Physiotherapy Equipment Market Size by Product (Cryotherapy, Laser Therapy, Ultrasound Therapy, Electrotherapy, and Accessories), Application (Musculoskeletal, Neurology, Pediatrics, Gynecology, Cardiovascular), End User (Hospital) & Region - Global Forecast to 2027

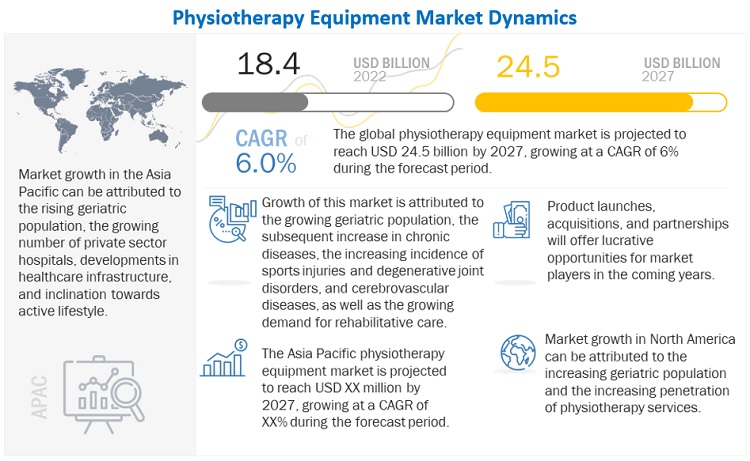

The global size of physiotherapy equipment market in terms of revenue was estimated to be worth USD 18.4 billion in 2022 and is poised to reach USD 24.5 billion by 2027, growing at a CAGR of 6.0% from 2022 to 2027. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of this market is primarily driven by the rapidly growing geriatric population, the subsequent increase in the global prevalence of chronic diseases, the growing incidence of sports injuries, degenerative joint disorders, and cerebrovascular disease, and the growing demand for rehabilitative care. However, an unstable reimbursement scenario for physiotherapy, the shortage of skilled personnel, and the presence of alternative therapies such as acupuncture are the major factors that are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Physiotherapy Equipment Market Dynamics

Driver: Growing demand for rehabilitative care

The general aim of physiotherapy and rehabilitation therapies are to improve strength and mobility and find ways around any problems. If someone has had a fall, a physiotherapist may recommend using some equipment to help with walking and an exercise program to improve balance and strength. Rehabilitation can also help with stamina management for asthma, chronic fatigue syndrome, or after major surgery.

Physiotherapy-based rehabilitative care is gaining importance globally with increasing access to more advanced medical, emergency, and trauma care. Rehabilitation care constitutes an essential aspect of care for patients who experience or are at risk of experiencing short/long-term impairment following the injuries or illness. Integrating rehabilitation care into the healthcare continuum has significantly benefited patients and caregivers. With enhanced care and quick patient recovery, healthcare providers can meet value-based care standards by reducing the patient admission time. Similarly, patients can ensure optimal outcomes for medical and surgical interventions. As a result, many healthcare facilities are integrating rehabilitation care as an essential part of their care continuum. This has resulted in an increasing demand for rehabilitation equipment and, indirectly, physiotherapy equipment as well.

Restraint: Unstable reimbursement scenario for physiotherapy

Changes in healthcare insurance policies and coverage substantially influence out-of-pocket costs for patients. This may lead to variabilities in services and impact the quality of care. The variability in coverage between and within federal and private payers often leaves patients paying out of pocket. Patients may be responsible for a co-pay, co-insurance, facility fees, and meeting a high deductible until co-insurance begins. Co-pays can cost significantly high for certain physiotherapy treatments. The associated costs can limit patients’ access to services, resulting in instances where patients do not get therapy. In contrast, some patients may be unable to resume work or engage in daily activities.

Patients are also subjected to arbitrary visit limits per year that do not fall under the initial diagnosis or severity criteria, thereby leading to variabilities in rehabilitation progress and complications. As a result, most patients surpass their limits in terms of receiving therapy under insurance benefits, and out-of-pocket payment is the only option if individuals opt to continue receiving services. Thus, variabilities in coverage will hamper the growth of the overall market.

Opportunity: Rising technological advancements

Players in the global market are increasingly focusing on technological advancements and developing new products to bring out advanced, easy-to-use devices. Advancements such as virtual reality, robotics, exoskeletons, implanted devices, and interactive video games are expected to provide market players with a wide range of opportunities. Interactive video games are increasingly being used in physical and rehabilitation centers to speed up the recovery of patients suffering from neurological disorders. Cybertherapy is another technological advancement spurring market growth. In cybertherapy, patients use a wireless interface with their doctors. The use of eTherapy is also gaining wider acceptance as it is associated with a wide range of benefits for medical professionals and patients needing physiological treatments. Such technological advances will propel the demand for physiotherapy products in the forecast period.

Challenge: Alternative therapies such as Acupuncture

Acupuncture is widely used and accepted throughout the medical community as a viable alternative to physiotherapy owing to numerous benefits, such as high patient compliance and low cost. Many physiotherapists offer acupuncture as a treatment modality as part of physiotherapy management. Acupuncture may be suggested for a variety of conditions. It is often used as an adjunct in managing acute and chronic injuries, back and neck pain, muscle and joint problems, nerve pain, headaches and migraines, and sports injuries. Owing to its wide range of benefits and low costs, many patients opt for acupuncture over other physiotherapy options, which challenges the market growth to a certain extent.

The equipment segment was the largest product segment in the physiotherapy equipment industry.

Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the global market. The equipment segment is further segment into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Owing to increasing use of electrotherapy equipment in the treatment of musculoskeletal disorders and owing to increasing concerns for patients safety and minimal/no side-effects during the physiotherapy treatments.

The musculoskeletal application segment held the largest share in the physiotherapy equipment industry.

Based on application, the global physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). The musculoskeletal applications segment holds a dominating share attributed to an increasing adoption of physiotherapies to accelerate recovery of accidental injuries, rising incidence of musculoskeletal disorders, and growth in the geriatric population.

The physiotherapy and rehabilitation centers segment held the largest end-user segment in the physiotherapy equipment industry.

Based on end users, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). The physiotherapy & rehabilitation centers segment accounted for the largest share of the global market due to increasing demand for advanced physiotherapy equipment and their wide usage across the care continuum across these centers.

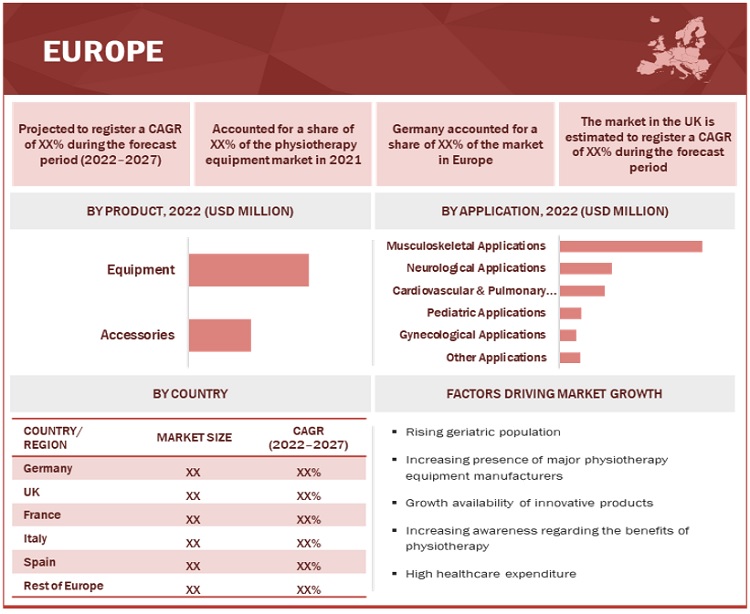

Europe accounted for the highest growth rate in the physiotherapy equipment industry.

The large share of this regional segment of the physiotherapy equipment market is attributed to a significant contribution from an economically stable and technologically advanced countries such as Germany, UK, and France. Additionally, increasing inclination for active lifestyles, rising geriatric population in Europe, increasing penetration of physiotherapy services, and favorable healthcare reforms are driving the market growth in Europe. The Asia Pacific market is projected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The physiotherapy equipment market is dominated by few globally established players such as Colfax Corp. (US), Zimmer MedizinSysteme GmbH (Germany), Zynex, Inc. (US), Performance Health (US), and ITO Co., Ltd. (Japan).

Scope of the Physiotherapy Equipment Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$18.4 billion |

|

Projected Revenue by 2028 |

$24.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.0% |

|

Market Driver |

Growing demand for rehabilitative care |

|

Market Opportunity |

Rising technological advancements |

The study categorizes the physiotherapy equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Equipment

- Electrotherapy equipment

- Ultrasound equipment

- Exercise therapy equipment

- Heat therapy equipment

- Cryotherapy equipment

- Combination therapy equipment

- Continuous passive motion therapy equipment

- Shockwave therapy equipment

- Laser therapy equipment

- Magnetic pressure therapy equipment

- Traction therapy

- Other physiotherapy equipment (hydrotherapy and vacuum therapy)

-

Accessories

- Physiotherapy Furnitures

- Other Accessories (physiotherapy tapes, bandages, braces, and support equipment)

By Application

- Musculoskeletal Applications

- Neurological Applications

- Cardiovascular & Pulmonary Applications

- Pediatric Applications

- Gynecological Applications

- Other Applications

By End User

- Physiotherapy & Rehabilitation Centers

- Hospitals

- Home Care Settings

- Physician Offices

- Other End Users

By Region

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

North America

- US

- Canada

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Physiotherapy Equipment Industry

- In February 2022, Colfax Corp (US), announced the renewal of the partnership with Professional Football Athletic Trainer Society (PFATS, US), that allowed the company to endorse and recommend its products to certified athletic trainers.

- In January 2022, BTL Industries (UK) acquired Schepp MedTech (US). This acquisition was carried out for robots to enhance BTL's already very complex physiotherapy product portfolio.

- In January 2022, Zynex, Inc. (US) announced the launch of Post-operative and OA (Osteoarthritis) knee braces. The Knee braces can limit the wear and tear on the affected joint, enabling inflammation to settle and reduce pain/degeneration of the affected knee joint and thereby delaying or minimizing the need for surgery.

- In January 2021, Dynatronic Corporation (US) launched a new bariatric stand-in table with a motorized patient lift and an H-brace treatment table.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the physiotherapy equipment market?

The physiotherapy equipment market boasts a total revenue value of $24.5 billion by 2027.

What is the estimated growth rate (CAGR) of the physiotherapy equipment market?

The global physiotherapy equipment market has an estimated compound annual growth rate (CAGR) of 6.0% and a revenue size in the region of $18.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND STUDY SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET SEGMENTATION

FIGURE 1 PHYSIOTHERAPY EQUIPMENT MARKET SEGMENTATION

FIGURE 2 PHYSIOTHERAPY EQUIPMENT MARKET REGIONAL SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH APPROACH

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 PHYSICAL THERAPY MARKET SIZE ESTIMATION

FIGURE 6 PHYSICAL THERAPY MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 PHYSICAL THERAPY MARKET SIZE ESTIMATION: SEGMENTAL EXTRAPOLATION

FIGURE 8 PHYSICAL THERAPY MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 12 PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY OVERVIEW

FIGURE 16 RISING GERIATRIC POPULATION AND INCREASING CHRONIC DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT MARKET, BY END USER AND COUNTRY (2021)

FIGURE 17 PHYSIOTHERAPY & REHABILITATION CENTERS SEGMENT TO DOMINATE ASIA PACIFIC MARKET IN 2021

4.3 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL MARKET (2022−2027)

FIGURE 19 EUROPE TO DOMINATE MARKET IN 2027

4.5 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 PHYSIOTHERAPY EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rapidly growing geriatric population and subsequent increase in prevalence of chronic diseases

TABLE 4 GERIATRIC POPULATION, BY REGION, 2018 VS. 2020

FIGURE 22 GLOBAL GERIATRIC POPULATION (65 YEARS & ABOVE), BY REGION

5.2.1.2 Growing incidence of sports injuries, degenerative joint disorders, and cerebrovascular diseases

5.2.1.3 Growing demand for rehabilitative care

5.2.2 RESTRAINTS

5.2.2.1 Unstable reimbursement scenario for physiotherapy

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Rising technological advancements

5.2.3.3 Increasing demand for home healthcare services

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled personnel

5.2.4.2 Alternative therapies such as Acupuncture

6 INDUSTRY INSIGHTS (Page No. - 60)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 INTEGRATION OF IOT IN PHYSIOTHERAPY EQUIPMENT

6.2.2 TECHNOLOGICAL ADVANCEMENTS IN PHYSIOTHERAPY EQUIPMENT

6.3 REGULATORY ANALYSIS

6.3.1 NORTH AMERICA

6.3.1.1 US

TABLE 5 US: REGULATORY PROCESS FOR MEDICAL DEVICES

6.3.1.2 Canada

6.3.2 EUROPE

6.3.3 ASIA PACIFIC

6.3.3.1 Japan

TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

6.3.3.2 China

TABLE 7 NMPA MEDICAL DEVICES CLASSIFICATION

6.3.3.3 India

6.3.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 KEY CONFERENCES AND EVENTS

TABLE 9 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY: DETAILED LIST OF CONFERENCES AND EVENTS

6.5 ECOSYSTEM ANALYSIS

FIGURE 23 ECOSYSTEM: GLOBAL MARKET (2021)

6.6 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: GLOBAL MARKET

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER'S FIVE FORCES ANALYSIS

6.7.1 THREAT OF NEW ENTRANTS

6.7.2 THREAT OF SUBSTITUTES

6.7.3 BARGAINING POWER OF SUPPLIERS

6.7.4 BARGAINING POWER OF BUYERS

6.7.5 INTENSITY OF COMPETITIVE RIVALRY

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR PHYSIOTHERAPY EQUIPMENT

FIGURE 25 GLOBAL PATENT PUBLICATION TRENDS IN GLOBAL MARKET, 2016–2021

6.8.2 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN GLOBAL MARKET

FIGURE 26 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR LATERAL FLOW ASSAYS COMPONENTS, 2016–2021

6.9 TECHNOLOGY ANALYSIS

6.10 COVID-19 IMPACT ON GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET

6.11 TRADE ANALYSIS

6.11.1 TRADE ANALYSIS FOR PHYSIOTHERAPY EQUIPMENT

FIGURE 27 EXPORTS OF MECHANO-THERAPY APPLIANCES, MASSAGE APPARATUS, PSYCHOLOGICAL APTITUDE TESTING APPARATUS, AND OTHERS, BY COUNTRY, 2021 (USD MILLION)

FIGURE 28 IMPORTS OF MECHANO-THERAPY APPLIANCES MASSAGE APPARATUS, PSYCHOLOGICAL APTITUDE TESTING APPARATUS, AND OTHERS, BY COUNTRY, 2021 (USD MILLION)

6.12 PRICING ANALYSIS

TABLE 11 ASP OF PHYSIOTHERAPY EQUIPMENT

TABLE 12 ASP OF ACCESSORIES

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

6.13.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 14 KEY BUYING CRITERIA FOR TOP 3 END USERS

7 PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT (Page No. - 77)

7.1 INTRODUCTION

TABLE 15 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 EQUIPMENT

TABLE 16 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 GLOBAL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 ELECTROTHERAPY EQUIPMENT

7.2.1.1 Neuromuscular electrical stimulation and therapeutic electrical stimulation to be used in rehabilitation settings

TABLE 18 ELECTROTHERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 19 ELECTROTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 ULTRASOUND EQUIPMENT

7.2.2.1 Ultrasound equipment to have major applications in connective tissue therapies

TABLE 20 ULTRASOUND EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 21 ULTRASOUND EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 EXERCISE THERAPY EQUIPMENT

7.2.3.1 Awareness of advantages of therapeutic exercises to drive segment

TABLE 22 EXERCISE THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 23 EXERCISE THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.4 HEAT THERAPY EQUIPMENT

7.2.4.1 Heat therapy to relax and soothe muscles by healing damaged tissues

TABLE 24 HEAT THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 25 HEAT THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.5 CRYOTHERAPY EQUIPMENT

7.2.5.1 Rising popularity of wellness and fitness to provide significant growth opportunities

TABLE 26 CRYOTHERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 27 CRYOTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.6 COMBINATION THERAPY EQUIPMENT

7.2.6.1 Wide application of combination therapy to drive segment

TABLE 28 COMBINATION THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 29 COMBINATION THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.7 CONTINUOUS PASSIVE MOTION THERAPY EQUIPMENT

7.2.7.1 Increasing number of reconstructive joint surgeries to drive segment

TABLE 30 CONTINUOUS PASSIVE MOTION THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 31 CONTINUOUS PASSIVE MOTION THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.8 SHOCKWAVE THERAPY EQUIPMENT

7.2.8.1 Fast pain relief and mobility restoration to propel segment

TABLE 32 SHOCKWAVE THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 33 SHOCKWAVE THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.9 LASER THERAPY EQUIPMENT

7.2.9.1 Light therapy to be versatile tool for physical therapy

TABLE 34 LASER THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 35 LASER THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.10 TRACTION THERAPY EQUIPMENT

7.2.10.1 Growing cases of non-traumatic spinal cord injuries to drive segment

TABLE 36 TRACTION THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 37 TRACTION THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.11 MAGNETIC PRESSURE THERAPY EQUIPMENT

7.2.11.1 Therapeutic effectiveness of magnetotherapy to be lower than other physical therapies

TABLE 38 MAGNETIC PRESSURE THERAPY EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 39 MAGNETIC PRESSURE THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.12 OTHER PHYSIOTHERAPY EQUIPMENT

TABLE 40 OTHER GLOBAL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 ACCESSORIES

TABLE 41 PHYSIOTHERAPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 PHYSIOTHERAPY ACCESSORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 PHYSIOTHERAPY FURNITURE

TABLE 43 PHYSIOTHERAPY FURNITURE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 OTHER ACCESSORIES

TABLE 44 OTHER PHYSIOTHERAPY ACCESSORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 PHYSIOTHERAPY EQUIPMENT MARKET, BY APPLICATION (Page No. - 101)

8.1 INTRODUCTION

TABLE 45 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 MUSCULOSKELETAL APPLICATIONS

8.2.1 RISING INCIDENCE OF MUSCULOSKELETAL DISORDERS TO DRIVE MARKET GROWTH

TABLE 46 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR MUSCULOSKELETAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 NEUROLOGICAL APPLICATIONS

8.3.1 INCREASING INCIDENCE OF NEUROLOGICAL DISORDERS TO DRIVE SEGMENT GROWTH

TABLE 47 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR NEUROLOGICAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 CARDIOVASCULAR & PULMONARY APPLICATIONS

8.4.1 CARDIOVASCULAR & PULMONARY APPLICATIONS TO BE FIRST RECOGNIZED CLINICAL SPECIALTY

TABLE 48 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR CARDIOVASCULAR & PULMONARY APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 PEDIATRIC APPLICATIONS

8.5.1 PEDIATRIC PHYSIOTHERAPY TO PROMOTE ACTIVITY AND PARTICIPATION IN EVERYDAY ROUTINES

TABLE 49 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR PEDIATRIC APPLICATIONS, BY COUNTRY 2020–2027 (USD MILLION)

8.6 GYNECOLOGICAL APPLICATIONS

8.6.1 GYNECOLOGICAL APPLICATIONS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 50 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR GYNECOLOGICAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 51 GLOBAL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 PHYSIOTHERAPY EQUIPMENT MARKET, BY END USER (Page No. - 109)

9.1 INTRODUCTION

TABLE 52 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2 PHYSIOTHERAPY AND REHABILITATION CENTERS

9.2.1 RISING INCIDENCE OF SPORTS INJURIES AND DISABILITIES TO SUPPORT SEGMENT GROWTH

TABLE 53 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR PHYSIOTHERAPY AND REHABILITATION CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 HOSPITALS

9.3.1 GROWING PATIENT VOLUMES AT HOSPITALS TO SUPPORT MARKET GROWTH

TABLE 54 GLOBAL MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 HOME CARE SETTINGS

9.4.1 RISING DEMAND FOR HOME CARE TO DRIVE SEGMENT

TABLE 55 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2020–2027 (USD MILLION)

9.5 PHYSICIAN OFFICES

9.5.1 PHYSICIAN OFFICES TO OFFER PREVENTIVE CARE FACILITIES WITHOUT HOSPITALIZATION

TABLE 56 GLOBAL MARKET FOR PHYSICIAN OFFICES, BY COUNTRY, 2020–2027 (USD MILLION)

9.6 OTHER END USERS

9.6.1 GROWING POPULARITY OF WELLNESS AND FITNESS TO PROVIDE GROWTH OPPORTUNITIES

TABLE 57 GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

10 PHYSIOTHERAPY EQUIPMENT MARKET, BY REGION (Page No. - 116)

10.1 INTRODUCTION

FIGURE 31 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 58 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 EUROPE

FIGURE 32 EUROPE: PHYSIOTHERAPY EQUIPMENT MARKET SNAPSHOT

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 EUROPE: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.1 GERMANY

10.2.1.1 Rising geriatric population and increase in chronic conditions to drive market

TABLE 65 GERMANY: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 66 GERMANY: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 68 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 UK

10.2.2.1 Wide acceptance of physical therapy to increase adoption of physiotherapy equipment

TABLE 70 UK: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 71 UK: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 72 UK: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 73 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 UK: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.3 FRANCE

10.2.3.1 Rising healthcare expenditure and favorable reimbursement scenario to support market growth

TABLE 75 FRANCE: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 76 FRANCE: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 79 FRANCE: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.4 ITALY

10.2.4.1 Increasing incidence of fall injuries and orthopedic disorders to support market growth

TABLE 80 ITALY: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 81 ITALY: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 82 ITALY: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 83 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 ITALY: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.5 SPAIN

10.2.5.1 Rising geriatric population to drive adoption of physiotherapy equipment

TABLE 85 SPAIN: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 86 SPAIN: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 87 SPAIN: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.6 REST OF EUROPE

TABLE 90 REST OF EUROPE: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 91 REST OF EUROPE: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

TABLE 95 NORTH AMERICA: PHYSIOTHERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.3.1 US

10.3.1.1 US to dominate North American market during forecast period

TABLE 101 US: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 102 US: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 103 US: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 104 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 105 US: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increased investments and awareness to boost physiotherapy adoption

TABLE 106 CANADA: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 CANADA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 108 CANADA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 109 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 CANADA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT MARKET SNAPSHOT

TABLE 111 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Large geriatric population to drive adoption of physiotherapy equipment

TABLE 117 JAPAN: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 119 JAPAN: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 120 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 JAPAN: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China to account for highest growth rate during forecast period

TABLE 122 CHINA: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 123 CHINA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 124 CHINA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 125 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 CHINA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Expansion of new acute care settings to drive demand for physiotherapy equipment

TABLE 127 INDIA: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 128 INDIA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 129 INDIA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 130 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 131 INDIA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 132 REST OF ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INCREASING HEALTHCARE COVERAGE AND RISING GERIATRIC POPULATION TO DRIVE MARKET GROWTH

TABLE 137 LATIN AMERICA: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 LATIN AMERICA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPROVED HEALTHCARE INFRASTRUCTURE AND AFFORDABILITY OF PHYSIOTHERAPIES TO DRIVE MARKET

TABLE 142 MIDDLE EAST & AFRICA: PHYSIOTHERAPY EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: PHYSIOTHERAPY EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 OVERVIEW

11.1.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PHYSIOTHERAPY EQUIPMENT MARKET

11.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN GLOBAL PHYSIOTHERAPY EQUIPMENT MARKET

11.3 MARKET RANKING ANALYSIS

FIGURE 35 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY RANKING, BY KEY PLAYER, 2021

11.4 COMPETITIVE BENCHMARKING

TABLE 148 PRODUCT FOOTPRINT OF COMPANIES (20 COMPANIES) (PHYSICAL THERAPY EQUIPMENT COMPANIES)

TABLE 149 APPLICATION FOOTPRINT OF COMPANIES (20 COMPANIES) (PHYSICAL THERAPY EQUIPMENT COMPANIES)

TABLE 150 REGIONAL FOOTPRINT OF COMPANIES (20 COMPANIES) (PHYSICAL THERAPY EQUIPMENT COMPANIES)

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 36 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY: COMPETITIVE LEADERSHIP MAPPING (2021)

11.6 COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (PHYSICAL THERAPY EQUIPMENT COMPANIES)

11.6.1 PROGRESSIVE COMPANIES (PHYSICAL THERAPY EQUIPMENT COMPANIES)

11.6.2 DYNAMIC COMPANIES (PHYSICAL THERAPY EQUIPMENT COMPANIES)

11.6.3 STARTING BLOCKS

11.6.4 RESPONSIVE COMPANIES (PHYSICAL THERAPY EQUIPMENT COMPANIES)

FIGURE 37 GLOBAL PHYSIOTHERAPY EQUIPMENT INDUSTRY: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2021) (PHYSICAL THERAPY EQUIPMENT COMPANIES)

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES/UPGRADES

TABLE 151 PRODUCT LAUNCHES, 2019–2022

TABLE 152 DEALS, 2019–2022

TABLE 153 OTHER DEVELOPMENTS, 2019–2022

12 COMPANY PROFILES (Page No. - 185)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 COLFAX CORP.

TABLE 154 COLFAX CORP.: COMPANY OVERVIEW

FIGURE 38 COLFAX CORP.: COMPANY SNAPSHOT (2021)

12.1.2 ZIMMER MEDIZINSYSTEME GMBH

TABLE 155 ZIMMER MEDIZINSYSTEME GMBH: COMPANY OVERVIEW

12.1.3 ZYNEX, INC.

TABLE 156 ZYNEX, INC: COMPANY OVERVIEW

FIGURE 39 ZYNEX, INC. COMPANY SNAPSHOT (2021)

12.1.4 PERFORMANCE HEALTH (SUBSIDIARY OF MADISON DEARBORN PARTNERS)

TABLE 157 PERFORMANCE HEALTH (SUBSIDIARY OF MADISON DEARBORN PARTNERS).: COMPANY OVERVIEW

12.1.5 ITO CO., LTD.

TABLE 158 ITO CO., LTD.: COMPANY OVERVIEW

12.1.6 DYNATRONICS CORPORATION

TABLE 159 DYNATRONICS CORPORATION: COMPANY OVERVIEW

FIGURE 40 DYNATRONICS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.7 BTL INDUSTRIES INC.

TABLE 160 BTL INDUSTRIES INC.: COMPANY OVERVIEW

12.1.8 ENRAF-NONIUS B.V.

TABLE 161 ENRAF-NONIUS B.V.: COMPANY OVERVIEW

12.1.9 EMS PHYSIO LTD.

TABLE 162 EMS PHYSIO LTD: COMPANY OVERVIEW

12.1.10 MECTRONIC MEDICALE

TABLE 163 MECTRONIC MEDICALE: COMPANY OVERVIEW

12.1.11 WHITEHALL MANUFACTURING

TABLE 164 WHITEHALL MANUFACTURING.: COMPANY OVERVIEW

12.1.12 RICHMAR (SUBSIDIARY OF COMPASS HEALTH BRANDS)

TABLE 165 RICHMAR: COMPANY OVERVIEW

12.1.13 LIFE CARE SYSTEMS

TABLE 166 LIFE CARE SYSTEMS: COMPANY OVERVIEW

12.1.14 STORZ MEDICAL AG

TABLE 167 STORZ MEDICAL AG: COMPANY OVERVIEW

12.1.15 METTLER ELECTRONICS CORP.

TABLE 168 METTLER ELECTRONICS CORP.: COMPANY OVERVIEW

12.1.16 ALGEOS

TABLE 169 ALGEOS.: COMPANY OVERVIEW

12.1.17 GYMNA INTERNATIONAL

TABLE 170 GYMNA INTERNATIONAL: COMPANY OVERVIEW

12.1.18 HMS MEDICAL SYSTEMS

TABLE 171 HMS MEDICAL SYSTEMS: COMPANY OVERVIEW

12.1.19 ASTAR

TABLE 172 ASTAR: COMPANY OVERVIEW

12.1.20 EMBITRON S.R.O. (A CERTICON GROUP COMPANY)

TABLE 173 EMBITRON S.R.O.: COMPANY OVERVIEW

12.2 OTHER PLAYERS

12.2.1 PROXOMED

12.2.2 TECNOBODY

12.2.3 COOLSYSTEMS, INC.

12.2.4 JOHARI DIGITAL

12.2.5 POWERMEDIC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted physical therapy equipment companies.

13 APPENDIX (Page No. - 249)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

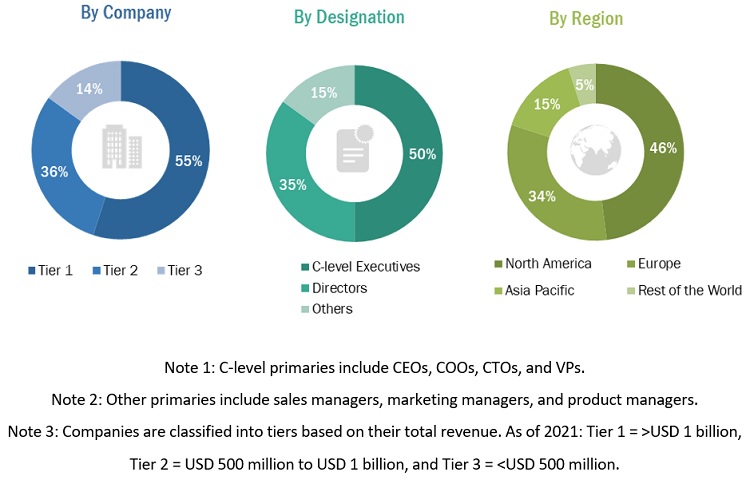

The report presents a detailed assessment of the physiotherapy equipment market, along with qualitative inputs and insights from MarketsandMarkets. This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify the segmentation types, industry trends, key players, competitive landscape of different products provided by market players, key player strategies, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; companies’ house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the physiotherapy equipment market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, managing directors, marketing heads and sales directors, marketing managers, product managers and related key executives from various key companies and organizations operating in the Physiotherapy Equipment Market. The primary sources from the demand side include physiotherapist, chiropractars hospital managers, directors, healthcare providers, and department heads.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Physical Therapy Market Size Estimation

The total size of the physiotherapy equipment market was arrived at after data triangulation from four different approaches- revenue share analysis, segmental extrapolation, demand side analysis, and primary interviews. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the physical therapy market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Objectives of the Study

- To define, describe, and forecast the physiotherapy equipment market on the basis of product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall physiotherapy equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To profile the key players and comprehensively analyze their core competencies in terms of key developments, product portfolios, and recent financials

- To track and analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the physiotherapy equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Latin America region (Brazil, Mexico, and Rest of Latin America)

How Physiotherapy Equipment Market is connected with Physiotherapy Systems Market?

The terms Physiotherapy Equipment Market and Physiotherapy Systems Market are often used interchangeably to refer to the market for devices and systems used in physiotherapy.

Physiotherapy Equipment refers to the physical devices and machines that are used in physiotherapy treatment, such as electrotherapy devices, ultrasound machines, traction devices, and exercise equipment.

Physiotherapy Systems, on the other hand, refer to the broader systems used in physiotherapy, which may include a combination of equipment, software, and services used to manage patient data, track progress, and create treatment plans.

Both the Physiotherapy Equipment Market and Physiotherapy Systems Market are part of the larger physiotherapy market, which is driven by factors such as the increasing prevalence of chronic diseases and the growing demand for non-invasive and drug-free treatment options. While they may represent different aspects of the physiotherapy market, they are closely connected and often work together to provide comprehensive care to patients.

Future hypothetic growth opportunities of Physiotherapy Systems Market

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Physiotherapy Systems: AI and ML can be used to develop systems that can analyze patient data and suggest treatment plans that are customized to the individual's needs. This can result in more effective treatments and improved patient outcomes.

Remote Physiotherapy: The COVID-19 pandemic has highlighted the importance of remote healthcare services. The use of telehealth and remote monitoring systems in physiotherapy can provide patients with access to care from the comfort of their own homes, while also allowing physiotherapists to monitor progress and make adjustments to treatment plans as needed.

Wearable Technology: The use of wearable technology, such as smart clothing and activity trackers, can provide physiotherapists with real-time data on a patient's movement and activity levels. This can be used to develop more personalized treatment plans and monitor progress.

Gamification of Physiotherapy: The use of gamification techniques, such as incorporating video games and virtual reality into physiotherapy treatments, can make treatment more engaging and motivating for patients. This can improve compliance with treatment plans and lead to better outcomes.

Data Analytics: The use of data analytics tools can provide physiotherapists with insights into patient outcomes and treatment effectiveness. This can be used to identify areas for improvement and develop more effective treatment plans.

Niche growth drivers of Physiotherapy Systems Market

Aging Population: As the population ages, the demand for physiotherapy services is expected to increase, driving demand for physiotherapy systems. This is because aging often leads to a decline in physical function and an increased risk of chronic conditions, such as arthritis and heart disease, which may require physiotherapy as part of treatment.

Increasing Prevalence of Chronic Conditions: Chronic conditions, such as diabetes, obesity, and cardiovascular disease, are on the rise globally. These conditions often require long-term management and care, which can include physiotherapy. This trend is expected to drive demand for physiotherapy systems.

Focus on Non-Invasive and Drug-Free Treatment Options: There is a growing focus on non-invasive and drug-free treatment options, particularly for conditions that require long-term management. Physiotherapy is a non-invasive treatment option that can help patients manage symptoms and improve function without the need for medication or surgery.

Technological Advancements: Technological advancements in the field of physiotherapy, such as the development of wearable technology and telehealth systems, are expected to drive growth in the Physiotherapy Systems Market. These advancements can provide patients with more personalized and convenient treatment options, and can help physiotherapists to monitor progress and make adjustments to treatment plans more effectively.

Increasing Awareness of the Benefits of Physiotherapy: There is a growing awareness of the benefits of physiotherapy, both among healthcare professionals and the general public. This is expected to drive demand for physiotherapy services and systems in the coming years.

Future niche threats of Physiotherapy Systems Market

Competition from Alternative Therapies: Physiotherapy faces competition from alternative therapies such as chiropractic, acupuncture, and massage therapy. These therapies are often perceived as more natural and less invasive than physiotherapy, and may appeal to patients who prefer alternative treatment options.

Reimbursement Issues: Reimbursement issues may pose a threat to the growth of the Physiotherapy Systems Market. Insurance coverage for physiotherapy services varies widely, and reimbursement rates can be low, which may limit access to care for some patients.

Lack of Standardization: The lack of standardization in the field of physiotherapy may pose a threat to the growth of the Physiotherapy Systems Market. There is currently no standardized approach to physiotherapy treatment, and different practitioners may use different techniques and approaches. This can make it difficult to develop and market physiotherapy systems that are widely accepted by the industry.

Regulatory Issues: Regulatory issues may pose a threat to the growth of the Physiotherapy Systems Market. Regulatory requirements for medical devices can be complex and costly, and the regulatory landscape is constantly evolving. This can make it difficult for manufacturers to bring new physiotherapy systems to market and can increase the cost of doing business in the industry.

Economic Factors: Economic factors, such as changes in healthcare policy and economic downturns, may pose a threat to the growth of the Physiotherapy Systems Market. Changes in policy or economic conditions may result in reduced funding for healthcare services, which could impact the demand for physiotherapy services and systems.

Key industries that are going to get imapcted because of the growth of Physiotherapy Systems Market

Healthcare Providers: Healthcare providers, such as hospitals, clinics, and rehabilitation centers, are likely to be impacted by the growth of the Physiotherapy Systems Market. These providers may need to invest in new physiotherapy systems to remain competitive and provide high-quality care to their patients.

Medical Device Manufacturers: Medical device manufacturers that specialize in physiotherapy systems are likely to benefit from the growth of the market. These companies may see increased demand for their products and may need to invest in research and development to keep pace with new innovations in the industry.

Insurance Companies: Insurance companies may be impacted by the growth of the Physiotherapy Systems Market if they provide coverage for physiotherapy services. As the market expands, insurance companies may need to adjust their coverage policies to meet the needs of their customers.

Fitness and Wellness Industry: The growth of the Physiotherapy Systems Market may also impact the fitness and wellness industry. As more people seek physiotherapy services for injury prevention and recovery, fitness and wellness providers may need to incorporate physiotherapy techniques into their offerings to remain competitive.

Sports Industry: The sports industry may also be impacted by the growth of the Physiotherapy Systems Market. Physiotherapy is often used in sports medicine to treat injuries and improve performance, and as the market expands, sports teams and organizations may need to invest in new physiotherapy systems to remain competitive.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Physiotherapy Equipment Market