Passwordless Authentication Market by Offering (Hardware, Software, and Services), Motility (Fixed/Rack Mounted, and Mobile/Portable), Authentication Type (Single-factor, Multi-factor), End-Use Industry and Region - Global Forecast to 2027

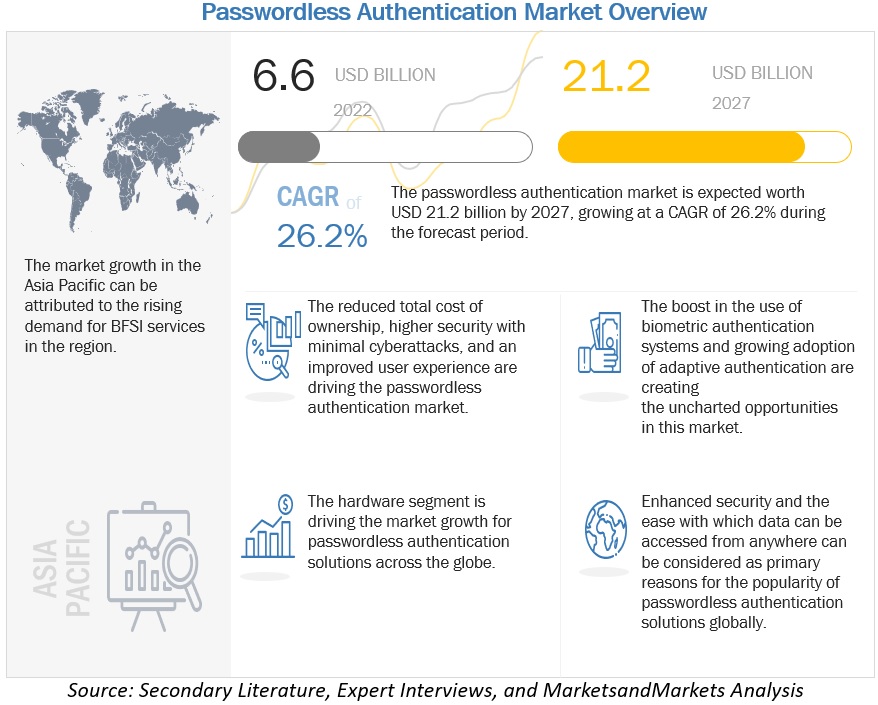

[304 Pages Report] The passwordless authentication market size is projected to grow at a CAGR of 26.2% during the forecast period to reach USD 21.2 billion by 2027 from an estimated USD 6.6 billion in 2022. The reduced total cost of ownership, higher security with minimal cyberattacks, and an improved user experience are some drivers fueling the market's growth. However, an increased cost of initial deployment is anticipated to restrain passwordless authentication market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The epidemic has advanced digital business and heightened the demand for cyber-savvy board members. During the COVID-19 pandemic, enterprises worldwide experienced a 37% increase in cybersecurity attacks, such as password breaches, credential compromises, phishing, and ransomware. Data breaches revealed 4.1 billion records in the first six months of 2019, with millions of credentials in a single breach published into the public and dark web. Due to this, organizations are bound to adopt advanced security solutions, such as passwordless authentication for streamlining their corporate governance and disclosures, workplace health and safety, data privacy, supply chain, and working capital, which are disturbed due to COVID-19. COVID-19 has fast-tracked the shift toward digitalization. As a result, risks and threats have evolved, making organizations and people shift from password-based authentication to passwordless solutions, including biometrics, iris scanner, face recognition, and fingerprint scanner. Security solutions such as passwordless authentication are gaining prominence, and the trend is expected to remain strong during the forecast period.

Market Dynamics

Driver: Rise in demand for enhanced user experience

To acquire a competitive edge, businesses are concentrating on enhancing their user experience because a decrease in login friction may persuade customers to pick one provider over another. Creating and remembering several passwords at once is not practical. In addition, changing a forgotten password is frequently a cumbersome task. Users typically use the simplest passwords they can remember as a result. Every tool or application they use has the same password, which they only slightly alter when prompted to do so once a month. For instance, according to SplashData, the top five most used passwords in 2022 were "123456", "123456789", "qwerty", "password", and "1234567". As a result, businesses are switching to passwordless authentication since it enhances user experience by eliminating the need for passwords.

Restraint: Increased cost of deployment

Passwordless authentication must be followed by a detailed, step-by-step plan that includes training staff and implementing new software or hardware. The development and implementation of a project and change management strategy consume time that may be spent on other chores or strategic projects. Additionally, training of personnel is necessary. The hardware and software expenses are also included in the adoption of passwordless authentication. Hardware installation costs also cover purchasing devices, tokens, and cards costs for each employee. Although using the software may be less expensive, one may need to account for certain unanticipated expenses, such as software administration, migration, and maintenance. Thus, the cost of deployment is a restraint for the passwordless authentication market.

Opportunity: Growing adoption of adaptive authentication

In passwordless authentication market, one of the passwordless authentication techniques that are expanding the quickest is adaptive authentication. Adaptive systems use behavioral and environmental factors to evaluate the danger of an access attempt. As an example, an access request comes from a strange place or at a strange time. Constructing an adaptive system to interpret this as suspicious behavior and request extra authentication is possible. Adaptive systems can identify potentially risky behavior using a range of behavior-measuring strategies in addition to location. These range from keyboard patterns to the order in which services and tabs are opened on a website. Other adaptive systems utilize computer algorithms to analyze user behavior rather than predefined protocols, indicating acts that do not fit the user's regular behavior. Integrating passwordless and adaptive authentication can significantly improve system resilience by adding an Al-powered layer of security. Thus, adaptive authentication is creating opportunities for passwordless authentication solutions.

Challenge: Reluctance to shift from traditional password-based authentication

The main barrier to abandoning a password-based system for many businesses is unfamiliarity with the new system. People have grown accustomed to using passwords over time, especially those that are simple to remember. Changing to a new password-less platform is perceived by organizations as having a negative impact on user experience and disrupting productivity. Furthermore, implementing passwordless authentication requires a lot of work in the beginning. It necessitates mastering new technologies, configuring new hardware, setting up biometric authentication factors, and consistently implementing new authentication factors throughout each login session. People find it challenging to switch to a passwordless authentication method. Passwordless authentication may not seem convenient to those who are used to password-based authentication. Many people have doubts about its effectiveness.

Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By motility, mobile/portable to account for larger market size during the forecast period

Mobile/portable devices rely on passwordless solutions, such as face recognition and fingerprint scanner, to authenticate a user’s identity. These devices are gaining popularity because they are easy to carry everywhere and enable flexibility to users. For instance, Incognia's zero-factor authentication technology identifies trustworthy individuals and detects irregularities using GPS, WiFi, Bluetooth, and device signals. Owing to the benefits of mobile/portable devices, the segment has acquired a large passwordless authentication market share during the forecast period.

By end-use industry, retail and consumer electronics industry to account highest CAGR during the forecast period

Retail and consumer electronics incorporate passwordless authentication technologies, such as face recognition and biometric payment systems. Passwordless authentication services relieve users of the burden of difficult-to-remember passwords. Customers may register using their fingerprints or face due to built-in biometric device authentication. With passwordless authentication solutions, customers will not ever have to rely on tiresome reset procedures to regain access to their accounts owing to passwordless authentication. Thus, in passwordless authentication market, it can be concluded that passwordless authentication solutions are making retail payments and account registration easy and secure, leading to a high CAGR during the forecast period.

By authentication type, MFA to grow at higher CAGR during the forecast period

Multi-factor Authentication (MFA) offers an additional layer of security, reducing the threats of password breaches, credential compromise, identity thefts, hacking, and other cyberattacks. MFA reduces the likelihood of unauthorized logins and fraudulent transactions by forcing users to confirm their identity using several different factors rather than simply a single password or password alternative. To provide advanced security, MFA offers biometric authentication solutions, including fingerprint scanning, face recognition, and iris scanner. It offers a multi-tiered defensive system that provides greater safety oversight and, consequently, better data protection. Thus, it is widely used by organizations and people for the safety of their data and hence is anticipated to have the highest CAGR in the passwordless authentication market during the forecast period.

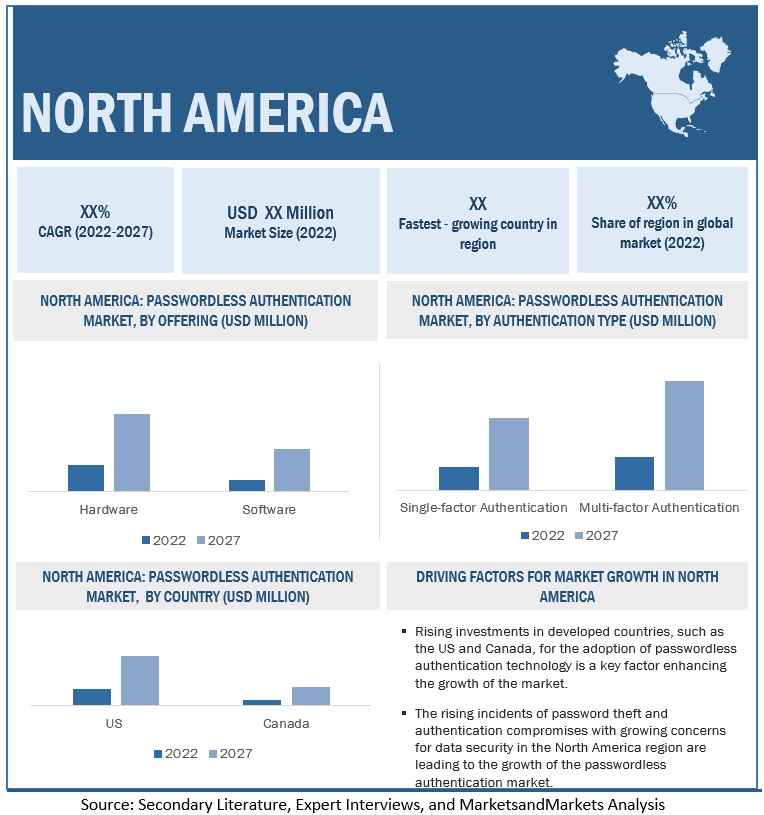

By region, North America to have the largest market size during the forecast period

North America dominates the global passwordless authentication market with a large number of vendors, such as HID Global, Duo Security, Okta, Ping Identity, Microsoft, IBM, and OneLogin, resulting in the adoption of passwordless solutions in the region. Rising investments in North American countries and the rising incidents of password thefts and credential compromises are the main growth drivers for passwordless authentication in the region. The other drivers for the growing demand for passwordless authentication solutions in the region include the early adoption of innovative and advanced technologies, such as AI and ML, and high awareness among people regarding cybersecurity, pushing North American businesses to adopt passwordless authentication solutions. The widespread use of personal devices, such as smartphones and laptops, to help businesses continue with their operations, and work from home amid the pandemic, is expected to significantly accelerate the adoption of passwordless authentication solutions in the region. These factors result in North America having the largest passwordless authentication market size during the forecast period.

Key Market Players

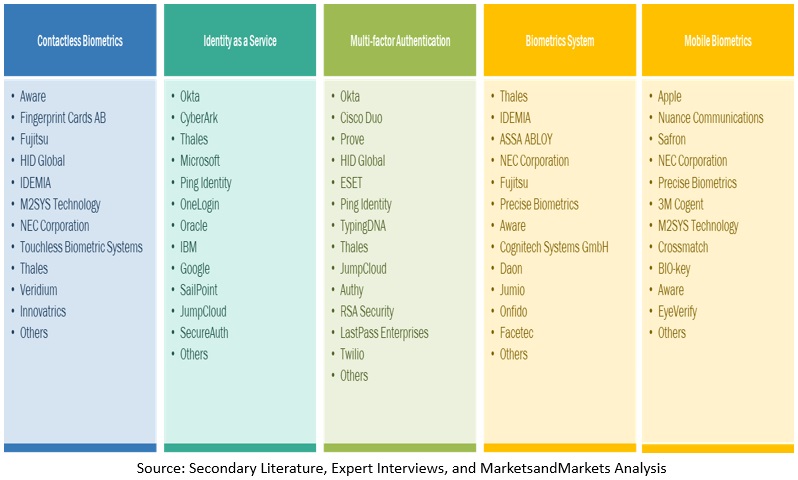

The key players in the global passwordless authentication market include HID Global (US), NEC (Japan), Microsoft (US), Fujitsu (Japan), Okta (US), Duo Security (US), Thales (France), Beyond Identity (US), Entrust (US), Ping Identity (US), Veridium (UK), OneLogin (US), IBM (US), Yubico (US), Secret Double Octopus (Israel), LogMeOnce (US), Trusona (US), LastPass (US), IDEE (Germany), Prove (US), HYPR (US), Authentiq (UK), BehavioSec (US), Stytch (US), Signicat (Norway), Ubisecure (UK), EmpowerID (US), 1Kosmos (US), Identite (US), Cidaas (Germany), Keyless (US), and PureID (UK).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market size value in 2022 | 6.6 billion |

| Market size value in 2027 | 21.2 billion |

| Market growth rate | 26.2% CAGR |

| Largest Market | North America |

| Market size available for years | 2016–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million/USD Billion) |

| Segments covered | By Offering, By Motility, By Authentication Type, By End-use Industry, and By Region |

| Geographies covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered in Passwordless Authentication Market |

|

The study categorizes the passwordless authentication market by offering, motility, authentication type, and end-use industry at the regional and global levels.

Market by Offering

- Hardware

- Software

- Services

Market by Motility

- Mobile/Portable

Market by Authentication Type

- Single-factor authentication

- Multi-factor authentication

Market by End-use Industry

- BFSI

- IT and ITeS

- Government and Law Enforcement

- Healthcare

- Manufacturing

- Retail and Consumer Electronics

- Travel and Hospitality

- Other Verticals (Education; Energy and Utilities; Aerospace and Defense; Media and Entertainment; Online Gaming; and Transportation and Logistics)

Market by Region

- North America

- Europe

- Middle East and Africa

- Asia Pacific

- Latin America

Recent development in passwordless authentication market:

- In October 2022, Okta enhanced its product Okta Workflows. Okta's Workflows platform has been expanded to address a broader range of identity automation use cases, including sophisticated security orchestration and DevOps. Customers now have the potential to accelerate innovation and automate identity processes owing to new functionalities.

- In March 2022, HID Global unveiled a new solution named Omnikey Secure Element. The Omnikey Secure Element supports new and current secure access identification and authentication applications, including locker management and electric vehicle charging. It provides multi-layer security that goes beyond card technology to further protect identity data. It also adds credential technologies, such as mobile IDs and employee badges to Apple Wallet.

- In March 2022, NEC launched a new solution named Account Based Ticketing system (ABT). NEC will develop an Account Based Ticketing (ABT) system with assistance from Electric Railway and LECIP Corporation for commuters in the Hiroshima region. ABT accounts will function as cloud-hosted services and be linked to QR codes or Smart cards. On a cloud server, balances, commuter pass information, trip histories, and concessions/discounts may all be saved, accessed, and changed.

- In January 2021, Fujitsu unveiled Multi-factor biometric authentication technology. To provide an innovative purchasing experience, Fujitsu Laboratories created a unique multi-factor biometric authentication system. The method uses non-contact biometrics to identify the verification target using palm vein recognition and face data. This device can recognize even when the user is wearing a mask with greater than 99% accuracy.

Frequently Asked Questions (FAQ):

What is passwordless authentication?

Passwordless authentication is a means to verify a user’s identity without using a password. Instead, passwordless authentication use more secure alternatives, such as possession factors (One-Time Passwords [OTP], registered smartphones), or biometrics (fingerprint, retina scans).

How big is the passwordless authentication market?

The global passwordless authentication market size is estimated to be USD 6.6 billion in 2022 and is projected to reach USD 21.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 26.2% during the forecast period.

Which are the key companies influencing the passwordless authentication market growth ?

HID Global (US), NEC (Japan), Microsoft (US), Fujitsu (Japan), Okta (US), Duo Security (US), Thales (France), Beyond Identity (US), Entrust (US), Ping Identity (US), Veridium (UK), OneLogin (US), IBM (US), Yubico (US), Secret Double Octopus (Israel), LogMeOnce (US), Trusona (US), LastPass (US), IDEE (Germany), Prove (US), HYPR (US), Authentiq (UK), BehavioSec (US), Stytch (US), Signicat (Norway), Ubisecure (UK), EmpowerID (US), 1Kosmos (US), Identite (US), Cidaas (Germany), Keyless (US), and PureID (UK) are the major influencing companies in the passwordless authentication market.

Is there any COVID-19 impact on the passwordless authentication market?

During the pandemic, SMEs and big organizations switched their whole operations to an online digital platform. Due to lockdown constraints, industries such as IT, BFSI, and healthcare use digitalized solutions and apps to provide customized services to clients. This aspect has considerably increased the amount of personal and sensitive information available online, raising security concerns, such as phishing, password breaches, and credential compromises. Due to these security issues, companies worldwide have expanded their use of passwordless authentication solutions to protect sensitive data and secure their clients' personal information.

What are some of the mandates for passwordless authentication?

There are several stringent regulations and policies in Europe, North America, and Asia Pacific countries, such as GDPR, SOX Act, SOC2, Know Your Customer (KYC), and Anti-Money Laundering (AML). These set of regulations and policies are meant to protect individuals and organizations from cybercrime activities, such as identity theft, password breaches, credential compromises, ransomware, and digital fraud, and mandate the incorporation of advanced security solutions, such as passwordless authentication in organizations and also for individuals. In case of any security breach or cybercrime, heavy penalties and fines are imposed on organizations if they do not adhere to these mandates. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

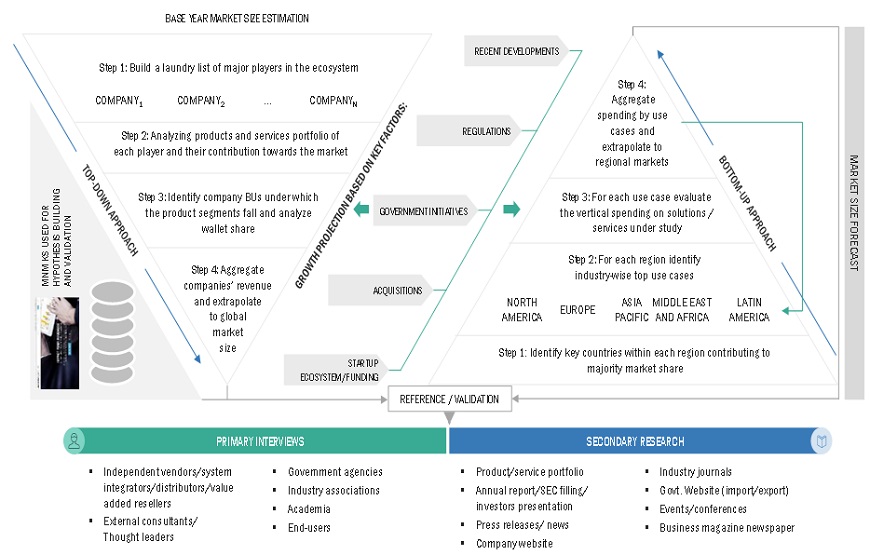

FIGURE 1 PASSWORDLESS AUTHENTICATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 MARKET: RESEARCH FLOW

2.3 MARKET SIZE ESTIMATION

FIGURE 3 PASSWORDLESS AUTHENTICATION MARKET: TOP DOWN VS. BOTTOM UP

2.3.1 REVENUE ESTIMATES

2.3.2 SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE ANALYSIS): REVENUE OF SOLUTIONS/SERVICES OF PASSWORDLESS AUTHENTICATION VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF PASSWORDLESS AUTHENTICATION VENDORS

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, TOP-DOWN (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

TABLE 3 STUDY ASSUMPTIONS

2.6 LIMITATIONS AND RISK ASSESSMENT

FIGURE 8 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 4 PASSWORDLESS AUTHENTICATION MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 5 MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PASSWORDLESS AUTHENTICATION MARKET

FIGURE 10 NEED FOR COMPLIANCE AUTOMATION AND FRICTIONLESS AUTHENTICATION TO DRIVE GROWTH OF MARKET

4.2 MARKET, BY OFFERING

FIGURE 11 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY AUTHENTICATION TYPE

FIGURE 12 MULTI-FACTOR AUTHENTICATION TO GAIN LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY MOTILITY

FIGURE 13 MOBILE/PORTABLE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 14 BFSI AND NORTH AMERICA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

4.6 MARKET INVESTMENT SCENARIO

FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 PASSWORDLESS AUTHENTICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need to reduce IT costs

5.2.1.2 Need to strengthen security and reduce attack vectors

FIGURE 17 COST OF DATA BREACHES, BY INITIAL ATTACK VECTOR

5.2.1.3 Increasing demand for better user experience

5.2.2 RESTRAINTS

5.2.2.1 High initial deployment cost

5.2.3 OPPORTUNITIES

5.2.3.1 Boost in use of biometric authentication systems

5.2.3.2 Growing adoption of adaptive authentication

FIGURE 18 RISK DETECTION BY ADAPTIVE AUTHENTICATION

5.2.4 CHALLENGES

5.2.4.1 Security limitations and weaknesses

5.2.4.2 Reluctance of people to shift from traditional password-based authentication

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: HYPR SAVED AETNA FROM “THE PASSWORD ARMAGEDDON”

5.3.2 CASE STUDY 2: DUO SECURITY HELPED AHA! ENHANCE CUSTOMER SECURITY

5.3.3 CASE STUDY 3: MICROSOFT’S ‘WINDOWS HELLO’ PROVIDED AXIATA WITH ELEVATED WORKER EASE AND TIGHTER CYBERSECURITY

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 PASSWORDLESS AUTHENTICATION MARKET: VALUE CHAIN

5.5 ECOSYSTEM ANALYSIS

FIGURE 20 MARKET ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 COMPETITIVE RIVALRY WITHIN INDUSTRY

FIGURE 21 MARKET: PORTER’S FIVE FORCES ANALYSIS:

5.7 PRICING ANALYSIS

TABLE 7 PASSWORDLESS AUTHENTICATION MARKET: PRICING LEVELS

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.8.2 PUBLIC-KEY CRYPTOGRAPHY

FIGURE 22 PUBLIC-KEY CRYPTOGRAPHY MODEL

5.8.3 DECENTRALIZED AUTHENTICATION

5.8.4 BIOMETRIC AUTHENTICATION

5.8.4.1 Facial recognition

5.8.4.2 3D face recognition

5.8.4.3 Finger vein recognition

5.8.4.4 Iris recognition

5.8.4.5 Voice recognition

5.9 PATENT ANALYSIS

TABLE 8 PASSWORDLESS AUTHENTICATION MARKET: PATENTS

TABLE 9 TOP 10 PATENT OWNERS (US)

FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

5.10 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 24 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 INTRODUCTION

5.11.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)

5.11.3 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) 27001

5.11.4 EUROPEAN UNION GENERAL DATA PROTECTION REGULATION (EU GDPR)

5.11.5 SERVICE ORGANIZATION CONTROL 2 (SOC 2) COMPLIANCE

5.11.6 SARBANES-OXLEY (SOX) ACT

5.11.7 ELECTRONIC IDENTIFICATION, AUTHENTICATION, AND TRUST SERVICES

5.11.8 KNOW YOUR CUSTOMER REGULATION

5.11.9 ANTI-MONEY LAUNDERING ACT

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS ON BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 11 DETAILED LIST OF CONFERENCES AND EVENTS

6 PASSWORDLESS AUTHENTICATION MARKET, BY TYPE (Page No. - 76)

6.1 INTRODUCTION

6.2 FINGERPRINT RECOGNITION

6.3 PALM AND VEIN RECOGNITION

6.4 IRIS RECOGNITION

6.5 FACE RECOGNITION

6.6 VOICE PRINT ANALYSIS

6.7 SMART CARDS AND SECURITY KEYS

6.8 OTHER TYPES

7 PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING (Page No. - 81)

7.1 INTRODUCTION

7.1.1 OFFERINGS: PASSWORD AUTHENTICATION MARKET DRIVERS

FIGURE 26 SERVICES TO GROW AT HIGHEST RATE DURING BY 2027

TABLE 12 MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 13 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE SECURITY IDENTIFICATION AND AUTHENTICATION DEVICES USE AUTOMATED METHODS TO VERIFY IDENTITY

TABLE 14 HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SOFTWARE

7.3.1 RISING NEED FOR FRICTIONLESS UI AND ENHANCED SOFTWARE EXPERIENCE

TABLE 16 SOFTWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 SERVICES

7.4.1 GROWING DEMAND FOR PASSWORDLESS AUTHENTICATION SERVICES IN SMES

TABLE 18 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 PASSWORDLESS AUTHENTICATION MARKET, BY AUTHENTICATION TYPE (Page No. - 87)

8.1 INTRODUCTION

8.1.1 AUTHENTICATION TYPES: MARKET DRIVERS

FIGURE 27 MULTI-FACTOR AUTHENTICATION TO GROW AT HIGHER RATE BY 2027

TABLE 20 MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 21 MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

8.2 SINGLE-FACTOR AUTHENTICATION (SFA)

8.2.1 SINGLE-FACTOR AUTHENTICATION MODE DIFFICULT TO FAKE

TABLE 22 SINGLE-FACTOR AUTHENTICATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 SINGLE-FACTOR AUTHENTICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 MULTI-FACTOR AUTHENTICATION

8.3.1 ADDED SECURITY LAYER PROVIDES PROTECTION AGAINST THEFT AND FRAUD

TABLE 24 MULTI-FACTOR AUTHENTICATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 MULTI-FACTOR AUTHENTICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 PASSWORDLESS AUTHENTICATION MARKET, BY MOTILITY (Page No. - 92)

9.1 INTRODUCTION

9.1.1 MOTILITIES: MARKET DRIVERS

FIGURE 28 FIXED/RACK MOUNTED TO WITNESS HIGHER GROWTH BY 2027

TABLE 26 MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 27 MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

9.2 FIXED/RACK MOUNTED

9.2.1 GROWING NEED TO STRENGTHEN USER EXPERIENCE AND FACILITATE AUTOMATION

TABLE 28 FIXED/RACK MOUNTED: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 FIXED/RACK MOUNTED: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MOBILE/PORTABLE

9.3.1 FINGERPRINT SENSORS AND IRIS RECOGNITION TECHNOLOGY TO IMPROVE MOBILE AUTHENTICATION CAPABILITIES

TABLE 30 MOBILE/PORTABLE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 MOBILE/PORTABLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PASSWORDLESS AUTHENTICATION MARKET, BY END-USE INDUSTRY (Page No. - 97)

10.1 INTRODUCTION

10.1.1 END-USE INDUSTRIES: MARKET DRIVERS

FIGURE 29 BFSI TO ACCOUNT FOR LARGEST MARKET BY 2027

TABLE 32 MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.2.1 CONTACTLESS BIOMETRICS TO IMPROVE CUSTOMER SERVICE

TABLE 34 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 INFORMATION TECHNOLOGY (IT) AND INFORMATION TECHNOLOGY-ENABLED SERVICES (ITES)

10.3.1 INCREASED ATTACKS AND DATA BREACHES TO DRIVE USE OF AUTHENTICATION SOLUTIONS IN IT SECTOR

TABLE 36 IT AND ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 GOVERNMENT AND LAW ENFORCEMENT

10.4.1 RISING DEMAND FOR PASSWORDLESS AUTHENTICATION TO ENHANCE NATIONAL SECURITY

TABLE 38 GOVERNMENT AND LAW ENFORCEMENT: PASSWORDLESS AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 GOVERNMENT AND LAW ENFORCEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE

10.5.1 INCREASING NEED FOR PASSWORDLESS AUTHENTICATION TO IMPROVE PATIENT CARE

TABLE 40 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MANUFACTURING

10.6.1 PASSWORDLESS AUTHENTICATION TO REDUCE OPERATIONAL LOSSES IN MANUFACTURING COMPANIES

TABLE 42 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 TRAVEL AND HOSPITALITY

10.7.1 GROWING NEED TO ENHANCE SECURITY AT MAJOR PUBLIC PLACES

TABLE 44 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 RETAIL AND CONSUMER ELECTRONICS

10.8.1 RISING DEMAND FOR PASSWORDLESS AUTHENTICATION FOR SMOOTH RETAIL PURCHASES

TABLE 46 RETAIL AND CONSUMER ELECTRONICS: PASSWORDLESS AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 RETAIL AND CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 OTHER END-USE INDUSTRIES

TABLE 48 OTHER END-USE INDUSTRIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 OTHER END-USE INDUSTRIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 PASSWORDLESS AUTHENTICATION MARKET, BY REGION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

TABLE 50 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.3 US

11.2.3.1 High technological awareness with presence of key vendors

TABLE 62 US: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 63 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 64 US: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 65 US: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 66 US: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 67 US: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 68 US: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 69 US: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Huge investments made to enhance cybersecurity needs

TABLE 70 CANADA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 71 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 72 CANADA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 73 CANADA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 74 CANADA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 75 CANADA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 76 CANADA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: PASSWORDLESS AUTHENTICATION MARKET DRIVERS

11.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 78 EUROPE: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Rising investments in passwordless technologies and industry standards, such as FIDO

TABLE 88 UK: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 89 UK: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 90 UK: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 91 UK: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 92 UK: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 93 UK: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 94 UK: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 95 UK: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Establishing of German Identity card as national eID

TABLE 96 GERMANY: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Increased digitalization and strict government regulations

TABLE 104 FRANCE: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 107 FRANCE: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 108 FRANCE: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 109 FRANCE: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 112 REST OF EUROPE: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 120 ASIA PACIFIC: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Increasing implementation of digital authentication solutions in various segments coupled with stringent government laws

TABLE 130 CHINA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 132 CHINA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 133 CHINA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 134 CHINA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 135 CHINA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 136 CHINA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 137 CHINA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Technological advancements and high awareness regarding cybercrime

TABLE 138 JAPAN: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 141 JAPAN: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Implementation of government policies to promote use of technology

TABLE 146 INDIA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 147 INDIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 148 INDIA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 149 INDIA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 150 INDIA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 151 INDIA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 152 INDIA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 153 INDIA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 154 REST OF ASIA PACIFIC: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: PASSWORDLESS AUTHENTICATION MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 162 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

11.5.3.1 Government’s agility in adopting modern technologies

TABLE 172 MIDDLE EAST: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 175 MIDDLE EAST: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 177 MIDDLE EAST: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 178 MIDDLE EAST: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 179 MIDDLE EAST: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.5.4 AFRICA

11.5.4.1 Strong government initiatives to develop passwordless authentication solutions

TABLE 180 AFRICA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 181 AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 182 AFRICA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 183 AFRICA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 184 AFRICA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 185 AFRICA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 186 AFRICA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 187 AFRICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: PASSWORDLESS AUTHENTICATION MARKET DRIVERS

11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 188 LATIN AMERICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 Increasing incidence of cybercrime

TABLE 198 BRAZIL: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 202 BRAZIL: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 203 BRAZIL: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 204 BRAZIL: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 205 BRAZIL: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.6.4 MEXICO

11.6.4.1 Increasing number of cyberattacks

TABLE 206 MEXICO: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 207 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 208 MEXICO: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 209 MEXICO: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 210 MEXICO: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 211 MEXICO: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 212 MEXICO: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 213 MEXICO: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 214 REST OF LATIN AMERICA: PASSWORDLESS AUTHENTICATION MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 215 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 216 REST OF LATIN AMERICA: MARKET, BY AUTHENTICATION TYPE, 2016–2021 (USD MILLION)

TABLE 217 REST OF LATIN AMERICA: MARKET, BY AUTHENTICATION TYPE, 2022–2027 (USD MILLION)

TABLE 218 REST OF LATIN AMERICA: MARKET, BY MOTILITY, 2016–2021 (USD MILLION)

TABLE 219 REST OF LATIN AMERICA: MARKET, BY MOTILITY, 2022–2027 (USD MILLION)

TABLE 220 REST OF LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 221 REST OF LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 182)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 33 MARKET EVALUATION FRAMEWORK, 2019–2022

12.3 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 222 OVERVIEW OF STRATEGIES ADOPTED BY KEY PASSWORDLESS AUTHENTICATION VENDORS

12.4 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 34 PASSWORDLESS AUTHENTICATION MARKET: REVENUE ANALYSIS

12.5 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 223 MARKET: DEGREE OF COMPETITION

12.6 HISTORICAL REVENUE ANALYSIS

FIGURE 35 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2017–2021 (USD MILLION)

12.7 PASSWORD AUTHENTICATION MARKET: RANKING OF KEY PLAYERS

FIGURE 36 RANKING OF KEY PLAYERS, 2022

12.8 EVALUATION MATRIX FOR KEY PLAYERS

12.8.1 EVALUATION MATRIX FOR KEY PLAYERS: DEFINITIONS AND METHODOLOGY

FIGURE 37 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

FIGURE 38 PASSWORDLESS AUTHENTICATION MARKET: KEY PLAYER EVALUATION QUADRANT, 2022

12.8.2 STARS

12.8.3 EMERGING LEADERS

12.8.4 PERVASIVE PLAYERS

12.8.5 PARTICIPANTS

12.9 COMPETITIVE BENCHMARKING

12.9.1 EVALUATION CRITERIA FOR KEY COMPANIES

TABLE 224 COMPANY INDUSTRY FOOTPRINT

TABLE 225 COMPANY REGIONAL FOOTPRINT

12.9.2 EVALUATION CRITERIA FOR STARTUPS

TABLE 226 DETAILED LIST OF STARTUPS

TABLE 227 REGIONAL FOOTPRINT FOR STARTUPS

12.10 EVALUATION MATRIX FOR STARTUPS

12.10.1 EVALUATION MATRIX FOR STARTUPS: DEFINITIONS AND METHODOLOGY

FIGURE 39 EVALUATION QUADRANT FOR STARTUPS: CRITERIA WEIGHTAGE

FIGURE 40 PASSWORDLESS AUTHENTICATION MARKET: STARTUP EVALUATION MATRIX, 2022

12.10.2 PROGRESSIVE COMPANIES

12.10.3 RESPONSIVE COMPANIES

12.10.4 DYNAMIC COMPANIES

12.10.5 STARTING BLOCKS

12.11 COMPETITIVE SCENARIO

12.11.1 PRODUCT/SOLUTION LAUNCHES

TABLE 228 MARKET: PRODUCT/SOLUTION LAUNCHES, 2019–2022

12.11.2 DEALS

TABLE 229 PASSWORDLESS AUTHENTICATION MARKET: DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 207)

13.1 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

13.1.1 HID GLOBAL

TABLE 230 HID GLOBAL: BUSINESS OVERVIEW

TABLE 231 HID GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 232 HID GLOBAL: PRODUCT LAUNCHES

TABLE 233 HID GLOBAL: DEALS

13.1.2 NEC

TABLE 234 NEC: BUSINESS OVERVIEW

FIGURE 41 NEC: COMPANY SNAPSHOT

TABLE 235 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 236 NEC: PRODUCT LAUNCHES

TABLE 237 NEC: DEALS

13.1.3 MICROSOFT

TABLE 238 MICROSOFT: BUSINESS OVERVIEW

FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

TABLE 239 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 240 MICROSOFT: PRODUCT LAUNCHES

TABLE 241 MICROSOFT: DEALS

13.1.4 FUJITSU

TABLE 242 FUJITSU: BUSINESS OVERVIEW

FIGURE 43 FUJITSU: COMPANY SNAPSHOT

TABLE 243 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 244 FUJITSU: PRODUCT LAUNCHES

TABLE 245 FUJITSU: DEALS

13.1.5 OKTA

TABLE 246 OKTA: BUSINESS OVERVIEW

FIGURE 44 OKTA: COMPANY SNAPSHOT

TABLE 247 OKTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 248 OKTA: PRODUCT LAUNCHES

TABLE 249 OKTA: DEALS

13.1.6 DUO SECURITY

TABLE 250 DUO SECURITY: BUSINESS OVERVIEW

TABLE 251 DUO SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 252 DUO SECURITY: PRODUCT LAUNCHES

TABLE 253 DUO SECURITY: DEALS

13.1.7 THALES

TABLE 254 THALES: BUSINESS OVERVIEW

FIGURE 45 THALES: COMPANY SNAPSHOT

TABLE 255 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 THALES: PRODUCT LAUNCHES

TABLE 257 THALES: DEALS

13.1.8 BEYOND IDENTITY

TABLE 258 BEYOND IDENTITY: BUSINESS OVERVIEW

TABLE 259 BEYOND IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 260 BEYOND IDENTITY: PRODUCT LAUNCHES

TABLE 261 BEYOND IDENTITY: DEALS

13.1.9 ENTRUST

TABLE 262 ENTRUST: BUSINESS OVERVIEW

TABLE 263 ENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 264 ENTRUST: PRODUCT LAUNCHES

TABLE 265 ENTRUST: DEALS

13.1.10 PING IDENTITY

TABLE 266 PING IDENTITY: BUSINESS OVERVIEW

FIGURE 46 PING IDENTITY: COMPANY SNAPSHOT

TABLE 267 PING IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 PING IDENTITY: PRODUCT LAUNCHES

TABLE 269 PING IDENTITY: DEALS

13.1.11 VERIDIUM

TABLE 270 VERIDIUM: BUSINESS OVERVIEW

TABLE 271 VERIDIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272 VERIDIUM: PRODUCT LAUNCHES

TABLE 273 VERIDIUM: DEALS

13.1.12 ONELOGIN

TABLE 274 ONELOGIN: BUSINESS OVERVIEW

TABLE 275 ONELOGIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 ONELOGIN: PRODUCT LAUNCHES

TABLE 277 ONELOGIN: DEALS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 IBM

13.2.2 YUBICO

13.2.3 SECRET DOUBLE OCTOPUS

13.2.4 LOGMEONCE

13.2.5 TRUSONA

13.2.6 LASTPASS

13.2.7 IDEE

13.2.8 PROVE

13.2.9 HYPR

13.2.10 AUTHENTIQ

13.2.11 BEHAVIOSEC

13.2.12 STYTCH

13.2.13 SIGNICAT

13.2.14 UBISECURE

13.2.15 EMPOWERID

13.3 STARTUPS

13.3.1 1KOSMOS

13.3.2 IDENTITE

13.3.3 CIDAAS

13.3.4 KEYLESS

13.3.5 PUREID

14 ADJACENT MARKETS (Page No. - 285)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 278 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 PASSWORDLESS AUTHENTICATION: ADJACENT MARKETS

14.3.1 CONTACTLESS BIOMETRICS MARKET

TABLE 279 CONTACTLESS BIOMETRICS MARKET, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 280 CONTACTLESS BIOMETRICS MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 281 FACE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 282 FACE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 283 IRIS RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 284 IRIS RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 285 CONTACTLESS FINGERPRINT RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 286 CONTACTLESS FINGERPRINT RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 287 CONTACTLESS BIOMETRIC CARDS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 288 CONTACTLESS BIOMETRIC CARDS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 289 VOICE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 290 VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.2 DIGITAL IDENTITY SOLUTIONS MARKET

TABLE 291 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 292 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 293 SOLUTIONS: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 294 SOLUTIONS: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 295 SERVICES: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 296 SERVICES: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.3 MULTI-FACTOR AUTHENTICATION MARKET

TABLE 297 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2016–2021 (USD MILLION)

TABLE 298 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2022–2027 (USD MILLION)

TABLE 299 TWO-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 300 TWO-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 301 THREE-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 302 THREE-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 303 FOUR-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 304 FOUR-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 305 FIVE-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 306 FIVE-FACTOR: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 296)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

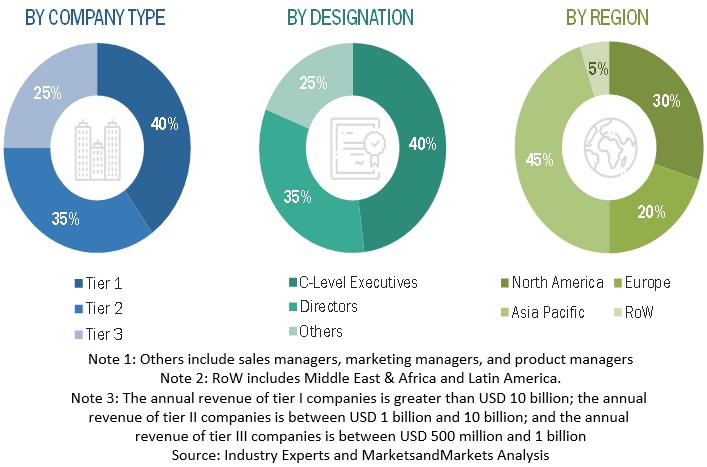

The study involved major activities in estimating the current market size for the passwordless authentication market. Exhaustive secondary research was done to collect information on the passwordless authentication industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of passwordless authentication software and service vendors, forums, certified publications, and white papers. The secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major passwordless authentication solution providers.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the passwordless authentication market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of passwordless authentication market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Passwordless Authentication Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down and bottom-up approaches were used to estimate and validate the size of the global passwordless authentication market and estimate the size of various other dependent subsegments in the overall market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the passwordless authentication market based on offerings, motilities, authentication types, end-use industries, and regions.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market.

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market.

- To profile the key players of the market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global passwordless authentication market.

Customization options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional passwordless authentication market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company information

- Detailed analysis and profiling of additional market players (up to 5)

WebAuthn Market & Its Impact on the Passwordless Authentication Market

WebAuthn provides a secure and user-friendly way to authenticate users without the need for passwords. It allows users to use a physical device, such as a hardware security key or a mobile device, to authenticate themselves. This eliminates the need for passwords, which are a common target for cyberattacks and can be easily compromised.

- Improved security: One of the primary benefits of WebAuthn is its ability to improve security by eliminating the need for passwords. Passwords are often the weakest link in security, as they can be easily guessed or stolen. By using WebAuthn, users can authenticate themselves using biometrics or hardware security keys, which are much more difficult to compromise.

- Improved user experience: Another benefit of WebAuthn is its ability to improve the user experience by simplifying the authentication process. With WebAuthn, users can authenticate themselves with a single touch or click, without having to remember complex passwords or go through multiple authentication steps.

- Increased adoption: With the growing demand for more secure and user-friendly authentication methods, the adoption of WebAuthn is likely to continue to grow in the coming years. As more organizations adopt WebAuthn, it is likely to become the de facto standard for passwordless authentication.

- Disruption of the password-based authentication market: WebAuthn is likely to disrupt the password-based authentication market, as more organizations shift away from traditional password-based authentication methods in favour of more secure and user-friendly alternatives. This shift is likely to be driven by factors such as security breaches, user frustration with passwords, and regulatory requirements.

- The emergence of new business opportunities: As WebAuthn continues to grow and mature, it is likely to create new business opportunities for companies that offer hardware security keys, biometric authentication technologies, and other related products and services. These companies are likely to benefit from the growing demand for passwordless authentication solutions.

Futuristic Growth Use-Cases of WebAuthn Market

- Mobile authentication: As mobile devices become increasingly central to our lives, WebAuthn can play a key role in providing secure authentication methods for mobile devices. This could include using biometrics such as facial recognition or fingerprints to authenticate users on their mobile devices.

- IoT authentication: As the Internet of Things (IoT) grows, there is a need for secure authentication methods for IoT devices. WebAuthn can provide a standardized way to authenticate users on IoT devices, using hardware security keys or other authentication methods.

- Cross-platform authentication: WebAuthn can enable cross-platform authentication, allowing users to authenticate themselves seamlessly across different platforms, such as desktop, mobile, and IoT devices.

- Financial services: WebAuthn can provide a more secure way to authenticate users in financial services, such as banking and investment applications. This can reduce the risk of cyber-attacks and fraud, while also providing a more user-friendly authentication experience for customers.

- Healthcare: WebAuthn can help to secure sensitive healthcare data by providing secure authentication methods for healthcare applications. This can help to ensure that only authorized users have access to sensitive patient information.

Top Players in WebAuthn Market

- Yubico

- Duo Security

- Microsoft

- Okta

- Auth0

Industries Getting Impacted in the Future by WebAuthn Market

- E-commerce: WebAuthn can provide a more secure way to authenticate users on e-commerce websites, reducing the risk of fraud and improving the user experience.

- Government: WebAuthn can be used to secure government websites and services, such as tax filings or social security applications, ensuring that only authorized users have access to sensitive information.

- Education: WebAuthn can be used to authenticate students and staff on educational platforms, such as learning management systems or online courses, ensuring that only authorized users have access to course materials and other sensitive information.

- Healthcare: WebAuthn can be used to secure healthcare applications, such as patient portals and electronic medical records, ensuring that only authorized users have access to sensitive patient information.

- Banking and Finance: WebAuthn can provide a more secure and user-friendly way to authenticate users on banking and financial applications, reducing the risk of fraud and improving the user experience.

- Gaming: WebAuthn can be used to authenticate users on gaming platforms, ensuring that only authorized users have access to their accounts and reducing the risk of account theft or fraud.

New Business Opportunities in WebAuthn Market

- Hardware security keys: WebAuthn is based on the use of hardware security keys, which can provide a highly secure way to authenticate users. There is an opportunity for businesses to manufacture and sell these hardware security keys to customers who are looking for more secure authentication methods.

- Authentication software: With the growing adoption of WebAuthn, there is an opportunity for businesses to develop and sell software solutions that enable WebAuthn-based authentication for websites and applications.

- Consulting services: As WebAuthn is still a relatively new technology, there is a need for consulting services that can help businesses implement and integrate WebAuthn into their existing authentication systems.

- Integration services: Similarly, there is an opportunity for businesses to offer integration services that can help other businesses to integrate WebAuthn into their existing applications and services.

- Managed services: There is also an opportunity for businesses to offer managed authentication services that are based on WebAuthn. This can include managing hardware security keys, authentication software, and other aspects of the authentication process.

- Cross-platform authentication: With the growing need for cross-platform authentication, there is an opportunity for businesses to develop solutions that enable seamless WebAuthn-based authentication across multiple devices and platforms.

Key Challenges for Growing WebAuthn Business in the Future Market

- Education and awareness: One of the biggest challenges facing the WebAuthn market is educating businesses and consumers about the benefits of this technology, and how it can be used to improve security and simplify the authentication process. Many people are still unfamiliar with WebAuthn and may be hesitant to adopt this technology without a better understanding of how it works.

- Adoption and integration: Another key challenge for the WebAuthn market is getting businesses and other organizations to adopt and integrate this technology into their existing authentication systems. This may require significant investments in new hardware, software, and training, which may be a barrier to adoption for some organizations.

- Standardization: WebAuthn is still a relatively new technology, and there is a need for standardization in this space to ensure that different implementations of WebAuthn can work seamlessly together. Without standardization, there may be fragmentation and inconsistencies in the WebAuthn market, leading to confusion and potential compatibility issues.

- User experience: Another challenge for the WebAuthn market is providing a seamless and user-friendly authentication experience for users. While WebAuthn is designed to be more convenient and secure than traditional authentication methods, it may still be difficult for some users to navigate the authentication process, particularly if they are not familiar with this technology.

- Cybersecurity threats: WebAuthn is designed to be a highly secure authentication method, but it is not immune to cybersecurity threats. There is a risk that cybercriminals may find ways to bypass or circumvent WebAuthn-based authentication methods, potentially leading to data breaches and other security incidents.

- Cost: The cost of implementing WebAuthn solutions can be a potential barrier to adoption, particularly for small and medium-sized businesses. The need to purchase hardware security keys and invest in software and services to support WebAuthn-based authentication may be a significant expense for some organizations.

Speak to our Analyst today to know more about the "WebAuthn Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Passwordless Authentication Market