Predictive Maintenance Market by Component (Hardware, Solution (Deployment Mode), & Services), Technology, Technique (Vibration Analysis, Infrared Thermography, Motor Circuit Analysis), Organization Size, Vertical, & Region - Global Forecast to 2029

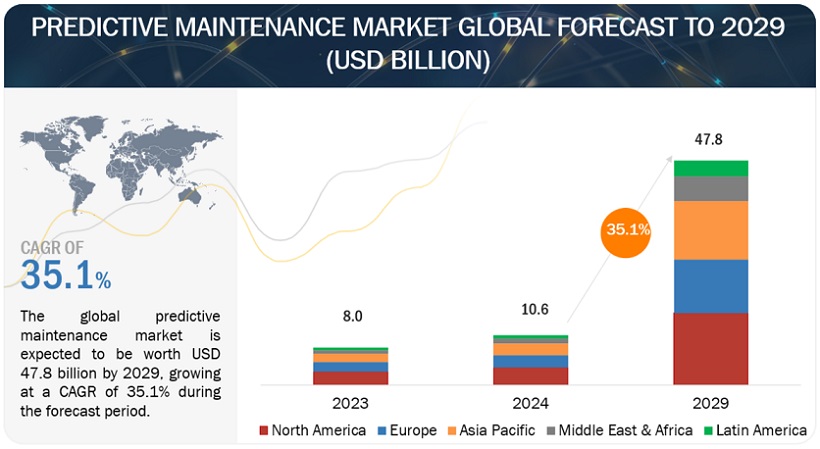

[376 Pages Report] The global market for the predictive maintenance market is projected to grow from USD 10.6 billion in 2024 to USD 47.8 billion in 2029, at a CAGR of 35.1% during the forecast period. The predictive maintenance market is propelled by several factors, including the rising adoption of emerging technologies for obtaining valuable insights, the emergence of machine learning (ML) and artificial intelligence (AI), and the increasing demand to minimize maintenance costs, equipment failures, and downtime.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Advent of ML and AI

Digitalization in the current day and age has exponentially transformed the landscape of predictive maintenance, thereby encouraging predictive maintenance vendors and service providers to adopt digitized systems for in-store activities. Organizations are increasingly focusing on the re-engineering of businesses with the help of the immense power of the internet and digital technology. The advent of AI and ML has enhanced organizations’ ability to gather information, analyze it, and perform quick actions with minimum human intervention. Organizations are also adopting AI systems to speed up investment decisions. According to an industry expert, the use of machine learning to detect machine and system faults early extends the service life of facility machinery by 30 percent on average. Organizations that use a predictive maintenance approach minimize not only the degree of damages but also the spread of problems. This is because a problem with a low-cost part might lead to damage to a critical component, shortening the asset lifecycle.

Restraint: Lack of skilled workforce

Skilled personnel are essential for managing the latest software systems used to deploy AI-based IoT technologies and capabilities. Therefore, it is imperative to train existing employees on how to operate these new and upgraded systems. Additionally, industries are actively adopting new technologies but are encountering challenges due to a shortage of highly skilled and proficient workers. With many global vendors initiating predictive maintenance projects, there is a growing demand for a skilled workforce. Companies must develop expertise in areas such as cybersecurity, networking, and applications. They also aim to leverage IoT data for predictive analysis, failure prevention, operational optimization, product innovation, and advanced analytics incorporating AI and ML technologies.

Opportunity: Real-time condition monitoring to assist in taking rapid actions

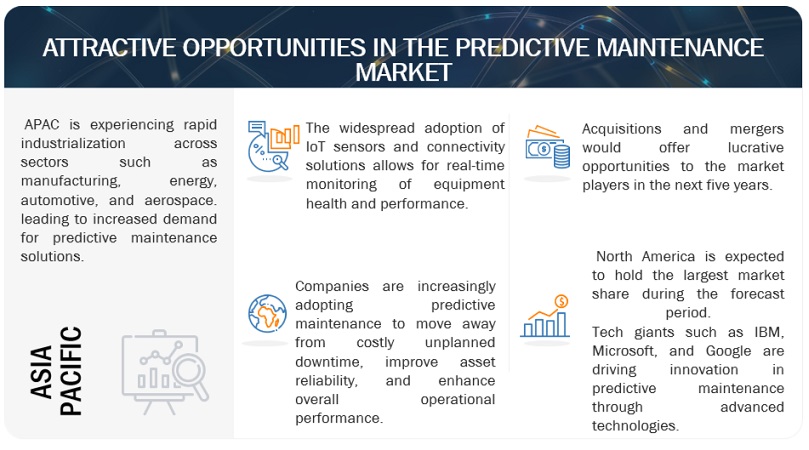

Enhanced asset management is increasingly essential across diverse industries. Providers equipped with AI and ML capabilities can gather and transform vast amounts of customer-related data into actionable insights, particularly as IoT generates significant data from interconnected devices. AI can also be integrated with IoT devices to optimize service delivery aspects like predictive maintenance and quality assessment, eliminating the need for manual intervention. AI-driven IoT solutions are already gaining traction in various sectors, a trend expected to continue as technology advances. Real-time data from sensors, actuators, and control parameters not only forecast potential asset failures but also enable companies to monitor operations in real-time and take immediate actions when necessary.

Challenge: The requirement of frequent maintenance and upgradation to keep the systems updated

Enterprises are increasingly embracing AI-based IoT solutions for predictive maintenance and to enhance the customer experience. In this market landscape, vendors must develop predictive maintenance systems with a focus on two critical factors: maintenance and updates. An AI-based IoT system requires regular updates and maintenance to align with evolving business needs and implement technological advancements. This includes upgrading the software to accommodate new components and integrating the new system with existing ones. However, as the number of systems grows, so does the maintenance cost. Managing and upgrading AI-based IoT systems poses a significant challenge for companies aiming to provide uninterrupted solutions to their clients.

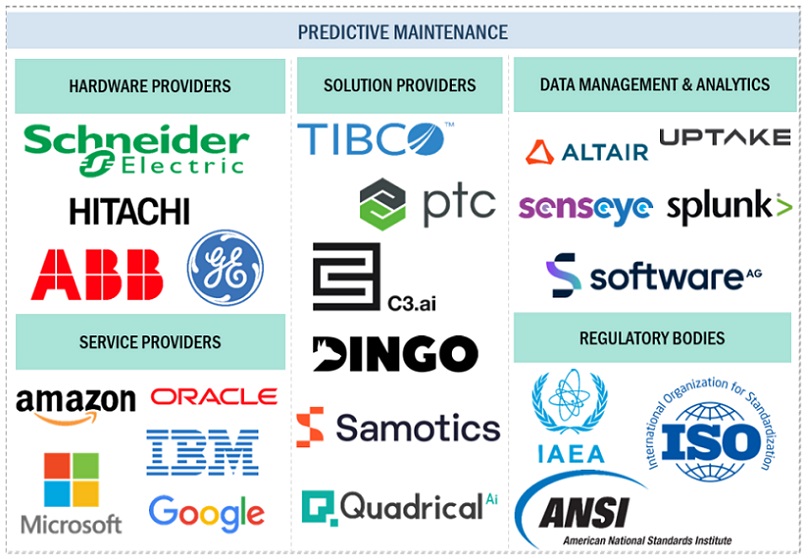

Predictive Maintenance Market Ecosystem

The predictive maintenance ecosystem comprises hardware providers supplying sensors and monitoring devices, solution providers offering software for data analysis and predictive modelling, service providers delivering consulting, implementation, and managed services, data management, and analytics providers specializing in processing and deriving insights from maintenance data, and regulatory bodies setting standards and guidelines to ensure reliability and safety.

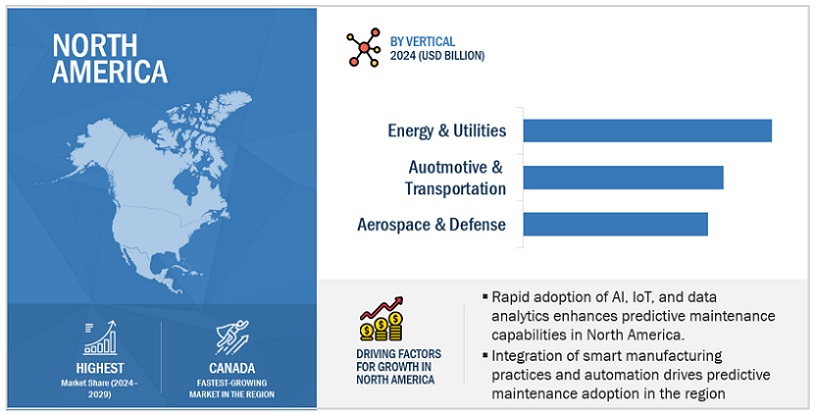

By Vertical, Energy & Utilities segment accounts for the largest market size during the forecast period.

The energy & utilities sector conventionally relies on time-based preventive maintenance to look after its assets, leading to static maintenance routines prone to errors and delays. However, AI or machine learning (ML)-driven predictive maintenance solutions usher in intelligence-based maintenance, enabling energy companies, including those in the oil and gas sector, to leverage historical and real-time data for accurate asset and infrastructure condition forecasting. Oil and gas production plants, with their highly hazardous nature, often necessitate complete shutdowns for planned and unplanned maintenance, and unidentified faults can lead to resource leakage, safety risks, and capital loss. To address these challenges, startups develop predictive maintenance platforms utilizing AI, ML, and predictive analytics to swiftly identify asset anomalies, allowing oil and gas plant operators to detect deviations in pumps, vessels, pipelines, tanks, and drills for better maintenance planning and reduced downtimes. This approach also reduces the need for continuous manual inspections of critical infrastructures, saving labor hours and improving productivity.

By Solution, Standalone segment is projected to grow at the highest CAGR during the forecast period.

Initially, predictive maintenance was integrated into IoT suites and platforms as a basic capability. However, given the escalating volume of operational data generated by organizations today, there's a growing demand for advanced predictive maintenance solutions. These advanced solutions empower organizations to transition from reactive to proactive maintenance processes. Standalone predictive maintenance solutions meet this rising need for advanced capabilities by employing vertical-focused and automated maintenance techniques. They offer flexibility and a variety of optional features, enabling enterprises to forecast equipment failures based on historical data from operational machines, leading to cost savings and reduced downtime. Although standalone software lacks customization capabilities, its affordability makes it popular among small and mid-sized enterprises. Standalone solution providers also offer support for integrating their predictive maintenance solutions into various leading IoT suites.

North America to account for the largest market size during the forecast period.

North America is expected to be the largest contributor to the adoption of AI technologies. The countries considered for the analysis of the North American predictive maintenance market are the US and Canada. Both countries have heavily invested in R&D activities, contributing to the growth of new technologies. Companies in various countries of this region, especially in the US, are leveraging AI, IoT, ML, and deep learning technologies in their business processes to gain a competitive edge in the market. The countries in this region have a well-established economy, enabling predictive maintenance vendors to invest in technological advancements and innovation. Additionally, the region is known as the center of innovation as IT giants are launching new offerings and aggressively collaborating with the predictive maintenance market. The government and public sector have also joined the race to become technologically advanced to cater to a larger customer base. North America is contributing significantly to the predictive maintenance market and is expected to grow at a good pace. Furthermore, the presence of global vendors, such as IBM, Microsoft, General Electric, and Fiix Software, plays a vital role in the adoption of predictive maintenance solutions in the market.

Key Market Players

The major predictive maintenance hardware, solution and service providers include IBM (US) , ABB (Switzerland), Schneider Electric (France), AWS (US), Google (US) , Microsoft (US), Hitachi (Japan), SAP (Germany), SAS Institute (US), Software AG (Germany), TIBCO Software (US), Altair (US), Oracle (US), Splunk (US), C3.ai (US), Emerson (US), GE (US), Honeywell (US), Siemens (Germany), PTC (US), Dingo (Australia), Uptake (US), Samotics (Netherlands), WaveScan (Singapore), Quadrical Ai (Canada), UpKeep (US), Limble (US), SenseGrow (US), Presage Insights (India), Falcon Labs (India). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the predictive maintenance market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2019 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Component (Hardware, Solution [Solution by Deployment mode {Cloud (Public, Private, Hybrid) & On-premises}] & Services), Technology (Analytics & Data Management, Artificial Intelligence, IoT Platform, Sensors & Other Devices), Technique (Vibration Analysis, Infrared Thermography, Acoustic Monitoring, Oil Analysis, Motor Circuit Analysis, Other Techniques) Organization size (Large Enterprises, SMEs), Vertical (Energy & Utilities, Manufacturing, Automotive & Transportation, Aerospace & Defense, Construction & Mining, Healthcare, Telecommunications) and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

IBM (US), ABB (Switzerland), Schneider Electric (France), AWS (US), Google (US), Microsoft (US), Hitachi (Japan), SAP (Germany), SAS Institute (US), Software AG (Germany), TIBCO Software (US), Altair (US), Oracle (US), Splunk (US), C3.ai (US), Emerson (US), GE (US), Honeywell (US), Siemens (Germany), PTC (US), Dingo (Australia), Uptake (US), Samotics (Netherlands), WaveScan (Singapore), Quadrical Ai (Canada), UpKeep (US), Limble (US), SenseGrow (US), Presage Insights (India), Falcon Labs (India). |

This research report categorizes the predictive maintenance market based on component (hardware, solution [By deployment mode] & services), technology, technique, organization size, vertical and region.

Component:

- Hardware

-

Solution

- Integrated

- Standalone

-

Solution By Deployment Mode

- Cloud

- On-premises

-

Services

-

Professional Services

- System Integration

- Support & Maintenance

- Consulting

- Managed Services

-

Professional Services

By Technology:

- Analytics & Data Management

- Artificial Intelligence (AI)

- Internet Of Things (IoT) Platform

- Sensors and Other Devices

By Technique:

- Vibration Analysis

- Infrared Thermography

- Acoustic Monitoring

- Oil Analysis

- Motor Circuit Analysis

- Other Techniques

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Energy & Utilities (includes oil and gas)

- Manufacturing

- Automotive & Transportation

- Aerospace & Defense

- Construction & Mining

- Healthcare

- Telecommunications

- Other Verticals (Retail, Agriculture, Logistics)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments:

- In January 2024, Siemens and AWS deepened their collaboration to simplify the development and scaling of generative artificial intelligence (AI) applications for businesses across various industries and sizes. This partnership enables domain experts in fields like engineering, manufacturing, logistics, insurance, or banking to leverage advanced generative AI technology to create and enhance applications efficiently.

- In December 2023, ABB enhanced its ABB Ability Field Information Manager (FIM 3.0) to provide system engineers and maintenance teams with enhanced connectivity and expanded reach across the latest communication protocols.

- In June 2023, Qatar Airways and Google Cloud partnered to create innovative data and artificial intelligence (AI) solutions tailored for the airline industry. This collaboration will concentrate on enhancing areas like predictive maintenance, passenger experience, and cargo operations, aiming to elevate efficiency and customer satisfaction within the airline sector.

- In April 2023, TrendMiner launched an updated version of its predictive maintenance software, the Digital Twin Manager. This release includes enhanced support for cloud data sources from AWS and Microsoft, along with interactive search functionality, enabling users to make data-driven decisions more efficiently.

- In January 2023, AVEVA, a global leader in industrial software, finalized its acquisition by Schneider Electric. AVEVA's strategic objective is to emerge as the top Software as a Service (SaaS) provider in software and industrial information, transitioning to a subscription-only business model.

Frequently Asked Questions (FAQ):

What is Predictive Maintenance?

Predictive maintenance is a proactive maintenance strategy that utilizes data analysis, sensor technology, and machine learning algorithms to forecast equipment failures before they occur. By continuously monitoring equipment conditions and analyzing performance data, predictive maintenance enables timely intervention, minimizing downtime, reducing maintenance costs, and optimizing asset reliability and efficiency.

Which region is expected to hold the highest share in the predictive maintenance market?

North America boasts the highest market share in the predictive maintenance market due to several factors. The region has a robust industrial sector with a high adoption rate of advanced technologies like IoT, machine learning, and big data analytics, driving the implementation of predictive maintenance solutions.

Which are key verticals adopting predictive maintenance hardware, solution and services?

Predictive maintenance components is adopted cross various verticals, including Energy & Utilities (Oil & Gas), Manufacturing, Automotive & Transportation, Aerospace & Defense, Healthcare, Construction & Mining, Telecommunication, and other verticals such as agriculture, retail and logistics.

Which are the key drivers supporting the market growth for predictive maintenance market?

The key drivers that propel the predictive maintenance market are the widespread adoption of emerging technologies for obtaining valuable insights, the emergence of machine learning (ML) and artificial intelligence (AI), and the rising imperative to minimize maintenance expenses, equipment failures, and operational downtime.

Who are the key vendors in the market for predictive maintenance market?

The key vendors in the global predictive maintenance market include FIS (US), Fiserv (US), Oracle (US), ICE Mortgage Technology (US), TCS (India), Finastra (UK), Newgen Software (India), Nucleus Software (India), Intellect Design Arena (India), Wipro (India), Comarch (Poland), JurisTech (Malaysia), Servosys solutions (India), Sigma Infosolutions (US), HES FinTech (India), Temenos (Switzerland), Nelito (India), Tavant (US), Tietoevry (Finland), Moody’s Analytics (US), AllCloud (India), Relational FS (Greece), Origence (US), RupeePower (India), Decimal Technologies (India), LenderKit (Estonia), Biz2x (US), FUNDINGO (US), Novac Technology Solutions (India) and Banxware (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research study for the predictive maintenance market involved extensive secondary sources, directories, International Journal of Innovation and Technology Management and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred predictive maintenance market providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering predictive maintenance hardware, solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

The market size of companies offering predictive maintenance market hardware, solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, predictive maintenance market spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on hardware, solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to component, technology, technique, organization size, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and predictive maintenance market expertise; related key executives from predictive maintenance market solution vendors, System Integrators (SIs), professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using predictive maintenance market solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of predictive maintenance market hardware, solutions and services, which would impact the overall predictive maintenance market.

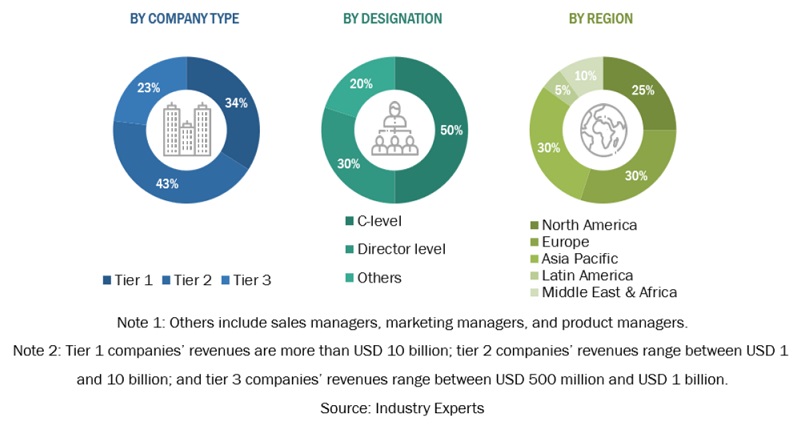

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

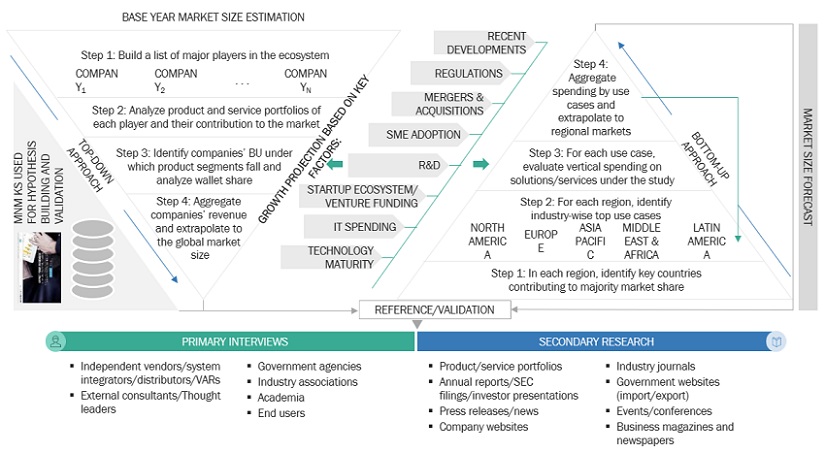

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the predictive maintenance market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering hardware, solutions and services in the predictive maintenance market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of hardware, solutions, solution by deployment mode, and services, technology, technique, organization size, vertical and regions. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of predictive maintenance hardware, solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of predictive maintenance hardware, solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the predictive maintenance market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major predictive maintenance hardware, solution, service providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall predictive maintenance market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to TIBCO Spotfire, Predictive maintenance, also referred to as condition-based maintenance, involves performance monitoring and equipment condition monitoring during regular operations to reduce the chances of a breakdown. Manufacturers began using predictive maintenance in the nineties.

According to Splunk, Predictive maintenance is a maintenance strategy that uses machine learning algorithms trained with Industrial Internet of Things (IIoT) data to make predictions about future outcomes, such as determining the likelihood of equipment and machinery breaking down.

Stakeholders

- Predictive maintenance service providers

- Predictive maintenance vendors

- System integrators

- Value-added resellers

- IoT platform providers

- AI solution developers

- Information Technology (IT) service providers

Report Objectives

- To describe and forecast the predictive maintenance market, in terms of value,

- by component, technology, technique, organization size, and vertical

- To describe and forecast the market, in terms of value,

- by region—North America, Europe, Asia Pacific, Middle East & Africa and Latin America

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and ongoing research and development (R&D) in the predictive maintenance market

- To provide the illustrative segmentation, analysis, and projection of the main regional markets

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per feasibility

- Further breakup of the North American predictive maintenance Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Predictive Maintenance Market

Need documentation on predictive maintenance for students research at Roma 3 University

Predictive Maintenance Market Size In Latin America During Forecast Period

Market size and trends on the heavy equipment maintenance software in various verticles.

Need to know Predictive maintenance application in consumer goods industry and its scope in coming years.