Project Portfolio Management (PPM) Market by Component (Solutions and Services), Deployment Mode, Organization Size (Large Enterprises & SMEs), Vertical (Energy & Utilities, Government & Defense, BFSI, IT & Telecom) and Region - Global Forecast to 2028

Project Portfolio Management (PPM) Market Size, Growth Report & Forecast

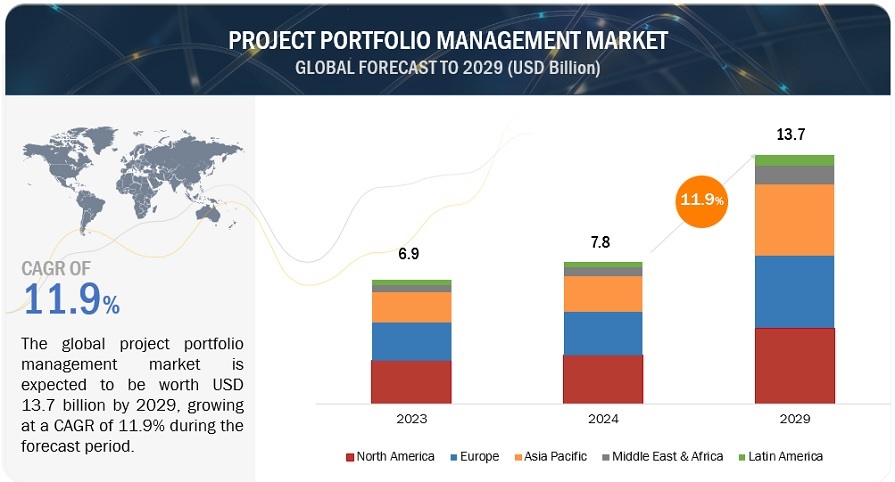

[342 Pages Report] The Project Portfolio Management Market worldwide size was worth approximately $4.8 billion in 2023. It is expected to grow at an effective Compound Annual Growth Rate (CAGR) of 5.5% from 2023 to 2028. The revenue forecast for 2028 is set to enjoy a valuation $6.3 billion. The base year considered for estimation is 2022 and the historical data span from 2023 to 2028.

The need to manage complex project landscapes, optimize resource utilization, ensure regulatory compliance, manage assets effectively, mitigate risks, navigate the renewable energy transition, control costs and budgets, and facilitate collaboration among stakeholders’ demand for PPM among organizations is increasing. PPM software supports companies in achieving project success, meeting industry standards, and driving operational excellence by facilitating effective collaboration, document sharing, and communication among project participants. PPM software provides financial tracking and reporting capabilities, allowing companies to monitor project costs, track budgets, and manage financial risks. By having real-time visibility into project finances, companies can make informed decisions, optimize spending, and ensure projects are financially viable.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Project Portfolio Management Market Growth Dynamics

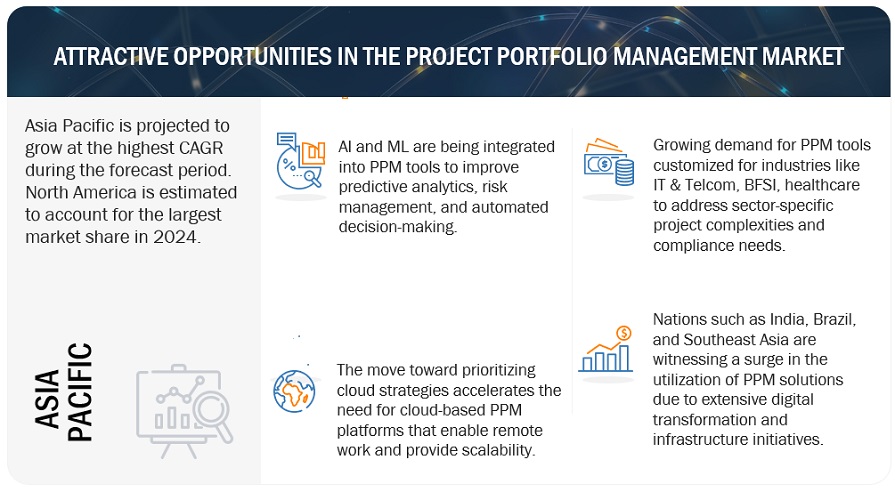

Driver: Strong demand for cloud-based PPM technologies

The use of cloud-based Project Portfolio Management systems has grown significantly in recent years. PPM is the collective name for the collection of procedures and equipment that organizations employ to efficiently manage and order their projects. In the past, PPM software was deployed locally, demanding a special infrastructure and maintenance. However, the emergence of cloud computing has completely changed the PPM industry and has increased its appeal due to the number of benefits it provides. As an organization's project management capabilities can be scaled up or down as necessary, cloud-based PPM systems offer flexibility. Without substantial upfront costs or complicated hardware settings, they may quickly add or remove users, change storage capacity, and utilize extra capabilities. Further, the majority of cloud-based PPM systems work on a subscription-based approach, allowing businesses to only pay for the services they really utilize. As a result, there is no longer a need for expensive upfront expenditures for infrastructure upkeep, software licenses, and hardware. Since the cloud service provider is in charge of infrastructure administration and updates, the cloud model also lowers ongoing IT costs. Moreover, organizations may obtain the most recent features, bug fixes, and security patches due to the service provider's continuous updates for cloud-based PPM solutions. This eliminates the need for manual software updates and lessens the workload on IT workers, allowing them to concentrate on other important tasks.

Restraint: Combining advanced PPM technologies with legacy system

The interfaces or compatibility with modern PPM tools may not be present in legacy systems, which are frequently constructed using an older technology. It could take a lot of customization or development work to integrate these systems with cutting-edge PPM technology and create seamless data exchange and seamless connectivity. Further, employees used to deal with older systems will need training and adaptation efforts when advanced PPM technologies are introduced alongside for them. The user interface, process, and feature changes might create problems with user adoption. To achieve seamless user delivery and acceptance, addressing these problems requires sufficient training, change management techniques, and open communication. Moreover, the integration of legacy systems with cutting-edge PPM technology may be hampered by technical constraints. These constraints may be brought about by outdated hardware or software, a lack of new APIs, or limitations on how data may be accessed and changed in old systems. It could take a lot of money, time, and effort to design new solutions or even improve existing ones in order to get around these technical constraints.

Opportunity: Increasing demand for digital transformation among organizations

Project portfolio management market expansion is anticipated to be fueled by rising demand for digital transformation efforts. As organizations seek to use technology to increase their operational effectiveness, customer experience, and competitive advantage, digital transformation has become an essential priority for businesses across all industries. PPM plays a crucial role in managing and executing digital transformation projects effectively. The implementation of process modifications and the adoption of new technology are just two examples of the numerous projects and activities that together make up digital transformation. PPM enables organizations to give these projects priority and match them to their overall goals. PPM solutions enable organizations to assess the possible impact, risks, and rewards of digital transformation projects and to make sure that resources are directed to the most important projects. Moreover, initiatives for digital transformation frequently need significant resource allocation, including expenditures on infrastructure, technology, and employees. Through the identification of resource gaps, capacity management, and resource alignment with high-impact projects, PPM solutions assist businesses in maximizing resource allocation. This ensures that resources are used effectively while ensuring crucial projects get the support they require, increasing the overall success of efforts to implement digital transformation. Lastly, cross-functional cooperation and interaction with numerous stakeholders, including internal teams, outside partners, and customers, are frequently involved in the digital transformation process. PPM solutions include collaboration capabilities, such as document sharing, communication tools, and project portals, enabling seamless stakeholder engagement and cooperation. In order for a digital transformation to be successful, this makes it easier for teams to communicate, share knowledge, and coordinate.

Challenge: Lack of standardization and best practices

PPM lacks common frameworks and procedures. Various businesses and sectors may adopt various methods, which can cause inconsistencies and make benchmarking performance challenging. Consistent PPM processes are difficult to acquire and utilize in effect since there are no globally recognized standards. It is challenging to define PPM best practices that are universally helpful since different industries have different requirements and limitations. It may be necessary to use customized PPM strategies in sectors including construction, healthcare, and IT due to unique project characteristics, rules, and compliance needs. The adoption of standardized PPM approaches may be hampered by a lack of sector-specific best practices. Furthermore, collaboration and knowledge sharing among PPM practitioners might be difficult due to the lack of standards. Sharing best practices, experiences, and lessons gained is essential for developing the PPM sector. Collaboration and utilizing collective knowledge are more challenging without established techniques.

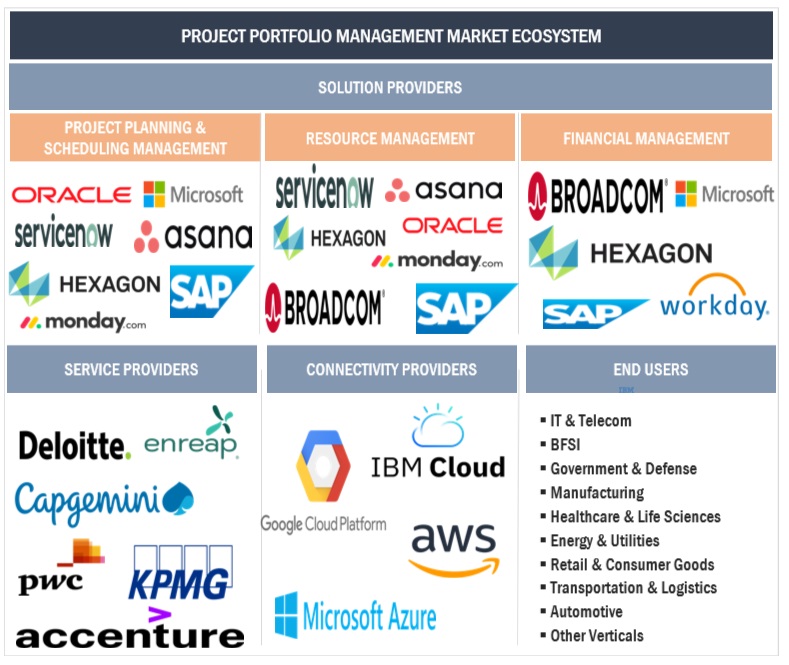

Project Portfolio Management Market Ecosystem

Prominent companies in this PPM Software Market are responsible for delivering project portfolio management solutions and services to end users via various deployment models. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Oracle Corporation (US), Planview (US), Broadcom (US), SAP (Germany), and Microsoft Corporation (US). The section highlights the market's key players, including solution providers, service providers, and respective channel partners who provides PPM solutions and services. The ecosystem provides a description of the companies offering services and solutions in the project portfolio management market, the latest company developments related to the recession, and MarketsandMarkets’ analysis of these vendors. It further highlights the unique differentiation points of each company and its expertise in the market.

Based on vertical, the energy and utilities holds the largest market share during the forecast period

Based on the vertical, the Project portfolio management market is segmented into energy and utilities, government and defense, IT and telecom, BFSI, manufacturing, healthcare and life sciences, consumer goods and retail, transportation & logistics, agriculture, and other verticals. As per vertical segment, energy and utilities segment is expected to hold the largest market share during the forecast period. The sector of energy and utilities is renowned for its substantial capital and turnaround projects. The vertical includes organizations in the oil and gas, electricity, and metal sectors that are currently going through a significant digital transformation due to the shifting role of customers. Issues might vary from project to project and are frequently unpredictable. Further, the majority of project investments in the energy and utilities sector are long-term commitments. Their payback times are measured in years or even decades, and they demand enormous quantities of capital and resources. Therefore, it is crucial that choices about making such investments are made with as much knowledge as possible. To ensure that leaders can make the best judgments, accurate cost predictions, and risk assessments, through realistic timelines, the demand for PPM solutions are increasing. Energy and utility companies manage large-scale assets, such as power plants, substations, pipelines, and transmission lines. PPM software assists in managing the entire lifecycle of these assets, including planning, construction, maintenance, and decommissioning. It provides tools for asset tracking, maintenance scheduling, and cost management, ensuring optimal asset performance and longevity.

Based on services, the training, support, and maintenance segment holds the highest CAGR during the forecast period

Based on the services, the project portfolio management market is segmented as consulting and implementation, and training, support, and maintenance services segments. As per the services segment training, support, and maintenance are expected to hold the highest CAGR during the forecast period. Training, support, and maintenance services for project portfolio management (PPM) are expert services offered to enterprises following the adoption of PPM procedures and equipment. These services are designed to make sure that the organization's PPM systems and procedures continue to function well and provide long-term benefits. To improve staff training, a number of manufacturers are providing training, support, and maintenance services in addition to their bundled software. With appropriate training, employees may effectively use the solutions and ensure that businesses' activities run without interruption with the help of systemic training and live assistance. Further, PPM support services involve giving users of PPM tools and systems ongoing support. This entails answering customer questions, resolving problems, and giving instructions on how to use the PPM software efficiently. A specialized helpdesk or support team is available to respond to user queries and guarantee the PPM system's efficient operation.

The US market is projected to contribute the largest share of the project portfolio management market in North America.

North America is expected to lead the project portfolio management market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the project portfolio management market, and the trend is expected to continue until 2028. Many businesses in the US prioritize strategic alignment, ensuring that projects support their overarching goals and objectives, which is fuelling market growth in the country. For instance, Lockheed Martin, a multinational aerospace and armed forces firm with headquarters in the US, implemented PPM solution to increase project delivery across all of its business units and to strengthen its project management procedures. The business required a centralized system to properly prioritize, track, and manage projects due to its varied portfolio of complicated projects. Lockheed Martin increased insight into its project portfolio by installing a PPM software system, allowing project managers to monitor the progress of their work as well as resource and financial performance. Moreover, the US has stringent regulatory frameworks and compliance requirements across various industries, such as finance, healthcare, and technology. PPM software offers features to track and manage compliance-related tasks, documentation, and reporting. By using PPM software, organizations can ensure they meet regulatory obligations and minimize the risk of penalties or legal issues.

Key Market Players

The project portfolio management market is dominated by a few globally established players such as Oracle Corporation (US), Planview (US), Broadcom (US), SAP (Germany), Microsoft Corporation (US), Adobe Inc. (US), Hexagon (Sweden), ServiceNow (US), Upland Software (US), and Atlassian Corporation (US), among others, are the key vendors that secured project portfolio management contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the project portfolio management market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Component, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the significant metaverses in education market vendors are Oracle Corporation (US), Planview (US), Broadcom (US), SAP (Germany), Microsoft Corporation (US), Adobe Inc. (US), Hexagon (Sweden), ServiceNow (US), Upland Software (US), Atlassian Corporation (US), GFT Technologies (Germany), Micro Focus (UK), Planisware (US), Sciforma (US), and Sopheon (US). |

This research report categorizes the project portfolio management market based on component, deployment mode, organization size, vertical, and region.

Based on the Component:

- Solution

-

Services

- Consulting and Implementation

- Training, Support, and Maintenance

Based on the Deployment Mode:

- Cloud

- On-premises

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Vertical:

- Energy and Utilities

- Government and Defense

- IT and Telecom

- BFSI

- Manufacturing

- Healthcare and Life Sciences

- Consumer Goods and Retail

- Transportation and Logistics

- Agriculture

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Switzerland

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Singapore

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2023, Planview introduced a new feature for PPM pro, where Admin users may submit a support case to enable the new notification log.

- In May 2022, Adobe unveiled the latest version of Adobe Workfront which allows teams to bring together their marketing strategy, work management, asset management, and content production to produce exceptional digital experiences for customers. Newly designed agile capabilities help marketing teams be nimble and responsive, so they can quickly adapt to changing market opportunities and conditions. Teams can use a new flexible, visual board so they can work how they want using lean agile principles to increase their productivity and improve their work quality.

- In June 2021, Hexagon launched a renewable energy project portfolio to include new PV and wind sites with innovative storage capacity, increasing Hexagon's technology leverage in renewable energy projects while generating cash flow for future R-evolution investments.

Frequently Asked Questions (FAQ):

What is project portfolio management?

According to Smartsheet, Businesses can manage their resources and create an effective project prioritizing system with the help of project portfolio management (PPM). The term project portfolio management (PPM) refers to the effective grouping and oversight of linked projects by a team in order to realize strategic objectives. Utilizing specified criteria, managers prioritize portfolios and assign resources based on priority level.

Which country is an early adopter of Project portfolio management?

Who are vital clients adopting project portfolio management?

Key clients adopting the project portfolio management market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

Which are the key vendors exploring project portfolio management?

What is the total CAGR expected to be recorded for the project portfolio management market during 2023-2028?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

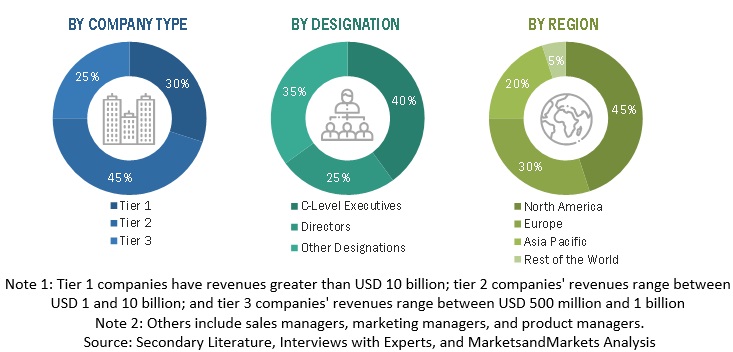

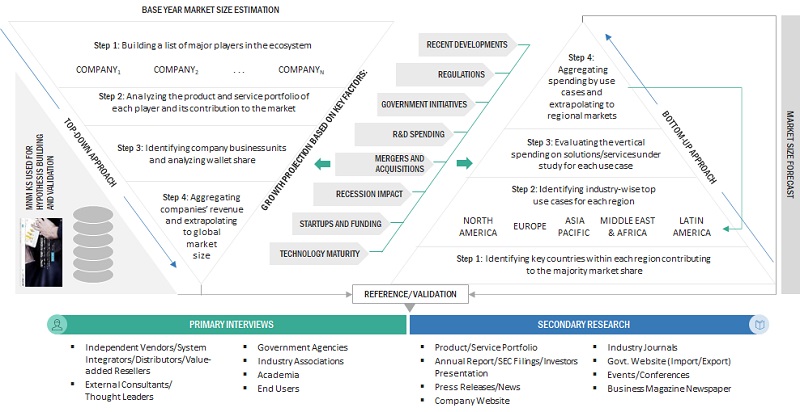

This research study involved extensive secondary sources, directories, and paid databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the project portfolio management market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology applied in developing this report on the project portfolio management market.

Secondary Research

The market size of companies offering project portfolio management solutions was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their solution capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from PPM vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of end users using PPM solution, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of PPM solution, which would affect the overall project portfolio management market.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

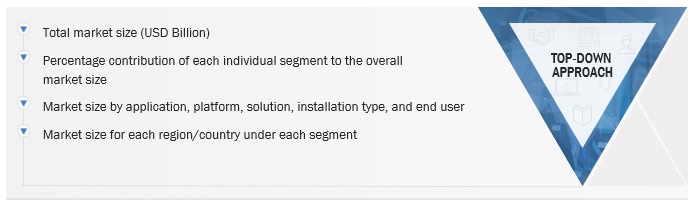

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the project portfolio management market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of Project Portfolio Management Market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the PPM market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of Project Portfolio Management Market

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from government agencies' demand and supply sides.

Market Definition

Project portfolio management is the centralized control of the procedures, techniques, and tools that project management teams use to evaluate and coordinate the administration of various projects or programs. Further, project management organizations (PMOs) and project managers employ project portfolio management (PPM) as a strategy to organize, prioritize, and profit from projects. In essence, it evaluates a project's prospective return on investment. The amount of funding that is available for a project, probable turnaround times, anticipated results, and risk vs. reward ratios are all taken into consideration. The project managers, under the direction of the project management office director, or a PPM group or project steering committee, are responsible for carrying out all of this. They evaluate each project's benefits, returns, and priority to decide how a business should use its capital and human resources.

Key Stakeholders

- PPM Solution Providers

- Application Solution Providers

- Enterprise PPM Solution Providers

- Enterprise Resource Planning (ERP) Solution Providers

- Simulation and Modeling Solution Providers

- Cloud Service Providers

- Business Intelligence (BI) Solution Providers

- Communication and Collaboration Solution Providers

- Professional Service Providers

- System Integrators

- Resellers and Distributors

- Research Organizations

- Government Agencies

- Enterprise Users

- Venture Capitalists, Private Equity Firms, and Startup Companies

Report Objectives

- To define, describe, and forecast the Project Portfolio Management (PPM) market by component (solution and services), deployment mode, organization size, vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the project portfolio management market.

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall market.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment.

- To analyze the competitive developments, such as partnerships, acquisitions, and product/solution launches and enhancements, in the PPM market.

- To analyze the impact of the recession on the global PPM market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the project portfolio management market

Company Information

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Project Portfolio Management (PPM) Market