Precast Concrete Market by Element (Columns & Beams, Floors & Roofs, Girders, Walls & Barriers, Utility Vaults, Pipes, Paving Slabs), Construction Type, End-use Sector (Residential, Non-residential) and Region - Global Forecast to 2027

Precast Concrete Market

The global precast concrete market size was valued at USD 144.6 billion in 2022 and is projected to reach USD 198.9 billion by 2027, growing at 6.6% cagr during the forecast period. The construction industry has been shifting toward the precast concrete method due to its ability to reduce cost, time, and labor and enhanced construction quality through process standardization, which ensures high-quality control and better finish. Being constructed under a closed and controlled facility, precast modules are less affected by adverse environmental conditions, such as excessive moisture, heat, and pollution. In addition to this, factors such as improved work-zone safety for workers, easier material handling, and minimized need for scaffolding are encouraging contractors and builders to adopt the precast concrete technique.

Precast concrete is reinforced concrete that has been manufactured using industrialised methods. It is distinguished by the division of the building into components that are manufactured in a precast concrete plant and transported to the site using special transportation equipment. Because the elements are made ahead of time, precasting reduces construction time. Precast concrete is reinforced with reinforcing bars, high tensile strength strands, or a combination of the two.

Global Precast Concrete Market Trends

Note:e-estimated,p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Precast Concrete Market Dynamics

DRIVERS: Need for reduced construction time and cost-effective products

Precast concrete construction offers significantly reduced construction time. Reduction in time also results in a reduction of human labor, which leads to cost savings. Precast components are produced in factories under a controlled environment, enabling easy adjustments and real-time monitoring. Unlike cast-in-situ constructions, precast construction uses fewer resources such as cement, steel, water, energy, and human labor, thereby generating less waste in the factory and at the construction site. Precast construction allows parts of an entire building to be made even before the completion of the foundation for the same. Modular constructions take only four to eight weeks to be completed and assembled, while the conventional on-site constructed buildings require twice the time for construction of a similar-sized structure. Improved quality and productivity, shortened construction time, and reduced waste generation make this type of construction method cheaper and so a preferable choice for end users.

RESTRAINT : Volatility in raw material prices

Raw materials and energy used in precast concrete have volatile prices. Sudden increase or decrease in price affect the profit margin of manufacturers as well. The main raw materials used for manufacturing precast concrete products are cement, aggregates, and sand, among others. Volatility in the prices of energy and crude oil, which are used for manufacturing and transporting these materials, is the main cause of fluctuations in prices of these raw materials. These fluctuations, in turn, result in volatility of prices of finished products.

OPPORTUNITIES: Rise in renovation and remodeling activities globally

Government organizations in emerging countries are actively investing and focusing on developing commercial and industrial infrastructures by implementing multiple programs & assigning projects escalating the precast concrete market expansion.

Increasing remodeling and renovation operations in non-residential spaces will accelerate the demand for precast concrete during the forecast year. Hotel and resort renovation activities are also growing. Rising investments from industry players in industrial construction are further expected to propel the adaptation of precast concrete and create opportunities in the market.

CHALLENGES : Volatility in transportation charges leading to unpredictable business environment

Precast modular construction relies heavily on carriage facilities for the transportation of raw materials from the supplier and to move modules from the factory to the site of installation. The transportation charges include fuel charges, workforce cost, warehouse cost, and handling charges. As long as the transportation is available at a reasonable price, the production can be carried out smoothly. However, transportation charges are highly volatile. If prices rise, the cost of the overall production will also increase, as it not only increases the transportation cost of modules but also raises the raw material cost for the manufacturer, which results in inflated prices of modular buildings for end users. In the situation of high prices of modular buildings, end users are expected to turn to conventional construction techniques, which can hamper the growth of the precast modular construction market. Thus, the volatility in transportation charges leads to an unpredictable business environment in the precast concrete industry.

Girders segment forecasted to be the fastest growing element of precast concrete

Girders made of precast concrete are mainly used in the construction of bridges and large building structures. For the rapid construction of bridges, girders are precast in the factory, transported to the site, and erected at their specified section of the main construction. This type of girder requires no falsework, making it the preferred choice for accelerated bridge constructions (ABC), where the speed of construction, minimal traffic disruption, and environmental impact are of paramount interest. High-performance concrete is used for the fabrication of precast girders, which offer tremendous strength and durability as well as are more competitive and economical in terms of repeatability.

Non-residential segment to dominate the precast concrete industry in 2021

In terms of value and volume, the non-residential segment is projected to lead the precast concrete industry. According to American Institute of Architects (AIA), the recovering in manufacturing sector, growing retail facilities will ensure an optimistic future growth of the market. The industrial sector is expected to pace the building construction upturn in 2022 and 2023, while the institutional sector is forecast to begin its recovery this year and accelerate moving into 2023. This will drive the demand for non-residential market during forecast period.

Elemental construction segment to dominate the precast concrete market during the forecast period

In terms of value and volume, the elemental construction segment is projected to lead the precast concrete market. Factory made precast elements ensures excellent finish, strength, dimensional tolerances, adequate consistency and quality controls. Building an entire structure using precast elements expedite construction, reduces time on site and defects, reduces labor cost, and lowers propping and scaffolding costs. All these factors attribute to the elemental construction to be most popular construction type among builders and contractors.

Asia Pacific is expected to be the fastest growing region during the forecast period.

Emerging economies in the region are expected to experience significant demand for precast concrete because of the expansion of the construction industry due to rapid economic development and government initiatives toward infrastructural development. The growing population in these countries represents a strong customer base. Tremendous growth in residential and non-residential construction, cost effective, time efficient, and low maintenance solutions are driving the growth of precast concrete market in Asia-Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Precast Concrete Market Players

The precast concrete market is dominated by a few globally established players such as Cemex S.A.B. de C.V. (Mexico), LafargeHolcim Ltd (Switzerland), Skanska AB (Sweden), CRH Plc (Ireland), Balfour Beatty Plc (UK), Boral Limited (Australia) among others.

Precast Concrete Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 144.6 billion |

|

Revenue Forecast in 2027 |

USD 198.9 billion |

|

CAGR |

6.6% |

|

Market size available for years |

2018–2027 |

|

Base Year considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (Million Square Feet) |

|

Segments covered |

Element, construction type, type, end-use industry, application and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

The major players include Cemex S.A.B. de C.V. (Mexico), LafargeHolcim Ltd (Switzerland), CRH Plc (Ireland), Boral Limited (Australia), and Balfour Beatty Plc (UK). |

This research report categorizes the precast concrete market based on element, construction type, type, end-use industry, application and region.

Precast Concrete Market on the basis of element:

- Columns & beams

- Floors & roofs

- Girders

- Walls & barriers

- Utility vaults

- Pipes

- Paving slabs

- Others

Precast Concrete Market on the basis of construction type:

- Elemental constructions

- Permanent modular building

- Relocatable buildings

Precast Concrete Market on the basis of type:

- Dry/semi-dry concrete

- Wet concrete

Precast Concrete Market on the basis of end-use industry:

- Residential

-

Non-residential

- Tunnels

- Bridges

- Wind tower

Precast Concrete Market on the basis of application:

- Structural building components

- Architectural building components

- Transportation products

- Waste & waste handling products

- Others

Precast Concrete Market on the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2022, Boral Limited partnered with leading technology group Calix Limited to explore the feasibility of developing a carbon capture plant in the NSW Southern Highlands after being awarded a grant from the Commonwealth to utilize Calix's innovative carbon technology. The grant will support Boral and Calix in assessing the viability of a commercial scale plant that captures and compresses up to 100ktpa of unavoidable CO2 emissions resulting from the decomposition of limestone in cement manufacturing.

- In January 2021, LafargeHolcim acquired Firestone Building Products from Bridgestone Americas for USD 3.4 billion.

- In June 2020, Balfour Beatty's joint venture precast company Gammon Construction secured a contract to deliver tunnels and associated works for an automatic people mover (APM) and baggage handling system (BHS) at the Hong Kong International Airport.

- In February 2021, Skanska secured a contract from Kanta-Hame Hospital District to build a new hospital in Hameenlinna, Finland.

Frequently Asked Questions (FAQ):

How big is the precast concrete industry?

precast concrete industry is USD 198.9 billion by 2027

Who are Top Precast Concrete Manufactures in the USA?

CRH Americas, Inc.(Atlanta, Georgia), R.W. Sidley, Inc.(Painesville, Ohio), Stromberg Architectural Products, Inc.(Greenville, Texas), Norwalk Concrete Industries, Inc.(Norwalk, Ohio), Jensen Rock & Sand, Inc.(Modbridge, South Dakota), Precast Specialties Corp.(Abington, Massachusettes), Premier Stoneworks(Delray Beach, Florida), Basetek, LLC (Middlefield, Ohio), Mid State Concrete Products, Inc. (Santa Maria, California), Pipping Concrete, Inc.(Brandon, Wisconsin)

What is the total CAGR expected to be recorded for the precast concrete market during 2022-2027?

The market size for precast concrete is expected to be USD 144.6 billion in 2022 to USD 198.9 billion by 2027, at a CAGR of 6.6% from 2022 to 2027

What are the driving factors for the precast concrete?

Booming construction sector, rise in renovation & remodeling activities, and rapid urbanization & globalization, Increasing demand for cost-effective, time-efficient, low maintenance, green & energy-efficient buildings and accelerating construction of new residential & commercial spaces.

Which are the significant players operating in the precast concrete market?

Cemex S.A.B. de C.V. (Mexico), LafargeHolcim Ltd (Switzerland), Skanska AB (Sweden), CRH Plc (Ireland), Balfour Beatty Plc (UK), Boral Limited (Australia) are some of the major companies operating in the precast concrete market.

Which region will lead the precast concrete market in the future?

Asia Pacific is expected to lead the precast concrete market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 52)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

FIGURE 1 PRECAST CONCRETE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 57)

2.1 RESEARCH DATA

FIGURE 2 PRECAST CONCRETE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 APPROACH 1: BOTTOM-UP

FIGURE 4 APPROACH 2: BASED ON COUNTRY-LEVEL DATA

2.3 DATA TRIANGULATION

FIGURE 5 PRECAST CONCRETE MARKET: DATA TRIANGULATION

2.3.1 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

FIGURE 7 ASSUMPTIONS

FIGURE 8 LIMITATIONS

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

FIGURE 9 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPP0RTUNITIES

3 EXECUTIVE SUMMARY (Page No. - 67)

FIGURE 10 COLUMNS & BEAMS SEGMENT TO DOMINATE PRECAST CONCRETE MARKET BY 2027

FIGURE 11 ELEMENTAL CONSTRUCTIONS TO BE LARGEST SEGMENT OF PRECAST CONCRETE MARKET

FIGURE 12 NON-RESIDENTIAL SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 13 WET CONCRETE TO DOMINATE PRECAST CONCRETE MARKET DURING FORECAST PERIOD

FIGURE 14 STRUCTURAL BUILDING COMPONENTS TO GROW AT HIGHEST CAGR IN PRECAST CONCRETE MARKET

FIGURE 15 ASIA PACIFIC LED PRECAST CONCRETE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 EMERGING ECONOMIES TO WITNESS HIGHER DEMAND FOR PRECAST CONCRETE

FIGURE 16 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECAST CONCRETE MARKET

4.2 ASIA PACIFIC: PRECAST CONCRETE MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 17 CHINA WAS LARGEST MARKET FOR PRECAST CONCRETE IN ASIA PACIFIC IN 2021

4.3 PRECAST CONCRETE MARKET, BY ELEMENT

FIGURE 18 UTILITY VAULTS TO LEAD PRECAST CONCRETE MARKET DURING FORECAST PERIOD

4.4 PRECAST CONCRETE MARKET, BY CONSTRUCTION TYPE

FIGURE 19 RELOCATABLE BUILDINGS SEGMENT TO BE LARGEST PRECAST CONCRETE MARKET BY 2027

4.5 PRECAST CONCRETE MARKET, BY END-USE INDUSTRY

FIGURE 20 NON-RESIDENTIAL SEGMENT TO LEAD PRECAST CONCRETE MARKET

4.6 PRECAST CONCRETE MARKET, BY TYPE

FIGURE 21 WET CONCRETE SEGMENT TO LEAD PRECAST CONCRETE MARKET

4.7 PRECAST CONCRETE MARKET, BY APPLICATION

FIGURE 22 STRUCTURAL BUILDING COMPONENTS SEGMENT TO GROW AT HIGHEST RATE IN PRECAST CONCRETE MARKET

4.8 PRECAST CONCRETE MARKET, BY COUNTRY

FIGURE 23 CHINA TO RECORD HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 76)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PRECAST CONCRETE MARKET

5.2.1 DRIVERS

5.2.1.1 Concerns about work-zone safety and environmental impacts

5.2.1.2 Need for reduced construction time and cost-effective products

5.2.1.3 Ease of installation and relocation

5.2.1.4 Supportive government initiatives

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Population growth and rapid urbanization translating to large number of construction projects

TABLE 2 ASIA PACIFIC URBANIZATION TREND, 1990–2050

5.2.3.2 Rise in renovation and remodeling activities globally

5.2.4 CHALLENGES

5.2.4.1 Volatility in transportation charges creating unpredictable business environments

5.2.4.2 Lack of awareness about precast concrete method

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

6.2.1 PRODUCT DEVELOPMENT & DISTRIBUTION: INTEGRAL PART OF SUPPLY CHAIN

FIGURE 25 PRECAST CONCRETE SUPPLY CHAIN

6.2.1.1 Prominent companies

6.2.1.2 Small & medium-sized enterprises

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 ECOSYSTEM MAPPING

6.5 TECHNOLOGY ANALYSIS

6.5.1 ULTRA HIGH-PERFORMANCE CONCRETE (UHPC)

6.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 LIST OF CEMENT AND CONCRETE STANDARDS DEVELOPED BY ASTM INTERNATIONAL

TABLE 4 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS FOR CEMENT AND CONCRETE

6.7 PRICING ANALYSIS

TABLE 5 PRECAST CONCRETE, AVERAGE PRICE

6.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY END-USE INDUSTRY

FIGURE 27 AVERAGE SELLING PRICES OF KEY PLAYERS FOR END-USE INDUSTRIES

TABLE 6 AVERAGE SELLING PRICES OF KEY PLAYERS FOR END-USE INDUSTRIES (USD)

6.8 CASE STUDY ANALYSIS

TABLE 7 PRECAST SOLUTION FOR BRESSI RANCH

TABLE 8 PRECAST SOLUTION FOR RUNOFF PROBLEM

TABLE 9 PRECAST SOLUTION FOR ENGLISH NATIONAL BALLET, LONDON

6.9 TRADE ANALYSIS

TABLE 10 CEMENT EXPORTS (BY COUNTRY) IN 2021

TABLE 11 CEMENT IMPORTS (BY COUNTRY) IN 2021

6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 28 YC-YCC DRIVERS

6.11 TARIFF AND REGULATORY LANDSCAPE

6.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 PRECAST CONCRETE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END-USE INDUSTRIES (%)

6.13.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR RESIDENTIAL AND NON-RESIDENTIAL END-USE INDUSTRIES

TABLE 14 KEY BUYING CRITERIA FOR PRECAST CONCRETE IN END-USE INDUSTRIES

6.14 PRECAST CONCRETE MARKET PATENT ANALYSIS

6.14.1 METHODOLOGY

6.14.2 DOCUMENT TYPE

TABLE 15 TOTAL NUMBER OF PATENTS FOR PRECAST CONCRETE MARKET

FIGURE 31 PRECAST CONCRETE MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 32 PUBLICATION TRENDS - LAST 10 YEARS

6.14.3 INSIGHTS

6.14.4 LEGAL STATUS OF PATENTS

FIGURE 33 LEGAL STATUS OF PATENTS

FIGURE 34 JURISDICTION ANALYSIS

6.14.5 TOP COMPANIES/APPLICANTS

FIGURE 35 TOP APPLICANTS FOR PRECAST CONCRETE

TABLE 16 LIST OF PATENTS BY TAISEI CORP.

TABLE 17 PATENTS BY KH HOUSING SOLUTIONS CO., LTD.

TABLE 18 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 COVID-19 IMPACT ON PRECAST CONCRETE MARKET (Page No. - 105)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT ON PRECAST CONCRETE MARKET

7.2.1 IMPACT ON PERMANENT MODULAR BUILDINGS AND RELOCATABLE BUILDINGS

7.2.2 IMPACT ON END-USE SECTORS

8 PRECAST CONCRETE MARKET, BY ELEMENT (Page No. - 107)

8.1 INTRODUCTION

FIGURE 36 GIRDERS SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 19 MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 21 MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 22 MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

8.2 COLUMNS & BEAMS

8.3 WALLS & BARRIERS

8.4 FLOORS & ROOFS

8.5 UTILITY VAULTS

8.6 GIRDERS

8.7 PIPES

8.8 PAVING SLABS

8.9 OTHERS

9 PRECAST CONCRETE MARKET, BY CONSTRUCTION TYPE (Page No. - 113)

9.1 INTRODUCTION

FIGURE 37 ELEMENTAL CONSTRUCTIONS SEGMENT TO LEAD PRECAST CONCRETE MARKET BY 2027

TABLE 23 MARKET SIZE, BY CONSTRUCTION TYPE, 2017–2020 (USD MILLION)

TABLE 24 MARKET SIZE, BY CONSTRUCTION TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 25 MARKET SIZE, BY CONSTRUCTION TYPE, 2021–2027 (USD MILLION)

TABLE 26 MARKET SIZE, BY CONSTRUCTION TYPE, 2021–2027 (MILLION SQUARE FEET)

9.2 ELEMENTAL CONSTRUCTIONS

9.3 PERMANENT MODULAR BUILDINGS

9.4 RELOCATABLE BUILDINGS

10 PRECAST CONCRETE MARKET, BY END-USE INDUSTRY (Page No. - 117)

10.1 INTRODUCTION

FIGURE 38 NON-RESIDENTIAL TO REMAIN LARGER PRECAST CONCRETE MARKET UNTIL 2027

TABLE 27 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 29 MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 30 MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

10.2 RESIDENTIAL

10.3 NON-RESIDENTIAL

TABLE 31 MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 33 MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 34 MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

10.3.1 TUNNELS

10.3.2 BRIDGES

10.3.3 WIND TOWERS

10.3.4 OTHERS

11 PRECAST CONCRETE MARKET, BY TYPE (Page No. - 123)

11.1 INTRODUCTION

FIGURE 39 WET CONCRETE SEGMENT TO LEAD PRECAST CONCRETE MARKET BY 2027

TABLE 35 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 37 MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 38 MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

11.2 WET CONCRETE

11.3 DRY/SEMI-DRY CONCRETE

12 PRECAST CONCRETE MARKET, BY APPLICATION (Page No. - 126)

12.1 INTRODUCTION

FIGURE 40 STRUCTURAL BUILDING COMPONENTS SEGMENT TO LEAD PRECAST CONCRETE MARKET BY 2027

TABLE 39 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 40 MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 41 MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 42 MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

12.2 STRUCTURAL BUILDING COMPONENTS

12.3 ARCHITECTURAL BUILDING COMPONENTS

12.4 TRANSPORTATION PRODUCTS

12.5 WASTE & WASTE HANDLING PRODUCTS

12.6 OTHERS

13 PRECAST CONCRETE MARKET, BY REGION (Page No. - 131)

13.1 INTRODUCTION

FIGURE 41 CHINA TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

TABLE 43 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE FEET)

TABLE 45 MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 46 MARKET SIZE, BY REGION, 2021–2027 (MILLION SQUARE FEET)

13.2 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: PRECAST CONCRETE MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

13.2.1 CHINA

13.2.1.1 Increasing applicability of precast concrete in non-residential construction

TABLE 71 CHINA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 73 CHINA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 74 CHINA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 75 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 76 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 77 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 78 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 79 CHINA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 CHINA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 81 CHINA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 82 CHINA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.2.2 JAPAN

13.2.2.1 High demand for reloca TABLE or temporary houses

TABLE 83 JAPAN: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 84 JAPAN: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 85 JAPAN: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 86 JAPAN: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 87 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 88 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 89 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 90 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 91 JAPAN: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 JAPAN: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 93 JAPAN: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 94 JAPAN: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.2.3 INDIA

13.2.3.1 New construction projects to accelerate demand

TABLE 95 INDIA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 96 INDIA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 97 INDIA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 98 INDIA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 99 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 100 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 101 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 102 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 103 INDIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 INDIA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 105 INDIA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 106 INDIA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.2.4 INDONESIA

13.2.4.1 Government-sponsored infrastructure projects offering enormous opportunities

TABLE 107 INDONESIA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 108 INDONESIA: SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 109 INDONESIA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 110 INDONESIA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 111 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 112 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 113 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 114 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 115 INDONESIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 INDONESIA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 117 INDONESIA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 118 INDONESIA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.2.5 AUSTRALIA

13.2.5.1 Demand for prefab or modular constructions

TABLE 119 AUSTRALIA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 120 AUSTRALIA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 121 AUSTRALIA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 122 AUSTRALIA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 123 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 124 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 125 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 126 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 127 AUSTRALIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 AUSTRALIA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 129 AUSTRALIA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 130 AUSTRALIA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.2.6 REST OF ASIA PACIFIC

TABLE 131 REST OF ASIA PACIFIC: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 133 REST OF ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 135 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 137 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 138 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 139 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 141 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.3 NORTH AMERICA

TABLE 143 NORTH AMERICA: PRECAST CONCRETE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 145 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 146 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 153 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 155 NORTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 157 NORTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 158 NORTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

TABLE 159 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 161 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 162 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

TABLE 163 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 165 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

13.3.1 US

13.3.1.1 Rise in demand for modular buildings

TABLE 167 US: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 168 US: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 169 US: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 170 US: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 171 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 172 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 173 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 174 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 175 US: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 176 US: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 177 US: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 178 US: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.3.2 CANADA

13.3.2.1 Growing commercial and industrial sectors

TABLE 179 CANADA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 180 CANADA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 181 CANADA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 182 CANADA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 183 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 184 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 185 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 186 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 187 CANADA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 188 CANADA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 189 CANADA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 190 CANADA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.3.3 MEXICO

13.3.3.1 Rising infrastructural constructions

TABLE 191 MEXICO: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 192 MEXICO: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 193 MEXICO: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 194 MEXICO: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 195 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 196 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 197 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 198 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 199 MEXICO: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 200 MEXICO: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 201 MEXICO: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 202 MEXICO: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4 EUROPE

TABLE 203 EUROPE: PRECAST CONCRETE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 204 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 205 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 206 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 207 EUROPE: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 208 EUROPE: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 209 EUROPE: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 210 EUROPE: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 211 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 212 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 213 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 214 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 215 EUROPE: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 216 EUROPE: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 217 EUROPE: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 218 EUROPE: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

TABLE 219 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 220 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 221 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 222 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

TABLE 223 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 224 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 225 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 226 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

13.4.1 GERMANY

13.4.1.1 High demand for cost-effective modular buildings

TABLE 227 GERMANY: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 228 GERMANY: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 229 GERMANY: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 230 GERMANY: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 231 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 232 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 233 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 234 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 235 GERMANY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 GERMANY: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 237 GERMANY: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 238 GERMANY: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4.2 UK

13.4.2.1 Rapid construction and renovation activities

TABLE 239 UK: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 240 UK: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 241 UK: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 242 UK: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 243 UK: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 244 UK: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 245 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 246 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 247 UK: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 248 UK: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 249 UK: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 250 UK: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4.3 FRANCE

13.4.3.1 Non-residential projects to provide opportunities for market players

TABLE 251 FRANCE: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 252 FRANCE: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 253 FRANCE: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 254 FRANCE: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 255 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 256 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 257 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 258 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 259 FRANCE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 260 FRANCE: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 261 FRANCE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 262 FRANCE: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4.4 RUSSIA

13.4.4.1 Increased demand for new housing

TABLE 263 RUSSIA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 264 RUSSIA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 265 RUSSIA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 266 RUSSIA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 267 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 268 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 269 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 270 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 271 RUSSIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 272 RUSSIA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 273 RUSSIA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 274 RUSSIA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4.5 ITALY

13.4.5.1 Growing housing market to increase demand

TABLE 275 ITALY: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 276 ITALY: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 277 ITALY: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 278 ITALY: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 279 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 280 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 281 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 282 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 283 ITALY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 284 ITALY: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 285 ITALY: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 286 ITALY: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.4.6 REST OF EUROPE

TABLE 287 REST OF EUROPE: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 288 REST OF EUROPE: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 289 REST OF EUROPE: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 290 REST OF EUROPE: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 291 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 292 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 293 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 294 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 295 REST OF EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 296 REST OF EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 297 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 298 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.5 MIDDLE EAST & AFRICA

TABLE 299 MIDDLE EAST & AFRICA: PRECAST CONCRETE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 300 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 301 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 302 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 303 MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 304 MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 305 MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 306 MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 307 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 308 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 309 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 310 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 311 MIDDLE EAST & AFRICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 312 MIDDLE EAST & AFRICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 313 MIDDLE EAST & AFRICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 314 MIDDLE EAST & AFRICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

TABLE 315 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 316 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 317 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 318 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

TABLE 319 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 320 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 321 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 322 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

13.5.1 UAE

13.5.1.1 Accelerated demand for modular buildings

TABLE 323 UAE: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 324 UAE: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 325 UAE: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 326 UAE: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 327 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 328 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 329 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 330 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 331 UAE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 332 UAE: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 333 UAE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 334 UAE: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.5.2 SAUDI ARABIA

13.5.2.1 Increasing construction activities

TABLE 335 SAUDI ARABIA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 336 SAUDI ARABIA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 337 SAUDI ARABIA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 338 SAUDI ARABIA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 339 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 340 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 341 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 342 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 343 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 344 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 345 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 346 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.5.3 SOUTH AFRICA

13.5.3.1 Rapid urbanization and growing demand for sustainable buildings

TABLE 347 SOUTH AFRICA: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 348 SOUTH AFRICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 349 SOUTH AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 350 SOUTH AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 351 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 352 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 353 SOUTH AFRICA: PRECAST CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 354 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 355 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 356 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 357 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 358 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.5.4 TURKEY

13.5.4.1 Significant infrastructural investments

TABLE 359 TURKEY: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 360 TURKEY: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 361 TURKEY: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 362 TURKEY: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 363 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 364 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 365 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 366 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 367 TURKEY: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 368 TURKEY: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 369 TURKEY: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 370 TURKEY: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 371 REST OF MIDDLE EAST & AFRICA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 372 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 373 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 374 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 375 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 376 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 377 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 378 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 379 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 380 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 381 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 382 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.6 SOUTH AMERICA

TABLE 383 SOUTH AMERICA: PRECAST CONCRETE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 384 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 385 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 386 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 387 SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 388 SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 389 SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 390 SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 391 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 392 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 393 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 394 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 395 SOUTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (USD MILLION)

TABLE 396 SOUTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 397 SOUTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (USD MILLION)

TABLE 398 SOUTH AMERICA: MARKET SIZE, BY NON-RESIDENTIAL APPLICATION, 2021–2027 (MILLION SQUARE FEET)

TABLE 399 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 400 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 401 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 402 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

TABLE 403 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 404 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE FEET)

TABLE 405 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 406 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (MILLION SQUARE FEET)

13.6.1 BRAZIL

13.6.1.1 Strong market for affordable housing

TABLE 407 BRAZIL: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 408 BRAZIL: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 409 BRAZIL: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 410 BRAZIL: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 411 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 412 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 413 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 414 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 415 BRAZIL: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 416 BRAZIL: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 417 BRAZIL: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 418 BRAZIL: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.6.2 ARGENTINA

13.6.2.1 Growth in non-residential construction

TABLE 419 ARGENTINA: PRECAST CONCRETE MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 420 ARGENTINA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 421 ARGENTINA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 422 ARGENTINA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 423 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 424 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 425 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 426 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 427 ARGENTINA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 428 ARGENTINA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 429 ARGENTINA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 430 ARGENTINA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

13.6.3 REST OF SOUTH AMERICA

TABLE 431 REST OF SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (USD MILLION)

TABLE 432 REST OF SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2017–2020 (MILLION SQUARE FEET)

TABLE 433 REST OF SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (USD MILLION)

TABLE 434 REST OF SOUTH AMERICA: MARKET SIZE, BY ELEMENT, 2021–2027 (MILLION SQUARE FEET)

TABLE 435 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 436 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE FEET)

TABLE 437 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 438 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (MILLION SQUARE FEET)

TABLE 439 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 440 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE FEET)

TABLE 441 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 442 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (MILLION SQUARE FEET)

14 COMPETITIVE LANDSCAPE (Page No. - 269)

14.1 INTRODUCTION

14.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 443 OVERVIEW OF STRATEGIES ADOPTED BY PRECAST CONCRETE MANUFACTURERS

14.3 MARKET SHARE ANALYSIS

14.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN MARKET, 2021

14.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 444 MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 44 PRECAST CONCRETE: MARKET SHARE ANALYSIS

14.3.2.1 CEMEX S.A.B. de C.V.

14.3.2.2 LafargeHolcim Ltd

14.3.2.3 CRH PLC

14.3.2.4 Boral Limited

14.3.2.5 Balfour Beatty Plc

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STARS

14.4.2 PERVASIVE PLAYERS

14.4.3 EMERGING LEADERS

14.4.4 PARTICIPANTS

FIGURE 45 MARKET: COMPANY EVALUATION QUADRANT, 2021

14.5 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

14.5.1 PROGRESSIVE COMPANIES

14.5.2 RESPONSIVE COMPANIES

14.5.3 DYNAMIC COMPANIES

14.5.4 STARTING BLOCKS

FIGURE 46 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

14.6 COMPETITIVE BENCHMARKING

TABLE 445 MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 446 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

14.7 COMPETITIVE SITUATIONS AND TRENDS

14.7.1 DEALS

TABLE 447 MARKET: DEALS (2016 TO 2022)

15 COMPANY PROFILES (Page No. - 282)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1 MAJOR PLAYERS

15.1.1 CEMEX S.A.B. DE C.V.

TABLE 448 CEMEX S.A.B. DE C.V.: COMPANY OVERVIEW

FIGURE 47 CEMEX S.A.B. DE C.V.: COMPANY SNAPSHOT

15.1.2 BORAL LIMITED

TABLE 449 BORAL LIMITED: COMPANY OVERVIEW

FIGURE 48 BORAL LIMITED: COMPANY SNAPSHOT

15.1.3 LAFARGEHOLCIM LTD

TABLE 450 LAFARGEHOLCIM LTD: COMPANY OVERVIEW

FIGURE 49 LAFARGEHOLCIM LTD: COMPANY SNAPSHOT

15.1.4 BALFOUR BEATTY PLC

TABLE 451 BALFOUR BEATTY PLC: COMPANY OVERVIEW

FIGURE 50 BALFOUR BEATTY PLC: COMPANY SNAPSHOT

15.1.5 CRH PLC

TABLE 452 CRH PLC: COMPANY OVERVIEW

FIGURE 51 CRH PLC: COMPANY SNAPSHOT

15.1.6 SKANSKA AB

TABLE 453 SKANSKA AB: COMPANY OVERVIEW

FIGURE 52 SKANSKA AB: COMPANY SNAPSHOT

15.1.7 FORTERRA, INC.

TABLE 454 FORTERRA, INC.: COMPANY OVERVIEW

FIGURE 53 FORTERRA, INC.: COMPANY SNAPSHOT

15.1.8 DEVINCI PRECAST

TABLE 455 DEVINCI PRECAST: COMPANY OVERVIEW

15.1.9 ATCO CONCRETE PRODUCTS N.V.

TABLE 456 ATCO CONCRETE PRODUCTS N.V.: COMPANY OVERVIEW

15.1.10 BEAVER GULF PRECAST CONCRETE

TABLE 457 BEAVER GULF PRECAST CONCRETE: COMPANY OVERVIEW

15.2 ADDITIONAL PLAYERS

15.2.1 TINDALL CORPORATION

TABLE 458 TINDALL CORPORATION: COMPANY OVERVIEW

15.2.2 GULF PRECAST CONCRETE COMPANY L.L.C.

TABLE 459 GULF PRECAST CONCRETE COMPANY L.L.C.: COMPANY OVERVIEW

15.2.3 LAING O'ROURKE

TABLE 460 LAING O'ROURKE: COMPANY OVERVIEW

15.2.4 THE PRECAST GROUP

TABLE 461 THE PRECAST GROUP: COMPANY OVERVIEW

15.2.5 JULIUS BERGER NIGERIA PLC

TABLE 462 JULIUS BERGER NIGERIA PLC: COMPANY OVERVIEW

15.2.6 KATERRA

TABLE 463 KATERRA: COMPANY OVERVIEW

15.2.7 OLDCASTLE INFRASTRUCTURE, INC.

TABLE 464 OLDCASTLE INFRASTRUCTURE, INC.: COMPANY OVERVIEW

15.2.8 PRECA SOLUTIONS INDIA PRIVATE LIMITED

TABLE 465 PRECA SOLUTIONS INDIA PRIVATE LIMITED: COMPANY OVERVIEW

15.2.9 VME PRECAST PRIVATE LIMITED

TABLE 466 VME PRECAST PRIVATE LIMITED: COMPANY OVERVIEW

15.2.10 MACKAY PRECAST PRODUCTS

TABLE 467 MACKAY PRECAST PRODUCTS: COMPANY OVERVIEW

15.2.11 CONSOLIS

TABLE 468 CONSOLIS: COMPANY OVERVIEW

15.2.12 COLTMAN PRECAST CONCRETE LTD.

TABLE 469 COLTMAN PRECAST CONCRETE LTD.: COMPANY OVERVIEW

15.2.13 METROMONT CORPORATION

TABLE 470 METROMONT CORPORATION: COMPANY OVERVIEW

15.2.14 SMEET PRECAST

TABLE 471 SMEET PRECAST: COMPANY OVERVIEW

15.2.15 MSE PRECAST LTD.

TABLE 472 MSE PRECAST LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 316)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities for estimating the current global size of the precast concrete. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of precast concrete through primary research. The supply-side approach was employed to estimate the overall size of the precast concrete. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the precast concrete. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

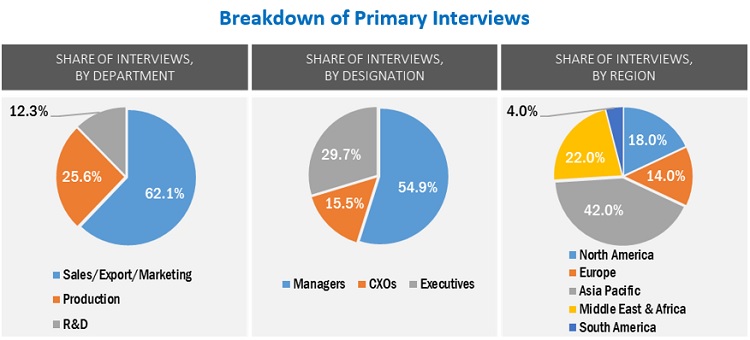

Various primary sources from both the supply and demand sides of the precast concrete were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the precast concrete industry. Primary sources from the demand side include experts and key personnel in various end-use industries.The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

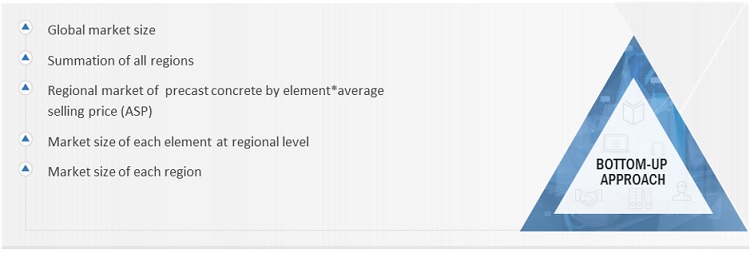

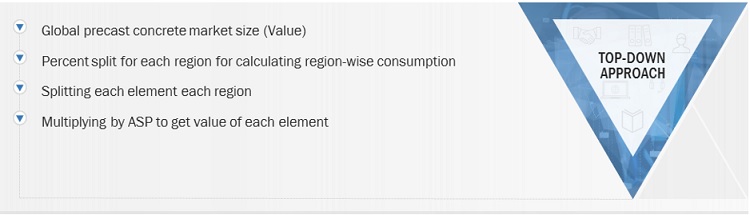

The bottom-up and top-down approaches have been used to estimate the precast concrete market by element, construction type, end-use industry, type, application and region. The research methodology used to calculate the market size includes the following steps:

- The key players of each type in the precast concrete market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The market size of the precast concrete market has been derived from the aggregation of the market shares of the leading players in each product, and the forecast is based on the analysis of market trends, such as pricing and consumption of precast concrete in various end-use industries.

- The market size of the precast concrete by region has been calculated by using the market sizes of each product in each end-use industry.

- The market size for precast concrete for each end-use, in terms of value, has been calculated by multiplying the average price of the product with their volumes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Precast Concrete Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Precast Concrete Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market has been split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches. It has been then verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and interviews with experts. The data is assumed correct only when the values arrived at from these three sources match.

Report Objectives

- To define, analyze, and project the size of the precast concrete in terms of value and volume based on element, construction type, end-use industry, type, application and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, and merger & acquisitions, in the precast concrete

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the precast concrete report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the precast concrete for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Precast Concrete Market