Single Use Assemblies Market by Product (Bag, Filtration, Bottle, Mixing Assemblies), Solution (Standard, Customized), Application (Filtration, Cell Culture, Storage, Sampling, Fill-finish), End User (Biopharma, CROS & CMOS) & Region - Global Forecast to 2028

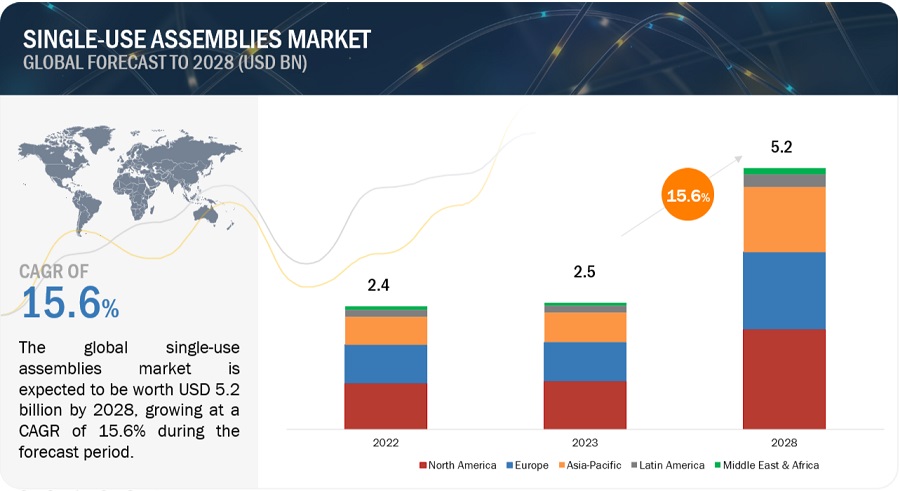

The global single use assemblies market in terms of revenue was estimated to be worth $2.5 billion in 2023 and is poised to reach $5.2 billion in 2028, growing at a CAGR of 15.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of the single-use assemblies market is largely driven by the increasing adoption of single-use assemblies among startups and SMEs, rapid implementation and the low risk of cross-contamination, growing biologics and biosimilar markets, cost savings with single-use assemblies, and technological advancements in single-use assemblies. On the other hand, extractability and leachability issues regarding disposable components, leakage and integrity issues, and regulatory concerns related to single-use assemblies are the major factors restraining the growth of this market.

Single Use Assemblies Market- Global Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Single Use Assemblies Market

Single Use Assemblies Market Dynamics

DRIVER: Technological advancements in single-use assemblies is projecting the market growth

Players operating in the global single-use assemblies market are increasingly developing and commercializing technologically advanced single-use products that offer streamlined workflows, portability, and rapid implementation. This increased focus has led to the development of affordable, innovative, integrated, and ready-to-implement single-use assemblies by major market players during the last decade. Such innovative products are expected to show significant demand growth during the forecast period, especially in mature markets where the adoption rate of technologically advanced products is high. In March 2022, Dover Corporation (US) announced the launch of liquid single-use bioprocessing bags for the handling and supply of sterile liquids for the biotherapeutics market

RESTRAINT: Issues related to leachables and extractives

Suppliers provide data regarding extractables from their products based on analysis under various likely process conditions (temperature, agitation, various buffers, etc.), but leachables can only be confirmed by testing the drug product. If leachables are present in the drug product, it is likely to be at trace levels compared to the biopharmaceutical product. Single-use assemblies are primarily made up of plastic films composed of multiple polymer layers. Each layer adds to the physical or chemical properties required for the single-use assembly to function in bioprocessing properly. Still, these layers may have their own set of additives like antioxidants, fillers, plasticizers, and stabilizers, among others, to obtain the necessary characteristics. The identities and levels of these additives are proprietary information and often not communicated to the biopharmaceutical manufacturer. Also, regulations regarding the contamination of single-use assemblies due to extractables and leachables are not yet established. This is a major factor restricting the use of single-use assemblies.

OPPORTUNITY: Emerging Market

The significant growth opportunities offered by emerging countries such as China, India, and Indonesia can be attributed to the high growth in their respective pharmaceutical & biopharmaceutical sectors due to the presence of less stringent regulatory policies and low-cost and skilled labor. Owing to cost advantages and skilled labor, these countries are a hub for bioprocess outsourcing.

CHALLENGE: Disposal of waste

Single-use assemblies are stainless-steel bodies that use bioprocessing bags, assemblies, and other accessories for applications like process development, bioproduction, and R&D. After a single use, these bags and assemblies are discarded. This results in significant amounts of plastic waste after each cycle of production. Since single-use bioprocessing systems have benefits like lower costs, faster process development time, and lower capital investments, biopharmaceutical companies are increasingly adopting them. However, there are significant issues with where the solid waste materials generated by this alternative technology are disposed of. The creation or adoption of more environmentally friendly options for manufacturers is an issue that many single-use providers are currently focusing on. The majority of single-use manufacturing materials are currently decontaminated and landfilled or incinerated commercially. However, through incineration with energy recovery or other more sustainable waste streams, there is a potential to further reduce the adverse effects of single-use systems. These include recycling, incineration (with and without energy recovery), landfill (untreated, treated, or with grinding), and pyrolysis.

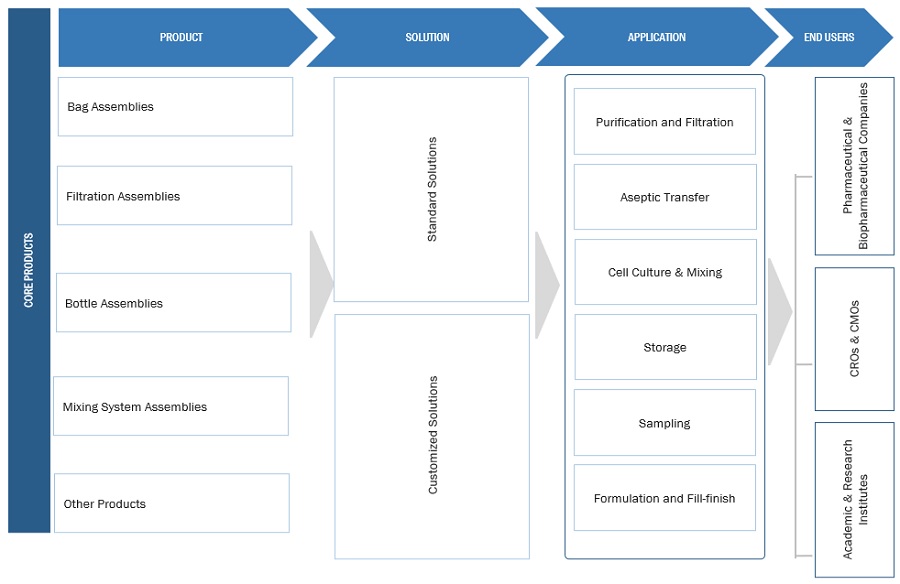

Global Single Use Assemblies Ecosystem Analysis

The single use assemblies market ecosystem comprises raw material suppliers, single-use assemblies product manufacturers, and end users such as pharmaceutical and biopharmaceutical manufacturers, CROs, CDMOs, and academic & research institutes. Single-use assemblies manufacturers provide various types of assemblies, such as bag assemblies, filtration assemblies, bottle assemblies, mixing system assemblies, and other products.

Pharmaceutical & biopharmaceuticals companies held a dominant share in end user segment in single use assemblies industry

The single use assemblies market is divided into three categories based on the end user: pharmaceutical and biopharmaceutical companies, contract research organizations & contract manufacturing organizations, and academic and research institutes. In 2022, the biopharmaceuticals and pharmaceutical companies segment held the largest market share. Since elderly people are more likely to develop diseases or disorders that require the use of biologics for the treatment, there is an increase in the demand for biopharmaceuticals among the geriatric population. As a result, pharmaceutical and biopharmaceutical companies are focusing more on producing affordable biologics at a lower price. Additionally, with the rise in the production of biologics and biosimilars, single-use assemblies are becoming more common since they have multiple applications in various stages of the production cycle.

The customized solutions segment of the single use assemblies industry is expected to register fastest growth during the forecast period.

Based on solution, the single use assemblies market is segmented into standard solutions and customized solutions. In 2022, the customized solutions segment is anticipated to grow at fastest pace during the forecast period. Customized solutions in single-use assemblies are tailored and specialized configurations of components designed to meet the specific needs and requirements of bioprocessing and manufacturing operations. These solutions offer flexibility and adaptability in optimizing the processes.

To know about the assumptions considered for the study, download the pdf brochure

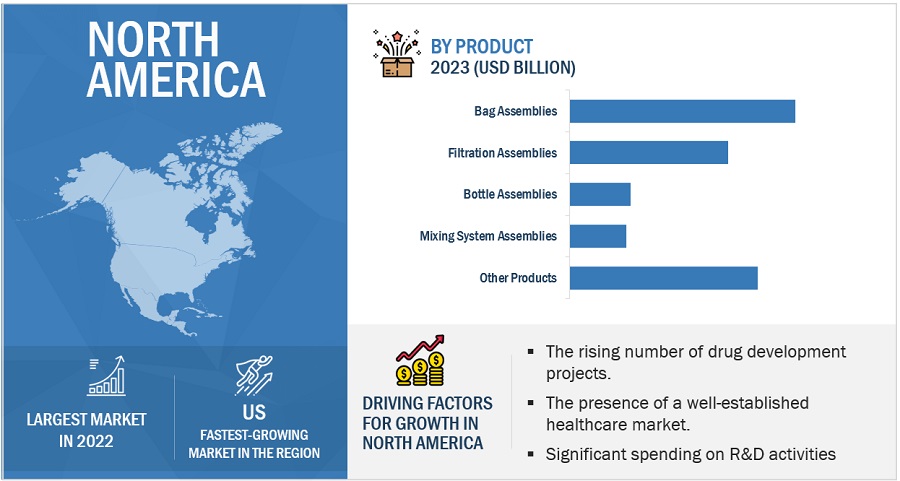

North America accounted for largest share in Single-use assemblies industry in 2022

Geographically, the single use assemblies market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held dominant share followed by Europe. The major players operating in the single-use assemblies market, such as Danaher (US) and Thermo Fisher Scientific (US), have a strong presence in North America, with a wide customer base and established distribution channels. The presence of a well-established biopharmaceutical industry in the region has also created a significant demand for single-use assemblies in this region. However, problems associated with the use of plastic-based disposable products (leachables and extractable) and the presence of stringent regulations for disposable systems are expected to restrain the growth of the single-use assemblies market in North America.

Key players in the global single use assemblies market include Thermo Fisher Scientific Inc. (US), Sartorius AG (Germany), Danaher (US), Merck KGaA (Germany), Avantor, Inc. (US), Parker Hannifin Corp. (US), Saint-Gobain (France), Repligen Corporation (US), Corning Incorporated (US), Entegris (US), Meissner Filtration Products, Inc. (US), NewAge Industries (US), Antylia Scientific (US), Lonza (Switzerland), Romynox (Netherlands), SaniSure (US), Keofitt A/S (Denmark), Intellitech, Inc. (US), Dover Corporation (US), Foxx Life Sciences (US), TSE Industries, Inc. (US), Fujimori Kogyo Co., Ltd. (Japan), Michelin (France), Cellexus (Scotland), and Fluid Flow Products, Inc. (US).

Scope of the Single Use Assemblies Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.5 billion |

|

Estimated Value by 2028 |

$5.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 15.6% |

|

Market Driver |

Technological advancements in single-use assemblies is projecting the market growth |

|

Market Opportunity |

Emerging Market |

This report categorizes the single use assemblies market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Mixing System Assemblies

- Other Products

By Solution

- Standard Solutions

- Customized Solutions

By Application

- Filtration & Purification

- Cell culture & Mixing

- Storage

- Sampling

- Formulation & Fill-Finish

- Other Applications

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- China

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- RoLATAM

-

Middle East & Africa

- Middle East

- Africa

Recent Developments of Single Use Assemblies Industry

- In February 2022, Sartorius Stedim Biotech (France) acquired the chromatography division of Novasep (France). The portfolio acquired comprises chromatography systems primarily suited for smaller biomolecules.

- In August 2022, Thermo Fisher Scientific opened a new single-use technology site in Tennessee, which has 400,000 square feet of floor space. It became the company’s largest SUT site in its growing network.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global single use assemblies market?

The global single use assemblies market boasts a total revenue value of $5.2 billion by 2028.

What is the estimated growth rate (CAGR) of the global single use assemblies market?

The global single use assemblies market has an estimated compound annual growth rate (CAGR) of 15.6% and a revenue size in the region of $2.5 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

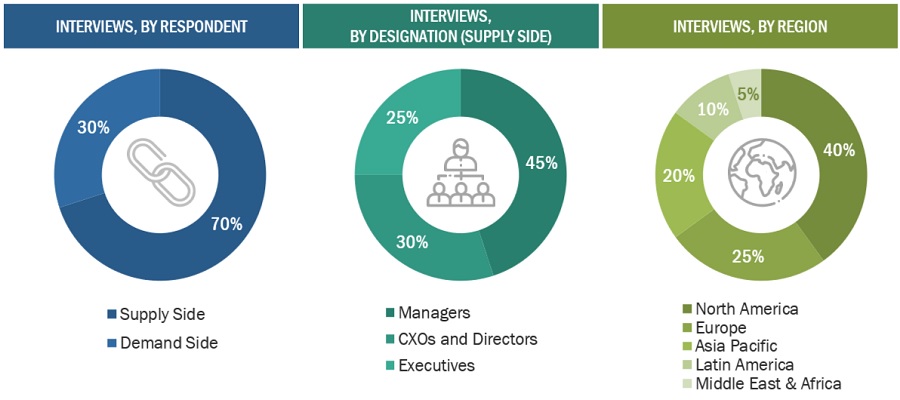

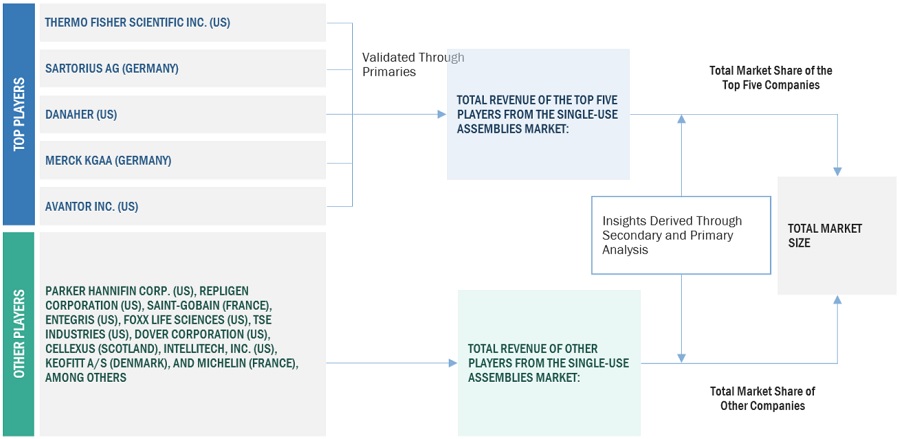

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global single-use assemblies market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the single-use assemblies market. The secondary sources used for this study include World Health Organization (WHO), National Institutes of Health (NIH), National Institute for Bioprocessing Research and Training (NIBRT), Society for Biological Engineering (SBE), Canadian Cancer Statistics (CCS), Germany Trade and Invest (GTAI), Bio-Process Systems Alliance (BPSA), European Patent Office (EPO), Pharmaceuticals Export Promotion Council of India (Pharmexcil), India Brand Equity Foundation (IBEF), Biotechnology Innovation Organization (BIO), National Center for Biotechnology Information (NCBI), World Bank, United States Food and Drug Administration (US FDA), US Census Bureau, Eurostat, Statistics Canada, Factiva, BioProcess International Magazine, BioPharm International, EvaluatePharma, Pharma Vision 2022, PharmaVOICE, Journal of Bioprocessing and Biotechniques, BioPlan Associates, The Scientist Magazine, ScienceDirect, research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global single-use assemblies market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical and biopharmaceutical companies, CROs, CMOs, and academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across five major regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

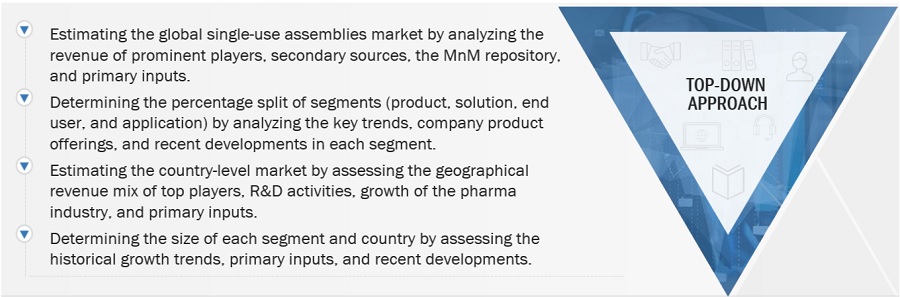

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the single-use assemblies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the single-use assemblies business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Single-use assemblies are a set of single-use bioprocessing components, such as bags, bottles, filters, mixers, and custom-made solutions, which are integrated/molded with tubing, connectors, pumps, adapters, and other fluid path management accessories for setting up bioprocess workflows. Single-use assemblies are widely used by pharmaceutical and biopharmaceutical companies, contract research organizations (CROs), contract manufacturing organizations (CMOs), and academic & research institutes to manufacture biopharmaceuticals and biosimilars.

Stakeholders

- Life Science Instrumentation and Reagent Companies

- Pharmaceutical and Biotechnology Companies

- Research and Consulting Firms

- Research Institutes

- Biopharmaceutical Manufacturers

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOs)

- Contract Development and Manufacturing Organizations

- Healthcare Service Providers (Including Hospitals and Diagnostic Centers)

Report Objectives

- To define, describe, and forecast the global single-use assemblies market based on the solution, product, application, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contributions to the overall single-use assemblies market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, and R&D activities in the single-use assemblies market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies.

Company Information

- Detailed analysis and profiling of additional market players (up to three).

Geographical Analysis

- A further breakdown of the Rest of Asia Pacific single-use assemblies market into countries

- A further breakdown of the Rest of European single-use assemblies market into countries

- A further breakdown of the Rest of Latin American single-use assemblies market into countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Single Use Assemblies Market

What are the new growth opportunities in industry segments related to Single-use Assemblies Market?

What are the growth opportunities and industry-specific challenges in Single-use Assemblies Market?

What are the key industry insights, current and future perspectives?

Can you elaborate more on the growth opportunities across different geographies for Single Use Assemblies Market?

How are leading companies advancing global growth of the Single Use Assemblies Market?