Radiotherapy Market by Type (Product, Service), Technology (MRI LINAC, Stereotactic, Particle Therapy, Cobalt-60 Teletherapy), Procedure (IMRT, IGRT, 3D-CRT, LDR, HDR), Application (Prostate, Breast, Lung), End User (Hospital) & Region - Global Forecast to 2028

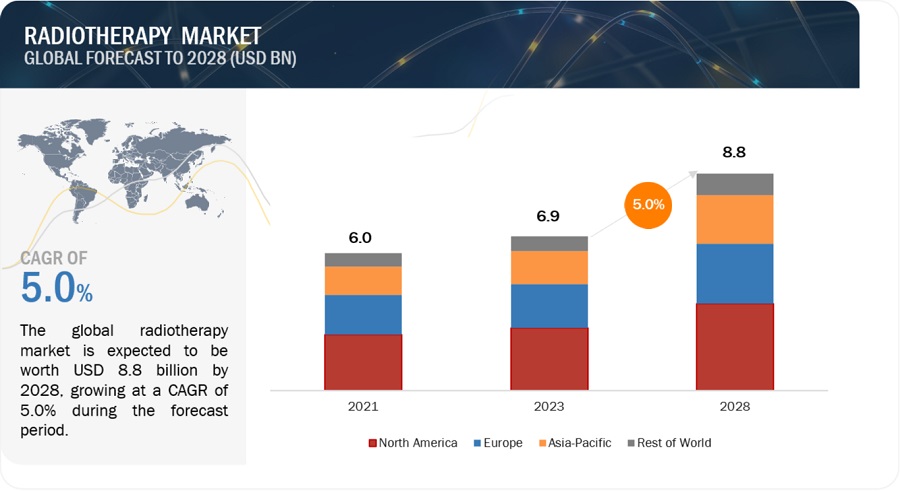

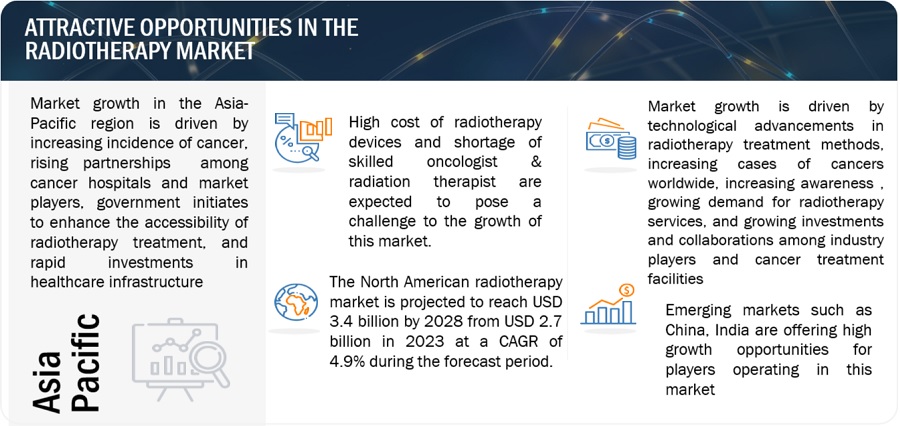

The global radiotherapy market in terms of revenue was estimated to be worth $6.9 billion in 2023 and is poised to reach $8.8 billion by 2028, growing at a CAGR of 5.0% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is influenced by factors such as increasing incidence of cancer globally, and continuous technological advancements such as development of MRI linear accelerators, proton therapy, introduction of treatment planning software that integrates with imaging data. All these innovations have enhanced the overall cancer treatment outcome. Moreover, increased awareness about early detection of tumours and availability of advanced radiotherapy treatment and ongoing investments by government in the procurement of advanced radiotherapy technologies and establishment of new cancer treatment centers across developing nations are anticipated to play a significant role in accelerating the radiotherapy market during the forecast period.

Additionally, growing collaboration & partnerships among industry players, cancer treatment centers, and oncology research institutes are contributing towards the expansion of radiotherapy services globally, which is further expected to boost the market growth.

However, high cost of obtaining & implementation of radiotherapy devices, especially in the emerging countries lacking adequate funds and healthcare infrastructure are likely to limit the adoption of new radiotherapy technologies. Also, shortage of qualified radiotherapist and oncologist and complexities linked with radiotherapy treatment are the factors expected to restrain the growth of this market during the forecast period.

Global Radiotherapy Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Radiotherapy Market Dynamics

Driver: Technological advancements in radiotherapy treatment

Radiotherapy industry is undergoing a technology-driven revolution. The incorporation of cutting edge technology , such as precision treatment delivery systems including intensity modulated radiation therapy (IMR)T, stereotactic body radiation therapy (SBRT) delivering precise dose of radiation to cancer cell , the development of MRI LINAC proving real time imaging during treatment, utilization of AI for treatment planning to analysis are playing a significant role in optimizing the radiotherapy treatment process. Industry players are focusing on the introduction of new radiotherapy technologies . For instance:

- In May 2022, Elekta (Sweden) launched Elekta Espirit which is a next-generation Gamma Knife to enable more personalized radiosurgery. The system is yet to receive FDA and CE clearance.

- In May 2022, MagnetTx Oncology Solutions Ltd. (Canada) received clearance from the FDA for its Aurora-RT, a LINAC-MR technology

Such technological advancements focus on improving the functionality of radiotherapy delivery systems and expanding their application areas. The growing adoption of these advanced radiothery systems among cancer treatment centers are likely to drive the growth of the radiotherapy market.

Restraint: lack of adequate healthcare infrastructure in emerging countries

Emerging and underdeveloped economies may face constraints in allocating adequate funds for healthcare infrastructure. The lack of investments and inability to establish radiotherapy facilities can limit the patient accessibility for treatment and slow down the adoption advanced radiotherapy technologies.

Opportunity: Rising Healthcare Expenditure Across Developing Countries

The rapid economic growth observed in developing countries such as China, India are expected to offer a significant growth opportunity for radiotherapy market. Rapid growth in per-capita healthcare expenditure, rising focus of governments across these countries in enhancing healthcare facilities and offering healthcare services are playing a significant role in boosting the market growth. Moreover, the increasing cancer patient population, growing awareness, and increase affordability of healthcare services are likely to fuel the radiotherapy market. Manufacturers of radiotherapy equipment are seeking partnerships with healthcare providers in these countries with an aim expand their market presence. All these factors are anticipated to contribute towards the rapid growth of market in these countries.

Challenge: Risk of Radiation Exposure

One of the major challenges associated with the use of radiation therapy for cancer treatment is the risk of radiation exposure to the healthy tissues. The risk of radiation exposure is more with HDR brachytherapy and systemic radiotherapy (including higher risk of injury to the focused area of tissue), as these include the use of strong doses per cycle. Also, the use of applicators and after loaders during brachytherapy poses a risk of radiation exposure to the technical and supporting staff in case of manual loading and removal of sources. These are the major factors limiting the widespread use of these products.

Market Ecosystem

Based on type, the product segment, held the largest share of radiotherapy industry in 2022

Based on type, the radiotherapy market is segmented into products and software & services. The product segment accounted for the largest share of market in 2022. This is attributed to the higher installed based of radiotherapy devices, increasing prevalence of cancer, and the growing demand for comprehensive cancer care.

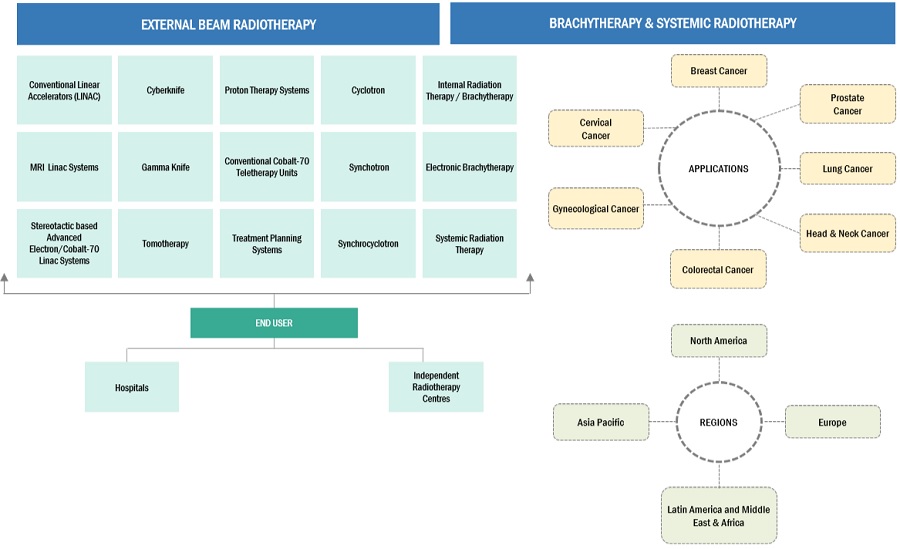

Based on technology, the external beam radiotherapy segment, held the largest share of radiotherapy industry in 2022

Based on technology, the radiotherapy market is segmented into external beam radiotherapy, internal beam radiotherapy/brachytherapy, and systemic radiotherapy. The external beam radiotherapy segment is further divided into linear accelerators, particle therapy systems, and conventional cobalt-60 teletherapy units. The internal beam radiotherapy/brachytherapy segment includes seeds, applicators, afterloaders, and IORT systems, while the systemic radiotherapy segment includes iobenguane (I-131), samarium-153, rhenium-186, and other radioisotopes.

In 2022, the external beam radiotherapy segment (EBRT) accounted for the largest market share radiotherapy market. External beam radiotherapy is widely and well-established cancer treatment modality, moreover, the high effectiveness of EBRT across various cancer, non-invasive nature of treatment and ongoing technological advancements in external beam radiotherapy such as development of newer techniques such as stereotactic radiosurgery and IMRT to deliver radiation externally with high accuracy and precision makes this mode suitable for many types of cancer treatment. All these factors are likely to contribute towards the substantial market share of the segment

Based on Procedure, the particle therapy segment, accounted for the highest growth rate in the external beam radiotherapy industry, during the forecast year

The external beam radiotherapy segment is segmented into Image-Guided Radiation Therapy (IGRT), Intensity-Modulated Radiation Therapy (IMRT), particle therapy, stereotactic therapy, and 3D Conformal radiotherapy. The particle therapy segment is expected to register the highest growth rate during the forecast period attributed to growing adoption of proton therapy by many cancer facilities, the ability to deliver high higher dose of radiation to tumour cells with reduced impact on surrounding cells, expansion of proton therapy centers worldwide, and rising number of research activities in the filed of proton therapy.

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest share of the radiotherapy industry during the forecast period.

North America is the expected to be the largest region for radiotherapy market during the forecast period. Countries in this market are witnessing a high number of cancer patients undergoing radiation therapy procedures, presence of well-established healthcare facilities, favourable reimbursement policies, and strong foothold of market players in the region.

As of 2022, prominent players in the radiotherapy market are Siemens Healthcare GmbH (Germany), Elekta (Sweden), Accuray Incorporated (US), IBA (Belgium), ViewRay Technologies, Inc. (US), IBA Worldwide (Belgium), among others.

Scope of the Radiotherapy Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$6.9 billion |

|

Projected Revenue by 2028 |

$8.8 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 5.0% |

|

Market Driver |

Technological advancements in radiotherapy treatment |

|

Market Opportunity |

Rising Healthcare Expenditure Across Developing Countries |

This report has segmented the global radiotherapy market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Product

- Software & Service

By Technology

-

External Beam Radiotherapy

-

Linear Accelerators

- Conventional Linear Accelerators

- MRI LINAC

- Stereotactic Advanced Electron/Cobalt-60 Linear Accelerators

- Gamma Knife

- CyberKnife

- TomoTherapy

- Conventional Cobalt-60 Teletherapy Units

-

Particle Therapy Systems

- Cyclotrons

- Synchrotrons

- Synchrocyclotron

-

Linear Accelerators

-

Internal Beam Radiotherapy/Brachytherapy

- Seeds

- Afterloaders

- Applicators

- IORT Systems

-

Systemic Radiotherapy

- Iobenguane (I-131)

- Samarium-153

- Rhenium-186

- Other Systemic Radiotherapy Products*

Note:*Other systemic radiotherapy products include Yttrium-90, Radium-223, Phosphorous-32, and Radio-labelled Antibodies, among others.

By Application

-

External Beam Radiotherapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Other Cancers*

-

Internal Beam Radiotherapy/Brachytherapy

- Prostate Cancer

- Gynecological Cancer

- Breast Cancer

- Cervical Cancer

- Penile Cancer

- Other Cancers**

Note 2: *Other cancers in external beam radiotherapy applications include spine, brain, and pediatric cancer, among others.

Note 3:**Other cancers in internal beam radiotherapy applications include lung and head & neck cancer, among others.

By Procedure

-

External Beam Radiotherapy

- Image-guided Radiotherapy

- Intensity-modulated Radiotherapy

- Stereotactic Therapy

- Particle Therapy

- 3D Conformal Radiotherapy

-

Internal Beam Radiotherapy/Brachytherapy

- High-dose-rate Brachytherapy

- Low-dose-rate Brachytherapy

- Pulsed-dose-rate Brachytherapy

- Systemic Radiotherapy

- Intravenous Radiotherapy

- Oral Radiotherapy

- Instillation Radiotherapy

By End User

- Hospitals

- Independent Radiotherapy Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments of Radiotherapy Industry

- In October 2023, Accuray incorporated received approval of Tomo C radiation therapy system by the Chinese National Medical Products Administration (NMPA).

- In July 2023, IBA entered into partnership with Apollo Proton Cancer Centre (APCC) (India) to provide training to Oncologist on proton beam therapy

- In April 2022, Elekta and GE Healthcare entered into a global commercial collaboration agreement in the field of radiation oncology, enabling them to provide hospitals a comprehensive offering across imaging and treatment for cancer patients requiring radiation therapy

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global radiotherapy market?

The global radiotherapy market boasts a total revenue value of $8.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global radiotherapy market?

The global radiotherapy market has an estimated compound annual growth rate (CAGR) of 5.0% and a revenue size in the region of $6.9 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

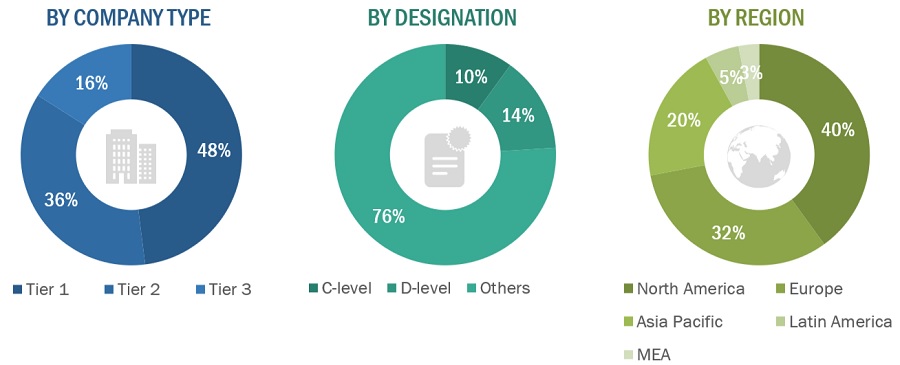

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the radiotherapy market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the radiotherapy market. The primary sources from the demand side include hospitals, independent radiotherapy centers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

To know about the assumptions considered for the study, download the pdf brochure

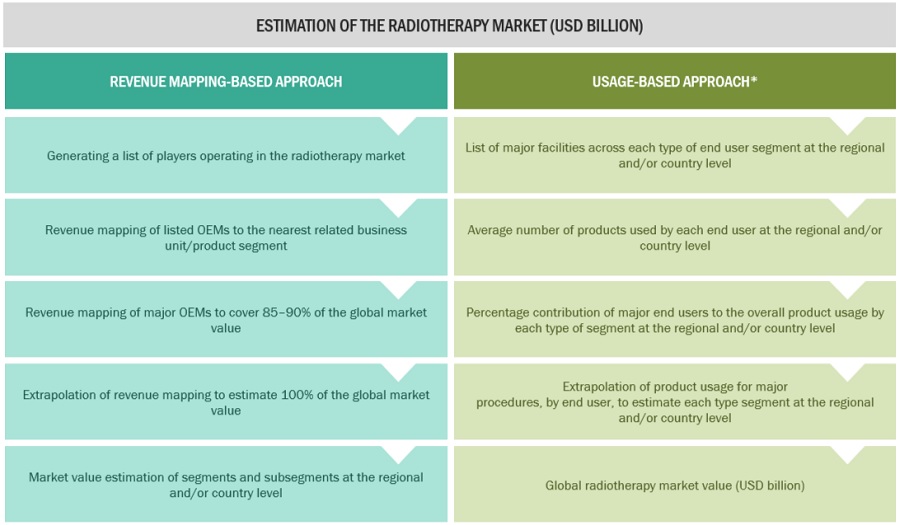

Market Estimation Methodology

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global radiotherapy market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 85–90% of the market share at the global level). Also, the global radiotherapy market was split into various segments and sub-segments based on:

- A list of major players operating in the radiotherapy market at the regional and/or country level

- Product mapping of various manufacturers for each type of radiotherapy product at the regional and/or country level

- Mapping of annual revenue generated by listed major players from radiotherapy segments (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 85–90% of the global market share as of 2022

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global radiotherapy market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

*The usage-based approach was used for the market estimation of specific segments with validated data points.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After deriving the overall Radiotherapy market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Market Definition

Radiotherapy/radiation therapy refers to therapeutic procedures using high-energy radiation from X-rays, gamma rays, neutrons, protons, and other sources to destroy abnormal cancerous cell growths and shrink tumors. Radiotherapy treatment is a minimally invasive alternative to chemotherapy and surgical measures, with lesser damage to normal healthy cells.

Key Market Stakeholders

- Radiotherapy product manufacturing companies

- Distributors, suppliers, and commercial service providers

- Healthcare service providers

- Radiotherapy service providers

- Radiotherapy product distributors

- Medical research laboratories

- Cancer care centers

- Cancer research organizations

- Academic medical centers and universities

- Market research and consulting firms

Report Objectives:

- To define, describe, and forecast the radiotherapy market based on type, technology, procedure, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global radiotherapy market.

- To analyze key growth opportunities in the global radiotherapy market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the revenue of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East and Africa.

- To profile the key players in the global radiotherapy market and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments such as new product launches; agreements, and partnerships; mergers & acquisitions; and research & development activities in the radiotherapy market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global radiotherapy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe's radiotherapy market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among other

- Further breakdown of the Rest of Asia Pacific radiotherapy market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Radiotherapy Market