RF-Over-Fiber Market Size, Share & Industry Growth Analysis Report by Component (Optical Cables, Amplifiers, Transceivers, Switches, Antennas, Connectors, Multiplexers), Frequency Band (L, S, C, X, Ku, Ka), Deployment (Underground, Aerial, Underwater), Application, Vertical - Global Forecast to 2029

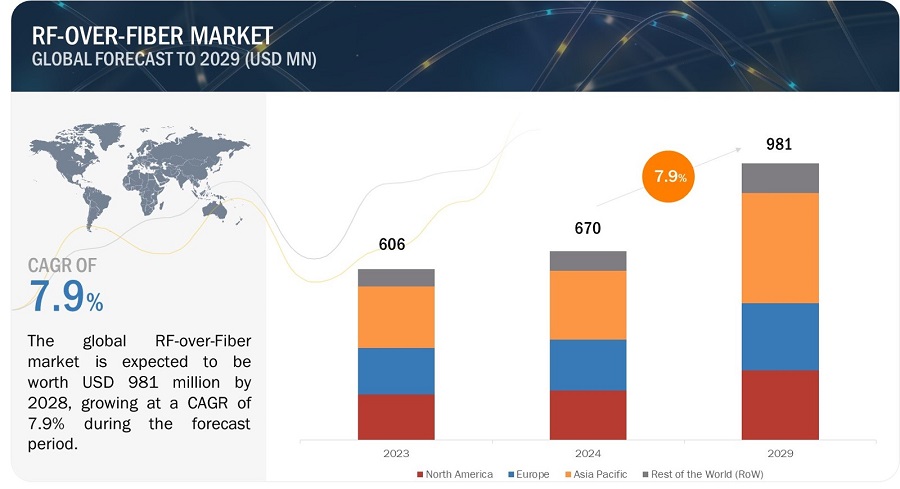

The global RF-over-Fiber market size is expected to be valued at USD 670 million in 2024 and is projected to reach USD 981 million by 2029; it is expected to grow at a CAGR of 7.9% from 2024 to 2029. Increasing demand for high-bandwidth communication solutions, fueled by the requirements of industries like telecommunications and defense for efficient data transfer, is driving the growth of the market.

This surge aligns with a significant opportunity arising from the growing adoption of Fiber-to-the-X (FTTX) architectures, where RFoF technology plays a pivotal role in delivering reliable and high-performance connectivity in Fiber-to-the-Home (FTTH) and other FTTX deployments. As global demand for faster and more robust internet access expands, RFoF stands poised to capitalize on this opportunity, serving as a critical component in modern fiber-optic communication infrastructure.

RF-Over-Fiber Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

RF-over-Fiber Market Dynamics

Driver: Increasing demand for high-bandwidth communication

The RF-over-Fiber (RFoF) market is the escalating demand for high-bandwidth communication solutions. As industries, particularly telecommunications, IT, and defense, strive to meet the ever-growing requirements for data transfer rates, low latency, and reliable connectivity, RFoF technology emerges as a crucial enabler.

The surge in applications such as 5G networks, government and defense communication systems, and data-intensive operations necessitates advanced solutions capable of efficiently transmitting radio frequency signals over fiber-optic cables. RFoF addresses these demands, offering a reliable and high-performance communication infrastructure that positions it at the forefront of technological innovation in meeting the global need for enhanced bandwidth capabilities.

Restraint: High cost of installation and infrastructure required for RF-over-Fiber

The RF-over-Fiber market is the high cost associated with installation and the infrastructure required for its implementation. The deployment of RFoF technology involves substantial upfront expenses for installing fiber-optic cables and related components. The need for specialized equipment and skilled professionals to integrate RFoF systems adds to the overall cost of implementation.

This financial barrier can pose challenges for businesses, notably smaller enterprises or those operating on tight budgets, hindering widespread adoption. As cost-effective alternatives and advancements in competing technologies emerge, addressing the financial considerations associated with RFoF installations will mitigate this restraint and foster broader market acceptance.

Opportunity: Growing adoption of FTTX to fuel market growth

The RF-over-fiber market presents a significant opportunity driven by the growing adoption of Fiber-to-the-X (FTTX) architectures. As global demand for high-speed broadband and data services increases, FTTX, which includes Fiber-to-the-Home (FTTH), Fiber-to-the-Premises (FTTP), and other variants, becomes a key enabler.

RFoF technology plays a pivotal role in these deployments by efficiently transmitting radio frequency signals over fiber-optic cables, extending its application in providing high-performance connectivity to end-users. With the ongoing expansion of FTTX networks worldwide to meet the demands of residential and commercial users for faster and more reliable internet access, the RFoF market is poised to capitalize on this opportunity and witness substantial growth as an integral component of modern fiber-optic communication infrastructure.

Challenge: Challenging testing process for RF-over-Fiber Systems

A significant challenge for the RF-over-Fiber market is the intricate testing process associated with ensuring the robust performance of RFoF systems. Verifying and validating the integrity of radio frequency signals over fiber-optic cables requires sophisticated testing equipment and expertise, contributing to a complex and time-consuming testing phase. Factors such as signal loss, dispersion, and electromagnetic interference must be meticulously assessed to guarantee optimal system functionality.

The challenge is further amplified as RFoF technology finds applications in diverse sectors with varying requirements, necessitating customized testing procedures for specific use cases. Overcoming the testing complexities is crucial for the widespread adoption of RFoF, and ongoing advancements in testing methodologies and equipment will be pivotal in addressing this challenge and fostering the seamless integration of RFoF solutions across diverse industries.

Rf-Over-Fiber Market Ecosystem

The RF-over-Fiber market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Coherent Corp. from the US, HUBER+SUHNER from Switzerland, EMCORE Corporation from the US, G&H Group from the UK, SEIKOH GIKEN CO., LTD from Japan, and Broadcom from the US.

Rf-Over-Fiber Market Segment Overview

Underground segment by deployment is expected to hold the second-highest market share during the forecast period.

The deployment of the RF-over-Fiber market underground, securing the second-highest share in the market, can be attributed to the increasing demand for reliable and secure communication solutions in critical infrastructure applications. Underground deployments are particularly crucial in sectors such as transportation, defense, and energy, where communication systems must operate seamlessly in challenging environments and ensure minimal signal interference.

RFoF technology, with its ability to transmit radio frequency signals over fiber-optic cables, offers a resilient solution for underground deployments by mitigating signal degradation and electromagnetic interference that can occur in subterranean conditions. Applications such as subway and tunnel communication systems, underground military installations, and energy exploration and distribution networks benefit from the robust and secure transmission capabilities of RFoF, driving its substantial market share in underground deployments. The technology's adaptability to challenging environments positions it as a key enabler for maintaining adequate communication infrastructure below the surface.

Based on application, the communication to hold the highest market share during the forecast period

Communication holds the highest share in the RF-over-Fiber market primarily due to the escalating demand for high-speed and reliable data transfer in various communication applications. As the telecommunications industry advances, especially with the widespread deployment of 5G networks, there is an increasing need for technologies that can efficiently transmit radio frequency signals over long distances without compromising signal integrity.

RFoF technology addresses this demand by leveraging fiber-optic cables to mitigate signal losses and ensure consistent and high-quality communication. Moreover, the application extends beyond traditional telecommunication to include satellite communication, broadcasting, and military communication systems, which rely on RFoF to deliver robust, low-latency, and high-bandwidth connectivity. The versatility of RFoF in meeting the intricate requirements of diverse communication applications positions it as a pivotal technology, driving its predominant share in the market.

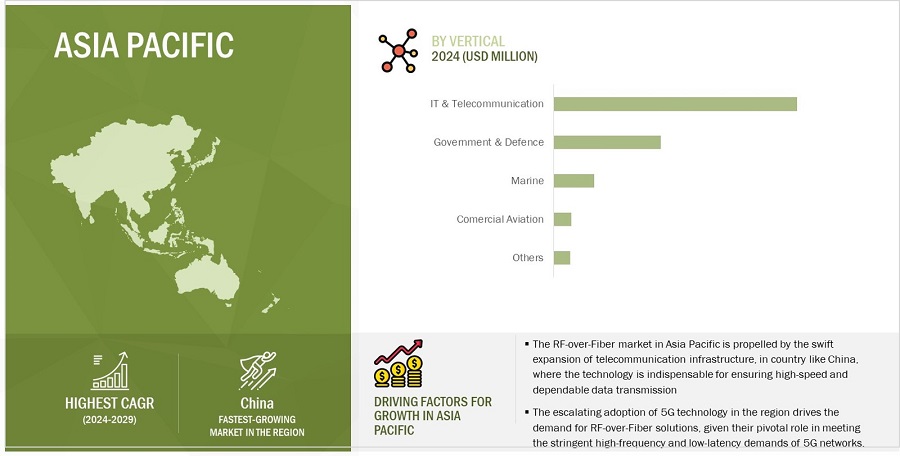

IT & Telecommunication in RF-over-Fiber market to hold the highest market share

In the RF-over-Fiber (RFoF) market, the dominance of the Information Technology (IT) and telecommunication vertical can be attributed to the sector's insatiable demand for high-performance and reliable communication infrastructure.

IT and Telecommunication companies are at the forefront of technological advancements, constantly seeking solutions that provide enhanced bandwidth, reduced signal loss, and improved transmission capabilities. RFoF technology aligns seamlessly with these requirements, offering efficient signal transmission over fiber-optic cables, thereby addressing the growing demands of the industry for high-frequency and high-speed data transfer.

The deployment of 5G networks, the proliferation of data centers, and the increasing reliance on wireless communication technologies further underscore the critical role of RFoF in IT and telecommunication verticals, positioning it as an indispensable component for optimizing network performance and ensuring seamless connectivity.

Rf-Over-Fiber Market Growth

RF-over-Fiber market in Asia Pacific region to exhibit highest CAGR during the forecast period

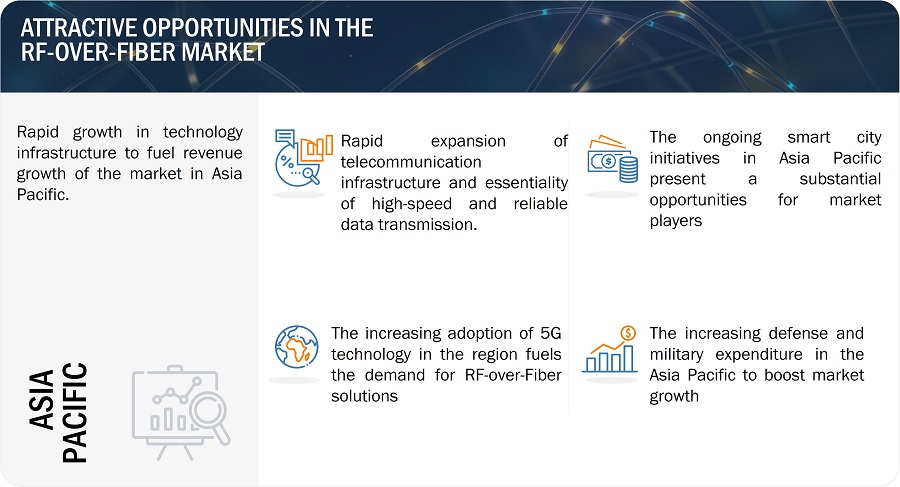

The Asia Pacific region is experiencing the highest CAGR in the RF-over-Fiber (RFoF) market due to a confluence of factors driving increased demand and adoption. The region's burgeoning telecommunications sector, characterized by rapid urbanization and a surge in mobile communication infrastructure, has heightened the need for efficient and reliable RFoF solutions.

Additionally, the increasing deployment of 5G networks, which demand higher data transfer rates and low latency, has fueled the demand for RFoF technology to transmit radio frequency effectively signals over fiber-optic cables. Furthermore, the proactive investments by governments and telecommunications companies in expanding network capabilities and enhancing communication infrastructure in countries across the Asia Pacific region contribute to the robust growth of the RFoF market, positioning it as a critical driver of technological advancement in the region.

RF-Over-Fiber Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top RF-over-Fiber Companies - Key Market Players

The RF-over-Fiber companies is dominated by players such as Coherent Corp. (US), HUBER+SUHNER (Switzerland), EMCORE Corporation (US), G&H Group (UK), SEIKOH GIKEN CO., LTD (Japan), Broadcom (US) and others.

RF-over-Fiber Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 670 million |

| Projected Market Size | USD 981 million |

| Growth Rate | CAGR of 7.9% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Component, By Frequency Band, By Deployment, By Application, By Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world (RoW) |

|

Companies covered |

The major market players include Coherent Corp. (US), HUBER+SUHNER (Switzerland), EMCORE Corporation (US), G&H Group (UK), SEIKOH GIKEN CO., LTD (Japan), (Total of 25 players are profiled) |

RF-Over-Fiber Market Highlights

The study categorizes the RF-over-Fiber market based on the following segments:

|

Segment |

Subsegment |

|

By Component |

|

|

By Frequency Band |

|

|

By Deployment |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in RF-over-Fiber Industry

- In September 2023, Coherent Corp. introduced the pump laser module with 1200 mW output power in a 10-pin butterfly package, catering to the demands of erbium-doped fiber amplifiers (EDFAs) in optical networks. The advanced pump lasers address the evolving needs of the RF over the fiber market by supplying additional power crucial for amplifying a more significant number of channels in next-gen ultra-broadband optical transmission systems.

- In January 2023, HUBER+SUHNER's MFBX Evo, featuring a modular design, promotes resource efficiency by allowing connector parts to be utilized in various connections, realizing economies of scale. The solution's high tolerance compensation between boards contributes to infinite design options, reducing the Total Cost of Ownership (TCO). With the capability to handle axial misalignment of ± 0.8mm and radial misalignment of ± 0.7mm at 17mm, the MFBX Evo offers flexibility without compromising excellent electrical values.

- In October 2022, HUBER+SUHNER acquired UK-based Phoenix Dynamics Ltd., known for customized cable solutions and electro-mechanical assemblies in industrial markets. The acquisition aligned with HUBER+SUHNER's strategy to enhance component sales with tailored solutions, focusing on aerospace and defense. This move expanded the company's industry offerings and strengthened its capabilities in providing comprehensive connectivity solutions, including RF over fiber products.

- In March 2022, EMCORE Corporation launched the MAKO-X C/X-Band RF over Fiber Transceiver, catering to military-grade applications like electronic warfare systems and high-dynamic-range functions within the 3.4 GHz to 8.4 GHz range. The ruggedized flange-mount module has undergone testing adhering to environmental MIL-STD-810G, as well as EMI & EMC MIL-STD-461F standards, ensuring robust performance in challenging conditions.

- In February 2022, EMCORE Corporation recently acquired the L3Harris Space and Navigation Business. This move is expected to fuel growth and contribute additional revenue streams, potentially leading to increased innovation and integration of advanced technologies, which could indirectly benefit the RF over fiber market by leveraging synergies in navigation and communication technologies.

Frequently Asked Questions (FAQs) Addressed by the Report:

What are the RF-over-Fiber market's major driving factors and opportunities?

Some of the major driving factors for the growth of this market include growth in military and defense expenditure, increasing demand for high-bandwidth communication, and higher adoption of advanced network technologies such as 4G, LTE advanced, 5G, and VoIP. Furthermore, opportunities such as increasing demand for high-speed and secure communication across expanding data center infrastructures and growing adoption of fiber-to-the-x (FTTx) to fuel market expansion are factors expected to boost the growth of the RF-over-Fiber market.

Which region is expected to hold the highest market share?

The Asia Pacific market will dominate the market share in 2024, fueled by a booming telecommunications sector driven by rapid urbanization and mobile infrastructure growth. The surge in 5G network deployments, requiring high data transfer rates, has elevated the demand for efficient RFoF solutions. Proactive investments from governments and telecom companies in expanding network capabilities further contribute to the region's robust RFoF market growth, positioning it as a key driver of technological advancement.

Who are the leading players in the global RF-over-Fiber market?

Companies such as Coherent Corp. (US), HUBER+SUHNER (Switzerland), EMCORE Corporation (US), G&H Group (UK), SEIKOH GIKEN CO., LTD (Japan), and Broadcom (US) are the leading players in the market. Moreover, these companies rely on several strategies, including new product launches and developments, collaborations and partnerships, and acquisitions. Such strategies give these companies an edge over other players in the market.

What are some of the technological advancements in the market?

Technological advancements in the RF-over-Fiber (RFoF) market are innovations focused on enhancing data transfer rates, reducing signal losses, and improving overall system efficiency. Developments include the integration of advanced modulation techniques, such as higher-order modulation schemes, to optimize signal quality. Additionally, ongoing research explores novel materials and designs for fiber-optic components, aiming to push the boundaries of RFoF capabilities and meet the evolving demands of high-performance communication systems.

What is the size of the global RF-over-Fiber market?

The global RF-over-Fiber market was valued at USD 606 Million in 2023 and is anticipated to reach USD 981 Million at a CAGR of 7.9% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

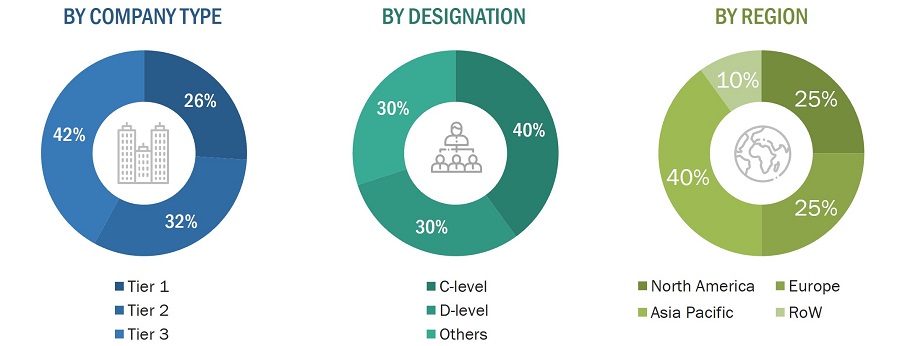

The study involved four major activities in estimating the current size of the RF-over-Fiber market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

The Optical Society (OSA) |

https://www.osa.org/en-us/home/ |

|

IEEE Communications Society (ComSoc) |

https://www.comsoc.org/ |

|

IEEE Photonics Society |

https://www.photonicssociety.org/ |

|

The Fiber Optic Association, Inc. |

https://www.thefoa.org/ |

|

The Fiber Optic Sensing Association (FOSA) |

https://www.fiberopticsensing.org/ |

|

Journal of Optical Communications and Networking |

https://www.osapublishing.org/jocn/journal/jocn |

|

European Optical Society |

https://www.myeos.org/ |

|

The Optical Society (OSA) |

https://www.osa.org/en-us/home/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the RF-over-Fiber market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the RF-over-Fiber market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying entities in the RF-over-Fiber value chain influencing the entire RF-over-Fiber industry

- Analyzing each entity along with related major companies identifying technology providers for the implementation of products and services

- Estimating the market for these RF-over-Fiber end users

- Tracking ongoing and upcoming implementation of RF-over-Fiber developments by various companies and forecasting the market based on these developments and other critical parameters

- Arriving at the market size by analyzing RF-over-Fiber companies based on their countries and then combining it to get the market estimate by region

- Verifying estimates and crosschecking them by a discussion with key opinion leaders, which include CXOs, directors, and operation managers

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the top-down approach. This study has determined and confirmed the overall parent market and individual market sizes by the data triangulation method and data validation through primaries. The data triangulation method in this study is explained in the next section.

- Focusing initially on topline investments by market players in the RF-over-Fiber ecosystem

- Calculating the market size based on the revenue generated by market players through the sales of RF-over-Fiber components

- Mapping the use of RF-over-Fiber in different component types

- Building and developing the information related to the revenue generated by market players through key products

- Estimating the geographic split using secondary sources considering factors, such as the number of players in a specific country and region, the role of major players in the development of innovative products, and adoption and penetration rates in a particular country for various components, frequency band, deployment, application, vertical.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

RF over Fiber (RFoF) is an analog data transmission technology over optical fibers, where radio signals modulate light signals for wireless access. These signals are transmitted optically, typically between a central station and base stations, and are later converted back to RF for transmission through the air. RFoF technology is recognized for its low signal attenuation, making it ideal for long-distance wireless signal transmission via optical links, particularly in applications such as broadband and broadcasting. A typical RFoF system includes an RF source, optical transmitter, amplitude modulator, receiver, and fiber optic cables.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

Report Objectives

- To describe and forecast the RF-over-Fiber market, in terms of value, based on component, frequency band, deployment, application and, vertical.

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the RF-over-Fiber market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the RF-over-Fiber landscape

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the RF-over-Fiber market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as partnerships and joint ventures, mergers and acquisitions, new product developments, expansions, and research and development, in the RF-over-Fiber market

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product/service launches, and other developments in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the RF-over-Fiber market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the RF-over-Fiber market.

Growth opportunities and latent adjacency in RF-Over-Fiber Market