Process Automation and Instrumentation Market by Instrument (Field Instruments, Process Analyzers), Solution (PLC, DCS, SCADA, HMI, Functional Safety, MES), Industry and Region (2022-2027)

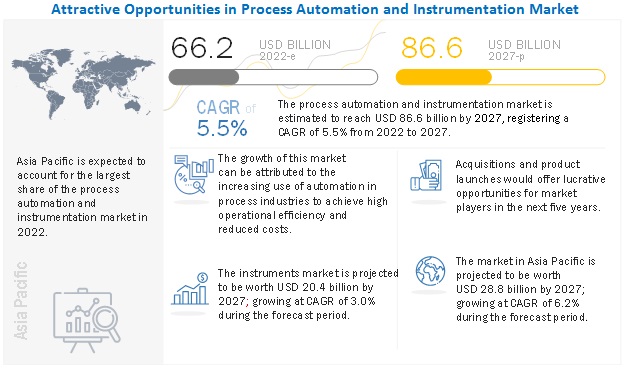

The global process automation and instrumentation market size is projected to reach USD 86.6 billion by 2027, at a CAGR of 5.5% during the forecast period.

The growth of this market can be attributed to the growing importance of energy efficiency and cost optimization, increased productivity, minimized errors and better scalability; the increasing use of digital technologies such as IIoT, machine learning, and artificial intelligence; and the rising emphasis on industrial automation and optimum utilization of resources.

Process Automation and Instrumentation Market Statistics to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the Process Automation and Instrumentation Market

The outbreak of the COVID-19 pandemic had negatively impacted the growth of the process automation and instrumentation industry in 2020 due to disruptions in the supply chain and a decline in demand.

The worldwide outbreak of COVID-19 has forced many businesses to limit their production and halt most of their operations. During this crisis, the main objective of the companies was to sustain their businesses by finding safer ways to continue manufacturing operations or find other sustainable ways to get the revenue stream flowing. The future impact is uncertain and depends on the spread of COVID-19 or the success of control measures undertaken to curb the spread of the virus.

Global Process Automation and Instrumentation Market Dynamics

DRIVERS: Increasing focus of manufacturing firms on achieving cost saving and better efficiency

Industries worldwide increasingly focus on improving production efficiency and reducing operating costs to sustain in the changing global industrial environment. The efficiency of a production site is assessed by its ability to respond quickly to rapid and unexpected changes in demand, preferences, and resource availability.

This can be accomplished through process automation. Instrumentation products help measure and analyze process parameters such as pressure, temperature, level, and humidity, while process automation solutions help monitor and control processes to lower rework costs, minimize inspection costs, and reduce system failures. Thus, process automation helps manufacturing firms decrease costs and increase revenue. Industries are actively adopting process automation and instrumentation solutions across their production sites to streamline industry operations, achieve enhanced productivity, and reduce labor-related costs.

RESTRAINTS: High implementation and maintenance costs associated with process automation

Establishing a new automated manufacturing plant requires deploying the latest automation technologies such as SCADA, DCS, PLC, and HMI. One of the most significant factors limiting the growth of the process automation and instrumentation market is the need for high initial investments to set up an automated production plant.

Huge capital is required to deploy automation solutions such as DCS and SCADA, as well as instrumentation devices such as process analyzers and transmitters. The installation of solutions such as DCS at an industrial site involves various stages, including system implementation, process running, data acquisition, and consultation; this subsequently increases the overall costs, thereby increasing the operating expenses of the plant owner. Furthermore, automation software solutions require frequent upgrades owing to ongoing technological advancements. It is not feasible for small businesses to bear such expenses. Thus, system installation, maintenance, and upgrade require huge capital investment, restricting market growth to a certain extent.

OPPORTUNITIES: Growing adoption of Industry 4.0 by manufacturing firms

The process automation market is expected to grow at a significant rate owing to the rising adoption of Industry 4.0 principles in manufacturing industries, including oil & gas, food & beverages, chemicals. With the adoption of Industry 4.0, most processes and systems in the manufacturing sector are automated using a variety of technologies, such as cyber-physical systems, IoT, cloud computing, which allow production units to operate efficiently 24/7 with zero human errors.

It helps reduce production cycle time, achieve process efficiency, right from the raw material procurement stage to the development of the end product. Automation enhances industrial processes through improved communication and self-monitoring techniques, intelligent collection of real-time data, which analyzes and diagnoses issues without human intervention.

Industry 4.0 enables improvement in operational efficiency, productivity, product quality, asset utilization, supply chain management, workplace safety, and environmental sustainability. Thus, the adoption of Industry 4.0 principles by several industries is expected to create lucrative opportunities for market players in the next few years.

CHALLENGES: Shortage of skilled personnel to operate sophisticated automation systems

Skilled resources are required to operate process automation and instrumentation solutions because of the complex processes, which can be misinterpreted and may lead to errors and faults if handled by an unskilled workforce. As artificial intelligence (AI) and the Internet of Things (IoT) are changing the nature of work, process automation will accelerate the shift in required skill sets.

The demand for a skilled workforce will increase as companies seek to use IoT data to predict outcomes, optimize operations, prevent failures, develop new products, and deploy advanced analytics competencies, including artificial intelligence (AI) and machine learning (ML), in manufacturing. Process automation systems integrated with advanced technologies, such as AI and IoT, need attention and expertise while handling various scenarios. Therefore, the shortage of skilled workforce creates challenges for providers of process automation and instrumentation products.

Process Automation and Instrumentation Industry Segment Overview

“Field instruments dominated the global process automation and instrumentation market in 2021”

Field instruments assist in managing plant assets, enhancing plant safety, and optimizing overall production processes through data acquisition, control, and measurement. It is necessary to obtain key information regarding major parameters, including temperature, pressure, and level, to monitor and control processes quickly,

smoothly, securely, and accurately, as well as to achieve optimum productivity. These instruments play a pivotal role in measuring and controlling process parameters in process industries. For example, in June 2021, Emerson Electric Co. introduced a new Rosemount 1408H level transmitter, specifically designed for the food & beverages industry. The constant release of advanced products to automate industrial processes and measure and control different process parameters is expected to drive the process automation and instrumentation market for field instruments.

To know about the assumptions considered for the study, download the pdf brochure

Process Automation and Instrumentation Market Share & Growth

“Asia Pacific to grow at the highest CAGR during the forecast period of 2022 to 2027”

In terms of region, Asia Pacific led the global process automation and instrumentation market, followed Asia Pacific led the global process automation and instrumentation market, followed by North America and Europe in 2021. In Asia Pacific, the demand for process automation and instrumentation solutions is growing from the oil & gas and food & beverages industries due to the ever-increasing population in Asia Pacific.

Increasing investments in clean energy infrastructure in Asia Pacific to meet escalating demand for electricity and reduce reliance on fossil fuels to generate energy. Also, the process automation and instrumentation market for the pharmaceuticals industry in this region is expected to grow at the highest CAGR from 2022 to 2027 due to changing regulatory environment. Also, advantages such as higher reliability and flexibility and greater speed and accuracy offered by process automation encourage pharma companies to adopt process automation and instrumentation solutions.

Top Process Automation and Instrumentation Companies - Key Market Players

ABB Ltd. (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), and Schneider Electric (France) are a few major players in process automation and instrumentation market.

Process Automation and Instrumentation Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 66.2 billion by 2022 |

| Projected Value | USD 86.6 billion by 2027 |

| Growth Rate | CAGR of 5.5% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Instrument, Solution, and Industry |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: ABB Ltd (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), and Schneider Electric (France),and Others- total 30 players have been covered. |

This research report categorizes the process automation and instrumentation market by instrument, solution, industry, and region.

By Instrument:

-

Field Instruments

- Level Transmitters

- Pressure Transmitters

- Temperature Transmitters

- Others

- Process Analyzers

By Solution:

- PLC

- DCS

- SCADA

- HMI

- Functional Safety

- MES

By Industry:

- Oil & Gas

- Chemicals

- Pulp & Paper

- Pharmaceuticals

- Metals & Mining

- Food & Beverages

- Energy & Power

- Water & Wastewater Treatment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments in Process Automation and Instrumentation Industry

- In September 2021, Siemens launched Sitrans IQ, a new digitalization portfolio designed for targeted monitoring of critical measurement points to complete asset management covering instrumentation for multiple plants. This solution meets all types of requirements, including apps for smart asset management, smart inventory management, remote monitoring, Bluetooth connectivity for field devices and condition monitoring of capital assets

- In June 2020, Emerson Electric Co. launched ASCO Series 353 pulse valves. These valves are expected to help end users achieve effective, efficient, and convenient bag cleaning. These valves can be used in different applications in agriculture, pharmaceuticals, mining, rubber, metals, cement, and power industries

- In February 2019, General Electric Company launched the sixth version of iFIX, an HMI/SCADA software designed to improve operational productivity by providing plant operators with high performance to give users the most informed view of the problem or task and secure visualization from anywhere at any time.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the process automation and instrumentation market during 2022-2027?

The global process automation and instrumentation market is expected to record a CAGR of 5.5% from 2022–2027.

Does this report include the impact of COVID-19 on the process automation and instrumentation market?

Yes, the report includes the impact of COVID-19 on the process automation and instrumentation market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the process automation and instrumentation?

Increasing focus of manufacturing firms on achieving cost saving & better efficiency and rising trend of connected enterprises in process industries are some of the key driving factors for this market.

Which are the significant players operating in the process automation and instrumentation market?

ABB Ltd (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), and Schneider Electric (France) are some of the major companies operating in the process automation and instrumentation market.

Which region will lead the process automation and instrumentation market in the future?

Asia Pacific is expected to lead the process automation and instrumentation market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 3 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 4 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR LEVEL TRANSMITTERS MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 7 IMPACT OF COVID-19 ON PROCESS AUTOMATION AND INSTRUMENTATION MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 FIELD INSTRUMENTS TO ACCOUNT FOR LARGER MARKET SHARE THAN PROCESS ANALYZERS THROUGHOUT FORECAST PERIOD

FIGURE 9 DCS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 OIL & GAS TO ACCOUNT FOR LARGEST SHARE OF PROCESS AUTOMATION AND INSTRUMENTATION MARKET BETWEEN 2022 AND 2027

FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PROCESS AUTOMATION AND INSTRUMENTATION MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PROCESS AUTOMATION AND INSTRUMENTATION MARKET

FIGURE 12 RISING ADOPTION OF PROCESS AUTOMATION AND INSTRUMENTATION SOLUTIONS IN VARIOUS INDUSTRIES TO INCREASE OPERATIONAL EFFICIENCY WOULD FUEL MARKET GROWTH DURING FORECAST PERIOD

4.2 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT

FIGURE 13 FIELD INSTRUMENTS TO CAPTURE LARGER MARKET SHARE FROM 2022 TO 2027

4.3 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY SOLUTION

FIGURE 14 MANUFACTURING EXECUTION SYSTEM (MES) TO REGISTER HIGHEST CAGR IN PROCESS AUTOMATION AND INSTRUMENTATION MARKET FROM 2022 TO 2027

4.4 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN NORTH AMERICA, BY COUNTRY

FIGURE 15 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN 2027

4.5 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INDUSTRY

FIGURE 16 OIL & GAS INDUSTRY TO HOLD MAJORITY MARKET SHARE IN 2027

4.6 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY COUNTRY

FIGURE 17 INDIA TO EXHIBIT HIGHEST CAGR IN PROCESS AUTOMATION AND INSTRUMENTATION MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing focus of manufacturing firms on achieving cost saving and better efficiency

5.2.1.2 Growing need for efficient utilization of resources

5.2.1.3 Rising trend of connected enterprises in process industries

FIGURE 19 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High implementation and maintenance costs associated with process automation

5.2.2.2 Sharp decline in revenue of major end-user industries such as oil & gas and energy & power

FIGURE 20 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of Industry 4.0 by manufacturing firms

5.2.3.2 Surging demand for safety automation systems across process industries

5.2.3.3 Rising need for efficient multivariable pressure transmitters

5.2.3.4 Increasing adoption of IIoT across industries

FIGURE 21 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Cyberattacks and security threats

5.2.4.2 Shortage of skilled personnel to operate sophisticated automation systems

FIGURE 22 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN: PROCESS AUTOMATION AND INSTRUMENTATION MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: ECOSYSTEM ANALYSIS

TABLE 1 PROCESS AUTOMATION AND INSTRUMENTATION MARKET ECOSYSTEM: KEY PLAYERS

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN PROCESS AUTOMATION AND INSTRUMENTATION MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY ANALYSIS

TABLE 3 INDUSTRIAL NETWORKING SOLUTIONS (INS) HELPED ARB MIDSTREAM DEPLOY SCADA SOLUTIONS FOR NEW PIPELINE

TABLE 4 EMERSON HELPED CRUDE OIL PRODUCER TO REDUCE OPERATIONAL COSTS USING PRESSURE TRANSMITTERS

TABLE 5 AVEVA HELPED CITY OF BARCELONA EFFECTIVELY MANAGE RESOURCES AND INTEGRATE NEW PROCESSES AND FACILITIES

TABLE 6 COLOMBIAN OIL AND GAS COMPANY REDUCED MAINTENANCE COSTS AND INCREASED CYBER SECURITY FOR ITS ABB DISTRIBUTED CONTROL SYSTEMS

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT

5.8.1.1 IoT connectivity for process automation and instrumentation

5.8.2 ARTIFICIAL INTELLIGENCE

5.8.2.1 AI in process automation to reduce human intervention

5.8.3 PREDICTIVE MAINTENANCE

5.8.3.1 Maximum benefits of predictive maintenance

5.8.4 DIGITAL TWIN

5.8.4.1 Digital twin as foundation of Industry 4.0

5.9 PRICING ANALYSIS

5.9.1 LEVEL TRANSMITTERS

5.9.2 MES

TABLE 7 MANUFACTURING EXECUTION SYSTEM: AVERAGE PRICE ANALYSIS

5.9.3 FUNCTIONAL/INDUSTRIAL SAFETY COMPONENTS

TABLE 8 AVERAGE SELLING PRICE OF COMPONENTS

5.9.4 PROCESS ANALYZERS

5.9.5 DCS

TABLE 9 PRICE OF CONVENTIONAL DISTRIBUTED CONTROL SYSTEMS:

5.9.6 PLC

TABLE 10 PRICING ANALYSIS OF PROGRAMMABLE LOGIC CONTROLLER (PLC):

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO FOR INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE OR OTHER VARIABLES

FIGURE 26 IMPORT DATA FOR INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES, BY KEY COUNTRY, 2016−2020 (USD MILLION)

5.10.2 EXPORT SCENARIO FOR INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES

FIGURE 27 EXPORT DATA FOR INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES, BY KEY COUNTRY, 2016−2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 11 TOP 20 PATENT OWNERS IN US FROM 2011 TO 2021

TABLE 12 LIST OF FEW PATENTS IN INDUSTRIAL AUTOMATION MARKET, 2019–2021

5.12 MARKET REGULATIONS AND STANDARDS

TABLE 13 REGULATIONS AND STANDARDS FOR PROCESS AUTOMATION AND INSTRUMENTATION

5.13 COMMUNICATION PROTOCOLS

5.13.1 WIRED COMMUNICATION PROTOCOLS

FIGURE 30 WIRED COMMUNICATION PROTOCOLS

5.13.1.1 USB protocol

5.13.1.2 UART protocol

5.13.1.3 SPI protocol

5.13.1.4 I2C protocol

5.13.1.5 CAN protocol

5.13.2 WIRELESS COMMUNICATION PROTOCOLS

5.13.2.1 Wi-Fi

5.13.2.2 Bluetooth

5.13.2.3 Zigbee

5.13.2.4 3G & 4G cellular

5.13.2.5 Others

TABLE 14 COMPARISON: WIRELESS COMMUNICATION PROTOCOLS

6 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT (Page No. - 91)

6.1 INTRODUCTION

FIGURE 31 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT

FIGURE 32 SOLUTIONS TO LEAD PROCESS AUTOMATION AND INSTRUMENTATION MARKET FROM 2022 TO 2027

TABLE 15 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 16 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 17 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2018–2021 (USD MILLION)

TABLE 18 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2022–2027 (USD MILLION)

6.2 FIELD INSTRUMENTS

TABLE 19 FIELD INSTRUMENTS: COMMON TYPES OF TRANSMITTERS USED IN PROCESS INDUSTRIES

6.2.1 IMPACT OF COVID-19 ON MARKET FOR FIELD INSTRUMENTS

TABLE 20 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 22 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 23 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 24 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FIELD INSTRUMENTS, BY REGION, 2022–2027 (USD MILLION)

6.2.2 LEVEL TRANSMITTERS

6.2.2.1 Accurate measurements offered by level transmitters for applications in water & wastewater treatment industry to foster market growth

TABLE 26 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR LEVEL TRANSMITTERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 27 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR LEVEL TRANSMITTERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 28 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR LEVEL TRANSMITTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR LEVEL TRANSMITTERS, BY REGION, 2022–2027 (USD MILLION)

6.2.3 PRESSURE TRANSMITTERS

6.2.3.1 Widespread use of pressure transmitters in oil & gas industry to push market growth

TABLE 30 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PRESSURE TRANSMITTERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 31 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PRESSURE TRANSMITTERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 32 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PRESSURE TRANSMITTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PRESSURE TRANSMITTERS, BY REGION, 2022–2027 (USD MILLION)

6.2.4 TEMPERATURE TRANSMITTERS

6.2.4.1 Advanced capabilities of temperature transmitters to simplify operations will facilitate their demand

TABLE 34 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR TEMPERATURE TRANSMITTERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 35 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR TEMPERATURE TRANSMITTERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 36 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR TEMPERATURE TRANSMITTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR TEMPERATURE TRANSMITTERS, BY REGION, 2022–2027 (USD MILLION)

6.2.5 OTHERS

6.2.5.1 Humidity transmitters

6.2.5.2 Vibration level switches

TABLE 38 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR OTHERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 39 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR OTHERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 40 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

6.3 PROCESS ANALYZERS

6.3.1 HIGH DEMAND FROM PHARMACEUTICALS INDUSTRY TO DRIVE GROWTH OF MARKET FOR PROCESS ANALYZERS

TABLE 42 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PROCESS ANALYZERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 43 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PROCESS ANALYZERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 44 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PROCESS ANALYZERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PROCESS ANALYZERS, BY REGION, 2022–2027 (USD MILLION)

7 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY SOLUTION (Page No. - 109)

7.1 INTRODUCTION

FIGURE 33 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY SOLUTION

FIGURE 34 DCS TO HOLD LARGER SHARE OF PROCESS AUTOMATION AND INSTRUMENTATION MARKET FROM 2022 TO 2027

TABLE 46 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 47 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 48 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SOLUTIONS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 49 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SOLUTIONS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 50 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SOLUTIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SOLUTIONS, BY REGION, 2022–2027 (USD MILLION)

7.2 PROGRAMMABLE LOGIC CONTROLLER

7.2.1 GROWING USE OF MICRO AND NANO CONTROLLERS IN DIFFERENT PROCESS INDUSTRIES TO FUEL MARKET GROWTH

7.2.2 IMPACT OF COVID-19 ON MARKET FOR PROGRAMMABLE LOGIC CONTROLLERS

TABLE 52 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PLC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 53 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PLC, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 54 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PLC, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR PLC, BY REGION, 2022–2027 (USD MILLION)

7.3 DISTRIBUTED CONTROL SYSTEM

7.3.1 RISING NEED FOR AUTOMATION TO ACHIEVE IMPROVED OPERATIONAL EFFICIENCY WILL AUGMENT DEMAND FOR DCS

7.3.2 IMPACT OF COVID-19 ON MARKET FOR DCS

TABLE 56 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR DCS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 57 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR DCS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 58 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR DCS, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR DCS, BY REGION, 2022–2027 (USD MILLION)

7.4 SCADA

7.4.1 SURGING ADOPTION OF SCADA SYSTEMS TO COLLECT REAL-TIME DATA REGARDING PRODUCTION COUNT AND DOWNTIME PROPELS MARKET GROWTH

7.4.2 IMPACT OF COVID-19 ON MARKET FOR SCADA

TABLE 60 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SCADA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 61 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SCADA, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 62 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SCADA, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR SCADA, BY REGION, 2022–2027 (USD MILLION)

7.5 HUMAN–MACHINE INTERFACE

7.5.1 INCREASING ADOPTION OF IIOT BY MANUFACTURING COMPANIES TO BOOST DEMAND FOR HMI

7.5.2 IMPACT OF COVID-19 ON MARKET FOR HMI

TABLE 64 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR HMI, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 65 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR HMI, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 66 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR HMI, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR HMI, BY REGION, 2022–2027 (USD MILLION)

7.6 FUNCTIONAL SAFETY

7.6.1 RISING FOCUS OF GOVERNMENT ON IMPOSING STRINGENT SAFETY STANDARDS ACROSS INDUSTRIES ACCELERATES DEMAND FOR FUNCTIONAL SAFETY SOLUTIONS

7.6.2 IMPACT OF COVID-19 ON MARKET FOR FUNCTIONAL SAFETY

TABLE 68 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FUNCTIONAL SAFETY, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 69 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FUNCTIONAL SAFETY, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 70 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2022–2027 (USD MILLION)

7.7 MANUFACTURING EXECUTION SYSTEM

7.7.1 ACCELERATING NEED FOR EFFICIENT DATA MONITORING AND CONTROL SOFTWARE SOLUTIONS TO SPUR DEMAND FOR MES

7.7.2 IMPACT OF COVID-19 ON MARKET FOR MANUFACTURING EXECUTION SYSTEM

TABLE 72 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR MES, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 73 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR MES, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 74 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR MES, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 PROCESS AUTOMATION AND INSTRUMENTATION MARKET FOR MES, BY REGION, 2022–2027 (USD MILLION)

8 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INDUSTRY (Page No. - 128)

8.1 INTRODUCTION

FIGURE 35 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INDUSTRY

FIGURE 36 OIL & GAS INDUSTRY TO CAPTURE MAJORITY SHARE OF PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN 2027

TABLE 76 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 77 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.2 OIL & GAS

8.2.1 ACCELERATED DEPLOYMENT OF AUTOMATION SOLUTIONS IN OIL & GAS SECTOR TO REDUCE RISK OF ACCIDENTS AND ACHIEVE OPTIMUM EQUIPMENT NETWORK PERFORMANCE AUGMENT MARKET GROWTH

8.2.2 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

8.3 CHEMICALS

8.3.1 INCREASED USE OF PROCESS AUTOMATION PRODUCTS IN CHEMICAL PLANTS TO ENHANCE SAFETY AND IMPROVE EFFICIENCY TO STIMULATE MARKET GROWTH

8.3.2 IMPACT OF COVID-19 ON CHEMICALS INDUSTRY

8.4 PULP & PAPER

8.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND CRITICAL NEED TO REDUCE OPERATING COSTS BOOST ADOPTION OF PROCESS AUTOMATION SOLUTIONS IN PULP & PAPER INDUSTRY

8.4.2 IMPACT OF COVID-19 ON PULP & PAPER INDUSTRY

8.5 PHARMACEUTICALS

8.5.1 RAPID ADOPTION OF PROCESS AUTOMATION SOLUTIONS IN PHARMACEUTICALS INDUSTRY TO IMPROVE PRODUCTION EFFICIENCY AND REDUCE PRODUCTION AND OPERATING COSTS TO SUPPORT MARKET GROWTH

8.5.2 IMPACT OF COVID-19 ON PHARMACEUTICALS INDUSTRY

8.6 METALS & MINING

8.6.1 HIGH NEED FOR EFFICIENT MONITORING AND CONTROL SOLUTIONS IN MINING OPERATIONS TO BOOST DEMAND FOR PROCESS AUTOMATION AND INSTRUMENTATION SOLUTIONS

8.6.2 IMPACT OF COVID-19 ON METALS & MINING INDUSTRY

8.7 FOOD & BEVERAGES

8.7.1 ESCALATED NEED FOR PROCESS AUTOMATION SOLUTIONS TO IMPROVE PLANT PRODUCTIVITY AND EFFICIENCY WILL PROPEL MARKET GROWTH FOR F&B INDUSTRY

8.7.2 IMPACT OF COVID-19 ON FOOD & BEVERAGES INDUSTRY

8.8 ENERGY & POWER

8.8.1 ELEVATED DEMAND FOR ELECTRICITY AND STRONG NEED FOR HIGH OPERATIONAL EFFICIENCY TO PUSH MARKET GROWTH

8.8.2 IMPACT OF COVID-19 ON ENERGY & POWER INDUSTRY

8.9 WATER & WASTEWATER TREATMENT

8.9.1 URGENT NEED TO IMPROVE WATER TREATMENT PROCESSES TO SPUR DEMAND FOR PROCESS AUTOMATION AND INSTRUMENTATION SOLUTIONS

8.9.2 IMPACT OF COVID-19 ON WATER & WASTEWATER TREATMENT INDUSTRY

8.10 OTHERS

8.10.1 IMPACT OF COVID-19 ON OTHER INDUSTRIES

9 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION (Page No. - 139)

9.1 INTRODUCTION

FIGURE 37 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, GEOGRAPHIC ANALYSIS

TABLE 78 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 38 GEOGRAPHIC SNAPSHOT: PROCESS AUTOMATION AND INSTRUMENTATION MARKET

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 39 SNAPSHOT: PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN NORTH AMERICA

FIGURE 40 US TO LEAD NORTH AMERICAN PROCESS AUTOMATION AND INSTRUMENTATION MARKET THROUGHOUT FORECAST PERIOD

TABLE 80 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Increasing adoption of automation solutions in oil & gas, pharmaceuticals, and food & beverages industries drives market growth in US

9.2.3 CANADA

9.2.3.1 Growing support offered by Canadian government to small-scale food processing industries to adopt advanced technologies such as machine learning and automation to boost market growth

9.2.4 MEXICO

9.2.4.1 Rising adoption of Industry 4.0 to provide growth opportunities for process automation and instrumentation market

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 41 SNAPSHOT: PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN EUROPE

FIGURE 42 GERMANY TO HOLD LARGEST SHARE OF EUROPEAN PROCESS AUTOMATION AND INSTRUMENTATION MARKET DURING FORECAST PERIOD

TABLE 82 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Declining working-age population and stringent regulatory framework in Germany promote deployment of process automation solutions across process industries

9.3.3 UK

9.3.3.1 Increasing adoption of IoT across several industries to foster process automation and instrumentation market

9.3.4 FRANCE

9.3.4.1 Thriving chemical and food processing industries in France fuel demand for process automation and instrumentation solutions

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 IMPACT OF COVID-19 ON MARKET IN ASIA PACIFIC

FIGURE 43 SNAPSHOT: PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ASIA PACIFIC

FIGURE 44 CHINA TO ACCOUNT FOR LARGEST SHARE OF PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 84 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Growing demand for SCADA from water & wastewater treatment industry to foster market growth in China

9.4.3 JAPAN

9.4.3.1 Increasing labor shortage and labor wages to accelerate demand for automation solutions in Japan

9.4.4 INDIA

9.4.4.1 Supportive government initiatives to fuel adoption of automation solutions across process industries in India

9.4.5 REST OF ASIA PACIFIC

9.5 ROW

9.5.1 IMPACT OF COVID-19 ON MARKET IN ROW

FIGURE 45 MIDDLE EAST TO COMMAND PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ROW THROUGHOUT FORECAST PERIOD

TABLE 86 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

9.5.2 MIDDLE EAST

9.5.2.1 Strong oil & gas industry in Middle East drives demand for process automation solutions

TABLE 88 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 PROCESS AUTOMATION AND INSTRUMENTATION MARKET IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.3 SOUTH AMERICA

9.5.3.1 High demand for automation in oil & gas industry to fuel market growth in South America

9.5.4 AFRICA

9.5.4.1 Increased use of automation in mining industry to streamline processes provides growth opportunities for process automation and instrumentation market

10 COMPETITIVE LANDSCAPE (Page No. - 158)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 90 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PROCESS AUTOMATION AND INSTRUMENTATION MARKET

10.3 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 46 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016–2020

10.4 MARKET SHARE ANALYSIS, 2021

TABLE 91 DCS MARKET: MARKET SHARE ANALYSIS (2021)

TABLE 92 MES MARKET: MARKET SHARE ANALYSIS (2021)

TABLE 93 SCADA MARKET: MARKET SHARE ANALYSIS (2021)

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 47 SCADA MARKET: COMPANY EVALUATION QUADRANT, 2021

10.6 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 48 SCADA MARKET, SME EVALUATION QUADRANT, 2021

10.7 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: COMPANY FOOTPRINT

TABLE 94 COMPANY FOOTPRINT

FIGURE 49 INDUSTRY: COMPANY FOOTPRINT

TABLE 95 REGIONAL: COMPANY FOOTPRINT

FIGURE 50 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

FIGURE 51 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: PRODUCT LAUNCHES

10.8.2 PROCESS AUTOMATION AND INSTRUMENTATION MARKET: DEALS

11 COMPANY PROFILES (Page No. - 183)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 ABB LTD.

TABLE 96 ABB LTD: BUSINESS OVERVIEW

FIGURE 52 ABB LTD: COMPANY SNAPSHOT

TABLE 97 ABB LTD: PRODUCT OFFERINGS

TABLE 98 ABB LTD: PRODUCT LAUNCHES

11.1.2 EMERSON ELECTRIC CO.

TABLE 99 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 53 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 100 EMERSON ELECTRIC CO.: PRODUCT OFFERINGS

TABLE 101 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

TABLE 102 EMERSON ELECTRIC CO.: DEALS

11.1.3 SIEMENS

TABLE 103 SIEMENS: BUSINESS OVERVIEW

FIGURE 54 SIEMENS: COMPANY SNAPSHOT

TABLE 104 SIEMENS: PRODUCT OFFERINGS

TABLE 105 SIEMENS: PRODUCT LAUNCHES

TABLE 106 SIEMENS: DEALS

11.1.4 GENERAL ELECTRIC COMPANY

TABLE 107 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 55 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 108 GENERAL ELECTRIC COMPANY: PRODUCT OFFERING

TABLE 109 GENERAL ELECTRIC COMPANY: PRODUCT LAUNCHES

TABLE 110 GENERAL ELECTRIC COMPANY: DEALS

11.1.5 SCHNEIDER ELECTRIC

TABLE 111 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 112 SCHNEIDER ELECTRIC: PRODUCT OFFERING

TABLE 113 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 114 SCHNEIDER ELECTRIC: DEALS

TABLE 115 SCHNEIDER ELECTRIC: OTHERS

11.1.6 HONEYWELL INTERNATIONAL INC.

TABLE 116 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCT OFFERINGS

TABLE 118 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 119 HONEYWELL INTERNATIONAL INC.: DEALS

TABLE 120 HONEYWELL INTERNATIONAL INC.: OTHERS

11.1.7 ROCKWELL AUTOMATION, INC.

TABLE 121 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

FIGURE 58 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

TABLE 122 ROCKWELL AUTOMATION, INC.: PRODUCT OFFERINGS

TABLE 123 ROCKWELL AUTOMATION, INC.: PRODUCT LAUNCHES

TABLE 124 ROCKWELL AUTOMATION INC.: DEALS

11.1.8 YOKOGAWA ELECTRIC CORPORATION

TABLE 125 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 59 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 126 YOKOGAWA ELECTRIC CORPORATION: PRODUCT OFFERING

TABLE 127 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

TABLE 128 YOKOGAWA ELECTRIC CORPORATION: DEALS

11.1.9 MITSUBISHI ELECTRIC CORPORATION

TABLE 129 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 60 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 130 MITSUBISHI ELECTRIC CORPORATION: PRODUCT OFFERINGS

TABLE 131 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

TABLE 132 MITSUBISHI ELECTRIC CORPORATION: DEALS

11.1.10 ENDRESS+HAUSER GROUP SERVICES AG

TABLE 133 ENDRESS+HAUSER GROUP SERVICES AG: BUSINESS OVERVIEW

FIGURE 61 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

TABLE 134 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT OFFERINGS

TABLE 135 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

TABLE 136 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

11.1.11 OMRON CORPORATION

TABLE 137 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 62 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 138 OMRON CORPORATION: PRODUCT OFFERINGS

TABLE 139 OMRON CORPORATION: PRODUCT LAUNCHES

TABLE 140 OMRON CORPORATION: DEALS

11.1.12 THERMO FISHER SCIENTIFIC INC.

TABLE 141 THERMO FISCHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 63 THERMO FISCHER SCIENTIFIC INC.: COMPANY SNAPSHOT

TABLE 142 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

TABLE 143 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

TABLE 144 THERMO FISHER INC.: DEALS

11.1.13 FUJI ELECTRIC CO., LTD.

TABLE 145 FUJI ELECTRIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 64 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

TABLE 146 FUJI ELECTRIC CO., LTD.: PRODUCT OFFERINGS

TABLE 147 FUJI ELECTRIC CO., LTD.: PRODUCT LAUNCHES

TABLE 148 FUJI ELECTRIC CO., LTD.: DEALS

11.1.14 HITACHI, LTD.

TABLE 149 HITACHI, LTD.: BUSINESS OVERVIEW

FIGURE 65 HITACHI, LTD.: COMPANY SNAPSHOT

TABLE 150 HITACHI, LTD.: PRODUCT OFFERINGS

TABLE 151 HITACHI, LTD.: PRODUCT LAUNCHES

TABLE 152 HITACHI, LTD.: DEALS

11.1.15 DELTA ELECTRONICS, INC.

TABLE 153 DELTA ELECTRONICS, INC.: BUSINESS OVERVIEW

FIGURE 66 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

TABLE 154 DELTA ELECTRONICS, INC.: PRODUCT OFFERINGS

TABLE 155 DELTA ELECTRONICS, INC.: PRODUCT LAUNCHES

TABLE 156 DELTA ELECTRONICS, INC.: DEALS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 HOLLYSYS

TABLE 157 HOLLYSYS: COMPANY OVERVIEW

11.2.2 WIKA ALEXANDER WIEGAND SE & CO. KG

TABLE 158 WIKA ALEXANDER WIEGAND SE & CO. KG: COMPANY OVERVIEW

11.2.3 AZBIL CORPORATION

TABLE 159 AZBIL CORPORATION: COMPANY OVERVIEW

11.2.4 XYLEM

TABLE 160 XYLEM: COMPANY OVERVIEW

11.2.5 HACH CORPORATION

TABLE 161 HACH CORPORATION: COMPANY OVERVIEW

11.2.6 SHIMADZU CORPORATION

TABLE 162 SHIMADZU CORPORATION: COMPANY OVERVIEW

11.2.7 HIMA PAUL HILDEBRANDT GMBH

TABLE 163 HIMA PAUL HILDEBRANDT GMBH: COMPANY OVERVIEW

11.2.8 AMETEK, INC.

TABLE 164 AMETEK, INC.: COMPANY OVERVIEW

11.2.9 CHRISTIAN BÜRKERT GMBH & CO. KG

TABLE 165 CHRISTIAN BÜRKERT GMBH & CO. KG: COMPANY OVERVIEW

11.2.10 KROHNE MESSTECHNIK GMBH

TABLE 166 KROHNE MESSTECHNIK GMBH: COMPANY OVERVIEW

11.2.11 DWYER INSTRUMENTS, INC.

TABLE 167 DWYER INSTRUMENTS, INC.: COMPANY OVERVIEW

11.2.12 ANDRITZ AG

TABLE 168 ANDRITZ AG: COMPANY OVERVIEW

11.2.13 VALMET

TABLE 169 VALMET: COMPANY OVERVIEW

11.2.14 SPRECHER AUTOMATION GMBH

TABLE 170 SPRECHER AUTOMATION GMBH: COMPANY OVERVIEW

11.2.15 INDUCTIVE AUTOMATION, LLC

TABLE 171 INDUCTIVE AUTOMATION, LLC: COMPANY OVERVIEW

12 ADJACENT & RELATED MARKETS (Page No. - 253)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 RFID MARKET

12.3.1 INTRODUCTION

FIGURE 67 RFID TAG MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 172 RFID TAG MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 173 RFID TAG MARKET, BY REGION, 2021–2026 (USD BILLION)

12.3.2 AMERICAS

FIGURE 68 SNAPSHOT: RFID TAG MARKET IN AMERICAS

TABLE 174 AMERICAS: RFID TAG MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 175 AMERICAS: RFID TAG MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 176 AMERICAS: RFID TAG MARKET, BY COUNTRY/REGION, 2017–2020 (USD MILLION)

TABLE 177 AMERICAS: RFID TAG MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

12.3.2.1 US

12.3.2.1.1 US accounted for largest share of RFID tag market in Americas in 2020

12.3.2.2 Canada

12.3.2.2.1 Healthcare sector to generate growth opportunities for RFID solutions in Canada

12.3.2.3 Mexico

12.3.2.3.1 RFID market in Mexico is expected to witness significant growth

12.3.2.4 Brazil

12.3.2.4.1 Brazil to emerge as key contributor to RFID market in Americas

12.3.2.5 Rest of Americas

12.3.2.6 Impact of COVID-19 on Americas

12.3.2.6.1 High demand for RFID solutions in various service- and manufacturing-oriented industries during COVID-19 pandemic to boost market growth

FIGURE 69 AMERICAS: PRE- AND POST-COVID-19 MARKET SCENARIOS FOR RFID TAGS, 2017–2026 (USD BILLION)

TABLE 178 AMERICAS: PRE- AND POST-COVID-19 MARKET SCENARIOS FOR RFID TAGS, 2017–2026 (USD BILLION)

12.3.3 EUROPE, MIDDLE EAST, AND AFRICA (EMEA)

FIGURE 70 SNAPSHOT: RFID TAG MARKET IN EMEA

TABLE 179 EMEA: RFID TAG MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 180 EMEA: RFID TAG MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 181 EMEA: RFID TAG MARKET, BY COUNTRY/REGION, 2017–2020 (USD MILLION)

TABLE 182 EMEA: RFID TAG MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

12.3.3.1 Germany

12.3.3.1.1 Germany to account for largest share of RFID tag market in EMEA

12.3.3.2 UK

12.3.3.2.1 Increasing government regulations in UK would boost RFID tag market

12.3.3.3 France

12.3.3.3.1 Aerospace is most prominent growth sector for RFID market in France

12.3.3.4 Italy

12.3.3.4.1 Need for effective assets management would drive Italian RFID market

12.3.3.5 Russia

12.3.3.5.1 Energy, oil & gas, and aviation industries are expected to drive Russian RFID market

12.3.4 REST OF EMEA

12.3.4.1 Impact of COVID-19 on EMEA

12.3.4.1.1 Declining demand from automobiles and aerospace applications is expected to restrain growth of RFID tag market in EMEA

FIGURE 71 EMEA: PRE- AND POST-COVID-19 MARKET SCENARIOS FOR RFID TAGS, 2017–2026 (USD BILLION)

TABLE 183 EMEA: PRE- AND POST-COVID-19 MARKET SCENARIOS FOR RFID TAGS, 2017–2026 (USD BILLION)

12.3.5 ASIA PACIFIC (APAC)

FIGURE 72 SNAPSHOT: RFID TAG MARKET IN APAC

TABLE 184 APAC: RFID TAG MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 185 APAC: RFID TAG MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 186 APAC: RFID TAG MARKET, BY COUNTRY/REGION, 2017–2020 (USD MILLION)

TABLE 187 APAC: RFID TAG MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

12.3.5.1 Japan

12.3.5.1.1 Healthcare sector to offer growth opportunities to RFID market in Japan due to aging population

12.3.5.2 China

12.3.5.2.1 China to account for largest share of RFID market in APAC during forecast period

12.3.5.3 South Korea

12.3.5.3.1 Electronics manufacturing industry to largely adopt RFID solutions

12.3.5.4 India

12.3.5.4.1 Manufacturing and healthcare industries in India to drive growth of RFID market

12.3.5.5 Australia

12.3.5.5.1 Sports and entertainment industries providing growth avenues for RFID market in Australia

12.3.5.6 Rest of APAC

12.3.5.7 Impact of COVID-19 on APAC

12.3.5.7.1 Increasing demand for industrial automation, supply chain automation, and service industry automation in region could improve demand for RFID solutions

FIGURE 73 APAC: PRE- AND POST-COVID-19 SCENARIOS FOR RFID TAG MARKET, 2017–2026 (USD BILLION)

TABLE 188 APAC: PRE- AND POST-COVID-19 SCENARIOS FOR RFID TAG MARKET, 2017–2026 (USD BILLION)

13 APPENDIX (Page No. - 278)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

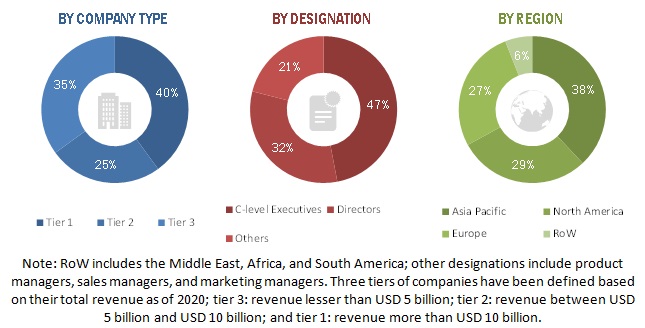

The study involved four major activities in estimating the current size of the process automation and instrumentation system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the process automation and instrumentation market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries, as well as process automation and instrumentation market, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred process automation and instrumentation solution providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from process automation and instrumentation solution providers, such as ABB Ltd (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), and Schneider Electric (France); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the process automation and instrumentation market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Process Automation and Instrumentation Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe and forecast the process automation and instrumentation market, in terms of instrument, solution, and industry.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of process automation and instruemntation

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the process automation and instrumentation market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the process automation and instrumentation.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the process automation and instrumentation market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Process Automation and Instrumentation Market