Operational Technology (OT) Security Market by Offering (Solutions & Services), Deployment Mode, Organization Size (SMEs & Large Enterprises), Verticals (Manufacturing, Energy & Power, Oil & Gas) & Region - Global Forecast to 2028

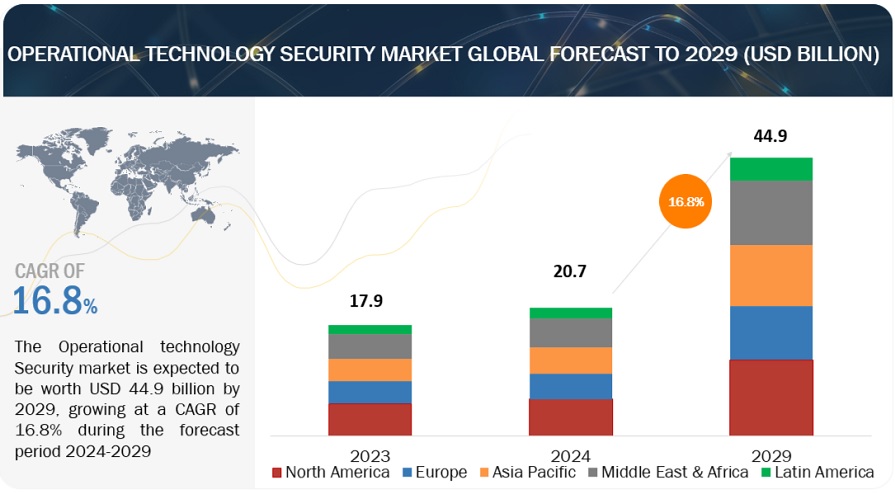

[344 Pages Report] The global OT security market size is expected to grow from an estimated value of USD 17.9 billion in 2023 to 38.2 billion USD by 2028, at a Compound Annual Growth Rate (CAGR) of 16.3% from 2023 to 2028. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 16.3% during the period from 2023 to 2028. The OT security market presents a lucrative opportunity for technology vendors and is anticipated to experience significant expansion over the next five years.

The market's growth can be attributed to several factors, including government initiatives aimed at digitalization, increased regulatory requirements, and the rising number of cyberattacks targeting OT infrastructure. These factors collectively contribute to the market's attractiveness and signify the potential for substantial growth in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Operational Technology Security Market Dynamics

Driver: Rising demand for Industry 4.0 and smart infrastructure to prioritize the integration of OT Security

In today's fast-paced and interconnected world, businesses increasingly embrace Industry 4.0 and smart infrastructure to enhance operational efficiency and gain a competitive edge. However, the rapid digital transformation also brings forth new security challenges that must be addressed to ensure the resilience and reliability of OT systems. This has led to a significant rise in the demand for operational technology security solutions. Organizations recognize the importance of protecting their critical infrastructure, industrial control systems (ICS), and SCADA networks from cyber risks. The potential consequences of OT security breaches include operational disruptions, financial losses, damage to reputation, and compromise of sensitive data. Therefore, the rising demand for Industry 4.0 and smart infrastructure has prompted organizations to prioritize the implementation of OT security solutions. Investing in OT security allows businesses to mitigate risks, prevent cyber-attacks, and maintain continuous production and service delivery. It ensures the resilience and reliability of industrial operations while safeguarding valuable assets, processes, and data. Collaboration between stakeholders is crucial to effectively address the complex security challenges of Industry 4.0 and smart infrastructure. Close partnerships between OT solution providers, cybersecurity experts, government agencies, and regulatory bodies can facilitate the exchange of knowledge, best practices, and threat intelligence. This collaboration is essential for establishing robust security frameworks and standards that ensure the resilience of OT systems.

Restraint: Interoperability and Standardization Challenges

As organizations embrace digital transformation and the integration of OT systems, they face a significant obstacle: ensuring interoperability and standardization of security measures. OT environments encompass a diverse range of devices, systems, and protocols, often originating from different manufacturers and vendors. This heterogeneity creates complexities in ensuring seamless interoperability and standardized security practices across the OT landscape. The absence of widely accepted industry standards makes it difficult to establish consistent security measures and practices across diverse OT systems. This lack of standardization hampers the interoperability of security solutions and limits the ability to achieve comprehensive security coverage. The interoperability challenges arise due to the varying protocols and proprietary technologies used in different OT devices and systems. Integrating security solutions across these disparate systems can be complex, requiring custom integrations, specialized expertise, and additional resources. The lack of interoperability can hinder the seamless implementation of OT security measures, potentially leaving gaps in the security infrastructure. Moreover, the pace of technological advancements in the OT landscape often outpaces the development of standardized security solutions. As new devices and systems are introduced, they may not adhere to common security protocols or exhibit compatibility issues with existing security infrastructure. This creates challenges in ensuring that emerging technologies are adequately secured and integrated into the overall OT security framework. Addressing these challenges requires collaborative efforts among industry stakeholders, standardization bodies, and regulatory agencies. Establishing industry-wide security standards, protocols, and frameworks can drive interoperability and facilitate the seamless integration of security solutions across diverse OT systems.

Opportunity: Technological Advancements to provide opportunities for OT solutions

The rapid evolution of technology has brought new cybersecurity challenges and created exciting opportunities in the OT security market. Technological advancements play a pivotal role as organizations strive to protect their critical infrastructure and adapt to the changing threat landscape. Technological advancements have led to the development of sophisticated threat detection and analytics solutions. Artificial intelligence (AI), machine learning (ML), and big data analytics enable real-time monitoring, anomaly detection, and behavioral analysis of OT systems. These advancements empower organizations to rapidly identify and respond to cyber threats, minimizing potential breaches' impact and ensuring operational continuity. In operational technology security, gaining comprehensive visibility into OT assets and their vulnerabilities is crucial. Innovations such as asset discovery tools, network mapping solutions, and vulnerability assessment platforms provide organizations with deep insights into their OT environments. The increasing need for remote access and monitoring of OT systems demands robust security measures. Advancements in secure remote access technologies, multi-factor authentication, and encryption protocols enable organizations to establish secure connections between remote users and critical OT infrastructure. To protect OT systems from cyber threats, next-generation firewalls (NGFWs) offer advanced features such as deep packet inspection, intrusion prevention, and granular access controls. These solutions help organizations enforce security policies and segment OT networks, reducing the attack surface and limiting lateral movement of threats within the infrastructure.

Challenge: Complexity involved with the OT Environments

The OT security market faces a significant challenge stemming from the complexity of OT environments. As organizations embrace digital transformation and rely on interconnected systems, the intricate nature of OT landscapes presents unique hurdles to securing critical infrastructure. OT environments are characterized by diverse systems, legacy infrastructure, and a mix of proprietary protocols and devices from different vendors. This complexity poses obstacles to developing and implementing comprehensive security solutions. Securing OT environments requires specialized knowledge and expertise in OT systems and cybersecurity. The unique characteristics of OT systems, such as their real-time nature and critical operational processes, require security measures that are specifically tailored to address their complexities. The presence of legacy systems adds to the complexity challenge. Many OT environments still rely on outdated systems and infrastructure not designed with security in mind. These legacy systems may have vulnerabilities and lack the necessary security controls. Retrofitting security measures into these systems can be complex and costly, requiring careful planning and coordination. Addressing the complexity of OT environments requires a holistic approach. Organizations need to invest in specialized resources and expertise to understand the intricacies of their OT systems and develop tailored security solutions. They must also prioritize integrating security measures during system design and consider security an integral part of the overall operational process.

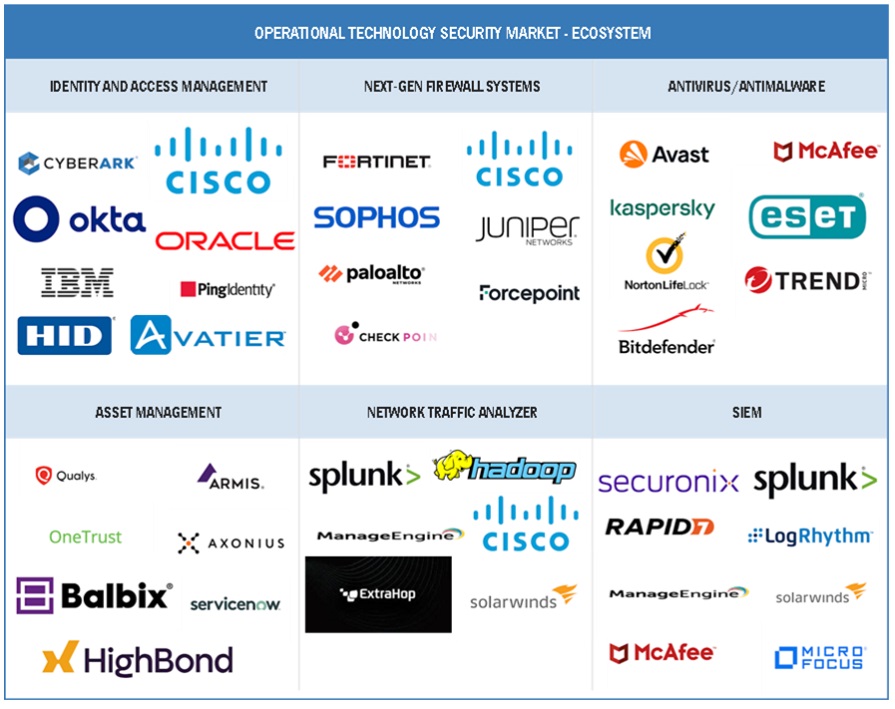

Market Ecosystem.

By vertical, the energy and power (generation) vertical to have the largest CAGR during the forecast period.

The energy and power (generation) vertical within the OT security market is expected to demonstrate the highest Compound Annual Growth Rate (CAGR). Power utilities encounter various challenges, including increasing regulatory requirements, a rise in the frequency of attacks, the necessity to connect market participants to core utility systems, and the significant influx of private consumer data into utility systems through initiatives like smart metering and smart homes. OT systems are commonly employed in thermal and hydropower plants. Implementing these systems in thermal power plants enhances system efficiency by optimizing, supervising, and controlling the generation and transmission processes. A well-designed monitoring and analytics system plays a crucial role in reducing downtime caused by shutdowns or errors. However, the demand for integrating multiple solutions onto a unified platform for thermal and hydropower plants presents a major challenge for security solution providers. Meeting this demand requires developing comprehensive solutions that address the specific requirements of these plants, ensuring seamless integration while upholding robust security measures.

By offering, the solution segment has the highest market size during the forecast period.

During the forecast period, the solution segment in terms of offerings is anticipated to exhibit the highest market size. Control systems, which are often proprietary and may involve integration from multiple vendors, are a significant component of this segment. Additionally, OT endpoints frequently consist of legacy devices that were designed without considering cyber threats since they were not originally intended to be interconnected. Breaches in SCADA/ICS (Supervisory Control and Data Acquisition/Industrial Control Systems) can have severe consequences. According to a report by InfoSec Institute, approximately 63% of organizations experienced a SCADA/ICS security breach that had a significant impact on the safety of their employees. Furthermore, 58% reported major effects on their organization's financial stability, while 63% faced significant obstacles in maintaining operational efficiency. In response to changing business dynamics and the growing recognition of these risks, OT security solutions have been increasingly adopted in recent years.

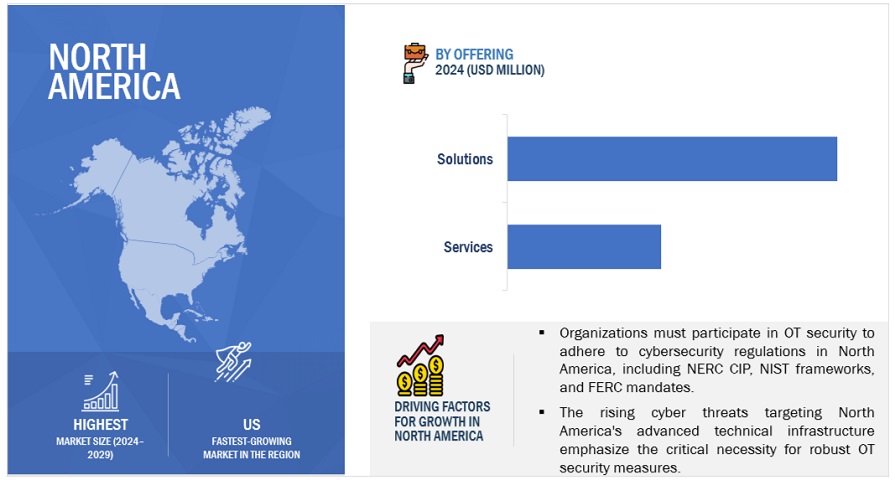

By Region, Americas has the largest market size during the forecast period

The Americas region is projected to make the largest contribution in terms of market size within the OT Security market. Government initiatives focused on investments in OT security and research and development activities have resulted in advancements and are expected to further drive the OT security market's growth, enhancing the region's cybersecurity landscape. The Americas region has been at the forefront of technological innovation and has rapidly embraced digital transformations. Consequently, there is an increasing demand for OT solutions and services due to the significant threats faced by industrial networks. However, a major concern in the region is the lack of industrial security policies and the use of outdated systems, solutions, and software. The frequency of attacks on OT systems has witnessed a substantial increase in the Americas region. As a result, organizations and governments in North America are actively pursuing the adoption of security systems within their industrial sites, thereby fueling the demand for OT security solutions in the region.

Key Market Players:

The key players in the global OT security market include Broadcom (US), Cisco (US), Fortinet (US), Forcepoint (US), Forescout (US), Trellix (US), Zscaler (US), Darktrace (UK), CyberArk (US), BeyondTrust (US), Microsoft (US), Kaspersky (Russia), Nozomi Networks (US), Rapid7 (US), Checkpoint (Israel), Okta (US), Palo Alto Networks (US), Qualys (US), Radiflow (US), SentinelOne (US), Sophos (UK), Tenable (US), Thales (France), Tripwire (US), Armis (US), Seckiot (France), Siga OT Solutions (Israel), OPSWAT (US), Claroty (US), Cydome (Israel), Dragos (US), Mission Secure (US), Ordr (US), runZero (US), Scadafence (US) and Sectrio (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Geographies covered |

Americas, Europe, Asia Pacific, and Middle East and Africa |

|

Major companies covered |

Broadcom (US), Cisco (US), Fortinet (US), Forcepoint (US), Forescout (US), Trellix (US), Zscaler (US), Darktrace (UK), CyberArk (US), BeyondTrust (US), Microsoft (US), Kaspersky (Russia), Nozomi Networks (US), Rapid7 (US), Checkpoint (Israel), Okta (US), Palo Alto Networks (US), Qualys (US), Radiflow (US), SentinelOne (US), Sophos (UK), Tenable (US), Thales (France), Tripwire (US), Armis (US), Seckiot (France), Siga OT Solutions (Israel), OPSWAT (US), Claroty (US), Cydome (Israel), Dragos (US), Mission Secure (US), Ordr (US), runZero (US), Scadafence (US) and Sectrio (US). |

Market Segmentation:

The study categorizes the Operational Technology (OT) Security Market by offering, deployment mode, organization size, vertical, and region.

By Offering:

- Solutions

- Services

By Deployment Mode:

- Cloud

- On-Premises

By Organization Size:

- SMEs

- Large Enterprises

By Vertical:

- Transportation & Logistics

- Manufacturing

- Energy & Power (Generation)

- Oil & Gas (Distribution)

- Others

By Region:

- Americas

- Europe

- Middle East & Africa

- Asia Pacific

Other verticals are mining and defense.

Source: MarketsandMarkets Analysis

Note 1: Rest of Americas include Brazil, Columbia, Chile, and Peru

Note 2: Rest of Europe includes The Netherlands, Sweden, Greece, Belgium, Denmark, and Finland

Note 3: Rest of Asia Pacific includes Singapore, Australia, South Korea, and New Zealand

Recent Development

- In May 2023, Forcepoint upgraded the Forcepoint NGFW with advanced vulnerabilities and situation detection technology.

- In April 2023, Fortinet launched new solutions such as FortiGate 7080F. It represents a cutting-edge lineup of next-generation firewalls (NGFWs) designed specifically for businesses. These innovative firewalls go beyond traditional point products, streamlining operations, and simplifying security infrastructure.

- In March 2023, Tenable enhanced the Tenable Security Solution with Upgraded management experience for Tenable OT Security sensors, advanced Vulnerability and Threat Detection and Enhanced Dashboards and Reporting system.

- In December 2022, Microsoft enhanced the Microsoft Sentinel Solution which provides features such as as MultiCloud SOAR, Enrichment and Threat Intelligence, Incident Management and Remediation and Response.

- In November 2022, Okta introduced a series of innovative enhancements to its Workforce Identity Cloud, reinforcing its unified control platform for efficient identity management across all enterprise resources and user profiles.

Frequently Asked Questions (FAQ):

What is the definition of OT security?

According to MarketsandMarkets, OT is the full stack of hardware and software used to monitor, detect, and control physical devices, processes, and events in an enterprise. OT security includes various security solutions, such as NGFWs, IAM, and SIEM, used to protect people, physical assets, processes, and information.

What is the projected market value of the global OT security market?

The global OT security market size is expected to grow from an estimated value of USD 17.9 billion in 2023 to USD 38.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 16.3% from 2023 to 2028.

Who are the key companies influencing the market growth of the OT security market?

Broadcom, Cisco, Fortinet, Forcepoint, Forescout, FireEye, Zscaler, Darktrace, CyberArk, BeyondTrust, Microsoft, Kaspersky, Nozomi Networks, and Rapid7 are prominent players in the OT security market and are acknowledged as industry leaders. These companies hold a significant market share and provide comprehensive solutions and services for OT security. They are known for offering tailored solutions based on the specific requirements of their clients and implementing growth strategies to consistently drive their desired expansion and establish a strong market presence.

Who are the emerging start-ups/SMEs that are significantly supporting the market growth?

Claroty, Dragos, Armis, SCADAfence, Nozomi Networks, and Darktrace are dynamic SMEs/start-ups that are playing a pivotal role in fostering market growth through their technical proficiency and expertise. These emerging companies are dedicated to enhancing their product and service portfolios and introducing innovative solutions to the market, setting them apart from their competitors. They are actively contributing to the advancement of the industry with their unique capabilities and forward-thinking approaches.

Which are the key verticals adopting Operational Technology Security?

Key verticals adopting Operational Technology Security include Transportation & Logistics, Manufacturing, Energy & Power, Oil & Gas, and Other Verticals such as Mining and Defense.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The research study involved the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, Let’s Talk Payments, MSSP Alert, CyberDB, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the OT security market. Additionally, sources such as the Information System Security Association, National Association of Information Sharing and Analysis Centers (ISACs), and various cybersecurity associations were used to collect information specific to the market.

Secondary Research

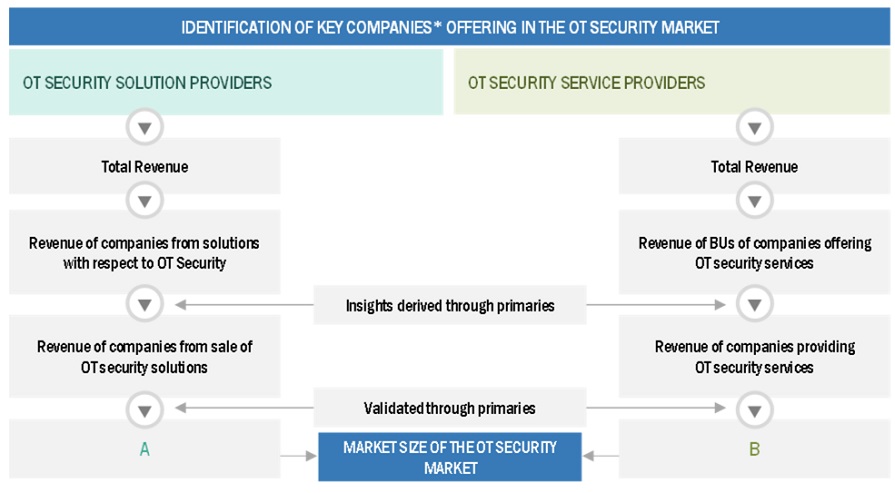

The market size of companies offering OT security solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases. The cybersecurity investment and spending of various countries were extracted from their respective security associations, such as the US Department of Homeland Security (DHS) and European Union Agency for Cybersecurity (ENISA). Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players according to their offerings and industry trends related to technology, application, region, and key developments from market and technology-oriented perspectives.

Primary Research

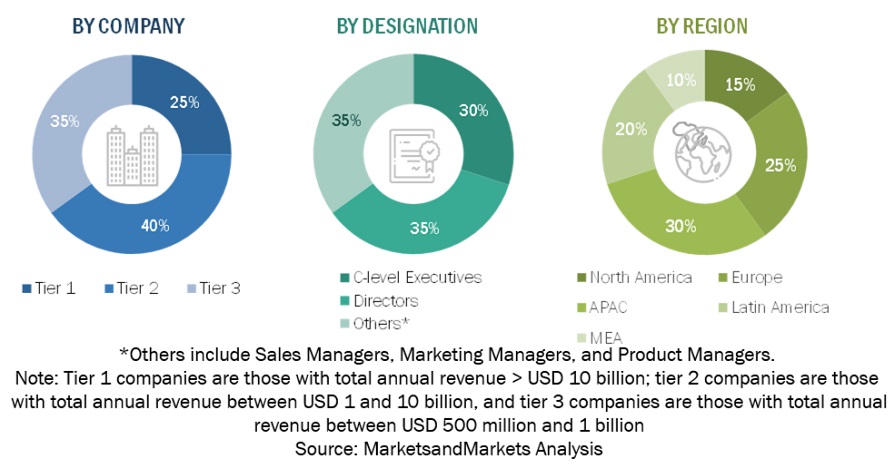

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the OT security market.

In the market engineering process, top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to list key information/insights throughout the report.

After the complete market engineering process (calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of the OT security market players; and the key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down and bottom-up approaches were used to estimate and validate the size of the global OT security market and estimated the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included the studying of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All parameters that affect the market and have been covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying numerous factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, OT is the full stack of hardware and software used to monitor, detect, and control physical devices, processes, and events in an enterprises. OT Security includes a broad array of security solutions such as NGFWs, IAM, SIEM, and others - used to protect people, physical assets, processes, and information.

Key Stakeholders

- Government bodies and public safety agencies

- Project managers

- Developers

- Business analysts

- Quality Assurance (QA)/ test engineers

- OT Security specialists

- OT Security solution and service providers

- Consulting firms

- Third-party vendors

- Investors and venture capitalists

- System Integrators (SIs)

- Technology providers

Report Objectives

- To define, describe, and forecast the OT Security market based on offering, solutions, services, deployment mode, organization size, vertical, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the OT Security market

- To forecast the size of the market segments with respect to five main regions: Americas, Europe, Asia Pacific, and Middle East and Africa

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the OT Security market and comprehensively analyze their market size and core competencies.

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions.

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the OT Security market globally.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Operational Technology (OT) Security Market