Simulation Software Market by Offering (Software & Professional Services), Software Type (Computer-Aided Design, Finite Element Analysis), Deployment Mode (On-Premises and Cloud), Application, Vertical and Region - Global Forecast to 2028

Simulation Software Market Share, Forecast & Growth Report

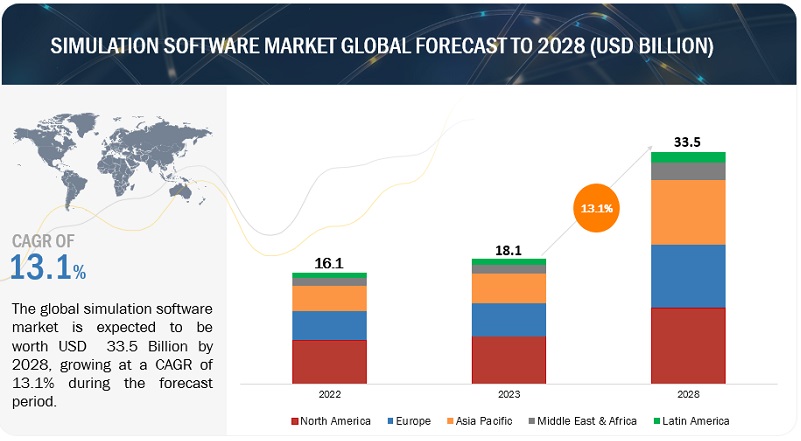

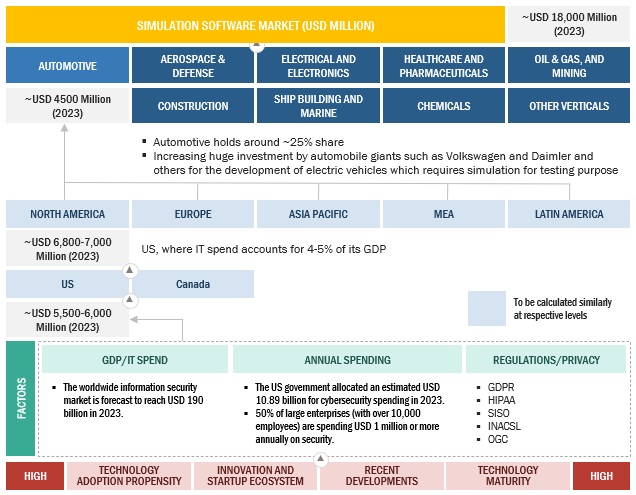

[343 Pages Report] TheSimulation Software Market size was worth approximately $18.1 billion in 2023. It is expected to grow at an effective compound annual growth rate (CAGR) of 13.1% from 2023 to 2028. The revenue forecast for 2027 is projected to reach $33.5 billion. The base year consider for estimation is 2022 and the historical data spans from 2023 to 2028.

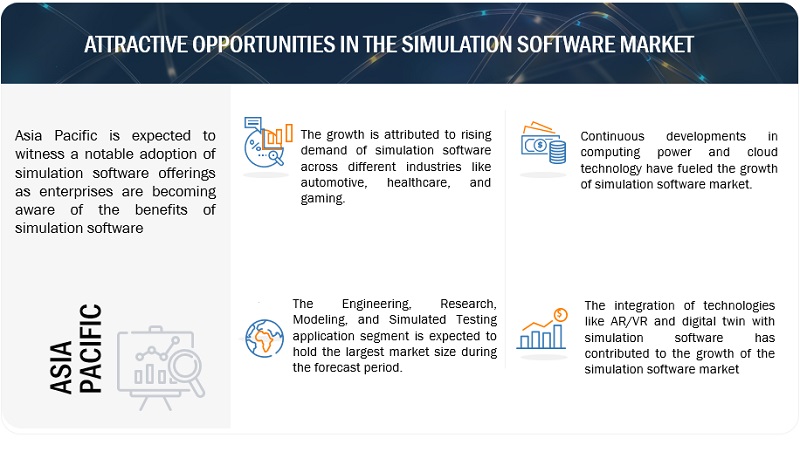

The surge in demand for efficient solutions to reduce production expenses and training costs is driving the growth of the simulation software market. This growth is attributed to the efficient utilization of simulation software, which also reduces risks and enhances performance across industries. Furthermore, the continuous advancements in computing power and cloud technology have played a pivotal role in promoting the widespread adoption of simulation software. As these technologies progress, simulations become more accessible, realistic, and scalable, making them increasingly valuable across various industries.

Additionally, the integration of technologies like Digital Twin, AR/VR, and 3D printing is amplifying the impact of simulation software. These innovations are revolutionizing processes and bolstering competitiveness in multiple aerospace, automotive, and healthcare sectors. These factors collectively point to a promising growth trajectory for the simulation software market as businesses seek innovative ways to optimize their operations and gain a competitive edge. Consequently, the demand for simulation software will witness a significant upsurge shortly.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Simulation Software Market Growth Dynamics

Driver: There is a growing need for efficient software solutions to minimize production expenses and training costs

The growing demand for efficient simulation software solutions to cut production expenses and training costs is driving the rapid growth of the simulation software market. Companies across various industries increasingly use simulation software to optimize their operations and streamline training processes. These sophisticated tools empower businesses to replicate real-world scenarios, identify operational inefficiencies, and experiment with innovative ideas in a risk-free environment. By adopting this approach, companies can significantly reduce production expenses and training costs while enhancing overall productivity and performance. This prevailing trend underscores the growing recognition of simulation software as an invaluable resource for modern businesses seeking cost-effective, data-driven solutions.

Restraint: Absence of proficient individuals to operate simulation software

Efficient employment of simulation software necessitates expertise in software operation and the simulation domain. Tasks like configuring model parameters and interpreting results demand skilled engineering, physics, or related professionals. The shortage of such experts presents challenges for organizations, potentially increasing operational costs and limiting the software’s benefits.

Opportunity: Expansion of the Automotive industry

The automotive industry is undergoing a significant transformation, driven by customer demand for personalized experiences, the rise of new competitors, and the adoption of electric, connected, and autonomous vehicles. Companies like Ansys are addressing these challenges with innovative solutions like Vehicle Performance Engineering tailored for the automotive sector. In this dynamic landscape, the growth in the automotive industry presents a significant opportunity for the expansion of simulation software, enabling quicker time-to-market, reduced risks, controlled costs, and the creation of appealing products for both established and new players in the evolving automotive ecosystem.

Challenge: Absence of standardization norms

The absence of standardized practices in the simulation software market hampers collaboration across diverse sectors such as engineering, healthcare, and gaming. The variation in software design and data formats disrupts seamless integration and resource allocation, resulting in increased costs, time inefficiencies, and data accuracy challenges. Furthermore, the absence of benchmarks complicates performance assessment and progress monitoring. Addressing these issues necessitates collaborative efforts to establish industry standards that boost compatibility, foster innovation, and enhance cohesion within the simulation software market.

Simulation Software Market Ecosystem

By vertical, the Healthcare and Pharmaceuticals segment will grow at the highest CAGR during the forecast period.

Due to several key factors, the healthcare and pharmaceuticals segment is experiencing remarkable growth in the simulation software market. The increasing complexity of drug development and healthcare systems necessitates advanced tools for research, testing, and optimization. Simulation software offers a cost-effective and efficient means to model intricate biological processes, drug interactions, and clinical scenarios, accelerating innovation. Additionally, the global emphasis on personalized medicine and the urgent need for drug discovery, especially during health crises, further drive demand. Moreover, regulatory agencies are increasingly recognizing the value of simulation in assessing drug safety and efficacy, boosting its adoption in this sector. Consequently, the healthcare and pharmaceuticals segment is witnessing rapid growth as stakeholders recognize the indispensable role of simulation software in advancing patient care and drug development.

By deployment mode, the cloud segment will grow at the highest CAGR during the forecast period.

The cloud deployment mode is experiencing explosive growth in the simulation software market. It offers scalability, allowing organizations to access and utilize simulation tools on-demand without hefty hardware investments. Additionally, cloud deployment fosters collaboration by enabling remote access and real-time data sharing among geographically dispersed teams. Furthermore, automatic updates and maintenance reduce IT overhead, ensuring that users always have access to the latest simulation capabilities. These benefits drive the rapid adoption of cloud-based solutions in the simulation software sector.

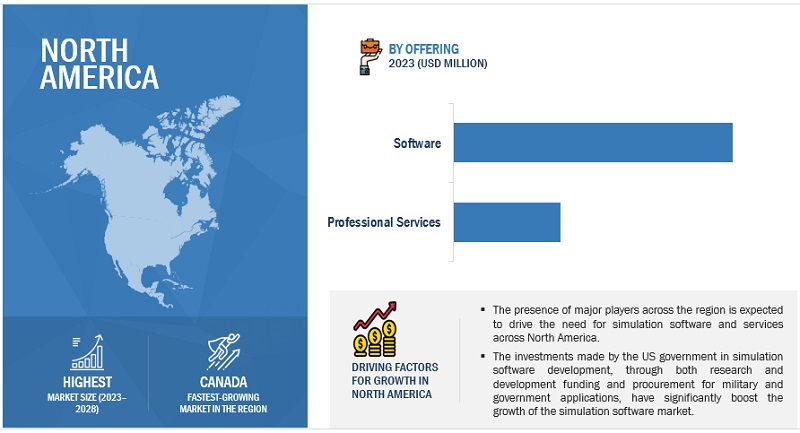

By region, North America accounts for the highest market size during the forecast period.

The simulation market in North America is experiencing rapid growth due to many research and development (R&D) institutions and major industry players like Siemens, ANSYS, Dassault Systemes, etc. These organizations continually drive innovation, fostering early adoption of simulation technology and the development of high-quality solutions. Additionally, the region hosts a diverse range of target industries, including automotive, aerospace & defense, industrial manufacturing, and healthcare. These increasingly turn to simulation software to enhance their operations and decision-making processes. Government support further amplifies this growth, with initiatives like R&D funding and tax incentives, creating a conducive environment for the region’s simulation software market to flourish.

Key Market Players

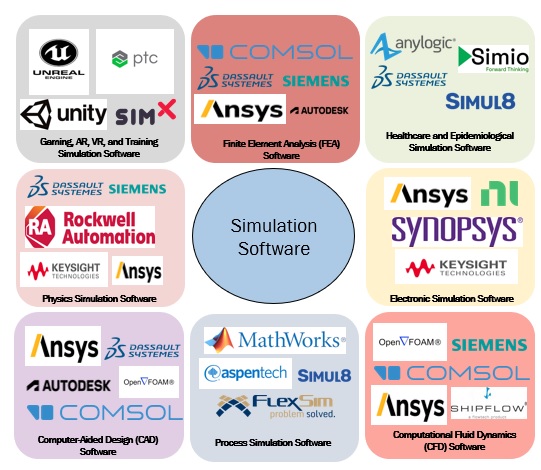

Siemens (Germany), Ansys (US), Dassault Systemes (France), MathWorks (US), Autodesk (US), Keysight (US), Hexagon (US), Honeywell (US), Altair (US), PTC (US), AVL (Austria), AVEVA (UK), Spirent (UK), Bentley (US), Synopsys (Canada), Certara (US), aPriori (US), AnyLogic (US), SimScale (Germany), Simul8 (UK), Simio (US), FlexSim (US), MOSIMTEC (US), ProSim (US), Cybernet (US), and Cesim (Finland) are the players in the simulation software market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Software Type, Deployment Mode, Application, Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global simulation software market include Siemens (Germany), Ansys (US), Dassault Systemes (France), MathWorks (US), Autodesk (US), Keysight (US), Hexagon (US), Honeywell (US), Altair (US), PTC (US), AVL (Austria), AVEVA (UK), Spirent (UK), Bentley (US), Synopsys (Canada), Certara (US), aPriori (US), AnyLogic (US), SimScale (Germany), Simul8 (UK), Simio (US), FlexSim (US), MOSIMTEC (US), ProSim (US), Cybernet (US), and Cesim (Finland). |

The study categorizes the simulation software market by segments - offering, software type, deployment mode, application, vertical, and region.

By Offering:

- Software

- Professional Services

By Software Type:

- Computer-Aided Design (CAD) Software

- Physics Simulation Software

- Finite Element Analysis (FEA) Software

- Computational Fluid Dynamics (CFD) Software

- Process Simulation Software

- Electronic Simulation Software

- Healthcare and Epidemiological Simulation Software

- Gaming, AR, VR, and Training Simulation Software

- Other Software Types (Financial and Economic, Environmental, Social, Molecular and Chemical, Traffic and Transportation)

By Deployment Mode:

- On-Premises

- Cloud

By Application

- Engineering, Research, Modeling, and Simulated Testing

- Automotive and Vehicle Simulation

- Gamification, VR, AR, and Immersive Experience

- Manufacturing and Process Optimization

- Urban Planning, Supply Chain, Logistics Management, and Transportation

- Healthcare and Medical Devices Simulation

- Other Applications (Cyber Simulation, Financial and Risk Management, Energy and Environmental)

By Vertical:

- Automotive

- Aerospace & Defense

- Electrical and Electronics

- Healthcare and Pharmaceuticals

- Oil & Gas, and Mining

- Construction

- Ship Building and Marine

- Chemicals

- Other Verticals

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In July 2023, Ansys (US) partnered with EikoSim to strengthen simulation validation. The partnership integrates EikoSim’s image analysis with Ansys Mechanical and LS-DYNA software, enhancing engineering simulation with EikoTwin’s validation capabilities.

- In June 2023, Dassault Systemes (France) joined forces with Dassault Aviation to deploy the 3DEXPERIENCE platform on a sovereign cloud infrastructure, enhancing European defense initiatives’ security and collaborative capabilities. This strategic endeavor seeks to cultivate self-sufficiency and extend its impact to various sectors, including healthcare and public services.

- In March 2023, MathWorks (US) and Green Hills Software partnered to integrate Simulink with Infineon AURIX TC4x microcontrollers for the streamlined design of safety-related applications. The collaboration facilitates automated code compilation through Embedded Coder and enables processor-in-loop (PIL) simulations for testing.

- In September 2022, Autodesk (US) and Epic Games joined forces, offering free access to Twinmotion for Autodesk Revit users. This collaboration enhances project visualization, including lifelike renders, animations, and VR, by integrating Twinmotion with Revit’s BIM software.

- In July 2022, Siemens (Germany) and Esri joined forces to enhance power grid planning, operations, and maintenance. This collaboration leverages Esri’s geospatial software and Siemens’ specialized knowledge to develop an all-encompassing digital representation of the grid. This advancement enhances the integration of Distributed Energy Resources and expedites the transition to a more sustainable energy ecosystem.

Frequently Asked Questions (FAQ):

What are the opportunities in the global simulation software market?

The expansion of the healthcare industry and the evolution of new technologies like quantum computing and artificial intelligence (AI) are a few factors contributing to the growth and creating new opportunities for the simulation software market.

What is the definition of the simulation software market?

Simulation software helps you predict the behavior of a system. You can use simulation software to evaluate a new design, diagnose problems with an existing structure, and test a system under conditions that are hard to reproduce, such as a satellite in outer space. To run a simulation, you need a mathematical model of your system, expressed as a block diagram, schematic, state diagram, or even code. The simulation software calculates the model’s behavior as conditions evolve over time or as events occur. Simulation software also includes visualization tools, such as data displays and 3D animation, to help monitor the simulation as it runs.

Which region is expected to show the highest market share in the simulation software market?

North America is expected to account for the largest market share during the forecast period.

What are the key players covered in the report?

Major vendors in the global simulation software market include Siemens (Germany), Ansys (US), Dassault Systemes (France), MathWorks (US), Autodesk (US), Keysight (US), Hexagon (US), Honeywell (US), Altair (US), PTC (US), AVL (Austria), AVEVA (UK), Spirent (UK), Bentley (US), Synopsys (Canada), Certara (US), aPriori (US), AnyLogic (US), SimScale (Germany), Simul8 (UK), Simio (US), FlexSim (US), MOSIMTEC (US), ProSim (US), Cybernet (US), and Cesim (Finland).

What is the current size of the global simulation software market?

The global simulation software market size is projected to grow from USD 18.1 billion in 2023 to USD 33.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 13.1% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

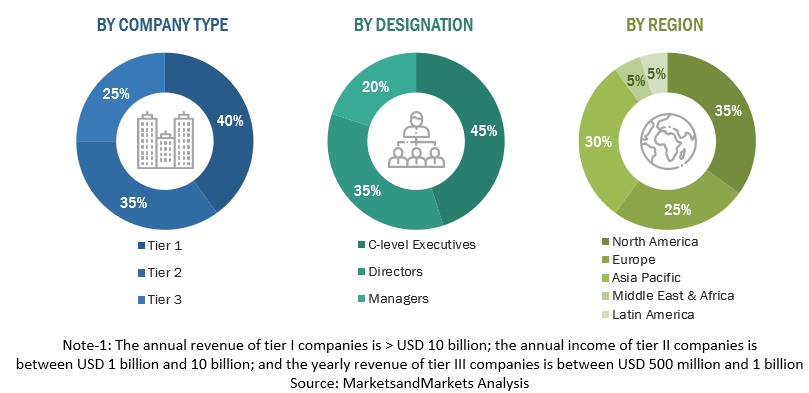

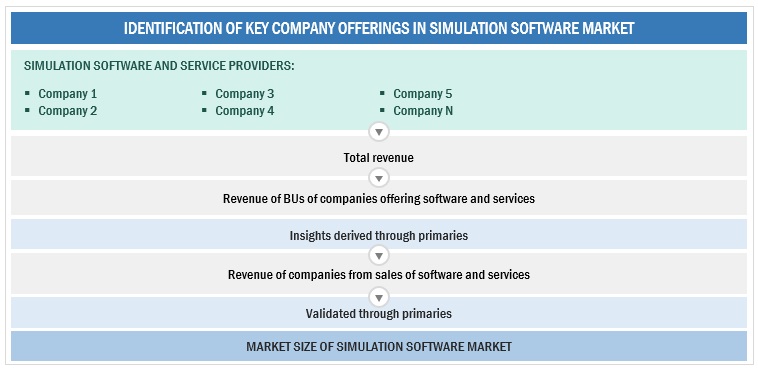

The study involved significant activities in estimating the current market size for the simulation software market. Exhaustive secondary research was done to collect information on the simulation software industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Simulation software market.

Secondary Research

The market for the companies offering simulation software and professional services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of simulation software vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Simulation software market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of Simulation software solutions offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global simulation software market and the size of various other dependent sub-segments in the overall simulation software market. The research methodology used to estimate the market size includes the following details: critical players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-Up and Top-Down Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MathWorks, Simulation software helps you predict the behavior of a system. You can use simulation software to evaluate a new design, diagnose problems with an existing design, and test a system under conditions that are hard to reproduce, such as a satellite in outer space. To run a simulation, you need a mathematical model of your system, which can be expressed as a block diagram, schematic, state diagram, or even code. The simulation software calculates the behavior of the model as conditions evolve over time or as events occur. Simulation software also includes visualization tools, such as data displays and 3D animation, to help monitor the simulation as it runs

Key Stakeholders

- Chief technology and data officers

- Simulation service professionals

- Business analysts

- Information Technology (IT) professionals

- Investors and venture capitalists

- Third-party providers

- Consultants/consultancies/advisory firms

- Product designers/computer-aided software engineers

- System Integrators

- Value-added Resellers (VARs)

Report Objectives

- To describe and forecast the global simulation software market by offering, software type, deployment mode, application, vertical, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information on significant factors (drivers, restraints, opportunities, and challenges) influencing the market’s growth

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the simulation software market and comprehensively analyze their market shares and core competencies

- Track and analyze competitive developments, such as mergers and acquisitions (M&A), new product developments, and partnerships and collaborations in the market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Simulation Software Market