Overhead Catenary System Market by Catenary Wire (Simple, Stitched, Compound), Train (Metro, Light Rail, High-Speed Rail), Voltage (Low, High), Component (Catenary Wire, Dropper, Insulator, Cantilever), Material, Track & Region - Global Forecast to 2025

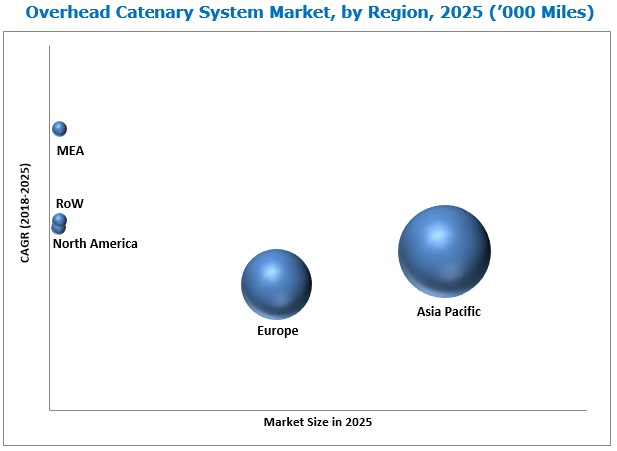

The overhead catenary system market was valued at $21.85 billion in 2017 and is expected to reach $46.94 billion by 2025, at a CAGR of 9.09% during the forecast period. The overhead catenary system market for electrified track length in operation is projected to grow at a CAGR of 6.55% during the forecast period, from an estimated market size of 232.6 thousand miles in 2018 to 326.7 thousand miles by 2025.

The overhead catenary system acts as the contact line technique for the transmission of electrical power to the trains. It is also called overhead lines equipment, overhead contact system, and overhead wiring in the rail industry. Thus, the combination of pantograph and catenary system is responsible for transferring electrical power to the train for its operation at varying speeds. The major characteristics of the system are its reliability and safety for the transmission of power supply. The overhead catenary system market is expanding with the development of the rail industry worldwide. In this study, 2017 has been considered the base year, and 2018 to 2025, the forecast period for estimating the market size of the market.

Overhead Catenary System Market Dynamics

Drivers

- Expansion of high-speed rail network generating the need for overhead lines

- High reliability and safety of the overhead catenary system

- Growing need for energy efficient rail transport

Restraints

- High capital investment and maintenance costs of the overhead catenary system

- Growth of the third rail system in urban rail transit

Opportunities

- Expansion of electrified network for rail transport

Challenges

- The overhead catenary system is prone to high wear and fatigue failure

- Transmission losses associated with the overhead catenary system

Expansion of high-speed rail network and adoption of electric rapid rail transit would drive the global overhead catenary system demand to approximately USD 46.94 billion by 2025

Several countries of Europe, Asia Pacific, and the Middle East have introduced high-speed rail projects to encourage mass rapid transit. The rail authorities of countries have developed high-speed train projects just after its introduction in the rail industry. The development of rail infrastructure indirectly fosters the growth of the overhead catenary system market. The acceptance of high-speed trains is anticipated to rise in the near future due to the prospects of economic growth created by the development of high-speed rails. As the high-speed rail is operated purely with electric propulsion, the market is anticipated to grow in the coming years.

Many emerging countries as well as developed countries are focusing on expanding their rail network for a better standard of living and economic growth. Moreover, urban rail transit such as metro and trams have emerged as reliable modes of city transport. Many urban rail projects are currently in the pipeline and are due for completion in the coming years. Several major rail companies are working on the enhancement of the power transmission technology across the globe. The respective rail authorities of the countries have implemented the use of the overhead catenary systems for the operation of the metro rail transit.

Many countries have constructed metros and heavy rails for traveling to longer distances. The efficient operation and low-cost installation of the mass rapid transit system (MRTS) have made most countries to opt for the system as an alternative mode of transportation. Thus, the metro is a highly adopted mode of transportation channel and subsequently pulls the growth of the overhead catenary system market globally.

The major objectives of the study are as follows:

- To define, describe, and project the overhead catenary system market (2018-2025), in terms of value (USD million) and volume (miles)

- To provide detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, expansions, and other activities carried out by key industry participants

- To segment the market and forecast its size, by volume, based on region (Asia Pacific, Europe, North America, RoW, and MEA)

- To segment the market and forecast the market size, by volume, based on train type (metro, light rail, and high-speed rail)

- To segment the market and forecast the market size, by volume, based on voltage type (low, medium, and high)

- To segment the market and forecast the market size, by value and volume, based on catenary type (simple catenary, stitched catenary, and compound catenary)

- To segment the market and forecast the market size, by volume (units), based on components [catenary wire (miles), droppers, insulators, and cantilevers]

- To segment the market and forecast the market size, by volume, based on material (Cu-Mg, Cu-Sn, Cu-Cd, and Cu-Ag)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall overhead catenary system market

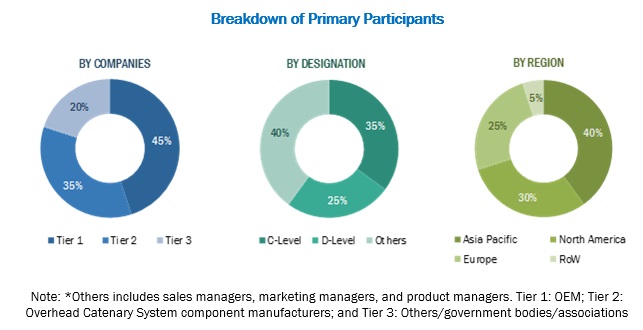

During this research study, major players operating in the overhead catenary system market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. The top-down and bottom-up approaches have been used to determine the overall market size. The size of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The overhead catenary system market comprises a network of players involved in the research and product development, raw material supply, component manufacturing, distribution and sale, and post-sales services. The key players considered in the analysis of the market are CRRC (China), Alstom (France), Siemens (Germany), Bombardier (Canada), and NKT (Denmark), ABB (Switzerland), Strukton (The Netherlands), TE Connectivity (Switzerland), Wabtec (US), and Lamifil (Belgium).

Major Market Developments

- Alstom to supply 5 additional Citadis trams to Bordeaux Metropole for a total amount of approximately USD 17.3 million. This order comes in addition to a tranche of 25 trams currently being manufactured on Alstom's site in La Rochelle. With this development, the company may cater to the increasing demand for the overhead catenary system for the rail industry.

- Dogus Construction Group chose Nexans to supply low and medium voltage Alsecure cables for Istanbul’s new Metro line to establish an additional 20 km of railway to serve the city’s suburbs. Nexans supplied both low and medium voltage Alsecure cables for the USD 641.2 million project commissioned by the Istanbul Metropolitan Municipality (IMM).

- NKT A/S acquired ABB HV cables. The European Commission approved and announced NKT Cables’ acquisition of ABB’s high-voltage cables business as complete. This acquisition is likely to be a strong move to cater the demands of the rail industry and gain a strong foothold in the overhead catenary market

Overhead Catenary System Market Target Audience:

- Associations related to the railway industry

- Country-level government authorities

- Infrastructure providers for railway lines

- Legal and regulatory authorities

- Manufacturers of rail components

- Overhead catenary system service providers

- Overhead catenary system components manufacturers

- Overhead catenary wire manufacturers

- Rail leasing authorities

- Railway contractors

- Railway manufacturers

- Railway organizations

- Raw material suppliers for overhead catenary system

- Traders, distributors, and suppliers of overhead catenary system

Report Scope

Overhead Catenary System Market By Train Type

- Metro

- Light Rail

- High-speed Rail

Overhead Catenary System Market By Voltage

- Low

- Medium

- High

Overhead Catenary System Market By Catenary Type

- Simple Catenary

- Stitched Catenary

- Compound Catenary

Overhead Catenary System Market By Component

- Contact Wire

- Droppers

- Insulators

- Cantilevers

- Connectors

- Clamps

- Steady Arm

Overhead Catenary System Market By Material

- Cu-Cd

- Cu-Ag

- Cu-Mg

- Cu-Sn

Overhead Catenary System Market By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

- MEA

Critical questions which the report answers

- What are the different materials used for manufacturing catenary and contact wire for conduction of high power?

- Who are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Additional country-level analysis of the overhead catenary system market

Company Information

- Profiling of additional market players (up to 3)

Market Scenario

- Competitive Leadership Mapping (Micro-quadrant)

The overhead catenary system market is estimated to be USD 25.53 billion in 2018 and is projected to reach USD 46.94 billion by 2025, at a CAGR of 9.09% from 2018 to 2025. The market for electrified track length in operation is projected to grow at a CAGR of 6.55% during the forecast period, from an estimated market size of 232.6 thousand miles in 2018 to 326.7 thousand miles by 2025. The key growth factors for the market are the expansion of high-speed rail network and electrified rail tracks for urban rail transit.

The high voltage segment is estimated to hold the largest market share during the forecast period. The increasing development of high-speed rail transit in the Asia Pacific and European region is contributing to the growth of the overhead catenary system market. Also, the growing focus of urban planners to develop rail transport over other transportation mediums is majorly boosting the market.

The overhead catenary system market has been segmented, on the basis of component, into contact wire, droppers, insulators, and cantilevers. The market for contact wire is expected to grow at a significant rate between 2018 and 2025, by volume. In terms of units, insulators are projected to register the largest market share by 2025 because of its usage in high numbers in the overhead catenary system.

The overhead catenary system market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia Pacific is the fastest growing market for the overhead catenary system. The exponential expansion of the electrified rail tracks in countries such as China, Japan, and India has led to the increase in demand for overhead lines for rail application which, in turn, has increased the growth of the market in this region. Moreover, the gradual rise in the adoption of urban rail and high-speed rail transit in the regional countries is contributing to the growth of the market. As a result, APAC holds a significant share of the overall market.

The overhead catenary system is primarily used for energizing the trains. Thus, the growth of the rail industry would ultimately govern the growth of the overhead catenary system market.

Metros

Metros are primarily a part of the Mass Rapid Transit System (MRTS) and widely accepted across the globe as a transport channel. It is a more convenient, fast, comfortable, and an affordable mode of urban transport. It is known for its high capacity carriers and short travel duration, which are the key factors for the global implementation of the metro rail. Many metro projects are operating globally and successfully delivering transport services. In the developing countries, an increase in urbanization has led to the rise in the demand for transportation systems. This has led the governments to develop an infrastructure for MRTS. Thus, the development of MRTS would ultimately drive the growth of the overhead catenary system market.

Light Rail

Light rail comprises conventional intercity train fleet and trams that are presently being operated in many countries. The need for energy efficient transport has forced the urban planners to implement the electric operation of train fleet without affecting efficiency and reliability. Thus, the rail authorities of several countries have started expanding the electrification of rail tracks through overhead lines. This factor is contributing to the growth of the overhead catenary system market.

High-Speed Rail

The high-speed train operates at a high voltage power due to its high-velocity mobility. Supplying the high voltage power to the train overhead lines is the most suitable method of electrification with utmost safety and reliability. Thus, the anticipated growth of high-speed train lines across the world would lead to the growth of the catenary system market.

Critical questions the report answers:

- Where will the urban rail transit developments take the overhead catenary system industry in the mid to long term?

- How does hydrogen power pose a threat to the overhead catenary system in the coming years?

The increasing acceptance of the third rail system for urban rail transit is a major factor restraining the growth of the market. Third rail has been developed to overcome the disadvantages associated with the overhead catenary system to electrify the rail track. A third rail system is an additional rail that is placed in between or alongside the rails of a railway track. The additional rail, which is also called as conductor rail, is a cost-effective method of rapid transit system with a high traffic density. Unlike overhead catenary system, the third rail system does not require structures to carry wires and over-bridge for clearances.

The key players in the market include CRRC (China), Alstom (France), Siemens (Germany), Bombardier (Canada), NKT (Denmark), ABB (Switzerland), Strukton (The Netherlands), TE Connectivity (Switzerland), Wabtec (US), and Lamifil (Belgium). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Breakdown & Data Triangulation

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Overhead Catenary System Market

4.2 Market Share, By Country

4.3 Market, By Catenary Type

4.4 Market, By Train Type

4.5 Market, By Voltage

4.6 Market, By Component

4.7 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Overhead Catenary System Market Dynamics

5.2.1 Drivers

5.2.1.1 Expansion of High-Speed Rail Network Generating the Need for Overhead Lines

5.2.1.2 High Reliability and Safety of the Overhead Catenary System

5.2.1.3 Growing Need for Energy-Efficient Rail Transport

5.2.2 Restraints

5.2.2.1 High Capital Investment and Maintenance Costs of the Overhead Catenary System

5.2.2.2 Growth of Third Rail System in Urban Rail Transit

5.2.3 Opportunities

5.2.3.1 Expansion of Electrified Network for Rail Transport

5.2.4 Challenges

5.2.4.1 The Overhead Catenary System is Prone to High Wear and Fatigue Failure

5.2.4.2 Transmission Losses Associated With the Overhead Catenary System

6 Industry Trends (Page No. - 42)

6.1 Pantograph

6.2 Third Rail

7 Overhead Catenary System Market, By Track Length (Page No. - 44)

7.1 Introduction

7.2 China

7.2.1 Operational High-Speed Trains in China

7.2.2 Under Construction HSR Lines in China

7.3 Japan

7.3.1 Operational High-Speed Trains in Japan

7.3.2 Under Construction HSR Lines in Japan

7.4 South Korea

7.4.1 Operational High-Speed Trains in South Korea

7.4.2 Under Construction HSR Lines in South Korea

7.4.3 Long Term Plan HSR Lines in South Korea

7.5 Turkey

7.5.1 Operational High-Speed Trains in Turkey

7.5.2 Under Construction HSR Lines in Turkey

7.5.3 Long Term Plan for HSR Lines in Turkey

7.6 France

7.6.1 Operational High-Speed Trains in France

7.6.2 Under Construction HSR Lines in France

7.6.3 Long Term Plan for HSR Lines in France

7.7 Germany

7.7.1 Operational High-Speed Trains in Germany

7.7.2 Under Construction HSR Lines in Germany

7.7.3 Long Term Plan for HSR Lines in Germany

7.8 Italy

7.8.1 Operational High-Speed Trains in Italy

7.8.2 Under Construction HSR Lines in Italy

7.8.3 Long Term Plan for HSR Lines in Italy

7.9 Spain

7.9.1 Operational High-Speed Trains in Spain

7.9.2 Under Construction HSR Lines in Spain

7.9.3 Long Term Plan for HSR Lines in Spain

7.10 UK

7.10.1 Operational High-Speed Trains in the UK

7.10.2 Long Term Plan for HSR Lines in the UK

7.11 US

7.11.1 Operational High-Speed Trains in the US

7.11.2 Long Term Plan for HSR Lines in the US

7.11.3 Long Term Plan for HSR Lines in the US

8 Overhead Catenary System Market, By Train Type (Page No. - 56)

8.1 Introduction

8.2 Metro

8.3 Light Rail

8.4 High-Speed Rail

9 Overhead Catenary System Market, By Voltage Type (Page No. - 63)

9.1 Introduction

9.2 Low Voltage Wire

9.3 Medium Voltage Wire

9.4 High Voltage Wire

10 Overhead Catenary System Market, By Component (Page No. - 70)

10.1 Introduction

10.2 Catenary Wire

10.3 Contact Wire

10.4 Droppers

10.5 Insulator

10.6 Cantilever

10.7 Connectors

10.8 Clamps

10.9 Steady ARM

11 Overhead Catenary System Market, By Catenary Wire Type (Page No. - 79)

11.1 Introduction

11.2 Simple Catenary Wire

11.3 Stitched Catenary Wire

11.4 Compound Catenary Wire

12 Overhead Catenary System Market, By Material (Page No. - 88)

12.1 Introduction

12.2 Cadmium Copper (CU-CD)

12.3 Copper Tin (CU-SN)

12.4 Copper Magnesium (CU-MG)

12.5 Copper Silver (CU-AG)

13 Overhead Catenary System Market, By Region (Page No. - 90)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.3 Europe

13.3.1 Germany

13.3.2 France

13.3.3 Italy

13.3.4 Spain

13.3.5 UK

13.3.6 Russia

13.4 North America

13.4.1 Canada

13.4.2 Mexico

13.4.3 US

13.5 Rest of the World

13.5.1 Brazil

13.5.2 Iran

13.6 Middle East

13.6.1 Saudi Arabia

13.6.2 Egypt

14 Competitive Leadership (Page No. - 109)

14.1 Overview

14.2 Market Ranking

14.3 Competitive Senario

14.3.1 New Product Developments

14.3.2 Expansions

14.3.3 Collaborations/Joint Ventures/Supply Contracts/Partnerships/AGreements

14.3.4 Mergers & Acquisitions

15 Company Profile (Page No. - 114)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

15.1 CRRC

15.2 Alstom

15.3 Siemens

15.4 Bombardier

15.5 NKT

15.6 ABB

15.7 Strukton

15.8 TE Connectivity

15.9 Nexans

15.10 Wabtec

15.11 Lamifil

15.12 Pfisterer

15.13 Other Key Regional Players

15.13.1 Asia Pacific

15.13.1.1 LS Cable & System

15.13.1.2 Niigata Transys

15.13.2 Europe

15.13.2.1 Rhombergrail

15.13.2.2 Kruch

15.13.2.3 Steconfer

15.13.2.4 Galland

15.13.2.5 Charignon

15.13.2.6 Sarkuysan

15.13.2.7 Generale Costruzioni Ferroviarie S.P.A

15.13.2.8 Kummler+Matter

15.13.2.9 Balfour Beatty

15.13.2.10 Elcowire

15.13.2.11 Eland Cables

15.13.3 North America

15.13.3.1 Emspec

15.13.4 RoW

15.13.4.1 Alucast Iran

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 145)

16.1 Key Industry Insights

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Available Customizations

16.4.1 Overhead Catenary System Market, Additional Components (Up to 2)

16.4.2 Profiles of Additional Market Players (Up to 3)

16.4.3 Competitive Leadership Mapping (Micro-Quadrant) Companies

16.5 Related Reports

16.6 Author Details

List of Tables (37 Tables)

Table 1 Impact of Market Dynamics

Table 2 Overhead Catenary System Market Size, By Train Type, 2016–2025 (Miles)

Table 3 Metro: Market Size, By Region, 2016–2025 (Miles)

Table 4 Light Rail: Market Size, By Region, 2016–2025 (Miles)

Table 5 High-Speed Rail: Market Size, By Region, 2016–2025 (Miles)

Table 6 Market Size, By Voltage Type, 2016–2025 (Miles)

Table 7 Low Voltage Wire: Market Size, By Region, 2016–2025 (Miles)

Table 8 Medium Voltage Wire: Market Size, By Region, 2016–2025 (Miles)

Table 9 High Voltage Wire: Market Size, By Region, 2016–2025 (Miles)

Table 10 Contact Wire: Market Size, By Region, 2016–2025 (Miles)

Table 11 Droppers: Overhead Catenary System Market Size, By Region, 2016–2025 (’000 Units)

Table 12 Insulator: Market Size, By Region, 2016–2025 (’000 Units)

Table 13 Cantilever: Market Size, By Region, 2016–2025 (Units)

Table 14 Market, By Catenary Wire Type, 2016–2025 (Miles)

Table 15 Market, By Catenary Wire Type, 2016–2025 (USD Million)

Table 16 Simple Catenary Wire: Market, By Region, 2016–2025 (Miles)

Table 17 Simple Catenary Wire: Market, By Region, 2016–2025 (USD Million)

Table 18 Stitched Catenary Wire: Market, By Region, 2016–2025 (Miles)

Table 19 Stitched Catenary Wire: Market, By Region, 2016–2025 (USD Million)

Table 20 Compound Catenary Wire: Market, By Region, 2016–2025 (Miles)

Table 21 Compound Catenary Wire: Market, By Region, 2016–2025 (USD Million)

Table 22 Overhead Catenary System Market, By Region, 2016–2025 (Miles)

Table 23 Asia Pacific: Market, By Voltage Type, 2016–2025 (Miles)

Table 24 Asia Pacific: Market, By Train Type, 2016–2025 (Miles)

Table 25 Europe: Market, By Voltage Type, 2016–2025 (Miles)

Table 26 Europe: Market, By Train Type, 2016–2025 (Miles)

Table 27 North America: Market, By Voltage Type, 2016–2025 (Miles)

Table 28 North America: Market, By Train Type, 2016–2025 (Miles)

Table 29 RoW: Market, By Voltage Type, 2016–2025 (Miles)

Table 30 RoW: Market, By Train Type, 2016–2025 (Miles)

Table 31 Middle East: Market, By Voltage Type, 2016–2025 (Miles)

Table 32 Middle East: Market, By Train Type, 2016–2025 (Miles)

Table 33 Rank Analysis of Key Players in the Overhead Catenary System Market in 2018

Table 34 New Product Developments, 2018

Table 35 Expansions, 2016-2017

Table 36 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements, 2016-2018

Table 37 Mergers & Acquisitions, 2016-2018

List of Figures (58 Figures)

Figure 1 Overhead Catenary System Market: Markets Covered

Figure 2Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Data Triangulation

Figure 6 Market: Bottom-Up Approach

Figure 7 Market: Top-Down Approach

Figure 8 Market Size, By Catenary Wire (USD Million), 2018 vs 2025

Figure 9 Overhead Catenary System Market Size, By Train Type, 2018 vs 2025

Figure 10 Expansion of High-Speed Rail Network and the High Safety & Reliability of Overhead Transmission Method is Likely to Boost the Growth of the Market From 2018 to 2025

Figure 11 MEA Region Estimated to Be the Fastest Growing Market for Overhead Catenary System From 2018 to 2025

Figure 12 Simple Catenary Segment of Market to Have the Largest Market Size By 2025

Figure 13 Light Rail Segment to Have the Largest Share of Market, 2018 vs 2025

Figure 14 High Voltage Segment to Have the Largest Share of Market, 2018 vs 2025

Figure 15 Insulators to Hold the Largest Share of Market, 2018 vs 2025 (‘000 Units)

Figure 16 Asia Pacific to Be the Largest Market for Overhead Catenary System, 2018 vs 2025

Figure 17 Overhead Catenary System: Market Dynamics

Figure 18 Carbon Dioxide & Energy Consumption From Madrid to Barcelona

Figure 19 Overhead Catenary System Market, By Train Type, 2018 vs 2025 (Miles)

Figure 20 Metro: Market, By Region, 2018 vs 2025 (Miles)

Figure 21 Light Rail: Market, By Region, 2018 vs 2025 (Miles)

Figure 22 High-Speed Rail: Market, By Region, 2018 vs 2025 (Miles)

Figure 23 Market, By Voltage Type, 2018 vs 2025 (Miles)

Figure 24 Low Voltage Wire: Market, By Region, 2018 vs 2025 (Miles)

Figure 25 Medium Voltage Wire: Market, By Region, 2018 vs 2025 (Miles)

Figure 26 High Voltage Wire: Market, By Region, 2018 vs 2025 (Miles)

Figure 27 Market, By Component, 2018 vs 2025 (’000 Units)

Figure 28 Contact Wire: Market, By Region, 2018 vs 2025 (Miles)

Figure 29 Droppers: Market, By Region, 2018 vs 2025 (’000 Units)

Figure 30 Insulator: Market, By Region, 2018 vs 2025 (’000 Units)

Figure 31 Cantilever: Market, By Region, 2018 vs 2025 (’000 Units)

Figure 32 Overhead Catenary System Market, By Catenary Wire Type, 2018–2025 (USD Million)

Figure 33 Simple Catenary Wire: Market, By Region, 2018 vs 2025 (USD Million)

Figure 34 Stitched Catenary Wire: Market, By Region, 2018 vs 2025 (USD Million)

Figure 35 Compound Catenary Wire: Market, By Region, 2018 vs 2025 (USD Million)

Figure 36 MEA Region is Estimated to Be the Fastest-Growing Market for Overhead Catenary System During the Forecast Period (2018–2025)

Figure 37 Asia Pacific: Market Snapshot

Figure 38 Europe: Market Snapshot

Figure 39 North America: Market, By Country, 2018–2025 (Miles)

Figure 40 RoW: Market, 2018 vs 2025 (Miles)

Figure 41 Middle East: Overhead Catenary System Market, 2018 vs 2025 (Miles)

Figure 42 Key Developments By Leading Players in the Market, 2015-2018

Figure 43 CRRC: Company Snapshot

Figure 44 CRRC: SWOT Analysis

Figure 45 Alstom: Company Snapshot

Figure 46 Alstom: SWOT Analysis

Figure 47 Siemens: Company Snapshot

Figure 48 Siemens: SWOT Analysis

Figure 49 Bombardier: Company Snapshot

Figure 50 Bombardier: SWOT Analysis

Figure 51 NKT: Company Snapshot

Figure 52 NKT: SWOT Analysis

Figure 53 ABB: Company Snapshot

Figure 54 ABB: SWOT Analysis

Figure 55 StruKTon: Company Snapshot

Figure 56 TE Connectivity: Company Snapshot

Figure 57 Nexans: Company Snapshot

Figure 58 Wabtec: Company Snapshot

Growth opportunities and latent adjacency in Overhead Catenary System Market