Risk Analytics Market by Offering (Software (ETL Tools, Risk Calculation Engines, GRC Software), Services), Risk Type (Strategic Risk, Operational Risk, Financial Risk, Regulatory Risk), Risk Stages, Vertical and Region - Global Forecast to 2029

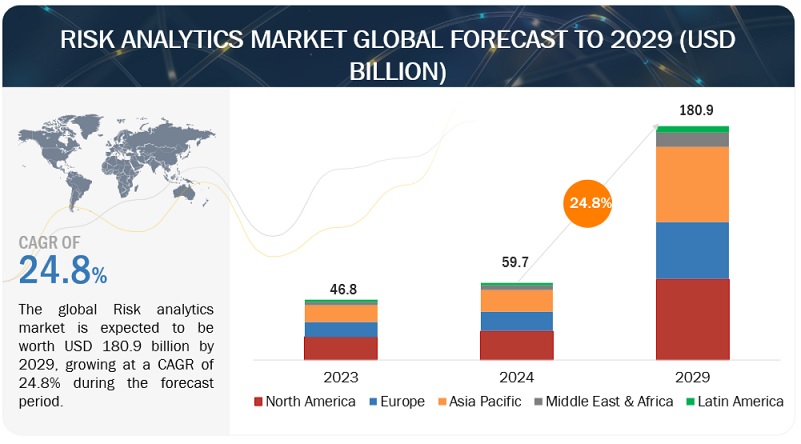

[343 Pages Report] The global market for the risk analytics market is projected to grow from USD 59.7 billion in 2024 to USD 180.9 billion in 2029, at a CAGR of 24.8% during the forecast period. Risk analytics is important in the global market due to its ability to identify, assess, and mitigate various risks that businesses encounter. By leveraging data and analytical tools, organizations can anticipate market fluctuations, geopolitical instability, regulatory changes, and financial risks. This enables proactive decision-making, enhances operational efficiency, and protects against potential losses. In a highly interconnected global economy, understanding and managing risks across borders is essential for maintaining competitiveness and sustaining growth. Risk analytics empowers businesses to navigate uncertainties effectively, safeguard assets, and capitalize on emerging opportunities in the dynamic global marketplace..

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing incidences data theft and security breaches

The risk landscape is continuously evolving, and rising instances of cyberattacks have resulted in huge losses to enterprises. The growth in ransomware attacks and security breaches, such as Equifax, Spectre, Meltdown, cloud malware injection attacks, account or service hijacking, and man-in-the-cloud attacks, are making organizations focus more on data security to safeguard themselves from losing millions of records and sensitive information. According to the Herjavec Group’s Cyber Crime report 2019, damage from ransomware would cost USD 11.5 billion to organizations in 2019. Hence, to safeguard themselves from growing security breaches, organizations are looking forward to shifting from traditional security to advanced security to protect their critical assets from potential threats.

Organizations in various countries focus on the implementation of data protection directives to safeguard individuals’ data. The increasing advanced cyberattacks and the growing number of ransomware attacks on banks and various other financial service enterprises have encouraged governments across regions to adopt a more robust and effective security model to maintain the information security of business-critical assets. The rise in the number of cross-border transactions and data transfers is encouraging the need for developing data protection, and information security laws and regulations promoting the adoption of risk analytics solutions among enterprises that have global footprints. The growing rate of cybercrimes has encouraged various verticals to implement stringent regulations for data security and constantly monitor their networks for threats

Restraint: Resistance to Change

Resistance to change represents a significant barrier for businesses seeking to implement new risk management practices or technologies. This resistance often stems from ingrained organizational cultures, employee apprehension about unfamiliar processes, or concerns about job security. Despite recognizing the benefits of modern risk management approaches, such as advanced analytics or automation, employees may resist adoption due to fear of the unknown or perceived disruption to existing workflows. Moreover, middle management resistance can impede progress, as these individuals may be comfortable with established routines and hesitant to embrace change that could challenge their authority or status quo. Overcoming resistance to change requires effective communication, stakeholder engagement, and change management strategies. Leaders must articulate the rationale behind proposed changes, address employee concerns, and provide training and support to facilitate the transition. By fostering a culture of openness, collaboration, and continuous improvement, organizations can mitigate resistance to change and drive successful adoption of innovative risk management practices

Opportunity: Adoption of AI and blockchain technology in the market

AI and blockchain are among the recent trending technologies that are expected to add advanced capabilities to risk analytics solutions and open new growth avenues. The integration of these technologies with risk analytics solutions would address some of the key challenges and pain points faced by the end-user industry over the past few decades. The advanced technologies facilitate faster transactions and settlements, which helps financial institutions and customers conduct transactions more easily while eliminating the intermediary charging fee.

As businesses gather data from various channels, safeguarding that information becomes paramount. Blockchain technology offers a promising avenue for security analysts to expedite the detection of data breaches and mitigate the risk of data loss. By leveraging Artificial Intelligence (AI) and Machine Learning (ML), which operate with pre-defined algorithms, companies can enhance their understanding of threat classification. These advanced technologies enable rapid analysis of system anomalies, identifying potential threats efficiently. This approach facilitates proactive detection and response to security risks, ensuring a more resilient and secure operational environment.

Challenge: Scarcity of highly skilled professionals in the field of risk management

In an increasingly complex and uncertain business landscape, effective risk management is essential for safeguarding assets, ensuring compliance, and sustaining long-term growth. However, the shortage of skilled professionals poses challenges for organizations seeking to build robust risk management frameworks. This scarcity result in gaps in expertise, leading to inadequate risk assessment, mitigation, and response strategies. Consequently, businesses may face heightened exposure to financial, operational, and reputational risks. This shortage also presents opportunities for strategic investment and talent development. Businesses can attract and retain top talent by offering competitive compensation packages, professional development opportunities, and a supportive work culture. Additionally, organizations can collaborate with educational institutions and industry associations to cultivate a pipeline of skilled risk management professionals through internships, mentorship programs, and specialized training initiatives. By addressing the scarcity of highly skilled professionals in risk management proactively, businesses can enhance their resilience, competitive advantage, and long-term sustainability. Moreover, investing in talent development can foster a culture of risk awareness and proactive risk management throughout the organization, driving innovation and value creation..

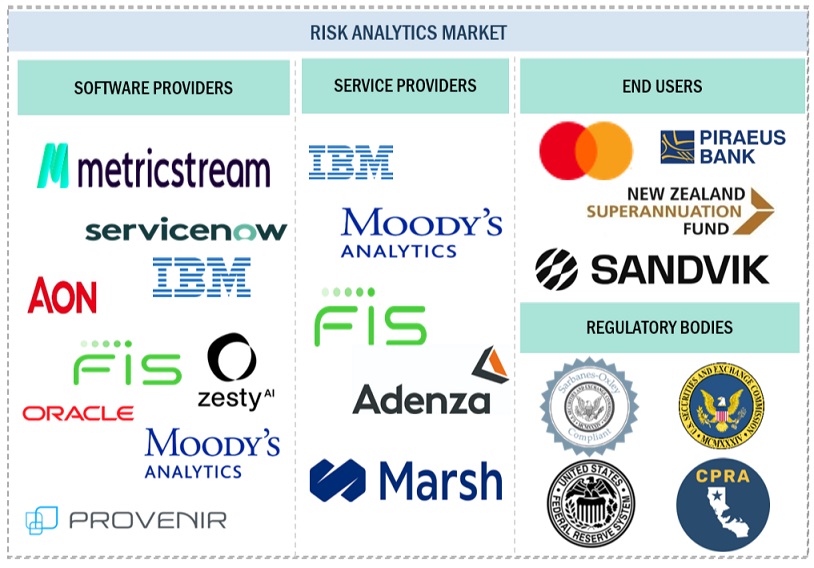

Risk analytics Market Ecosystem

The risk analytics ecosystem is a dynamic and interconnected network of entities that collectively enable seamless communication between machines and devices through satellite networks. This ecosystem encompasses a diverse range of players, each contributing specialized services and solutions to facilitate efficient and global connectivity. The ecosystem of the risk analytics include software/services providers, end users, and regulatory bodies.

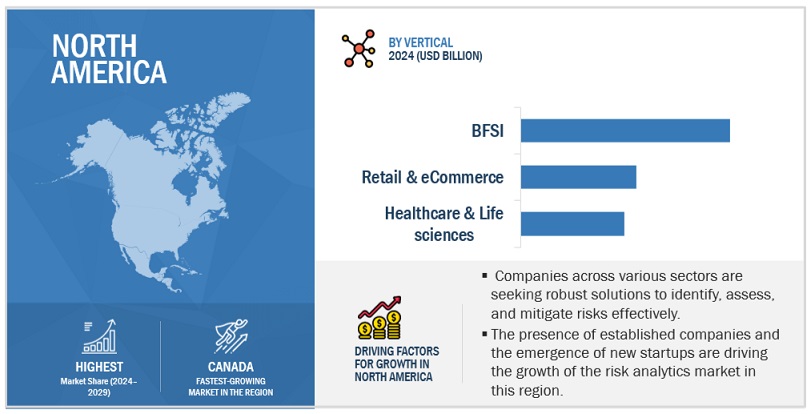

By vertical, BFSI segment accounts for the largest market size during the forecast period.

The BFSI (Banking, Financial Services, and Insurance) sector dominates the risk analytics market primarily due to its inherent complexity and exposure to various risks. Within this sector, institutions face multifaceted challenges ranging from credit and market risks to operational and compliance risks. As a result, there is a critical need for advanced risk analytics solutions to assess, monitor, and mitigate these risks effectively. BFSI firms heavily rely on risk analytics to enhance decision-making processes, optimize capital allocation, and ensure regulatory compliance. The increasing volume and diversity of financial transactions, coupled with stringent regulatory requirements, further drive the demand for sophisticated risk analytics tools and techniques. Additionally, the high stakes involved in financial transactions necessitate proactive risk management strategies, making risk analytics indispensable for maintaining stability and competitiveness in the industry. Thus, BFSI's significant market size in the risk analytics market reflects its pivotal role in driving innovation and adoption of advanced analytics technologies to navigate the complex landscape of financial risks.

By Risk Stages, Risk Assessment and Prioritization segment is projected to grow at the highest CAGR during the forecast period.

Risk assessment and prioritization are critical components of effective risk management, enabling organizations to systematically identify, evaluate, and address potential risks. Firstly, the identification stage involves recognizing hazards, vulnerabilities, and threats that could adversely affect objectives or operations. Secondly, evaluation entails assessing the likelihood and potential impact of identified risks, enabling organizations to rank them based on severity and potential consequences. Prioritization is essential for focusing resources on managing the most significant risks first, optimizing resource allocation and enhancing overall risk management efficiency. This process supports decision-making by providing insights into risk severity and informing mitigation strategies or risk acceptance decisions. Regular review and updating of risk assessments facilitate continuous improvement, ensuring that risk management practices remain relevant and effective in the face of evolving circumstances.

North America to account for the largest market size during the forecast period.

Key Market Players

The major risk analytics solution and service providers include IBM (US), SAS Institute (US), Oracle (US), FIS(US), Moody’s Analytics (US), ProcessUnity(US), ServiceNow (US), MarshMeclennan(US), Aon (UK), MetricStream (US), Resolver (Canada), SAP (Germany), Milliman(US), LogicManager(US), Provenir(US), SAI360(US), Deloitte(UK), OneTrust(US), Diligent(US), Alteryx(US), Crisil(India), Archer(US), ZestyAI(US), Fusion Risk Management(US), RiskVille(Ireland), Spin Analytics(UK), Kyvos Insights(US), Imperva(US), Cirium(UK), Quantexa(UK), ClickUp(US), Sprinto(US), Ventiv(US), Adenza(US), Centrl.AI(Canada), SafetyCulture(Australia), Quantifi(US), CubeLogic(UK), Onspring(US), Riskoptics(US). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the risk analytics market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2023 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering,Risk Type, Risk stages, Vertical, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), SAS Institute (US), Oracle (US), FIS(US), Moody’s Analytics (US), ProcessUnity(US), ServiceNow (US), Marsh (US), Aon (UK), MetricStream (US), Resolver (Canada), SAP (Germany), Milliman(US), LogicManager(US), Provenir(US), SAI360(US), Deloitte(UK), OneTrust(US), Diligent(US), Alteryx(US), CRISIL(India), Archer(US), ZestyAI(US), Fusion Risk Management(US), RiskVille(Ireland), SPIN Analytics(UK), Kyvos Insights(US), Imperva(US), Cirium(UK), Quantexa(UK), ClickUp(US), Sprinto(US), Ventiv(US), Adenza(US), Centrl.AI(Canada), SafetyCulture(Australia), Quantifi(US), CubeLogic(UK), Onspring(US), Riskoptics(US) |

This research report categorizes the risk analytics market based on Offerings, Risk Type, Risk Stages, Verticals, and Region.

Offering:

-

Software

-

By type

- ETL Tools

- Risk Calculation Engines

- Scorecard and Visualization Tools

- Risk Reporting Tools

- Dashboard Analytics

- GRC Software

- Others (Portfolio Management, Operation Risk Management))

-

By Deployment Mode

- Cloud

- On-Premises

-

By type

-

Services

-

Professional Services

- Consulting services

- Deployment & Integration

- System & Maintenance

- Managed Services

-

Professional Services

By Risk Stages:

- Risk identification

- Risk assessment and prioritization

- Risk response and mitigation

- Risk monitoring

- Risk reporting.

By Risk Type:

-

Strategic risk

- Operational Risk

- Reputational Risk

- Governance Risk

- Political Risk

- Financial Risk

- Regulatory risk

- Environmental risk

- other (economic risk and change risk )

By Verticals:

- BFSI

- Retail and Ecommerce

- Healthcare and Life sciences

- Telecommunications

- Energy and utilities

- Manufacturing

- Transporatation and Logistics

- Government and Defense

- Mining

- Construction

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- ANZ

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Qatar

- Israel

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In March 2024, Orcale announced Oracle Risk Management Cloud in Release 24B. It offers comprehensive solution designed to help organizations identify, assess, and mitigate risks across their business operations. It offers advanced analytics, automation, and collaboration tools to streamline risk management.

- In March 2024, FIS Global announces card fraud detection capabilities leveraging artificial intelligence (AI) with aim to bolster FIS's ability to identify and prevent fraudulent transactions, providing greater security for cardholders and financial institutions alike.

- In March 2024, Aon acquired an AI-powered platform to assist fleet and mobility clients in making data-driven decisions, enhancing operational efficiency and risk management. The platform utilizes artificial intelligence to analyze data and provide insights, enabling clients to optimize their fleet operations and improve decision-making processes.

- In March 2024, Crisp joined Resolver, with the aim to enhance Resolver's risk intelligence capabilities by integrating Crisp's expertise and technology into its platform, offering clients improved risk assessment and mitigation tools.

- In February 2024, SAS partnered with Carahsoft to bring analytics, AI, and data management solutions to the public sector. The aim is to leverage SAS's expertise in advanced analytics and Carahsoft's extensive government market reach to offer tailored solutions that enable public sector organizations to harness the power of data for informed decision-making and improved outcomes.

Frequently Asked Questions (FAQ):

What is Risk analytics?

Risk analytics entails employing data analysis and statistical methods to evaluate, quantify, and address potential risks across diverse sectors like finance, insurance, and business operations. It encompasses identifying threats, assessing their probability and impact, and devising strategies to mitigate or manage them effectively. By scrutinizing historical data, market trends, and relevant variables, organizations can make informed decisions, allocate resources optimally, and refine their risk-return profiles.

Which region is expected to hold the highest share in the risk analytics market?

North America leads the risk analytics market with its strong economy, advanced technological infrastructure, and supportive regulatory framework, which stimulate innovation and expansion in the field of risk analytics.

Which are key verticals adopting risk analytics platform, solutions and services?

Key end users adopting risk analytics solutions and services include BFSI, retail & eCommerce, healthcare & life sciences, telecommunications,transportation & logistics, energy & utilities, manufacturing, government & defense, and other verticals.

Which are the key drivers supporting the market growth for risk analytics market?

The key drivers supporting the market growth for risk analytics include digital transformation, data availability, technological advancements like AI and machine learning, regulatory requirements, increasing complexity of risks, and the need for real-time insights..

Who are the key vendors in the market for risk analytics market?

The key vendors in the global risk analytics market include IBM (US), SAS Institute (US), Oracle (US), FIS(US), Moody’s Analytics (US), ProcessUnity(US), ServiceNow (US), Marsh (US), Aon (UK), MetricStream (US), Resolver (Canada), SAP (Germany), Milliman(US), LogicManager(US), Provenir(US), SAI360(US), Deloitte(UK), OneTrust(US), Diligent(US), Alteryx(US), CRISIL(India), Archer(US), ZestyAI(US), Fusion Risk Management(US), RiskVille(Ireland), SPIN Analytics(UK), Kyvos Insights(US), Imperva(US), Cirium(UK), Quantexa(UK), ClickUp(US), Sprinto(US), Ventiv(US), Adenza(US), Centrl.AI(Canada), SafetyCulture(Australia), Quantifi(US), CubeLogic(UK), Onspring(US), Riskoptics(US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

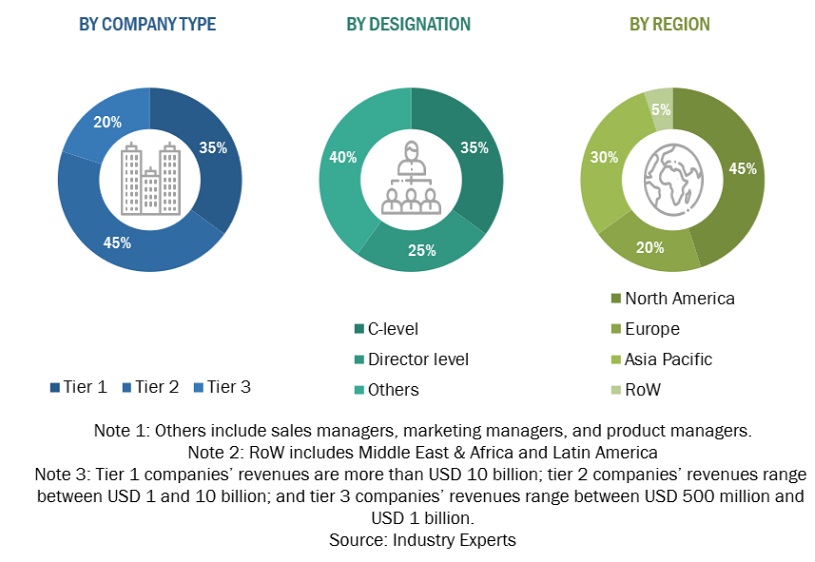

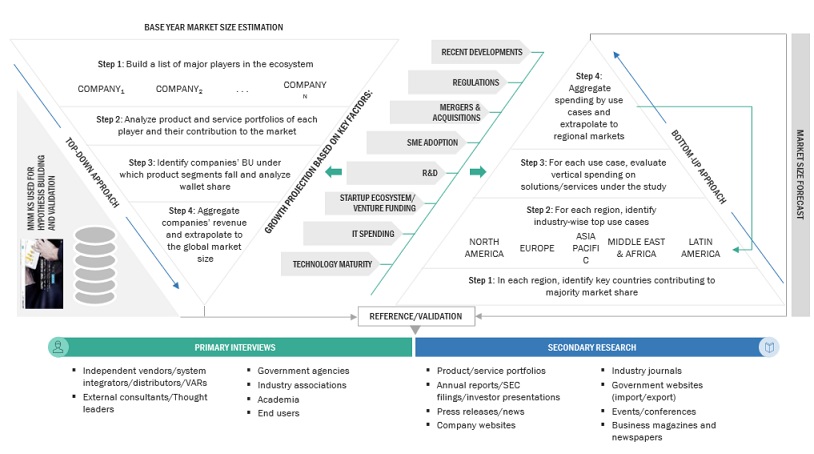

The research study for the risk analytics market involved extensive secondary sources, directories, and several journals. Primary sources were mainly industry experts from the core and related industries, preferred risk analytics solution providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering risk analytics software and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, risk analytics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on software, services, market classification, and segmentation according to offerings of major players, industry trends related to software, services, risk type, risk stages, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and risk analytics expertise; related key executives from risk analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using risk analytics, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of risk analytics software and services which would impact the overall risk analytics market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the risk analytics market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of software, and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering software and services in the risk analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of offerings, risk types, risk stages, verticals, and regions. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of risk analytics offerings among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of risk analytics solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in the different areas for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the risk analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major risk analytics solution providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall risk analytics market size and segments’ size were determined and confirmed using

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Risk analytics encompasses methodologies aimed at enhancing the precision of risk assessment and prediction. Enabled by the proliferation of big data, bolstered computing capabilities, and sophisticated analytics, enterprises now wield their operational data more effectively. Leveraging artificial intelligence, machine learning, and robust BI acceleration platforms, businesses bolster their decision-making processes. Such tools are indispensable for managers leveraging risk analytics techniques to discern, quantify, and address risk factors. While risk management is a longstanding corporate imperative, these advancements amplify its efficacy in contemporary business landscapes.

Stakeholders

- Risk analytics software providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-added Resellers (VARs) and distributors

- Consultancy firms and advisory firms

- Regulatory agencies

- Governments

Report Objectives

- To define, describe, and predict the risk analytics market by offering, risk type, risk stages, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the risk analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American risk analytics Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American risk analytics Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Risk Analytics Market

We're trying to better understand the capital markets risk management space market sizing.