Real-Time Payments Market by Nature of Payment (P2P, P2B & B2P), Component (Solutions (Payment Gateway, Payment Processing & Payment Security & Fraud Management) & Services), Deployment Mode, Enterprise Size, Vertical, & Region - Global Forecast to 2023

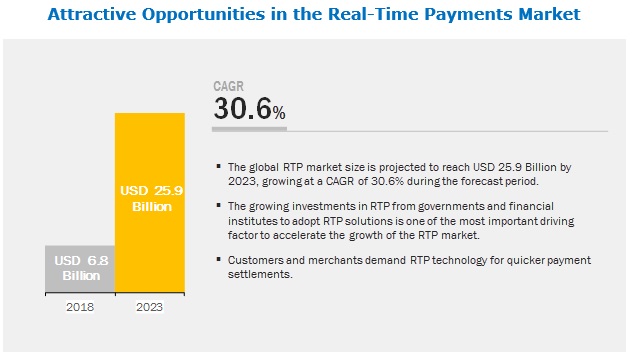

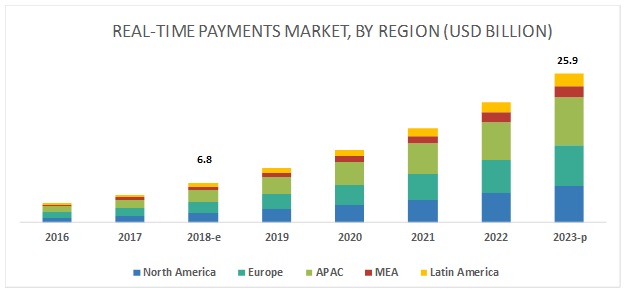

[182 Pages Report] The real time payments market expected to grow from USD 6.8 billion in 2018 to USD 25.9 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 30.6%.

The major growth factors expected to drive the growth of the market include the high proliferation of smartphones, adoption of cloud-based solutions, customers demand for immediacy of payments and quicker payment settlements, and the government initiatives.

The study involved 4 major activities to estimate the current market size of the real time payments market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whit papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; real-time payments technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

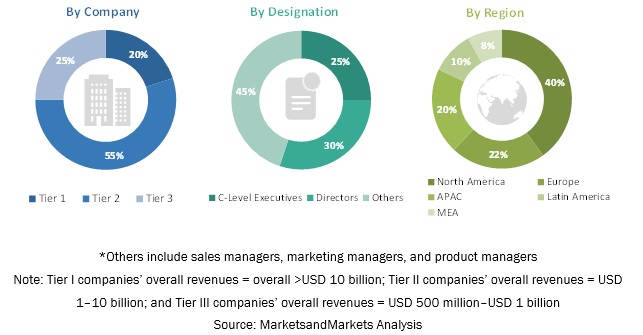

Various primary sources from both supply and demand sides of the real time payments market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the real time payments software and associated service providers and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Real Time Payments Market Size Estimation

For making market estimates and forecasting the real time payments market and the other dependent sub-markets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the real time payments market by nature of payment (Person-to-Person (P2P), Person-to-Business (P2B), Business-to-Person (B2P), and others), component (solutions and services), deployment mode (cloud and on-premises), vertical (Banking, Financial Services, and Insurance (BFSI), IT and telecom, transport, retail and e-commerce, government, energy and utilities, and others), and region (North America, Asia Pacific (APAC), Europe, Latin America, and Middle East and Africa (MEA)). The report also aims at providing detailed information about major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- The report also aims at providing detailed information about the major factors influencing the growth of the real time payments market (drivers, restraints, opportunities, and challenges).

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the real time payments market

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

nature of payment, component, deployment mode, enterprise size, vertical, and region |

|

Geographies covered |

North America, Europe, APAC, MEA and Latin America |

|

Companies covered |

ACI Worldwide (US), FIS (US), Fiserv (US), Mastercard (US), Worldline (France), PayPal (US), Visa (US), Apple (US), Ant Financial (China), INTELLIGENT PAYMENTS (Gibraltar), Tmenos (Swtizerland), Wirecard (Germany), Global Payments (US), Capgemini (France), IntegraPay (Australia), SIA (Italy), Obopay (India), Ripple (US), Pelican (UK), Finastra (UK), Nets (Denmark), FSS (India), Montran (US), REPAY (US) and iCon Solutions (UK). |

This research report categorizes the market based on nature of payments, components, deployment modes, enterprise size, verticals, and regions.

Based on the nature of payment, the real time payments market has been segmented as follows:

- Person-to-Person (P2P)

- Person-to-Business (P2B)

- Business-to-Person (B2P)

- Others (Business-to-Government (B2G), Government-to-Business (G2B), Business-to-Business (B2B), Person-to-Government (P2G), and Government-to-Person (G2P))

Based on components, the real time payments market has been segmented as follows:

- Solutions

- Payment Gateway Solution

- Payment Processing Solution

- Payment Security and Fraud Management Solution

- Services

- Professional Services

- Managed Services

Based on deployment modes, the real time payments market has been segmented as follows:

- On-premises

- Cloud

Based on the enterprise size, the market has been segmented as follows:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals, the real time payments market has been segmented as follows:

- BFSI

- IT and Telecommunications

- Retail and e-commerce

- Government

- Energy and Utilities

- Others (Healthcare and Life Sciences, Media and Entertainment, Manufacturing, Transport, Travel and Hospitality, and Education)

Based on regions, the real time payments market has been segmented as follows:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American real time payments market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players up to 5

The services segment is expected to grow at a higher CAGR during forecast period

On the basis of components, the real time payments market has been classified into solutions and services, out of which the services segment is expected to grow at a higher CAGR during the forecast period. The utilization of real time payments solutions is growing; this has resulted in the increasing demand for payments services. The services segment has further been broken down into professional services and managed services. Among these segments, the managed services segment is expected to grow at a higher CAGR, whereas the professional services segment is expected to be a larger contributor to the market size. The increasing demand for real time payments solutions has resulted in the growing demand for professional and managed services.

The retail and e-commerce vertical is expected to have the largest market size and grow at the highest CAGR during the forecast period

The retail and e-commerce vertical is expected to have the largest real time payments market size and grow at the highest CAGR during the forecast period. The huge demand for instant payment settlements from retailers and merchants has led to the maximum adoption real time payments solutions and the associated services. Real time payments solutions provide a competitive edge to retail and e-commerce businesses by offering them a cheaper and faster mode of payment. Moreover, customers prefer online shopping due to the increasing integration of mobile devices in their shopping habits.

Asia Pacific (APAC) is expected to hold the largest market size and grow at the highest CAGR during the forecast period

On the basis of regions, the global real time payments market has been segmented into North America, Europe, APAC, Middle East and Africa (MEA), and Latin America. APAC is expected to hold the largest market size and grow at the highest CAGR during the forecast period. In the APAC region, the growth rate can be attributed to various factors, including the adoption of advanced technologies, economic developments, increasing rate of digitalization, and high investments by real time payments solution and service providers. The driving forces for the growth of the market in this region include the huge population in this region that contributes to the volume of transactions, and the domestic and international enterprises that are investing in this region.

Major vendors in the global real time payments market include ACI Worldwide (US), FIS (US), Fiserv (US), Mastercard (US), Worldline (France), PayPal (US), Visa (US), Apple (US), Ant Financial (China), INTELLIGENT PAYMENTS (Gibraltar), Temenos (Swtizerland), Wirecard (Germany), Global Payments (US), Capgemini (France), IntegraPay (Australia), SIA (Italy), Obopay (India), Ripple (US), Pelican (UK), Finastra (UK), Nets (Denmark), FSS (India), Montran (US), REPAY (US) and Icon Solutions (UK).

MnM view of Wirecard:

Wirecard is a leading supplier of online banking payment services. It focuses on expanding its services and solutions portfolio in the emerging markets by introducing various strategies and developments in eCommerce. It combines the latest technologies with banking services and products to innovate new solutions that can improve the customer experience and reduce the security risks related to payment transactions. Wirecard provides a wide range of software-enabled payment solutions and helps companies implement real time payments strategies across all their sales channels.

Wirecard aims to offer a comprehensive portfolio of digital financial services from a single source on a digital platform. The company follows a mix of organic and inorganic strategies and is focused on new product launches, partnerships, business expansions, and acquisitions for its stable growth in the digital payment industry. For instance, in July 2018, Wirecard extended its partnership with SAP to launch the Wirecard Extension for SAP Commerce. The company also launched a new Payment Page Designer for online retailers and expanded its value-added services for the eCommerce vendors.

MnM view of Mastercard:

Mastercard is a leading financial technology company. The company is significantly investing in the areas of real-time account payments, digital services, data analytics, and geographic expansion. The company plans to diversify its business through organic and inorganic growth strategies. For instance, in July 2016, Mastercard acquired VocaLink Holdings Limited for approximately USD 920 million. The acquisition helped Mastercard in becoming an active participant in all types of electronic payments and payment flows and enhance its services for the benefit of customers and partners. The company is also focusing on strengthening its product portfolio by introducing new products. For instance, in September 2018, Mastercard, along with Microsoft, introduced Mastercard Track, a B2B platform powered by Microsoft Azure, to connect buyers and suppliers with networks, banks, and solution providers. The solution would help in streamlining and automating the procure-to-pay process that enables businesses to manage their business identity, compliances, and payments in a more efficient way.

Recent developments

- In August 2018, ACI Worldwide partnered with SPAN Enterprises, a cloud-based software company, to boost payments and enhance the customer experience in the transportation industry by deploying ACIs Official Payments, an IRS tax payment system.

- In September, Fiserv agreed to acquire Elan Financial Services, a unit of U.S. Bancorp. Elan Financial Services is a provider of debit card processing, ATM managed services, and MoneyPass surcharge-free ATM network. The acquisition would enable Fiserv to strengthen its presence in the arena of debit card processing and expand its mobile and digital payments offering for consumers and businesses.

- In June 2018, PayPal acquired Simility, a leading fraud prevention and risk management platform, for USD 120 million. Paypal aims at expanding its fraud prevention and risk management portfolio for merchants, following this acquisition.

Critical questions the report answers

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming industry trends in the real time payments market?

- Which are the vendors operating in the market?

- What are the drivers and challenges of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakdown and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Assumptions of the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Real Time Payments Market

4.2 Top 3 Verticals

4.3 Top 3 Solutions and Verticals

4.4 Market By Vertical

5 Real Time Payments Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Proliferation of Smartphones

5.2.1.2 Customers Demand for Immediacy of Payments and Quicker Payment Settlements

5.2.1.3 Government Initiatives are Accelerating the Adoption of Real Time Payments Solutions

5.2.2 Restraints

5.2.2.1 Lack of Interoperability Between Schemes

5.2.2.2 Increasing Market Competition

5.2.3 Opportunities

5.2.3.1 Progressive Changes in Regulatory Framework

5.2.3.2 Increasing Use of Real Time Payments Across Different Industry Verticals

5.2.4 Challenges

5.2.4.1 Payment Security is Posing a Challenge for Banks

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.4 Payment System Evolution Overview

5.5 Standards and Regulatory Implications

5.5.1 Afinis Interoperability Standards

5.5.2 International Organization for Standardization 20022

5.5.3 General Data Protection Regulation

5.5.4 Payment Services Directive

5.6 Regulatory Financial Associations

5.6.1 Electronic Transactions Association

5.6.2 Consumer Financial Protection Bureau

5.6.3 European Automated Clearing House Association

5.6.4 Payment Card Industry Security Standards Council

5.6.5 Continuous Linked Settlement Group

5.6.6 R3CEV Blockchain Consortium

5.6.7 Global Payments Steering Group

5.6.8 Financial Blockchain Shenzhen Consortium

5.6.9 Blockchain Collaborative Consortium

5.6.10 Wall Street Blockchain Alliance

6 Real Time Payments Market, By Nature of Payment (Page No. - 51)

6.1 Introduction

6.2 Person-to-Person

6.2.1 Increasing Demand for Immediacy of Payments and Quicker Settlements Drive the Adoption of the P2P Nature of Payment

6.3 Person-To-Business

6.3.1 High Proliferation of Smartphones and Connected Devices Accelerate the Adoption of the P2B Nature of Payment

6.4 Business-To-Person

6.4.1 Increase in Data Transparency and Enhanced Safety Boost the Growth of the B2P Nature of Payment

6.5 Others

7 Real Time Payments Market, By Component (Page No. - 58)

7.1 Introduction

7.2 Solutions

7.2.1 Payment Gateway

7.2.1.1 Financial Institutes Demand Payments Gateway Solutions, as they Automatically and Securely Approve Transactions

7.2.2 Payment Processing

7.2.2.1 Real Time Payments Processing Solutions Enable Continuous Availability for Transactions

7.2.3 Payment Security and Fraud Management

7.2.3.1 Increasing Number of Financial Frauds in Online Transactions has Led to the Demand for Ai-Based Security and Fraud Management Solutions

7.3 Services

7.3.1 Professional Services

7.3.1.1 The Technicalities Involved in Implementing Payments Solutions would Boost the growth of Professional Services

7.3.2 Managed Services

7.3.2.1 With the Increasing Deployment of Payments Solutions, the Requirement for Managed Services will also Increase

8 Real Time Payments Market, By Deployment Mode (Page No. - 67)

8.1 Introduction

8.2 On-Premises

8.2.1 Data-Sensitive Organizations Adopt the On-Premises Deployment Mode

8.3 Cloud

8.3.1 Scalability and Ease of Implementation Boost the Growth of the Cloud Deployment Mode

9 Real Time Payments Market By Enterprise Size (Page No. - 71)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 The SMEs are Major Investments to Implement Real Time Payments

9.3 Large Enterprises

9.3.1 Faster Interactions, Cost Reduction, Business Expansion Capability, and Enhanced Security are Expected to Fuel the Adoption of the Real Time Payments Technology Among Large Enterprises

10 Real Time Payments Market, By Vertical (Page No. - 75)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Real Time Payments has the Potential to Eventually Reduce Costs for Banks By Breaking Their Payment Silos

10.3 IT and Telecommunications

10.3.1 Offers More Convenient and Faster Modes of Bill Payment, Leading to Enhanced Customer Experience

10.4 Retail and Ecommerce

10.4.1 Provides A Competitive Edge to the Retail and Ecommerce Vendors By Offering Them With Faster Modes of Payment

10.5 Government

10.5.1 Governments Use Real Time Payments to Uplift Economies and Promote Cashless Transactions Across the Globe

10.6 Energy and Utilities

10.6.1 Offers Online Billing Solutions and Real-Time Rating for Enhanced Customer Experience

10.7 Others

11 Real Time Payments Market, By Region (Page No. - 83)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 The Systems Make Payments Simpler, Faster, and Secure

11.2.2 Canada

11.2.2.1 Canadian Individuals and Merchants are Adopting Payments Solutions to Encourage Customers for Making Instant Payments

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Increasing Adoption of Omnichannel Payments Solutions Among Financial Institutions and Merchants

11.3.2 Sweden

11.3.2.1 As Real Time Payments is Gaining Popularity in Sweden, It Presents Growth Opportunities for the Solution and Service Providers

11.3.3 Denmark

11.3.3.1 The Government of Denmark is Investing in Real Time Payments Systems to Make Payment Settlements Quicker

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.1.1 The Real Time Payments Market in Japan is Expected to Grow Due to the Upgradation in Instant Retail Payments

11.4.2 China

11.4.2.1 The Large Population Results in Many Payments Transactions

11.4.3 India

11.4.3.1 Government Initiatives and Demonetization are the Major Driving Factors for the Growing Real Time Payments Market

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 United Arab Emirates

11.5.1.1 Growing Digital Initiatives would Offer Opportunities to Deploy Payments Solution in UAE

11.5.2 South Africa

11.5.2.1 Rise in the Adoption of Advanced Digital Technologies would Provide Opportunities for Payments Services

11.5.3 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Rising Focus of Real Time Payments Solution Providers in Brazil would Boost the Market Growth in the Coming Years

11.6.2 Mexico

11.6.2.1 The Revolution of Various Technologies in Mexico May Create a Demand for Payments Solutions in the Coming Years

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 113)

12.1 Overview

12.2 Ranking of Key Players, 2018

12.3 Competitive Scenario

12.3.1 New Product/Service Launches and Product/Service Enhancements

12.3.2 Agreements and Partnerships

12.3.3 Acquisitions

12.3.4 Expansions

13 Company Profiles (Page No. - 119)

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 ACI Worldwide

13.2 FIS

13.3 Fiserv

13.4 PayPal

13.5 Wirecard

13.6 Mastercard

13.7 Worldline

13.8 Temenos

13.9 Visa

13.10 Apple

13.11 Alipay (Ant Financial)

13.12 Global Payments

13.13 Capegemini

13.14 Icon Solutions

13.15 REPAY

13.16 IntegraPay

13.17 SIA

13.18 Obopay

13.19 Ripple

13.20 Pelican

13.21 Finastra

13.22 Nets

13.23 FSS

13.24 INTELLIGENT PAYMENTS

13.25 Montran

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 172)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: MarketsandMarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (79 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Real Time Payments Market Size and Growth Rate, 20162023

Table 3 Smartphone Users By Country, 20172023 (Million)

Table 4 Real-Time Payment Schemes Across the World, 2018

Table 5 Use Cases for Different Nature of Payments

Table 6 Market Size, By Nature of Payment, 20162023 (USD Million)

Table 7 Person-To-Person: Market Size, By Region, 20162023 (USD Million)

Table 8 Person-To-Business: Market Size, By Region, 20162023 (USD Million)

Table 9 Business-To-Person: Market Size, By Region, 20162023 (USD Million)

Table 10 Others: Market Size, By Region, 20162023 (USD Million)

Table 11 Real Time Payments Market Size, By Component, 20162023 (USD Million)

Table 12 Market Size, By Solution, 20162023 (USD Million)

Table 13 Payment Gateway: Market Size, By Region, 20162023 (USD Million)

Table 14 Payment Processing: Market Size, By Region, 20162023 (USD Million)

Table 15 Payment Security and Fraud Management Solution: Market Size, By Region, 20162023 (USD Million)

Table 16 Market Size, By Service, 20162023 (USD Million)

Table 17 Professional Services: Market Size, By Region, 20162023 (USD Million)

Table 18 Managed Services: Market Size, By Region, 20162023 (USD Million)

Table 19 Real Time Payments Market Size, By Deployment Mode, 20162023 (USD Million)

Table 20 On-Premises: Market Size, By Region, 20162023 (USD Million)

Table 21 Cloud: Market Size, By Region, 20162023 (USD Million)

Table 22 Market Size, By Enterprise Size, 20162023 (USD Million)

Table 23 Small and Medium-Sized Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 24 Large Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 25 Real Time Payments Market Size, By Vertical, 20162023 (USD Million)

Table 26 Banking, Financial Services, and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 27 IT and Telecommunications: Market Size, By Region, 20162023 (USD Million)

Table 28 Retail and Ecommerce: Market Size, By Region, 20162023 (USD Million)

Table 29 Government: Market Size, By Region, 20162023 (USD Million)

Table 30 Energy and Utilities: Market Size, By Region, 20162023 (USD Million)

Table 31 Others: Market Size, By Region, 20162023 (USD Million)

Table 32 Market Size, By Region, 20162023 (USD Million)

Table 33 Smartphone Users in North America, 20182023 (Million)

Table 34 North America: Real Time Payments Market Size, By Country, 20162023 (USD Million)

Table 35 North America: Market Size, By Nature of Payment, 20162023 (USD Million)

Table 36 North America: Market Size, By Component, 20162023 (USD Million)

Table 37 North America: Market Size, By Solution, 20162023 (USD Million)

Table 38 North America: Market Size, By Service, 20162023 (USD Million)

Table 39 North America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 40 North America: Market Size, By Enterprise Size, 20162023 (USD Million)

Table 41 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 42 Smartphone Users in Europe, 20182023 (Million)

Table 43 Europe: Real Time Payments Market Size, By Country, 20162023 (USD Million)

Table 44 Europe: Market Size, By Nature of Payment, 20162023 (USD Million)

Table 45 Europe: Market Size, By Component, 20162023 (USD Million)

Table 46 Europe: Market Size, By Solution, 20162023 (USD Million)

Table 47 Europe: Market Size, By Service, 20162023 (USD Million)

Table 48 Europe: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 49 Europe: Market Size, By Enterprise Size, 20162023 (USD Million)

Table 50 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 51 Smartphone Users in Asia Pacific, 20182023 (Million)

Table 52 Asia Pacific: Real Time Payments Market Size, By Country, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size, By Nature of Payment, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size, By Component, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size, By Solution, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 58 Asia Pacific: Market Size, By Enterprise Size, 20162023 (USD Million)

Table 59 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 60 Middle East and Africa: Real Time Payments Market Size, By Country, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size, By Nature of Payment, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size, By Component, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size, By Solution, 20162023 (USD Million)

Table 64 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 65 Middle East and Africa: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 66 Middle East and Africa: Market Size, By Enterprise Size, 20162023 (USD Million)

Table 67 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 68 Latin America: Real Time Payments Market Size, By Country, 20162023 (USD Million)

Table 69 Latin America: Market Size, By Nature of Payment, 20162023 (USD Million)

Table 70 Latin America: Market Size, By Component, 20162023 (USD Million)

Table 71 Latin America: Market Size, By Solution, 20162023 (USD Million)

Table 72 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 73 Latin America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 74 Latin America: Market Size, By Enterprise Size, 20162023 (USD Million)

Table 75 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 76 New Product/Service Launches and Product/Service Enhancements, 20152018

Table 77 Agreements and Partnerships, 20162018

Table 78 Acquisitions, 20152018

Table 79 Expansions, 20162018

List of Figures (57 Figures)

Figure 1 Countries Covered

Figure 2 Real Time Payments Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Asia Pacific is Estimated to Account for the Highest Market Share in 2018

Figure 6 Market Snapshot, By Nature of Payment, 2018

Figure 7 Market Snapshot, By Component, 2018

Figure 8 Market Snapshot, By Solution, 2018

Figure 9 Market Snapshot, By Service, 2018

Figure 10 Market Snapshot, By Deployment Mode, 2018

Figure 11 Market Snapshot, By Enterprise Size, 2018

Figure 12 Market Snapshot, Top 5 Verticals

Figure 13 Global Real Time Payments Market is Expected to Witness Significant Growth During the Forecast Period

Figure 14 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Payment Security Gateway Solution and the Asia Pacific Region are Estimated to Account for the Highest Market Shares in 2018

Figure 16 Retail and Ecommerce Vertical is Expected to Register the Highest Market Share in 2018

Figure 17 Real Time Payments Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Payment System Evolutions Overview

Figure 19 Person-To-Person Nature of Payment is Expected to Witness the Highest CAGR During the Forecast Period

Figure 20 Services Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 21 Payment Security and Fraud Management Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 22 Payment Security and Fraud Management Solutions Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 23 Professional Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Large Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 Retail and Ecommerce Vertical is Expected to Witness the Highest CAGR During the Forecast Period

Figure 27 Asia Pacific is Expected to Register the Largest Marker Size and the Highest CAGR During the Forecast Period

Figure 28 India is Expected to Register the Highest CAGR During the Forecast Period

Figure 29 Global Volume of Electronic Payments (USD Billion)

Figure 30 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During Forecast Period

Figure 31 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During Forecast Period

Figure 32 Europe: Volume of Ecommerce Purchases Via Real-Time Payments

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During Forecast Period

Figure 35 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During Forecast Period

Figure 36 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During Forecast Period

Figure 37 Key Developments By Leading Players in the Market During 20152018

Figure 38 ACI Worldwide Led the Real Time Payments Market in 2018

Figure 39 ACI Worldwide: Company Snapshot

Figure 40 ACI Worldwide: SWOT Analysis

Figure 41 FIS: Company Snapshot

Figure 42 FIS: SWOT Analysis

Figure 43 Fiserv: Company Snapshot

Figure 44 Fiserv: SWOT Analysis

Figure 45 PayPal: Company Snapshot

Figure 46 PayPal: SWOT Analysis

Figure 47 Wirecard: Company Snapshot

Figure 48 Wirecard: SWOT Analysis

Figure 49 Mastercard: Company Snapshot

Figure 50 Worldline: Company Snapshot

Figure 51 Temenos: Company Snapshot

Figure 52 Visa: Company Snapshot

Figure 53 Apple: Company Snapshot

Figure 54 Global Payments: Company Snapshot

Figure 55 Capegemini: Company Snapshot

Figure 56 SIA: Company Snapshot

Figure 57 Nets: Company Snapshot

Growth opportunities and latent adjacency in Real-Time Payments Market