Reverse Osmosis (RO) Membrane Market by Type (Thin-film Composite Membranes, Cellulose Based Membranes), End-use Industry (Water & Wastewater treatment, Industrial Processing), Filter Module, Application, and Region - Global Forecast to 2026

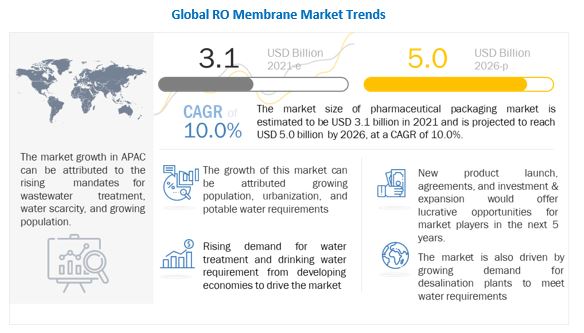

The global reverse osmosis membrane market size was valued at USD 3.1 billion in 2021 and is projected to reach USD 5.0 billion by 2026, growing at a cagr 10.0% from 2021 to 2026. The growing requirement for RO membrane in water & wastewater treatment is driving the market. In addition, increasing water scarcity and evolving government regulations mandating treatment of industrial and municipal wastewater are also driving the RO membrane market. The increase in demand for industrial process water and growth in urbanization in the emerging economies, such as APAC, Middle East & Africa, and South America, are also driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Reverse Osmosis (RO) Membrane Market

RO membranes are used in applications, such as water & wastewater treatment, which are in turn used in sectors like residential, commercial, and industrial. Due to the ongoing pandemic, sectors such as food & beverage, textile, pulp & paper, power, and others have been impacted globally. The Covid-19 pandemic slowed the growth of the water sector in 2020 during the lockdown period. The industry had to cope with supply chain disruptions, shift on demand patterns, and other emergency measures. Many significant users of water downscaled their requirement due to shutdowns or reduced activities. Revenue loss and decreased capital expenditures were observed during this crisis period. In the short term, measures such as long-term capex planning to build resilience, maintaining proper hygiene at workplaces, government fiscal support, better supply chain planning, proper communication, resuming of industrial operations, and similar others are expected to boost revenue and stabilize growth.

Covid-19 has reinforced the importance of proper access to water and sanitation. The pandemic had led to an increase in domestic water demand while witnessing decreased demand from businesses. In the long term, accelerating water treatment projects, incorporation of advanced digital technologies, increased investments in crisis preparedness, and resiliency of staff, systems, and equipment in water treatment sector, and increased political prioritization of water are expected to boost sectoral growth thereby propelling demand for treatment materials and systems.

Reverse Osmosis (RO) Membrane Market Dynamics

Driver: Government regulations and increasing demand of clean drinking water

The government regulations and increasing demand for clean processed drinking water are driving the water and wastewater treatment industry. Government of different countries have initiated various programs, such as Water Management Action Plan (2009) and the Environmental and Resource Efficiency Plan in Australia (2008), The Special Plan for Seawater utilization in China (2005), and the US Clean Water Act (1972, Amendment 1987) for clean and safe water, and others. They also have emphasized on treating and reusing contaminated water. The World Health Organization (WHO) has set international guidelines for drinking water for all the countries. All these regulations and mandatory water treatment initiatives are expected to drive the market for RO membranes in the near future.

Restrain: Membrane fouling and scaling

RO membrane continues to increase in demand with the growth of the water treatment sector. However, fouling and scaling are its major drawbacks. Fouling occurs in both cellulose-based and thin-film composite membranes. There are four types of fouling, namely, biological, colloidal, scaling, and organic. The saturation of salts on the surface of the membrane is core reason for scaling in the desalination plants and the fouling results in reduced flux and life span of the membrane. Fouling can be controlled to some extent by using disinfectant, anti-scaling, and other pre-treatment, which add to the cost of operation. The fouling persists and remains a key area for improvement in the quality of the membrane, which has hampered the RO membrane market growth.

Opportunity: Growing demand from emerging economies

The need for water desalination from seas and oceans is likely to increase in the developing countries. Countries in the MENA and South America are establishing water desalination and brackish water treatment units to deal with water scarcity problems. RO membrane is the leading technology for seawater and brackish water desalination and accounts for a significant portion in all desalination plants, as it consumes less energy compared to other technologies. The surge in demand for RO membranes in water treatment processes, especially in the countries of Asia Pacific and the Middle East & Africa is accounted by the increase in demand for potable water in developing economies for drinking, agriculture, and other industries.

Challenge: Discharge of dense brine

Brine is generally defined as water with a salt concentration higher than 50 parts per thousand, though some brines can be several times saltier. Producing fresh water in the driest parts of the world by removing the salt from sea water is resulting in a deluge of brine which is a significant challenge, especially in the Middle East and North Africa region. Also, another challenge faced during the development of RO seawater desalination plants is the impingement of marine organisms that are larger than intake screens and the entrainment of small organisms. RO seawater and inland desalination plants discharge dense brine into the ocean, which may cause harmful effects on the marine environment. This challenge has to be overcome through technological advancement and finding a sustainable avenue to manage brine and safeguard the marine environment.

Thin-film composite membranes accounted for the largest share amongst other types in the RO membrane market

Thin film composite membranes are widely for water & wastewater treatment. Thin film composite membranes are manufactured largely for use in water purification or desalination systems. These membranes have high rejection for unwanted materials such as metal ions and salts, good mechanical strength, and high filtration rate. In addition, these membranes possess good chemical and mechanical stability and portray excellent membrane formability characteristics. Also, these membranes have been recognized to promote water permeation thus, high water recovery and good quality of treated water.

Water & wastewater treatment accounted for the largest market share amongst other end-use industry in the RO membrane market

Water & wastewater treatment segment is estimated to be the largest end-use industry for the RO membrane market. Water shortage and improving regulations mandating wastewater treatment and reuse are driving the market for water & wastewater treatment segment. Rising demand for potable water from countries such as China, India, Brazil, African nations, and others have also led to the large market size. In addition, increasing desalination activities in countries such as Saudi Arabia, the UAE, India, China, the US, and others are expected to further drive the market for water & wastewater treatment.

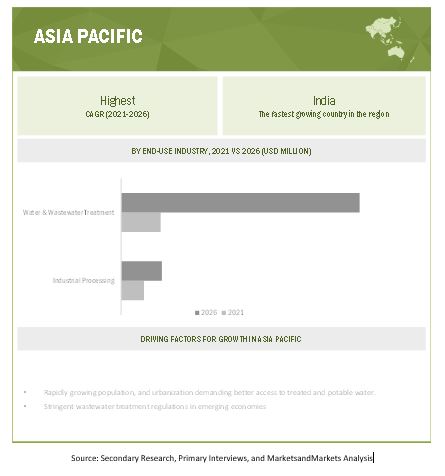

APAC is projected to grow the fastest in the RO membrane market during the forecast period.

APAC is predicted to be the fastest-growing region amongst others in the RO membrane market in 2020, in terms of value. Increasing government initiatives in providing water access to all, an increase in the population, and heightened urbanization are driving the market in APAC. China, Japan, and India are the major markets in this region. In addition, expanding industrial activities, residential & commercial sector growth in countries such as Singapore, China, Malaysia, Thailand, Vietnam, Indonesia, India, and others, are also driving the market growth of water & wastewater treatment in the RO membrane industry.

Key Market Players in Reverse Osmosis (RO) Membrane Market

The key players in this market are DuPont Water Solutions (US), Toray Industries (Japan), Suez Water Technologies and Solutions (US)France), Hydranautics (US), LG Chem (South Korea), Koch (US), Mann Hummel Water & Fluid Solutions (Germany), Membranium (Russia), and Toyobo Co. Ltd. (Japan). These players have established a strong foothold in the market by adopting strategies, such as new product launches, investment & expansions, agreements, joint ventures, partnerships, and mergers & acquisitions between 2019 and 2021.

Reverse Osmosis (RO) Membrane Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Volume (Million Meter Square) and Value (USD) |

|

Segments |

End-use industry, Type, Filter Module, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

DuPont Water Solutions (US), Toray Industries (Japan), Suez Water Technologies and Solutions (US), Hydranautics (US), LG Chem (South Korea), Koch (US), Mann Hummel Water & Fluid Solutions (Germany), Membranium (Russia), and Toyobo Co. Ltd. (Japan) |

This research report categorizes the RO membrane market based on end-use industry, type, filter module, application, and region.

By Type:

- Thin-film composite membranes

- Cellulose based membranes

By End-use industry

- Water & Wastewater treatment

- Industrial Processing

By Filter Module

- Spiral Wound

- Hollow Fiber

- Tubular

- Plate and Frame

By Application

- Desalination

- Utility water treatment

- Wastewater treatment & reuse

- Process water

By Region

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The RO membrane market has been further analyzed based on key countries in each of these regions.

Recent Developments in Reverse Osmosis (RO) Membrane Market Industry

- In January 2020, DuPont Water Solutions launched dry-tested seawater reverse osmosis elements which will enable the transition from wet to dry testing and increase shelf life and flexibility for storage. It aims to exceed membrane performance standards and achieve long-term operational benefits.

- In December 2019, Toray Industries created a seawater desalination reverse osmosis membrane. This membrane can produce 70% cleaner water than other conventional offerings. This technology helps in the reduction of water production cost and aims to fulfill global demand of clean water.

- In October 2020, Koch partnered with Waste 3R Engineering & Solutions. The partnership aims to promote company’s advanced separation technologies for industrial water and wastewater projects across Bangladesh and help to achieve the recycling and reuse by leveraging the company’s membrane products and system.

- In November 2020, LG Chem supplied RO membrane to Al Khobar II project, in the Kingdom of Saudi Arabia. The plant has production capacity of 600 million liters per day (MLD). The project aims to meet the water quality requirements with low energy consumption.

Frequently Asked Questions (FAQ):

What is the current size of the global RO membrane market?

Global RO membrane market size is estimated to reach USD 5.0 billion by 2026 from USD 3.1 billion in 2021, at a CAGR of 10.0% during the forecast period.

Are there any regulations for RO membrane?

Several countries in Europe and North America have introduced regulations for this market. For e.g., in the European Union, Water and Sewage Utilities Sector (NAICS 2213), the Safe Drinking Water Act (SDWA) and others are followed for proper water treatment. The US EPA is the authority which regulates and provides guidelines on proper water and wastewater treatment in the US.

Who are the winners in the global RO membrane market?

Companies such as DuPont Water Solutions, Toray Industries, Suez Water Technologies and Solutions, Hydranautics, LG Chem, Koch, Mann Hummel Water & Fluid Solutions, Membranium, and Toyobo come under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.<

What is the COVID-19 impact on RO membrane manufacturers?

Water consumption activities were considered essential during the pandemic. However, loss of revenue due to lockdown was witnessed in the utility water treatment, and industrial sectors. RO membrane companies had increased their productivity to support the increased demand for water treatment, globally.

What are some of the drivers in the market?

The increasing requirement of RO membrane in emerging economies for water treatment and demand due to stringent government regulations on wastewater treatment drive the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 RO MEMBRANE MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 INCLUSIONS & EXCLUSIONS

TABLE 1 RO MEMBRANE MARKET: INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 RO MEMBRANE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.3 LIST OF PRIMARY SOURCES

FIGURE 2 KEY DATA FROM PRIMARY SOURCES

2.1.3.1 Key industry insights

2.1.3.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 RO MEMBRANE MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 RO MEMBRANE MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 RO MEMBRANE MARKET: DATA TRIANGULATION

2.3.1 RO MEMBRANE MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 6 RO MEMBRANE MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 7 RO MEMBRANE MARKET ANALYSIS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6.1 SUPPLY SIDE

2.6.2 DEMAND SIDE

2.6.3 INSIGHTS FROM KEY RESPONDENTS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 THIN FILM COMPOSITE MEMBRANE TO BE THE LARGER SEGMENT OF THE MARKET

FIGURE 9 WATER & WASTEWATER TREATMENT TO BE THE LARGER END-USE INDUSTRY OF RO MEMBRANES

FIGURE 10 APAC TO BE THE FASTEST-GROWING RO MEMBRANE MARKET

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN RO MEMBRANE MARKET

FIGURE 11 GROWING DEMAND FOR RO MEMBRANES IN EMERGING ECONOMIES TO DRIVE THE MARKET

4.2 RO MEMBRANE MARKET, BY TYPE

FIGURE 12 THIN FILM COMPOSITE MEMBRANE TO BE THE LARGER SEGMENT OF THE MARKET

4.3 RO MEMBRANE MARKET, BY END-USE INDUSTRY

FIGURE 13 WATER & WASTEWATER TREATMENT TO BE THE LARGER END-USE INDUSTRY OF RO MEMBRANES

4.4 RO MEMBRANE MARKET, BY MAJOR COUNTRIES

FIGURE 14 INDIA TO RECORD THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.5 APAC RO MEMBRANE MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 15 THIN FILM COMPOSITE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN THE RO MEMBRANE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing water scarcity

5.2.1.2 Government regulations and increasing demand for clean drinking water

5.2.2 OPPORTUNITIES

5.2.2.1 Growing demand for water treatment in developing countries

5.2.3 RESTRAINTS

5.2.3.1 Membrane fouling and scaling

5.2.4 CHALLENGES

5.2.4.1 Discharge of dense brine as waste

5.3 PATENT ANALYSIS

5.3.1 DOCUMENT TYPE

FIGURE 17 GRANTED VS. APPLIED PATENTS

FIGURE 18 PUBLICATION TRENDS - LAST 10 YEARS

5.3.2 INSIGHTS

5.3.3 JURISDICTION ANALYSIS

FIGURE 19 JURISDICTION ANALYSIS, BY COUNTRY

5.3.4 TOP APPLICANTS

FIGURE 20 TOP APPLICANTS WITH THE HIGHEST NUMBER OF PATENTS

5.3.4.1 List of Patents by Kurita Water Industries Ltd.

5.3.4.2 List of Patents by Dainippon Ink & Chemical

5.3.4.3 List of Patents by Toray Industries, Inc.

5.3.4.4 List of Patents by LG Chem Ltd.

5.3.4.5 List of Patents by Midea Group Co. Ltd.

TABLE 2 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.4 REGULATORY & TARIFF LANDSCAPE

5.4.1 NORTH AMERICA

5.4.1.1 Clean Water Act (CWA)

5.4.1.2 Safe Drinking Water Act (SDWA)

5.4.2 EUROPE

5.4.2.1 The urban wastewater treatment directive (1991)

5.4.2.2 The drinking water directive (1998)

5.4.2.3 The water framework directive (2000)

5.4.3 ASIA

5.4.3.1 China

5.4.3.1.1 Environmental Protection Law (EPL)

5.4.3.1.2 Water law of the people’s republic of China

5.4.3.1.3 Water pollution prevention and control law

5.4.3.2 India

5.4.3.2.1 Water prevention and control of pollution act, 1974

5.4.3.3 Japan

5.4.3.3.1 Water pollution control law, 1971

5.5 ECOSYSTEM

FIGURE 21 RO MEMBRANE ECOSYSTEM

5.5.1 RO MEMBRANE MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 NEW TECHNOLOGIES – RO MEMBRANES

5.7 IMPACT OF COVID-19 ON RO MEMBRANE MARKET

5.7.1 COVID-19

5.7.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 22 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.7.3 IMPACT ON WATER SECTOR

5.8 RAW MATERIAL ANALYSIS

5.8.1 POLYAMIDE

5.8.2 POLYSULFONE & POLYETHERSULFONE

5.8.3 CELLULOSE ACETATE

5.9 PRICE ANALYSIS

FIGURE 23 AVERAGE PRICING IN RO MEMBRANE MARKET

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 PORTER’S FIVE FORCES ANALYSIS OF RO MEMBRANE MARKET

5.10.1 THREAT OF SUBSTITUTES

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 THREAT OF NEW ENTRANTS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.11.1 RAW MATERIAL SUPPLIERS

5.11.2 MEMBRANE MANUFACTURERS

5.11.3 DISTRIBUTORS

5.11.4 END USERS

5.12 MACROECONOMIC INDICATORS

5.12.1 GLOBAL GDP TRENDS

TABLE 3 GDP OF KEY COUNTRIES, USD BILLION, 2016-2019

TABLE 4 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2019-2022

5.12.2 WATER TREATMENT STATISTICS

TABLE 5 TREATED MUNICIPAL WASTEWATER (10^9M3/YEAR) AND NUMBER OF MUNICIPAL WASTEWATER TREATMENT FACILITIES

5.13 CASE STUDY ANALYSIS

5.13.1 TURNING CALIFORNIA WASTEWATER INTO DRINKING WATER USING DUPONT’S RO MEMBRANES

5.13.2 SEAWATER DESALINATION USING TORAY'S RO MEMBRANES

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 26 AUTOMATION, DESALINATION, AND NANOTECHNOLOGY TO DRIVE FUTURE GROWTH

5.15 TRADE ANALYSIS

TABLE 6 MAJOR IMPORT PARTNERS – RO MEMBRANES

5.16 OPERATIONAL DATA

TABLE 7 OPERATIONAL DATA – RO MEMBRANES

6 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE (Page No. - 82)

6.1 INTRODUCTION

6.2 PLATE-AND-FRAME (PF)

6.3 TUBULAR

6.4 SPIRAL WOUND

6.5 HOLLOW FIBER

7 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION (Page No. - 84)

7.1 INTRODUCTION

7.2 DESALINATION

7.3 UTILITY WATER TREATMENT

7.4 WASTEWATER TREATMENT & REUSE

7.5 PROCESS WATER

8 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 27 THIN FILM COMPOSITE MEMBRANE TO BE THE LARGER TYPE DURING THE FORECAST PERIOD

TABLE 8 RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

TABLE 9 RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

8.2 CELLULOSE-BASED MEMBRANE

8.2.1 THE OLDEST FORM OF RO MEMBRANES USED COMMERCIALLY

8.2.2 CELLULOSE ACETATE (CA) MEMBRANES

8.2.3 OTHERS

8.3 THIN FILM COMPOSITE MEMBRANE

8.3.1 IDEAL FOR THE PURIFICATION OF FEED STREAMS CONTAINING A WIDE VARIETY OF DISSOLVED CONTAMINANTS

8.3.2 POLYAMIDE (PA) COMPOSITE MEMBRANES

8.3.3 OTHERS

9 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY (Page No. - 90)

9.1 INTRODUCTION

FIGURE 28 WATER & WASTEWATER TREATMENT TO BE THE LARGER END-USE INDUSTRY DURING THE FORECAST PERIOD

TABLE 10 RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 11 RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 12 RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 13 RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2 WATER & WASTEWATER TREATMENT

9.2.1 RESIDENTIAL & COMMERCIAL

9.2.1.1 RO is the low-maintenance, chemical-free option to achieve clean water used for household purposes

9.2.2 MUNICIPAL

9.2.2.1 Limited freshwater resources driving the market in this segment

9.3 INDUSTRIAL PROCESSING

9.3.1 ENERGY

9.3.1.1 RO membranes are used to treat feedwater sourced from groundwater sources or seawater and for wastewater treatment

9.3.2 FOOD & BEVERAGE

9.3.2.1 The use of membrane equipment is an integral part of manufacturing milk, cheese, and whey proteins

9.3.3 HEALTHCARE

9.3.3.1 RO membranes are used in hospital water and wastewater treatment for the production of ultra-pure water

9.3.4 CHEMICAL & PETROCHEMICAL

9.3.4.1 Selective separation properties provided by RO membranes are beneficial for various processes

9.3.5 OTHERS

10 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 29 RO MEMBRANE MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

TABLE 14 RO MEMBRANE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 RO MEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 RO MEMBRANE MARKET SIZE, BY REGION, 2017–2020 (MILLION METER SQUARE)

TABLE 17 RO MEMBRANE MARKET SIZE, BY REGION, 2019–2026 (MILLION METER SQUARE)

10.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: RO MEMBRANE MARKET SNAPSHOT

TABLE 18 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 19 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 20 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 21 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 22 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 23 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 25 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 26 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

10.2.1 US

10.2.1.1 Large industrial water treatment sector to drive the market

TABLE 28 US: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 29 US: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 30 US: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 31 US: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.2.2 CANADA

10.2.2.1 Competitive business environment boosts the market

TABLE 32 CANADA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 33 CANADA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 34 CANADA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 35 CANADA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.2.3 MEXICO

10.2.3.1 Government initiatives and manufacturing sector growth aiding high demand

TABLE 36 MEXICO: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 37 MEXICO: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 38 MEXICO: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 39 MEXICO: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3 EUROPE

TABLE 40 EUROPE: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 41 EUROPE: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 43 EUROPE: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 44 EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 45 EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 46 EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 47 EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 48 EUROPE: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 EUROPE: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

10.3.1 GERMANY

10.3.1.1 Wastewater is treated according to the highest EU standards in the country

TABLE 50 GERMANY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 GERMANY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 52 GERMANY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 53 GERMANY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.2 UK

10.3.2.1 Commercial, domestic, and municipality segments to drive the market in the country

TABLE 54 UK: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 55 UK: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 UK: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 57 UK: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.3 FRANCE

10.3.3.1 Water treatment infrastructural advancement to drive the market

TABLE 58 FRANCE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 59 FRANCE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 60 FRANCE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 61 FRANCE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.4 ITALY

10.3.4.1 Food & beverage, pharmaceutical, and electronics sectors to drive the market

TABLE 62 ITALY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 63 ITALY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 64 ITALY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 65 ITALY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.5 SPAIN

10.3.5.1 High demand for efficient wastewater and drinking water treatment to drive the market

TABLE 66 SPAIN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 67 SPAIN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 68 SPAIN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 69 SPAIN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.6 RUSSIA

10.3.6.1 Drinking and industrial water supply business to increase the demand for RO membranes

TABLE 70 RUSSIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 71 RUSSIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 72 RUSSIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 73 RUSSIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.3.7 REST OF EUROPE

TABLE 74 REST OF EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 75 REST OF EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 REST OF EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 77 REST OF EUROPE: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4 APAC

FIGURE 31 APAC: RO MEMBRANE MARKET SNAPSHOT

TABLE 78 APAC: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 APAC: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 APAC: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 81 APAC: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 82 APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 83 APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 84 APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 85 APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 86 APAC: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 APAC: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

10.4.1 CHINA

10.4.1.1 Strong government policies to drive the RO membrane market in the country

TABLE 88 CHINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 89 CHINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 90 CHINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 91 CHINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4.2 JAPAN

10.4.2.1 Huge investments in water treatment and desalination projects to drive the market

TABLE 92 JAPAN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 93 JAPAN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 JAPAN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 95 JAPAN: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4.3 SOUTH KOREA

10.4.3.1 Increase in domestic and industrial wastewater due to urbanization and industrialization to drive the market

TABLE 96 SOUTH KOREA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 97 SOUTH KOREA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 98 SOUTH KOREA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 99 SOUTH KOREA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4.4 INDIA

10.4.4.1 The fastest-growing RO membrane market in the region

TABLE 100 INDIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 101 INDIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 102 INDIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 103 INDIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4.5 AUSTRALIA

10.4.5.1 Severe drought and climate change are affecting the availability of freshwater

TABLE 104 AUSTRALIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 105 AUSTRALIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 106 AUSTRALIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 107 AUSTRALIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.4.6 REST OF APAC

TABLE 108 REST OF APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 109 REST OF APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 110 REST OF APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 111 REST OF APAC: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.5 SOUTH AMERICA

TABLE 112 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 114 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 115 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 116 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 117 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 119 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 120 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

10.5.1 BRAZIL

10.5.1.1 Improved regulatory conditions and consumer awareness to drive the market

TABLE 122 BRAZIL: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 123 BRAZIL: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 124 BRAZIL: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 125 BRAZIL: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.5.2 ARGENTINA

10.5.2.1 Treatment capacity increase and foreign investments to boost market development

TABLE 126 ARGENTINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 127 ARGENTINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 128 ARGENTINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 129 ARGENTINA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.5.3 REST OF SOUTH AMERICA

TABLE 130 REST OF SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 133 REST OF SOUTH AMERICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.6 MIDDLE EAST & AFRICA

TABLE 134 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 137 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 138 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 141 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

TABLE 142 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER SQUARE)

10.6.1 SAUDI ARABIA

10.6.1.1 Saudi Arabia leads the RO membrane market in the region

TABLE 144 SAUDI ARABIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 145 SAUDI ARABIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 146 SAUDI ARABIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 147 SAUDI ARABIA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.6.2 TURKEY

10.6.2.1 Turkey’s water-intensive industries propel RO membrane consumption

TABLE 148 TURKEY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 149 TURKEY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 TURKEY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 151 TURKEY: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.6.3 EGYPT

10.6.3.1 Increased wastewater treatment and desalination in Egypt to aid market growth

TABLE 152 EGYPT: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 153 EGYPT: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 154 EGYPT: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 155 EGYPT: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.6.4 SOUTH AFRICA

10.6.4.1 South Africa is increasingly adopting water desalination owing to frequent water shortage concerns

TABLE 156 SOUTH AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 157 SOUTH AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 158 SOUTH AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 159 SOUTH AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

10.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 160 REST OF MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 162 REST OF MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION METER SQUARE)

TABLE 163 REST OF MIDDLE EAST & AFRICA: RO MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER SQUARE)

11 COMPETITIVE LANDSCAPE (Page No. - 152)

11.1 OVERVIEW

11.1.1 RO MEMBRANE MARKET, KEY DEVELOPMENTS

TABLE 164 OVERVIEW OF STRATEGIES ADOPTED BY KEY RO MEMBRANE PLAYERS

11.2 REVENUE ANALYSIS

11.2.1 RO MEMBRANE MARKET

FIGURE 32 REVENUE ANALYSIS FOR KEY COMPANIES, 2016-2020.

11.3 MARKET SHARE ANALYSIS

FIGURE 33 RO MEMBRANE MARKET SHARE, BY COMPANY (2020)

TABLE 165 RO MEMBRANE: DEGREE OF COMPETITION

11.4 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 34 RANKING OF TOP 5 PLAYERS IN THE RO MEMBRANE MARKET, 2020

11.4.1 DUPONT WATER SOLUTIONS

11.4.2 HYDRANAUTICS

11.4.3 TORAY INDUSTRIES INC.

11.4.4 LG CHEM

11.4.5 SUEZ WATER TECHNOLOGIES & SOLUTIONS

11.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)

11.5.1 TERMINOLOGY/NOMENCLATURE

11.5.1.1 Star

11.5.1.2 Pervasive

11.5.1.3 Emerging leader

FIGURE 35 RO MEMBRANE MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2020

11.5.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE RO MEMBRANE MARKET

11.5.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE RO MEMBRANE MARKET

11.6 COMPETITIVE EVALUATION QUADRANT (OTHER KEY PLAYERS)

11.6.1 TERMINOLOGY/NOMENCLATURE

11.6.1.1 Progressive companies

11.6.1.2 Responsive companies

11.6.1.3 Dynamic companies

FIGURE 38 RO MEMBRANE MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR OTHER KEY PLAYERS, 2020

11.6.2 STRENGTH OF PRODUCT PORTFOLIO (OTHER KEY PLAYERS)

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE RO MEMBRANE MARKET (OTHER KEY PLAYERS)

11.6.3 BUSINESS STRATEGY EXCELLENCE (OTHER KEY PLAYERS)

FIGURE 40 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE RO MEMBRANE MARKET (OTHER KEY PLAYERS)

11.6.4 COMPANY FOOTPRINT

11.6.5 COMPANY FILTER MODULE FOOTPRINT

11.6.6 COMPANY APPLICATION FOOTPRINT

11.6.7 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE SCENARIO AND TRENDS

11.7.1 RO MEMBRANE MARKET

TABLE 166 RO MEMBRANE MARKET: PRODUCT LAUNCHES, JANUARY 2016- DECEMBER 2020

TABLE 167 RO MEMBRANE MARKET: DEALS, JANUARY 2016-DECEMBER 2020

TABLE 168 RO MEMBRANE MARKET: OTHERS, JANUARY 2016-DECEMBER 2020

12 COMPANY PROFILES (Page No. - 172)

(Business overview, products/solutions/services offered, Recent Developments, MNM view)*

12.1 DUPONT WATER SOLUTIONS

TABLE 169 DUPONT WATER SOLUTIONS: COMPANY OVERVIEW

FIGURE 41 DUPONT WATER SOLUTIONS: COMPANY SNAPSHOT

TABLE 170 DUPONT WATER SOLUTIONS: PRODUCT OFFERINGS

TABLE 171 DUPONT WATER SOLUTIONS: DEALS

TABLE 172 DUPONT WATER SOLUTIONS: PRODUCT LAUNCH

12.2 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY)

TABLE 173 HYDRANAUTICS: COMPANY OVERVIEW

TABLE 174 HYDRANAUTICS: PRODUCT OFFERINGS

TABLE 175 HYDRANAUTICS: PRODUCT LAUNCH

12.3 TORAY INDUSTRIES, INC.

TABLE 176 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 42 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 177 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

TABLE 178 TORAY INDUSTRIES INC.: PRODUCT LAUNCH

TABLE 179 TORAY INDUSTRIES INC.: DEALS

TABLE 180 TORAY INDUSTRIES INC.: OTHERS

12.4 LG CHEM

TABLE 181 LG CHEM: COMPANY OVERVIEW

FIGURE 43 LG CHEM: COMPANY SNAPSHOT

TABLE 182 LG CHEM: PRODUCT OFFERINGS

TABLE 183 LG CHEM: OTHERS

12.5 SUEZ WATER TECHNOLOGIES & SOLUTIONS

TABLE 184 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY OVERVIEW

FIGURE 44 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY SNAPSHOT

TABLE 185 SUEZ WATER TECHNOLOGIES & SOLUTIONS: PRODUCT OFFERINGS

12.6 ALFA LAVAL

TABLE 186 ALFA LAVAL: COMPANY OVERVIEW

FIGURE 45 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 187 ALFA LAVAL: PRODUCT OFFERINGS

12.7 KOCH SEPARATION SOLUTIONS

TABLE 188 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

TABLE 189 KOCH SEPARATION SOLUTIONS: PRODUCT OFFERINGS

TABLE 190 KOCH SEPARATION SOLUTIONS: PRODUCT LAUNCH

TABLE 191 KOCH SEPARATION SOLUTIONS: DEALS

12.8 MANN+HUMMEL WATER & FLUID SOLUTIONS

TABLE 192 MANN+HUMMEL WATER & FLUID SOLUTIONS: COMPANY OVERVIEW

TABLE 193 MANN+HUMMEL WATER & FLUID SOLUTIONS: PRODUCT OFFERINGS

TABLE 194 MANN+HUMMEL WATER & FLUID SOLUTIONS: DEALS

TABLE 195 MANN+HUMMEL WATER & FLUID SOLUTIONS: OTHERS

12.9 MEMBRANIUM (RM NANOTECH)

TABLE 196 MEMBRANIUM: COMPANY OVERVIEW

TABLE 197 MEMBRANIUM: PRODUCT OFFERINGS

TABLE 198 MEMBRANIUM: OTHERS

12.10 TOYOBO CO. LTD.

TABLE 199 TOYOBO CO. LTD.: COMPANY OVERVIEW

FIGURE 46 TOYOBO CO. LTD: COMPANY SNAPSHOT

TABLE 200 TOYOBO CO. LTD.: PRODUCT OFFERINGS

12.11 OTHER PLAYERS

12.11.1 APPLIED MEMBRANE INC.

12.11.2 AXEON

12.11.3 HYDRAMEM

12.11.4 KEENSEN

12.11.5 LENNTECH

12.11.6 MERCK

12.11.7 MEMBRACON (UK) LTD.

12.11.8 OSMOTECH

12.11.9 PALL WATER

12.11.10 PARKER HANNIFIN CORPORATION

12.11.11 PERMOINICS

12.11.12 RECKSON

12.11.13 THERMO FISHER SCIENTIFIC

12.11.14 VONTRON

12.11.15 WATTS

*Details on Business overview, products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 198)

13.1 LIMITATIONS

13.2 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET

13.2.1 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET, MARKET OVERVIEW

13.2.2 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET, BY PRODUCT TYPE

TABLE 201 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 2015–2022 (USD MILLION)

13.2.2.1 Filtration

13.2.2.2 Disinfection

13.2.2.3 Desalination

13.2.2.4 Testing

13.2.3 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET, BY APPLICATION

TABLE 202 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

13.2.3.1 Municipal

13.2.3.2 Industrial

13.2.4 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET, BY REGION

TABLE 203 WATER & WASTEWATER TREATMENT EQUIPMENT MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

13.2.4.1 Asia-Pacific

13.2.4.2 Western Europe

13.2.4.3 Central & Eastern Europe

13.2.4.4 North America

13.2.4.5 South America

13.3 MIDDLE EAST & AFRICA

13.4 MEMBRANE SEPARATION TECHNOLOGY MARKET

13.4.1 MEMBRANE SEPARATION TECHNOLOGY MARKET, BY TECHNOLOGY

TABLE 204 MEMBRANE SEPARATION TECHNOLOGY MARKET SIZE, BY TECHNOLOGY, 2015–2022 (USD MILLION)

13.4.1.1 RO

13.4.1.2 UF

13.4.1.3 MF

13.4.1.4 NF

13.4.1.5 Others

13.4.2 MEMBRANE SEPARATION TECHNOLOGY MARKET, BY APPLICATION

TABLE 205 MEMBRANE SEPARATION TECHNOLOGY MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

13.4.2.1 Water & wastewater treatment

13.4.2.2 Food & beverage

13.4.2.3 Medical & pharmaceutical

13.4.2.4 Industry processing

13.4.2.5 Others

13.4.3 MEMBRANE SEPARATION TECHNOLOGY MARKET, BY REGION

TABLE 206 MEMBRANE SEPARATION TECHNOLOGY MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

13.4.3.1 APAC

13.4.3.2 North America

13.4.3.3 Europe

13.4.3.4 Middle East & Africa

13.4.3.5 South America

14 APPENDIX (Page No. - 211)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

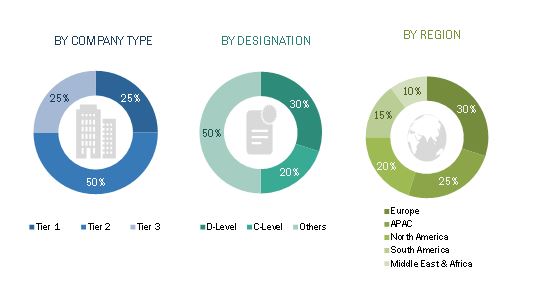

The study involved four major activities in estimating the current market size for RO membrane. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Bloomberg, World Bank, Statista, American Membrane Technology Association, American Water Works Association, Water Treatment Industry Associations, Trademap, Zauba, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the US Environmental Protection Agency (EPA), European Commission, country level regulatory bodies, and databases.

Primary Research

The RO membrane market comprises several stakeholders such as raw material suppliers, distributors of RO membrane, manufacturers, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of municipal organizations, power generation facilities, refineries, healthcare institutions, chemical plants, textile processors, paper manufacturers, and so on. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the RO membrane market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, types, and end-users in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of RO membrane and their applications.

Objectives of the Study:

- To define, describe, and forecast the RO membrane market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type, filter module, application, and end-use industry

- To forecast the size of the market with respect to five regions: Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as mergers & acquisitions, new product launch, investments & expansions, and agreements & collaborations, and joint ventures in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- Notes: 1. Micro markets are defined as sub segments of the RO membrane market included in the report.

-

2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the RO membrane market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Reverse Osmosis (RO) Membrane Market