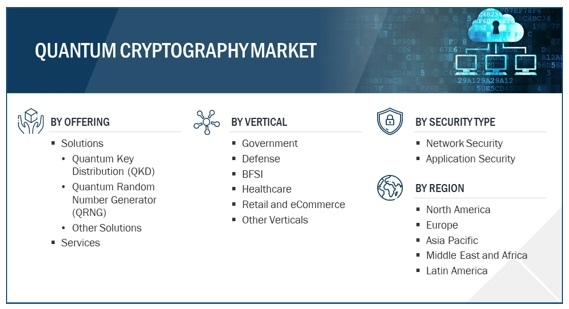

Quantum Cryptography Market by Offering (Solutions and Services), Security Type (Network Security and Application Security), Vertical (Government, Defense, BFSI, Healthcare, Retail, and eCommerce) and Region - Global Forecast to 2028

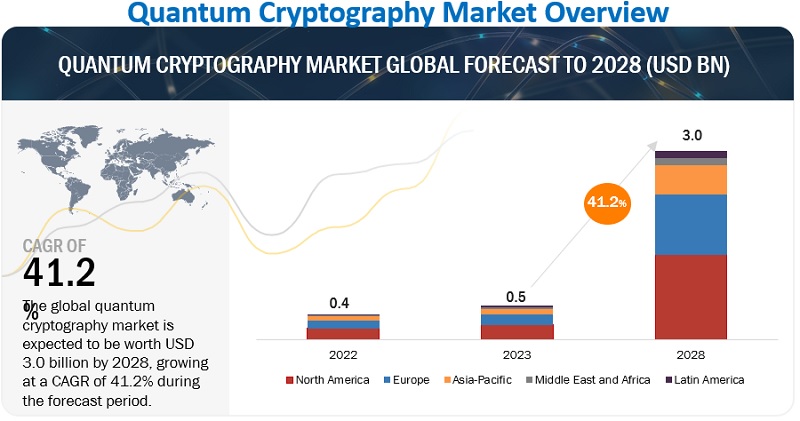

[223 Pages Report] MarketsandMarkets forecasts the Quantum Cryptography market size to grow from an estimated USD 0.5 billion in 2023 to USD 3.0 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 41.2%. Factors driving market growth include increasing cybersecurity funding and evolving next-generation wireless network technologies. However, high implementation cost and rising technical complexities are expected to hinder the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Quantum Cryptography Market Dynamics

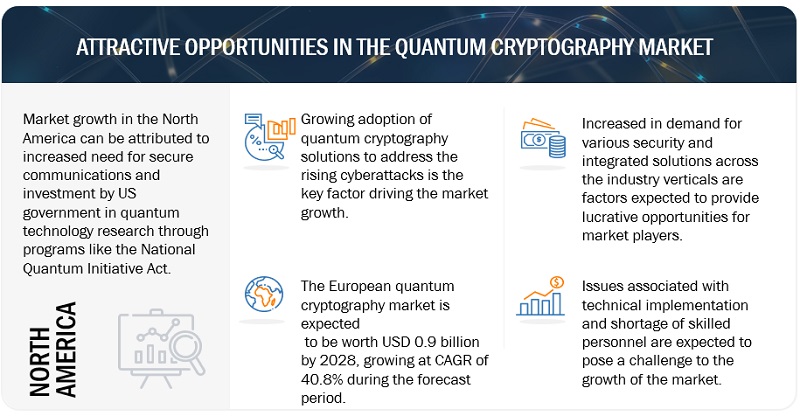

Driver: Rising cyberattacks in digitalization era

The rising cyberattacks in the digitalization era highlight the need for advanced security measures like quantum cryptography to ensure the safety of sensitive data in a world where technology is rapidly advancing. An example of a rising cyberattack highlighting the importance of quantum cryptography is the recent ransomware attack on the Colonial Pipeline in the United States. The attackers used sophisticated encryption methods to encrypt the company's data and demanded a ransom of $4.4 million in Bitcoin to restore access to the data. If the company had been using quantum cryptography to secure its data transmission, the attackers would not have been able to decrypt the information, and the attack would have been unsuccessful.

Restraint: High implementation cost

One of the main restraints of quantum cryptography is its high cost. The equipment required for quantum cryptography is expensive, and the technology is not yet widely available or accessible to all industries. This makes it difficult for small and medium-sized businesses to adopt quantum cryptography. The high implementation cost of quantum cryptography can be attributed to several factors. For example, the hardware required to implement quantum cryptography is still relatively expensive and difficult to produce. Additionally, specialized expertise is required to design and operate quantum cryptography systems, which can add to the overall cost. An example of high implementation cost in quantum cryptography can be seen in the case of quantum key distribution (QKD) systems.

Opportunity: Spur in demand for security solutions across industry verticals

The increasing demand for security solutions across various industries presents an opportunity for the adoption of quantum cryptography. Quantum cryptography is a method of securing communication that uses the principles of quantum mechanics to provide unconditional security. Unlike traditional cryptography, which relies on mathematical algorithms, quantum cryptography uses the laws of physics to prevent eavesdropping and hacking. An example of the application of quantum cryptography in the context of the spur in demand for security solutions can be seen in the financial industry. Financial institutions deal with sensitive information, such as personal and financial data, and require high levels of security to protect against cyber threats. With the rise of digital banking and online financial transactions, secure communication between banks, financial institutions, and customers has become paramount.

Challenge: Commercialization of quantum cryptography

Quantum cryptography is a cutting-edge technology that offers a new level of security in communications by leveraging the principles of quantum mechanics to transmit information in a way that is impossible to intercept or decode. However, despite its potential, commercializing quantum cryptography has proven to be a significant challenge due to various factors such as high costs, limited infrastructure, and technical complexities. One example of this challenge is the development of quantum key distribution (QKD) systems, designed to exchange encryption keys between two parties using quantum mechanics. While QKD has been demonstrated in research labs and experimental settings, the commercialization of QKD systems has been slow due to the cost and complexity of implementing them in real-world scenarios.

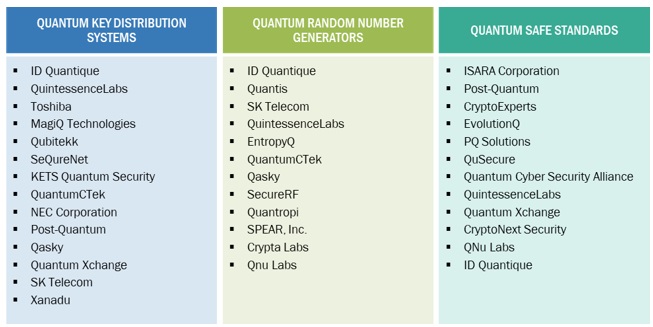

Quantum Cryptography Market Ecosystem

Quantum cryptography is a technology that leverages the principles of quantum mechanics to provide secure communication channels. The ecosystem of quantum cryptography includes various components, such as QKD, QRNG, and Quantum Safe Standards. The quantum cryptography market is highly competitive, comprising several global and regional players. Below is the representation of the ecosystem involved in the quantum cryptography market:

By Offering, services segment to grow at the highest CAGR during the forecast period

Quantum cryptography service providers render various services, such as consulting and advisory, deployment and integration, and support and maintenance services. These services offer advisory consulting and professional and technical design and implementation services to assist different industry verticals, in building security for a quantum-safe future. Based on their extensive experience in the industry-specific quantum cryptography sector, experts assist organizations from consultation to implementing customized solutions. These service provider’s teams are focused on helping the organization increase their efficiency and productivity while ensuring the long-term data security.

By Security Type, Network Security segment to grow at the highest CAGR during the forecast period

Key trends contributing to growth in the adoption of the network security segment are the rise in virtualization of servers, enhanced use of cloud computing services, increased BYOD trend at workplaces, and the upswing in the use of IoT applications. Gateway antivirus and antispyware ensure the security of IoT/ mobile to mobile (M2M) gateway from intrusions, viruses, spyware, worms, Trojans, adware, keyloggers, and Malicious Mobile Code (MMC) by using mechanisms, such as access control lists (ACLs), intrusion detection system (IDS)/ intrusion prevention system (IPS), and filtering. This has tempted attackers to gain illegitimate access to information for various reasons. A secret key is generated using polarized photons in quantum systems using quantum cryptography. The data is encoded and decoded using a code generator, making transmitting data through a channel less vulnerable to attacks. Large enterprises and SMEs are adopting network security solutions on a large scale to incorporate robust security for their networks and IT infrastructure.

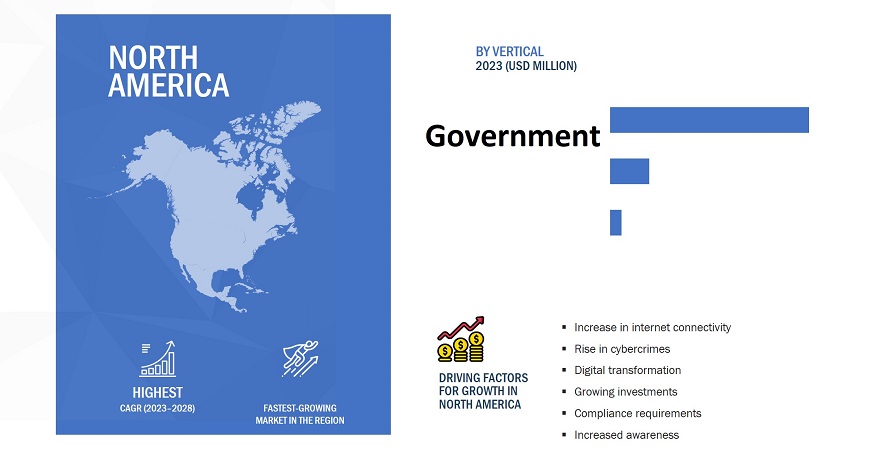

By vertical, Government segment to account for a largest market size during the forecast period

The government vertical primarily consists of three institutional units: central government, state government, and local government. Public utilities are those businesses that fulfill the everyday needs of citizens. With the increasing use of mobility, government bodies across the globe have progressively started using mobile devices to enhance workers' productivity and improve the functioning of public sector departments. They must work on critical information, intelligence reports, and other confidential data. It can help protect sensitive data from hackers and provide a secure platform for conducting transactions and exchanging information. It can also be used to secure communication networks, such as those used by government organizations.

By region, North America is expected to grow at the highest CAGR during the forecast period

North America comprises developed countries with strong economies, such as the US and Canada, which are technologically advanced with well-developed infrastructure. North America has been a major hub for quantum cryptography research and development, with several leading academic institutions and private companies in the field. The scope of quantum cryptography in North America is significant, as the region has been at the forefront of advancing quantum technology and its applications. The US government has invested heavily in quantum technology research through programs like the National Quantum Initiative Act. This has resulted in increased funding for quantum research and the establishment of research centers, which is expected to drive the growth of the quantum cryptography market.

Key Market Players

Key players in the Quantum Cryptography market include ID Quantique (Switzerland), QuintessenceLabs (Australia), Toshiba (Japan), QuantumCTek (China), Magiq Technologies (US), Crypta Labs (UK), Qasky (China), Qubitekk (US), ISARA (Canada), Nucrypt (US), Quantum Xchange (US), qutools (Germany), QNu Labs (India), Post Quantum (UK), IBM (US), HPE (US), NEC (Japan), Crypto Quantique (UK), Qrypt (US), KETS Quantum Security (UK), PQShield (UK), QuBalt (Germany), VeriQloud (France), SSH Communication Security (Finland), QuantLR (Israel), and QuSecure (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Major companies covered |

ID Quantique (Switzerland), QuintessenceLabs (Australia), Toshiba (Japan), QuantumCTek (China), Magiq Technologies (US), Crypta Labs (UK), Qasky (China), Qubitekk (US), ISARA (Canada), Nucrypt (US), Quantum Xchange (US), qutools (Germany), QNu Labs (India), Post Quantum (UK), IBM (US), HPE (US), NEC (Japan), Crypto Quantique (UK), Qrypt (US), KETS Quantum Security (UK), PQShield (UK), QuBalt (Germany), VeriQloud (France), SSH Communication Security (Finland), QuantLR (Israel), and QuSecure (US). |

Market Segmentation

Recent Developments

- In May 2022, IDQ launched the Clavis XG. This new device adds to the XG Series' capabilities with higher critical throughput and a more extended range to give businesses and governments the highest level of trust. Additionally, it is intended to provide "QKD as a Service" to a larger group of clients, including instantaneous intrusion detection, the smallest footprint, widespread interoperability, simple installation, and remote support.

- In July 2022, Toshiba partnered with Safe Quantum to address the growing curiosity of potential users in North America who are seeking to gain a deeper understanding of QKD solutions as a novel approach to protect their communications from potential threats.

- In June 2021, ISARA collaborated with Crypto4A collaborate to provide organizations with next-generation security for digital transformations, combining Crypto4A'shardware-anchored Qx Trust Architecture and ISARA's software expertise in implementing crypto-agility and quantum-safe security.

Frequently Asked Questions (FAQ):

What is the definition of quantum cryptography?

MarketsandMarkets defines quantum cryptography as a field of cryptography that uses quantum mechanics principles to secure communications. Unlike classical cryptography, which relies on mathematical techniques to encrypt and decrypt messages, quantum cryptography uses the principles of quantum physics to create unbreakable codes. Quantum cryptography is based on the properties of quantum particles such as photons, which can exist in multiple states simultaneously and can be used to transmit information in a way that is resistant to eavesdropping. By leveraging the principles of quantum entanglement and superposition, quantum cryptography allows two parties to share a secret key that is completely secure and cannot be intercepted by an eavesdropper.

What is the projected value of the Quantum Cryptography market?

The Quantum Cryptography market is expected to grow from an estimated USD 0.54 billion in 2023 to 3.0 billion USD by 2028, at a Compound Annual Growth Rate (CAGR) of 41.2% from 2023 to 2028.

Which are the key companies influencing the growth of the Quantum Cryptography market?

ID Quantique (Switzerland), QuintessenceLabs (Australia), Toshiba (Japan), QuantumCTek (China), and Magiq Technologies (US) are recognized as star players in the Quantum Cryptography market. These companies account for a significant share of the Quantum Cryptography market. They offer comprehensive solutions related to Quantum Cryptography solutions and services. These vendors offer customized solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The healthcare vertical is expected to grow at the highest CAGR during the forecast period.

Which region is expected to hold the largest market size during the forecast period?

North America is expected to hold the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

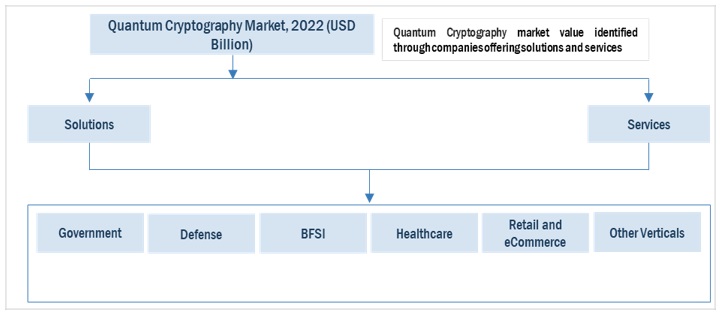

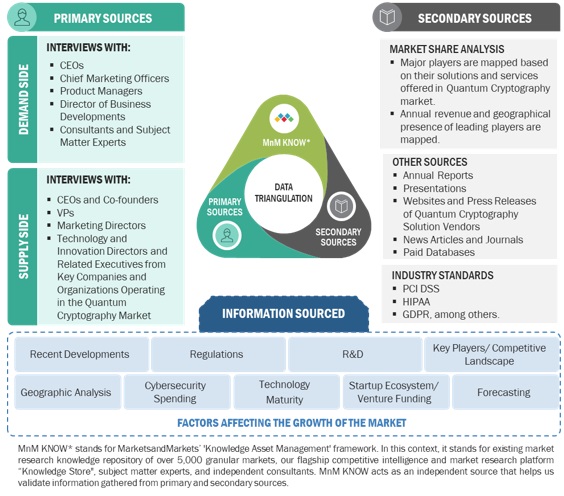

This study involved multiple steps in estimating the current size of the Quantum Cryptography market. Exhaustive secondary research was carried out to collect information on the Quantum Cryptography industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Quantum Cryptography solutions/ services and information from various trade, business, and professional associations. The secondary data was collated and analysed to arrive at the overall size of the Quantum Cryptography market, which was validated by primary respondents.

Primary Research

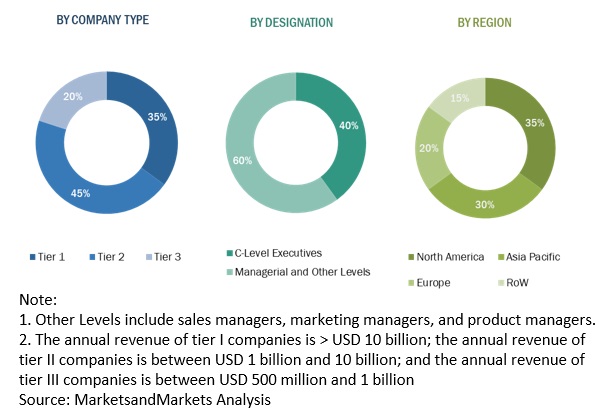

Extensive primary research was conducted after obtaining information regarding the Quantum Cryptography market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across all the major regions. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Quantum Cryptography vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using quantum cryptography solutions/services were interviewed to understand the buyer's perspective on the suppliers, products, component providers, and their current usage of cryptography solutions/services and future outlook of their business which will affect the overall market.

The breakup of the primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

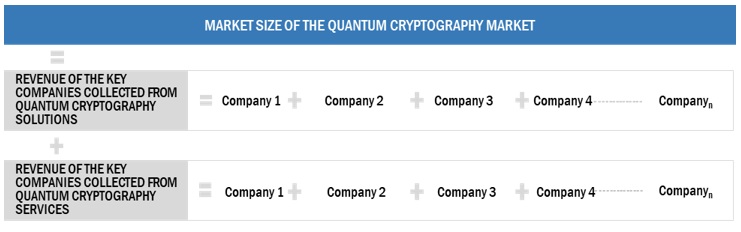

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Quantum Cryptography Market Size: Bottom Up Approach

Quantum Cryptography Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Quantum Cryptography is a field of cryptography that uses quantum mechanics principles to secure communications. Unlike classical cryptography, which relies on mathematical techniques to encrypt and decrypt messages, quantum cryptography uses the principles of quantum physics to create unbreakable codes. Quantum cryptography is based on the properties of quantum particles such as photons, which can exist in multiple states simultaneously and can be used to transmit information in a way that is resistant to eavesdropping. By leveraging the principles of quantum entanglement and superposition, quantum cryptography allows two parties to share a secret key that is completely secure and cannot be intercepted by an eavesdropper.

Key stakeholders

- Government bodies and public safety agencies

- Project managers

- Developers

- Business analysts

- Quality Assurance (QA)/test engineers

- Quantum cryptography specialists

- Quantum cryptography solution and service providers

- Consulting firms

- Third-party vendors

- Investors and venture capitalists

- System Integrators (SIs)

- Technology providers

Report Objectives

- To define, describe, and forecast the quantum cryptography market based on offerings, security types, verticals, and regions

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the quantum cryptography market

- To forecast the quantum cryptography market size across five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the quantum cryptography market and comprehensively analyze their market size and core competencies

- To profile key players and comprehensively analyze their market rankings and core competencies

- To map the companies to get competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the quantum cryptography market globally

Available Customization

MarketsandMarkets offers the following customization for this market report:

- Additional country-level analysis of the Quantum Cryptography Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Quantum Cryptography Market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quantum Cryptography Market

What could be the estimated Quantum Cryptography Market size for security type segment?