Multi-Cloud Networking Market by Component (Solutions and Services), Deployment Type (Public Cloud and Private Cloud), Organization Size, Vertical (IT & ITeS, BFSI, Healthcare & Life Sciences) and Region - Global Forecast to 2027

Updated on : April 10, 2023

Multi-Cloud Networking Market Analysis

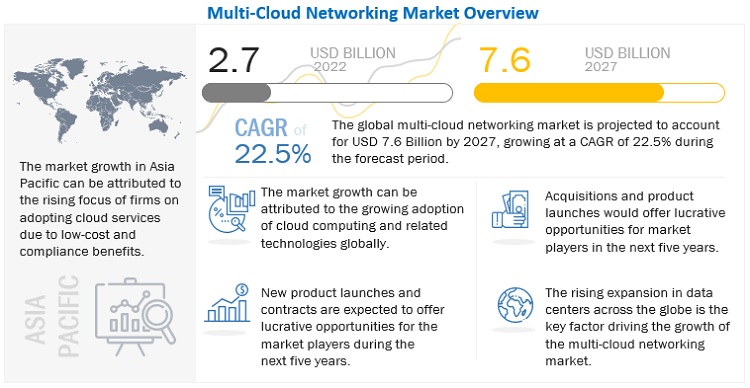

The global multi-cloud networking market is expected to increase from USD 2.7 billion in 2022 to USD 7.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 22.5% during the forecast period. Multi-Cloud Networking market helps in network performance. The practice of using cloud services from multiple, disparate providers is known as multi-cloud networking. This includes public cloud providers such as Amazon Web Services, Google Cloud Platform, and Microsoft Azure, as well as specialized platform-as-a-service, infrastructure-as-a-service, and software-as-a-service providers. Major key drivers of this market are such as dynamic provision, management, and control connectivity among enterprise networks, private data centers, public, hybrid clouds, improved capabilities driving new workloads to multi-cloud solutions. With organizations and enterprises starting to use multiple cloud resources, including both public clouds and private clouds, they need better ways to connect these resources using a software-defined approach and hence multi-cloud networking.

To know about the assumptions considered for the study, Request for Free Sample Report

In Multi-Cloud Networking Market Dynamics

Driver: Need for disaster recovery and contingency plan

With the rising IT consumerization and the increased usage of computing devices, the rate of data generation has increased multifold. Multi-cloud disaster recovery entails storing data with more than one cloud vendor. Multi-cloud backups can be as simple as sending data to multiple providers, such as Google Cloud Platform or Amazon AWS, for many organizations. Cloud disaster recovery is a cloud computing service that allows system data to be stored and recovered on a remote cloud-based platform. In addition, users need to store important documents, files, and other information as a backup in case of contingencies. Since individual users cannot afford expensive hardware for storing data as a backup, there is a need for low-cost, personal storage services. They also facilitate data recovery in case of data loss due to stolen devices or corrupted memory. Thus, users having a limited budget use the multi-cloud networking to store, access, and share data from anywhere using any device, thereby encouraging the growth of this market. This has made multi-cloud networking a necessity for consumers and enterprises with budget constraints to store, access, and share data from anywhere using any device, thereby encouraging the growth of this market.

Restraint: Limited technical expertise among enterprises in technologically developing geographies

Enterprises are rapidly moving toward digitalization by adopting emerging technologies to automate and accelerate their business processes efficiently. Cloud has become an essential part of enterprises’ IT strategy, due to its benefits such as low costs and enhanced business agility. The adoption of cloud computing services increases the demand for technically skilled labor and efficient change management to effectively implement and run cloud services in enterprises. Mostly, employees are reluctant to upgrade their skillsets and accept changes, which hinder the enterprises’ transition process. Moreover, these days, enterprises are more focused on driving profits rather than upgrading employee skills by providing appropriate training. In addition to this, companies are resistant to adopting the maturation process and willing to stick to traditional infrastructures or software services to avoid initial costs. These factors result in skills shortage and may lead to business saturation, as competitors might invest huge amounts in upgrading their business processes and service offerings. These factors might lead to customer and profit loss for companies not adopting new changes and would enable competitors to increase their market shares and customer base.

Opportunity: Emergence of Rise in number of small and medium-sized enterprises to create new revenue opportunities for cloud vendor

SMEs face budget constraints and constantly struggle to meet regulatory needs. Moreover, it is difficult for SMEs to efficiently focus on every business activity, as they have smaller IT teams and face a shortage of skilled employees. These complications are compelling SMEs to adopt cloud computing services, as they help in easily meeting regulatory needs, lowering Capital Expenditure [CAPEX] and Operating Expenditure [OPEX], enhancing security, increasing storage and flexibility, and automating software updates and business tasks, leading to improved employee productivity. Additionally, advantages such as scalability, pay-as-you-go, and easy access to information are helping SMEs access and use cloud services in a faster way. These factors are creating new opportunities for cloud vendors in this market.

Challenge: Complexity in redesigning the network for cloud

Redesigning networks from on-premises to cloud requires a significant initial investment, which is difficult for SMEs with limited budgets and resources. Furthermore, most businesses have found the transition to cloud deployment to be complex and costly. To accommodate their cloud infrastructure setup, enterprises must address a number of issues, including network architecture. Visibility, measuring performance, and managing workloads across multiple cloud deployment models is extremely difficult. Because of the deployment structure and the strategies required for building and managing multi-cloud environments, complexity is the most difficult challenge in the multi-cloud environment.

Based on organization size, SMEs segment is to be a larger dominator showcasing higher growth potential in the Multi-Cloud Networking market during the forecast period.

Organizations with fewer than 1000 employees are classified as SMEs. When compared to the large enterprise segment, the SMEs segment faces resource challenges. SMEs are focused on lowering overall costs and implementing improved infrastructure. They require a flexible payment model to improve the cost-effectiveness of their business process. Due to ease and flexibility, cloud infrastructure services are being rapidly adopted by SMEs; the demand is expected to grow during the forecast period. Major SMEs across the globe need to pay only according to their time and hardware. The benefits, such as seamless scalability, flexibility, a pay-as-you-go payment model, reduced operational costs, and customized offerings per business requirements, facilitate the adoption of cloud among SMEs. Some major vendors offering cloud computing to SMEs include Oracle, IBM, and Adobe. Today, IT managers at companies of all sizes are more experienced with purchasing cloud services (cloud-native, to use the terminology) and are beginning to feel more confident in adopting a multi-cloud approach. It's important that small businesses also consider becoming this type of cloud buyer to get the flexible, customized infrastructure they need to grow, innovate, and thrive.

Because SMEs are cost-conscious, cloud computing technology will be widely adopted over the next three to five years. The following are the primary advantages of cloud adoption among SMEs: Saving up to 50% on IT labour costs in configuration, operations, management, and monitoring reducing provisioning cycle times for servers and applications from weeks to minutes. Multi-cloud network services are adaptable in terms of demand and are priced on a pay-per-use basis, in which organizations pay for the IT services they consume. The compensation, per-utilize model implies that organizations pay for the services that they require and can easily scale up by paying for more clients or modules when the business requirement emerges, without having to invest heavily in hardware, applications, or IT faculty. Cloud operation and orchestration, governance, and compliance across large as well as small and mid-sized enterprises are multi-cloud networking intensive.

Based on vertical retail and e-commerce segment to grow at the highest CAGR during the forecast period

With the proliferation of online markets, retailers are adopting more innovative technologies, such as cloud computing, big data analytics, digital stores, and social networks. Vendors, in a particular industry, need a comprehensive cloud environment to offer their respective product and service portfolios to the customers. The retail and eCommerce vertical is facing the challenge of managing instabilities and changes in demand, for various products, due to high competition. Digital businesses will survive only if they respond to the customers’ needs quickly and get the pricing models right. The retail and eCommerce vertical is expected to experience potential growth in the near future due to the availability of retail outlets and omni-commerce adoption. The basic challenge in the retail and wholesale vertical is to deliver responsive and efficient customer services, across locations, at a reasonable cost. By ensuring that customers are provided with real-time insights, the retailers can maintain a strong relationship with their customers. This is possible only if the retailers have the best cloud services with multi-cloud networking solutions and services, to deliver immediate services to the customers across all regions.

To know about the assumptions considered for the study, download the pdf brochure

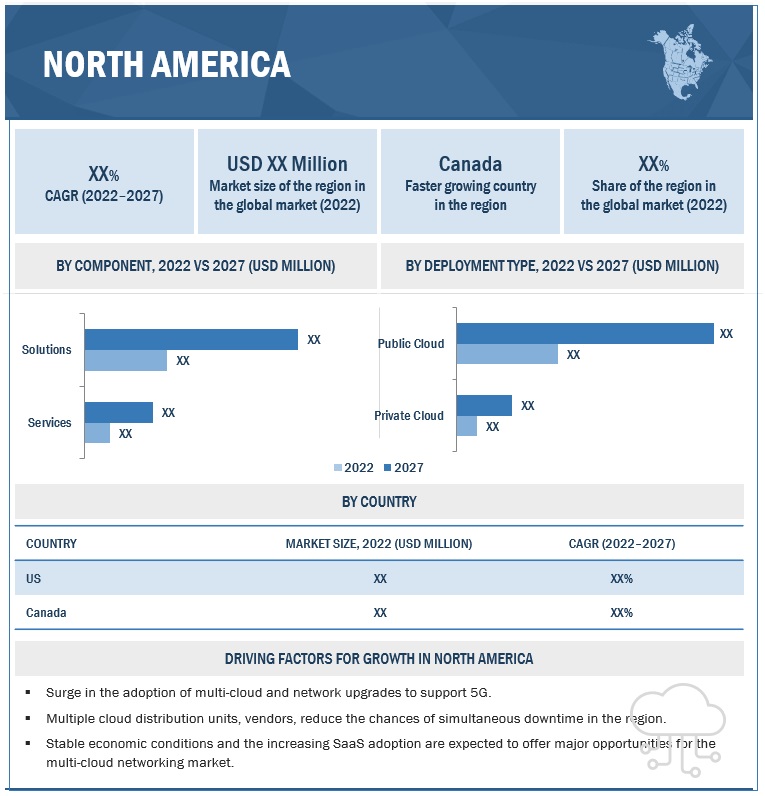

North America to record the largest market share during the forecast period

The multi-cloud networking market in the region is quickly shifting from isolated cloud solution to platform that integrate onsite, public, and private IaaS. Enterprises in this region are moving to cloud for its agility and cost-efficiency. The region robustly identifies several leading use cases and capabilities that are more often than not required in the building a global private multi-cloud network that connects on-premises environment to single or multiple public clouds with Internet and SaaS connectivity. Strict security policy enforcement for intra and inter-cloud traffic via next-generation firewalls, Secure Web Gateways (SWG), etc., while autoscaling the network services capacity based on real-time demand. When it comes to cloud computing adoption, US is the most mature market. This is due to the early adoption of cloud-based networks by the US markets. Organizations in both the countries (US and Canada) of this region have taken high level of initiatives towards adoption of latest digital technologies. The high internet penetration, coupled with initiatives from government agencies moving partially to the cloud to improve information services would also drive the growth of multi-cloud software-defined networking (SDN) technologies in the US & Canada. Moreover, US is home to multiple multi-cloud SDN solution vendors, such as Cisco, Oracle, Juniper Networks, Fortinet, F5, HPE, Dell among others. These companies are targeting higher revenue and business expansions due to high competition and demand prevailing across the region. Remote access and teleworking solutions for mobile users to possess omnipresent existence in order to access cloud and on-premises resources that are provisioned effectively. Optimal distributed access to SaaS and Internet applications being major cloud-based offerings in the region.

Key Market Players

The Multi-Cloud Networking market is dominated by companies such as VMware (US), Oracle (US), F5 (US), HPE (US), Cisco (US), Nutanix (US), CloudFlare (US), Juniper (US), Citrix (US), Versa networks (US), Illumio (US), Akamai (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 2.7 Billion |

|

Market size value in 2027 |

USD 7.6 Billion |

|

Growth rate |

CAGR of 22.5% |

|

Segments covered |

Component, deployment model, organization size, solutions, services, vertical and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

VMware (US), Oracle (US), F5 (US), HPE (US), Cisco (US), Nutanix (US), CloudFlare (US), Juniper (US), Citrix (US), Versa networks (US), Illumio (US), Akamai (US), Alkira (US), Aviatrix (US), Arista (US), Aryaka (US), Nefeli networks (US), Volterra (US), Prosimo (US), Infoblox (US) |

This research report categorizes the Multi-Cloud Networking market based on Component, deployment type, organization size, solutions, services, vertical and region

Based on Component:

- Solutions

- Services

Based on Deployment Type:

- Public Cloud

- Private Cloud

Based on Organization Size:

- SMEs

- Large Enterprises

Based on Solutions:

- Multi-cloud management [Cloud operations (monitoring), Security]

- Other solutions

Based on Services:

- Training and Support

- Integration and Implementation

- Consulting

Based on Vertical:

- IT & ITeS

- Banking, Financial Services, and insurance

- Retail & eCommerce

- Healthcare & Life Sciences

- Transportation & Logistics

- Manufacturing

- Media & Entertainment

- Energy & Utilities

- Other Verticals

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In June 2022, Versa Networks expanded Asia Pacific and Japan Leadership team to continue Global growth and meet accelerating Asia Pacific-Japan region demand for Versa SASE solution

- In March 2022, HPE launched HPE GreenLake edge-to-cloud Platform. In the hybrid cloud market, HPE GreenLake is unique in its simplicity, unification, depth of cloud services, and partner network. Now furthering the differentiation, boldly setting HPE GreenLake even further apart as the ideal platform for customers to drive data-first modernization, a new, unified operational experience is launched that provides a simplified view and access to all cloud services, spanning the entire HPE portfolio, with single sign-on access, security, compliance, elasticity, and data protection.

- In October 2021, with Illumio’s CloudSecure solution, organizations agentless visibility increased which enabled teams to build and orchestrate dynamic cloud workload policies at scale using native controls in their public, hybrid, and multi-cloud environments. Now, with Illumio’s market-leading Zero Trust segmentation solutions, security teams can prevent the devastating impact of cyberattacks and ransomware by securing their entire environment, including cloud-native applications such as platform as a service (PaaS), serverless, cloud managed containers, and managed database services. This is in addition to workloads running in public and hybrid clouds, data centers and endpoints

Frequently Asked Questions (FAQ):

What is the projected market value of the global multi-cloud networking market?

The global market for multi-cloud networking is projected to reach USD 7.6 billion.

What is the estimated growth rate (CAGR) of the global multi-cloud networking market for the next five years?

The global multi-cloud networking market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% from 2022 to 2027.

What are the major revenue pockets in the multi-cloud networking market currently?

The multi-cloud networking market in the region is quickly shifting from isolated cloud solution to platform that integrate onsite, public, and private IaaS. Enterprises in this region are moving to cloud for its agility and cost-efficiency. The region robustly identifies several leading use cases and capabilities that are more often than not required in the building a global private multi-cloud network that connects on-premises environment to single or multiple public clouds with Internet and SaaS connectivity. Strict security policy enforcement for intra and inter-cloud traffic via next-generation firewalls, Secure Web Gateways (SWG), etc., while autoscaling the network services capacity based on real-time demand. When it comes to cloud computing adoption, US is the most mature market. This is due to the early adoption of cloud-based networks by the US markets. Organizations in both the countries (US and Canada) of this region have taken high level of initiatives towards adoption of latest digital technologies. The high internet penetration, coupled with initiatives from government agencies moving partially to the cloud to improve information services would also drive the growth of multi-cloud software-defined networking (SDN) technologies in the US & Canada. Moreover, US is home to multiple multi-cloud SDN solution vendors, such as Cisco, Oracle, Juniper Networks, Fortinet, F5, HPE, Dell among others. These companies are targeting higher revenue and business expansions due to high competition and demand prevailing across the region. Remote access and teleworking solutions for mobile users to possess omnipresent existence in order to access cloud and on-premises resources that are provisioned effectively. Optimal distributed access to SaaS and Internet applications being major cloud-based offerings in the region.

Which are the major vendors in the multi-cloud networking market?

F5 (US), HPE (US), Oracle (US), VMware (US), Cisco (US) are major vendors in multi-cloud networking market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 MULTI-CLOUD NETWORKING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF MULTI-CLOUD NETWORKING FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF MULTI-CLOUD NETWORKING VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND-SIDE): MULTI-CLOUD NETWORKING MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): VENDOR-REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 10 MULTI-CLOUD NETWORKING MARKET SNAPSHOT, 2020–2027

FIGURE 11 MARKET, TOP SEGMENTS, 2022–2027

FIGURE 12 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 MULTI-CLOUD MANAGEMENT SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 INTEGRATION & IMPLEMENTATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 15 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 16 PUBLIC CLOUD SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 17 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 18 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 BRIEF OVERVIEW OF MULTI-CLOUD NETWORKING MARKET

FIGURE 19 SHIFTING WORKLOADS OF ENTERPRISES TOWARD CLOUD ENVIRONMENTS TO DRIVE MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 20 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODEL, 2022 VS. 2027

FIGURE 21 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 22 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 23 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET: INVESTMENT SCENARIO

FIGURE 24 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MULTI-CLOUD NETWORKING MARKET

5.2.1 DRIVERS

5.2.1.1 Avoidance of vendor lock-ins

5.2.1.2 Increased agility and automation

5.2.1.3 Need for high level of governance and policy

5.2.1.4 Increased return on investments with lower infrastructure and storage costs

5.2.1.5 Limited storage capacity of secondary storage devices and issues of accidental data loss

5.2.1.6 Surging demand for remote workspaces due to COVID-19 outbreak

5.2.1.7 Need for disaster recovery and contingency plans

5.2.2 RESTRAINTS

5.2.2.1 Data security and privacy concerns

5.2.2.2 Internet and connectivity issues

5.2.2.3 Limited technical expertise among enterprises in technologically developing geographies

5.2.2.4 Inadequate network bandwidth providers and lack of access to high-speed internet in many countries

5.2.2.5 Application portability in various cloud environments

5.2.3 OPPORTUNITIES

5.2.3.1 Transformation opportunity for ISVs into SaaS providers

5.2.3.2 Significant growth in hybrid cloud adoption

5.2.3.3 Boosting adoption of edge technologies

5.2.3.4 Rise in number of SMEs to create new revenue opportunities for cloud vendors

5.2.3.5 Rise in use of smart devices and cloud-based services

5.2.4 CHALLENGES

5.2.4.1 Integration with third-party applications

5.2.4.2 Compatibility complexities with legacy systems

5.2.4.3 Complexities in redesigning network for cloud

5.2.4.4 Lack of expertise and management overheads

5.3 ECOSYSTEM

FIGURE 26 ECOSYSTEM: MULTI-CLOUD NETWORKING MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: OVERALL CLOUD AND MULTI-CLOUD ENVIRONMENTS

5.5 PRICING ANALYSIS

TABLE 3 PRICING ANALYSIS OF CLOUD COMPUTING PROVIDERS

5.6 REGULATIONS

5.6.1 GENERAL DATA PROTECTION REGULATION

5.6.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.6.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.6.4 GRAMM-LEACH-BLILEY ACT

5.6.5 SARBANES-OXLEY ACT

5.6.6 SOC2

5.7 CASE STUDY ANALYSIS

5.7.1 MANUFACTURING: NISSAN MOTOR CO. LTD AUTOMATED BUSINESS PROCESSES BY DEPLOYING CISCO’S SOLUTIONS

5.7.2 FINANCIAL SERVICES: VMWARE HELPED DISCOVERY MOVE BUSINESS TOWARD CLOUD

5.7.3 HOSPITALITY: HOTEL SPIDER TRANSITIONED TO MICROSERVICES AND CLOUD WITH CYCLOID

5.7.4 HEALTHCARE: NIPRO CORPORATION KEPT REPORTING CONSISTENT AND LEVERAGED EXISTING DATA BY SAP

5.7.5 PHARMACEUTICALS: CELGENE USED AWS-BASED HPC RESOURCES TO AUTOMATE ANALYSES

5.7.6 GAMING: FSB TECHNOLOGY EXPANDED ITS GEOGRAPHICAL REACH BY DEPLOYING NUTANIX’S SOLUTIONS

5.8 TECHNOLOGY ANALYSIS

5.8.1 NETWORK OPERATIONS (NETOPS)

5.8.2 SECURITY OPERATIONS (SECOPS)

6 MULTI-CLOUD NETWORKING MARKET, BY COMPONENT (Page No. - 69)

6.1 INTRODUCTION

FIGURE 28 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2022

6.1.1 COMPONENTS: MARKET DRIVERS

TABLE 4 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 5 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

TABLE 6 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 7 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

TABLE 8 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 9 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MULTI-CLOUD NETWORKING MARKET, BY SOLUTION (Page No. - 73)

7.1 INTRODUCTION

FIGURE 29 MULTI-CLOUD MANAGEMENT SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

7.1.1 SOLUTIONS: MARKET DRIVERS

TABLE 10 MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 11 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.2 MULTI-CLOUD MANAGEMENT

TABLE 12 MULTI-CLOUD MANAGEMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 13 MULTI-CLOUD MANAGEMENT: 7.2.1 CLOUD OPERATIONS (MONITORING)

7.2.1.1 Security

7.3 OTHER SOLUTIONS

TABLE 14 OTHER SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 15 OTHER SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MULTI-CLOUD NETWORKING MARKET, BY SERVICE (Page No. - 78)

8.1 INTRODUCTION

FIGURE 30 INTEGRATION & IMPLEMENTATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

8.1.1 SERVICES: MARKET DRIVERS

TABLE 16 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

8.2 TRAINING & SUPPORT

TABLE 18 TRAINING & SUPPORT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 TRAINING & SUPPORT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 INTEGRATION & IMPLEMENTATION

TABLE 20 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 CONSULTING

TABLE 22 CONSULTING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MULTI-CLOUD NETWORKING MARKET, BY DEPLOYMENT MODEL (Page No. - 84)

9.1 INTRODUCTION

FIGURE 31 PUBLIC CLOUD SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

9.1.1 DEPLOYMENT MODELS: MARKET DRIVERS

TABLE 24 MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 25 MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

9.2 PUBLIC CLOUD

TABLE 26 PUBLIC CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 PRIVATE CLOUD

TABLE 28 PRIVATE CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 PRIVATE CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MULTI-CLOUD NETWORKING MARKET, BY ORGANIZATION SIZE (Page No. - 89)

10.1 INTRODUCTION

FIGURE 32 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

10.1.1 ORGANIZATION SIZES: MARKET DRIVERS

TABLE 30 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 31 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 LARGE ENTERPRISES

TABLE 34 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MULTI-CLOUD NETWORKING MARKET, BY VERTICAL (Page No. - 94)

11.1 INTRODUCTION

FIGURE 33 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

11.1.1 VERTICALS: MARKET DRIVERS

TABLE 36 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 37 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES

TABLE 38 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 40 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 RETAIL & ECOMMERCE

TABLE 42 RETAIL & ECOMMERCE: MULTI-CLOUD NETWORKING MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 HEALTHCARE & LIFE SCIENCES

TABLE 44 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 TRANSPORTATION & LOGISTICS

TABLE 46 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 MANUFACTURING

TABLE 48 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 MEDIA & ENTERTAINMENT

TABLE 50 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 MEDIA & ENTERTAINMENT: MULTI-CLOUD NETWORKING MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 ENERGY & UTILITIES

TABLE 52 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.1 OTHER VERTICALS

TABLE 54 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 MULTI-CLOUD NETWORKING MARKET, BY REGION (Page No. - 106)

12.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 56 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

12.2.1 NORTH AMERICA: MARKET DRIVERS

TABLE 58 NORTH AMERICA: MULTI-CLOUD NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.3 CANADA

12.3 EUROPE

12.3.1 EUROPE: MULTI-CLOUD NETWORKING MARKET DRIVERS

TABLE 72 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UNITED KINGDOM

12.3.3 GERMANY

12.3.4 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MULTI-CLOUD NETWORKING MARKET DRIVERS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 86 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.3 JAPAN

12.4.4 REST OF ASIA PACIFIC

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: MULTI-CLOUD NETWORKING MARKET DRIVERS

TABLE 100 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 KINGDOM OF SAUDI ARABIA

12.5.3 UNITED ARAB EMIRATES

12.5.4 REST OF MIDDLE EAST & AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: MULTI-CLOUD NETWORKING MARKET DRIVERS

TABLE 114 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.3 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 138)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 MARKET EVALUATION FRAMEWORK, 2019–2022

13.3 COMPANY RANKING AND MARKET SHARE (KEY PLAYERS)

FIGURE 38 MULTI-CLOUD NETWORKING MARKET: VENDOR SHARE ANALYSIS

13.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2017–2021

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 40 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

TABLE 128 COMPANY COMPONENT FOOTPRINT

TABLE 129 COMPANY VERTICAL FOOTPRINT

TABLE 130 COMPANY REGIONAL FOOTPRINT

TABLE 131 OVERALL COMPANY FOOTPRINT

13.6 KEY MARKET DEVELOPMENTS

13.6.1 NEW LAUNCHES

TABLE 132 NEW LAUNCHES, 2020–2022

13.6.2 DEALS

TABLE 133 DEALS, 2020–2022

13.6.3 OTHERS

TABLE 134 OTHERS, 2022

14 COMPANY PROFILES (Page No. - 151)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products, Solutions & Services Offered, Recent Developments, MnM View)*

14.2.1 VMWARE

TABLE 135 VMWARE: BUSINESS OVERVIEW

FIGURE 41 VMWARE: COMPANY SNAPSHOT

TABLE 136 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 137 VMWARE: PRODUCT LAUNCHES

TABLE 138 VMWARE: DEALS

14.2.2 ORACLE

TABLE 139 ORACLE: BUSINESS OVERVIEW

FIGURE 42 ORACLE: COMPANY SNAPSHOT

TABLE 140 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 141 ORACLE: PRODUCT LAUNCHES

TABLE 142 ORACLE: DEALS

TABLE 143 ORACLE: OTHERS

14.2.3 F5

TABLE 144 F5: BUSINESS OVERVIEW

FIGURE 43 F5: COMPANY SNAPSHOT

TABLE 145 F5: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 F5: PRODUCT LAUNCHES

TABLE 147 F5: DEALS

14.2.4 NUTANIX

TABLE 148 NUTANIX: BUSINESS OVERVIEW

FIGURE 44 NUTANIX: COMPANY SNAPSHOT

TABLE 149 NUTANIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 NUTANIX: PRODUCT LAUNCHES

TABLE 151 NUTANIX: DEALS

14.2.5 CLOUDFLARE

TABLE 152 CLOUDFLARE: BUSINESS OVERVIEW

FIGURE 45 CLOUDFLARE: COMPANY SNAPSHOT

TABLE 153 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 CLOUDFLARE: PRODUCT LAUNCHES

TABLE 155 CLOUDFLARE: DEALS

TABLE 156 CLOUDFLARE: OTHERS

14.2.6 JUNIPER NETWORKS

TABLE 157 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 46 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 158 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 159 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 160 JUNIPER NETWORKS: DEALS

14.2.7 HPE

TABLE 161 HPE: BUSINESS OVERVIEW

FIGURE 47 HPE: COMPANY SNAPSHOT

TABLE 162 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 164 HPE: DEALS

14.2.8 CISCO

TABLE 165 CISCO: BUSINESS OVERVIEW

FIGURE 48 CISCO: COMPANY SNAPSHOT

TABLE 166 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 167 CISCO: DEALS

14.2.9 CITRIX

TABLE 168 CITRIX: BUSINESS OVERVIEW

FIGURE 49 CITRIX: COMPANY SNAPSHOT

TABLE 169 CITRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 170 CITRIX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 CITRIX: DEALS

14.2.10 VERSA NETWORKS

TABLE 172 VERSA NETWORKS: BUSINESS OVERVIEW

TABLE 173 VERSA NETWORKS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 174 VERSA NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 175 VERSA NETWORKS: DEALS

14.2.11 ILLUMIO

TABLE 176 ILLUMIO: BUSINESS OVERVIEW

TABLE 177 ILLUMIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 178 ILLUMIO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 ILLUMIO: DEALS

14.2.12 AKAMAI

TABLE 180 AKAMAI: BUSINESS OVERVIEW

FIGURE 50 AKAMAI: COMPANY SNAPSHOT

TABLE 181 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 AKAMAI: DEALS

*Details on Business Overview, Products, Solutions & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.3 OTHER COMPANIES

14.3.1 ALKIRA

14.3.2 AVIATRIX

14.3.3 ARISTA

14.3.4 ARYAKA

14.3.5 NEFELI NETWORKS

14.3.6 VOLTERRA

14.3.7 PROSIMO

14.3.8 INFOBLOX

15 ADJACENT MARKETS (Page No. - 201)

15.1 INTRODUCTION

15.1.1 RELATED MARKETS

15.1.2 LIMITATIONS

15.2 MULTI-CLOUD MANAGEMENT MARKET

15.2.1 MULTI-CLOUD MANAGEMENT MARKET, BY PLATFORM

15.2.2 INTERNAL ENABLEMENT

TABLE 183 INTERNAL ENABLEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.3 EXTERNAL ENABLEMENT

TABLE 184 EXTERNAL ENABLEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.4 MULTI-CLOUD MANAGEMENT MARKET, BY APPLICATION

TABLE 185 MULTI-CLOUD MANAGEMENT MARKET, BY APPLICATION, 2015–2022 (USD MILLION)

15.2.5 METERING AND BILLING

TABLE 186 METERING AND BILLING: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.6 INFRASTRUCTURE AND RESOURCE MANAGEMENT

TABLE 187 INFRASTRUCTURE AND RESOURCE MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.7 PROVISIONING

TABLE 188 PROVISIONING: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.8 COMPLIANCE MANAGEMENT

TABLE 189 COMPLIANCE MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.9 LIFECYCLE MANAGEMENT

TABLE 190 LIFECYCLE MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.10 IDENTITY AND POLICY MANAGEMENT

TABLE 191 IDENTITY AND POLICY MANAGEMENT: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.2.11 OTHERS

TABLE 192 OTHERS: MULTI-CLOUD MANAGEMENT MARKET, BY REGION, 2015–2022 (USD MILLION)

15.3 CLOUD COMPUTING MARKET

15.3.1 CLOUD COMPUTING MARKET, BY SERVICE MODEL

TABLE 193 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2015–2020 (USD BILLION)

TABLE 194 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2021–2026 (USD BILLION)

15.3.2 INFRASTRUCTURE AS A SERVICE

TABLE 195 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 196 INFRASTRUCTURE AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2021–2026 (USD BILLION)

15.3.3 PLATFORM AS A SERVICE

TABLE 197 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 198 PLATFORM AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2021–2026 (USD BILLION)

15.3.4 SOFTWARE AS A SERVICE

TABLE 199 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 200 SOFTWARE AS A SERVICE: CLOUD COMPUTING MARKET, BY REGION, 2021–2026 (USD BILLION)

16 APPENDIX (Page No. - 212)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

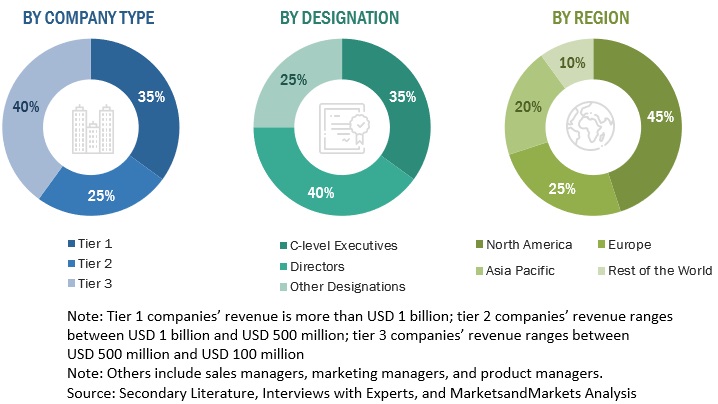

The study involved 4 major activities in estimating the current size of the Multi-Cloud Networking market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering multi-cloud networking was derived based on the secondary data available through paid and unpaid sources by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from multi-cloud networking vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using multi-cloud networking solutions, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall multi-cloud networking market.

All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the multi-cloud networking market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall Multi-Cloud Networking market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the global multi-cloud networking market based on components, solutions, services, deployment model, organization sizes, verticals, and regions

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19-related and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multi-Cloud Networking Market