Electric Construction Equipment Market by Equipment type, Battery Capacity, Battery Chemistry, Power Output, Application, Propulsion, Electric Tractor Market, Electric Construction & Mining Equipment and Region - Global Forecast to 2030

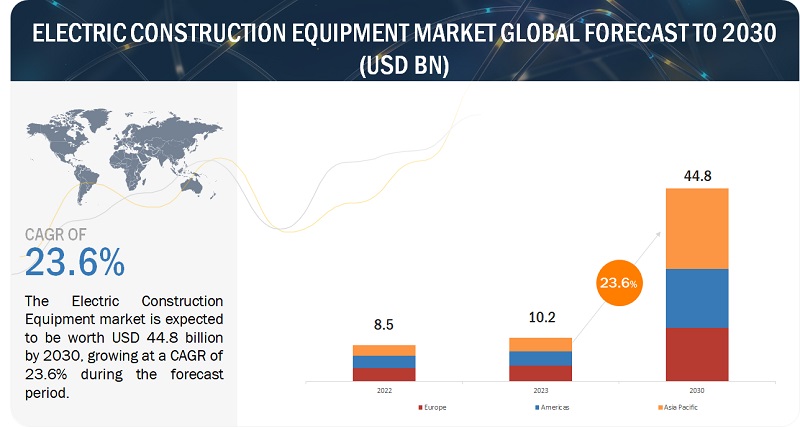

[404 Pages Report] The global electric construction equipment market is projected to grow from USD 10.2 billion in 2023 to USD 44.8 billion by 2030, at a CAGR of 23.6% during the forecast period. The electric construction equipment market has shown significant growth recently. The market growth is primarily driven by the increasing demand to minimize exhaust emissions from construction equipment, reduce ventilation costs in underground mining, and the preference for low noise construction machines in residential areas.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Rising demand for low-noise construction activities in residential areas would drive the demand for electric construction vehicles market

The surge in construction activities within city limits has heightened noise pollution concerns, leading to stringent regulations in many metropolitan areas. Diesel-powered construction machinery is a primary source of this noise, impacting health and urban tranquility. To counter this, cities like Oslo and London are pioneering initiatives mandating electric equipment on public construction sites to curb noise and emissions. This move aligns with broader plans in London and Paris to reduce vehicle pollution in residential areas. Several companies, including Volvo, offer machinery designed explicitly for noise-sensitive areas. These machines prioritize lower noise emissions, making them suitable for environments where noise reduction is crucial. JCB, for instance, has a range of construction equipment models engineered to operate quietly, minimizing disruptions in noise-sensitive locations such as urban areas or residential zones. JCB 403E wheel loader ensures a more productive environment. It is ideal for noise-sensitive areas like hospitals or schools, and it minimizes fatigue, facilitates communication, and supports uninterrupted work.

The noise regulations have spurred the preference for electric construction equipment. The electric machines comply with noise limits and enhance operational efficiency, enabling work within city limits during the day. Major manufacturers are introducing compact electric machinery tailored for urban settings, meeting noise standards while offering comfort and safety benefits. Quieter operations reduce fatigue for operators and improve overall staff well-being, potentially expanding work opportunities in noise-sensitive areas. Ultimately, the shift to electric equipment aligns with regulations, boosts employee satisfaction, and aids in bidding for restricted projects due to noise concerns.

RESTRAINT: Loss of productivity due to prolonged charging time

The electric construction equipment, while featuring large battery capacities for extensive workloads, faces hurdles due to lengthy charging times, leading to downtime and decreased productivity. Mining and construction companies, operating long hours daily, struggle to allocate sufficient time for complete recharging of these vehicles, hampering their widespread adoption. Some electric models like the JC85 19C-IE mini excavator and Volvo CE's ECR25 compact excavator offer faster charging times, but most other construction and mining equipment still require considerably longer charging durations. The extended charging duration required by electric construction machinery poses a challenge to productivity. When these machines need lengthy periods for recharging, they become non-operational, causing downtime that impacts work schedules. This loss of operational time affects project timelines and overall efficiency, especially in industries where continuous equipment operation is crucial, hindering seamless workflow and potentially delaying project completion.

Commercial users of lawnmowers, operating extensively, find gas refills more practical than frequent battery recharging, impacting the demand for electric equipment in gardening applications. Manufacturers are addressing these challenges by developing rapid charging technologies and exploring swappable battery packs to minimize downtime. However, ensuring batteries can withstand rapid charging without issues like overheating remains a priority. The evolution of fast chargers and swappable batteries is expected to mitigate productivity losses, enhancing the feasibility of electric construction equipment in demanding industries.

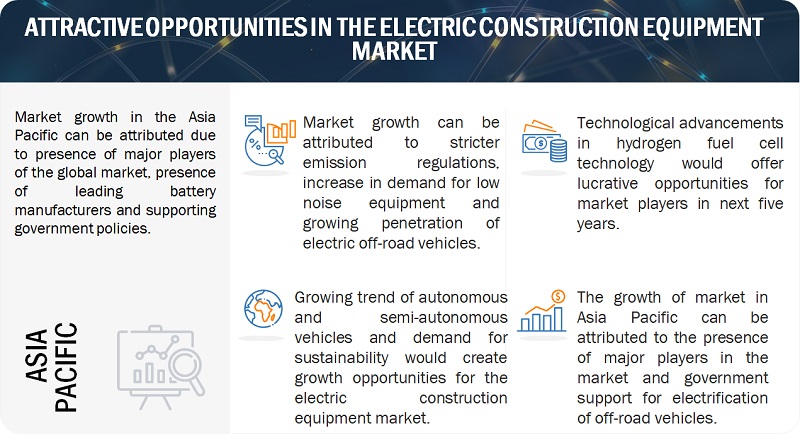

OPPORTUNITY: Emergence of hydrogen-powered construction equipment

The emergence of hydrogen-powered construction equipment presents a significant market opportunity. Hydrogen fuel cells, along with combustion engines, stand as key elements in transitioning toward carbon-neutral transportation and infrastructure. These fuel cells, used in vehicles and machines, boast efficiency and quick refueling, offering a longer range compared to battery electric vehicles. They excel in applications where weight and quick refueling are vital, such as long-haul trucking and heavy machinery.

Volvo Group views hydrogen fuel cells as pivotal in achieving fossil-free transportation systems, envisioning a balance of power, flexibility, and zero emissions. The process involves the chemical reaction of hydrogen and oxygen, producing electricity and water vapor as the sole emission. In various applications like off-road vehicles, marine, and industrial machinery, hydrogen fuel cells offer promise, contingent upon local hydrogen generation infrastructure. In November 2020, Ineos and Hyundai collaborated for hydrogen fuel cells for off-road vehicles which further emphasizes the potential of this technology. The partnership aims to develop reliable hydrogen supplies and utilize fuel cells in vehicles, acknowledging the limitations of battery electric power in challenging environments. With hydrogen's higher energy density, it's seen as a leading technology for larger vehicles, from buses to trains, due to its promising capabilities and lower emissions compared to traditional engines. JCB also provides hydrogen-powered machinery, aiming for mass production; already piloting them in the UK on off-road machines like backhoe loaders. With zero carbon emissions and only water vapor output, their hydrogen combustion engines aim for commercial deployment in India and globally.

List of Upcoming Hydrogen models in market:

- JCB (220X Excavator)

- Hyundai Construction Equipment (HX900 Hydrogen Fuel Cell Excavator)

- Komatsu Ltd. (Medium-sized hydraulic excavator)

- Volvo Construction Equipment (Volvo HX04)

- JCB (Backhoe Loader)

- Liebherr (R 9XX H2 hydrogen excavator)

Companies are collaborating to develop reliable hydrogen supplies and infrastructure, signaling a growing interest in hydrogen fuel cells for larger vehicles, from off-road equipment to trains, as they offer higher energy density compared to lithium-ion batteries. In summary, the exploration of hydrogen-powered construction equipment, driven by advancements in hydrogen fuel cell technology, represents a promising opportunity to enhance efficiency, reduce emissions, and address the challenges associated with long charging times in traditional electric construction machinery.

CHALLENGE: Complex thermal management of batteries and charging infrastructure for electric machinery

The electric construction machinery market faces a pivotal challenge in its reliance on charging infrastructure. Operational efficiency hinges on dependable and rapid charging systems, but the existing infrastructure grapples with limitations in availability, capacity, and compatibility. Scarcity of charging stations, particularly in remote job sites and urban work zones, leads to operational difficulties and potential downtime. The lack of standardized charging connectors further complicates matters, impacting productivity and incurring additional time and expenses for contractors and rental companies.

This hindrance in reliable and efficient charging infrastructure could dampen the appeal of electric construction machinery, potentially impeding market growth. Despite these challenges, initiatives are underway, including government and business investments in public charging infrastructure, with a focus on Level 2 and DC fast chargers. Additionally, companies are developing mobile charging solutions tailored for job sites to provide a convenient means of charging electric construction machinery.

An equally critical aspect of electric construction equipment is its battery system. Efficient operation necessitates effective thermal management, especially considering diverse construction environments with extreme temperatures. Batteries generate heat during charging and discharging, requiring optimal working temperatures. Operating in varied conditions demands proper ventilation and cooling systems to ensure safety and performance. The battery's optimal performance occurs within a temperature range of 20 to 40 degrees Celsius. Deviations from this range significantly impact charging and discharging parameters.

Efficient thermal management involves maintaining the battery temperature within the optimal range. Common technologies employed include liquid jackets surrounding the battery and cooling fans in high-temperature scenarios. Designing these systems is challenging, requiring flawless functionality to ensure peak performance and safety. In summary, the performance and safety of electric construction equipment heavily depend on a robust battery thermal management system capable of navigating extreme temperatures and operational demands construction machinery.

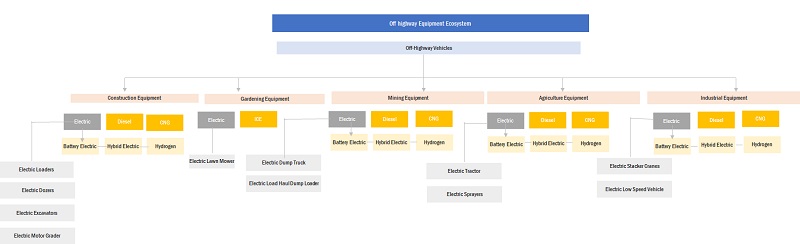

Electric Construction Equipment market ecosystem

The ecosystem analysis highlights electric construction equipment market players, primarily represented by component manufacturers, manufacturers, and dealers.

The mining segment is projected to dominate the electric construction equipment market in 2030

The mining industry, a cornerstone of economies in regions like Asia Pacific, the Americas, and Europe, faces operational challenges due to rising ventilation costs and stringent emission regulations. Diesel-powered mining equipment stands as a significant contributor to emissions and heat in underground mining, demanding around 30% of the operation's total energy for ventilation systems. To combat these challenges, the industry is swiftly embracing emission-free electric mining equipment. Leading manufacturers like Komatsu Ltd., Caterpillar, Inc., and Hitachi are pioneering the development of robust, high-performance electric mining machinery suited for harsh mining environments. This shift to electric machinery is driven by factors such as environmental regulations, technological advancements, cost efficiency, safety concerns, and market demand for sustainable solutions. The mining industry is on track to reach 1 million mining EVs by 2030, with Toyota and Komatsu collaborating on an Autonomous Light Vehicle (ALV) project. This aims to integrate ALVs with Komatsu's GPS-based Autonomous Haulage System, enhancing safety and productivity by reducing collision risks between manual and autonomous vehicles. Testing is underway, with a proof of concept expected at a customer site by January 2024, showcasing advancements in mining vehicle autonomy and safety.

The electrification of mining represents a transformative change, offering cleaner, quieter, and more productive alternatives to diesel-powered machinery. Electric equipment significantly reduces pollutants and heat generation, cutting ventilation requirements and enhancing the working environment in underground mines. The industry's adoption of electric machinery signals a paradigm shift towards a more sustainable and technologically advanced mining landscape.

The Battery Electric propulsion in Electric Tractor market is anticipated to dominate based on propulsion type.

The evolving emission and noise control regulations in the Europe, US, and other regions are reshaping the landscape of vehicle and equipment standards. The stringent EU regulations have significantly slashed particulate matter and emission levels for off-highway equipment, while parallel reductions have been witnessed under the US EPA norms. This trend is expected to extend to countries like China, Japan, South Korea, and India, aligning with global emission standards. As petrol and diesel prices escalate, farmers in developing economies are seeking electric alternatives for their agricultural needs. This surge in demand is anticipated to drive rapid growth in the battery electric farm tractor market. To encourage adoption of electric tractors, India implements various initiatives, including financial incentives, tax credits, the FAME scheme, and R&D funding. Infrastructure development, regulatory support, public awareness, demonstration projects, and capacity building form a robust strategy. These efforts aim to empower farmers, drive sustainability, and propel India's agricultural sector toward productivity and environmental responsibility. Notable industry players like John Deere, Sonalika Tractors, and Kubota Corporation are making strategic moves, introducing electric and hybrid tractor models to meet these evolving norms.

For instance, in December 2020, Sonalika Tractors launched the Tiger Electric, powered by an 11-kW motor, catering to various applications such as spraying, grass cutting, and hauling. Kubota's LXe-261, developed to comply with stringent European regulations, boasts a large-capacity battery and quick one-hour charging capability, ensuring extended operational hours and swift recharge intervals, optimizing productivity. The European market is set to witness the highest growth rate in the battery electric tractor segment, followed by the Americas. This inclination toward advanced technology adoption, especially in Europe, aligns with government initiatives focusing on emission reduction and sustainable agriculture practices. Financial incentives and stringent regulatory frameworks are propelling farmers toward cleaner technologies like electric tractors, reinforcing the shift toward eco-friendly farming practices.

The market for >500 kWh equipment is estimated to grow at a fastest rate by 2030

The current market for >500 kWh electric construction equipment is relatively limited due to challenges related to the power-to-weight ratio of existing batteries. However, there's an anticipated surge in the introduction of >500 kWh equipment in the future, expected to grow at an impressive rate. Presently, most high-capacity construction equipment combines hybrid and diesel propulsion. But ongoing developments in >500 kWh electric construction machinery, particularly in regions like LIS, China, and Europe, are geared toward emission reduction and cost-saving initiatives, paving the way for significant growth in this segment. Elevated operational and ventilation costs in construction and mining sites are driving the demand for greener alternatives. Technological strides in battery advancements are enhancing operational efficiency while reducing costs, making electric options economically viable. Additionally, the allure of superior performance, characterized by enhanced torque, noiseless operation, and real-time data insights, amplifies productivity on construction sites. These factors collectively fuel the rapid expansion of the >500 kWh electric equipment segment across Europe, signifying a shift toward more efficient and eco-friendly construction practices.

Asia Pacific is projected to be the largest market for electric construction equipment

The leading countries such as includes China, Japan, India, South Korea, and the Rest of Asia Pacific are considered under the Asia Pacific region. The electric off-highway equipment demand in Americas is rapidly increasing because of the environmental protection measures adopted in these key countries. In addition, entry of multinational electric construction equipment manufacturing companies and increasing awareness about electrification are expected to drive the electric construction equipment market in the region. Increasing demand for electric construction equipment in countries such as Japan and South Korea is one of the major drivers of the growth of this market. Some of the leading companies that are present in this region are Komatsu Ltd. (Japan), Doosan Group (South Korea), Sany Heavy Industries Co., Ltd. (China), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group Co., Ltd. (XCMG) Group (China), etc.

China's significant presence in battery manufacturing, with companies like BYD and CATL, has a substantial impact on the Asia Pacific electric construction equipment market. Simultaneously, the prominence of major construction manufacturers in Japan and South Korea fuels market development. For instance, Komatsu is set to launch a 3-ton class electric mini excavator equipped with a lithium-ion battery in Japan this October. This move aims to swiftly develop the domestic electric construction equipment market, aligning with the company's goal of achieving carbon neutrality by 2050. Additionally, XCMG, a Chinese manufacturer, unveiled a pure electric heavy-duty off-road dump truck and battery-powered forklifts, signaling a shift toward electric products in response to global climate concerns and environmental priorities. Chinese manufacturers are actively embracing greener, smarter technologies, showcasing electric vehicle options and smart technology applications at major industry events.

Key Market Players

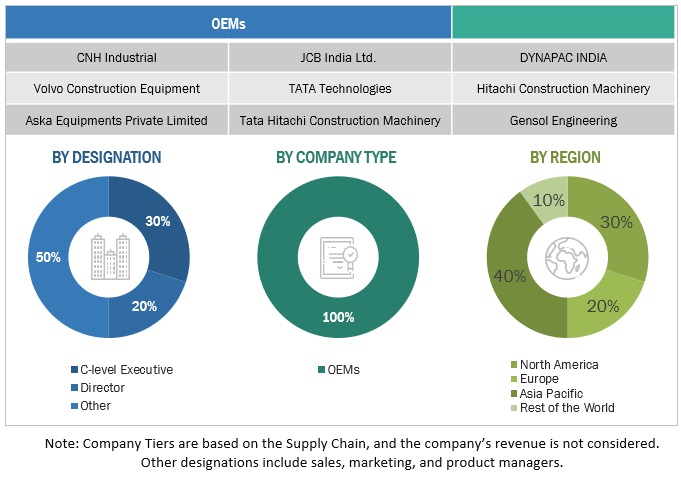

The electric construction equipment market is dominated by a few globally established companies such as, Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Deere & Company (US).

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the electric construction equipment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Base year considered for estimation |

2023 |

|

Forecast period |

2023–2030 |

|

Market Growth and Revenue Forecast |

USD 44.80 Bn by 2030 at a CAGR of 23.6% |

|

Top Players |

Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Deere & Company (US). |

|

Fastest Growing Market |

Asia Pacific |

|

Largest Market |

Europe |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments Covered |

By Equipment Type, By Battery Capacity, By Battery Chemistry, By Power Output, By Propulsion, By Application, Electric Agriculture by equipment type, Electric tractor market, by propulsion, Electric construction and mining market, by propulsion and region |

|

By Equipment Type |

Electric excavator, electric motor grader, electric dozer, electric loader, electric dump truck and electric load-haul-dump loader |

|

By battery capacity |

<50 KwH, 50-200 KwH, 200-500 KwH and >500 KwH |

|

By battery chemistry |

Lithium-ion phosphate, Lithium-ion NMC, and other battery chemistries |

|

By power output |

<50 HP, 50-150 HP, 150-300 HP and >300 HP |

|

By propulsion |

Hybrid-electric, battery-electric and Hydrogen |

|

By Application |

Construction, Mining, Agriculture, Gardening |

|

Electric agriculture equipment market, by equipment type |

Electric lawn mower, electric sprayer, and electric tractor |

|

Electric tractor market, by propulsion type |

Hybrid-electric, battery-electric and Hydrogen |

|

Electric construction and mining market, by propulsion type |

Hybrid-electric, battery-electric and Hydrogen |

|

By Region |

Asia Pacific, Americas, and Europe |

|

Additional Customization to be offered |

Electric construction equipment by application and country, |

Recent Developments

- In 2023, Komatsu has marked significant progress in the electric construction equipment market. Notable launches include the PC05E-1 Electric Micro Excavator, their 3-ton mini excavator offering zero emissions in Europe. The PC200LCE-11 and PC210LCE-11 Electric Excavators, as the company's first large electric models, promise comparable performance to diesel equivalents with zero emissions. Also introduced was the HB365LC-3 Hybrid Excavator at CONEXPO 2023, boasting improved fuel efficiency and lower emissions by integrating a diesel engine with an electric motor and battery.

- In 2023, Deere and Company have actively propelled the electric construction equipment market with notable developments. The unveiling of the 310 X-Tier E-Power Backhoe at CONEXPO 2023, currently undergoing field testing, showcases its electric backhoe loader with comparable performance to diesel counterparts, featuring zero emissions and reduced noise. Additionally, the 244 X-Tier Compact Wheel Loader, launched at the same event, prioritizes operator comfort and productivity.

- In 2023, Volvo Construction Equipment (Volvo CE) played a pivotal role in advancing the electric construction equipment market with significant developments. The introduction of the ECR25 Electric Compact Excavator in January, marking Volvo CE's first commercially available electric model, and the simultaneous launch of the L25 Electric Compact Wheel Loader, both emphasizing zero emissions and battery-powered operation, showcase the company's commitment to sustainable solutions.

- In June 2022, Cummins, a global power leader, and Komatsu signed a memorandum of understanding to collaborate on developing zero-emissions haulage equipment. In 2021, Komatsu announced its power-agnostic truck concept for haulage equipment that can run on various power sources. These power sources included diesel-electric, trolley, battery power, and hydrogen fuel cells.

- In June 2022, John Deere announced its new global agreement with Wacker Neuson on developing 0-9-metric ton excavators. Both companies will collaborate on developing less than five metric tons of excavators that Wacker Neuson will manufacture. John Deere will control the design, manufacturing, and technology innovation for the 5-9-metric-ton models.

- In May 2022, Volvo Construction Equipment (Volvo CE) invested in Dutch firm Limach, a manufacturer of electric excavators for the domestic market. This investment aims to benefit Volvo CE's long-term electrification plan and allows the opportunity to broaden its electromobility portfolio.

- In March 2022, Honda and Komatsu showcased their joint development work, the PC01E-1. The PC01E-1 is Komatsu's first electric micro excavator powered by portable and swappable mobile batteries. Komatsu and Honda developed the PC01E-1 by electrifying the conventional PC01 micro excavator by incorporating the Honda swappable mobile battery and Honda eGX electrified power unit.

- In December 2021, Volvo Construction Equipment (Volvo CE) and its partners explored every aspect of the electric ecosystem to deliver a complete site solution for real urban applications. Volvo CE is working with Gothenburg City, NCC, Gothenburg Energy, Lindholmen Science Park, Chalmers University of Technology, and ABB Electrification Sweden, among many others, to conduct a machine demonstration in large at Gothenburg. The Swedish Energy Agency funded this project.

- In October 2021, Caterpillar Venture Capital Inc. (Caterpillar) and another venture invested USD 16 Million as Series B funding for BrightVolt, Inc. BrightVolt Inc. is a global leader in the design, development, and manufacturing of safe, high-energy, low-cost solid-state lithium-ion batteries. This funding aims to develop larger form factor products for industrial electrification and e-mobility markets.

Frequently Asked Questions (FAQ):

What is the current size of the global electric construction equipment market?

The electric construction equipment market is estimated to grow from USD 10.2 billion in 2023 to USD 44.8 billion by 2030 at a CAGR of 23.6% over the forecast period.

Which application is currently leading the global electric construction equipment market?

Mining applications are leading in the global electric construction equipment market.

Many companies are operating in the global electric construction equipment market space. Do you know who the front leaders are and what strategies they have adopted?

The electric construction equipment market is dominated by a few globally established companies such as Hitachi Construction Machinery (Japan), Caterpillar Inc. (US), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Deere & Company (US). These companies adopted new product launches, partnerships, and joint ventures to gain traction in the electric construction equipment market.

How does the demand for the global electric construction equipment market vary by region?

With the high electrification trend in developed countries and increased demand for construction and mining equipment, the Asia Pacific region is predicted to lead the electric construction market with a CAGR of XX%. The stringent emission norms from this region and many sustainability initiatives by the government are some of the key reasons for this region to also have the largest market for electric construction equipment, with USD XX Million in 2030.

What are the growth opportunities for the global electric construction equipment market supplier?

Developing hydrogen-powered construction equipment would create growth opportunities for the electric construction equipment market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four main activities to estimate the current size of the electric construction equipment market.

- Exhaustive secondary research collected information on the market, such as equipment type, battery capacity, battery chemistry, power output, application, propulsion, equipment type, propulsion, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

- After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted through secondary research after understanding the electric construction equipment market scenario. Several primary interviews were conducted with market experts from construction equipment providers, component/system providers, and end-user organizations across three major regions: the Americas, Europe, and Asia Pacific. Several primary interviews were conducted with the construction equipment and component/system providers and from the end-user organizations. Approximately 100% of the primary interviews were conducted from the demand side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries. After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the electric construction equipment market and other dependent submarkets, as mentioned below:

Electric Construction Equipment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

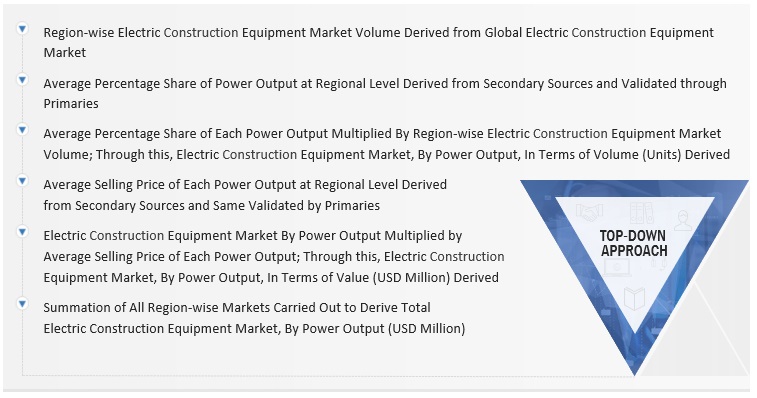

Electric Construction Equipment Market Size: Top-Down Approach

Market Definition:

Electric construction equipment includes both battery-electric and hybrid-electric construction equipment. Hybrid electric equipment is powered by an Internal Combustion Engine (ICE) in combination with one or more electric motors that use energy stored in batteries to meet the additional auxiliary power for the equipment, electronic devices, and power tools. Battery electric equipment is fully electric, where the combustion engine is replaced with batteries and an electric motor that powers the movement of the machine and its attachments.

Stakeholders:

Report Objectives

- The bottom-up approach was used to estimate and validate the size of the electric construction equipment market. The market size by equipment, in terms of volume, was derived by multiplying the region-level breakup for each equipment (electric excavators, electric motor graders, electric dozers, electric loaders, electric dump trucks, electric load-haul-dump loaders, electric lawn mower, electric sprayer, electric tractor) with region-level electric construction equipment sales.

- The region-level market by equipment by volume is multiplied with the region-level average selling price (ASP) for each application to get the electric construction equipment market for each equipment by value.

- The summation of the region-level market would give the global electric construction equipment market by equipment (electric excavators, electric motor graders, electric dozers, electric loaders, electric dump trucks, electric load-haul-dump loaders, electric lawn mowers, electric sprayers, electric tractors). The total value of each region was then summed up to derive the total value of the market by equipment.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

-

The top-down approach estimated and validated the market by battery type regarding volume and value. The global electric construction equipment market value (USD million) by region (Asia Pacific, Americas, and Europe) was derived from the worldwide market. The penetration of each battery chemistry (Lithium-ion Phosphate, Lithium-ion NMC, and other battery chemistries) at the regional level was derived from secondary sources and validated through primary sources. The penetration of each battery chemistry (Lithium-ion Phosphate, Lithium-ion NMC, and other battery chemistries) was multiplied by the regional market to get the market value (USD million) by battery chemistry type for each region. All region-wise markets were summated to derive the total electric construction equipment market value (USD million) by battery chemistry. The top-down approach was followed by battery capacity, power output, and propulsion segments.

- Component Manufacturers of Various Electric Construction Equipment

- Raw Material Suppliers for Electric Construction Equipment

- Battery and Drivetrain Suppliers

- Electric Construction Equipment Manufacturers

- Electric Mining Equipment Manufacturers

- Electric Tractor Manufacturers

- Lawn Mower Manufacturers

- Traders, Distributors, and Suppliers of Electric Construction Equipment Systems/Components

- Automotive Industry Associations, Government Authorities, and Research Organizations

-

To define, describe, and forecast the size of the electric off-highway equipment market in terms of volume and value

- By equipment type (electric excavator, electric motor grader, electric dozer, electric loader, electric dump truck, and electric load-haul-dump loader)

- By battery capacity (<50 KwH, 50-200 KwH, 200-500 KwH and >500 KwH)

- By battery type (Lithium-ion Phosphate, Lithium-ion NMC, and Other Battery Chemistries)

- By power output (<50 HP, 50-150 HP, 150-300 HP and >300 HP)

- By propulsion (Battery Electric, Hybrid Electric, and Hydrogen)

- By Application (Construction, Mining, Gardening, and Agriculture)

- Electric agriculture equipment market, by equipment type (electric lawn mower, electric sprayer, and electric tractor)

- Electric tractor market, by propulsion (Battery Electric, Hybrid Electric, and Hydrogen)

- Electric construction and mining market, by propulsion (Battery Electric, Hybrid Electric, and Hydrogen)

- By region (Asia Pacific, Americas, and Europe)

- To qualitatively analyze and assess the electric off-highway equipment market, by region

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of leading players in the electric off-highway equipment market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue analysis

- To strategically analyze the market with recession impact analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend and regulatory analysis.

- To analyze recent developments, including new product launches, expansions, and other activities, undertaken by key industry participants in the market.

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Electric Construction Equpiment Market, By Application & Country

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Rest of Europe

-

Americas

- US

- Canada

- Mexico

- Brazil

- Argentina

Electric Construction Equipment Market, By Type & Country

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Rest of Europe

-

Americas

- US

- Canada

- Mexico

- Brazil

- Argentina

Electric Construction Equipment Market, By Battery Capacity & Battery Chemistry

- <50 kWh

- 50-200 kWh

- 200-500 kWh

- >500 kWh

- Lithium-ion Phosphate

- Lithium-ion NMC

- Other Battery Chemistries

Electric Mining Machinery Market, By Battery Capacity & Battery Chemistry

- <50 kWh

- 50-200 kWh

- 200-500 kWh

- >500 kWh

- Lithium-ion Phosphate

- Lithium-ion NMC

- Other Battery Chemistries

Electric Agriculture Equipment Market, By Battery Capacity & Battery Chemistry

- <50 kWh

- 50-200 kWh

- 200-500 kWh

- >500 kWh

- Lithium-ion Phosphate

- Lithium-ion NMC

- Other Battery Chemistries

Detailed Analysis And Profiling Of Additional Market Players (Up To 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Construction Equipment Market

Beyond the big names there are many smaller or new comers in the electric equipment market, does this report map them?

Hi, I am a graduate student researching the EV market and I came across your report. I would greatly appreciate if I can get a free sample of the report as this will greatly enhance the quality of my research.

I write in my blog in the Spanish Financial Newspaper Expansion., about climate change and solutions, like renewable energy and electric mobility.

Electric vehicle markets Evolution of electrification in mobility (road transport, maritime, aviation)

Hello. I am looking to gain some statistics on commercial market and consumer market market share. In addition to this, how much of the commercial market is already electric? Thank you in advance.