Plant-Based Protein Market by Source (Soy, Wheat, Pea, Canola Rice & Potato, Beans & Seeds, Fermented Protein), Type (Concentrates, Isolates, Textured), Form (Dry, Liquid), Nature (Conventional, Organic), Application and Region - Global Forecast to 2028

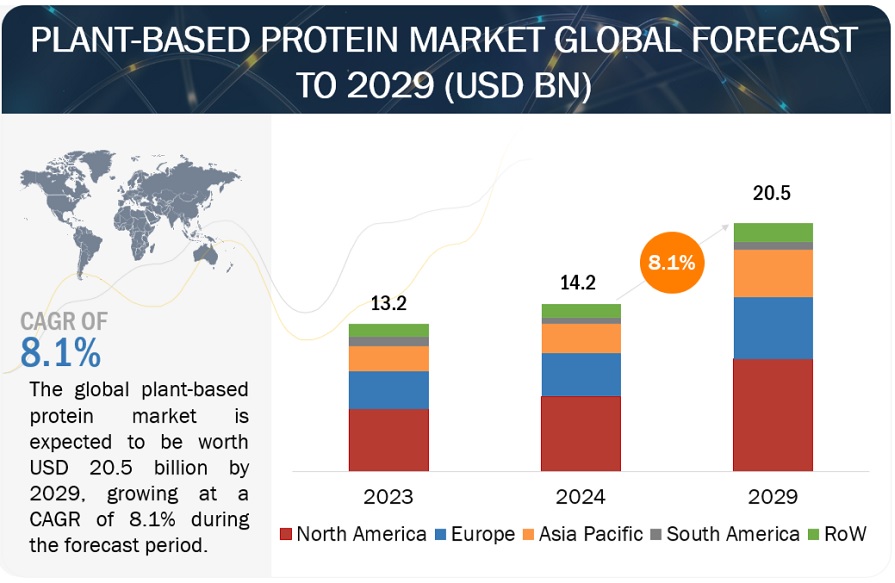

[446 Pages Report] The plant-based protein market is estimated to be valued at USD 13.3 billion in 2023 and is projected to reach USD 19.2 billion by 2028, at a CAGR of 7.7% from 2023 to 2028

In recent years, the global food industry has witnessed a significant shift in consumer preferences, with a growing demand for plant-based protein alternatives. This trend reflects changing consumer attitudes toward health, sustainability, and ethical considerations. Many consumers are becoming more health-conscious, looking for options that align with their dietary preferences and restrictions. Plant-based protein sources, such as tofu, legumes, and pea protein, are often perceived as healthier choices due to their lower saturated fat content and absence of cholesterol. Additionally, they are often rich in fiber and essential nutrients, making them attractive alternatives for those seeking to maintain a balanced diet. Environmental sustainability is another significant factor contributing to the popularity of plant-based protein. With growing concerns about the environmental impact of traditional animal agriculture, many consumers are turning to plant-based options as a more sustainable choice. The production of plant-based protein typically requires fewer natural resources, generates fewer greenhouse gas emissions, and has a lower ecological footprint, aligning with the eco-conscious preferences of modern consumers. Ethical considerations also play a substantial role in the rise of plant-based protein. An increasing number of consumers are concerned about animal welfare and the ethical treatment of animals in the food industry. Plant-based protein sources provide an ethical alternative for those who wish to reduce or eliminate their consumption of animal products, as they do not involve animal exploitation. Accessibility to a variety of innovative plant-based protein products is another driving force. With advancements in food technology and culinary innovation, there is now a wide range of plant-based protein options available, from plant-based burgers and sausages to meatless chicken and fish alternatives. These products are designed to mimic the taste and texture of traditional meat, making the transition to a plant-based diet more seamless for consumers. The rising demand for plant-based protein alternatives is a multifaceted phenomenon driven by health consciousness, environmental concerns, ethical considerations, and the availability of diverse and appealing products. As this trend continues to gain momentum, the plant-based protein market is likely to evolve even further, with increased investment in research and development, more diverse plant-based product offerings, and a broader consumer base. Whether for health, ethical, or environmental reasons, plant-based protein alternatives are transforming the way we think about and consume protein, reflecting a dynamic shift in the global food industry.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

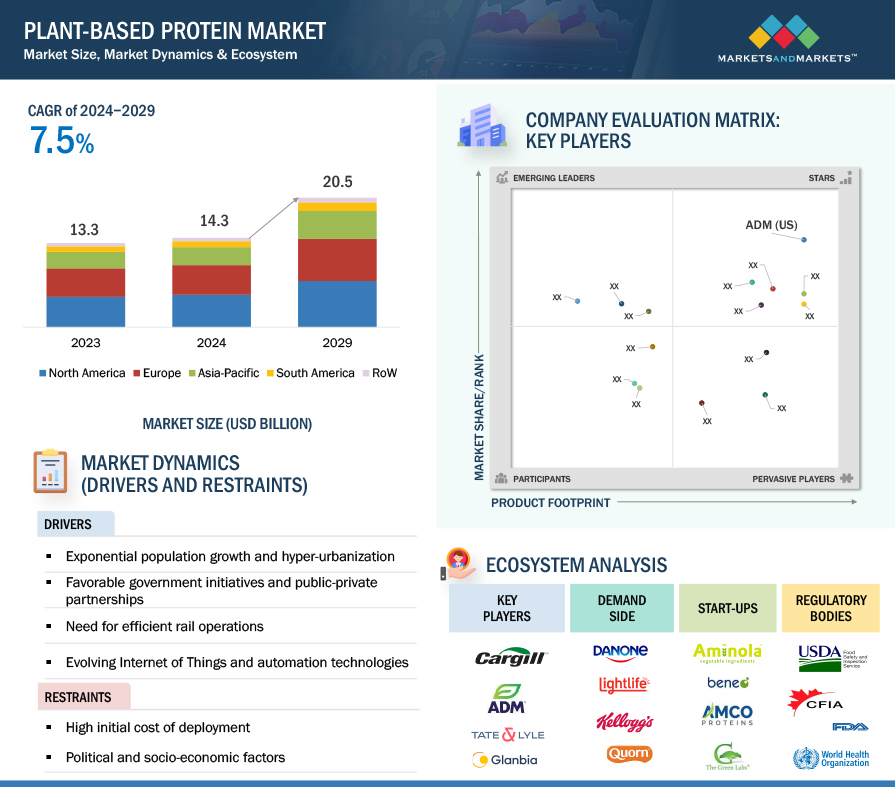

Drivers: Growth in consumer preference for a vegan diet

The surging global demand for plant-based protein products is primarily propelled by a heightened awareness among consumers regarding the benefits of incorporating these sources into their diets. Notably, developed nations like the United States and the United Kingdom have witnessed a pronounced uptick in the acceptance of plant-based protein options. Consumers in these regions are embracing plant-based proteins for their capacity to deliver essential nutrients, improve overall health, facilitate weight management, and enhance the palatability of meals. Environmental organizations emphasize the pivotal role of transitioning to plant-based proteins in mitigating the environmental footprint of food production, especially in terms of carbon emissions.

The global livestock industry bears a significant responsibility for greenhouse gas emissions, contributing approximately 18% to the total emissions across the five key sectors. Within the agricultural sector, farmed animals alone are accountable for almost 80% of these emissions. This alarming environmental impact has prompted conscientious consumers to pivot towards plant-based protein products. Recent years have witnessed a notable proliferation of new plant-based protein offerings, underscoring the mounting consumer interest and market demand. In 2021, for instance, numerous organizations registered a substantial array of plant-based protein products, distinguished by vegan or plant-based certifications or trademarks. This burgeoning product landscape reflects the escalating adoption of plant-based protein alternatives. The market for plant-based protein products is expanding rapidly to cater to a growing consumer base with a strong focus on health, sustainability, and environmental concerns. As the plant-based lifestyle continues to flourish and plant-based protein sources gain greater prominence, manufacturers and food producers are increasingly channeling investments into diversifying their plant-based protein portfolios, which is poised to positively influence the global plant-based protein market.

Restraints: Allergies associated with plant-based protein sources, such as soy & wheat

Plant-based foods and beverages offer various health benefits and essential minerals, but their consumption has been associated with allergies in some cases, which hinders market growth. For instance, soybeans are packed with nutrients like vitamins, minerals, and proteins, but they can trigger allergies due to the presence of anti-nutritional components. Soy is among the "Big Eight" allergens, responsible for 90% of food allergies, along with cow's milk, eggs, peanuts, tree nuts, wheat, fish, and shellfish. A soy allergy occurs when the human immune system mistakenly identifies harmless soy proteins as harmful and produces antibodies to combat them. Furthermore, soy protein contains high levels of phytic acid, which can potentially inhibit the absorption of essential minerals such as calcium, magnesium, copper, iron, and zinc. Soy allergies can also lead to itching, hives, and other symptoms like bloating, diarrhea, nausea, and abdominal pain.

In a 2019 study published by the National Institute of Health (NIH), wheat is recognized as a staple food and a vital nutrient source for millions of people. However, concerns about the adverse effects of wheat on health, particularly in North America and Europe, have grown in recent years. Wheat gluten proteins can trigger various adverse reactions, including allergies, celiac disease, and non-celiac gluten sensitivity in humans. Celiac disease, which often begins in early infancy, can affect genetically predisposed individuals. Allergic reactions to gluten in the diet cause inflammation and damage to the inner lining of the small intestines in celiac disease. Therefore, allergies associated with certain plant-based ingredients are expected to limit the growth of the global plant-based protein market in the forecast period.

Opportunities: Focus on aquatic plants as new & emerging sources of protein

Plant-based foods and beverages offer various health benefits and essential minerals; however, they can cause allergies in some individuals, which presents a challenge to market growth. For example, soybeans, despite their nutrient-rich profile, contain anti-nutritional components that can trigger allergies. Soy is part of the "Big Eight" allergens, alongside cow's milk, eggs, peanuts, tree nuts, wheat, fish, and shellfish, responsible for 90% of food allergies. Soy allergy occurs when the immune system mistakenly identifies harmless soy proteins as harmful, leading to allergic reactions. Additionally, soy protein contains high levels of phytic acid, which may hinder the absorption of vital minerals like calcium, magnesium, copper, iron, and zinc, potentially causing symptoms such as itching, hives, bloating, diarrhea, nausea, and abdominal pain.

Another concern revolves around wheat, which has traditionally been a staple food providing essential nutrients. However, recent years have seen rising apprehensions about its adverse health effects, particularly in North America and Europe. Wheat gluten proteins can lead to various adverse reactions, including allergies, celiac disease, and non-celiac gluten sensitivity. Celiac disease, often beginning in infancy, results from an allergic reaction to gluten in the diet, leading to inflammation and damage to the small intestine's inner lining. These allergies associated with specific plant-based ingredients are expected to limit the growth of the global plant-based protein market in the forecast period.

On the other hand, as health-conscious consumers increasingly seek personalized nutrition, there is a growing interest in harnessing aquatic plants as a source of plant-based protein and ingredients tailored to individual physiological and metabolic needs. Aquatic plants utilize natural processes, driven by sunlight and chlorophyll, to synthesize plant-based protein, making them a promising resource. With over 70% of solar energy directed at oceans and freshwater bodies, untapped potential for aquatic proteins suitable for human consumption exists in water bodies worldwide, which can be expanded through advanced aquaculture methods.

Duckweeds have garnered attention due to their capacity to remove mineral contaminants from wastewater and are found in various geographic and climatic zones. These small floating aquatic plants are becoming prominent in the fish farming industry, offering protein-rich ingredients. Companies like Hinoman, Plantible Foods, and Parabel are at the forefront of innovation in extracting proteins from aquatic sources. For example, Parabel has developed LENTENIN, derived from water lentils, with a high protein concentration of approximately 68%. In essence, aquatic plants present a significant opportunity for sourcing plant-based proteins in the evolving landscape of personalized nutrition.

Challenges: Economic constraints related to processing capacity of pea protein

The use of pea as a source of plant-based protein has seen a notable uptick, but manufacturers of pea protein face a significant challenge due to a lack of processing capacity. To make production economically viable, it's essential for food developers to find valuable uses for pea starch, which accounts for 60% of the pea volume but typically goes unused in pea protein-based products. The economic feasibility of the process hinges on whether the protein or starch is sold, and selling the protein without incurring losses on the starch could be profitable.

Beyond Meat, a US-based company, has recently entered a three-year contract with Roquette, a French company, with the aim of meeting the growing demand for plant-based food and beverages. Roquette is planning to invest over $500 million to expand its production of high-quality pea protein. While some food manufacturers, especially those producing products like veggie burgers, have relied on soybean protein due to lower costs and a stable supply, premium food product makers have turned to pea protein to meet consumer expectations for a niche ingredient known for its health benefits, hypoallergenic properties, and other functional qualities.

Based on source, the wheat sub segment is estimated to reach at USD 3.1 billion during forecasted period.

Wheat protein is obtained by separating it from other components of wheat flour, including starch, fats, fibers, and simple sugars found in the wheat kernel. There are three main types of wheat proteins: wheat protein isolates, wheat protein concentrates, and textured wheat protein, known for its rich sulfur amino acid content. According to reports from the European Vegetable Protein Association (EUVEPRO), wheat proteins are abundant in sulfur-rich amino acids, making them suitable for creating well-balanced protein supplements when combined with pulse proteins for both human and pet food. Wheat proteins are also valuable for enhancing the texture, softness, and shelf life of low-fat food products, making them a valuable addition to healthy, low-fat food items.

However, the growth of wheat proteins is limited by their gluten content, which can have severe side effects for some individuals and is considered an allergen. As per a report from the Harvard School of Public Health, one out of every 133 people in the US has Celiac disease triggered by consuming gluten-containing foods, with a staggering 83% of them either undiagnosed or misdiagnosed with other conditions. Wheat proteins have gained significant popularity as a plant-based protein choice, especially for improving the texture of meat alternatives, and this has been a key driver for the growth of wheat proteins in recent years. Consequently, companies in the plant-based protein industry are actively expanding their product offerings by introducing both textured and non-textured wheat products while also enhancing their production capabilities for textured wheat protein.

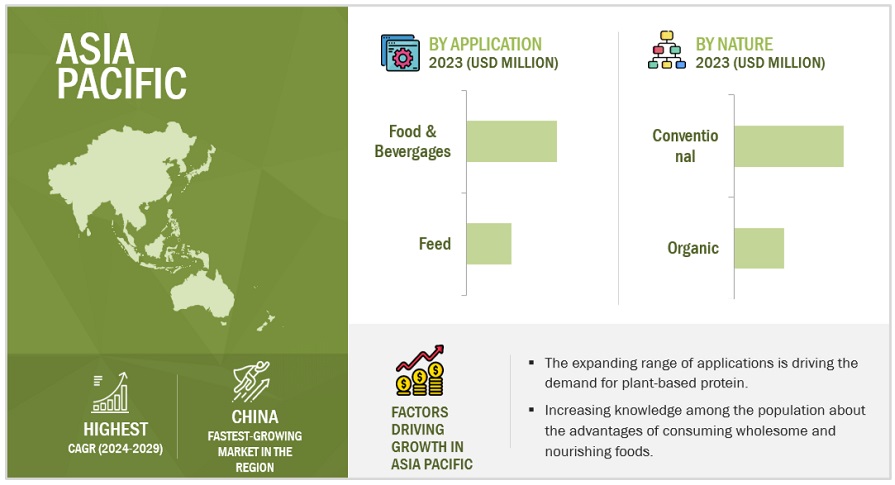

Based on applications, the food & beverages sub-segment of the plant-based protein market is anticipated to dominate the market.

The utilization of plant-based proteins in food applications has witnessed substantial growth in recent years, primarily due to the increasing adoption of plant-based meat and dairy products. This shift in consumer preferences has been driven by heightened awareness of meat-sourcing practices, their ecological impact, and concerns related to animal-borne diseases. As a result, consumers are transitioning from traditional animal-based proteins to plant-based alternatives, giving rise to a flourishing vegan trend and an influx of manufacturers in this sector.

The growing embrace of plant-based protein in diets has spurred manufacturers to enhance their product offerings. Although soy has historically been a popular choice for plant-based protein, it, along with wheat gluten, has faced criticism due to allergenic concerns. Consequently, protein manufacturers are pivoting towards alternative sources like chickpeas, lentils, and beans, which offer a rich nutritional profile and are anticipated to experience significant growth in the forecast period. For example, Parabel USA Inc. introduced water lentil protein hydrolysate in response to customer demand for plant proteins that provide complete amino acid profiles and high digestibility, with applications spanning plant-based burgers, sausages, and sports nutrition supplements. Additionally, NUTRIS Group launched faba bean protein isolate, aligning with the surging global popularity of faba bean protein, which shares functional characteristics with soy but doesn't pose major allergenic concerns and is viewed favorably by consumers.

The North American market is projected to dominate the plant-based protein market.

The increasing demand for plant-based proteins in North America can be attributed to several factors. First, ethical considerations and growing consumer awareness regarding personal and environmental health have driven many people to adopt veganism and flexitarian diets, emphasizing the importance of sustainable and cruelty-free food choices.

Additionally, a report from the Plant Based Foods Association (PBFA) in March 2022 revealed that plant-based food retail sales in the United States reached USD 7.4 billion, surpassing total food retail sales. This impressive growth of 6.1% in 2021, despite supply chain disruptions and pandemic restrictions, has sparked a continued surge in demand for plant-based foods, offering significant business opportunities for plant-based protein ingredients.

North America serves as a significant production hub for plant-based protein manufacturers. Canada stands out as a leading producer of peas, hosting numerous pea processing units, while the United States plays a crucial role in soybean and wheat production. The US is the world's top soybean producer and the second-largest exporter, with soybeans accounting for a substantial 90% of the country's oilseed production. In contrast, other oilseeds like peanuts, sunflower seeds, canola, and flax make up the remaining share. The highly diverse and multicultural population in Mexico also contributes to the high demand for protein-rich food and beverage products, bolstering the growth of plant-based protein offerings in the region.

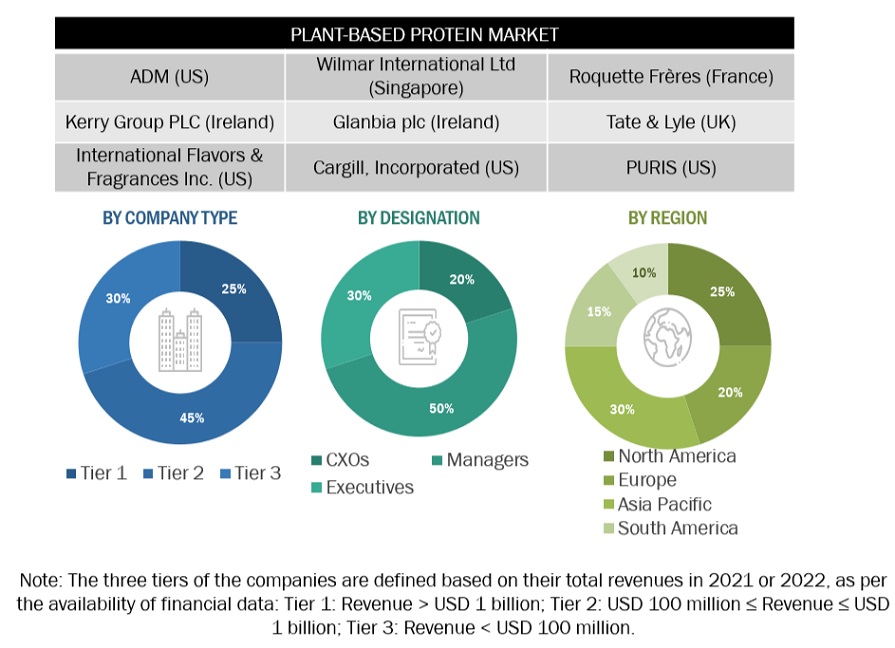

Key Market Players

The key players in this market include Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), ADM (US), Ingredion Incorporated (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), Kerry Group PLC (Ireland), DSM (Netherlands), AGT Food and Ingredients (Canada), Burcon NutraScience Corporation (Canada), Emsland Group (Germany), PURIS (US), COSUCRA (Belgium), Tate & Lyle (UK), BENEO GmbH (Germany), SOTEXPRO (France), Shandong Jianyuan group (China), AMCO Proteins (US), Axiom Foods, Inc (US), Aminola (Netherlands), The Green Labs LLC. (US), Australian Plant Proteins Pty Ltd (Australia), ETChem (China), PROEON (India), Nutraferma, Inc. (US), MycoTechnology (US), European Protein A/S (Denmark).

Other players in the ecosystems:

Batory Foods, Berkem Group, CHS Inc., Crown Soya Protein Group Company, Devansoy Inc., Fuji Oil Holdings, Gushen Biotechnology Group Co., Ltd., among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Report Metric |

Details |

Market size estimation |

2023–2028 |

Base year considered |

2022 |

Forecast period considered |

2023–2028 |

Units considered |

Value (USD) |

Segments Covered |

By Source, By Type, By Form, By Nature and By Application |

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

Companies studied |

|

Plant-based Protein Market:

By Source

- Soy

- Wheat

- Pea

- Yellow Split Peas

- Chickpeas

- Lentils

- Canola, Rice, & Potato

- Beans & Seeds

- Fermented Protein

- Soy

- Pea

- Rice

- Others

- Other Sources

By Type

- Concentrates

- Isolates

- Textured

By Form

- Dry

- Liquid

By Nature

- Conventional

- Organic

By Application

- Food & beverages

- Meat Alternatives

- Dairy Alternatives

- Bakery Products

- Performance Nutrition

- Convenience Foods

- Other Food & Beverages Applications

- Feed

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

- Other sources include jackfruit, legumes, mushrooms, quinoa, tempeh.

- Other food applications include confectioneries, beverages, baby food products, and dairy & dairy products.

- RoW includes the Middle East & Africa.

Recent Developments

- In April 2022, ADM (US) made a investment of USD 300 million to boost the production of alternative proteins at its plant in Decatur, Illinois, which will double the facility’s soy extrusion capacity. ADM, as part of the investment, is also building a Protein Innovation Center, including labs, test kitchens, and pilot-scale production capabilities, which will boost the company’s R&D capabilities.

- In April 2022, Ingredion expanded its production capacity by setting up a new manufacturing plant at Vanscoy, Canada, through the acquisition of Verdient Foods (Canada). This strategic initiative would vastly increase the company’s production capacity to produce plant-based protein.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the dairy alternatives market?

The North America region accounted for the largest share, in terms of value, of USD 4.5 billion, of the global plant-based protein market in 2022 and is expected to grow at a CAGR of 7.4%. The growing consumer base and rising demand for healthy and nutritive animal free products are expected to drive the growth of the plant-based protein market in emerging countries such as Canada, Mexico, and US.

What is the current size of the global plant-based protein market?

The plant-based protein market is estimated at USD 13.2 billion in 2023 and is projected to reach USD 19.2 billion by 2028, at a CAGR of 7.7% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include ADM (US), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France).

What are the factors driving the plant-based protein market?

Consumers inclination toward plant-based products.

Which segment by source accounted for the largest plant-based protein market share?

The soy segment dominated the market for plant-based protein market and was valued at USD 6.4 billion in 2022. The growing popularity of plant-based and vegan diets has significantly boosted the demand for plant-based protein. Soy is a prominent choice because it provides a creamy texture and a source of plant-based protein that is comparable to dairy products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant-based protein market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, the EU Commission, the European Food Safety Authority, the German Federal Institute of Risk Assessment, the Food Safety and Standards Authority of India (FSSAI), and the Japanese Ministry of Health, Labor and Welfare have referred to, to identify and collect information for this study. The secondary sources also included plant-based proteins annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The plant-based protein market comprises multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of plant-based protein products, from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

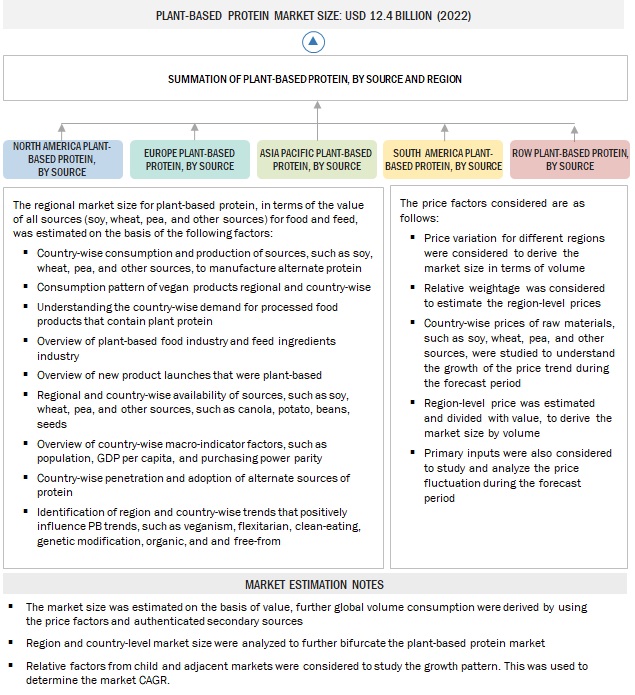

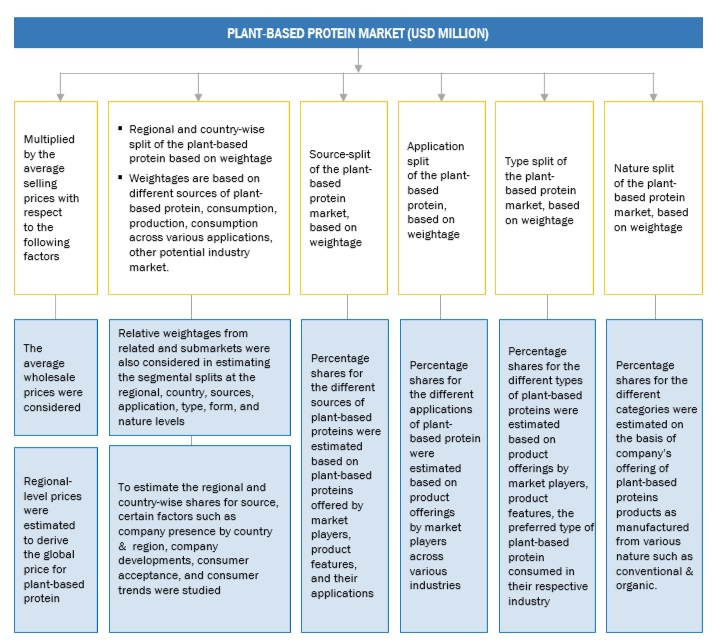

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the total size of the plant-based protein market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from industry experts (such as CEOs, vice presidents, directors, and marketing executives).

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Plant-Based Protein Market Size Estimation (Bottom-Up Approach)

Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the plant-based protein market in particular regions, and its share in the market was validated through primary interviews conducted with product manufacturers, suppliers, dealers, and distributors.

With the data triangulation procedure and validation of data through primaries, the overall size of the parent market and each segmental market were determined.

To know about the assumptions considered for the study, Request for Free Sample Report

Plant-Based Protein Market Size Estimation (Top-Down Approach)

For the estimation of the plant-based protein market, the size of the most appropriate immediate parent market was considered to implement the top-down approach. For the plant-based protein market, the plant-based food market was considered as the parent market to arrive at the market size, which was again used to estimate the size of individual markets (mentioned in the market segmentation) through percentage shares arrived from secondary and primary research.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall plant-based protein market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Plant protein refers to the derivation of protein from plant-based sources, such as pulses, grains, and seeds. Different sources of plant-based protein include soy, wheat, pea, canola, rice, and potato. Proteins are polymers of amino acids, which are used in various applications for their nutritional and functional properties. Their potential to increase the nutritional level and the resultant healthy diet makes them one of the key ingredients in both the food and feed industries.

According to the US Agency for International Development (USAID), “Soy protein concentrates (SPC), and soy protein isolates (SPI) are processed food ingredients produced from wholly defatted soy meal through a water extraction process. The resulting concentrates and isolates contain 65%-90% protein, respectively, and are used as ingredients to enrich other food products.”.

Stakeholders

- Food & beverage manufacturers, suppliers, and processors

- Research & development institutions

- Traders & retailers

- Distributors, importers, and exporters

- Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, and Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers

- Universities and industry bodies

- End users

Report Objectives

Market Intelligence

- Determining and projecting the size of the plant-based protein market with respect to source, application, formulation, distribution channel, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions and analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the plant-based protein market

- Determining the market share of key players operating in the plant-based protein market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by key players across the key regions

- Providing insights on the trade scenario

Available Customizations:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the rest of the Asia Pacific’s plant-based protein market into Singapore, Cambodia, Sri Lanka, Taiwan, Myanmar, Nepal, Tonga.

- Further breakdown of the rest of Europe's plant-based protein market into Denmark, Russia, and other EU and non-EU countries.

- Further breakdown of the Rest of South America includes Ecuador, Paraguay, Uruguay, Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant-Based Protein Market