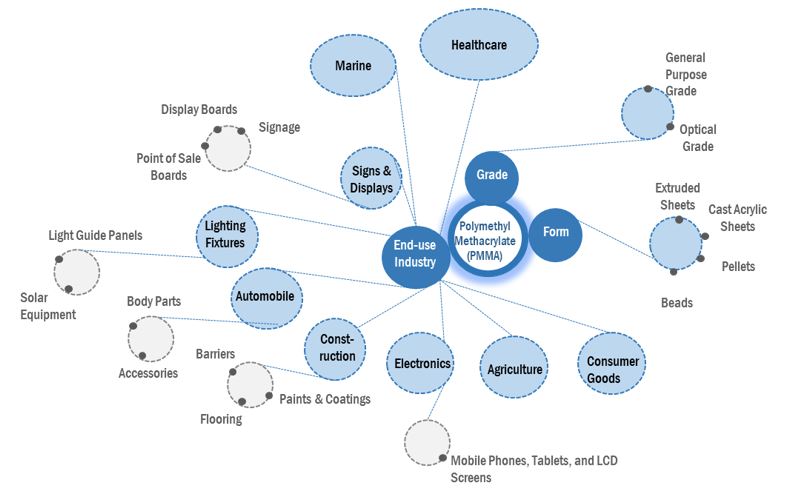

Polymethyl Methacrylate (PMMA) Market by Grade (General Purpose, Optical), Form(Extruded Sheet, Cast Acrylic Sheet, Pellets, Beads),End-Use Industry(Signs & Displays, Construction, Automotive, Lighting Fixtures, Electronics, Marine, Healthcare) & Region - Global Forecast to 2027

Polymethyl Methacrylate Market Analysis

The global polymethyl methacrylate market was valued at USD 4.8 billion in 2022 and is projected to reach USD 6.3 billion by 2027, growing at a cagr 5.4% from 2022 to 2027. Increasing usage of PMMA in automotive, construction, electronics and signs & displays are driving the demand for PMMA during the forecast period. Growth potential in emerging economies in Asia pacific region offers opportunities for PMMA market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global PMMA market

Automotive, Construction, and electronics are major end-use industries in PMMA market. COVID-19 pandemic resulted in suspension of the manufacturing facilities, declining demand for oil & gas and industrial products, and disruption of supply chain, resulting in decline of global economy in 2020. Automotive production was suspended temporarily due to lockdown and government measures. In construction industry new projects were suspended and delayed. Moreover, disruption in global supply chain resulted in global chip shortage further impacting automotive and electronics industry. PMMA manufacturers went into a temporary shutdown phase. The utilization rate declined because of labour shortage due to social distancing regulations. The pandemic impacted on the supply, demand, and prices of products. Manufacturers of PMMA witnessed a decline in revenue due to sluggish growth in the construction, electronics, and automotive market. However, due to COVID-19 pandemic, the demand for medical and healthcare goods has risen, which, in turn, support for the growth of PMMA market. In 2021-2022 with global economy returning to normal, increased vaccination and reopening of businesses, the demand expects to increase during the forecast period.

PMMA market dynamics

Driver: Expected recovery from impact of COVID-19 and rising penetration of EVs expected to drive market

Polymethyl methacrylate (PMMA) is widely used in the automotive industry as it is light in weight and weather-resistant. In automotive applications, it is utilized in body parts (including lamp covers and interior and exterior trims) and accessories (including windshields and sun visors). It is used in taillights, windshields, windscreens, side windows, instrument panels, headlamps and rear lights, lenses of exterior lights, meter panels, sun visors, car sculptures, tail lamp covers, speedometer covers, and signal lamps. It is also used as interior glazing in buses and trains.

Since 2019, conventional automobile production is affected due to declining sales, shifting consumer preferences toward EVs, changing regulatory scenarios, shift towards car rentals and ride sharing, declining per-capita spending, and economic downturn in various countries. Due to the COVID-19 pandemic and the subsequent suspension of manufacturing operations, the demand for automotive vehicles declined in 2020.

According to OICA, in 2019, automobile production declined by 5.2%, which further decreased in 2020 due to the COVID-19 pandemic. In 2020, global automobile production declined by 15.8% compared to that in 2019.

The Asia Pacific region accounts for more than 50% of the global automobile production. China, India, Japan, and South Asian countries are majorly involved in automobile production. Technological developments and innovations in the automotive sector are expected to further enhance the PMMA market in these countries. The automotive industry in Asia is expected to recover by 2022 with steady improvements in the Chinese automotive industry.

- In China, even though the automotive sector declined initially due to COVID-19, according to the China Association of Automobile Manufacturers, vehicle production in March 2020 increased as compared to that in March 2019. Demand for new energy vehicles (EVs and hybrid vehicles) increased. Automobile sales for 2020, 2019, and 2018 were 25.28 million units, 25.76 million units, and 28.04 million units respectively. During the second half of 2020, automobile sales surpassed those of the 2017–2018 levels.

- According to the National Investment Promotion and Facilitation Agency of India, vehicle production rose by 6.26% in 2019 compared to that in the previous year. Demand for EVs is expected to increase further in the near future. Automobile production is expected to reach USD 300 billion by 2026.

PMMA is used in EVs due to their high-performance characteristics compared to traditional polymer and other materials. The changing regulatory scenario and government policies to support EVs boost the growth of the PMMA market. During the COVID-19 pandemic, the sale of EVs in Europe increased by 137%, majorly driven by incentives offered under green recovery funds. In terms of sales, the market in Europe has outpaced that in China and is expected to grow significantly in the future.

Thus, due to the recovery of the automotive industry and increasing penetration of EVs worldwide, the demand for PMMA is expected to increase during the forecast period.

Restraints: Availability of low-cost substitutes expected to hamper market growth

Several alternatives to PMMA are available in the market which is restraining market growth to a certain extent. Some of the substitutes available in the market include polycarbonates (PC), polyvinyl chloride polymers, and structured multiwall sheets, among others.

Polycarbonates are new thermoplastics which are gaining traction across the world and have demand owing to their eco-friendly nature unlike materials made of glass. They are widely being used as they are readily available, cheaper, reliable, and adaptable to a variety of functions.

Polycarbonates are used in eyewear in the automotive as well as aviation industries. They serve to protect eyes from any material entering into them. Polycarbonates are utilized in manufacturing DVDs and other electronics which were previously made of glass materials. Earlier, polycarbonates were not utilized in making complex shapes. Manufacturers undertook R&D to improve the strength of polycarbonate. This resulted in lowering the cost of the polycarbonate while at the same widening the scope of its uses.

A structured multiwall sheet is an extended polycarbonate which can be utilized for various functions which are performed by glass. Applications of structured multiwalls are either indoor or outdoor, depending upon user preference. For instance, fins that create channels similar to flutes, link layers of structured multiwalls together.

Polyvinyl polymers are another highly eco-friendly alternative to PMMA. This type of polymer is economical and is used in various industries such as electronics, construction, and automobiles, among others. Other uses of polyvinyl chloride polymers include blood banks, siding, piping, and bags for tubing for insulation and wire cables, as well as windshield systems.

Opportunity: Bio-based PMMA

PMMA synthesized from petrochemicals results in environmentally corrosive by-products and releases carbon emissions. However, due to the increasing demand for PMMA, alternatives manufacturing methods by utilizing biomass and biological processes have been identified. This has resulted in the production of enzymes capable of synthesizing PMMA, thus resulting in bio-based PMMA solutions.

In addition to reduced carbon footprint, bio-based PMMA can be formulated to meet a wide range of property requirements. For instance, Plexiglas Rnew bio-based thermoplastic resin offered by Arkema (France) is such an example. Its formulation contains higher than 25% bio-renewable content, which has resulted in enhanced chemical properties in comparison to regular thermoplastics. The enhanced properties include exceptional impact and chemical resistance, a radical increase in processability by improved melt flow, high miscibility resulting in excellent transparency, and enhanced weathering and thermal properties. These have been achieved without significant alteration in properties such as optics, scratch resistance, color acceptance, and surface esthetics.

Thus, bio-based PMMA is an alternative sustainable solution for high-performance, non-renewable products. Bio-based PMMA is majorly used in applications requiring durability such as consumer, medical, optical, and automotive markets. The technological advancement is expected to boost the growth of the market for bio-based PMMA products over the coming years.

Challenges: Negative impact on the environment

PMMA is widely used for sheeting as it is readily available and cost-efficient. However, it also leads to adverse negative environmental impacts. Awareness regarding these negative environmental impacts is expected to lead to reduced demand. These factors pose a challenge to the growth of the PMMA industry.

A calculated estimate shows during the manufacture one kilogram acrylic fiber, approximately 5.5 kgs carbon dioxide is released into the ecosystem.. Under sunlight, carbon decomposition takes place from acrylic sheets, releasing fragments of carbon dioxide particles. Emitted carbon particles reach the ozone layer, leading to its significant depletion.

Acrylic sheets are recyclable. However, the process of recycling is complex and challenging. The recommended method of recycling acrylic sheets is with the use of a perspex and cutting large pieces of acrylic material into smaller pieces after which further steps are followed. The process of recycling acrylic material is a challenge and has led to too much acrylic waste materials being deposited everywhere, affecting flora and fauna ecosystems. Plants cannot grow in places which have deposits of acrylic waste materials that impact negatively the dissolution of oxygen-carbon dioxide.

PMMA has a negative environmental impact which is a major challenge for market growth. Other negative impacts of PMMAs on the environment include acidification, eutrophication, respiratory inorganics, fossil fuel depletion, carcinogenic effects, and environmental toxicity.

Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Extruded sheets is the fastest growing segment by form in the PMMA market.

Based on form, extruded sheets is estimated to be the largest and fastest growing segment of PMMA during the forecast period. The advantages of extruded sheets includes optical clarity, weather resistant, glossy surface, ease in fabrication, and others. Moreover, extruded sheets are cost effective option compared to other form.

Automotive is the fastest growing segment by end-use industry in the PMMA market.

Automotive is estimated to be the largest end-use industry segment in the PMMA market during the forecast period. PMMA is utilized in body parts, lamp cover, and interior & exterior trim in automotive industry. Increase penetration of EVs and increase preference for lightweight vehicle are one of the primary drivers in automotive market. PMMA is a lightweight material and is preferred over to traditional polymer and other materials due to due to their high-performance characteristics. Therefore, changing regulatory scenario and government policies to support EVs boost the growth of the PMMA market in forecast period.

Asia Pacific is estimated to be the largest market for PMMA.

Asia Pacifc is the largest and fastest growing market for PMMA, followed by North America and Europe. The growth of the Asia Pacifc PMMA market can be attributed to the increased demand for PMMA from various end-use industries of the region. The major end users of PMMA in Asia Pacifc include construction, automotive, electronics, signs & display, and others. China dominates the PMMA market in Asia Pacifc in terms of value and volume. Global PMMA manufacturers such as ChiMei Corporation (Taiwan), Mitsubishi Chemical Holdings Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), LG Chem Ltd. (South Korea), Kuraray Co., Ltd (Japan), Kolon Industries Inc. (South Korea), Toray Industries, Inc. (Japan), Lotte Chemical Corporation (South Korea), and others have their business operation in the region.

Key Market Players

The leading players in the PMMA market are Röhm GmbH (Germany), ChiMei Corporation (Taiwan), Mitsubishi Chemical Holdings Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Trinseo S.A. (US), Kuraray Co., Ltd (Japan), Kolon Industries Inc. (South Korea), Toray Industries, Inc. (Japan), Lotte Chemical Corporation (South Korea), Plaskolite LLC (US), and others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2021 to strengthen their position in the market. New product development, joint venture, acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for the PMMA in the emerging economies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million), Volume (Kilotons) |

|

Segments |

Grade, Form, End-use industry and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa and South America |

|

Companies |

The major players are Röhm GmbH (Germany), ChiMei Corporation (Taiwan), Mitsubishi Chemical Holdings Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Trinseo S.A. (US), Kuraray Co., Ltd (Japan), Kolon Industries Inc. (South Korea), Toray Industries, Inc. (Japan), Lotte Chemical Corporation (South Korea), Plaskolite LLC (US), and others are covered in the PMMA market. |

This research report categorizes the global PMMA market on the basis of Grade, Form, End-use industry, and Region.

PMMA market, By Form

- Extruded sheet

-

Cast acrylic sheet

- Cell Cast

- Solid Surface

- Continuous

- Composite

- Pellets

- Beads

- Others

PMMA market, By Grade

- General purpose grade

- Optical grade

PMMA market, By End-use Industry

-

Signs & displays

- Signage

- Display boards

- Point of sale boards

-

Construction

-

End-use

- Residential

- Multi-Family

- Commercial

- Industrial

-

Type

-

Barriers

- Shatterproof Glass

- Noise Barriers

-

Flooring

- PMMA Resin Flooring

- High-End Decorative Flooring

- Paints and Coatings

-

Barriers

-

End-use

-

Automotive

-

Automotive Part and Accessories

- Body parts

- Lamp covers

- Interior & Exterior trim

-

Vehicle Type

- Passenger car

- Light commercial

- Heavy Commercial Vehicles

- Quad/ATV & Side by side

- Snowmobile

- Recreational Vehicles

-

Fuel Type

- ICE vehicles (Petrol, diesel, Other)

- Electric Vehicles

-

Automotive Part and Accessories

-

Lighting Fixtures

- Light Guide Panels

- Solar Equipment

-

Electronics

- Mobile Phones, Tablets, and LCD screens

- Others

-

Marine

-

Type

- Personal Watercraft

- Commercial

- Sport watercraft/Jet Skis

-

By Accessories and Parts

- Glazing and Windows

- Consoles

- Interior Surfacing

- Sinks

- Shower Pans

- Countertops

- Wall Cladding

- Outboard Engine Covers

- Portable Tables

- Others

-

Type

-

Healthcare

- Healthcare Devices

- Furniture

- Wall Cladding

- Sanitary ware

- Others

-

Agriculture

- Glazing/ Windows

- Agriculture Machinery & Vehicles

-

Consumer Goods

- Exercise Equipment

- Homeware

- Others

- Others

PMMA market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In 2021, Trinseo completes the acquisition of Arkema’s PMMA business segment. For Trinseo, the acquisition included the addition of PMMA and MMA products and technology through seven.

- In 2021, Trinseo S.A. acquired Aristech Surfaces LLC. Aristech Surfaces is a North America-based manufacturer of PMMA continuous cast and solid surface sheets.

- In 2021, Plaskolite LLC acquired Plazit-Polygal (Israel), manufacturer of engineering thermoplastic sheets. Plaskolite is expected to acquire Plazit-Polygal's operations and assets in North America, South America, and Europe.

- In 2021, Rohm GmbH built a plant with a capacity of 250,000 tons per year methyl methacrylate (MMA) on the US Gulf Coast.

- In 2021, Sumitomo Chemical planned to construct a pilot facility for recycling acrylic resin at Niihama City, Japan. The project is expected to be completed in 2022.

- In 2018, Mitsubishi Chemical Corporation in joint venture with Saudi Basic Industries Corporation commences the production plant for methyl methacrylate monomers and polymethyl methacrylate (PMMA) in Saudi Arabia.

- In 2018, Plaskolite LLC acquired Covestro US polycarbonate sheet manufacturing business. The acquisition is expected to expand the company’s business in North America.

Key Questions addressed by the report

- What was the market size of PMMA and the estimated share of each region in 2021, in terms of volume and value?

- What will be the CAGR of the PMMA market in all the key regions during the forecast period?

- What is the estimated demand for PMMA in the various end-use industry?

- What are the industry trends in PMMA market?

- Who are the major players in the market region-wise?

- What is the impact of the COVID-19 pandemic on the PMMA market?

FAQ:

What is the major driver influencing the growth of the PMMA market?

The major drivers influencing the growth of PMMA are increasing demand from the electronics and automobile industry.

How is the PMMA market segmented by end-use industry?

The PMMA market is segmented on the basis of end-use industry as Signs & Displays, Construction, Automotive, Lighting Fixtures, Electronics, Marine, Healthcare, Agriculture, Consumer Goods, and Others.

What is the major challenge in the PMMA market?

The major challenges in PMMA market are its negative impact on environment.

How is the PMMA market segmented by the grade?

The PMMA market is segmented on the basis of grade as General Purpose Grade and Optical Grade.

How is the PMMA market segmented by the form?

The PMMA market is segmented on the basis of form as Extruded Sheet, Cast Acrylic Sheet, Pellets, and Beads.

What are the major opportunities in the PMMA market?

Bio-based PMMA is an opportunity for the PMMA market.

Which region has the largest market for PMMA?

Asia pacific has the largest market for PMMA owing to the increase in demand from China.

How market segments for PMMA by region?

On the basis of region the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and South America.

What is PMMA?

Polymethyl methacrylate (PMMA) is a transparent thermoplastic and impact-resistant substitute for glass. It is highly durable and offers the advantage of being chemical and impact resistance. It is lightweight, rigid, and offers versatility in color.

Who are the major manufacturers of PMMA?

The major manufacturers of PMMA are are Röhm GmbH (Germany), ChiMei Corporation (Taiwan), Mitsubishi Chemical Holdings Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Trinseo S.A. (US), Kuraray Co., Ltd (Japan), Kolon Industries Inc. (South Korea), Toray Industries, Inc. (Japan), Lotte Chemical Corporation (South Korea), Plaskolite LLC (US), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 RESEARCH SCOPE: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET SCOPE

FIGURE 1 PMMA: MARKET SEGMENTATION

FIGURE 2 PMMA: END-USE INDUSTRY

1.2.3 REGIONS AND COUNTRIES COVERED

1.2.4 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 3 PMMA MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 List of participating industry experts

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 DEMAND-SIDE: ASCERTAINING CONSUMPTION OF PMMA IN AUTOMOTIVE APPLICATION

FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE

2.2.2 SUPPLY-SIDE: FROM OVERALL CONSUMPTION OF EXTRUDED SHEETS

2.2.3 TOP-DOWN APPROACH: PMMA MARKET

FIGURE 5 MARKET SIZE ESTIMATION – SUPPLY-SIDE AND TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 PMMA MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.5.1 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 7 EXTRUDED SHEETS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

FIGURE 8 CONSTRUCTION SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

FIGURE 9 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 ATTRACTIVE OPPORTUNITIES IN PMMA MARKET

FIGURE 10 INCREASING USE OF PMMA IN AUTOMOTIVE AND BUILDING & CONSTRUCTION MATERIALS IN EMERGING ECONOMIES TO DRIVE DEMAND

4.2 PMMA MARKET IN ASIA PACIFIC, BY GRADE

FIGURE 11 GENERAL PURPOSE GRADE TO LEAD PMMA MARKET IN ASIA PACIFIC

4.3 PMMA MARKET, BY COUNTRY

FIGURE 12 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

FIGURE 13 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Recovery from impact of COVID-19 and rising penetration of EVs expected to drive market

TABLE 1 COUNTRY-WISE AUTOMOTIVE PRODUCTION, 2018–2020 (UNIT)

FIGURE 14 GLOBAL PROVISIONAL PRODUCTION DATA FOR ALL VEHICLES

5.2.1.2 Rising demand for LED flat screens

5.2.1.3 Rising demand from electronics industry

FIGURE 15 DURABLE GOODS MANUFACTURING INDEX, 2016 TO 2021

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost substitutes expected to hamper market growth

5.2.3 OPPORTUNITIES

5.2.3.1 Bio-based PMMA

5.2.4 CHALLENGES

5.2.4.1 Negative impact on environment

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 POLYMETHYL METHACRYLATE (PMMA) MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 PMMA: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP GROWTH PROJECTION WORLDWIDE

TABLE 3 GDP GROWTH PROJECTION WORLDWIDE

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS OF POLYMETHYL METHACRYLATE (PMMA) MARKET

5.5.1 DISRUPTIONS DUE TO COVID-19

5.6 REGULATORY LANDSCAPE

5.7 ECOSYSTEM MARKET MAP

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 18 SHIFT IN IMPERATIVES & OUTCOMES IN APPLICATIONS SUCH AS AUTOMOTIVE INDUSTRY ARE EXPECTED TO LEAD TO CHANGE IN FUTURE REVENUE MIX!!

5.9 SCENARIO ANALYSIS OF PMMA MARKET

FIGURE 19 PMMA MARKET, IN TERMS OF VALUE, BASED ON SCENARIO ANALYSIS, 2020–2027 (USD MILLION)

5.10 PRICING ANALYSIS

5.10.1 FACTORS AFFECTING PRICES OF PMMA

FIGURE 20 AVERAGE PRICING OF PMMA

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DIFFERENT GRADES

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DIFFERENT GRADES (%)

5.11.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR DIFFERENT GRADES

TABLE 5 KEY BUYING CRITERIA FOR DIFFERENT GRADES

5.12 CASE STUDY ANALYSIS

5.13 ADJACENT MARKETS

5.13.1 INTRODUCTION

5.13.2 LIMITATIONS

5.13.3 ACRYLIC RESINS MARKET

5.13.3.1 Market definition

5.13.3.2 Acrylic resins market, by chemistry

TABLE 6 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2016–2019 (KILOTON)

TABLE 7 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2020–2025 (KILOTON)

TABLE 8 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2016–2019 (USD MILLION)

TABLE 9 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2020–2025 (USD MILLION)

5.13.3.3 Acrylic resins market, by solvency

TABLE 10 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2016–2019 (KILOTON)

TABLE 11 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2020–2025 (KILOTON)

TABLE 12 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2016–2019 (USD MILLION)

TABLE 13 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2020–2025 (USD MILLION)

5.13.3.4 Acrylic resins market, by application

TABLE 14 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 15 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 16 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

5.13.3.5 Acrylic resins market, by end-use industry

TABLE 18 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 19 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 20 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 21 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

5.13.3.6 Acrylic resins market, by region

TABLE 22 ACRYLIC RESINS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 23 ACRYLIC RESINS MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 24 ACRYLIC RESINS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 ACRYLIC RESINS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

5.13.4 METHYL METHACRYLATE ADHESIVES MARKET

5.13.4.1 Market definition

5.13.4.2 MMA adhesives market, by substrate

TABLE 26 MMA ADHESIVES MARKET SIZE, BY SUBSTRATE, 2016–2023 (USD MILLION)

TABLE 27 MMA ADHESIVES MARKET SIZE, BY SUBSTRATE, 2016–2023 (KILOTON)

5.13.4.3 MMA adhesives market, by end-use industry

TABLE 28 MMA ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2023 (USD MILLION)

TABLE 29 MMA ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2023 (KILOTON)

5.13.4.4 MMA adhesives market, by region

TABLE 30 MMA ADHESIVES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 31 MMA ADHESIVES MARKET SIZE, BY REGION, 2016–2023 (KILOTON)

5.14 TRADE ANALYSIS

5.14.1 MAJOR IMPORTERS

TABLE 32 MAJOR IMPORTERS OF PMMA IN PRIMARY FORMS, 2018–2020 (USD THOUSAND)

TABLE 33 MAJOR IMPORTERS OF PMMA IN PRIMARY FORMS (USD THOUSAND), (Q1-2020 TO Q1-2021)

5.14.2 MAJOR EXPORTERS

TABLE 34 MAJOR EXPORTERS OF PMMA IN PRIMARY FORMS, 2018–2020 (USD THOUSAND)

TABLE 35 MAJOR EXPORTERS OF PMMA IN PRIMARY FORMS (USD THOUSAND), (Q1-2020 TO Q1-2021)

5.15 TECHNOLOGY ANALYSIS

5.16 FACTORS AFFECTING GROWTH FORECAST AND IMPACT OF COVID-19

FIGURE 23 FACTORS AFFECTING GROWTH FORECAST AND IMPACT OF COVID-19

5.17 KEY CONFERENCES & EVENTS IN 2022-2023

5.18 PATENT ANALYSIS

5.18.1 INTRODUCTION

5.18.2 METHODOLOGY

5.18.3 DOCUMENT TYPE

FIGURE 24 NUMBER OF PATENTS FILED DURING LAST TEN YEARS

5.18.4 PUBLICATION TRENDS - LAST TEN YEARS

FIGURE 25 YEAR-WISE DATA FOR NUMBER OF PATENTS PUBLISHED, 2011–2021

5.18.5 INSIGHTS

5.18.6 LEGAL STATUS OF PATENTS

FIGURE 26 LEGAL STATUS

5.18.7 JURISDICTION ANALYSIS

FIGURE 27 PATENT ANALYSIS FOR TOP TEN JURISDICTIONS BY DOCUMENT

5.18.8 TOP COMPANIES/APPLICANTS

FIGURE 28 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2011–2021

TABLE 36 LIST OF PATENTS BY EVONIK ROHM GMBH

TABLE 37 LIST OF PATENTS BY HERAEUS MEDICAL GMBH

TABLE 38 LIST OF PATENTS BY LG CHEMICAL LTD.

TABLE 39 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

6 PMMA MARKET, BY GRADE (Page No. - 108)

6.1 INTRODUCTION

FIGURE 29 OPTICAL GRADE SEGMENT TO LEAD

TABLE 40 PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 41 PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 42 PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 43 PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

6.2 GENERAL PURPOSE GRADE

6.2.1 SUITABILITY IN WIDE RANGE OF APPLICATIONS EXPECTED TO SUPPORT MARKET GROWTH

TABLE 44 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 45 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 47 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.3 OPTICAL GRADE

6.3.1 TRANSPARENCY PROPERTY MAKES IT SUITABLE FOR USE IN VARIOUS INDUSTRIAL APPLICATIONS

TABLE 48 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 49 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 50 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 51 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7 PMMA MARKET, BY FORM (Page No. - 114)

7.1 INTRODUCTION

FIGURE 30 EXTRUDED SHEETS FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 52 PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 53 PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 54 PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 55 PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

7.2 EXTRUDED SHEETS

7.2.1 RISING PENETRATION IN INTRICATE SHAPE APPLICATIONS TO DRIVE MARKET

TABLE 56 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 58 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 59 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.3 CAST ACRYLIC SHEETS

7.3.1 ENHANCED SURFACE FINISHING AND OPTICAL CLARITY CHARACTERISTICS SUPPORT MARKET GROWTH

TABLE 60 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 61 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2017–2019 (KILOTON)

TABLE 63 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 64 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 65 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 66 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 67 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.4 PELLETS

7.4.1 RISING USAGE IN LENSES, LAMPS, AND AUTOMOTIVE SECTOR TO DRIVE MARKET

TABLE 68 PELLETS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 69 PELLETS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 70 PELLETS MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 71 PELLETS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7.5 BEADS

7.5.1 PRODUCED THROUGH SUSPENSION POLYMERIZATION

TABLE 72 BEADS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 73 BEADS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 74 BEADS MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 75 BEADS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8 PMMA MARKET, BY END-USE INDUSTRY (Page No. - 124)

8.1 INTRODUCTION

FIGURE 31 CONSTRUCTION SEGMENT TO LEAD PMMA MARKET DURING FORECAST PERIOD

TABLE 76 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 77 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 78 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 79 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

8.2 SIGNS & DISPLAYS

8.2.1 DEVELOPMENT OF INFRASTRUCTURE DRIVES DEMAND FOR PMMA

8.2.2 SIGNAGE

8.2.3 DISPLAY BOARDS

8.2.4 POINT OF SALE BOARDS

TABLE 80 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2017–2019 (USD MILLION)

TABLE 81 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE 2017–2019 (KILOTON)

TABLE 83 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2020–2027 (KILOTON)

TABLE 84 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2017–2019 (USD MILLION)

TABLE 85 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2020–2027 (USD MILLION)

TABLE 86 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION 2017–2019 (KILOTON)

TABLE 87 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2020–2027 (KILOTON)

8.3 CONSTRUCTION

8.3.1 RISE IN GLOBAL CONSTRUCTION OUTPUT TO INCREASE DEMAND FOR PMMA

8.3.2 BY END-USE

8.3.2.1 Residential

8.3.2.2 Multi-family

8.3.2.3 Commercial

8.3.2.4 Industrial

TABLE 88 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2017–2019 (USD MILLION)

TABLE 89 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2020–2027 (USD MILLION)

TABLE 90 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE 2017–2019 (KILOTON)

TABLE 91 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2020–2027 (KILOTON)

8.3.3 BY TYPE

8.3.3.1 Barriers

8.3.3.1.1 Shatterproof glass

8.3.3.1.2 Noise barriers

TABLE 92 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2017–2019 (USD MILLION)

TABLE 93 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2020–2027 (USD MILLION)

TABLE 94 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS 2017–2019 (KILOTON)

TABLE 95 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2020–2027 (KILOTON)

8.3.3.2 Flooring

8.3.3.2.1 PMMA resin flooring

8.3.3.2.2 High-end decorative flooring

TABLE 96 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2017–2019 (USD MILLION)

TABLE 97 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2020–2027 (USD MILLION)

TABLE 98 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING 2017–2019 (KILOTON)

TABLE 99 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2020–2027 (KILOTON)

8.3.4 PAINTS & COATINGS

TABLE 100 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2017–2019 (USD MILLION)

TABLE 101 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE 2017–2019 (KILOTON)

TABLE 103 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2020–2027 (KILOTON)

TABLE 104 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2017–2019 (USD MILLION)

TABLE 105 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2020–2027 (USD MILLION)

TABLE 106 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION 2017–2019 (KILOTON)

TABLE 107 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2020–2027 (KILOTON)

8.4 AUTOMOTIVE

8.4.1 HIGH USAGE IN AUTOMOTIVE INDUSTRY AS AN ALTERNATIVE TO GLASS

8.4.2 AUTOMOTIVE PARTS & ACCESSORIES

8.4.2.1 Body parts

8.4.2.2 Lamp covers

8.4.2.3 Interior and exterior trim

TABLE 108 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2017–2019 (USD MILLION)

TABLE 109 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2020–2027 (USD MILLION)

TABLE 110 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES 2017–2019 (KILOTON)

TABLE 111 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2020–2027 (KILOTON)

8.4.3 VEHICLE TYPE

8.4.3.1 Passenger cars

8.4.3.2 Light commercial vehicles

8.4.3.3 Heavy commercial vehicles

8.4.3.4 Quad/ATV & side by side

8.4.3.5 Snowmobiles

8.4.3.6 Recreation vehicles

TABLE 112 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 113 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2020–2027 (USD MILLION)

TABLE 114 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2017–2019 (KILOTON)

TABLE 115 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2020–2027 (KILOTON)

8.4.4 FUEL TYPE

8.4.4.1 ICE vehicles (petrol, diesel, other)

8.4.4.2 Electric vehicles

TABLE 116 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2017–2019 (USD MILLION)

TABLE 117 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2020–2027 (USD MILLION)

TABLE 118 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2017–2019 (KILOTON)

TABLE 119 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2020–2027 (KILOTON)

TABLE 120 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2019 (USD MILLION)

TABLE 121 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2027 (USD MILLION)

TABLE 122 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION 2017–2019 (KILOTON)

TABLE 123 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2027 (KILOTON)

8.5 LIGHTING FIXTURES

8.5.1 RISING DEMAND FOR LIGHTING IN VEHICLES

8.5.2 LIGHT GUIDE PANELS

8.5.3 SOLAR EQUIPMENT

TABLE 124 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 125 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE 2017–2019 (KILOTON)

TABLE 127 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2020–2027 (KILOTON)

TABLE 128 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2017–2019 (USD MILLION)

TABLE 129 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2020–2027 (USD MILLION)

TABLE 130 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION 2017–2019 (KILOTON)

TABLE 131 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2020–2027 (KILOTON)

8.6 ELECTRONICS

8.6.1 CHANGING LIFESTYLES INCREASE DEMAND IN ELECTRONICS

8.6.2 MOBILE PHONES, TABLETS, AND LCD SCREENS

8.6.3 OTHERS

TABLE 132 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2017–2019 (USD MILLION)

TABLE 133 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE 2017–2019 (KILOTON)

TABLE 135 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2020–2027 (KILOTON)

TABLE 136 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 137 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 138 PMMA MARKET SIZE IN ELECTRONICS, BY REGION 2017–2019 (KILOTON)

TABLE 139 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2020–2027 (KILOTON)

8.7 MARINE

8.7.1 INCREASED UTILIZATION IN WINDOW/GLAZING APPLICATIONS

8.7.2 ACCESSORIES AND PARTS

8.7.2.1 Interior surfacing

8.7.2.2 Consoles

8.7.2.3 Glazing/windows

8.7.2.4 Sinks

8.7.2.5 Shower pans

8.7.2.6 Counter tops

8.7.2.7 Wall cladding

8.7.2.8 Outboard engine covers

8.7.2.9 Portable tables

8.7.2.10 Others

TABLE 140 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2017–2019 (USD MILLION)

TABLE 141 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2020–2027 (USD MILLION)

TABLE 142 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2017–2019 (KILOTON)

TABLE 143 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2020–2027 (KILOTON)

8.7.3 TYPE

8.7.3.1 Personal watercraft

8.7.3.2 Commercial

8.7.3.3 Sports watercraft/ jet skis

TABLE 144 PMMA MARKET SIZE IN MARINE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 145 PMMA MARKET SIZE IN MARINE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 PMMA MARKET SIZE IN MARINE, BY TYPE 2017–2019 (KILOTON)

TABLE 147 PMMA MARKET SIZE IN MARINE, BY TYPE, 2020–2027 (KILOTON)

TABLE 148 PMMA MARKET SIZE IN MARINE, BY REGION, 2017–2019 (USD MILLION)

TABLE 149 PMMA MARKET SIZE IN MARINE, BY REGION, 2020–2027 (USD MILLION)

TABLE 150 PMMA MARKET SIZE IN MARINE, BY REGION 2017–2019 (KILOTON)

TABLE 151 PMMA MARKET SIZE IN MARINE, BY REGION, 2020–2027 (KILOTON)

8.8 HEALTHCARE

8.8.1 STEADY INCREASE IN HEALTHCARE DEVICES TO INCREASE DEMAND

8.8.2 HEALTHCARE DEVICES

8.8.3 FURNITURE

8.8.4 WALL CLADDING

8.8.5 SANITARYWARE

8.8.6 OTHERS

TABLE 152 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 153 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE 2017–2019 (KILOTON)

TABLE 155 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2020–2027 (KILOTON)

TABLE 156 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 157 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2020–2027 (USD MILLION)

TABLE 158 PMMA MARKET SIZE IN HEALTHCARE, BY REGION 2017–2019 (KILOTON)

TABLE 159 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2020–2027 (KILOTON)

8.9 AGRICULTURE

8.9.1 STEADY INCREASE IN GREENHOUSES TO DRIVE DEMAND

8.9.2 GLAZING/WINDOWS

8.9.3 AGRICULTURE MACHINERY & VEHICLES

TABLE 160 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 161 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE 2017–2019 (KILOTON)

TABLE 163 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2020–2027 (KILOTON)

TABLE 164 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2017–2019 (USD MILLION)

TABLE 165 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2020–2027 (USD MILLION)

TABLE 166 PMMA MARKET SIZE IN AGRICULTURE, BY REGION 2017–2019 (KILOTON)

TABLE 167 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2020–2027 (KILOTON)

8.10 CONSUMER GOODS

8.10.1 INCREASED UTILIZATION IN HOMEWARE APPLICATION

8.10.2 EXERCISE EQUIPMENT

8.10.3 HOMEWARE

8.10.4 OTHERS

TABLE 168 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2017–2019 (USD MILLION)

TABLE 169 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE 2017–2019 (KILOTON)

TABLE 171 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2020–2027 (KILOTON)

TABLE 172 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017–2019 (USD MILLION)

TABLE 173 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020–2027 (USD MILLION)

TABLE 174 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION 2017–2019 (KILOTON)

TABLE 175 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020–2027 (KILOTON)

8.11 OTHERS

TABLE 176 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 177 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 178 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION 2017–2019 (KILOTON)

TABLE 179 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (KILOTON)

9 PMMA MARKET,BY REGION (Page No. - 164)

9.1 INTRODUCTION

FIGURE 32 CHINA AND INDIA ARE EMERGING AS STRATEGIC LEADERS IN PMMA MARKET

TABLE 180 PMMA MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 181 PMMA MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 182 PMMA MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

TABLE 183 PMMA MARKET SIZE, BY REGION, 2020–2027 KILOTON)

9.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: PMMA MARKET SNAPSHOT

TABLE 184 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 185 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

TABLE 187 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 188 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 189 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 191 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 192 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 193 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 195 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 196 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 197 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 199 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

9.2.1 CHINA

9.2.1.1 Growth of manufacturing sector and upcoming government policies are key drivers

FIGURE 34 AUTOMOTIVE PRODUCTION (MILLION UNITS), 2019-2021

TABLE 200 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 201 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 202 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 203 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 204 CHINA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 205 CHINA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 206 CHINA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 207 CHINA: PMMA MARKET SIZE BY GRADE, 2020–2027 (KILOTON)

9.2.2 INDIA

9.2.2.1 Attractiveness of construction and automotive markets drives demand for PMMA

FIGURE 35 AUTOMOTIVE PRODUCTION (MILLION UNIT), 2019-2021

TABLE 208 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 209 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 210 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 211 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 212 INDIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 213 INDIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 214 INDIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 215 INDIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.2.3 JAPAN

9.2.3.1 Government support to boost industry growth helping drive market

TABLE 216 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 217 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 218 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 219 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 220 JAPAN: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 221 JAPAN: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 222 JAPAN: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 223 JAPAN: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Growth of automotive manufacturing industry to drive market

TABLE 224 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 225 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 226 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 227 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 228 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 229 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 230 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 231 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.2.5 AUSTRALIA & NEW ZEALAND

9.2.5.1 Market growth driven by increasing demand in automotive industry

TABLE 232 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 233 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 234 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 235 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 236 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 237 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 238 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 239 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.2.6 MALAYSIA

9.2.6.1 National Automotive Policy (NAP)2020 to support automotive industry and fuel PMMA market

TABLE 240 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 241 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 242 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 243 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 244 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 245 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 246 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 247 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.2.7 REST OF ASIA PACIFIC

TABLE 248 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 249 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 250 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 251 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 252 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 253 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 254 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 255 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.3 EUROPE

FIGURE 36 EUROPE: PMMA MARKET SNAPSHOT

TABLE 256 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 257 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 258 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

TABLE 259 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 260 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 261 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 262 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 263 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 264 EUROPE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 265 EUROPE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 266 EUROPE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 267 EUROPE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 268 EUROPE: PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 269 EUROPE: PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 270 EUROPE: PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 271 EUROPE: PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Increasing demand from automobile sector is a key driver

FIGURE 37 GERMANY AUTOMOTIVE PRODUCTION & SALES (MILLION UNIT), 2019 – 2021

TABLE 272 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 273 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 274 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 275 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 276 GERMANY: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 277 GERMANY: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 278 GERMANY: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 279 GERMANY: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.3.2 FRANCE

9.3.2.1 Rising automobile production and output from construction drive market

FIGURE 38 FRANCE: CONSTRUCTION OUTPUT, 2020-2021

TABLE 280 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 281 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 282 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 283 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 284 FRANCE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 285 FRANCE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 286 FRANCE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 287 FRANCE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.3.3 ITALY

9.3.3.1 Growth of automotive industry in Italy is a key driver for PMMA market

TABLE 288 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 289 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 290 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 291 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 292 ITALY: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 293 ITALY: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 294 ITALY: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 295 ITALY: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.3.4 SPAIN

9.3.4.1 Rise in automobile production and increase in construction output to drive demand

TABLE 296 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 297 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 298 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 299 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 300 SPAIN: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 301 SPAIN: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 302 SPAIN: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 303 SPAIN: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

FIGURE 39 SPAIN: CONSTRUCTION OUTPUT, 2020-2021 (PERCENTAGE)

9.3.5 UK

9.3.5.1 Increase in demand from construction industry to drive PMMA market

FIGURE 40 UK: CONSTRUCTION OUTPUT, 2020-2021 (PERCENTAGE)

FIGURE 41 UK: CAR PRODUCTION, 2020-2021 (UNITS)

TABLE 304 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 305 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 306 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 307 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 308 UK: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 309 UK: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 310 UK: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 311 UK: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.3.6 REST OF EUROPE

TABLE 312 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 313 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 314 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 315 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 316 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 317 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 318 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 319 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.4 NORTH AMERICA

FIGURE 42 NORTH AMERICA: PMMA MARKET SNAPSHOT

TABLE 320 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 321 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 322 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

TABLE 323 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 324 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 325 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 326 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 327 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 328 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 329 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 330 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 331 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 332 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 333 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 334 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 335 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

9.4.1 US

9.4.1.1 Increasing usage in automotive and building & construction industries to drive market

FIGURE 43 US AUTOMOTIVE PRODUCTION AND SALES (‘000 UNIT), 2019-2021

TABLE 336 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 337 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 338 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 339 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 340 US: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 341 US: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 342 US: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 343 US: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.4.2 CANADA

9.4.2.1 Steady growth in automotive production and increasing usage in building & construction and signs & displays applications support market growth

TABLE 344 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 345 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 346 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 347 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 348 CANADA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 349 CANADA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 350 CANADA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 351 CANADA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.4.3 MEXICO

9.4.3.1 Rise in automobile production is expected to surge demand for PMMA

TABLE 352 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2021-2022 (UNITS)

TABLE 353 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 354 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 355 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 356 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 357 MEXICO: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 358 MEXICO: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 359 MEXICO: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 360 MEXICO: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.5 SOUTH AMERICA

TABLE 361 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 362 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 363 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

TABLE 364 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 365 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 366 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 367 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 368 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 369 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 370 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 371 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 372 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 373 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 374 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 375 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 376 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

9.5.1 BRAZIL

9.5.1.1 Rising demand from automotive and construction sectors to support market growth

TABLE 377 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 378 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 379 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 380 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 381 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 382 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 383 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 384 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.5.2 ARGENTINA

9.5.2.1 Domestic production of automobiles to increase demand for PMMA

TABLE 385 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 386 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 387 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 388 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 389 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 390 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 391 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 392 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.5.3 REST OF SOUTH AMERICA

TABLE 393 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 394 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 395 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 396 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 397 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 398 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 399 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 400 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.6 MIDDLE EAST & AFRICA

TABLE 401 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 402 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 403 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

TABLE 404 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 405 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 406 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 407 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 408 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 409 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 410 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 411 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 412 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

TABLE 413 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (USD MILLION)

TABLE 414 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (USD MILLION)

TABLE 415 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2017–2019 (KILOTON)

TABLE 416 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2020–2027 (KILOTON)

9.6.1 SAUDI ARABIA

9.6.1.1 Vision 2030 and other government plans to boost construction industries to fuel market growth

TABLE 417 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 418 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 419 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 420 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 421 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 422 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 423 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 424 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.6.2 SOUTH AFRICA

9.6.2.1 Growth of automotive industry to drive market

TABLE 425 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 426 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 427 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 428 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 429 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 430 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 431 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 432 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

9.6.3 REST OF THE MIDDLE EAST & AFRICA

TABLE 433 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD MILLION)

TABLE 434 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 435 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (KILOTON)

TABLE 436 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

TABLE 437 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (USD MILLION)

TABLE 438 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (USD MILLION)

TABLE 439 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017–2019 (KILOTON)

TABLE 440 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 267)

10.1 INTRODUCTION

FIGURE 44 EXPANSIONS KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

10.2 MARKET SHARE ANALYSIS

FIGURE 45 MARKET SHARE OF KEY PLAYERS, 2021

10.3 STRATEGIES OF KEY PLAYERS

TABLE 441 STRATEGIC POSITIONING OF KEY PLAYERS

10.4 COMPANY EVALUATION MATRIX DEFINITION AND TECHNOLOGY

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 46 PMMA MARKET: COMPANY EVALUATION MATRIX, 2020

10.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.5.1 RESPONSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

FIGURE 47 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

10.6 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 442 REVENUE ANALYSIS OF KEY PLAYERS

10.7 COMPANY PRODUCT FOOTPRINT

TABLE 443 COMPANY FOOTPRINT, BY END-USE INDUSTRY

TABLE 444 COMPANY FOOTPRINT, BY REGION

10.7.1 COMPETITIVE BENCHMARKING

TABLE 445 PMMA MARKET: DETAILED LIST OF KEY MANUFACTURERS

10.8 KEY MARKET DEVELOPMENTS

10.8.1 DEALS

10.8.2 OTHERS

10.8.3 NEW PRODUCT LAUNCHES

11 COMPANY PROFILES (Page No. - 282)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 TRINSEO S.A.

TABLE 446 TRINSEO S.A.: BUSINESS OVERVIEW

FIGURE 48 TRINSEO S.A.: COMPANY SNAPSHOT

TABLE 447 TRINSEO S.A.: PRODUCT OFFERINGS

TABLE 448 TRINSEO S.A.: DEALS

TABLE 449 TRINSEO S.A.: OTHERS

11.1.2 ASAHI KASEI CORPORATION

TABLE 450 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

FIGURE 49 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

TABLE 451 ASAHI KASEI CORPORATION: PRODUCT OFFERINGS

11.1.3 SABIC

TABLE 452 SABIC: BUSINESS OVERVIEW

FIGURE 50 SABIC: COMPANY SNAPSHOT

TABLE 453 SABIC: PRODUCT OFFERINGS

TABLE 454 SABIC: DEALS

11.1.4 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

TABLE 455 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 51 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 456 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: PRODUCT OFFERINGS

TABLE 457 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: DEALS

TABLE 458 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: OTHERS

11.1.5 LG CHEM LTD.

TABLE 459 LG CHEM LTD.: BUSINESS OVERVIEW

FIGURE 52 LG CHEM LTD.: COMPANY SNAPSHOT

TABLE 460 LG CHEM LTD.: PRODUCT OFFERINGS

TABLE 461 LG CHEM LTD.: DEALS

11.1.6 RÖHM GMBH

TABLE 462 RÖHM GMBH: BUSINESS OVERVIEW

TABLE 463 RÖHM GMBH: PRODUCT OFFERINGS

TABLE 464 RÖHM GMBH: OTHERS

11.1.7 KURARAY CO., LTD

TABLE 465 KURARAY CO., LTD: BUSINESS OVERVIEW

FIGURE 53 KURARAY CO., LTD: COMPANY SNAPSHOT

TABLE 466 KURARAY CO., LTD: PRODUCT OFFERINGS

11.1.8 KOLON INDUSTRIES INC.

TABLE 467 KOLON INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 54 KOLON INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 468 KOLON INDUSTRIES INC.: PRODUCT OFFERINGS

11.1.9 SUMITOMO CHEMICAL CO., LTD

TABLE 469 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 55 SUMITOMO CHEMICALS CO., LTD: COMPANY SNAPSHOT

TABLE 470 SUMITOMO CHEMICAL CO., LTD.: PRODUCT OFFERINGS

TABLE 471 SUMITOMO CHEMICAL CO., LTD.: OTHERS

11.1.10 CHIMEI CORPORATION

TABLE 472 CHIMEI CORPORATION: BUSINESS OVERVIEW

TABLE 473 CHIMEI CORPORATION: PRODUCT OFFERINGS

TABLE 474 CHIMEI CORPORATION: PRODUCT LAUNCHES

11.1.11 LOTTE CHEMICAL CORPORATION

TABLE 475 LOTTE CHEMICAL CORPORATION: COMPANY OVERVIEW

FIGURE 56 LOTTE CHEMICAL CORPORATION: COMPANY SNAPSHOT

11.1.12 PLASKOLITE, LLC

TABLE 476 PLASKOLITE LLC: COMPANY OVERVIEW

TABLE 477 PLASKOLITE, LLC: DEALS

11.2 OTHER PLAYERS

11.2.1 TORAY INDUSTRIES, INC

TABLE 478 TORAY INDUSTRIES, INC: COMPANY OVERVIEW

11.2.2 GEHR PLASTICS INC.

TABLE 479 GEHR PLASTICS INC: COMPANY OVERVIEW

11.2.3 RTP COMPANY

TABLE 480 RTP COMPANY: COMPANY OVERVIEW

11.2.4 UNIGEL S.A.

TABLE 481 UNIGEL S.A.: COMPANY OVERVIEW

11.2.5 MAKEVALE GROUP LTD.

TABLE 482 MAKEVALE GROUP LTD.: COMPANY OVERVIEW

11.2.6 3A COMPOSITES

TABLE 483 3A COMPOSITES: COMPANY OVERVIEW

11.2.7 SPARTECH LLC

TABLE 484 SPARTECH LLC: COMPANY OVERVIEW

11.2.8 COSSA POLIMERI S.R.L.

TABLE 485 COSSA POLIMERI S.R.L.: COMPANY OVERVIEW

11.2.9 INEOS GROUP LTD

TABLE 486 INEOS GROUP LTD: COMPANY OVERVIEW

11.2.10 SAMYANG CORPORATION

TABLE 487 SAMYANG CORPORATION: COMPANY OVERVIEW

11.2.11 GO YEN CHEMICAL INDUSTRIAL CO LTD

TABLE 488 GO YEN CHEMICAL INDUSTRIAL CO LTD: COMPANY OVERVIEW

11.2.12 CELANESE CORPORATION

TABLE 489 CELANESE CORPORATION: COMPANY OVERVIEW

11.2.13 PARKER CHOMERICS

TABLE 490 PARKER CHOMERICS: COMPANY OVERVIEW

11.2.14 RABIGH REFINING AND PETROCHEMICAL COMPANY

TABLE 491 RABIGH REFINING AND PETROCHEMICAL COMPANY: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 318)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Plexiglass Market Overview

Plexiglass, also known as acrylic glass or PMMA (Polymethyl Methacrylate), is a transparent thermoplastic that is widely used as a lightweight and shatter-resistant alternative to glass. The plexiglass market is driven by various factors such as its increasing use in the automotive, construction, and electronics industries due to its durability, light weight, and UV resistance. The demand for plexiglass is also driven by its use in the production of medical devices and equipment due to its optical clarity, biocompatibility, and ease of sterilization.

Plexiglass is a major application of Polymethyl Methacrylate (PMMA), which is a transparent thermoplastic polymer that is widely used in various industries such as automotive, construction, electronics, medical devices, and signage. PMMA is used in the production of plexiglass due to its high transparency, UV resistance, and impact resistance.

The demand for plexiglass is expected to drive the growth of the Polymethyl Methacrylate market. As the use of plexiglass increases in various industries, the demand for PMMA is expected to rise, which will further drive the market growth. The growth of the PMMA market is also driven by its increasing use in the production of LEDs and LCDs, which are widely used in various electronic devices.

Futuristic Growth Use-Cases

The plexiglass market is expected to witness significant growth due to its increasing use in various industries. The growing demand for plexiglass in the construction and automotive industries, as well as in the production of medical devices and equipment, is expected to drive market growth. Additionally, the growing popularity of plexiglass in the field of interior design and architecture is expected to create new growth opportunities for the market.

Top Players in Plexiglass Market

Some of the top players in the plexiglass market include Evonik Industries AG, Mitsubishi Chemical Corporation, Arkema SA, Altuglas International, and Plaskolite LLC.

Impact on Other Industries

The plexiglass market is expected to impact various other industries such as automotive, construction, electronics, and medical devices. The growing use of plexiglass in these industries is expected to drive market growth and create new growth opportunities for the players in these industries. Additionally, the growing demand for plexiglass in the field of interior design and architecture is expected to impact the construction and real estate industries.

Speak to our Analyst today to know more about Plexiglass Market!

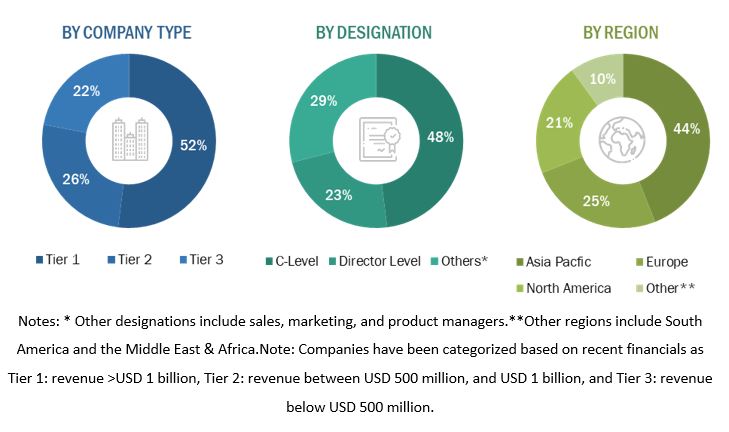

This technical and market-oriented study of the PMMA market involved extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information. Primary sources include industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research