Precision Farming Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware {Drones, GPS, Yield Monitors, Sensors}, Software, Services), Technology (Guidance Technology, Remote Sensing Technology and Variable Rate Technology), Application and Region - Global Forecast to 2031

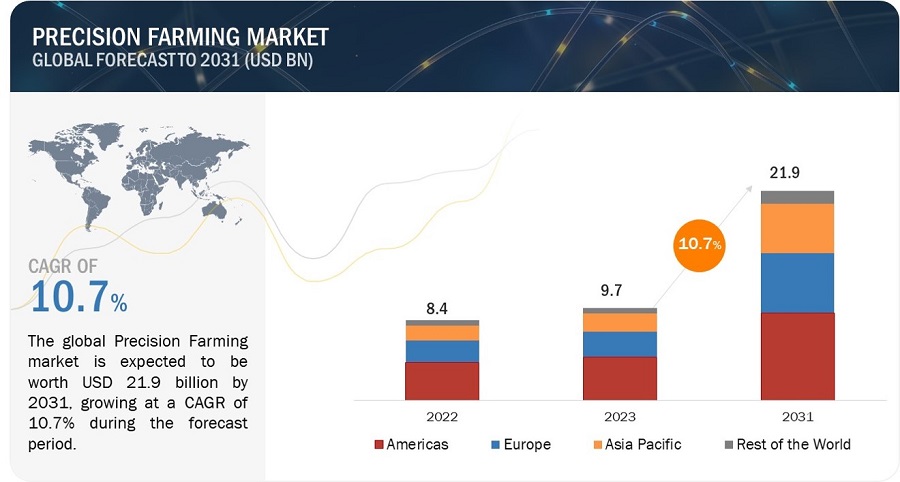

[301 Pages Report] The global precision farming market size is expected to grow from USD 9.7 billion in 2023 to USD 21.9 billion by 2031, at a CAGR of 10.7%. The primary drivers behind the expansion of the market include the swift uptake of cutting-edge technologies in precision agriculture aimed at lowering labor expenses, the growing embrace of Internet of Things (IoT) devices in farming domains, considerable monetary savings linked with precision farming, the impact of climate change and the imperative to meet escalating food requirements, as well as the mounting endorsement of precision farming methods by governments on a global scale.

Precision Farming Market Forecast to 2031

To know about the assumptions considered for the study, Request for Free Sample Report

Precision farming market dynamics

Driver: Integration of precision farming technologies with existing farm machinery

Integration with farm machinery is a pivotal driver propelling the widespread adoption of precision agriculture. With the rapid advancement of precision agriculture technologies, such as sensors, GPS, and data analytics, farmers can now seamlessly incorporate these innovations into their existing equipment, including tractors, drones, and harvesters. This integration streamlines data collection, enhances operational efficiency, and enables data-driven decision-making. Equipped with state-of-the-art sensors and monitoring systems, modern farm machinery can effortlessly gather real-time data on soil conditions, crop health, and weather patterns. GPS technology enables precise navigation and guidance, ensuring that machinery follows predetermined paths during planting, spraying, and harvesting operations, leading to optimized coverage and reduced overlap. Variable Rate Technology (VRT) allows farmers to adjust input application rates based on specific field requirements, resulting in resource optimization and improved crop yields. Moreover, the automation and remote monitoring capabilities facilitate increased operational efficiency and reduced labor costs. By leveraging data analytics and farm management software, farmers can make informed decisions about irrigation, fertilization, and pest control, resulting in enhanced productivity and sustainability. The integration of drones with farm machinery further extends precision agriculture's benefits, enabling aerial surveys and targeted responses to crop stress, pest infestations, and disease outbreaks. Ultimately, this integration empowers farmers to embrace precision practices seamlessly and efficiently, leading to more sustainable and productive agricultural operations.

Restraint: Lesser reliability of internet connectivity and infrastructure for precision farming

Rural Connectivity and Infrastructure significantly restrain the widespread adoption of precision farming technologies. In many agricultural regions, particularly in rural and remote areas where farming activities are prevalent, access to reliable and high-speed internet connectivity may be limited or unavailable. This lack of connectivity hinders the seamless integration and real-time transmission of crucial data required for precision agriculture. Farmers may encounter difficulties accessing data from sensors, drones, and other monitoring devices in the field without a stable internet connection. Transmitting this data to centralized systems or cloud-based platforms for analysis and decision-making becomes challenging. The absence of robust infrastructure may also limit the implementation of advanced precision farming practices that rely on constant connectivity and data exchange. As a result, farmers in these regions may face barriers in adopting precision farming solutions, potentially missing out on the optimization of inputs, efficient resource utilization, and improved crop management offered by these technologies. Efforts to expand rural internet coverage and improve infrastructure are vital to overcoming this restraint and empowering farmers in remote areas to benefit from the transformative potential of precision agriculture.

Opportunity: Rising usage of digital agricultural platforms along with rising demand for sustainable agriculture

Digital agriculture platforms and farm management software solutions are playing a pivotal role in the advancement of precision farming. These emerging technologies offer farmers comprehensive tools to seamlessly integrate and analyze data from various sources, including sensors, drones, and satellite imagery. By centralizing data on a user-friendly interface, these platforms simplify the adoption of precision farming practices, enabling farmers to make informed decisions based on real-time insights. Moreover, they provide a holistic view of farm operations, allowing farmers to efficiently monitor and manage their fields, crops, and equipment. With streamlined data collection and analysis, farmers can optimize resource allocation, adjust irrigation and fertilization schedules, and implement precision techniques, ultimately leading to enhanced crop yields and operational efficiency. In addition to increased productivity, precision farming aligns with the global trend towards sustainable and eco-friendly agriculture. Consumers are increasingly demanding food produced with minimal environmental impact, driving the need for more sustainable farming practices. Precision farming's ability to precisely target inputs, such as water and fertilizers, minimizes wastage and reduces the release of harmful chemicals into the environment. By promoting responsible resource management, precision farming addresses eco-conscious consumers' preferences, providing an opportunity for farmers to cater to this growing market segment. Embracing sustainable practices and highlighting eco-friendly production can also position precision farmers to access premium markets and secure a competitive edge in the agricultural industry. As the demand for sustainably produced food continues to rise, precision farming presents a promising opportunity for farmers to meet consumer expectations while also ensuring long-term environmental sustainability.

Challenge: Lacking data privacy and increased security concerns

Data privacy and security concerns present a significant challenge in the precision farming market. As precision agriculture heavily relies on data collection from various sources, including sensors, drones, and satellites, there is a growing need to address the privacy and security of this data. Farmers and technology providers must ensure that the collected, shared, and stored data remain protected from unauthorized access and potential breaches. This sensitive information may include details about crop yields, soil conditions, farm operations, and even personal information about farmers. Building trust between farmers and technology providers is crucial to encourage data sharing and adoption of precision farming technologies. Implementing robust encryption, secure data storage, and access controls are essential steps to safeguarding sensitive information. Clear data usage policies and transparent communication about how the data will be utilized can help alleviate concerns and promote responsible data handling practices. By proactively addressing data privacy and security concerns, the precision farming industry can foster a climate of trust and collaboration, enabling farmers to leverage the full potential of precision agriculture without compromising their data's confidentiality and integrity.

Precision Farming Market Ecosystem

The precision farming market includes key companies such as Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), AgJunction LLC (US), Raven Industries, Inc. (US), AG Leader Technology (US), Teejet Technologies (US), Topcon (US), Taranis (Israel), AgEagle Aerial Systems Inc (US), ec2ce (Spain), Descartes Labs, Inc. (US), Granular Inc. (US), Hexagon AB (Brazil), Climate LLC (US), and CropX Inc. (Israel). These companies have manufacturing facilities and corporate offices spread across various countries across Asia Pacific, Europe, Americas, and the Rest of the World. Several stakeholders purchase the precision farming products manufactured by these companies for various applications.

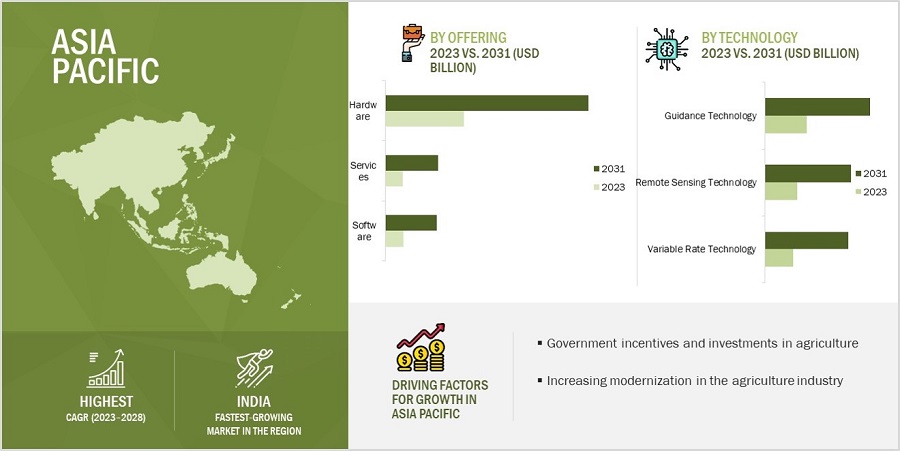

Hardware segment to hold the largest share of precision farming market during the forecast period

The categorization of the precision farming industry based on its offerings has resulted in the segmentation of hardware, software, and services. A further division has occurred within the hardware category, leading to automation and control systems, as well as monitoring and sensing devices. In particular, automation and control systems encompass GPS receivers, guidance and steering mechanisms, and variable-rate technology (VRT) devices. These elements are projected to hold a substantial portion of the hardware segment’s share in the market throughout the anticipated timeframe. This is primarily due to their widespread utilization within the precision farming sphere. The growth trajectory of this market sector can be ascribed to the significant adoption of automation and control devices, including drones/UAVs, GPS/GNSS systems, irrigation controllers, guidance and steering systems, yield monitors, and agricultural sensors, within the agricultural domain.

Variable rate technology is expected to witness higher CAGR during the forecast period

Variable rate technology is expected to demonstrate the highest CAGR compared to other technologies within the projected period. The accelerated adoption of variable rate technology can be attributed to its early uptake by farmers. This advancement is propelled by the integration of GPS-based auto-guidance technology, which empowers agricultural professionals to optimize equipment and tractor utilization, leading to reduced fuel and labor expenses, heightened operational efficiency, and minimized soil compaction.

Yield monitoring applications held the largest share of the precision farming market in 2022

Within the precision farming market, the application segment of yield monitoring emerged as the largest application in terms of market share. This dominance is underscored by the substantial advantages offered by climate service initiatives, empowering farmers to adeptly navigate climate-induced adversities and concurrently enhance food security while bolstering the quality of decision-making processes within the agricultural realm. Moreover, looking at the geographical landscape, the Asia-Pacific (APAC) region is poised to display the most noteworthy CAGR in the global market. This projection underscores the region's escalating interest and investment in precision farming technologies and practices, which are evidently contributing to the market's overall expansion and potential.

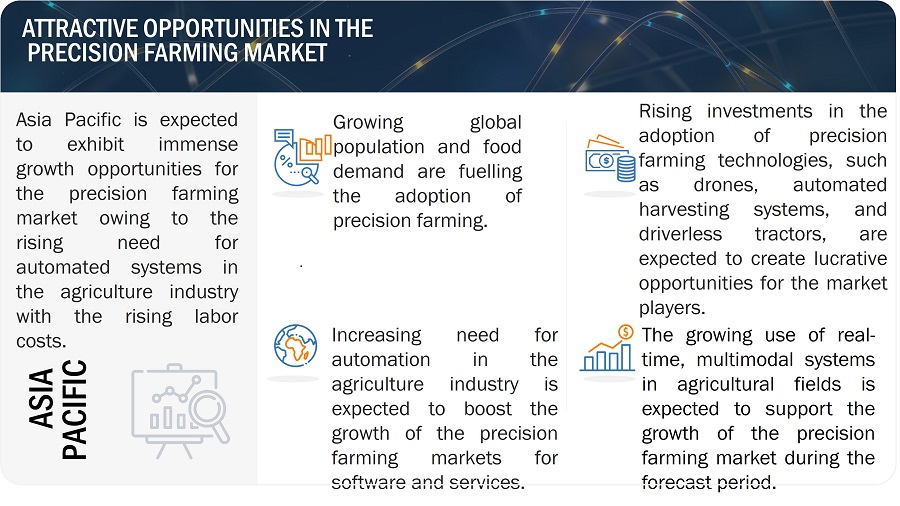

The precision farming market in Asia Pacific is expected to witness the highest growth from 2023 to 2031.

The burgeoning wave of modernization sweeping through the agricultural sector, particularly evident in nations like China, India, and Indonesia, stands as a pivotal catalyst propelling the expansion of the precision farming industry within the region. With the populace in these developing countries experiencing substantial growth, an escalating demand for enhanced agricultural productivity exists. Consequently, this demographic pressure is serving as a compelling impetus for the agriculture industry to embrace precision farming equipment and practices, ultimately fostering the heightened adoption and implementation of precision farming technologies across the region.

Precision Farming Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgJunction LLC (US), and Trimble Inc. (US) are some of the key players in the global precision farming companies. These players increasingly undertake product launches and development strategies, expansions, partnerships, contracts, and acquisitions to increase their market share.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Value |

USD 9.7 billion |

|

Expected Value |

USD 21.9 billion |

|

Growth Rate |

CAGR of 10.7% |

|

Market Size Available for Years |

2019–2031 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering, By Technology, By Application, and By Region |

|

Geographic Regions Covered |

Americas, Europe, Asia Pacific, and Rest of the World (includes Middle East, Africa, and Russia) |

|

Companies Covered |

The major players include Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), AgJunction LLC (US), Raven Industries, Inc. (US), AG Leader Technology (US), Teejet Technologies (US), Topcon (US), Taranis (Israel), AgEagle Aerial Systems Inc (US), ec2ce (Spain), Descartes Labs, Inc. (US), Granular Inc. (US), Hexagon AB (Brazil), Climate LLC (US), and CropX Inc. (Israel). Total 25 companies profiled. |

Precision Farming Market Highlights

This report categorizes the precision farming market based on offering, technology, application, and geography available at the regional and global level

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology |

|

|

By Application |

|

|

By Geography |

|

Recent Developments

- In July 2023, Deere & Company acquired Smart Apply, Inc. (US), a precision spraying equipment company. The acquisition aims to strengthen the emphasis on high-value crop customers and dealers, while also broadening the range of solutions available to assist growers in tackling their primary concerns regarding labor, input costs, and regulatory compliance.

- In April 2023, AGCO Corporation revealed its partnership with Bosch BASF Smart Farming to introduce and market Smart Spraying technology on Fendt Rogator sprayers. Furthermore, both companies will collaborate to develop additional innovative features.

- In August 2022, Trimble Inc. and CLAAS entered a strategic alliance to develop an advanced precision farming system for CLAAS tractors collaboratively, combines, and forage harvesters. The precision farming system comprises the cutting-edge CLAAS CEMIS 1200 smart display, GPS PILOT steering system, and the SAT 900 GNSS receiver. Within this system, the CEMIS display leverages Trimble's latest embedded modular software architecture, facilitating precise positioning, steering, and seamless connectivity to control and monitor implements in the field using ISOBUS technology.

- In August 2022, Trimble Inc. entered into a definitive agreement to acquire Bilberry, a privately held French technology company known for its expertise in selective spraying systems for sustainable agriculture. Bilberry is at the forefront of using artificial intelligence (AI) technology to identify various weed species in real-time across a wide range of crops. This strategic acquisition will enhance Trimble's crop protection portfolio by incorporating green-on-green selective spraying capabilities and will further bolster their efforts in developing autonomous agricultural solutions.

- In April 2022, Topcon and MyAgData have joined forces to enhance access and data sharing involving electronic grain cart load data, offering a more streamlined workflow for farmers and a more efficient remittance process for crop insurance adjusters.

- In May 2021, and Class Telematics signed a partnership agreement wherein the Climate FieldView, and Class Telematics could connect through the Class API to exchange data for field and site-specific documentation easily. In January 2021, AGCO Corporation partnered with NEVONEX to help farmers use digital services and functions based on NEVONEX on its AGCO equipment.

- In May 2021, Raven Industries announced the launch of its new autonomous product brand “OMNI.” This brand highlights the company’s capabilities in autonomous solutions

Frequently Asked Questions (FAQs):

What is the current size of the global precision farming market share?

The precision farming market is in the introductory phase and is expected to grow further due to the growing adoption of global positioning system (GPS), guidance, and remote sensing technologies by farmers/growers. The precision farming market is expected to grow from USD 9.7 billion in 2023 to USD 21.9 billion by 2031, at a CAGR of 10.7%.

Who are the key players in the global precision farming market?

Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgJunction LLC (US), and Trimble Inc. (US) are some of the key players in the global precision farming market. These companies cater to the requirements of their customers, with a presence in multiple countries.

Which application of the precision farming market is expected to drive the market's growth in during the forecast period?

During the projected timeframe, the weather tracking and forecasting application is anticipated to experience a more substantial expansion. This market segment's growth can be attributed to the climate variability and extreme weather events are becoming more frequent and unpredictable due to the effects of climate change. In precision farming, where optimal timing and resource allocation are crucial, accurate weather information is essential for making informed decisions related to planting, irrigation, fertilization, and pest control.

Which region to offer lucrative growth for the precision farming market size by 2031?

During the projected period, it is anticipated that Asia PAcific will take the lead in the precision farming market, owing to the increasing population of the regon, leading to increased food demand, contributing towards the growth in precision farming during 2023-2031.

Which offering of precision farming market is expected to drive the market's growth in the next five years?

The services segment is expected to grow at a higher rate during the forecast period. The growth of this market segment can be attributed to the consistent requirement for repair and maintenance and consulting and support services for the precision farming equipment.

What are the opportunities for the existing players and for those who are planning to enter various stages of the precision farming value chain?

Numerous avenues are open for current participants to become part of the precision farming industry's value chain. Among these are possibilities like integrating smartphone applications with precision farming equipment, the increasing utilization of AI-driven solutions, and the uptake of technologically advanced tools and equipment within the agriculture sector.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

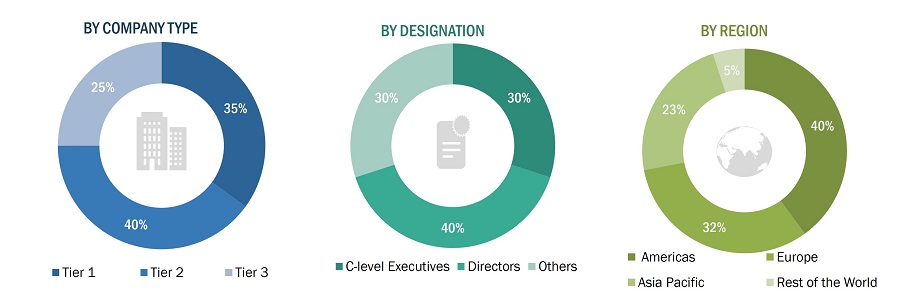

The determination of the precision farming market's size encompassed four primary endeavors. Extensive secondary research was conducted to accumulate pertinent data concerning the market, its comparable markets, and its overarching parent market. Primary research was subsequently conducted to authenticate essential discoveries, presumptions, and measurements with industry experts spanning the precision farming market's value chain. Both top-down and bottom-up methodologies were employed to ascertain the comprehensive market size. This was succeeded by implementing market breakdown and data triangulation techniques to gauge the dimensions of distinct segments and subsegments within the market.

Secondary Research

The research approach employed to gauge and predict the dimensions of the precision farming market commenced by procuring data on key vendors' revenues within the market using secondary research techniques. The secondary research applied in this study encompassed resources such as magazines, journals, and AgTech associations. Additionally, secondary sources, directories, and databases like Hoovers, Bloomberg Businessweek, Factiva, and OneSource were used to identify and amass information essential for a comprehensive technical, market-centric, and commercial evaluation of the precision farming market. The market segmentation was established by considering the offerings of various vendors. The comprehensive research methodology entailed scrutinizing companies' annual reports, press releases, investor presentations, authoritative white papers, certified publications, articles by recognized authors, directories, and databases.

Primary Research

After gaining insights into the precision farming market landscape from secondary research, a thorough primary research phase was conducted. This involved multiple interviews with industry experts representing both demand and supply-side participants across key regions: Americas, Europe, Asia Pacific, and the Middle East, Africa, and South America. A diverse range of primary sources from both sides of the market were engaged in order to obtain qualitative and quantitative insights. The primary data collection utilized methods such as questionnaires, emails, and telephonic interviews. To ensure a comprehensive perspective in our report, these efforts spanned various departments within organizations, including sales, operations, and administration.

Furthermore, interactions with industry experts were followed by concise sessions with seasoned independent consultants to corroborate the findings obtained from primary research. These insights, combined with the perspectives of our in-house subject matter experts, form the basis for the conclusions presented in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of precision farming market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the precision farming market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to precision farming market including key OEMs, IDMs, and Tier I suppliers

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Precision Farming Market Size: Bottom-Up Approach

Global Precision Farming Market Size: Top-down Approach

Data Triangulation

Following the determination of the comprehensive market size using the outlined market size estimation methodology, the market was subsequently partitioned into multiple segments and subsegments. To ensure the precision of the entire market engineering procedure, data triangulation and market breakdown methodologies were applied, whenever relevant, to ascertain precise statistics for each individual segment and subsegment within the market. The process of data triangulation involved a meticulous examination of diverse factors and trends originating from both the demand and supply perspectives of the precision farming market. This meticulous approach was taken to ensure a comprehensive and accurate evaluation of the market's various components.

Market Definition

Precision farming, also known as precision agriculture, is a modern farming management concept involving advanced technologies to monitor and optimize agricultural processes. Precision farming is based on optimizing field inputs according to crop needs. Data-based technologies, including satellite positioning systems such as Global Positioning System (GPS), remote sensing, and variable rate technology (VRT), are used in precision farming to manage crops and optimize the use of resources such as fertilizers, pesticides, and water. The precision farming market is highly diversified and competitive, with a large number of market players. Major market players are acquiring small players to expand their offerings worldwide. Guidance technology witnessed early adoption by farmers or growers as it allows growers to reduce overlapping of equipment and tractor passes, saving fuel, labor, time, and soil compaction.

Stakeholders

- Precision farming component providers

- Precision farming integrators and installers

- Precision farming solution providers

- Consulting companies

- Product manufacturers

- Precision farming software providers

- Precision farming-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and start-ups

- Distributors and traders

- OEMs

- End users

- Research institutes and organizations

- Market research and consulting firms

- Agri-food buyers

- Agriculture technology providers

Report Objectives

- To describe and forecast the precision farming market size, in terms of value, based on offering, technology, Application and Geography.

- To describe and forecast the precision farming market size, in terms of value, for various segments with respect to 4 key regions, namely, Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To provide a detailed overview of the precision farming value chain

- To strategically profile the key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the precision farming market

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the precision farming market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the precision farming market

- Estimation of the market size of the segments of the precision farming market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Precision Farming Market

Penetration of IoT and AI technologies in agriculture is increasing at rapid pace. Every year we are witnessing a large number of startups enetering this space. Does your report covers startups data and strategies adopted by them ?

Automated Guidance steering, GPS, and remore sensing are playing critical role in automation of farm machinery and increasing productivity of farms. Does your report cover agricultural machinery automation data and their adoption trend?

What is the future of Precision Farming in terms of Technology? What are the companies working on?

I would require some market analysis, data and figures about the current and forecasted oeriod for precision agriculture market

I need the detail of how many farmers have adopted precision farming and the results of the precision farming market when it comes out.

Have you included eastern European countries in your analysis. My focus is on major players in Estern Europe and Africa. What data you can provide?

I would like to know the number of devices sold for both crop and livestock related precision Ag hardware, not just the dollar value of the market size.