Patient Monitoring Devices Market Size by Product (Cardiac monitoring devices, Pulse Oximeter, Spirometer, Fetal Monitor, Temperature Monitor, blood pressure monitors, ECG, ICP, weight Monitoring), User, Customer Unmet Needs & Region - Global Forecast to 2029

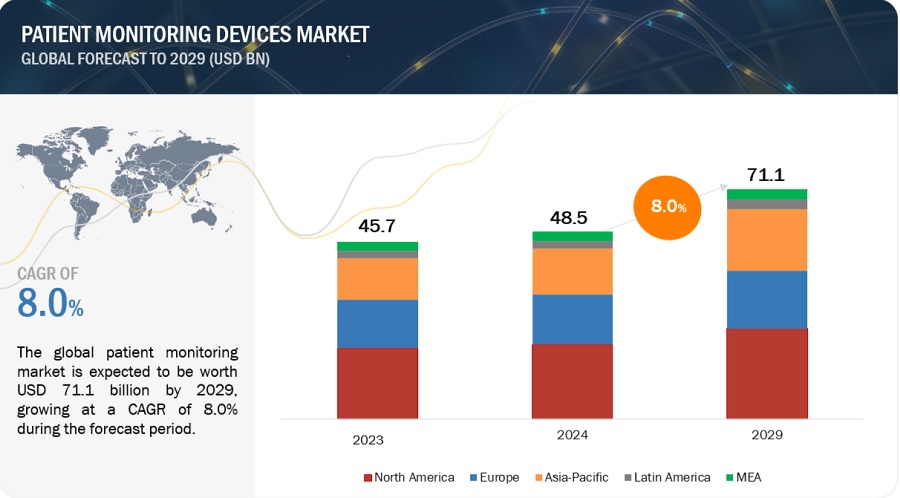

The size of global patient monitoring Devices market in terms of revenue was estimated to be worth USD 48.5 billion in 2024 and is poised to reach USD 71.1 billion by 2029, growing at a CAGR of 8.0% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

An increase in chronic disorders and the aging population, increasing research & funding initiatives from organizations, and worldwide advancement in surgical procedures are a few drivers that collectively contribute to the growth of the Patient monitoring market, and as healthcare technological advancement continues to evolve, the demand for patient monitoring procedure is expected to rise in the forecasting years. However, challenges for high cost, stringent regulatory policies can limit the market growth.

Attractive Opportunities in the Patient Monitoring Devices Market

To know about the assumptions considered for the study, Request for Free Sample Report

Patient Monitoring Devices Market Dynamics

Driver: Increase adoption of wireless monitoring devices

The healthcare landscape is witnessing a significant shift towards wireless monitoring devices within the broader patient monitoring market. Conventional patient monitoring methods often restrict patient mobility and comfort by tethering them to bedside equipment. Wireless devices address this limitation by facilitating greater freedom of movement, fostering a more patient-centric approach to care delivery. Wireless monitoring facilitates the continuous and real-time capture of vital signs, blood sugar levels, and other health metrics. This uninterrupted data stream offers a more holistic understanding of a patient's health compared to traditional, intermittent measurement.

Restraint: High cost of patient monitoring

Sophisticated patient monitoring systems, like hemodynamic monitors or certain wireless monitoring devices, can be expensive to purchase and install, creating a financial barrier for hospitals and healthcare facilities, particularly smaller institutions. Maintaining and upgrading patient monitoring equipment can add to the ongoing operational costs for healthcare providers. Hospital budget cuts were similar throughout Europe, and are anticipated in the upcoming years. Budget cuts have made cost-containment measures necessary in many areas of healthcare facilities.

Opportunity: Artificial Intelligence (AI) Integration - growth opportunities

Leveraging artificial intelligence (AI) empowers the analysis of vast datasets generated by patient monitoring systems. This enables real-time generation of actionable insights, facilitates predictive risk stratification, and supports the development of personalized treatment plans for improved patient outcomes. Traditionally, analyzing large datasets from patient monitoring was a time-consuming process. AI algorithms can now analyze this data in real time, identifying critical trends and potential issues as they occur.

Challenge: Technical expertise

Advanced patient monitoring systems, while generating valuable real-time vitals, waveform analysis, and trends, present a data interpretation challenge. Upskilling healthcare personnel, particularly nurses and technicians, is crucial for optimal utilization. However, time-consuming training and potential skill shortages create logistical hurdles for wider adoption in the healthcare industry.

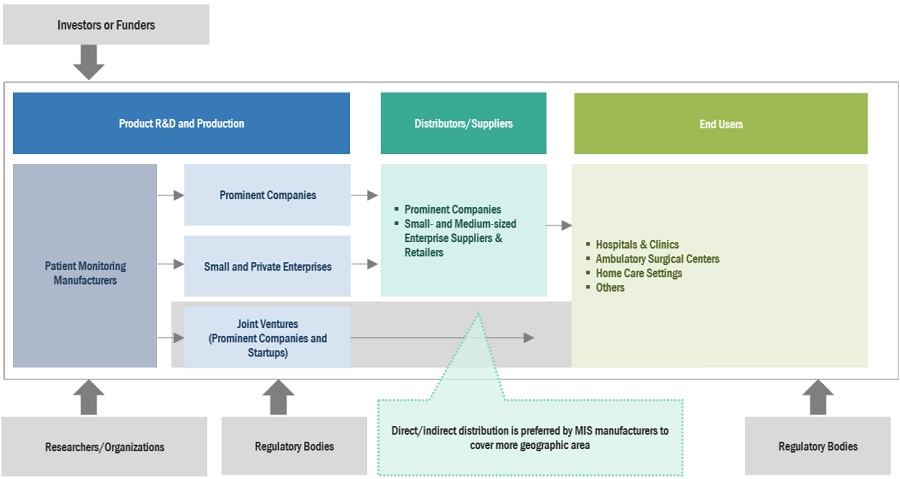

Patient Monitoring Industry Ecosystem

Major companies in this market include well-established and financially stable suppliers of Patient monitoring. Prominent companies in this market include Medtronic plc (Ireland), GE Healthcare (US), Philips Healthcare (Netherland), Nihon Kohden Corporation (Japan), Abbott Laboratories (US), Mindray Medical International Ltd (China), Boston Scientific Corporation (US), among several others.

Blood Glucose Monitoring Systems (BGMS) segment to register largest market share of the patient monitoring Devices industry in the year 2023.

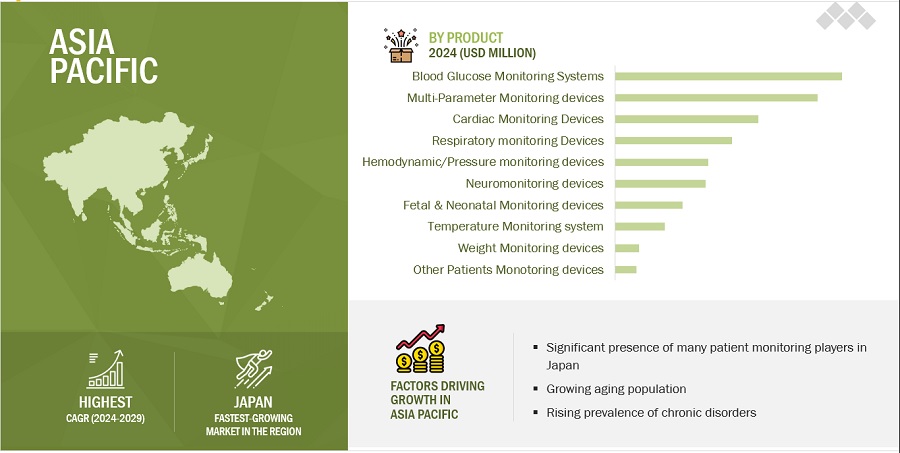

Based on the product, the patient monitoring devices market is segmented into Blood glucose monitoring systems, Cardiac Monitoring Devices, Multi-Parameter Monitoring, Respiratory Monitoring Devices, Hemodynamic/ Pressure Monitoring Devices, Weight Monitoring Devices, Fetal & Neonatal Monitoring Devices, Neuromonitoring Devices, Temperature Monitoring Devices and others. BGMS segment to register largest market share in the forecast period of 2024-2029. The Blood glucose monitoring systems are further divided into self-monitoring, continuous glucose monitoring, wearable glucose monitoring. Key drivers are Advancements like continuous glucose monitoring (CGM) have revolutionized blood sugar monitoring by offering a less invasive and more convenient approach compared to traditional finger-stick methods. Furthermore, the growing number of players in the BGMS market is driving innovation and potentially lowering device costs.

Ambulatory Surgical Centers (ASCs) segment of the patient monitoring devices industry is the highest market rate end-user segment in the forecasted year 2024-2029.

The ASCs end user segment of the patient monitoring devices market registers highest market rate in the forecasted year 2024-2029. Key factors driven by Easy-to-use and portable monitoring solutions are crucial to avoid delays and optimize workflow, cost-effectiveness, workflow efficiency, and meeting the specific needs of minimally invasive procedures. Additionally, user-friendly, and delivers value without compromising patient safety. Furthermore, requiring less complex monitoring compared to major surgeries in hospitals.

Asia-Pacific is expected to be the patient monitoring devices industry highest CAGR during the forecast period.

The patient monitoring devices market is divided into key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, the Asia Pacific region is anticipated to exhibit the highest CAGR during the forecasting year. However, North America held the largest market share in the global Patient monitoring market. This growth is primarily attributed to the a aging population, increasing availability of advanced patient monitoring equipment like wearable devices, wireless monitors, and remote monitoring systems caters to the growing demand for these technologies in APAC countries. The APAC region is emerging as a medical tourism hub, attracting patients seeking high-quality healthcare services, including advancements in surgical techniques and the adoption of advanced Patient monitoring. Additionally, the market in the Asia Pacific region is poised for significant growth due to a combination of demographic, economic, and technological factors.

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the market are Medtronic plc (Ireland), GE Healthcare (US), Philips Healthcare (US), Nihon Kohden Corporation (Japan), Mindray Medical International Ltd. (China), and Abbott Laboratories (US) among several others.

Scope of the Patient Monitoring Devices Industry

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$48.5 billion |

|

Projected Revenue by 2029 |

$71.1 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.0% |

|

Market Driver |

Increase adoption of wireless monitoring devices |

|

Market Opportunity |

Artificial Intelligence (AI) Integration - growth opportunities |

This report has segmented the patient monitoring devices market to forecast revenue and analyze trends in each of the following submarkets:

BY PRODUCT (USD MILLION; 2022—2029) *

-

BLOOD GLUCOSE MONITORING SYSTEMS

- Self-Monitoring Blood Glucose Systems

- Continuous Glucose Monitoring Systems

- Wearable Glucose Monitoring Systems

-

CARDIAC MONITORING DEVICES

- ECG Devices

- Implantable Loop Recorder

- Event Monitors

- MCT Monitors

- Smart/ Wearable ECG Monitors

-

MULTI-PARAMETER MONITORING DEVICES

- Low-Acuity Monitoring & Accessories Devices

- Mid- Acuity Monitoring Devices

- High- Acuity Monitoring Devices

-

RESPIRATORY MONITORING DEVICES

- Pulse Oximeter

- Spirometer

- Capnographs

- Peak Flow Meters

-

HEMODYNAMIC/ PRESSURE MONITORING DEVICES

- Hemodynamic Monitors

- Blood Pressure Monitors

- Disposables

-

WEIGHT MONITORING DEVICES

- Digital Weight Monitoring Devices

- Analog Weight Monitoring Devices

- Other weight monitoring devices

-

FETAL & NEONATAL MONITORING DEVICES

- Fetal Monitoring Devices

- Neonatal Monitoring Devices

-

NEUROMONITORING DEVICES

- EEG Machines

- EMG Machines

- Cerebral Oximeters

- ICP Monitors

- MEG Machines

- TCD Machines

-

TEMPERATURE MONITORING DEVICES

- Handheld Temperature Monitoring Devices

- Table-Top Temperature Monitoring Devices

- Wearable Continuous Monitoring Devices

- Invasive Temperature Monitoring Devices

- Smart Temperature Monitoring Patches

BY END USER (USD MILLION; 2021—2029) *

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Others

BY REGION

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- MEA

Recent Market Developments of Patient Monitoring Devices Industry:

- In 2023, GE HealthCare’s CARESCAPE Canvas Patient Monitoring Platform Received FDA Clearance.

- In 2024, GE HealthCare received FDA clearance for an expanded indication for Novii+ maternal and fetal monitoring solution for pregnant patients ≥34 weeks.

- In 2023, Abbott Receives FDA Clearance For Assert-IG Insertable Cardiac Monitor to Help Doctors Monitor People's Heart Rhythms Long-Term.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global patient monitoring Devices market?

The global patient monitoring Devices market boasts a total revenue value of $71.1 billion by 2029.

What is the estimated growth rate (CAGR) of the global patient monitoring Devices market?

The global patient monitoring Devices market has an estimated compound annual growth rate (CAGR) of 8.0% and a revenue size in the region of $48.5 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

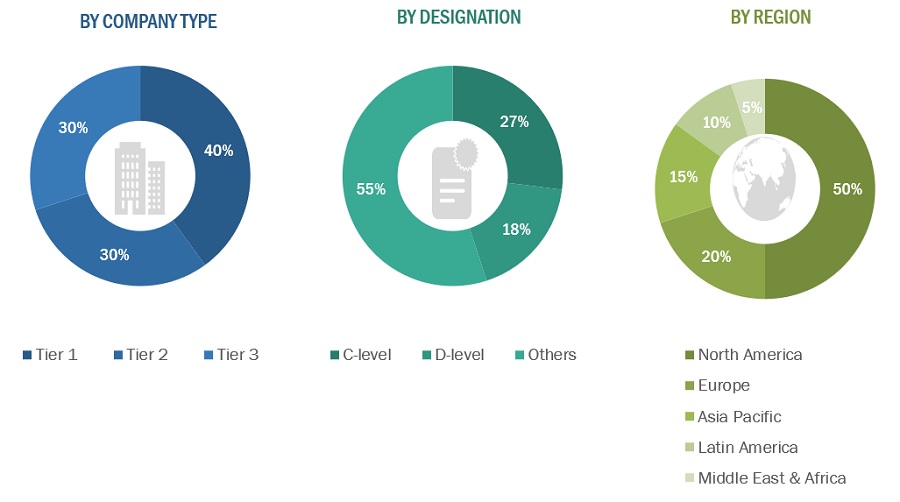

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Patient monitoring market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in product therapy markets. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

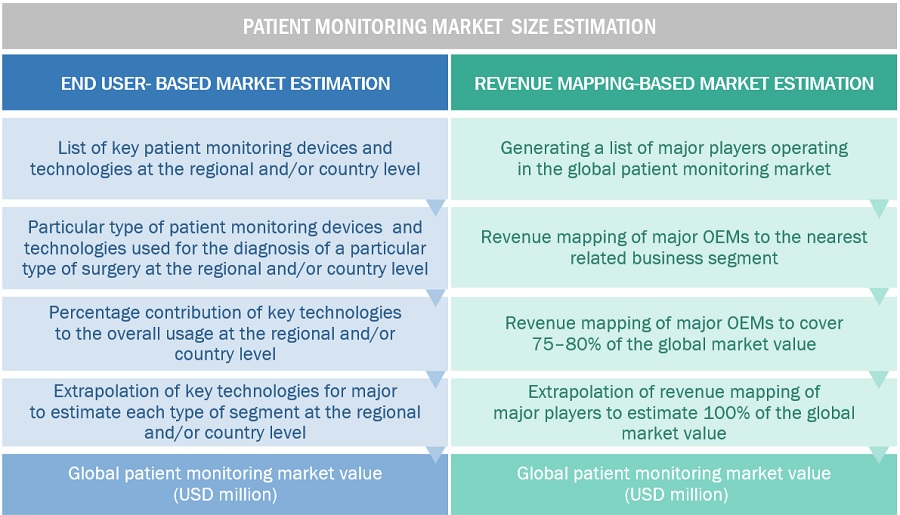

Market Estimation Methodology

In this report, the patient monitoring market size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the patient monitoring market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the patient monitoring market.

- Mapping annual revenues generated by major global players from the patient monitoring market(or nearest reported business unit/product category).

- Revenue mapping of key players to cover a major share of the global market, as of 2022

- Extrapolating the global value of the patient monitoring market.

Global Patient Monitoring Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

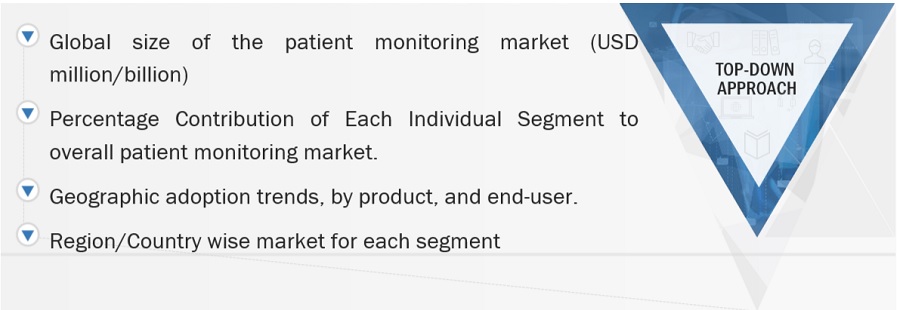

Global Patient Monitoring Market : Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the patient monitoring market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the patient monitoring market was validated using both top-down and bottom-up approaches.

Market Definition

Patient monitoring involves continuously or intermittently observing and evaluating a patient's physiological parameters, vital signs, and clinical condition to track their health status and response to medical treatment. This process utilizes various medical devices and technologies to measure and track parameters such as heart rate, blood pressure, oxygen saturation, respiratory rate, temperature, and electrocardiography (ECG) readings. Modern patient monitoring systems utilize advanced medical devices, sensors, telemetry systems, and software platforms to capture, display, analyze, and transmit patient data in real-time.

Key Stakeholders

- Manufacturers and distributors of patient monitoring devices

- Healthcare institutions (Hospitals and clinics)

- Ambulatory surgical centers

- Healthcare institutions (hospitals and cardiac centers)

- Research institutions

- Research and consulting firms

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Clinical research organizations

- Ambulatory Surgery Centers

- Group Purchasing Organizations (GPOs)

- Medical Research Laboratories

- Academic Medical Centers and Universities

- Accountable Care Organizations (ACOs)

Objectives of the Study

- To define, describe, and forecast the patient monitoring market on Product and end user.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To strategically analyze the micro markets concerning individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key market players and comprehensively analyze their market shares and core competencies.

- To forecast the revenue of the market segments concerning five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa.

- To track and analyze competitive developments such as new product launches and approvals; agreements, partnerships, expansions, acquisitions; and collaborations in the patient monitoring market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global patient monitoring market

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top thirteen companies.

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe's patient monitoring market Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific patient monitoring market Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the world patient monitoring market Latin America, MEA, and Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Monitoring Devices Market