Precision Livestock Farming Market by System Type (Milking Robotic Systems, Precision Feeding Systems, Livestock Monitoring Systems), Application, Offering, Farm Type (Dairy, Swine, Poultry), Farm Size and Geography - Global Forecast to 2028

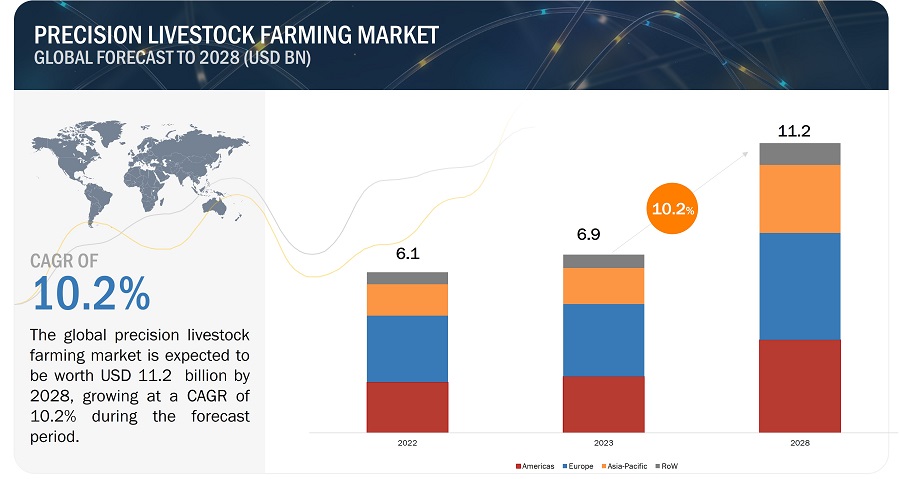

[286 Pages Report] The precision livestock farming market is estimated to be USD 6.9 billion in 2023 and projected to reach USD 11.2 billion by 2028, at a CAGR of 10.2%. Some of the major factors contributing towards growth of precision livestock farming market includes surging deployment of IoT- and AI-enabled devices on livestock farm, rising labor costs leading to automation in livestock industry, increasing focus on real-time monitoring and early disease detection, and growing demand for quality dairy products across the globe due to increasing awareness among consumers towards protein-rich diet and health consciousness.

Precision Livestock Farming Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Surging labor costs and rising demand for automation in the livestock industry

Labor costs worldwide have been increasing perpetually, prompting farmers to substitute expensive labor with cost-efficient, advanced digital solutions for livestock farming. Western countries, especially in Europe, rely upon immigrant laborers from Eastern Europe for farming operations. Similarly, the North American region relies on migrant laborers from South American countries to work in their fields. According to the US Department of Agriculture (USDA the average wage paid to hired workers by farm operators in April 2022 was USD 17.22 per hour, which represented an increase of 8% from April 2021. Field workers received an average wage of USD 16.50 per hour, a 9% increase, while livestock workers earned USD 15.82 per hour, up by 7%. The demand for automation in the livestock industry is increasing significantly to increase productivity, improve farm management, tackle the challenge of high labor cost, facilitate real-time analysis, and better decision-making.

Restraint: Availability of plant-based alternative products for dairy milk

Dairy milk production has raised concerns about animal welfare and the environment, which is driving consumers to seek alternatives. This will hamper global dairy milk production, thereby impeding the growth of the precision livestock farming market. According to Univar Solutions (US), in 2020, the demand for plant-based milk is growing by more than 10% yearly, while dairy milk is growing at a rate of 3% annually. Soymilk was first introduced in 1996, but the plant-based trend began to catch on in early 2010, and since then, it has expanded and changed. Plant, grain, and nut milk currently comprise over 10% of the total milk market. Milk substitutes have already seized market share and now make up 13% of retail milk sales in the US, in which almond milk has the most significant share among the substitutes.

Opportunity: Growing popularity of poultry robots and BSC smart cameras

A breakthrough in the precision livestock farming market is the emergence of poultry robots, which are used for several purposes such as monitoring, manure removal, egg collection, etc. Poultry robots have successfully received the attention of poultry farm owners and commercial poultry farms to facilitate poultry production with more precision. These robots can monitor flocks, detect dead birds, stress, and any other anomaly among poultry birds, and provide real-time information to farm operators. This could lead to better monitoring of birds, thereby improving farm hygiene, and bird comfort.

Body condition scoring (BSC), which is done to estimate fat in cattle, is done manually in dairy farms across the world. This process is labor-intensive and requires much time to evaluate the right amount of fat among cattle. Smart cameras can be used for the same; however, the penetration of these cameras is low. Nevertheless, these cameras are likely to be adopted at large in the coming years, which will offer opportunities for the players in the precision livestock farming market. DeLaval, LIC, and Afimilk are some of the key companies offering BCS smart cameras.

Challenge: Emergence & re-emergence of diseases and environmental concerns

Infectious diseases are quite common in the livestock farming industry. The African Swine Fever (ASF) outbreak resulted in significant monetary losses in South Africa and hit its exports by 20%. Factors affecting livestock's health include the livestock house structure, ventilation, temperature management, feed, water supply, and other hygienic conditions. The resistance of poultry birds toward antibiotics is affecting the overall industry, and hence, the use of vaccines to prevent the spread of diseases can impact poultry farming. According to the UN Food and Agriculture Organization, the demand for meat is expected to rise by 73% between 2010 and 2030; the demand for milk is expected to rise by 58% during the same period. Due to the increasing demand for livestock products, more pressure on the environment is expected to be visible by 2030.

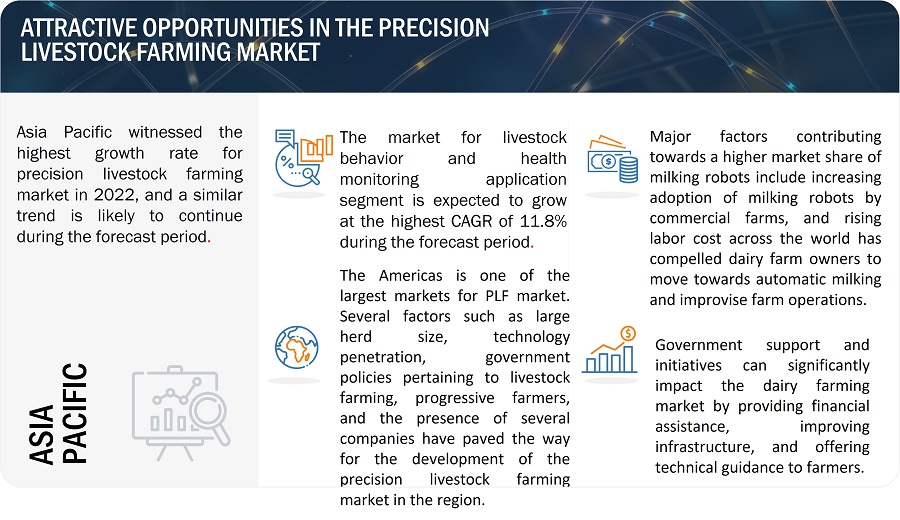

Dairy farms likely to dominate the overall precision livestock farming market between 2023 and 2028

Based on farm type, the market has been segmented into dairy farms, poultry farms, swine farms, and others. In 2023, the dairy farms segment held the largest share of the precision livestock farming market and is continuing to account for the largest market size during the forecast period. Increasingly strict regulations on the use of antibiotics and other medications in livestock production and environmental protection regulations are likely to drive the adoption of precision livestock farming technologies in the dairy industry. Further, government support and initiatives can significantly impact the dairy farming market by providing financial assistance, improving infrastructure, and offering technical guidance to farmers. This assistance can include subsidies, loans, insurances, and grants to invest in modern technologies and high-quality livestock, leading to improved milk production.

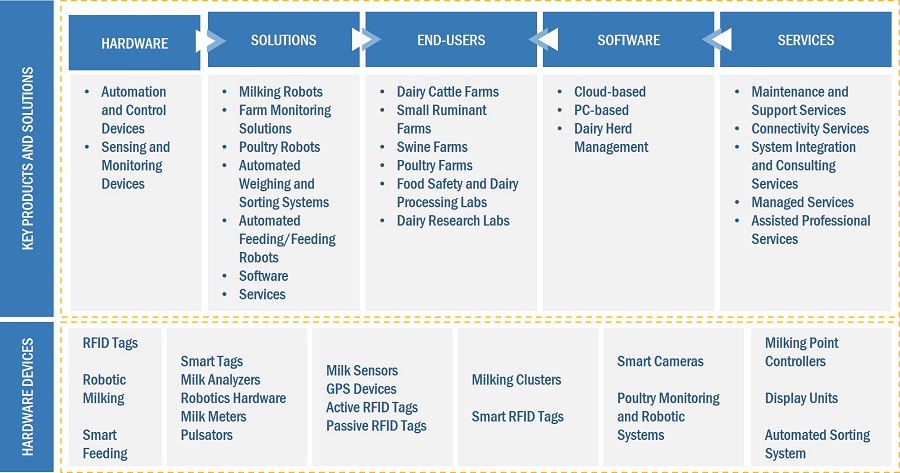

Precision Livestock Farming Market Ecosystems

The precision livestock farming market ecosystems market mainly includes research & development facilities, technology providers, OEMs & system integrators, suppliers & distributors, end users and post-sale service providers. Technology providers majorly include companies that offer components, robotic solutions, deeding systems, GPS systems, sensors, smart tags, software solutions, IoT and AI technologies. OEMs & system integrators majorly include component manufacturers, device manufactures, system manufactures and packaging, testing and calibration. The end users of precision livestock farming market mainly includes dairy farms, swine farms, poultry farms, food safety and processing labs, and dairy research labs.

Hardware segment likely to account for the largest market size in the global precision livestock farming market during the forecast period

The global precision livestock farming market is segmented into hardware, software, and services based on offering. Hardware devices used in precision livestock farming collect and analyze critical data points both on an individual and herd level. Hardware devices collect data that can provide insights on the health, heat stress, feeding, efficiency, and estrus of the cow and other livestock. The rising adoption of smart sensors, camera systems, robotics, and automation in livestock farming has resulted in better farm management by gathering information pertaining to the livestock. Moreover, the integration of emerging technologies such as artificial intelligence, machine learning, the internet of things (IoT), and the hardware devices have resulted in innovative offerings for the livestock.

Feeding management application segment likely to witness second largest market size from 2023 to 2028

Rising awareness among livestock farm owners for better management of feed inventory and animal diets is likely to contribute significantly to the growth of the feeding management application segment. Sufficient feed intake is one of the most critical requirements for high milk production in dairy cows, of which phosphorus (P) and potassium (K) are essential minerals that must be supplied in sufficient quantities for healthy milk production, maintenance, and the growth of dairy cattle. Feeding management is gaining momentum in poultry farms, with several established companies catering to this demand. The right amount of nutrition is required for birds' proper growth, resulting in efficient poultry production.

Milking robotic systems is expected to dominate the precision livestock farming market from 2023 to 2028.

Milking robotic systems to hold the largest market share throughout the forecast period. Major factors contributing towards a higher market share of milking robots include increasing adoption of milking robots by commercial farms, and rising labor cost across the world has compelled dairy farm owners to move towards automatic milking and improvise farm operations. For instance, according to the Farm Labor Survey (FLS) by the US Department of Agriculture (USDA), the inflation-adjusted wages for nonsupervisory crop and livestock workers (excluding contract labor) increased at an average annual rate of 1.2 percent between 1990 and 2021. However, in the last five years, real farm wages grew at a rate of 2.5 percent per year, reflecting the difficulty that growers faced in finding workers.

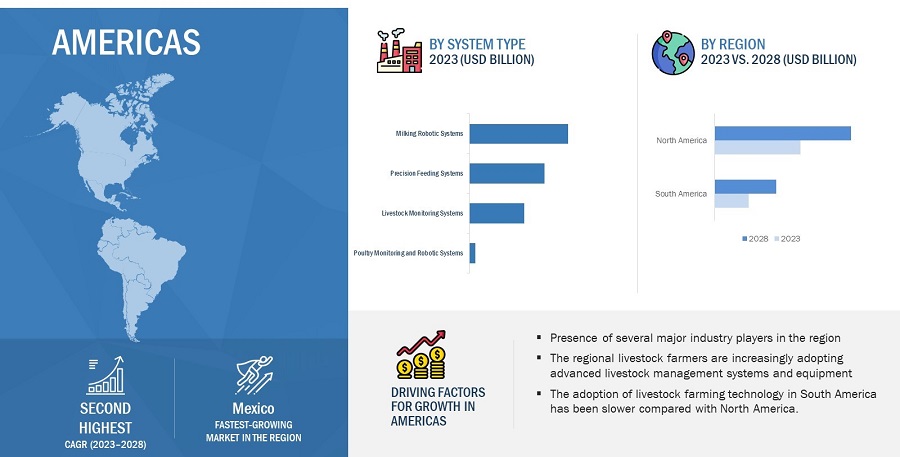

Americas likely to be the second-largest market for precision livestock farming throughout the forecast period

Precision Livestock Farming Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Americas is one of the largest markets for precision livestock farming technology. Several factors such as large herd size, technology penetration, government policies pertaining to livestock farming, progressive farmers, and the presence of several companies have paved the way for the development of the precision livestock farming market in the region. The adoption of advanced monitoring and farming techniques in the livestock segment is high in the Americas, especially in North America. Rising labor costs and increasing demand for milk and meat have resulted in the adoption of milking robots, precision feeding systems, livestock identification, monitoring, and tracking systems. In addition, poultry monitoring, and robotic systems are also witnessing heightened adoption in the region.

Key Market Players

The major players in the precision livestock farming companies are DeLaval (Sweden), Allflex Livestock Intelligence (US), GEA Farm Technology (GEA Group) (Germany), Afimilk (Israel), and Lely International (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Value |

USD 6.9 billion |

|

Expected Value |

USD 11.2 billion |

|

Growth Rate |

CAGR of 10.2% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion & Million) |

|

Segments Covered |

By Offering, By Farm Type, By System Type, By Farm Size, By Application, and By Region |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

DeLaval (Sweden), Allflex Livestock Intelligence (US), GEA Farm Technology (GEA Group) (Germany), Afimilk (Israel), and Lely International (Netherlands)., Dairymaster (Ireland), Livestock Improvement Corporation (New Zealand), Fancom (Netherlands), and Fullwood Packo (UK). |

Precision Livestock Farming Market Highlights

This research report categorizes the precision livestock farming market based on offering, farm type, system type, farm size, application, and by region.

|

Segment |

Subsegment |

|

By Offering |

|

|

System Type |

|

|

Farm Size |

|

|

Application |

|

|

Farm Type |

|

|

By Region |

|

Recent Developments:

- In March 2023, DeLaval launched an autonomous feed distribution robot called OptiWagon.

- In March 2023, Lely International introduced Mijn Boerderij (My Farm) Platform which includes a milk quality module that monitors milk quality parameters such as somatic cell count and bacterial content.

- In March 2023, DeLaval launched the cutting-edge DeLaval Rotary E500 rotary milking system. It increases milking efficiency, streamlines worker routines, automates the selection and sorting of cows, and minimizes stress on dairy cows.

- In October 2022, Merck Animal Health, which is known as MSD Animal Health unveiled the Allflex DataFlow II System mobile application.

- In September 2022, GEA introduced the GEA DairyFeed F4500, an autonomous feeding robot.

- In September 2022, Lely International recently introduced the next generation of its automated feed pushing solution, the Lely Juno.

- In July 2022, Fancom BV partnered with VDL Agrotech (the Netherlands), a leading supplier of innovative systems and solutions for the global poultry and pig farming industries.

- In May 2021, Nedap N.V. partnered with Waikato, a leading company to develop and manufacture dairy technology.

Frequently Asked Questions (FAQ):

What is the current size of the global precision livestock farming market?

The precision livestock farming market is estimated to be USD 6.9 billion in 2023 and projected to reach USD 11.2 billion by 2028, at a CAGR of 10.2%.

Who are the winners in the global precision livestock farming market?

The major players in the precision livestock farming market are DeLaval (Sweden), Allflex Livestock Intelligence (US), GEA Farm Technology (GEA Group) (Germany), Afimilk (Israel), and Lely International (Netherlands). These companies cater to the requirements of their customers by providing milking robotic systems, precision feeding systems, and livestock identification, monitoring and tracking systems.

What will be the impact of recession on the precision livestock farming market?

The impact of recession on precision livestock farming market is likely to have diverse impact on different regions. Nort America and European economies is likely to be impacted the most. In contrast, Asia Pacific is expected to show strong resilient in 2023 and 2024.

How is competitive scenario in the precision livestock farming market?

The precision livestock farming market is consolidated, with many global and local players. In 2022, DeLaval (Sweden), GEA Group (Germany), Afimilk Ltd. (Israel), Allflex Livestock Intelligence (US), and Lely International (Netherlands) were the major players in the precision livestock farming market. The key five companies' combined market share accounted for 60–70% of the overall precision livestock farming market.

Which region will likely offer lucrative growth for the precision livestock farming market between 2023 and 2028?

The precision livestock farming market in Asia Pacific is expected to register the highest growth rate during the forecast period. The rising awareness among farm owners regarding livestock farming technology and ways to interpret data offered by software platforms and mobile applications is estimated to fuel the demand for livestock farming equipment and devices in the Asia Pacific region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

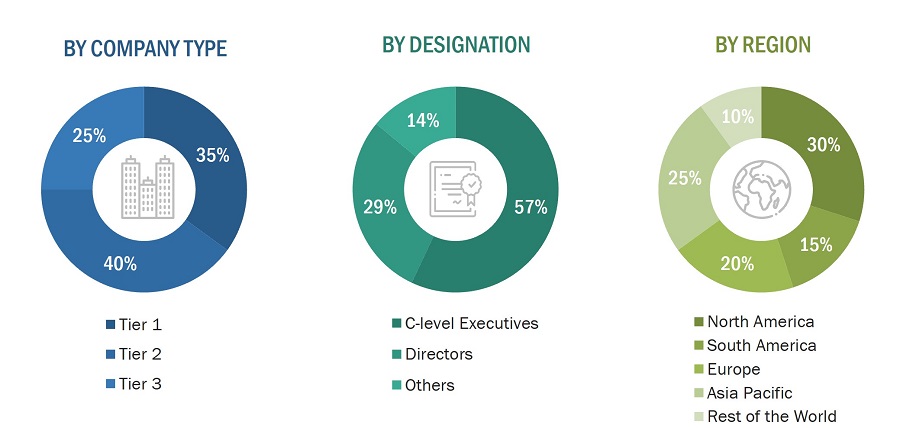

The research study involved 4 major activities in estimating the precision livestock farming market size. Exhaustive secondary research has been done to collect significant information on the precision livestock farming market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the global market size. In next step the market breakdown and data triangulation have been used to estimate the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred for this research study includes FAOstat, International Federation of Robotics (Germany), United States Department of Agriculture (USDA) (US), International Livestock Research Institute (ILRI) (Kenya), The Commonwealth Scientific and Industrial Research Organization (Australia), and Japan Livestock Technology Association (Japan).

In the precision livestock farming market report, the top-down and the bottom-up approaches have been used to estimate and validate the size of the precision livestock farming market, along with several other dependent submarkets. The major players in the precision livestock farming market were identified using extensive secondary research and their presence using primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding and analysing the precision livestock farming market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (The Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

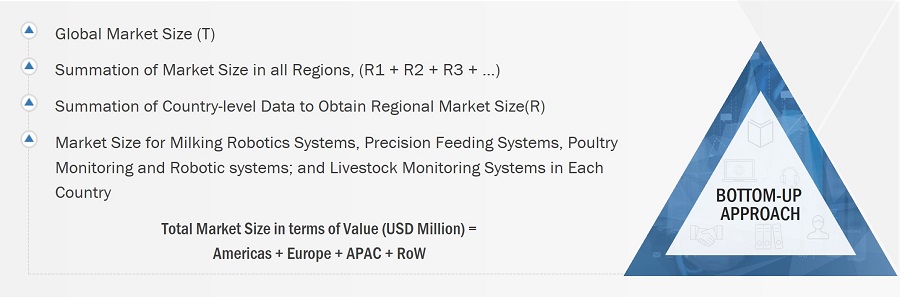

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the precision livestock farming market and various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the market for precision livestock farming based on milking robotic systems, precision feeding systems, livestock identification, monitoring, and tracking systems and poultry monitoring and robotic systems in each country.

- Identifying major offerings of precision livestock farming-related hardware, software, and services.

- Identifying major applications of precision livestock farming-related applications such as milk harvesting, feeding management, livestock health and behavior monitoring, and other applications.

- Estimating the size of the market in each region by adding the size of the country-wise markets

- Tracking the ongoing and upcoming implementation of precision livestock farming projects by various companies in each region and forecasting the size of the precision livestock farming market based on these developments and other critical parameters

- Arriving at the size of the global market by adding the size of the region-wise markets

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall precision livestock farming market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the precision livestock farming market has been validated using both top-down and bottom-up approaches.

Market Definition

Precision livestock farming involves livestock management by continuous, automated, real-time monitoring of livestock production, reproduction, health and welfare, and environmental impact based on livestock image analysis, sound analysis, sensors, software, and AI-based solutions. Livestock farming operations are becoming more efficient with the increasing adoption of advanced technologies such as RFID tags & readers, milking robots, automated feeding systems, smart camera systems, ventilation and climate control, and the integration of emerging technologies such as AI, IoT, machine learning and big data.

Key Stakeholders

- Hardware component suppliers and distributors

- Semiconductor component and IoT-based electronic device manufacturers

- Original equipment manufacturers (OEMs) and system integrators

- Manufacturers of products like ear tags, leg tags, neck tags, smart collar tags, sensors, and GPS-based livestock tags.

- Device suppliers and distributors

- Software, service, and technology providers

- Standardization and testing firms

- Government bodies such as regulatory authorities and policymakers for the livestock industry

- Associations, forums, and alliances related to robotics, semiconductor, electronics, and livestock industries

- Research institutes and organizations

- Market research and consulting firms

- Commercial livestock farming companies, ranchers, and livestock research universities

The main objectives of this study are as follows:

- To define, analyze, and forecast the precision livestock farming market size, by system type, offering, application, farm type, farm size, and geography, in terms of value and volume.

-

To forecast the precision livestock farming market size for various segments with respect to

4 regions—Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW) - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the precision livestock farming market

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contributions to the overall precision livestock farming market

- To provide a detailed overview of the precision livestock farming value chain and analyze the market trends.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the precision livestock farming market

- To strategically profile key players, comprehensively analyze their market rankings and core competencies2, and provide details of the competitive landscape.

- To benchmark market players using competitive leadership mapping, which analyzes players based on various parameters of broad business categories and product strategies.

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product launches, partnerships, and mergers and acquisitions

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis for milking robotics systems, precision feeding systems, and livestock identification, tracking & monitoring devices

- Detailed analysis of milking robotics systems, precision feeding systems, and hardware devices like RFID tags & readers, smart cameras for each country

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Precision Livestock Farming Market