Optical Imaging Market by Product (Cameras, Lenses), Technique (OCT, HIS, NIR, PAT), Therapeutic Area (Ophthalmology, Dermatology, Oncology), Application (Pathological, Intraoperative), End User (Hospital, Research Labs) & Region - Global Forecast to 2027

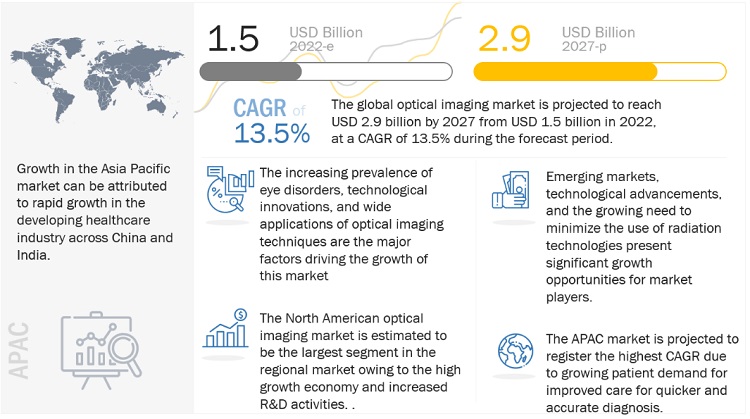

The global optical imaging market in terms of revenue was estimated to be worth $1.5 billion in 2022 and is poised to grow at a CAGR of 13.5% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Optical imaging is a rapidly developing field that has significantly impacted the global healthcare industry by facilitating effective and affordable healthcare. Factors such as the increased glaucoma and cataract cases among elderly population, increasing applications of optical imaging techniques in drug discovery processes and preclinical research, and rapid increased in geriatric populace across the world are fueling the growth of this market.

Global Optical imaging Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Optical imaging Market Dynamics

DRIVERS: Increasing prevalence of eye disorders due to the rising geriatric population

The growing prevalence of eye disorders, owing to the rising global geriatric population, is one of the key factors driving the growth of the global market. The tear layer loses stability and degrades faster in the elderly, making them more prone to eye disorders. Therefore, the risk of getting severe eye disorders increases significantly with age, particularly after 60 years. Currently, the prevalence rate of glaucoma is four times higher in individuals aged 80 years and above as compared to those aged 40 years and above. Also, the prevalence rates of several other eye disorders, such as cataract, presbyopia, and age-related macular degeneration (AMD), is increasing across the globe. For instance, according to Prevent Blindness (US), 24.41 million people were suffering from cataracts in the US in 2010; this number is expected to increase to 50.0 million by 2050.

RESTRAINTS: Reimbursement challenges

The US is the largest market for optical imaging technologies. However, recent changes in reimbursement policies in the country are expected to affect the growth of this market. With the implementation of the Affordable Care Act (ACA), the size of the insured population in the US has increased. However, this has also resulted in insufficient reimbursements for newly insured patients. Moreover, medical reimbursements for various optical imaging technologies are decided based on their use for intended applications.

In July 2020, the Centers for Medicare, and Medicaid Services (CMS) implemented major changes in reimbursements for several vitreoretinal procedures. They implemented a 15% reimbursement cut for all cataract surgeries performed within the US. Thus, reimbursement changes pose a great barrier to the market growth.

OPPORTUNITIES: Emerging economies

Emerging countries such as India, China, Japan, and Brazil are expected to provide significant growth opportunities for players operating in the global market. These countries are some of the fastest-growing economies in the world. According to estimates from the World Economic Forum, 2020, these emerging economies contributed to around one-third of the global healthcare expenditure. The rise in geriatric population and diseases associated with it are also certain factors that create high growth opportunities for the market.

CHALLENGES: Sustainability of small and medium-sized players

Increasing market competitiveness is one of the major challenges in the optical imaging systems market, especially for small and mid-tier companies. Although the global market is dominated by few players such as PerkinElmer, Inc., Carl Zeiss Meditec AG, and Abbott Laboratories, new entrants and mid-tier firms continuously strive to garner a greater market share and market visibility. However, higher costs and longer time required for the development of optical imaging products pose a major barrier for such companies.

Market Overview - Executive Summary

In this report, the optical imaging market is segmented on the basis of product, application, end users, therapeutic area, technique and region.

Optical Coherence Tomography segment accounted for the largest share in the optical imaging market by technique

The demand for better techniques and safer diagnostic procedures is rising as a result of changes in the medical technology sector. The demand for non-invasive diagnostic imaging modalities is driven by factors such as increasing elderly population, an increase in the prevalence of chronic diseases, and the need for safer diagnostic methods. This in turn fuels the market's expansion. OCT systems enables the visualisation of optically scattered, non transparent tissues, making it a useful tool for the diagnosis in various therapeutic areas.

Ophthalmology segment accounted for the largest share in the optical imaging market by therapeutic area

The market's overall growth for ophthalmology is likely to be driven by the growing number of ophthalmic procedures being performed every year across the globe. Nearly 3.7 million cataract procedures are performed in the US, 7 million in Europe and 20 million worldwide. With the increased awareness of optical instruments in the developing countries, the market provides great growth opportunity in these regions. Growing demand for low cost OCT systems is creating opportunities for the market to flourish in this region. This trend is expected to continue in the coming years and contribute to overall market growth. The increasing aging population, coupled with the rising prevalence of ophthalmic disorders, will play a vital role in the growth of the global market during the forecast period

Imaging systems segment accounted for the largest share in the optical imaging market by product

The imaging systems segment accounted for the largest share of the global market, by product in the forecast period. This segment's large share can be attributed to its wide application in ophthalmology, oncology, and other application. These systems are widely adopted as they provide real-time, 1D depth, 2D cross-sectional, and 3D volumetric images with micron-level resolution and imaging depths of up to a few millimeters with no hazardous radiation. Subsurface tissue details are hidden without OCT display in bright and sharp images, allowing for a better understanding of ocular pathology. In turn, this development helps surgeons overcome uncertainties during eye surgeries to achieve the best possible patient outcome.

Hospital segment accounted for the largest share in the optical imaging market by end user

Based on end user, the market, by end user is led by the hospital and clinics segment Hospitals and clinics majorly adopt optical imaging technologies for ophthalmological diagnostic imaging and cancer screening procedures. These technologies are also used in cardiology, neurology, and dermatology, but to a lesser extent. This market's growth is mainly driven by the increasing clinical applications of optical imaging techniques in various therapeutic areas and the growing demand for optical imaging products by clinicians across the globe.

Geographic Snapshot: Optical Imaging Market

To know about the assumptions considered for the study, download the pdf brochure

Key players in the Optical imaging Market: Carl Zeiss Meditec (Germany), Abbott (US), Topcon Corporation (Japan), Canon (Japan), PerkinElmer (US), Koninklijke Philips (Netherlands), Heidelberg Engineering (US), Leica Microsystems (Germany), Headwall Photonics (US), Visionix (US), Optical Imaging (Israel), Optos (Scotland), Wasatch Photonics (US), ArcScan (US), DermaLumics (Spain), Cylite (Australia), MOPTIM (Guangdong), Michelson Diagnostics (England), Thorlabs (US), Hamamatsu Photonics (Japan), iTheraMedical (Germany), Kibero (Germany), Seno Medical (US), Aspectus Imaging (Germany), and Agfa-Gevaert (Belgium).

Optical Imaging Market Report Scope:

|

Report Metric |

Details |

|

Market Size available for years |

2020-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value(USD Billion) |

|

Segments covered |

Product, Application, Therapeutic Area, Techniques and End User |

|

Geographies covered |

|

|

Companies Covered |

Carl Zeiss Meditec (Germany), Abbott (US), Topcon Corporation (Japan), Canon (Japan), PerkinElmer (US), Koninklijke Philips (Netherlands), Heidelberg Engineering (US), Leica Microsystems (Germany), Headwall Photonics (US), Visionix (US), Optical Imaging (Israel), Optos (Scotland), Wasatch Photonics (US), ArcScan (US), DermaLumics (Spain), Cylite (Australia), MOPTIM (Guangdong), Michelson Diagnostics (England), Thorlabs (US), Hamamatsu Photonics (Japan), iTheraMedical (Germany), Kibero (Germany), Seno Medical (US), Aspectus Imaging (Germany), and Agfa-Gevaert (Belgium). |

The research report categorizes the optical imaging market into the following segments & sub-segments:

By Product

- Imaging Systems

- Camera

- Software

- Lenses

- Illuminating Systems

- Other

By Application

- Pathological Imaging

- Intraoperative Imaging

By End User

- Hospitals

- Research Laboratories

- Pharmaceutical and Biotechnology Companies

By Therapeutic Area

- Ophthalmology

- Oncology

- Cardiology

- Dermatology

- Neurology

- Others

By Technique

- Optical Coherence Tomography

- Near infrared Spectroscopy

- Hyperspectral Imaging

- Photoacoustic Tomography

By Region

-

North America North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

Recent Developments:

- In January 2023, Canon Medical Inc., partnered with ScImage. The strategic partnership between the two companies will directly broaden and advance Canon Medical Systems’ outreach in hemodynamics with the Fysicon QMAPP Hemo portfolio (Fysicon is a Canon Medical subsidiary). As a result, Canon Medical plans to increase its presence in the cardiac market, offering innovative solutions and unique business models tailored to each client’s specific needs.

- In August 2021, Topcon partnered with RetInSight to develop a seamless interface between RetInSight’s AI-assisted retinal biomarker applications and Topcon’s market-leading OCT devices and cloud-based data management solution, Harmony.

- In December 2020, Carl Zeiss acquired arivis to further strengthen its software competencies and market position in 3D image visualization, image processing, and analysis software for research microscopy.

Frequently Asked Questions (FAQs):

What is the projected market value of the global optical imaging market?

The global market of optical imaging is projected to reach USD 2.9 billion.

What is the estimated growth rate (CAGR) of the global optical imaging market for the next five years?

The global optical imaging market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% from 2022 to 2027.

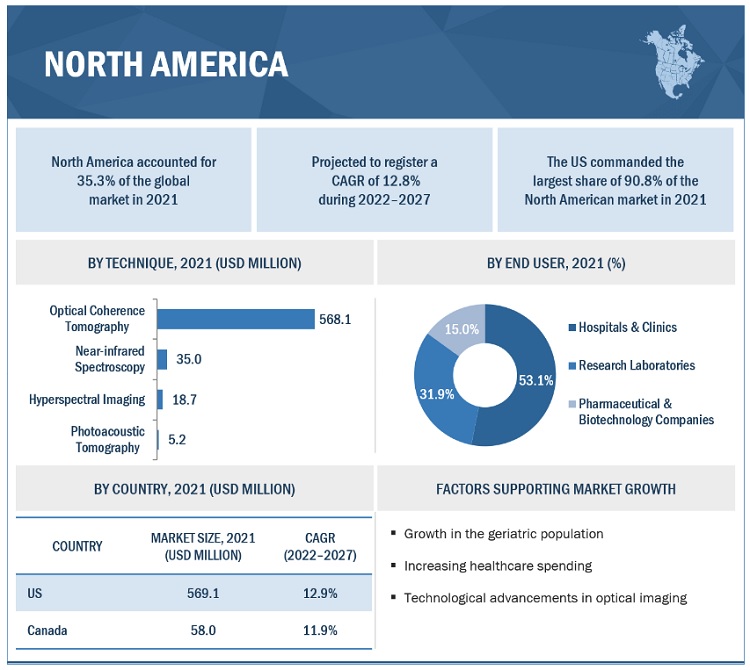

What are the major revenue pockets in the optical imaging market currently?

North America will continue to rule the optical imaging market over the forecast period. The greatest market share in the world is attributable to this region, which has seen a surge in glaucoma cases, government support, and the importance of research and development by well-known companies based there. In addition, stringent FDA regulations regarding the product, medical procedures, and research ensure the quality and safety of optical imaging instruments and technologies in the region. This is encouraging healthcare centers in North America to utilize optical imaging for various interventions and quickly adapt to newer technologies, which is driving the growth of the optical imaging market in North America

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

2 RESEARCH METHODOLOGY (Page No. - 38)

This study involved four major approaches in estimating the current optical imaging market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the optical imaging market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Some of the key secondary resources referred to in this study include:

- The United States Department of Health & Human Services (HHS)

- Center for Drug Evaluation and Research (CDER)

- Center for Disease Control and Prevention

- National Institute of Biomedical Imaging and Bioengineering (NIBIB)

- Center for Devices & Radiological Health

- World Health Organisation

- American Hospital Association

- U.S. Bureau of Labor Statistics

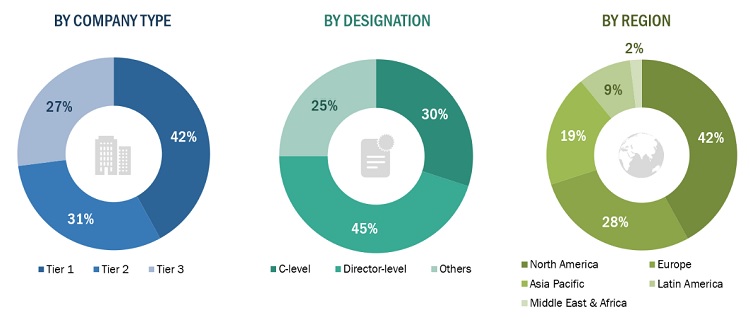

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, consultants, subject-matter experts, directors, general managers, developers, and other key opinion leaders of the various companies that offer optical imaging products. Primary sources from the demand side include industry experts such as hospital directors, research professionals, pharmaceutical company research and development head, and other medical professionals.

Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

Market Size Estimation

The total size of the optical imaging market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the medical device cleaning businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the global market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of optical imaging products in the overall market was obtained from secondary data and validated by primary participants to arrive at the total market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall optical imaging market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Breakdown of Primary Interviews (Supply Side): By End-User Type, Designation, and Region

* Others include sales managers, marketing managers, and product managers

Note: Tiers of companies are defined by their total revenues; as of 2020, Tier 1>= USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3<= USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

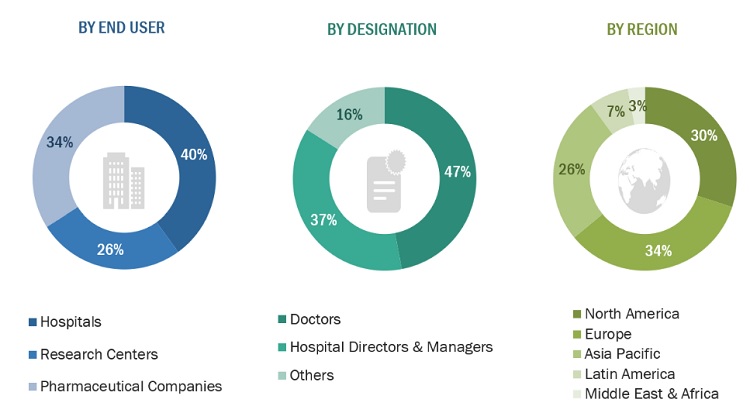

Breakdown of Primary Interviews (Demand Side): By End-User Type, Designation, and Region

Note: Other designation includes type-c executives of hospitals and clinics.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the optical imaging business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, and forecast the optical imaging market by product, application, end user, therapeutic area, techniques, and region.

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the global market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the global market

- To track and analyze competitive developments such as partnerships, agreements, acquisitions, product launches, and expansions in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific optical imaging market into Thailand, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Imaging Market

Does this study covers detailed segment list of optical imaging market report ?

please share information on optical preclinical imaging market