Patient Temperature Monitoring Market Size, Growth by Product (Wearable, Digital, Smart, Continuous, Infrared), Site (Axillary, Oral,Tympanic, Invasive), Application (Fever, Anesthesia, Hypothermia), End User (Hospitals, Home Care, ASCs) & Region - Global Forecast to 2027

The global size of patient temperature monitoring market in terms of revenue was estimated to be worth USD 3.6 billion in 2022 and is poised to reach USD 4.9 billion by 2027, growing at a CAGR of 6.4% from 2022 to 2027. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in this market is mostly driven by the rising incidence of infectious diseases coupled with increasing geriatric and pediatirc population along with growing demand for advanced temperature monitoring devices.

To know about the assumptions considered for the study, Request for Free Sample Report

Patient Temperature Monitoring Market Growth Dynamics

Drivers: Rising population and increasing prevalence of infectious diseases

Population in the world is presently growing at a fast rate of around 1.03% every year. Population growth is correlated with a striking increase in human density in an area, encouraging the spread of infectious diseases and viruses. Currently (as of 2021), SARS-COVID, tuberculosis (TB), malaria, pneumonia, dengue, HIV, and whooping cough are the most widespread infectious diseases and viruses in the world and are expected to increase across the globe. The geriatric and pediatric populations are most prone to such infections. These infectious diseases are accompanied by characteristic changes in body temperature. As a result, the timely monitoring of temperature can result in the efficient diagnosis and treatment of these diseases.

Opportunities: Growth opportunities in emerging markets

Emerging markets in countries such as India, Brazil, and Mexico are projected to offer significant growth opportunities for players operating in the patient temperature monitoring market. To meet the increasing demand for temperature monitoring in emerging markets, several manufacturers are focusing on strategic acquisitions and agreements/partnerships with regional/domestic players for product distribution and manufacturing. Also, the increasing competition in mature markets will compel manufacturers to shift their focus on emerging markets across the Asia Pacific and Latin America region.

Restraints: Lack of awareness regarding non-invasive and continuous temperature monitoring devices

The lack of awareness among doctors and healthcare practitioners about advancements that are incorporated by manufacturers, coupled with a dearth of trained and experienced personnel who can effectively operate and process these devices, are the major factors limiting their adoption.

Challenges: Concerns related to rectal temperature monitoring

In rectal temperature monitoring, a temperature catheter is inserted through the anus several centimeters into the rectum to achieve minimally invasive core temperature monitoring. Factors such as the extended time period of monitoring, associated privacy concerns, the high risk of intestinal damage, and the presence of feces preventing the thermometer from touching the wall of the bowel may discourage the use of these device.

The patient temperature monitoring market is highly consolidated. The top players in this market are Cardinal Health Inc. (US), 3M (US), Koninklijke Philips N.V. (Netherlands), Drägerwerk (Germany), and Hill-Rom Holdings, Inc. (US). These players lead the market because of their extensive product portfolios and a wide geographic presence.

In 2021, handheld temperature monitoring devices segment accounted for the largest share of the patient temperature monitoring market, by product.

The market is segmented into wearable continuous monitoring sensors, smart temperature monitoring patches, table-top temperature monitoring devices, handheld temperature monitoring devices, and invasive temperature monitoring devices. In 2021, the handheld temperature monitoring devices segment accounted for the largest share of the market. The large share of this segment can be attributed to non-invasive and non-traumatic in nature, are hygienic, as well as offer an easy and reliable interpretation of temperature readings.

In 2021, non-invasive temperature monitoring segment accounted for the largest share in the market, by site.

The patient temperature monitoring market has been segmented into invasive and non-invasive temperature monitoring. In 2021, the non-invasive temperature monitoring segment accounted for the largest share of the temperature monitoring market. Factors such as more accessible, accurate, comfortable, and easier temperature monitoring is driving the growth of the market.

In 2021, pyrexia/fever segment accounted for the largest share in the market, by application.

The patient temperature monitoring market has been segmented into pyrexia/fever, hypothermia, blood transfusion, anesthesia, and other applications. In 2021, the pyrexia/fever segment accounted for the largest share of the temperature monitoring market. Growing geriatric population and increasing number of trauma and hemolysis cases is driving the growth of this segment.

In 2021, hospitals segment accounted for the largest share in the market, by end users.

The patient temperature monitoring market has been segmented into hospitals, nursing facilities, home care settings, ambulatory care centers, and other end users. In 2021, hospitals are estimated to be the largest end users of the market. The large share of this segment can be attributed to the high and growing prevalence of infectious diseases and viruses and growing keenness for non-invasive monitoring.

North America is the largest regional market for patient temperature monitoring.

The global patient temperature monitoring market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America accounted for the largest share of the market. The North American market growth can be attributed to the large volume of surgical procedures performed and growth in blood donation and transfusion.

To know about the assumptions considered for the study, download the pdf brochure

Patient Temperature Monitoring Market Key Players

- Cardinal Health Inc. (US)

- 3M (US)

- Koninklijke Philips N.V. (Netherlands)

- Drägerwerk (Germany)

- Hill-Rom Holdings, Inc. (US)

Patient Temperature Monitoring Market Scope

|

Report Metrics |

Details |

|

Market Size value 2027 |

USD 4.9 billion |

|

Growth Rate |

6.4% CAGR |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

Handheld temperature monitoring devices, Non-invasive temperature monitoring, Pyrexia/fever & Hospitals |

|

Forecasts up to |

2027 |

|

Market Segmentation |

Product, Site, Application, End User and Region |

|

Patient Temperature Monitoring Market Growth Drivers |

|

|

Patient Temperature Monitoring Market Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the global patient temperature monitoring market into the following segments and subsegments:

By Product

- Wearable Continuous Monitoring Sensors

- Smart Temperature Monitoring Patches

-

Table-Top Temperature Monitoring Devices

- Non-invasive Vital Signs Monitoring Devices

- Continuous Core Body Temperature Monitoring Devices

-

Handheld Temperature Monitoring Devices

- Digital Thermometers

- Infrared Thermometers

- Mercury Thermometers

- Invasive Temperature Monitoring Devices

By Site

-

Noninvasive Temperature Monitoring

- Axillary and Temporal Artery Temperature Monitoring

- Tympanic Membrane Temperature Monitoring

- Oral Temperature Monitoring

-

Invasive Temperature Monitoring

- Esophageal Temperature Monitoring

- Urinary Bladder Temperature Monitoring

- Nasopharynx Temperature Monitoring

- Rectal Temperature Monitoring

By Application

- Pyrexia/Fever

- Hypothermia

- Anesthesia

- Blood Transfusion

- Other Applications

By End User

-

Hospitals

- Operating Rooms

- Emergency Rooms

- Intensive Care Units

- Home Care Settings

- Nursing Facilities

- Ambulatory Care Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In May 2020, Masimo Corporation (US) launched the Radius T continuous thermometer, a more convenient way to keep track of fever.

- In February 2021, Canon Solutions America Inc. (US) announced the launch of welloStationXTM, an automated, FDA-cleared, digital, and no-touch clinical thermometer.

Frequently Asked Questions (FAQ):

What is the size of Patient Temperature Monitoring Market?

The global patient temperature monitoring market size is projected to reach USD 4.9 billion by 2027, growing at a CAGR of 6.4%.

What are the major growth factors of Patient Temperature Monitoring Market?

Growth in this market is mostly driven by the rising incidence of infectious diseases coupled with increasing geriatric and pediatirc population along with growing demand for advanced temperature monitoring devices.

Who all are the prominent players of Patient Temperature Monitoring Market?

The patient temperature monitoring market is highly consolidated. The top players in this market are Cardinal Health Inc. (US), 3M (US), Koninklijke Philips N.V. (Netherlands), Drägerwerk (Germany), and Hill-Rom Holdings, Inc. (US). These players lead the market because of their extensive product portfolios and a wide geographic presence.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET, BY SEGMENTATION

FIGURE 2 MARKET, BY REGION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 3 PATIENT TEMPERATURE MONITORING MARKET: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primary interviews

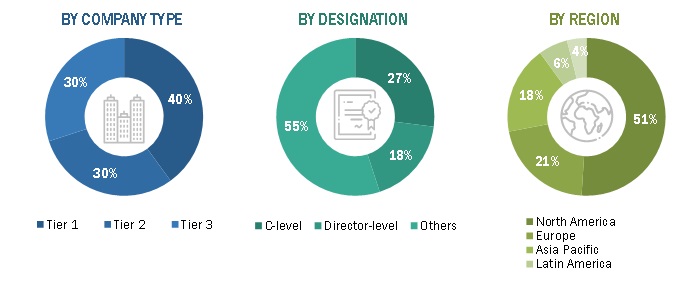

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach 1: Company revenue estimation approach

FIGURE 6 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.3.1.2 Approach 2: Presentations of companies and primary interviews

2.3.1.3 Growth forecast

2.3.1.4 CAGR projections

FIGURE 7 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 8 PATIENT TEMPERATURE MONITORING MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE

2.6 STUDY ASSUMPTIONS

2.7 RISK ASSESSMENT

2.7.1 RISK ASSESSMENT: PATIENT TEMPERATURE MONITORING MARKET

2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY SITE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 PATIENT TEMPERATURE MONITORING MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 PATIENT TEMPERATURE MONITORING MARKET OVERVIEW

FIGURE 15 RISING PREVALENCE OF INFECTIOUS DISEASES AND INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

4.2 MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 16 HANDHELD TEMPERATURE MONITORING DEVICES SEGMENT TO DOMINATE MARKET IN 2027

4.3 MARKET SHARE, BY SITE, 2022 VS. 2027

FIGURE 17 NON-INVASIVE TEMPERATURE MONITORING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 MARKET SHARE, BY APPLICATION, 2022 VS. 2027

FIGURE 18 PYREXIA/FEVER SEGMENT TO DOMINATE MARKET IN 2027

4.5 MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 19 HOSPITALS SEGMENT TO DOMINATE MARKET IN 2027

4.6 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 PATIENT TEMPERATURE MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising population and increasing prevalence of infectious diseases to drive market growth

5.2.1.2 Rising awareness for continuous temperature monitoring

5.2.1.3 Increasing demand for continuous temperature monitoring devices

5.2.1.4 Increasing number of surgical procedures

5.2.2 RESTRAINTS

5.2.2.1 High cost of advanced temperature monitoring devices in developing countries

5.2.2.2 Lack of awareness regarding non-invasive and continuous temperature monitoring in developing countries

5.2.2.3 Lack of proper supply chain management

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing growth opportunities in emerging markets

5.2.3.2 Developing healthcare infrastructure

5.2.4 CHALLENGES

5.2.4.1 Issues related to use of infrared and mercury thermometers

5.2.4.2 Concerns related to rectal temperature monitoring

5.2.4.3 Intense competition amongst manufacturers

5.2.5 IMPACT OF COVID-19 ON PATIENT TEMPERATURE MONITORING MARKET

5.3 PRICING ANALYSIS

5.3.1 INDICATIVE PRICING MODEL ANALYSIS

TABLE 1 AVERAGE SELLING PRICE OF PATIENT TEMPERATURE MONITORING PRODUCTS (2022)

5.4 PATENT ANALYSIS

FIGURE 22 PATENT ANALYSIS FOR PATIENT TEMPERATURE MONITORING DEVICES

TABLE 2 LIST OF KEY PATENTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND DISTRIBUTION PHASES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM MAP ANALYSIS

FIGURE 25 MARKET: ECOSYSTEM MAP

TABLE 3 PATIENT TEMPERATURE MONITORING MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 PESTLE ANALYSIS

5.10 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 NORTH AMERICA

5.10.2.1 US

5.10.2.2 Canada

5.10.3 EUROPE

5.10.4 ASIA PACIFIC

5.10.4.1 China

5.10.4.2 Japan

5.10.4.3 India

5.10.5 LATIN AMERICA

5.10.5.1 Brazil

5.10.5.2 Mexico

5.10.6 MIDDLE EAST

5.10.7 AFRICA

5.11 TRADE ANALYSIS

5.11.1 TRADE ANALYSIS FOR PATIENT TEMPERATURE MONITORING PRODUCTS

TABLE 10 IMPORT DATA FOR ARTICLES AND EQUIPMENT FOR PATIENT TEMPERATURE MONITORING PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 11 EXPORT DATA FOR ARTICLES AND EQUIPMENT FOR PATIENT TEMPERATURE MONITORING PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 TECHNOLOGY ANALYSIS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 12 PATIENT TEMPERATURE MONITORING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGICAL ADVANCED TEMPERATURE MONITORING DUE TO COVID-19 PANDEMIC

FIGURE 26 REVENUE SHIFT IN PATIENT TEMPERATURE MONITORING MARKET

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF PATIENT TEMPERATURE MONITORING PRODUCTS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF PATIENT TEMPERATURE MONITORING PRODUCTS

5.15.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR PATIENT TEMPERATURE MONITORING PRODUCTS

TABLE 14 KEY BUYING CRITERIA FOR PATIENT TEMPERATURE MONITORING PRODUCTS

5.16 CASE STUDIES

5.16.1 CASE STUDY 1

6 PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT (Page No. - 87)

6.1 INTRODUCTION

TABLE 15 MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 WEARABLE CONTINUOUS MONITORING SENSORS

6.2.1 VERSATILE FUNCTIONALITIES OFFERED TO DRIVE DEMAND

TABLE 16 WEARABLE CONTINUOUS MONITORING SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SMART TEMPERATURE MONITORING PATCHES

6.3.1 LONG-TERM MONITORING OFFERED TO DRIVE MARKET GROWTH

TABLE 17 SMART TEMPERATURE MONITORING PATCHES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 TABLE-TOP TEMPERATURE MONITORING DEVICES

TABLE 18 TABLE-TOP TEMPERATURE MONITORING DEVICES AVAILABLE

TABLE 19 TABLE-TOP TEMPERATURE MONITORING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 20 TABLE-TOP TEMPERATURE MONITORING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1 NON–INVASIVE VITAL SIGNS MONITORING DEVICES

6.4.1.1 High costs of these devices to hinder market growth

TABLE 21 NON-INVASIVE VITAL SIGNS MONITORING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2 CONTINUOUS CORE BODY TEMPERATURE MONITORING DEVICES

6.4.2.1 Increasing incidence of cardiac arrest, head injury, and stroke to drive market growth

TABLE 22 CONTINUOUS CORE BODY TEMPERATURE MONITORING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 HANDHELD TEMPERATURE MONITORING DEVICES

TABLE 23 HANDHELD TEMPERATURE MONITORING DEVICES AVAILABLE

TABLE 24 HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 25 HANDHELD TEMPERATURE MONITORING DEVICES, BY REGION, 2020–2027 (USD MILLION)

6.5.1 MERCURY THERMOMETERS

6.5.1.1 Toxicity, increased risk of injury, and cross infection to hinder market growth

TABLE 26 MERCURY THERMOMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5.2 DIGITAL THERMOMETERS

6.5.2.1 Non-invasive and non-traumatic features to drive market growth

TABLE 27 DIGITAL THERMOMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5.3 INFRARED THERMOMETERS

6.5.3.1 Faster response time for surface temperatures and better patient comfort to drive market growth

TABLE 28 INFRARED THERMOMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.6 INVASIVE TEMPERATURE MONITORING DEVICES

6.6.1 INCREASING PREVALENCE OF BLOODSTREAM INFECTIONS TO HINDER MARKET GROWTH

TABLE 29 INVASIVE TEMPERATURE MONITORING DEVICES, BY REGION, 2020–2027 (USD MILLION)

7 PATIENT TEMPERATURE MONITORING MARKET, BY SITE (Page No. - 101)

7.1 INTRODUCTION

TABLE 30 MARKET, BY SITE, 2020–2027 (USD MILLION)

7.2 NON-INVASIVE TEMPERATURE MONITORING

TABLE 31 NON-INVASIVE TEMPERATURE MONITORING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 32 NON-INVASIVE TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.1 ORAL TEMPERATURE MONITORING

7.2.1.1 Accurate temperature reading to drive market growth

TABLE 33 ORAL TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.2 AXILLARY AND TEMPORAL ARTERY TEMPERATURE MONITORING

7.2.2.1 Ease in accessibility to drive market growth

TABLE 34 AXILLARY AND TEMPORAL ARTERY TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.3 TYMPANIC MEMBRANE TEMPERATURE MONITORING

7.2.3.1 Multipurpose functionalities to drive market growth

TABLE 35 TYMPANIC MEMBRANE TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 INVASIVE TEMPERATURE MONITORING DEVICES

TABLE 36 INVASIVE TEMPERATURE MONITORING MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 37 INVASIVE TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3.1 ESOPHAGEAL TEMPERATURE MONITORING

7.3.1.1 High sensitivity and accuracy to drive market growth

TABLE 38 ESOPHAGEAL TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3.2 NASOPHARYNX TEMPERATURE MONITORING

7.3.2.1 Rising risk of epistaxis and sinusitis to hinder market growth

TABLE 39 NASOPHARYNX TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3.3 URINARY BLADDER TEMPERATURE MONITORING

7.3.3.1 High cost and risk of bladder or urine infection to limit market adoption

TABLE 40 URINARY BLADDER TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3.4 RECTAL TEMPERATURE MONITORING

7.3.4.1 High precision and accurate results to drive market growth

TABLE 41 RECTAL TEMPERATURE MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

8 PATIENT TEMPERATURE MONITORING MARKET, BY APPLICATION (Page No. - 112)

8.1 INTRODUCTION

TABLE 42 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PYREXIA/FEVER

8.2.1 RISING PREVALENCE OF INFECTIOUS DISEASES TO BOOST SEGMENT GROWTH

TABLE 43 MARKET FOR PYREXIA/FEVER, BY REGION, 2020–2027 (USD MILLION)

8.3 HYPOTHERMIA

8.3.1 INCREASING PEDIATRIC POPULATION AND SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

TABLE 44 MARKET FOR HYPOTHERMIA, BY REGION, 2020–2027 (USD MILLION)

8.4 BLOOD TRANSFUSION

8.4.1 GROWING INCIDENCE OF HEMOLYSIS AND BLOOD DONATIONS TO DRIVE SEGMENT GROWTH

TABLE 45 MARKET FOR BLOOD TRANSFUSION, BY REGION, 2020–2027 (USD MILLION)

8.5 ANESTHESIA

8.5.1 RISING MORTALITY RATE DUE TO MALIGNANT HYPERPYREXIA TO DRIVE SEGMENT GROWTH

TABLE 46 MARKET FOR ANESTHESIA, BY REGION, 2020–2027 (USD MILLION)

8.6 OTHER APPLICATIONS

TABLE 47 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

9 PATIENT TEMPERATURE MONITORING MARKET, BY END USER (Page No. - 119)

9.1 INTRODUCTION

TABLE 48 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS

9.2.1 HOSPITALS DOMINATED END USER MARKET IN 2021

TABLE 49 MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

9.3 OPERATING ROOMS

9.3.1 NECESSITY OF TEMPERATURE MONITORING DURING SURGERIES TO DRIVE SEGMENT GROWTH

TABLE 51 MARKET FOR OPERATING ROOMS, BY REGION, 2020–2027 (USD MILLION)

9.4 EMERGENCY ROOMS

9.4.1 INCREASING REQUIREMENT OF IMMEDIATE CARE TO DRIVE SEGMENT GROWTH

TABLE 52 MARKET FOR EMERGENCY ROOMS, BY REGION, 2020–2027 (USD MILLION)

9.5 INTENSIVE CARE UNITS

9.5.1 RISING NUMBER OF ILLNESSES REQUIRING CRITICAL ATTENTION FOR TREATMENT AND MONITORING TO DRIVE SEGMENT GROWTH

TABLE 53 MARKET FOR INTENSIVE CARE UNITS, BY REGION, 2020–2027 (USD MILLION)

9.6 HOME CARE SETTINGS

9.6.1 RISE IN GLOBAL GERIATRIC POPULATION REQUIRING LONG-TERM CARE TO SUPPORT SEGMENT GROWTH

TABLE 54 MARKET FOR HOME CARE SETTINGS, BY REGION, 2020–2027 (USD MILLION)

9.7 NURSING FACILITIES

9.7.1 GROWING PREVALENCE OF CHRONIC DISEASES AND DEMAND FOR SHORT-TERM NURSING CARE FACILITIES TO SUPPORT SEGMENT GROWTH

TABLE 55 MARKET FOR NURSING FACILITIES, BY REGION, 2020–2027 (USD MILLION)

9.8 AMBULATORY CARE CENTERS

9.8.1 GRADUAL SHIFT OF PATIENT CARE FROM INPATIENT TO OUTPATIENT SETTINGS TO DRIVE SEGMENT GROWTH

TABLE 56 MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2020–2027 (USD MILLION)

9.9 OTHER END USERS

TABLE 57 MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 PATIENT TEMPERATURE MONITORING MARKET, BY REGION (Page No. - 129)

10.1 INTRODUCTION

TABLE 58 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: PATIENT TEMPERATURE MONITORING MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising geriatric population and incidence of chronic diseases to drive market growth

TABLE 64 US: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 65 US: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 US: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 US: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 68 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing number of surgical procedures to propel market growth

TABLE 70 CANADA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 71 CANADA: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 CANADA: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 CANADA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 74 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 76 EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High demand for temperature monitoring devices for perioperative care to drive market growth

TABLE 81 GERMANY: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 GERMANY: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 GERMANY: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Increase in disease prevalence and healthcare expenditure to drive market growth

TABLE 87 UK: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 88 UK: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 UK: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 UK: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 91 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Strong healthcare system and growth in geriatric-pediatric population to propel segment growth

TABLE 93 FRANCE: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 94 FRANCE: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising incidence of lifestyle diseases to drive segment growth

TABLE 99 ITALY: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 100 ITALY: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 ITALY: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 ITALY: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 103 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing aging population to drive market growth

TABLE 105 SPAIN: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 106 SPAIN: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 SPAIN: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 SPAIN: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 109 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 111 REST OF EUROPE: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Large population base, increased chronic diseases, and favorable government support to drive market growth

TABLE 122 CHINA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 123 CHINA: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 CHINA: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 CHINA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 126 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Promising reimbursement scenario and well-developed healthcare system to support market growth

TABLE 128 JAPAN: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 JAPAN: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 JAPAN: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 JAPAN: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 133 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing target patient population to drive market growth

TABLE 134 INDIA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 135 INDIA: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 INDIA: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 INDIA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 138 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 140 REST OF ASIA PACIFIC: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: MARKET FOR TABLE-TOP TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET FOR HANDHELD TEMPERATURE MONITORING DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 144 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INCREASING HEALTHCARE EXPENDITURE TO SUPPORT MARKET GROWTH

TABLE 146 LATIN AMERICA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING AWARENESS INITIATIVES TO DRIVE SEGMENT GROWTH

TABLE 150 MIDDLE EAST & AFRICA: PATIENT TEMPERATURE MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY SITE, 2020–2027 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 192)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN PATIENT TEMPERATURE MONITORING MARKET

TABLE 154 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PATIENT TEMPERATURE MONITORING MANUFACTURING COMPANIES

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PATIENT TEMPERATURE MONITORING MARKET

11.4 MARKET SHARE ANALYSIS

11.4.1 PATIENT TEMPERATURE MONITORING MARKET

FIGURE 32 MARKET SHARE, BY KEY PLAYERS (2021)

TABLE 155 MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 LIST OF EVALUATED VENDORS

11.5.2 STARS

11.5.3 EMERGING LEADERS

11.5.4 PERVASIVE PLAYERS

11.5.5 PARTICIPANTS

FIGURE 33 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 34 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

11.7 COMPETITIVE BENCHMARKING

11.7.1 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

FIGURE 35 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 156 PATIENT TEMPERATURE MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 157 COMPANY PRODUCT & SERVICE FOOTPRINT

TABLE 158 COMPANY REGIONAL FOOTPRINT

TABLE 159 PATIENT TEMPERATURE MONITORING MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 160 KEY PRODUCT LAUNCHES AND REGULATORY APPROVALS

11.8.2 DEALS

TABLE 161 KEY DEALS

12 COMPANY PROFILES (Page No. - 204)

12.1 KEY PLAYERS

(Business overview, Products & services offered, Recent Developments, MNM view)*

12.1.1 CARDINAL HEALTH INC.

TABLE 162 CARDINAL HEALTH INC.: COMPANY OVERVIEW

FIGURE 36 CARDINAL HEALTH INC.: COMPANY SNAPSHOT (2021)

12.1.2 3M

TABLE 163 3M: COMPANY OVERVIEW

FIGURE 37 3M: COMPANY SNAPSHOT (2021)

12.1.3 KONINKLIJKE PHILIPS N.V.

TABLE 164 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

FIGURE 38 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

12.1.4 DRÄGERWERK AG & CO. KGAA

TABLE 165 DRÄGERWERK AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 39 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2021)

12.1.5 HILL-ROM HOLDINGS, INC.

TABLE 166 HILL-ROM HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 40 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

12.1.6 BECTON, DICKINSON AND COMPANY

TABLE 167 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

FIGURE 41 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

12.1.7 OMRON HEALTHCARE INC. (A PART OF OMRON CORPORATION)

TABLE 168 OMRON HEALTHCARE INC: COMPANY OVERVIEW

FIGURE 42 OMRON HEALTHCARE INC.: COMPANY SNAPSHOT (2021)

12.1.8 MASIMO CORPORATION

TABLE 169 MASIMO CORPORATION: COMPANY OVERVIEW

FIGURE 43 MASIMO CORPORATION: COMPANY SNAPSHOT (2021)

12.1.9 BRAUN GMBH (SUBSIDIARY OF PROCTER & GAMBLE)

TABLE 170 PROCTER & GAMBLE: COMPANY OVERVIEW

FIGURE 44 PROCTER & GAMBLE: COMPANY SNAPSHOT (2021)

12.1.10 TERUMO CORPORATION

TABLE 171 TERUMO CORPORATION: COMPANY OVERVIEW

FIGURE 45 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

*Details on Business overview, Products & services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 PAUL HARTMANN AG

TABLE 172 PAUL HARTMANN AG: COMPANY OVERVIEW

12.2.2 BEURER GMBH

TABLE 173 BEURER GMBH: COMPANY OVERVIEW

12.2.3 MICROLIFE

TABLE 174 MICROLIFE: COMPANY OVERVIEW

12.2.4 OMEGA ENGINEERING, INC.

TABLE 175 OMEGA ENGINEERING, INC.: COMPANY OVERVIEW

12.2.5 IHEALTH

TABLE 176 IHEALTH: COMPANY OVERVIEW

12.2.6 BRIGGS HEALTHCARE

TABLE 177 BRIGGS HEALTHCARE: COMPANY OVERVIEW

12.2.7 DELTATRAK, INC.

TABLE 178 DELTATRAK, INC.: COMPANY OVERVIEW

12.2.8 EXERGEN CORPORATION

TABLE 179 EXERGEN CORPORATION: COMPANY OVERVIEW

12.2.9 MEDISANA GMBH

TABLE 180 MEDISANA GMBH: COMPANY OVERVIEW

12.2.10 GERATHERM MEDICAL AG

TABLE 181 GERATHERM MEDICAL AG: COMPANY OVERVIEW

12.2.11 AMERICAN DIAGNOSTIC CORPORATION

TABLE 182 AMERICAN DIAGNOSTIC CORPORATION: COMPANY OVERVIEW

12.2.12 NURECA

TABLE 183 NURECA: COMPANY OVERVIEW

12.2.13 A&D MEDICAL

TABLE 184 A&D MEDICAL: COMPANY OVERVIEW

12.2.14 ACTHERM INC. (EASYWELL BIOMEDICALS INC.)

TABLE 185 ACTHERM INC.: COMPANY OVERVIEW

12.2.15 COSINUSS GMBH

TABLE 186 COSINUSS GMBH: COMPANY OVERVIEW

12.2.16 VANDELAY (SFT TECHNOLOGIES INDIA PVT LTD)

TABLE 187 VANDELAY: COMPANY OVERVIEW

12.2.17 KINSA

TABLE 188 KINSA: COMPANY OVERVIEW

12.2.18 EASYTEM CO., LTD.

TABLE 189 EASYTEM CO. LTD.: COMPANY OVERVIEW

12.2.19 HICKS THERMOMETERS INDIA LIMITED

TABLE 190 HICKS THERMOMETERS INDIA LIMITED: COMPANY OVERVIEW

12.2.20 SANOMEDICS, INC.

TABLE 191 SANOMEDICS, INC.: COMPANY OVERVIEW

13 APPENDIX (Page No. - 256)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

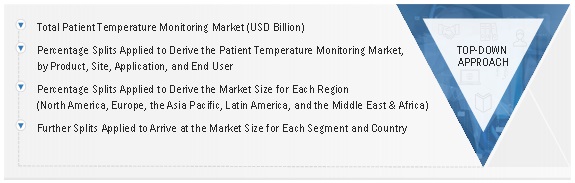

This study involved four major activities in estimating the current size of the patient temperature monitoring market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the patient temperature monitoring market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the patient temperature monitoring market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Patient Temperature Monitoring Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global patient temperature monitoring market by product, site, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall patient temperature monitoring market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the patient temperature monitoring market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Patient temperature monitoring market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company Profiles

- Additional five company profiles of players operating in the patient temperature monitoring market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Temperature Monitoring Market

What was the overall global market size of the patient temperature monitoring market in 2021?

Which industry is the largest end user in the patient temperature monitoring market?