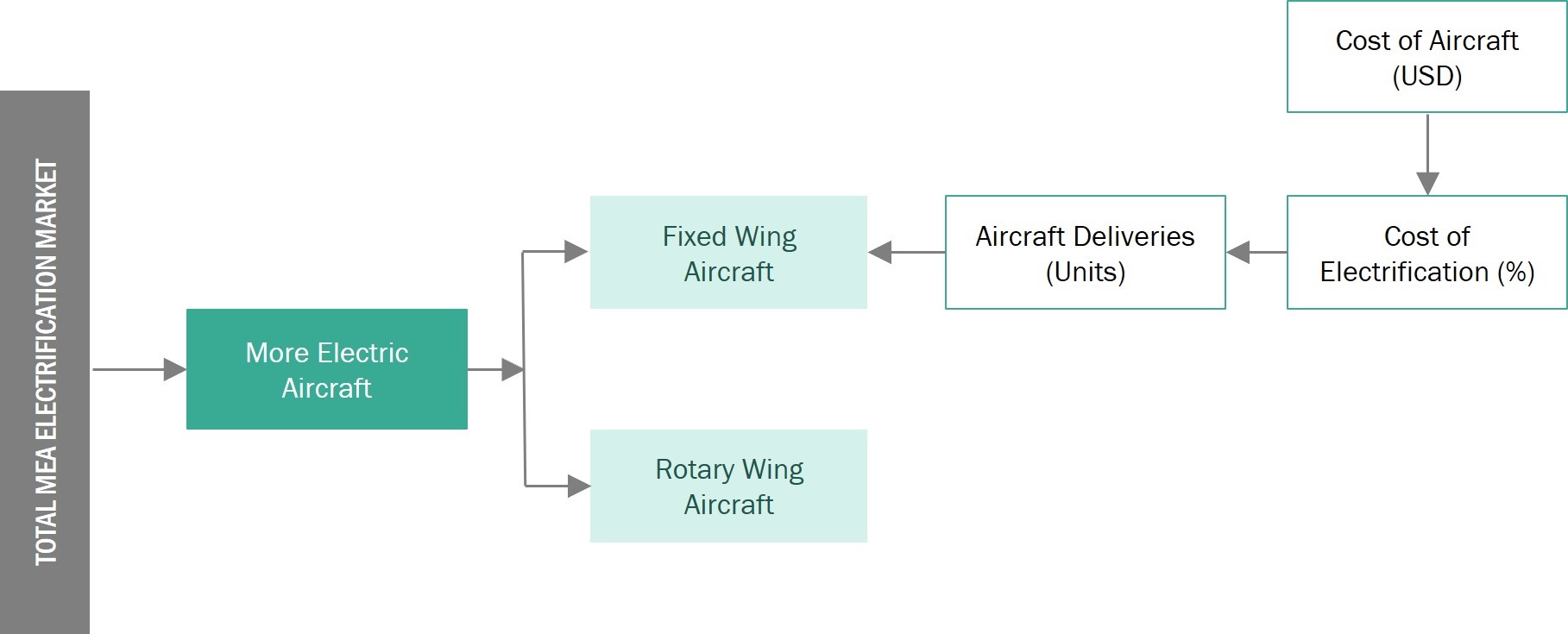

The top-down and bottom-up approaches have been used to estimate and validate the more electric aircraft market size. The following figure in this subsection represents the overall market size estimation process employed for this study.

The research methodology used to estimate the market size also includes the following details:

- Key players in the market have been identified through secondary research, and their market shares have been determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares split and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data has been consolidated, added with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation

This data has been consolidated, added with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

|

Step 1 |

Mapped the deliveries of more electric aircraft |

Mapped the deliveries of all types of aircraft considered under more electric aircraft segments from 2019 to 2027. |

|

Step 2 |

Classified the components required for each aircraft type |

Each aircraft considered in the scope (fixed and rotary wing) requires different electric components, in which the penetration of electric components and subcomponents is different. |

|

Step 3 |

Identified the total aircraft manufacturing cost |

Identified and mapped the total aircraft manufacturing cost for each aircraft considered in the study. |

|

Step 4 |

Percentage cost of more electric aircraft (MEA) |

Identified and co-related the cost of more electric architecture in the total cost for different aircraft under the more electric aircraft segment. |

|

Step 5 |

Arriving at the MEA market size (2021) |

MEA market 2021 = (Aircraft deliveries for 2021 * Cost of more electrification architecture (A). |

|

Step 6 |

Arriving at the MEA market size (2019-2027) |

The MEA market was estimated based on historical data and upcoming projects announced by OEMs |

More electric aircraft market research methodology

Market Size Estimation Methodology: Bottom-Up Approach

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual subsegments (mentioned in the market segmentation) through percentage splits acquired from secondary and primary research. For the calculation of specific market segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The bottom-up approach has been implemented to validate the market segment revenues obtained.

Market shares have been estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation and validation of data through primaries, the overall parent market size and each market size have been determined and confirmed in this study. The data triangulation used for this study is explained in the next section.

Market size estimation methodology: Top-down approach

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual subsegments (mentioned in the market segmentation) through percentage splits acquired from secondary and primary research. For the calculation of specific market segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The bottom-up approach has been implemented to validate the market segment revenues obtained.

Market shares have been estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation and validation of data through primaries, the overall parent market size and each market size have been determined and confirmed in this study. The data triangulation used for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, data triangulation and market breakdown procedures explained below have been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the more electric aircraft market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for five regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, as well as significant nations within each of these areas.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders

Available Customizations

MarketsandMarkets provides customizations in addition to market data to meet the individual demands of businesses. The following report customization options are available:

Product Evaluation

- The product matrix provides a thorough comparison of each company's product portfolio.

Regional Examination

- Further segmentation of the market at the national level

Information About the Company

- Additional market participants will be thoroughly examined and profiled (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in More Electric Aircraft Market