Self-healing Networks Market by Component (Solutions, Services), Network Type (Public, Private, & Hybrid), Application (Network Provisioning, Network Traffic Management), Vertical (Telecom, Healthcare & Life Sciences) and Region - Global Forecast to 2027

Self-Healing Networks Market - Industry Analysis, Demand & Size

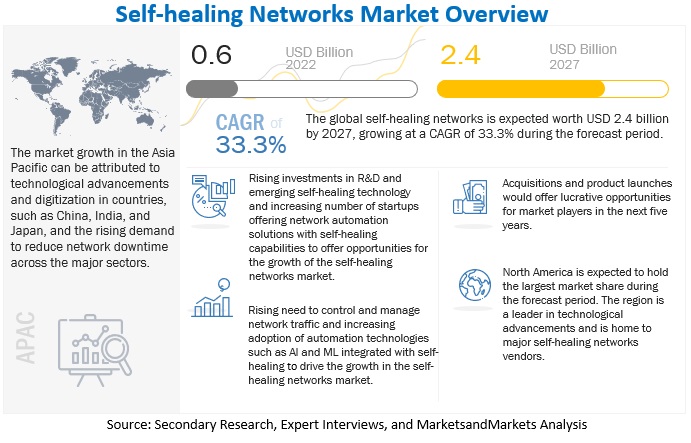

The global Self-Healing Networks Market size was valued at USD 0.6 billion in 2022 and is expected to grow at a CAGR of 33.3% from 2022 to 2027. The revenue forecast for 2027 is projected to reach $2.4 billion. The base year for estimation is 2021, and the historical data spans from 2022 to 2027.

The global Self-healing Networks Market size was valued at $0.6 billion in 2022 and it is projected to reach $2.4 billion by the end of 2027, growing at a CAGR of 33.3%. Few of the factors such as rising investments in R&D and emerging self-healing technology coupled with increasing number of startups offering network automation solutions with self-healing capabilities would create immense potential opportunities for self-healing networks vendors across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Self-healing Networks Market Dynamics

Driver: Increasing adoption of automation technologies such as AI and ML integrated with self-healing

The growing complexity of network infrastructure, combined with the low latency and determinism associated with next-generation services, makes it difficult to deploy and manage networks based on traditional network management methods and static policies. Therefore, the importance and value of innovative technologies, such as AI and Machine Learning (ML), has increased. These disruptive technologies play a very crucial role in protecting highly data-driven, software-defined, and virtualized network components. AI technology is applied in the network to improve various operations, including closed-loop automation and encrypted traffic analytics. AI and ML technology innovations have made closed-loop automation possible with NFV, which is essential to the remote monitoring and management of various network edge locations and billions of connected devices. For instance, Cisco offers Cisco AI network analytics, which drives network intelligence and allows the easy management of all devices and services, prioritizes and resolves network issues, and ensures better user experience across the network. Hence the increasing advancements of such disruptive technologies such as AI and ML will drive the growth of self-healing networks in the market.

Restraints: Rising security threats across the networks

Ever-more complex cyberattacks involves malware, phishing, and cryptocurrency have placed the data and assets of corporations, governments and individuals at continual threat. Also, networks are the key enabler for the enterprise, they are also a source of complete hazard. However, increasing connected devices leads to greater risk which affectIoT networks more vulnerable to cyber attacks.. IoT devices which is controlled by hackers can be used to create disaster, overload networks and lock down essential equipment for financial gain. . According to the Cisco Annual Internet Report, 2018-2023, there were a total of 1,272 breaches, with a total of nearly 163 million records exposed as of November 2019. Further, not all network engineers are completely trained in defending these attacks due to which they may pose threats in securing networks and may restraints the self-healing market.

Opportunity: Rising investments in R&D and emerging self-healing technology

Networking companies are heavily investing in the R&D of networking solutions with self-healing capabilities, with a focus on long-term value creation. Based on the fluctuations in short-term business performance and financial results, leading networking companies have not reduced their investment for the innovation and testing of self-healing networks solutions. For instance, Forta offers Intermapper's network monitoring software helps users create a network map, giving the user a live view of what's happening on the network. This tool will be able to find and fix technology issues before users or customers are impacted. Networking companies are also coming up with “Ethernet fabrics.” Ethernet fabric is a network topology that enhances the performance, utilization, availability, and simplicity required to meet the networking requirement of modern virtual data centers. These continuous investments and positive outcomes are expected to further fuel the growth of the self-healing networks in the market.

Challenge: Lack of awareness among network administrators

Self-healing networks solutions, with varied features and functionalities, are being offered by numerous vendors across the globe. Network admins need to understand their requirements to manage the network infrastructure and chose the appropriate solution. In the world of convergence, technology has been changing rapidly in the business system. Most of the network administrators are reluctant to modify the SOPs and are hesitant in automating their networks and upgrade self-healing capabilities. Therefore, solution providers need to offer updated training and education services to network admins, so that they can gain more insights from unstructured network data. Many organizations, especially SMEs, do not have enough skilled workforce to manage the network infrastructure. Hence, the lack of awareness among network admins to distinguish between precise self-healing networks solutions pose a key challenge for the growth of the self-healing networks market.

Services segment to register the higher growth rate during the forecast period

Based on services, the self-healing networks market is segmented into managed and professional services. Increasing adoption of self-healing networks services by enterprises to help deploy a proper platform to run and support their applications rather than investing in the software leads to a higher demands for services. Managed services are completely provided by the third-party vendor and offer clients on-time conveyance.

Cloud segment to register the larger market size during the forecast period

Vendors in the self-healing networks market offer on-premises and cloud-based deployment mode. The deployment mode is primarily dependent on the financial stability and IT infrastructure of the organizations deploying self-healing networks solution. Cloud deployment mode to hold the larger market size in the market. Cloud as a service is not only enabling organizations to manage their costs but also support businesses in ensuring improved business agility. Cloud-based solutions enables fast and secure network configuration by leveraging cloud computing capabilities. Moreover, the cloud deployment model scales a solution’s capacity to handle enormous network application traffic.

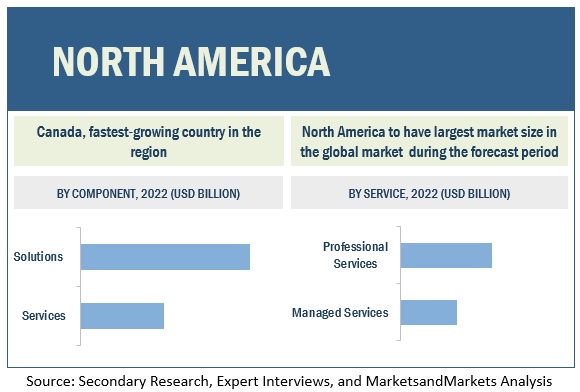

North America to have the largest self-healing networks market size during the forecast period

The major countries covered in North America are the US and Canada. The North American region, being the primary adopter of self-healing networks technology, is the major revenue-generating region in the global self-healing networks market. Moreover, it is a well-established economy, witnessing large-scale investments in digitalized IT infrastructure. The North American region has been extremely open toward adopting new and innovative technologies and is expected to provide market growth opportunities to self-healing networks vendors, as it is expected to witness an exponential growth of IT and network device-based generated data and stringent laws and policies for safeguarding the network data. Investment in various technologies such as AI, IoT, ML and big data would boost the growth of the self-healing networks in the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The self-healing networks solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the Self-healing networks market include Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 0.6 Billion |

|

Revenue forecast by 2027 |

USD 2.4 Billion |

|

Growth Rate (CAGR) |

CAGR of 33.3% from 2022 to 2027 |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

USD (Million/Billion) |

|

Segments covered |

Component, Network Type, Organization Size, Deployment Mode, Application, Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil). |

This research report categorizes the self-healing networks market based on component, network type, organization size, deployment mode, application, vertical, and region.

By Component:

-

Solutions

- Network Automation Software

- Intent-based Networking Tools

- Network Monitoring Tools

- Other Solutions

-

Services

- Professional Services

- Managed Services

By Network Type:

- Physical

- Virtual

- Hybrid

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- On-premises

- Cloud

By Applications:

- Network Provisioning

- Network Bandwidth Monitoring

- Policy Management

- Security Compliance Management

- Root Cause Analysis

- Network Traffic Management

- Network Access Control

- Other Applications

By Verticals:

- IT and ITES

- BFSI

- Media and Entertainment

- Healthcare and Life Sciences

- Telecom

- Retail and Consumer Goods

- Education

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- India

- Japan

- China

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2022, SolarWinds Corporation, a leading provider of simple, powerful, and secure IT management software, and DRYiCE, a division of HCL Software focused on humanizing enterprise application of AI, announced its intended expansion of their partnership aimed at revolutionizing IT operations for enterprises. The expanded partnership will focus on bringing together the best-in-class advanced AIOps, end-to-end observability, and service management platform from both companies.

- In October 2022, IBM Cloud Pak for Network Automation, in collaboration with Pliant.io, helps organizations increase their efficiency, lower overall operational costs, normalize configuration and management across many vendors and ensure network stability and security. By tapping IBM Cloud Pak for Network Automation with Pliant’s workflow engine and API gateway capabilities, enterprises can improve service delivery speed, prevent vendor lock-in and extend and expand an organization's integration capability—all while ensuring network remains in its desired state.

- In June 2022, Elisa Polystar acquires Cardinality Ltd, a UK-based supplier of cloud-native data management (DataOps), service assurance and customer experience analytics for communications service providers (CSPs) globally. By combining with Cardinality, Elisa Polystar will have stronger data management, AI-driven analytics and automation portfolio with comprehensive data ingestion and cloud-native capabilities enabling simultaneous top-and bottom-line improvements for network operators.

- In January 2021, Fortra acquired FileCatalyst, a leader in enterprise file transfer acceleration to continue expansion of Cybersecurity and Automation Portfolio. FileCatalyst enables organizations working with extremely large files to optimize and transfer information swiftly and securely across global networks. This can be particularly beneficial in industries such as broadcast media and live sports.

- In October 2020, VMware announced its acquisition of SaltStack, a pioneer in building intelligent, event-driven automation software, that helps customers to automate ITOps, DevOps, NetOps or SecOps functions. With the acquisition of SaltStack, VMware has broadened its automation capabilities including software configuration management, network automation, and infrastructure automation.

- In July 2020, HPE announced its acquisition of Silver Peak, a software-defined wide area network (SD-WAN) platform provider, which got incorporated into its Aruba Networks subsidiary.

Frequently Asked Questions (FAQ):

How big is the Self-Healing Networks Market?

What is growth rate of the Self-Healing Networks Market?

What are the key trends affecting the Self-Healing Networks Market?

- Network Provisioning

- Security Compliance Management

- Network Traffic Management

Who are the key players in Self-Healing Networks Market?

Who will be the leading hub for Self-Healing Networks Market?

What are the opportunities in Self-Healing Networks Market?

- IT and ITES

- Media and Entertainment

- Healthcare and Life Sciences

- Telecom

- Education

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

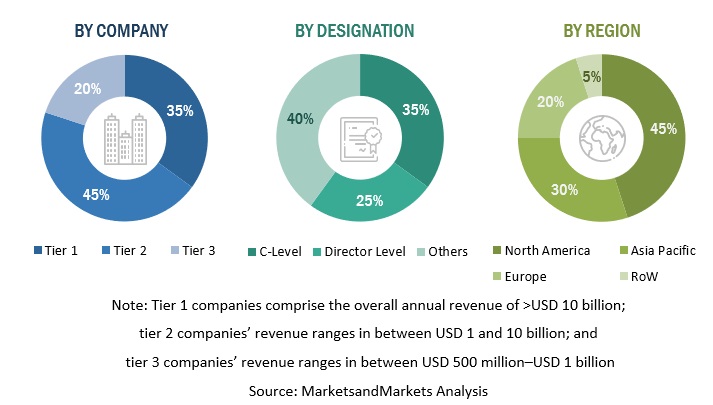

The research study for the self-healing networks market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred self-healing networks providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering self-healing networks solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, self-healing networks spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, applications, network types, organization sizes, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and self-healing networks expertise; related key executives from self-healing networks solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to adjacent technologies, applications, deployment modes, network types, verticals and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using self-healing networks, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of self-healing networks solutions and services, which would impact the overall self-healing networks market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For market estimation, key self-healing networks solutions and service vendors, such as Fortra (US), VMWare (US), IBM (US), CommScope (US), SolarWinds (US), ManageEngine (US), BMC Software (US), Elisa Polystar (Sweden), HPE (US), Cisco (US), Ivanti (US), Easyvista (France), Huawei (China), ACT (India), Ericsson (Sweden), Nokia (US), Anuta Networks (US), Juniper (US), Bluecat (Canada), Park Place Technologies (US), Appnomic (India), Versa Networks (US), Parallel Wireless (US), Itential (US), Kentik (US), Domotz (US), and Beegol (Brazil) were identified. These vendors contribute nearly 45%–55% to the global self-healing networks market.

The market is competitive due to the presence of several vendors. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. The revenue pertaining to Business Units (BUs) that offer self-healing networks solutions was identified through similar sources. Then, through primaries, the data of revenue generated from specific self-healing networks solutions was collected. The collective revenue of key companies that offer self-healing networks solutions comprises 40%–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, the USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on self-healing networks based on some of the key use cases. These factors for the self-healing networks industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the self-healing networks market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major self-healing networks providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall self-healing networks market size and segments’ size were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the self-healing networks market in terms of component (solutions and services), deployment mode, network type, application, organization size, vertical, and region.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the self-healing networks market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the self-healing networks market

- To analyze the impact of the recession across all the regions in the self-healing networks market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American self-healing networks market

- Further breakup of the European self-healing networks market

- Further breakup of the Asia Pacific self-healing networks market

- Further breakup of the Middle East and Africa self-healing networks market

- Further breakup of the Latin America self-healing networks market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Self-healing Networks Market