Push-to-talk Market by Offering (Hardware, Solutions, and Services), Network Type (LMR and Cellular), Vertical (Government & Public Safety, Aerospace & Defense, and Transportation & Logistics) and Region - Global Forecast to 2028

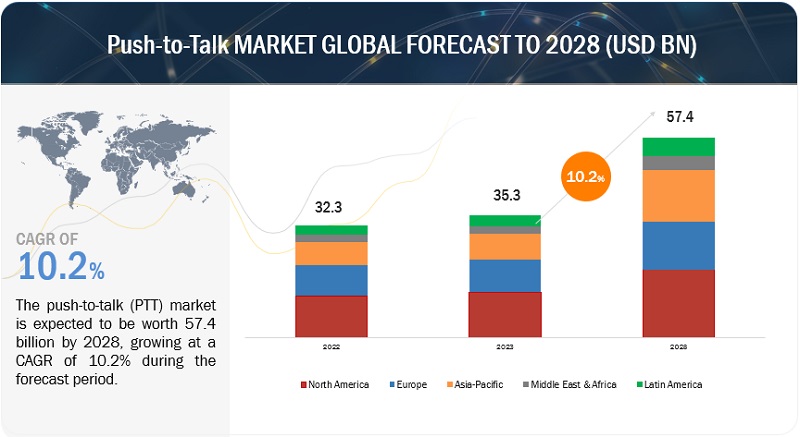

[251 Pages Report] The push-to-talk (PTT) market is estimated at USD 35.3 billion in 2023 to USD 57.4 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.2%. The availability of PTT applications on a wide range of consumer devices, including smartphones and tablets, has significantly contributed to their accessibility and popularity among a broad user base. This accessibility stems from the versatility and compatibility of PTT apps, allowing users to communicate seamlessly across different platforms and operating systems, which is driving the PTT market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

To know about the assumptions considered for the study, download the pdf brochure

Push-to-Talk Market Dynamics

Driver: Proliferation of rugged and ultra-rugged smartphones

The proliferation of rugged and ultra-rugged smartphones is driven by the increasing need for durable, reliable, and resilient mobile devices in various industries and outdoor activities. The integration of PTT functionality further enhances their value, making them essential tools for professionals and adventurers operating in challenging environments. As technology continues to advance, it is expected that these devices to evolve further, offering even more features and capabilities to meet the demands of their diverse user base.

Restraint: Dependence on a stable network connection

PTT technology, whether in the form of dedicated PTT devices or mobile apps, relies on a continuous network connection to enable instant communication. When a user presses the PTT button, their voice is transmitted over the network to the recipients, emulating the functionality of a traditional two-way radio. The restraint here lies in the dependence on a stable network connection. If a user is in an area with weak or no network coverage, such as remote wilderness locations, underground tunnels, or areas with heavy network congestion, PTT communication can suffer from latency, dropouts, or complete failure. This limitation is particularly critical in emergency situations, where immediate and reliable communication is essential.

Opportunity: Standardization of infrastructure platforms

The standardization of infrastructure platforms presents significant opportunities for various industries and organizations. Standardizing infrastructure platforms for PTT opens up opportunities for seamless interoperability. This means that PTT devices and systems from different manufacturers can work together effortlessly. Organizations can choose the best PTT hardware and software solutions for their needs without worrying about compatibility issues. This interoperability is particularly advantageous in industries like public safety and emergency response, where various agencies and departments need to coordinate communication during critical situations.

Challenge: LMR and PTT interoperability issues

The interoperability challenges between Land Mobile Radio (LMR) systems and Push-to-Talk (PTT) solutions can pose significant hurdles in the seamless communication landscape, especially in sectors where instant and reliable communication is paramount. LMR systems, including analog and digital variants like TETRA or P25, have been widely used by public safety agencies and other critical infrastructure sectors for many years. These systems often operate on proprietary or specialized technologies. In contrast, modern PTT solutions are predominantly software-based and utilize internet protocol (IP) networks. Bridging the gap between these diverse technologies is a significant challenge, as LMR systems are not inherently designed to integrate with IP-based PTT systems.

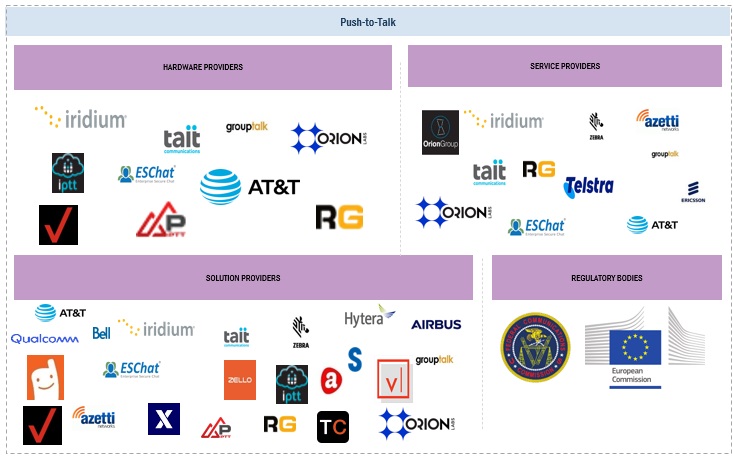

Push-to-Talk Market Ecosystem

Prominent companies in this market include well-established, financially stable PTT hardware, solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US)

By network type, land mobile radio segment to hold the largest market size during the forecast period

Land mobile radio (LMR) PTT systems offer rugged hardware designed for durability in harsh environments, and they operate on dedicated radio frequencies, providing robust coverage and ensuring that critical messages reach their intended recipients. While newer technologies like cellular PTT have emerged, LMR PTT remains a vital tool for mission-critical communications in industries where reliability and resilience are paramount.

Bu service, the support & maintenance service segment is expected to register the fastest growth rate during the forecast period.

The PTT technology support & maintenance service segment plays a crucial role in ensuring the uninterrupted functionality of PTT communication systems. This service encompasses a range of activities aimed at keeping PTT devices and networks operational. It includes regular software updates, firmware upgrades, troubleshooting, and hardware repairs. Additionally, PTT technology support & maintenance services offer proactive monitoring to detect and address potential issues before they disrupt communication. This segment is vital for industries such as public safety, transportation, and logistics, where instant and reliable communication is essential for day-to-day operations.

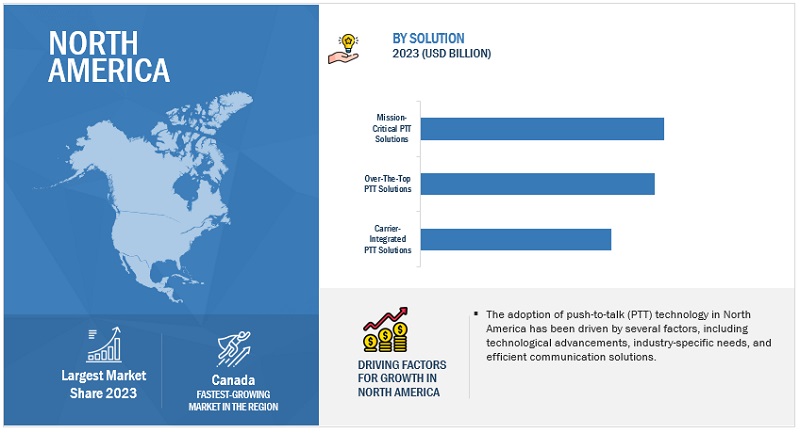

North America is expected to hold the largest market size during the forecast period

North America is expected to dominate the PTT market during the forecast period. Commercially, PTT technology has been integrated into the daily operations of businesses across North America. The ability to improve communication, streamline tasks, and enhance coordination among mobile workforces led to its widespread adoption. Companies in fields such as logistics, construction, and healthcare found value in PTT solutions.

Market Players:

The major players in the PTT market are AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the PTT market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Hardware, Solutions, and Services), Network Type, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US). |

This research report categorizes the PTT market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Hardware

-

Solutions

- Carrier Integrated Ptt Solution

- Over The Top Ptt Solution

- Mission-Critical Ptt Solution

-

Services

- Consulting

- Implementation

- Support & Maintenance

Based on Network Type:

- Land Mobile Radio

- Cellular

Based on Vertical:

- Government & Public Safety

- Aerospace & Defense

- Transportation & Logistics

- Manufacturing

- Construction & Mining

- Energy & Utilities

- Travel & Hospitality

- Healthcare

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East

- KSA

- UAE

- Rest of Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2023, Qualcomm’s subsidiary, Qualcomm Technologies, Inc., acquired Autotalks. Through the acquisition, the Autotalks standalone safety solutions was expected to be incorporated into Qualcomm Technologies’ expanding Snapdragon Digital Chassis product.

- In July 2022, Ericsson acquired Vonage, This acquisition was expected to support Ericsson’s strategy to leverage technology leadership to grow its mobile network business and expand into enterprise.

- In May 2022, Motorola Solutions, in partnership with Arya Communications & Electronics Services and Arya Omnitalk Wireless Solutions, launched WAVE PTX in India.

Frequently Asked Questions (FAQ):

What is the definition of the PTT market?

The PTT market includes PTT hardware, solutions/applications and associated services that help in establishing a two-way radio communications service, which operates with a push of a button on devices such as smartphones, rugged PTT devices, and accessories (headsets, microphones, etc.). The PTT technology addresses the need within enterprises and emergency first responders to communicate time-critical information quickly and efficiently.

What is the market size of the PTT market?

The PTT market is estimated at USD 35.3 billion in 2023 to USD 57.4 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.2%. from 2023 to 2028.

What are the major drivers in the PTT market?

The major drivers in the PTT market are the growing demand for PoC, proliferation of rugged and ultra-rugged smartphones, growing need for driver safety, and transition of LMR systems from analog to digital.

Who are the key players operating in the PTT market?

The key market players profiled in the PTT market are AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US).

What are the key technology trends prevailing in PTT market?

The key technology trends in PTT include 5G networks, mesh networking, IoT, and ML.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

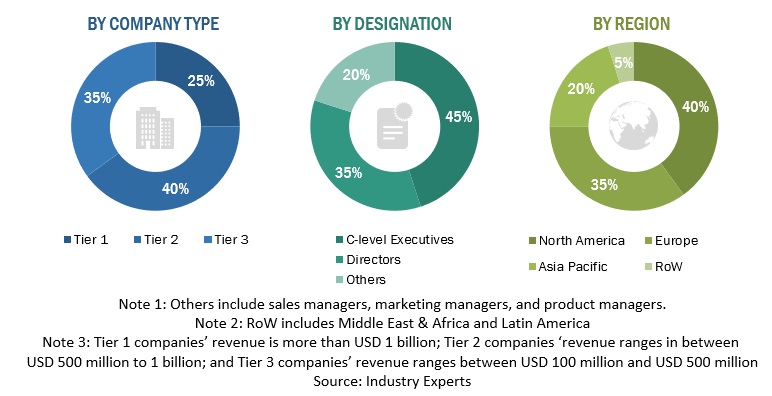

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the PTT market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for the companies offering push-to-talk hardware, solutions, and services for various industry verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Push-to-talk market. The primary sources from the demand side included Push-to-talk end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations. After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the PTT market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of PTT offerings, such as solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the PTT market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Push-to-Talk Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Push-to-Talk Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the PTT market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The PTT market includes PTT hardware, solutions/applications and associated services that help in establishing a two-way radio communications service, which operates with a push of a button on devices such as smartphones, rugged PTT devices, and accessories (headsets, microphones, etc.). The PTT technology addresses the need within enterprises and emergency first responders to communicate time-critical information quickly and efficiently.

Key Stakeholders

- Information Technology (IT) directors, managers, and support staff

- Network and system administrators

- Operations improvement managers

- Dispatch managers

- Communications and distribution managers

- Enterprise mobility managers

- Mobile device managers

- PTT specialists

- Account managers and sales managers

- Value-Added Resellers (VARs)

Report Objectives

- To determine and forecast the global PTT market by offering (hardware, solutions, and services), network type, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the PTT market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall PTT market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the PTT market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Push-to-talk Market