Smart City Platforms Market by Offering (Platforms (Connectivity Management, Integration, Device Management) and Services), Delivery Model (Offshore, Hybrid, On-site), Application (Smart Transportation and Public Safety) and Region - Global Forecast to 2028

Smart City Platforms Market - Size, Growth, Report & Analysis

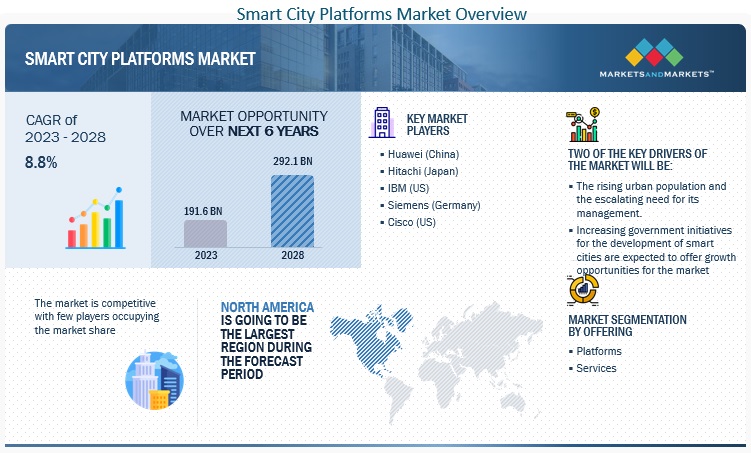

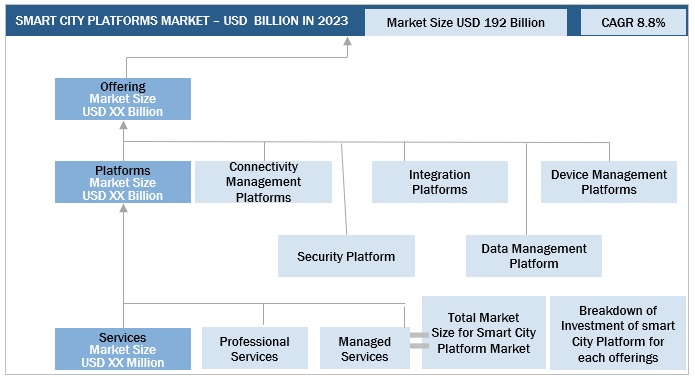

[289 Pages Report] The global Smart City Platforms Market size is estimated at $191.6 billion in 2023. The revenue forecast for 2028 is anticipated to reach $292.1 billion. It is projected to grow at a faster CAGR of 8.8% during the forecast period (2023-2028). The base year for estimation is 2022 and the market size available for the years 2016 to 2028.

The primary factor driving the growth of smart city platforms market is the increasing government spending and initiatives to establish smart city platforms developments. Governments worldwide have strong visions to improve the smart city platforms segment and fulfill future demands. They are undertaking several initiatives to provide better infrastructures, enhance security and safety, and offer seamless smart transportation. The augmented adoption of technologies in recent years has enabled better connectivity, resulting in the complete remodeling of the smart city platforms ecosystem.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart City Platforms Market Dynamics

Driver: Digital transformation augmenting scope for smart cities

With the rapid advancements in technologies, there is an increase in the adoption of digital solutions, connected devices, and IoT systems. This rapid rise in technological innovations has paved the way for digital transformation. Organizations across the world are increasingly implementing new technologies across their verticals to engage customers in innovative and captivating ways. The augmented adoption of multiple technologies, such as IoT, cloud, mobility, data communications, and AI, in recent years, has enabled better connectivity, resulting in complete remodeling of the smart cities ecosystem.

Restraint: Lack of standardization in IoT protocols

The diverse range of devices to be connected has increased the need to coordinate with these different devices. Various devices use different hardware, run over different platforms, and are manufactured by different vendors. This incompatibility among devices, sensors, and even interfaces of remote servers cause interoperability challenges in the IoT space. IoT and its applications involve every aspect of human life, and the challenge lies in unifying these standards so that M2M communication becomes user-friendly and flexible. Several associations and organizations are working toward resolving this issue. The absence of a universal standard for IoT is restraining IoT services and the smart city ecosystem from being more effective and scalable.

Opportunity: Rising smart city initiatives worldwide

The rapid explosion of IoT and smart cities initiatives is enhancing the need for smart security solutions, such as Perimeter Intrusion Detection System (PIDS), to make boundaries more secure. There is a growing focus on efficient energy management solutions to ensure proper metering and wastage minimization. Smart city infrastructure makes use of IoT technology to monitor and control different smart devices, minimize carbon emissions, and ensure improved and optimized route planning.

Challenge: Increasing concern over data privacy and security

The smart city platforms market has significant growth potential for enterprises across all verticals; however, maintaining data security and privacy is a key challenge for players operating in this market. The volume of data collected using installed smart devices and sensors introduces new security and privacy risks. The sharing of data through cloud services increases locations where personal data resides. Most of the cellular-based M2M application providers map, monitor, and store private data of individuals, and asset and vehicle information and provide remote access to different IT systems.

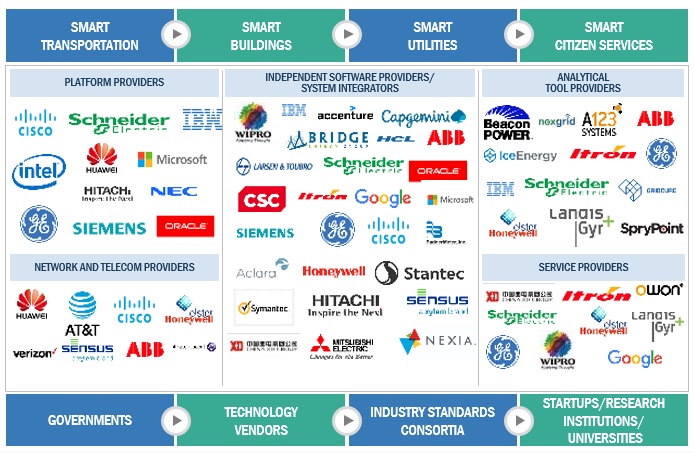

Smart City Platforms Market Ecosystem

Prominent companies in this market include well-established, financially stable provider of smart city platforms solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), Cisco (US), IBM (US), and Hitachi (Japan).

To know about the assumptions considered for the study, download the pdf brochure

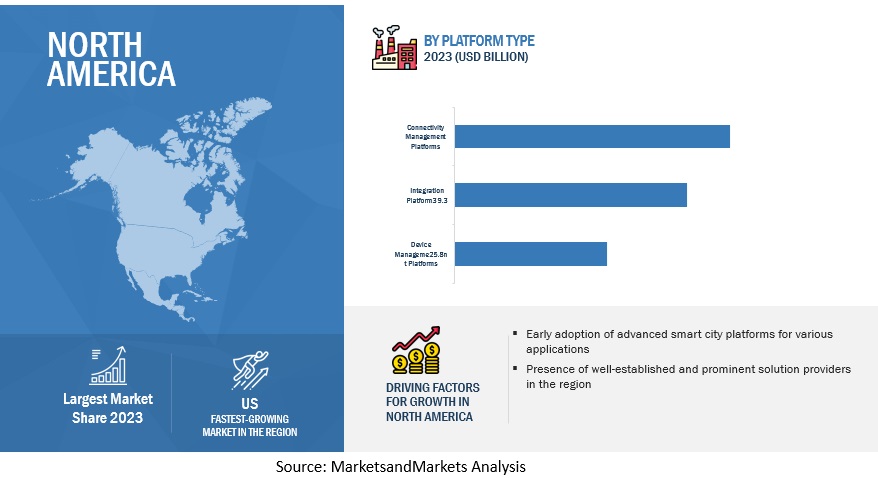

By platform type, connectivity management platform to hold the largest market size during the forecast period

Connectivity management platforms reduce additional costs and operational overheads while delivering an intelligent network of connected things. They primarily deal with connectivity operations across infrastructure that are carried out through cellular connectivity, Low Power Wide Area Network (LPWAN), and Wi-Fi. Prominent companies offering connectivity management platforms specifically for smart cities include Cisco, IBM, and Huawei. Since connectivity is the backbone of any smart infrastructure, the growth rate of the connectivity management platforms segment is relatively higher than that of other platforms.

By offering, the services segment is expected to register the fastest growth rate during the forecast period.

Smart city platforms services are segmented into professional services and managed services. These services facilitate smooth implementation, development, and maintenance of ongoing activities in organizations. Smart city platform providers assist and support customers, partners, support teams, marketing teams, and employees with individual development and training. The growing need for technical expertise for deployment is expected to be one of the key factors supporting the growth of deployment & training services.

North America is expected to hold the largest market size during the forecast period.

North America is expected to hold the largest share of the overall smart city platforms market. North America leads smart city usage, with the US and Canada at the forefront. These countries have sustainable and well-established economies, which empower them to invest strongly in R&D activities, thereby contributing to developing new technologies. Network operators in this region constantly invest in expanding and upgrading their telecom networks and transition toward 5G infrastructure. This leverages technologies, such as cloud edge computing and network slicing, thereby actuating the adoption of smart cities at a low cost for strategic urban management.

Market Players:

The major players in the smart city platforms market are Alibaba Group Holding Limited (China), Amazon Web Services, Inc. (US), Bosch.IO GmbH (Germany), Quantela, Inc. (US), Cisco Systems, Inc. (US), Ericsson (Sweden), Fujitsu Limited (Japan), Fybr (US), Google LLC (US), Hitachi, Ltd. (Japan), Huawei Technologies Co., Ltd. (China), IBM (US), Intel Corporation (US), KaaIoT Technologies (US), Microsoft (US), NEC Corporation (Japan), Oracle Corporation (US), SAP SE (Germany), Schneider Electric (France), SICE (Spain), Siemens AG (Germany), Sierra Wireless Inc. (Canada), SIRADEL SAS (France), Smarter City Solutions (Australia), Thethings.Io (Spain), Ubicquia, Inc (US), Verdigris Technologies, Inc (US), Softdel (US), Igor, Inc (US), Telensa Inc (UK), Enevo Inc. (US), Confidex Ltd (Finland), 75F (US), Ketos (US), and Cleverciti Systems GmbH (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the smart city platforms market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Platforms and Services), Delivery Model, Application, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Alibaba Group Holding Limited (China), Amazon Web Services, Inc. (US), Bosch.IO GmbH (Germany), Quantela, Inc. (US), Cisco Systems, Inc. (US), Ericsson (Sweden), Fujitsu Limited (Japan), Fybr (US), Google LLC (US), Hitachi, Ltd. (Japan), Huawei Technologies Co., Ltd. (China), IBM (US), Intel Corporation (US), KaaIoT Technologies (US), Microsoft (US), NEC Corporation (Japan), Oracle Corporation (US), SAP SE (Germany), Schneider Electric (France), SICE (Spain), Siemens AG (Germany), Sierra Wireless Inc. (Canada), SIRADEL SAS (France), Smarter City Solutions (Australia), Thethings.Io (Spain), Ubicquia, Inc (US), Verdigris Technologies, Inc (US), Softdel (US), Igor, Inc (US), Telensa Inc (UK), Enevo Inc. (US), Confidex Ltd (Finland), 75F (US), Ketos (US), and Cleverciti Systems GmbH (Germany). |

This research report categorizes the smart city platforms market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Platforms

- Connectivity Management Platforms

- Integration Platforms

- Device Management Platforms

- Security Platforms

- Data Management Platforms

-

Services

-

Professional Services

- Consulting & Architecture Designing

- Infrastructure Monitoring & Management

- Deployment & Training

- Managed Services

-

Professional Services

Based on Delivery Model:

- Offshore

- Hybrid

- On-site

Based on Application:

- Smart Transportation

- Public afety

- Smart Energy & Utility

- Infrastructure Management

- Citizen Engagement

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- KSA

- UAE

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments

- In November 2022, Hitachi launchedTRO610 cellular router, developed specifically to serve industrial internet of things (IIoT) applications for utilities, smart cities, oil & gas, manufacturing, and mining activities, offers cutting-edge communications and cybersecurity.

- In august 2022, Siemens acquired Brightly Software, this acquisition helped Siemens Smart Infrastructure (SI) to hold a dominant position in the software market for structures and built infrastructure.

- In September 2022, IBM acquired Dialexa, with a purpose to enhance the organization's hybrid cloud and AI expertise and capabilities. Contributing to IBM’s smart infrastructure solutions.

Frequently Asked Questions (FAQ):

What is the definition of smart city platforms market?

A smart city effectively uses its information and communication technology (ICT) infrastructure to enhance the quality of life of its residents and the efficiency of urban operations and services, thereby ensuring that the economic, social, and environmental needs of both the present and future generations are met. In order to provide latent-free solutions for smart cities, smart city platforms offer a middleware operational capacity that allows the integration of various software and hardware as well as a number of communication protocols.

What is the market size of the smart city platforms market?

The smart city platforms market is estimated at USD 191.6 billion in 2023 and is projected to reach USD 292.1 billion by 2028, at a CAGR of 8.8% from 2023 to 2028.

What are the major drivers in the smart city platforms market?

The major drivers in smart city platforms market are preference for platforms over standalone solutions, exponential rise in urban population resulting in need for smart management, increasing adoption of IoT technology for infrastructure management and city monitoring, and inefficient utilization of resources in developing countries

Who are the key players operating in the smart city platforms market?

The key market players profiled in the smart city platforms market are Alibaba Group Holding Limited (China), Amazon Web Services, Inc. (US), Bosch.IO GmbH (Germany), Quantela, Inc. (US), Cisco Systems, Inc. (US), Ericsson (Sweden), Fujitsu Limited (Japan), Fybr (US), Google LLC (US), Hitachi, Ltd. (Japan), Huawei Technologies Co., Ltd. (China), IBM (US), Intel Corporation (US), KaaIoT Technologies (US), Microsoft (US), NEC Corporation (Japan), Oracle Corporation (US), SAP SE (Germany), Schneider Electric (France), SICE (Spain), Siemens AG (Germany), Sierra Wireless Inc. (Canada), SIRADEL SAS (France), Smarter City Solutions (Australia), Thethings.Io (Spain), Ubicquia, Inc (US), Verdigris Technologies, Inc (US), Softdel (US), Igor, Inc (US), Telensa Inc (UK), Enevo Inc. (US), Confidex Ltd (Finland), 75F (US), Ketos (US), and Cleverciti Systems GmbH (Germany).

Which are the key technology trends prevailing in smart city platforms market?

The technologies trends dominating the smart city are adoption of Artificial intelligence (AI) and machine learning (ML), 5G connectivity being talked up as the catalyst that will create smarter cities and interoperable IoT.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

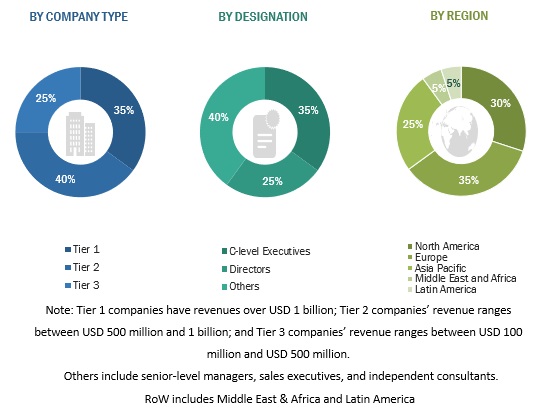

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global smart city platforms market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. These included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the US Department of Transportation, SmartAmerica Project, European Innovation Partnership on Smart Cities and Communities (EIP-SCC), European Business and Technology Centre (EBTC), and Smart Cities Council India. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the smart city platforms market. The primary sources from the demand side included DNS end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Hitachi |

Solution and Strategy Innovator |

|

NEC Corporation |

Presales Manager |

|

AIPARK GmbH |

COO |

|

Gaia Smart Cities |

Director |

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the smart city platforms market. The first approach involves estimating the market size by summating companies’ revenue generated through smart city platforms solutions and services. In this approach for market estimation, we identified the key companies offering smart city platforms solutions and services by offerings: products and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the smart city platforms market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Smart city platforms Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Smart city platforms Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall smart city platforms market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Smart cities are functional city systems built on smart infrastructure, such as intelligent grids, renewable energy sources, water treatment and supply systems, intelligent lighting systems, building automation systems, emergency management systems, security systems, and access control systems. Many end users are making an effort to integrate data from these various systems to present a comprehensive picture of the performance and state of the city as a whole, and of its numerous services.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- IT Department

Report Objectives

- To determine and forecast the global smart city platforms market by offering (platforms and services), delivery model, application, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the smart city platforms market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart City Platforms Market