Radiation Hardened Electronics Market by Component (Mixed Signal ICs, Processors & Controllers, Memory, Power Management), Manufacturing Techniques (RHBD, RHBP), Product Type, Application and Geography - Global Forecast to 2029

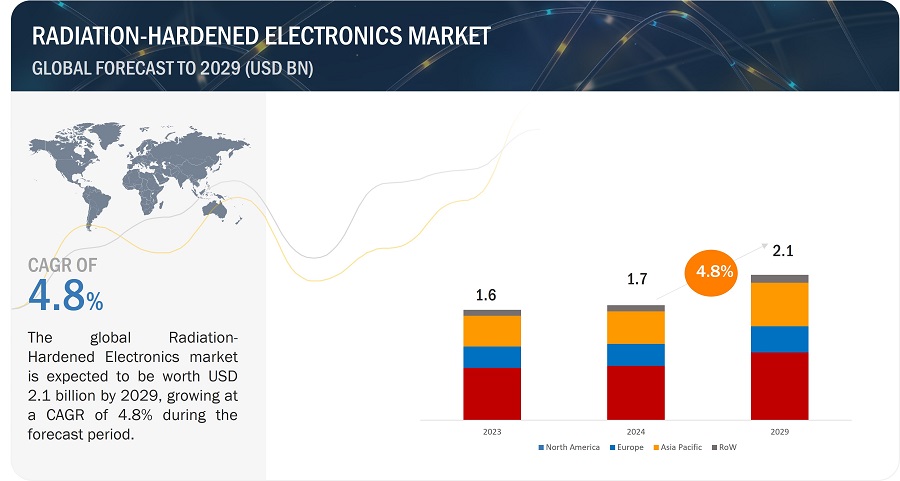

[260 Pages Report] The Radiation-Hardened Electronics Market Size is expected to grow from USD 1.7 billion in 2024 to USD 2.1 billion by 2029; it is expected to grow at a CAGR of 4.8% from 2024 to 2029.

The market has a positive growth potential due to several driving factors, including ongoing research and development in materials science, design techniques, and testing methodologies that are leading to improved performance, reliability, and affordability of radiation-hardened electronics, opening doors for new applications.

Radiation Hardened Electronics Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Radiation-Hardened Electronics Market Dynamics

Driver: Increasing intelligence, surveillance, and reconnaissance (ISR) activities.

Intelligence, surveillance, and reconnaissance (ISR) operations are increasing by the day in the defence industry to stay one step ahead of enemies and allies. Any ISR operation can be successful if high-quality, reliable, and environmentally acceptable end products are used. Hence, the latest processors, controllers, and electronic equipment are preferred for space, maritime, and military applications during ISR operations. The electronic equipment must survive highly challenging environments for an average of 15 years without degrading its performance and power, especially for space operations.

Restraint: Difficulties in creating a real testing environment

One of the restraints associated with these radiation-hardened components is the creation of a testing environment that can actually represent space, a nuclear war, or a defence environment. Real environments expose electronics to a complex mix of radiation types, energies, and intensities. Replicating this mix accurately in a testing lab is difficult and often requires multiple sources and techniques.

Opportunity: Increasing demand for commercial-off-the-shelf components in space satellite

The role of commercial off-the-shelf (COTS) products in satellites and other space applications is significant as the demand for low-cost nanosatellites is growing. COTS components can be used for small satellites that are mission specific. COTS solutions offer improved time-to-market and cost-saving features for various low earth orbit satellites, space rovers and robots, launchers, and other applications. These products are based on solid architecture and provide peripherals, such as ETHERNET and CAN.

Challenge: Customized requirements from high-end consumers

Different applications encounter varying radiation intensities and types. Customization ensures components withstand the specific radiation profile of the target environment, optimizing performance and cost-effectiveness. For example, a deep-space probe needs higher tolerance than a medical device used in low-dose radiation therapy.

Radiation-Hardened Electronics Market Map:

Processors & controllers component will hold significant market share in radiation-hardened electronics market during the forecast period

Processors and controllers play a crucial role in synchronizing, directing, and controlling components and ensuring that they function accurately. Any failure in processors or controllers can risk the entire space mission. Hence, it is imperative that processors can withstand the space environment and the effects of radiation. Spacecraft system designers are also adopting radiation-hardened FPGAs to obtain high-speed data communication and improved on-board data processing in the extreme space environment

RHBP is expected to grow at a significant CAGR during the forecast period

The RHBP technique uses the IC fabrication process and modifications to harden electronic components. RHBP tackles the radiation head-on by creating transistor bodies that are less sensitive to degrading effects. The technique can be widely used wherein there is not much demand for radiation-hardened components because manufacturers need to modify their IC fab for huge volume production, which is a time-consuming and expensive process.

The commercial-off-the-shelf product type segment is expected to dominate the radiation-hardened electronics market from 2024 to 2029

Radiation-hardened electronics are increasingly being adopted by commercial small satellites and military satellites. The space industry is also continuously booming with NASA deep space missions, mega-constellations of small satellites, etc., which are demanding microelectronics with high reliability and low-cost benefits. This can be achieved through COTS devices as they can be replaced with pin-out compatible ceramic packages, which offer the same functionality as the original device. This helps to achieve significant cost savings and reduces the risk and development time.

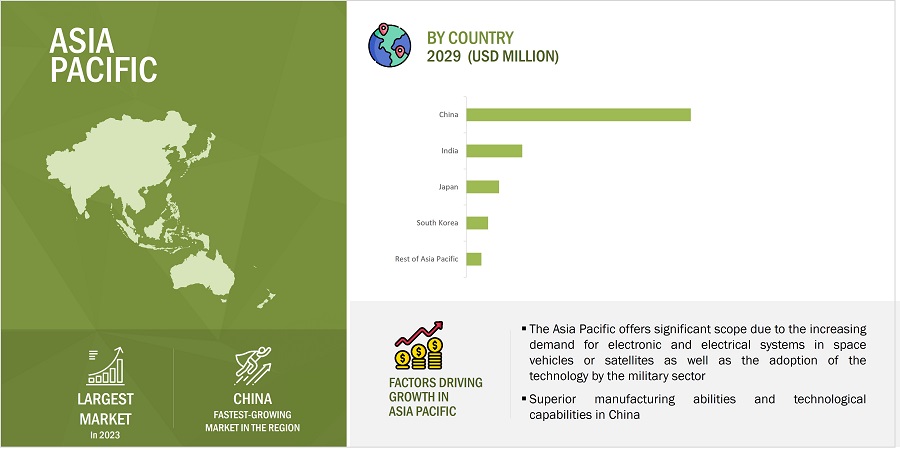

Radiation hardened electronics market in China is expected to maintain the highest CAGR in Asia Pacific region share during 2024

China has made significant progress in the space industry, has a nearly complete range of satellite launch vehicles, and can accomplish various space missions. These include remote sensing satellites with various resolutions, covering various spectrums, satellite navigation systems, communication satellites, robust human spaceflight, and the lunar exploration program. These government initiatives are also expected to benefit developments in military space technology. For instance, in March 2022, China launched a classified military remote-sensing satellite. It is expected to be used for surveying land resources, crop yield estimation, urban planning, and disaster prevention. These new space programs are expected to propel the demand for radiation-hardened electronics in the region.

Radiation Hardened Electronics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in the radiation-hardened electronics companies are Microchip Technology Inc.(US), BAE Systems (UK), Renesas Electronics Corporation (Japan), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), AMD (US), Texas Instruments Incorporated (US), Honeywell International Inc. (US), Teledyne Technologies Inc. (US), and TTM Technologies, Inc. (US). SMEs/startups covered in the study are Cobham Limited (UK), Analog Devices, Inc (US), Data Devices Corporation (US), 3D Plus (France), Mercury Systems, Inc. (US), PCB Piezotronics, Inc (US), Vorago Technologies (US), Micropac Industries, Inc (US), GSI technology, Inc (US), Everspin Technologies Inc (US), Semiconductor Components Industries, LLC (US), AiTech (US), Microelectronics Research Development Corporation (US), Space Micro, Inc (US), and Triad Semiconductor ( US).

Radiation-Hardened Electronics Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Thousand/Million/Billion |

|

Segments Covered |

Component, Manufacturing Technique, Product Type, Application, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and the Rest of the World |

|

Companies covered |

The key players operating in the radiation-hardened electronics market are Microchip Technology Inc.(US), BAE Systems (UK), Renesas Electronics Corporation (Japan), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), AMD (US), Texas Instruments (US), Honeywell International Inc. (US), Teledyne Technologies (US), TTM Technologies, Inc. (US), Cobham (UK), Analog Devices, Inc.(US), Data Device Corporation (DDC) (US), 3D Plus (France), Mercury Systems Inc (US), PCB Piezotronics (US), Vorago Technologies (US), Micropac Industries (US), GSI Technology (US), Everspin Technologies (US), Semiconductor Components Industries (US), Aitech (US), Microelectronics Research Development Corporation (US), Space Micro (US), Triad Semiconductor (US). |

Radiation Hardened Electronics Market Highlights

This report categorizes the Radiation Hardened Electronics Market based on Component, Manufacturing Technique, Product Type, Application, and Region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Manufacturing Technique: |

|

|

By Product Type: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In January 2024, Infineon Technologies AG unveiled radiation-hardened asynchronous static random-access memory (SRAM) chips for space applications. Using RADSTOP technology, these chips are designed with proprietary methods for enhanced radiation hardness, ensuring high reliability and performance in harsh environments.

- In October 2023, Teledyne e2v collaborated with Microchip Technology to develop a pioneering space computing reference design, featuring Microchip's Radiation-Tolerant Gigabit Ethernet PHYs. The innovative design focuses on high-speed data routing in space applications, presented at the EDHPC 2023.

- In September 2023, Microchip Technology Inc. launched the MPLAB Machine Learning Development Suite, a comprehensive solution supporting 8-bit, 16-bit, and 32-bit MCUs, and 32-MPUs for efficient ML at the edge. The integrated workflow streamlines ML model development across Microchip's product portfolio

- In September 2023, Infineon Technologies collaborated with Chinese firm Infypower in the new energy vehicle charger market, providing industry-leading 1200 V CoolSiC MOSFET power semiconductors. This partnership aimed to enhance efficiency in electric vehicle charging stations, offering wide constant power range, high density, minimal interference, and high reliability for Infypower's 30 kW DC charging module.

Critical questions answered by this report:

How big is the radiation-hardened electronics Market?

The market for radiation-hardened electronics was valued at USD 2.1 billion in 2029. Growth of the Internet penetration rate propels the demand for radiation-hardened electronics across different verticals during the forecast period.

Are radiation-hardened electronics in Demand?

It is further expected to grow significantly during the forecast period. The power management product is experiencing significant adoption owing to its ability to deliver the stringent voltage accuracy and load current variation capability required for various harsh environments.

What are the various verticals of the radiation-hardening electronics market?

The space is vertical to showcase the highest CAGR growth during the forecast period.

What region is expected to have a high adoption of the radiation-hardened electronics market?

North America is expected to lead the market during the forecast period.

Who is the Leader in the radiation-hardened electronics market?

BAE Systems (UK) is one of the key players in the radiation-hardened electronics market. The company is one of the leading providers globally, relying on its R&D capabilities and balanced product portfolio.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

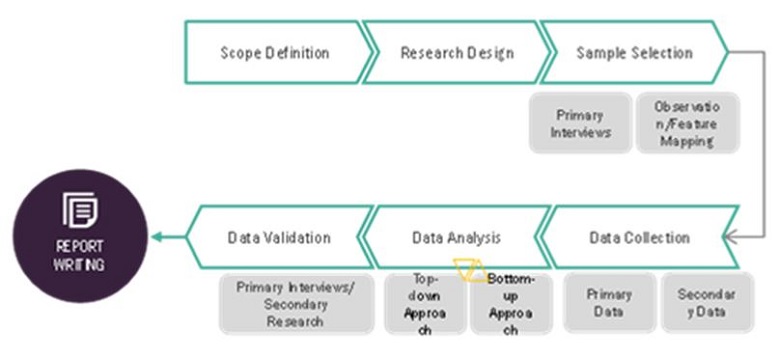

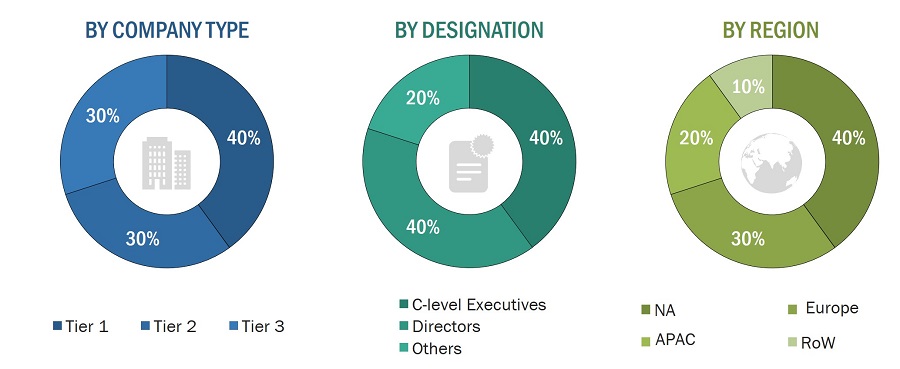

The study involved four major activities in estimating the size of the radiation-hardened electronics market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles from recognized authors, directories, and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the radiation-hardened electronics market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East, Africa, and South America). After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the radiation-hardened electronics market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both, quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Radiation Hardened Electronics Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the radiation-hardened electronics market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using the top-down and bottom-up approaches.

Market Definition

Radiation hardening is the development of electronic components and systems that are resistant to destruction or failures caused by ionizing radiation (particle radiation and high-energy electromagnetic radiation) occurring in outer space, high-altitude flights, around nuclear reactors, particle accelerators, during nuclear accidents, or nuclear warfare. Most semiconductor electronic components are susceptible to damage by radiation; radiation-hardened components are based on their hardened equivalents, with some design and manufacturing variations that reduce their susceptibility to damage by radiation.

Key Stakeholders

- Associations and Regulatory Authorities Related to Radiation-hardened Electronics.

- Government Bodies, Venture Capitalists, and Private Equity Firms

- Original Equipment Manufacturers (OEMs)

- Semiconductor Component Suppliers

- Radiation-hardened Equipment Distributors and Sales Firms

- Software Solution Providers

- System Integrators for Radiation-hardened Electronic Components

- Research Institutes and Organizations

Report Objectives

- To define, describe, and forecast the radiation-hardened electronics market size by component, manufacturing techniques, product type, and application in terms of value.

- To describe and forecast the size of the radiation-hardened electronics market across 4 regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective country-level market sizes.

- To analyze the material selection and packaging types utilized in the market.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a comprehensive overview of the value chain of the market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To analyze opportunities for stakeholders by identifying high-growth segments of the radiation-hardened electronics market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies.

- To analyze competitive developments, such as product launches, deals (mergers, acquisitions, joint ventures, and investments), and others (expansions), in the radiation-hardened electronics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of 25 market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Radiation Hardened Electronics Market