Natural Fragrance Market by Ingredients (Essential Oils, Natural Extracts), Application (Fine Fragrances, Personal Care & Cosmetics, Household Care), and Region (Europe, North America, APAC, South America, Middle East & Africa) - Global Forecast to 2024

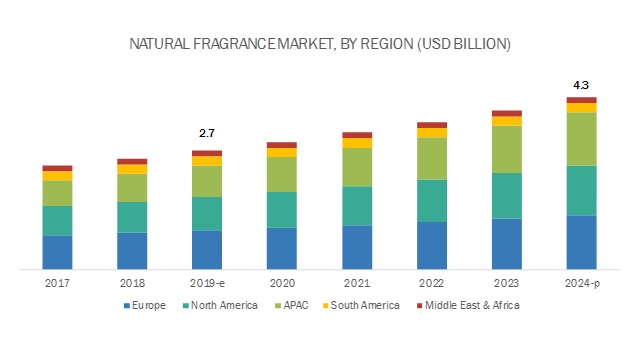

[112 Pages Report] The natural fragrance market size is projected to reach USD 4.3 million by 2024 from USD 2.7 million in 2019, at a CAGR of 9.6%. Increasing use of natural fragrance ingredients in various applications such as fine fragrances, personal care & cosmetics, and household care is expected to drive the natural fragrance market. Europe is the key market for natural fragrances, globally, followed by North America and Europe.

MnM helped an advanced European fragrance and cosmetics manufacturer to identify its market position among other dominant players across various geographies.

Client’s Problem Statement

Our client is an advanced European fragrance and cosmetics manufacturer who was interested to know its market position across various geographies. The top management needed to identify which factors most impacted revenue generation, which active ingredients to prioritize in a region, which certifications and trademarks to focus on, which fragrances were fresh and long-lasting, and what offering/value proposition to build for target customers.

MnM Approach

For a geographic ranking analysis, MnM designated selective parameters—product portfolio, brand value, trade analysis, packaging, trademarks & certifications, and quality controls. MnM analyzed the ranking analysis based on qualitative and quantitative data and also considered the regional macro indicators and their impact on the product revenue. Through interviews with industry experts, MnM defined the major macro indicators, namely, active ingredients, import regulation compliance, adequate packaging, long-lasting fragrance, price, and halal certification.

MnM also helped the client better understand the competitive landscape as well as the business models & strategies of different players who hold a potential share in these markets. This helped the client to launch their product offerings successfully as they worked on quality checks of the product to market them in the North American, European, Middle Eastern & African, and APAC markets. Interviews with various potential end users were conducted to understand their requirements, their acceptance of new products, their resistance to or acceptance of high prices, etc. MnM also conducted ground interviews and visited Middle Eastern countries to generate in-depth information and provide the best analysis to the client.

Revenue Impact (RI)

Our findings helped the client to understand the most impactful parameters in the fragrance and cosmetics industry in the North American, European, the Middle Eastern & African, and APAC regions. The study also highlighted the next most potential regional active ingredients, production standards, certifications approvals, and quality checks for future business growth. MnM made sure that the client had an understanding of both, the demand and supply side.

Essential oils natural fragrance ingredient is expected to lead the natural fragrance market during the forecast period.

Based on the ingredient, the natural fragrance market has been segmented into essential oils and natural extracts. The essential oils natural fragrance ingredient is estimated to lead the natural fragrance market in terms of value. The awareness about health hazards due to the use of synthetic products has increased, hence creating a surge in demand for natural & organic products. Thereby, it increases the need for essentials oils and natural extracts.

Fine fragrances are projected to be the largest application of natural fragrance during the forecast period.

The fine fragrances segment is projected to dominate the natural fragrance market during the forecast period in terms of value. The growing demand for fine fragrance in various applications such as perfumes, colognes, and deodorants is driving its demand.

Europe is expected to account for the largest share of the natural fragrance market during the forecast period.

Europe is expected to account for the largest market share in natural fragrance during the forecast period, in terms of value. The presence of various natural fragrance players, such as Givaudan SA (Switzerland), Firmenich SA (Switzerland), Symrise AG (Germany), Mane SA (France), Robertet SA (France), CPL Aromas (UK), Iberchem (Spain), and Dauper (Spain)., has a positive impact the market. In addition, growth in fine fragrances, personal care & cosmetics, and household care applications in the region is increasing the demand for natural fragrances.

Key Market Players

The key market players profiled in the report include as Givaudan SA (Switzerland), Firmenich SA (Switzerland), International Flavors & Fragrances (US), Symrise AG (Germany), Takasago International Corporation (Japan), Mane SA (France), Robertet SA (France), Sensient Technologies Corporation (US), T. Hasegawa Co., Ltd. (Japan), Bell Flavors & Fragrances (US).

Givaudan (Switzerland) is developing its mold release agents business by launching new products, expanding its R&D capabilities, and by acquiring smaller companies. Givaudan acquired Albert Vieille, a French company specialized in natural ingredients used in the fragrance and aromatherapy markets. It will help the company cater to the growing demand of customers for natural fragrances. It also acquired Centroflora’s Nutrition Division (Centroflora Nutra) (Brazil), a manufacturer of botanical extracts and dehydrated fruits for the food, beverage, and consumer goods sectors. The acquisition will help the company strengthen its global offering of natural extract and increase its presence in Brazil.

International Flavors & Fragrances (US) focused on expansion and acquisition strategy, as the company for the growth of natural fragrance business. The company had acquired Frutarom, which is one of the largest manufacturers of flavors & fragrances. This acquisition will strengthen the company’s product portfolio, and also will help the company to expand its customer base globally.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD million) |

|

Segments covered |

Ingredients, application, and region |

|

Regions covered |

Europe, North America, APAC, South America, and Middle East & Africa |

|

Companies profiled |

Givaudan SA (Switzerland), Firmenich SA (Switzerland), International Flavors & Fragrances (US), Symrise AG (Germany), Takasago International Corporation (Japan), Mane SA (France), Robertet SA (France), Sensient Technologies Corporation (US), T. Hasegawa Co., Ltd. (Japan), Bell Flavors & Fragrances (US). Top 25 major players covered |

This report categorizes the global natural fragrance market based on ingredients, application, and region.

Based on the ingredients, the natural fragrance market has been segmented as follows:

- Essential Oils

- Natural Extracts

On the basis of application, the natural fragrance market has been segmented as follows:

- Fine Fragrances

- Personal Care & Cosmetics

- Household Care

Based on the region, the natural fragrance market has been segmented as follows:

- Europe

- North America

- APAC

- South America

- Middle East & Arica

Recent Developments

- In April 2018, Mane SA opened a new manufacturing site in Colombia. This will help the company to strengthen its position to serve the customers in the Andean region better and capture growth opportunities in fragrances markets.

- In January 2018, Takasago International (Singapore) Pte. Ltd., a subsidiary of Takasago International Corporation, opened a new office in Lahore, Pakistan. The expansion will help the company increase its market presence in Pakistan.

- In October 2017, Givaudan opened a new fragrance creative center in Mexico City, Mexico. The new center will help the company support its natural fragrance business growth in North America.

- In October 2017, IFF opened a fragrance ingredients plant in China. The expansion helped the company strengthen its presence in the country.

- In June 2017, Symrise opened a new fragrance manufacturing center in Mumbai, India. The expansion helped the company strengthen its footprint in APAC.

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the upcoming products of natural fragrances?

- What are the emerging applications of natural fragrances?

- What are the major factors impacting market growth during the forecast period?

Frequently Asked Questions (FAQ):

Who are the major manufacturers?

Major manufactures include, Givaudan SA (Switzerland), Firmenich SA (Switzerland), International Flavors & Fragrances (US), Symrise AG (Germany), and Takasago International Corporation (Japan).

What are the ingredients used in natural fragrance? Which is the most commonly used?

High cost of using the recycled plastics and difficulty in managing the supply chain for post-consumer recycled plastic management is a big challenge for the market globally.

What are the emerging applications for natural fragrance?

The most anticipated application for natural fragrance is Fine fragrances, almost 50% of the current production is being utilized in fine fragrances. Personal care & Cosmetics application is also expected to grow.

What is the biggest challenge for natural fragrance?

High switching cost from synthetic to natural-based fragrances. Natural fragrances are quite expensive to produce than the synthetic products due to their sensitivity to temperature and pH level.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered For the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Market Size Estimation Methodology: Bottom-Up Approach

2.4.2 Market Size Estimation Methodology: Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Natural Fragrance Market

4.2 Europe: Natural Fragrance Market, By Application and Country

4.3 Natural Fragrance Market, By Region

4.4 Natural Fragrance Market Attractiveness

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Changing Lifestyle and Customer Preferences

5.2.1.2 Rising Demand For Natural Products

5.2.2 Restraints

5.2.2.1 High Production and R&D Costs

5.2.2.2 Compliance With Quality & Regulatory Standards

5.2.3 Opportunities

5.2.3.1 High Growth Potential in Emerging Economies

5.2.4 Challenges

5.2.4.1 High Switching Cost From Synthetic to Natural Sources

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Natural Fragrance Market, By Ingredients (Page No. - 37)

6.1 Introduction

6.2 Essential Oils

6.2.1 Increasing Demand For Essential Oils in Natural Fragrance Applications to Drive the Market

6.3 Natural Extracts

6.3.1 Increasing Use of Natural Fragrance Ingredients to Drive the Market

7 Natural Fragrance Market, By Application (Page No. - 44)

7.1 Introduction

7.2 Fine Fragrances

7.2.1 Increasing Demand For Natural Fragrance Ingredients in Perfumes & Colognes to Drive the Market

7.3 Personal Care & Cosmetics

7.3.1 Growing Awareness Among Consumers About Health Concerns and Hygiene Tend to Increase the Demand For Natural Fragrance in Personal Care Products

7.4 Household Care

7.4.1 Growing Demand For Natural Fragrances in Detergents to Significantly Boost the Market

8 Natural Fragrance Market, By Region (Page No. - 49)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.1.1 Growth in the Personal Care & Cosmetics Application to Boost the Market For Natural Fragrances in Germany

8.2.2 Italy

8.2.2.1 Increasing Awareness Regarding the Environmental and Social Aspects Drives the Natural Fragrance Market in Italy

8.2.3 France

8.2.3.1 Increasing Consumption of Natural Products Over Synthetic Ones Drives the Market

8.2.4 UK

8.2.4.1 Increasing Demand For Fragrance Ingredients Drives the Market

8.2.5 Rest of Europe

8.2.5.1 Rise in Per-Capita Income and Increase in Consumer Spending Drive the Market

8.3 North America

8.3.1 US

8.3.1.1 Increasing Awareness About Natural Ingredients Drives the Market

8.3.2 Mexico

8.3.2.1 Increasing Disposable Income of Consumers to Boost the Market

8.3.3 Canada

8.3.3.1 Increasing Trend Toward the Use of Natural Source-Based Fragrances to Drive the Market

8.4 APAC

8.4.1 China

8.4.1.1 China is the Largest Natural Fragrance Market in APAC

8.4.2 Japan

8.4.2.1 Increasing Awareness Regarding Personal Hygiene and Health Drives the Market

8.4.3 India

8.4.3.1 India is One of the Fastest-Growing Natural Fragrance Markets Globally

8.4.4 South Korea

8.4.4.1 Increase in Disposable Income Drives the Market

8.4.5 Rest of APAC

8.4.5.1 Increasing Consumption of Beauty Products Drives the Market

8.5 Middle East & Africa

8.5.1 Turkey

8.5.1.1 Rise in Disposable Income of the Middle-Class Population to Drive the Market.

8.5.2 UAE

8.5.2.1 The UAE to Witness the Highest Growth in the Natural Fragrance Market

8.5.3 Saudi Arabia

8.5.3.1 Higher Penetration of Premium Products Among the High-Income Population to Boost the Market

8.5.4 Rest of Middle East & Africa

8.5.4.1 Increasing Population and Rise in Middle-Class Income to Drive the Market

8.6 South America

8.6.1 Brazil

8.6.1.1 Growing Population and Increase in Consumer Spending Drive the Market

8.6.2 Argentina

8.6.2.1 Argentina is the Second-Largest Market For Natural Fragrances in South America

8.6.3 Rest of South America

8.6.3.1 Growth in Demand For Personal Care & Cosmetic Products Boosts the Market

9 Competitive Landscape (Page No. - 76)

9.1 Overview

9.2 Competitive Leadership Mapping (Overall Market)

9.2.1 Visionary Leaders

9.2.2 Dynamic Differentiators

9.2.3 Emerging Companies

9.2.4 Innovators

9.3 Strength of Product Portfolio

9.4 Business Strategy Excellence

9.5 Competitive Leadership Mapping (SMSE)

9.5.1 Progressive Companies

9.5.2 Responsive Companies

9.6 Strength of Product Portfolio

9.7 Business Strategy Excellence

9.8 Key Market Players

9.8.1 Givaudan

9.8.2 Firmenich SA

9.8.3 International Flavors & Fragrances

9.9 Competitive Situation and Trends

9.9.1 Expansion

9.9.2 New Product Launch

9.9.3 Acquisition

10 Company Profiles (Page No. - 88)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Givaudan SA

10.2 Firmenich SA

10.3 International Flavors & Fragrances

10.4 Symrise AG

10.5 Takasago International Corporation

10.6 Mane SA

10.7 Robertet SA

10.8 Sensient Technologies Corporation

10.9 T. Hasegawa

10.1 Bell Flavors & Fragrances

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Market Players

10.11.1 Huabao

10.11.2 Ogawa & Co., Ltd

10.11.3 CPL Aromas

10.11.4 KAO Chemicals Europe. S.L.

10.11.5 Yingyang (China) Aroma Chemical Group

10.11.6 S H Kelkar and Company Limited

10.11.7 Aarav Fragrances & Flavors

10.11.8 Iberchem

10.11.9 Alpha Aromatics

10.11.10 LA Scenteur Fragrance

10.11.11 BIO Aroma

10.11.12 Risdon International

10.11.13 Fragrance Oils (International) Ltd.

10.11.14 EPS Fragrances

10.11.15 Dauper

11 Appendix (Page No. - 109)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (69 Tables)

Table 1 Natural Fragrance Market Size, By Ingredients, 2017–2024 (USD Million)

Table 2 Plant Parts: Source of Essential Oils

Table 3 Essential Oil Plants - Producing Regions

Table 4 Essential Oils Market Size, By Region, 2017–2024 (USD Million)

Table 5 Key Sources of Essential Oils and their Producers

Table 6 Natural Extracts Market Size, By Region, 2017–2024 (USD Million)

Table 7 Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 8 Natural Fragrance Market Size in Fine Fragrances, By Region, 2017–2024 (USD Million)

Table 9 Natural Fragrance Market Size in Personal Care & Cosmetics, By Region, 2017–2024 (USD Million)

Table 10 Natural Fragrance Market Size in Household Care, By Region, 2017–2024 (USD Million)

Table 11 Natural Fragrance Market Size, By Region, 2017–2024 (USD Million)

Table 12 Europe: Natural Fragrance Market Size, By Country, 2017–2024 (USD Million)

Table 13 Europe: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 14 Europe: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 15 Germany: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 16 Germany: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 17 Italy: Natural Fragrance Market Size, By Application,2017–2024 (USD Million)

Table 18 Italy: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 19 France: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 20 France: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 21 UK: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 22 UK: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 23 Rest of Europe: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 24 Rest of Europe: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 25 North America: Natural Fragrance Market Size, By Country, 2017–2024 (USD Million)

Table 26 North America: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 27 North America: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 28 US: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 29 US: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 30 Mexico: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 31 Mexico: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 32 Canada: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 33 Canada: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 34 APAC: Natural Fragrance Market Size, By Country, 2017–2024 (USD Million)

Table 35 APAC: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 36 APAC: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 37 China: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 38 China: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 39 Japan: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 40 Japan: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 41 India: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 42 India: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 43 South Korea: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 44 South Korea: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 45 Rest of APAC: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 46 Rest of APAC: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 47 Middle East & Africa: Natural Fragrance Market Size, By Country, 2017–2024 (USD Million)

Table 48 Middle East & Africa: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 49 Middle East & Africa: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 50 Turkey: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 51 Turkey: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 52 UAE: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 53 UAE: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 54 Saudi Arabia: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 55 Saudi Arabia: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 56 Rest of Middle East & Africa: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 57 Rest of Middle East & Africa: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 58 South America: Natural Fragrance Market Size, By Country, 2017–2024 (USD Million)

Table 59 South America: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 60 South America: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 61 Brazil: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 62 Brazil: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 63 Argentina: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 64 Argentina: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 65 Rest of South America: Natural Fragrance Market Size, By Application, 2017–2024 (USD Million)

Table 66 Rest of South America: Natural Fragrance Market Size, By Ingredient, 2017–2024 (USD Million)

Table 67 Expansion, 2016–2019

Table 68 New Product Launch, 2016–2019

Table 69 Acquisition, 2016–2019

List of Figures (42 Figures)

Figure 1 Natural Fragrance Market: Research Design

Figure 2 Natural Fragrance: Data Triangulation

Figure 3 Natural Fragrance Market Analysis Through Primary Interviews

Figure 4 Natural Fragrance Market Analysis Through Secondary Sources

Figure 5 MnM Market Analysis- Natural Fragrance Market (Value in 2018)

Figure 6 Natural Extracts to Be the Faster-Growing Ingredient in the Natural Fragrance Market

Figure 7 Fine Fragrances to Be the Largest Application in the Overall Natural Fragrance Market

Figure 8 US to Be the Largest Natural Fragrance Market

Figure 9 Europe Accounted For the Largest Share of the Natural Fragrance Market in 2018

Figure 10 Growth Opportunities in the Market During the Forecast Period

Figure 11 France Led the European Natural Fragrance Market in 2018

Figure 12 South America to Be the Fastest-Growing Market During the Forecast Period

Figure 13 Argentina to Be the Fastest-Growing Market Between 2019 and 2024

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Natural Fragrance Market

Figure 15 Natural Fragrance Market: Porter’s Five Forces Analysis

Figure 16 Essential Oils to Dominate the Natural Fragrance Market Between 2019 and 2024

Figure 17 Fine Fragrance Application to Dominate the Natural Fragrance Market Between 2019 and 2024

Figure 18 South America to Register the Highest Cagr in the Natural Fragrance Market

Figure 19 Europe: Natural Fragrance Market Snapshot

Figure 20 North America: Natural Fragrance Market Snapshot

Figure 21 APAC: Natural Fragrance Market Snapshot

Figure 22 Natural Fragrance Market: Competitive Leadership Mapping, 2018

Figure 23 Strength of Product Portfolio, 2018

Figure 24 Business Strategy Excellence, 2018

Figure 25 Small and Medium-Sized Enterprises (SMSE) Mapping, 2018

Figure 26 Strength of Product Portfolio, 2018

Figure 27 Business Strategy Excellence, 2018

Figure 28 Expansion Was the Key Growth Strategy Adopted By the Market Players Between 2016 and 2019

Figure 29 Market Share Analysis, By Company, 2018

Figure 30 Givaudan SA: Company Snapshot

Figure 31 Givaudan SA: SWOT Analysis

Figure 32 Firmenich SA: SWOT Analysis

Figure 33 International Flavors & Fragrances: Company Snapshot

Figure 34 International Flavors & Fragrances: SWOT Analysis

Figure 35 Symrise AG: Company Snapshot

Figure 36 Symrise AG: SWOT Analysis

Figure 37 Takasago International Corporation: Company Snapshot

Figure 38 Takasago International Corporation: SWOT Analysis

Figure 39 Mane Sa: Company Snapshot

Figure 40 Robertet SA: Company Snapshot

Figure 41 Sensient Technologies Corporation: Company Snapshot

Figure 42 T. Hasegawa: Company Snapshot

The study involved four major activities in estimating the market size for natural fragrance. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and The International Fragrance Association. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

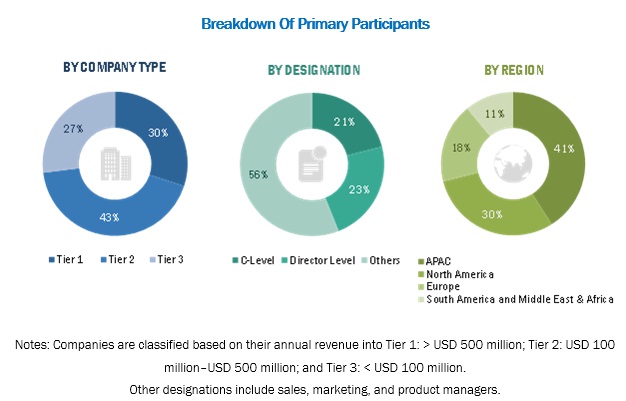

The Natural fragrance market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the fine fragrances, personal care & cosmetics, and household care industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Natural Fragrance Market