Automotive Smart Display Market by Application, Display Size (<5”, 5”-10”, >10”), Display Technology (LCD, TFT-LCD, OLED), Autonomous Driving (Semi-autonomous, Autonomous), Electric Vehicle, Vehicle Class, Vehicle Type, and Region - Global Forecast to 2025

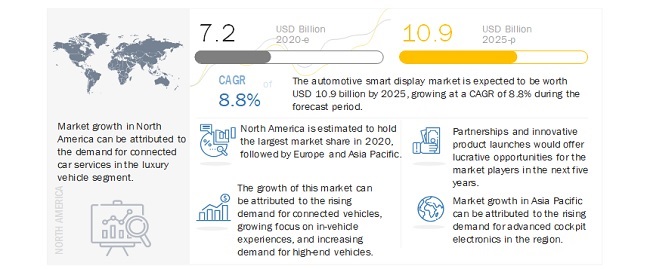

[ 242 Pages Report] The global automotive smart display market size was valued at USD 7.2 billion in 2020 and is expected to reach USD 10.9 billion by 2025, at a CAGR of 8.8% during the forecast period 2020-2025. The market is driven by increased demand for semi-autonomous and autonomous vehicles, demand for improved consumer experience in vehicles, and high growth in the luxury and high-end cars segments, mainly in the emerging markets.

The COVID-19 pandemic has decelerated the growth of the automotive smart display market. Lower vehicle sales are likely to weaken the demand for vehicle and passenger safety features. Nationwide lockdowns and suspension of major business activities by OEMs have delayed the testing of semi-autonomous driving systems and advanced safety features. The lack of interest from OEMs in investing in advanced technologies for the next one or two years will be a major setback for automotive smart manufacturers, and the market is estimated to witness a dip in 2020.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Integration of smartphone connectivity in cars

The syncing of smartphones with infotainment systems, such as Android Auto, Spotify, and Apple CarPlay, will increase the demand for smart displays in vehicles. Both Apple CarPlay and Android Auto are similar in that they involve the usage of smartphones to run the operating systems, which have been optimized for road applications. The systems enable easy navigation, integration of advanced features with cockpit electronics, easy access to music, phone call management etc., all of which without distracting the driver. Both the operating systems even integrate voice assistants, such as Apple Siri and Google Assistant, to deliver a handsfree experience. Cars must have the correct kit to run the operating systems, and more manufacturers are embracing them, often allowing a support feature as a standard inclusion on their infotainment systems or at least as an option.

Restraint: Threat of cyberattacks

Most modern vehicles have features that use wireless technologies, which, in turn, increase the risks of cyberattacks. The increase in vehicle connectivity through devices such as smartphones, music players, and tablets has also raised the vehicle’s cyber risk. When carry-in devices are connected to the vehicle, viruses and malware could attack automotive electronics through vehicle entertainment systems or vehicle information terminals. Excessive connectivity also increases the risk of hacking.

Even if external devices are not connected to the automotive cockpit electronics system of the vehicle, the vehicle can still be hacked, as all advanced cockpit electronics systems are connected to the Internet, and the data is stored in the cloud database or the research centers of the OEMs. This can be understood through the Nissan Sam system. Recently, Nissan announced the use of Mars Rover technology from NASA to operate its fleet of autonomous vehicles. This solution is termed as Seamless Autonomous Mobility (SAM), and the company considers it a solution for situations when autonomous vehicles react to counter any unexpected situation on the road. In such a situation, the mobility manager from the research center will interact with the autonomous car to guide the vehicle. Thus, all data is stored outside in a research center and, hence, there is an increased threat of a cyber breach.

As privacy and security are the cornerstones of telematics offerings, the existing global economic scenario indicates the shifting of focus on technologies that will give users a system that guarantees ease of driving, along with universal connectivity without compromising on privacy and security. There is a potential for the misuse of collected data through telematics. The driver may substitute the wrong data or hack into the vehicle application. Telecommunications Service Providers (TSPs) and application providers may sell the vehicle owners’ data to third parties without permission.

Opportunity: Focus on 5G and wireless technology

Along with the increasing use of wireless technology, the advent of 5G technology is expected to create more opportunities for the automotive smart display market. 5G offers high-speed internet, which helps in integrating automotive smart display systems with innovative applications, such as virtual reality (VR), augmented reality (AR), cloud gaming, and media streaming. These applications will require better quality display screens, which will trigger the demand for automotive smart displays.

5G enables the integration of automotive applications with smart display systems. Hence, large-size integrated display panels will be required in vehicles, instead of the conventional dashboards. AR and VR devices leverage 5G to offer a better experience. Both AR and VR require higher resolution panels for a display to offer better performance. Compared to 4G LTE technology, 5G offers a faster speed of up to 5 times and 10 times lower latency.

In October 2019, LG Display partnered with Qualcomm Technologies to develop a 5G connected car solution. 5G technology will facilitate V2V and V2I communication, which is among the main objectives of the partnership.

Challenge: Integration of multiple assistance systems

The integration of driver assistance systems and smart display systems significantly helps a driver in manoeuvring the vehicle. Since this integration helps in improving safety, the combination is being looked up by many automakers. However, the integration of driver assistance systems and smart display systems is not as easy as it sounds.

To know about the assumptions considered for the study, download the pdf brochure

The semi-autonomous segment is expected to be the largest automotive smart display market during the forecast period

The adoption of semi-autonomous vehicles is growing worldwide due to the increasing integration of automotive electronic components, safety features, and increased use of in-vehicle automotive smart display applications that provide better vehicle-driver communication. Thus, prominent OEMs are increasingly investing in the manufacturing of semi-autonomous vehicles and components. The rapid development of semi-autonomous vehicles shows that the demand for these vehicles would increase exponentially in the coming years. The semi-autonomous segment is also anticipated to rise in the coming years due to an increase in the electrification of vehicle components and the use of smart automotive components that assist the driver in terms of comfort and safe driving. Also, technologically driven companies and OEMs are collaborating to make semi-autonomous and autonomous vehicles a safer mode of transportation, thereby engaging consumer curiosity. With developments in autonomous driving, vehicles will be equipped with more number of automotive smart displays that will also be larger, providing advanced driver assistance on a single touchscreen platform. Hence, the semi-autonomous segment of the automotive smart display market is expected to grow significantly during the forecast period.

The center stack segment is projected to be the largest automotive smart display market during the forecast period

Center stack displays are infotainment systems that offer a wide range of interactive content like navigation, cabin temperature controls, music, and other entertainment information. Technological developments in connected and self-driving cars have led to the increased demand for center stack in vehicles. Factors such as increased use of electronics, elimination of multiple screens, and the inclusion of advanced features such as infotainment and telematics are driving the growth of the center stack segment. Japan Display and LG Display are among the major manufacturers of center stacks for vehicles. Europe is the largest market for center stack due to the high adoption in vehicles in countries such as Germany, the UK, and France. Almost all vehicle manufacturers in the UK are installing center stack in their cars. The market in the European countries is driven by technological advancements implemented by automotive manufacturers. These displays are developed to be compatible with advanced operating systems and connected car technologies. Also, the manufacturing practices of major European OEMs are driven by advanced technology, which, in turn, drives the development of autonomous and semi-autonomous cars, thereby raising the demand for smart displays.

Source: Secondary Research, Expert Interviews, Company Presentations, and MarketsandMarkets Analysis

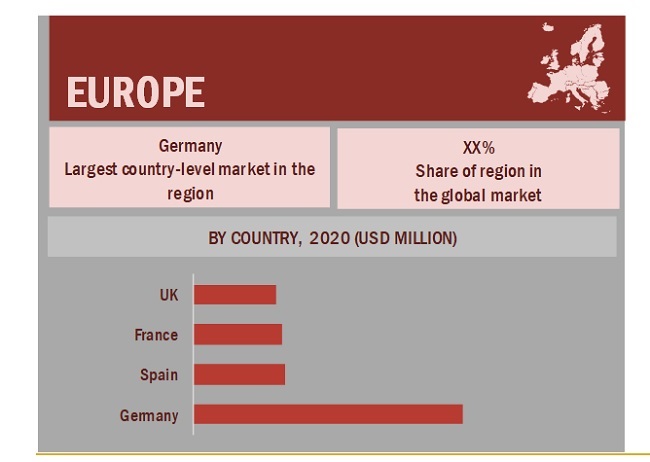

“The Europe automotive smart display market is projected to hold the largest share by 2025.”

The European region is a hub for automotive giants and premium vehicle manufacturers. Production activity in the region has been boosted by investments made by OEMs such as Jaguar Land Rover, Daimler, VW, Nissan, BMW, and Honda. Automobile giants such as Jaguar Land Rover manufacture premium cars with highly advanced electronics. The majority of OEMs in the region install advanced features in vehicles, which will drive the European automotive smart display market. The augmented reality smart display systems, such as HUDs, are also developed to be compatible with advanced operating systems and feature in several advanced connected car services in Europe. The manufacturing practices of major European OEMs are also driven by advanced technology, which, in turn, drives the development of autonomous and semi-autonomous cars and raises the demand for connected vehicles. Automotive smart display applications such as the center stack and HUD would play a key role in semi-autonomous and autonomous vehicles. The major growth drivers for the market in this region include growing demand for technology, the rising need for a safe and secure driving experience, and an increase in the development of connected cars.

Key Market Players

Some of the leading manufacturers and suppliers of automotive smart display market are Bosch(Germany), Continental (Germany), DENSO (Japan), Visteon (US), Nippon Seiki Japan), Panasonic (Japan), Pioneer (Japan), Yazaki (Japan), and others. These companies adopted inorganic and organic growth strategies such as new product developments, expansions, supply contracts, collaborations, partnerships, and mergers & acquisitions to gain traction in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Volume (Thousand Units), Value (USD million) |

|

Segments Covered |

Application, Display Size, Display Technology, Electric Vehicle, Autonomous Driving, Vehicle Class, Vehicle Type, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Bosch (Germany), Continental (Germany), Denso (Japan), Visteon (US), Nippon Seiki (Japan), Panasonic (Japan), Pioneer (Japan), and Yazaki (Japan) |

This research report categorizes the automotive smart display market on the basis of application, display size, display technology, electric vehicle, autonomous driving, vehicle class, vehicle type, and region.

Market, By Application

- Center Stack

- Digital Instrument Cluster

- Head-up Display (HUD)

- Rear Seat Entertainment

Market, By Display Size

- <5”

- 5”-10”

- >10”

Market, By Display Technology

- LCD

- TFT-LCD

- OLED

- Others

Market, By Autonomous Driving

- Semi-Autonomous

- Autonomous

Market, By Electric Vehicle

- BEV

- FCEV

- HEV

- PHEV

Market, By Vehicle Class

- Economy

- Mid-segment

- Luxury

Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In June 2020, Bosch launched the SMI230, a highly precise MEMS sensor that constantly registers changes in the vehicle’s direction and speed, evaluates the information, and transmits it to the navigation system. The information is combined with the positional data from the global navigation satellite system (GNSS) and used for navigation.

- In June 2020, Pioneer Corporation launched two new Smart Unit Receivers for in-car entertainment. Called the SDA-835TAB and SPH-T20BT, the two are available at about USD 460 as a combo. The SDA-835TAB tablet has an 8” high-resolution capacitive screen display and comes with Android. The SPH-T20BT sports a 2-DIN receiver equipped with a tablet mount cradle, MOSFET 50Wx4 ampli?er, 3 RCA preout, a rear camera input, Bluetooth, and more.

- In May 2020, Pioneer Corporation and Continental AG signed a strategic cooperation agreement. Their integrated infotainment solution means both partners create a holistic user experience that is especially aimed at the Asian market. Continental will integrate Pioneer’s entire infotainment subdomain into its high-performance computer for vehicle cockpits as part of the agreement. The integration of such extensive software packages into a complex overall solution such as the cockpit high-performance computer (HPC) from Continental will offer vehicle manufacturers a much greater degree of flexibility regarding the development of cockpit systems

- In May 2020, Alps Alpine proposed a form of the touchless control panel for situations when touching is undesirable, not possible, or not allowed in settings such as medical or nursing care or public facilities. Devices with touch panels are also being introduced for tasks traditionally performed via communication between people or with writing, such as ordering at a restaurant, front desk operations at public facilities, and recording of clinical notes by medical professionals.

- In October 2019, Nippon Seiki expanded its development center in Tokyo, Japan, for its HUD business. The new Tokyo R&D center would be responsible for tasks such as integrated cockpit development, next-generation HUD development, and product development enhancement.

Frequently Asked Questions (FAQ):

How will automotive smart display market perform through 2025?

The automotive smart display market is projected to reach USD 10.9 billion by 2025, at a CAGR of 8.8%

Which countries are considered in the European region?

The report inlcudes European countries such as:

- Germany

- France

- Spain

- Turkey

- Russia

- Italy

- UK

- Rest of Europe

We are interested in regional automotive smart display market for electric vehicles? Does this report cover the electric vehicle segment?

Yes, the report covers the automotive smart display market for different electric vehicle types at regional level.

Does this report include impact of COVID-19 on the automotive smart display market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the automotive smart display market.

Does this report contain market size of automotive smart display solutions for luxury vehicles or premium segment vehicles?

Yes, market size of automotive smart display is extensively covered in terms of volume across different vehicle classes (economy, mid-segment, and luxury). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE SMART DISPLAY MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: MARKET

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

FIGURE 2 MNM DOWNGRADES ITS FORECAST OF MARKET

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE SMART DISPLAY MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

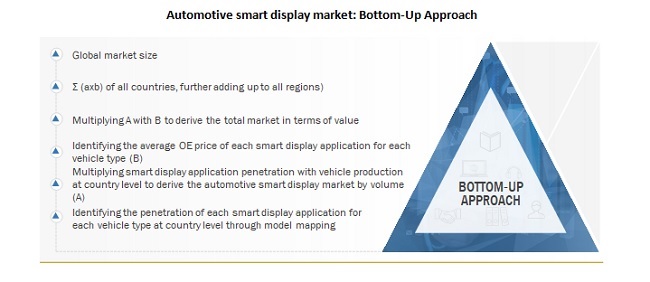

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 GLOBAL MARKET SIZE: BOTTOM-UP APPROACH

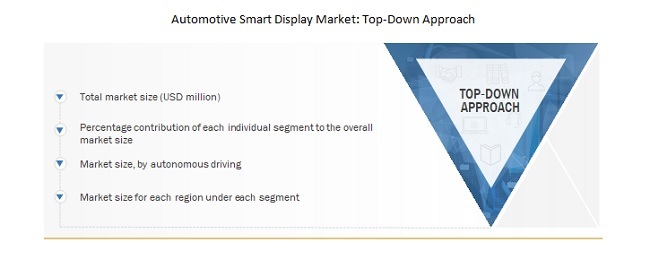

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 8 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 9 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF PANASONIC REVENUE ESTIMATION

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 11 AUTOMOTIVE SMART DISPLAY: MARKET OUTLOOK

FIGURE 12 AUTOMOTIVE SMART DISPLAY MARKET: MARKET DYNAMICS

FIGURE 13 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 14 COVID-19 IMPACT ON MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 MARKET TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD (2020-2025)

FIGURE 15 INCREASING DEMAND FOR CONNECTED CARS AND COCKPIT ELECTRONICS LIKELY TO BOOST MARKET GROWTH

4.2 NORTH AMERICA ESTIMATED TO LEAD MARKET IN 2020

FIGURE 16MARKET SHARE, BY REGION, 2020

4.3 MARKET, BY APPLICATION

FIGURE 17 CENTER STACK SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

4.4 MARKET, BY DISPLAY SIZE

FIGURE 18 5"-10" SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

4.5 MARKET, BY DISPLAY TECHNOLOGY

FIGURE 19 LCD SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 ('000 UNITS)

4.6 MARKET, BY AUTONOMOUS DRIVING

FIGURE 20 SEMI-AUTONOMOUS SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE, 2020 VS. 2025 (USD MILLION)

4.7 MARKET, BY ELECTRIC VEHICLE

FIGURE 21 BEV SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

4.8 MARKET, BY VEHICLE CLASS

FIGURE 22 MID-SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 ('000 UNITS)

4.9 MARKET, BY VEHICLE TYPE

FIGURE 23 PC SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MARKET DYNAMICS: AUTOMOTIVE SMART DISPLAY MARKET

5.2.1 DRIVERS

5.2.1.1 Integration of smartphone connectivity in cars

TABLE 2 FEATURES OF APPLE CARPLAY

TABLE 3 GLOBAL NUMBER OF SMARTPHONE USERS OVER THE YEARS

5.2.1.2 Increasing focus to provide AR experience

TABLE 4 AR HUD FEATURED AUTOMAKERS

5.2.1.3 Rising adoption of cameras in vehicles

5.2.1.4 Increasing adoption of OLED technology

5.2.2 RESTRAINTS

5.2.2.1 Threat of cyberattacks

FIGURE 25 NEW STUDY HIGHLIGHTS CRITICAL CYBERSECURITY RISKS IN AUTOMOTIVE INDUSTRY

5.2.3 OPPORTUNITIES

5.2.3.1 Focus on 5G and wireless technology

5.2.3.2 Advent of semi-autonomous vehicles

TABLE 5 ROADMAP FOR TECHNOLOGY LEVEL & IMPLEMENTATION OF SEMI-AUTONOMOUS AND AUTONOMOUS DRIVING SYSTEM

5.2.3.3 Rising sales of electric vehicles

TABLE 6 ELECTRIC PASSENGER CAR SALES

5.2.3.4 New entertainment and smart mirror applications

5.2.4 CHALLENGES

5.2.4.1 Integration of multiple assistance systems

TABLE 7 ISSUES RELATED WITH INTEGRATION OF DRIVER ASSISTANCE SYSTEMS

5.2.4.2 High cost of advanced automotive display systems

5.2.4.3 Distraction for drivers

TABLE 8 DISTRACTION-INDUCED CRASHES, BY CRASH SEVERITY, 2016-2018

5.3 PORTER'S FIVE FORCES

FIGURE 26 PORTER'S FIVE FORCES: AUTOMOTIVE SMART DISPLAY MARKET

5.3.1 TECHNOLOGY ANALYSIS

5.3.1.1 Introduction

5.3.1.2 AR Technology

5.3.1.3 Flexible display solution

5.3.1.4 Application of polycarbonate material

TABLE 9 BENEFITS OF POLYCARBONATE MATERIAL

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 MARKET: VALUE CHAIN ANALYSIS

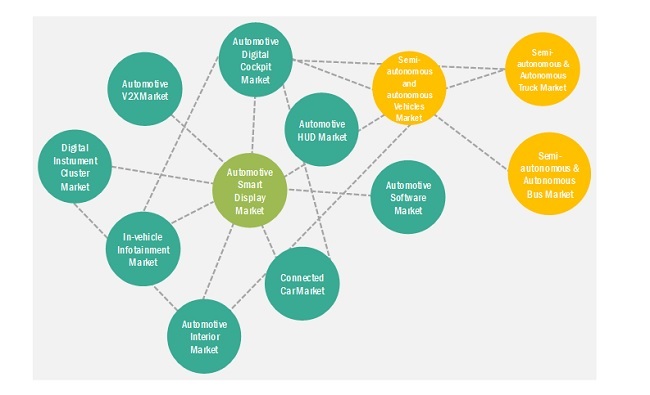

5.5 ECOSYSTEM ANALYSIS

FIGURE 28 MARKET: ECOSYSTEM ANALYSIS

5.6 PRICING ANALYSIS

FIGURE 29 MARKET: AVERAGE PRICE OF SMART DISPLAY

5.7 REGULATORY ANALYSIS

TABLE 10 REGULATIONS FOR SMART DISPLAY SYSTEMS

5.8 PATENT ANALYSIS

5.9 CASE STUDY ANALYSIS

5.9.1 LG ELECTRONICS LTD.

5.9.2 JAPAN DISPLAY INC.

6 COVID-19 IMPACT (Page No. - 65)

6.1 INTRODUCTION TO COVID-19

6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 30 COVID-19: THE GLOBAL PROPAGATION

FIGURE 31 COVID-19 PROPAGATION: SELECT COUNTRIES

6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 32 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.3.1 COVID-19 ECONOMIC IMPACT-SCENARIO ASSESSMENT

FIGURE 33 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 34 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

6.4 IMPACT ON GLOBAL AUTOMOTIVE INDUSTRY

6.4.1 IMPACT ON GLOBAL AUTOMOTIVE SMART DISPLAY MARKET

6.5 MARKET SCENARIOS (2020-2025)

FIGURE 35 MARKET- FUTURE TRENDS & SCENARIO, 2020-2025 (USD MILLION)

6.5.1 MOST LIKELY SCENARIO

TABLE 11 MARKET: MOST LIKELY SCENARIO, BY REGION, 2017-2025 (USD MILLION)

6.5.2 OPTIMISTIC SCENARIO

TABLE 12 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2020-2025 (USD MILLION)

6.5.3 PESSIMISTIC SCENARIO

TABLE 13 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2020-2025 (USD MILLION)

7 AUTOMOTIVE SMART DISPLAY MARKET, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

TABLE 14 ASSUMPTIONS: BY APPLICATION

7.1.3 KEY PRIMARY INSIGHTS

FIGURE 36 KEY PRIMARY INSIGHTS

7.1.4 OPERATIONAL DATA

TABLE 15 APPLICATIONS THAT BENEFIT FROM HUD

FIGURE 37 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2020-2025 ('000 UNITS)

TABLE 17 MARKET, BY APPLICATION, 2020-2025 (USD MILLION)

7.2 DIGITAL INSTRUMENT CLUSTER

7.2.1 INCREASING DEMAND FOR FULLY RECONFIGURABLE CLUSTER

TABLE 18 DIGITAL INSTRUMENT CLUSTER: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 19 DIGITAL INSTRUMENT CLUSTER: MARKET, BY REGION, 2017-2025 (USD MILLION)

7.3 CENTER STACK

7.3.1 EUROPE ESTIMATED TO HAVE LARGEST MARKET SHARE IN 2020

TABLE 20 CENTER STACK: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 21 CENTER STACK: MARKET, BY REGION, 2017-2025 (USD MILLION)

7.4 HEAD-UP DISPLAY (HUD)

7.4.1 INTEGRATION OF DRIVING ASSISTANCE FEATURES WITH HUD LIKELY TO INCREASE DEMAND FOR HUDS

TABLE 22 HUD: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 23 HUD: MARKET, BY REGION, 2017-2025 (USD MILLION)

7.5 REAR SEAT ENTERTAINMENT

7.5.1 RISING DEMAND FOR REAR SEAT ENTERTAINMENT

TABLE 24 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 25 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2017-2025 (USD MILLION)

8 AUTOMOTIVE SMART DISPLAY MARKET, BY DISPLAY SIZE (Page No. - 84)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

TABLE 26 ASSUMPTIONS: BY DISPLAY SIZE

8.1.3 KEY PRIMARY INSIGHTS

FIGURE 38 KEY PRIMARY INSIGHTS

FIGURE 39 MARKET, BY DISPLAY SIZE, 2020 VS. 2025 (USD MILLION)

TABLE 27 MARKET, BY DISPLAY SIZE, 2020-2025 ('000 UNITS)

TABLE 28 MARKET, BY DISPLAY SIZE, 2020-2025 (USD MILLION)

8.2 <5" DISPLAY SIZE

8.2.1 HIGH DEMAND FOR REAR SEAT ENTERTAINMENT AND DIGITAL INSTRUMENT CLUSTER

TABLE 29 <5": MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 30 <5": MARKET, BY REGION, 2017-2025 (USD MILLION)

8.3 5"-10" DISPLAY SIZE

8.3.1 INTEGRATION OF MORE FEATURES WILL INCREASE DEMAND FOR 5"-10" DISPLAY SIZE

TABLE 31 5"-10": MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 32 5"-10": MARKET, BY REGION, 2017-2025 (USD MILLION)

8.4 >10" DISPLAY SIZE

8.4.1 INCREASING DEMAND FOR PREMIUM VEHICLES WOULD BOOST DEMAND FOR >10" DISPLAYS

TABLE 33 >10": MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 34 >10": MARKET, BY REGION, 2017-2025 (USD MILLION)

9 AUTOMOTIVE SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY (Page No. - 91)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

TABLE 35 ASSUMPTIONS: BY DISPLAY TECHNOLOGY

9.1.3 KEY PRIMARY INSIGHTS

FIGURE 40 KEY PRIMARY INSIGHTS

FIGURE 41 MARKET, BY DISPLAY TECHNOLOGY, 2020 VS. 2025 ('000 UNITS)

TABLE 36 MARKET, BY DISPLAY TECHNOLOGY, 2017-2025 ('000 UNITS)

9.2 LCD

9.2.1 DEMAND FOR COST-EFFECTIVE DISPLAY LIKELY TO FUEL DEMAND FOR LCD

TABLE 37 LCD: MARKET, BY REGION, 2017-2025 ('000 UNITS)

9.3 TFT-LCD

9.3.1 TECHNOLOGICAL ADVANCEMENTS IN TFT-LCD DISPLAY

TABLE 38 TFT-LCD: MARKET, BY REGION, 2017-2025 ('000 UNITS)

9.4 OLED

9.4.1 ADVENT OF AUTONOMOUS VEHICLES WILL BOOST DEMAND FOR OLED TECHNOLOGY

TABLE 39 OLED: MARKET, BY REGION, 2017-2025 ('000 UNITS)

9.5 OTHERS

TABLE 40 OTHERS: MARKET, BY REGION, 2017-2025 ('000 UNITS)

10 AUTOMOTIVE SMART DISPLAY MARKET, BY AUTONOMOUS DRIVING (Page No. - 99)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

TABLE 41 ASSUMPTIONS: BY AUTONOMOUS DRIVING

10.1.3 KEY PRIMARY INSIGHTS

FIGURE 42 KEY PRIMARY INSIGHTS

10.1.4 OPERATIONAL DATA

TABLE 42 EUROPE: ANNUAL NUMBER OF ROAD ACCIDENT FATALITIES, BY COUNTRY (2012-2016

FIGURE 43 MARKET, BY AUTONOMOUS DRIVING, 2020 VS. 2025 (USD MILLION)

TABLE 43 MARKET, BY AUTONOMOUS DRIVING, 2017-2025 (USD MILLION)

10.2 SEMI-AUTONOMOUS

10.2.1 RISING ADOPTION OF SEMI-AUTONOMOUS TECHNOLOGY IN VEHICLES

TABLE 44 SEMI-AUTONOMOUS DRIVING: MARKET, BY REGION, 2017-2025 (USD MILLION)

10.3 AUTONOMOUS

10.3.1 INCREASING USE OF SOFTWARE AND HARDWARE IN AUTONOMOUS DRIVING

TABLE 45 AUTONOMOUS DRIVING: MARKET, BY REGION, 2017-2025 (USD MILLION)

11 AUTOMOTIVE SMART DISPLAY MARKET, BY ELECTRIC VEHICLE (Page No. - 105)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

TABLE 46 ASSUMPTIONS: BY ELECTRIC VEHICLE TYPE

11.1.3 KEY PRIMARY INSIGHTS

FIGURE 44 KEY PRIMARY INSIGHTS

11.1.4 OPERATIONAL DATA

TABLE 47 TAXATION SCHEME FOR ALTERNATE FUEL VEHICLES, BY KEY COUNTRIES

FIGURE 45 MARKET, BY ELECTRIC VEHICLE, 2020 VS. 2025 (USD MILLION)

TABLE 48 MARKET, BY ELECTRIC VEHICLE, 2017-2025 ('000 UNITS)

TABLE 49 MARKET, BY ELECTRIC VEHICLE, 2017-2025 (USD MILLION)

11.2 BATTERY ELECTRIC VEHICLE (BEV

11.2.1 GROWING ADOPTION OF BEV DUE TO EMISSION NORMS

TABLE 50 BEV: MARKET, BY APPLICATION, 2017-2025 ('000 UNITS)

TABLE 51 BEV: MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

11.3 FUEL CELL ELECTRIC VEHICLE (FCEV

11.3.1 INTEGRATION OF ADVANCED FEATURES IN FCEVS

TABLE 52 FCEV: MARKET, BY APPLICATION, 2017-2025 (UNITS

TABLE 53 FCEV: MARKET, BY APPLICATION, 2017-2025 (USD THOUSAND

11.4 HYBRID ELECTRIC VEHICLE (HEV

11.4.1 STANDARDIZATION OF DIGITAL CLUSTER AND CENTER STACK

TABLE 54 HEV: AUTOMOTIVE SMART DISPLAY MARKET, BY APPLICATION, 2017-2025 ('000 UNITS)

TABLE 55 HEV: MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

11.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV

11.5.1 CENTER STACK EXPECTED TO LEAD MARKET IN PHEV SEGMENT

TABLE 56 PHEV: MARKET, BY APPLICATION, 2017-2025 ('000 UNITS)

TABLE 57 PHEV: MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

12 AUTOMOTIVE SMART DISPLAY MARKET, BY VEHICLE CLASS (Page No. - 115)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

TABLE 58 ASSUMPTIONS: BY VEHICLE CLASS

12.1.3 KEY PRIMARY INSIGHTS

FIGURE 46 KEY PRIMARY INSIGHTS

FIGURE 47 MARKET, BY VEHICLE CLASS, 2020 VS 2025 ('000 UNITS)

TABLE 59 MARKET, BY VEHICLE CLASS, 2017-2025 ('000 UNITS)

12.2 ECONOMY

12.2.1 INEXPENSIVE HUD SOLUTIONS TO DRIVE ECONOMY CAR SEGMENT

TABLE 60 ECONOMY: MARKET, BY REGION, 2017-2025 ('000 UNITS)

12.3 MID-SEGMENT

12.3.1 INCREASING ADOPTION OF SMART DISPLAYS IN MID-SEGMENT VEHICLES

TABLE 61 MID-SEGMENT: MARKET, BY REGION, 2017-2025 ('000 UNITS)

12.4 LUXURY

12.4.1 RISING DEMAND FOR CONNECTIVITY SERVICES TO FUEL LUXURY CAR SEGMENT

TABLE 62 LUXURY: MARKET, BY REGION, 2017-2025 ('000 UNITS)

13 AUTOMOTIVE SMART DISPLAY MARKET, BY VEHICLE TYPE (Page No. - 121)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

TABLE 63 ASSUMPTIONS: BY VEHICLE TYPE

13.1.3 KEY PRIMARY INSIGHTS

FIGURE 48 KEY PRIMARY INSIGHTS

13.1.4 OPERATIONAL DATA

TABLE 64 GLOBAL PASSENGER CAR PRODUCTION, 2018 VS 2019

FIGURE 49 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 65 MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 66 MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

13.2 PASSENGER CAR (PC

13.2.1 RISING DEMAND FOR COCKPIT ELECTRONICS LIKELY TO INCREASE DEMAND FOR AUTOMOTIVE SMART DISPLAYS

TABLE 67 PASSENGER CAR: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 68 PASSENGER CAR: MARKET, BY REGION, 2017-2025 (USD MILLION)

13.3 LIGHT COMMERCIAL VEHICLE (LCV

13.3.1 NORTH AMERICA ESTIMATED TO HAVE THE LARGEST MARKET SHARE IN 2020

TABLE 69 LCV: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 70 LCV: MARKET, BY REGION, 2017-2025 (USD MILLION)

13.4 HEAVY COMMERCIAL VEHICLE (HCV

13.4.1 ADOPTION OF DRIVING ASSISTANCE FEATURES IN HCV

TABLE 71 HCV: MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 72 HCV: MARKET, BY REGION, 2017-2025 (USD MILLION)

14 AUTOMOTIVE SMART DISPLAY MARKET, BY REGION (Page No. - 129)

14.1 INTRODUCTION

FIGURE 50 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 73 MARKET, BY REGION, 2017-2025 ('000 UNITS)

TABLE 74 MARKET, BY REGION, 2017-2025 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 51 ASIA PACIFIC: MARKET, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY COUNTRY, 2017-2025 ('000 UNITS)

TABLE 76 ASIA PACIFIC: MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

14.2.1 IMPACT OF COVID-19 ON MARKET IN ASIA PACIFIC 134

14.2.2 CHINA

14.2.2.1 China vehicle production data

TABLE 77 CHINA: VEHICLE PRODUCTION DATA (UNITS

14.2.2.2 China: Decline in vehicle production due to COVID-19

TABLE 78 CHINA: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.2.2.3 China: Decline in vehicle sales due to COVID-19

TABLE 79 CHINA: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.2.2.4 High automotive production driving automotive smart display market in China

TABLE 80 CHINA: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 81 CHINA: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.2.3 INDIA

14.2.3.1 India vehicle production data

TABLE 82 INDIA: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.2.3.2 India: Decline in vehicle production due to COVID-19

TABLE 83 INDIA: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.2.3.3 India: Decline in vehicle sales due to COVID-19

TABLE 84 INDIA: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.2.3.4 Rise in foreign investments due to improved FDI policies expected to boost Indian automotive market

TABLE 85 INDIA: MARKET, BY VEHICLE TYPE, 2017-2025 (UNITS

TABLE 86 INDIA: MARKET, BY VEHICLE TYPE, 2017-2025 (USD THOUSAND

14.2.4 JAPAN

14.2.4.1 Japan vehicle production data

TABLE 87 JAPAN: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.2.4.2 Japan: Decline in vehicle production due to COVID-19

TABLE 88 JAPAN: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.2.4.3 Japan: Decline in vehicle sales due to COVID-19

TABLE 89 JAPAN: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.2.4.4 Presence of leading HUD manufacturers

TABLE 90 JAPAN: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 91 JAPAN: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.2.5 SOUTH KOREA

14.2.5.1 South Korea vehicle production data

TABLE 92 SOUTH KOREA: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.2.5.2 Increasing adoption of HUDs by South Korean OEMs, such as Hyundai and KIA

TABLE 93 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 94 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.2.6 THAILAND

14.2.6.1 Thailand vehicle production data

TABLE 95 THAILAND VEHICLE PRODUCTION, 2017-2019 (UNITS

14.2.6.2 Thailand: Decline in vehicle production due to COVID-19

TABLE 96 THAILAND: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.2.6.3 Thailand: Decline in vehicle sales due to COVID-19

TABLE 97 THAILAND: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.2.6.4 Rising demand for reconfigurable display systems

TABLE 98 THAILAND: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 99 THAILAND: MARKET, BY VEHICLE TYPE, 2017-2025 (USD THOUSAND

14.2.7 REST OF ASIA PACIFIC

14.2.7.1 Smart displays expected to be widely available in luxury segment in Rest of Asia Pacific

TABLE 100 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2020-2025 (UNITS

TABLE 101 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2020-2025 (USD THOUSAND

14.3 EUROPE

FIGURE 52 EUROPE: MARKET SNAPSHOT

TABLE 102 EUROPE: MARKET, BY COUNTRY, 2017-2025 ('000 UNITS)

TABLE 103 EUROPE: MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

14.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

14.3.2 FRANCE

14.3.2.1 France vehicle production data

TABLE 104 FRANCE: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.2.2 France: Decline in vehicle production due to COVID-19

TABLE 105 FRANCE: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.2.3 France: Decline in vehicle sales due to COVID-19

TABLE 106 FRANCE: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.3.2.4 Strong presence of luxury car manufacturers

TABLE 107 FRANCE: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 108 FRANCE: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.3 GERMANY

14.3.3.1 Germany vehicle production data

TABLE 109 GERMANY: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.3.2 Germany: Decline in vehicle production due to COVID-19

TABLE 110 GERMANY: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.3.3 Germany: Decline in vehicle sales due to COVID-19

TABLE 111 GERMANY: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.3.3.4 Germany is home to leading car and HUD manufacturers

TABLE 112 GERMANY: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 113 GERMANY: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.4 RUSSIA

14.3.4.1 Russia vehicle production data

TABLE 114 RUSSIA: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.4.2 Russia: Decline in vehicle production due to COVID-19

TABLE 115 RUSSIA: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.4.3 Luxury car segment holds largest automotive smart display market share

TABLE 116 RUSSIA: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 117 RUSSIA: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Spain vehicle production data

TABLE 118 SPAIN: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.5.2 Spain: Decline in vehicle production due to COVID-19

TABLE 119 SPAIN: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.5.3 Spain: Decline in vehicle sales due to COVID-19

TABLE 120 SPAIN: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.3.5.4 Increasing adoption of semi-autonomous vehicles

TABLE 121 SPAIN: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 122 SPAIN: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.6 UK

14.3.6.1 UK vehicle production data

TABLE 123 UK: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.6.2 UK: Decline in vehicle production due to COVID-19

TABLE 124 UK: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.6.3 UK: Decline in vehicle sales due to COVID-19

TABLE 125 UK: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.3.6.4 High demand for luxury and high-end cars

TABLE 126 UK: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 127 UK: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.7 ITALY

14.3.7.1 Italy vehicle production data

TABLE 128 ITALY PRODUCTION DATA (UNITS

14.3.7.2 Government policies to support higher vehicle production

TABLE 129 ITALY: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 130 ITALY: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.8 TURKEY

14.3.8.1 Turkey vehicle production data

TABLE 131 TURKEY: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.3.8.2 Turkey: Decline in vehicle production due to COVID-19

TABLE 132 TURKEY: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.3.8.3 Turkey: Decline in vehicle sales due to COVID-19

TABLE 133 TURKEY: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.3.8.4 Efficient automotive ecosystem

TABLE 134 TURKEY: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 135 TURKEY: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.3.9 REST OF EUROPE

14.3.9.1 High demand for advanced automotive features

TABLE 136 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 137 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 53 NORTH AMERICA: MARKET SNAPSHOT

TABLE 138 NORTH AMERICA: MARKET, BY COUNTRY, 2017-2025 ('000 UNITS)

TABLE 139 NORTH AMERICA: MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

14.4.1 IMPACT OF COVID-19 ON THE MARKET IN NORTH AMERICA

14.4.2 CANADA

14.4.2.1 Canada vehicle production data

TABLE 140 CANADA: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.4.2.2 Canada: Decline in vehicle production due to COVID-19

TABLE 141 CANADA: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.4.2.3 Canada: Decline in vehicle sales due to COVID-19

TABLE 142 CANADA: Q1 VEHICLE SALES DATA, 2019 & 2020

14.4.2.4 Passenger car projected to lead automotive smart display market

TABLE 143 CANADA: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 144 CANADA: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Mexico vehicle production data

TABLE 145 MEXICO: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.4.3.2 Mexico: Decline in vehicle production due to COVID-19

TABLE 146 MEXICO: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.4.3.3 Mexico: Decline in vehicle sales due to COVID-19

TABLE 147 MEXICO: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.4.3.4 Lower production costs compared to other North American countries

TABLE 148 MEXICO: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 149 MEXICO: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.4.4 US

14.4.4.1 US vehicle production data

TABLE 150 US: VEHICLE PRODUCTION DATA, 2017-2019 (UNITS

14.4.4.2 US: Decline in vehicle production due to COVID-19

TABLE 151 US: Q1 VEHICLE PRODUCTION DATA, 2019 & 2020 (UNITS

14.4.4.3 US: Decline in vehicle sales due to COVID-19

TABLE 152 US: Q1 VEHICLE SALES DATA, 2019 & 2020 (UNITS

14.4.4.4 High demand for premium features in vehicles

TABLE 153 US: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 154 US: MARKET, BY VEHICLE TYPE, 2017-2025 (USD MILLION)

14.5 REST OF THE WORLD (ROW

TABLE 155 REST OF THE WORLD: MARKET, BY COUNTRY, 2017-2025 ('000 UNITS)

TABLE 156 REST OF THE WORLD: MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Decrease in smart display prices

TABLE 157 BRAZIL: MARKET, BY VEHICLE TYPE, 2017-2025 ('000 UNITS)

TABLE 158 BRAZIL: MARKET, BY VEHICLE TYPE, 2017-2025 (USD THOUSAND

14.5.2 IRAN

14.5.2.1 Less production of luxury cars restraining market growth

TABLE 159 IRAN: MARKET, BY VEHICLE TYPE, 2017-2025 (UNITS

TABLE 160 IRAN: MARKET, BY VEHICLE TYPE, 2017-2025 (USD THOUSAND

14.5.3 OTHERS IN ROW

14.5.3.1 Smart displays expected to be available mainly in luxury segment

TABLE 161 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2017-2025 (UNITS

TABLE 162 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2017-2025 (USD THOUSAND

15 COMPETITIVE LANDSCAPE (Page No. - 173)

15.1 MARKET EVALUATION FRAMEWORK

FIGURE 54 MARKET EVALUATION FRAMEWORK

15.2 OVERVIEW

15.3 MARKET RANKING ANALYSIS

FIGURE 55 MARKET RANKING ANALYSIS

15.4 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 56 TOP 5 PLAYERS DOMINATED MARKET IN LAST 3 YEARS

15.5 MARKET SHARE ANALYSIS, 2019

FIGURE 57 MARKET SHARE ANALYSIS, 2019

15.6 COVID-19 IMPACT ON AUTOMOTIVE SMART DISPLAY PROVIDERS

15.7 COMPETITIVE LEADERSHIP MAPPING

15.7.1 STAR

15.7.2 EMERGING LEADERS

15.7.3 PERVASIVE

15.7.4 EMERGING COMPANIES

FIGURE 58 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR AUTOMOTIVE SMART DISPLAY PROVIDERS, 2019

15.8 STRENGTH OF PRODUCT PORTFOLIO: AUTOMOTIVE SMART DISPLAY PROVIDERS

FIGURE 59 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

15.9 BUSINESS STRATEGY EXCELLENCE: AUTOMOTIVE SMART DISPLAY PROVIDERS

FIGURE 60 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 61 AUTOMOTIVE SMART DISPLAY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS, 2020

15.1 STRENGTH OF PRODUCT PORTFOLIO: AUTOMOTIVE SMART DISPLAY STARTUPS

15.11 BUSINESS STRATEGY EXCELLENCE: AUTOMOTIVE SMART DISPLAY STARTUPS

15.12 WINNERS VS. TAIL-ENDERS

FIGURE 62 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2016-2020

15.13 COMPETITIVE SCENARIO

15.13.1 NEW PRODUCT DEVELOPMENTS

TABLE 163 NEW PRODUCT DEVELOPMENTS, 2016-2020

15.13.2 EXPANSIONS

TABLE 164 EXPANSIONS, 2016-2019

15.13.3 PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 165 PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/MERGERS & ACQUISITIONS, 2016-2020

16 COMPANY PROFILES (Page No. - 195)

(Business overview, Products & Services offered, Recent developments, SWOT analysis & MnM View

16.1 ROBERT BOSCH GMBH

FIGURE 63 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 166 ROBERT BOSCH: PRODUCTS& SERVICES OFFERED

FIGURE 64 ROBERT BOSCH GMBH: SWOT ANALYSIS

16.2 PANASONIC CORPORATION

FIGURE 65 PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 167 PANASONIC CORPORATION: PRODUCTS & SERVICES OFFERED

FIGURE 66 PANASONIC CORPORATION: SWOT ANALYSIS

16.3 CONTINENTAL AG

FIGURE 67 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 168 CONTINENTAL AG: PRODUCTS & SERVICES OFFERED

FIGURE 68 CONTINENTAL AG: SWOT ANALYSIS

16.4 DENSO CORPORATION

FIGURE 69 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 169 DENSO CORPORATION: PRODUCTS& SERVICES OFFERED

FIGURE 70 DENSO CORPORATION: SWOT ANALYSIS

16.5 ALPS ALPINE CO., LTD.

FIGURE 71 ALPS ALPINE CO., LTD.: COMPANY SNAPSHOT

TABLE 170 ALPS ALPINE CO., LTD.: PRODUCTS & SERVICES OFFERED

FIGURE 72 ALPS ALPINE CO., LTD.: SWOT ANALYSIS

16.6 VISTEON CORPORATION

FIGURE 73 VISTEON CORPORATION: COMPANY SNAPSHOT

TABLE 171 VISTEON CORPORATION: PRODUCTS & SERVICES OFFERED

16.7 LG DISPLAY CO., LTD.

FIGURE 74 LG DISPLAY CO., LTD.: COMPANY SNAPSHOT

TABLE 172 LG DISPLAY CO., LTD.: PRODUCTS & SERVICES OFFERED

16.8 YAZAKI CORPORATION

FIGURE 75 YAZAKI CORPORATION: COMPANY SNAPSHOT

TABLE 173 YAZAKI CORPORATION: PRODUCTS & SERVICES OFFERED

16.9 PIONEER CORPORATION

FIGURE 76 PIONEER CORPORATION: COMPANY SNAPSHOT

TABLE 174 PIONEER CORPORATION: PRODUCTS & SERVICES OFFERED

16.1 HYUNDAI MOBIS

FIGURE 77 HYUNDAI MOBIS: COMPANY SNAPSHOT

TABLE 175 HYUNDAI MOBIS: PRODUCTS & SERVICES OFFERED

16.11 SAMSUNG ELECTRONICS CO., LTD.

FIGURE 78 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 176 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS & SERVICES OFFERED

16.12 NIPPON SEIKI CO., LTD.

FIGURE 79 NIPPON SEIKI CO., LTD.: COMPANY SNAPSHOT

TABLE 177 NIPPON SEIKI CO., LTD.: PRODUCTS & SERVICES OFFERED

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

16.13 OTHER KEY REGIONAL PLAYERS

16.13.1 ASIA PACIFIC

16.13.1.1 Kyocera Corporation

16.13.1.2 AU Optronics Corp.

16.13.1.3 Clarion

16.13.1.4 Desay SV Automotive

16.13.1.5 Japan Display Inc.

16.13.1.6 Spark Minda

16.13.2 NORTH AMERICA

16.13.2.1 Gentex Corporation

16.13.2.2 Garmin Ltd.

16.13.2.3 Stoneridge Inc.

16.13.3 EUROPE

16.13.3.1 Valeo

16.13.3.2 IAC Group

16.13.3.3 Magneti Marelli

17 APPENDIX (Page No. - 234)

17.1 CURRENCY & PRICING

TABLE 178 CURRENCY EXCHANGE RATES (W.R.T. USD)

17.2 PACKAGE SIZE

17.3 DISCUSSION GUIDE

17.4 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

17.5 AVAILABLE CUSTOMIZATIONS

17.6 RELATED REPORTS

17.7 AUTHOR DETAILS

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive smart display market. The primary sources—experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as to assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

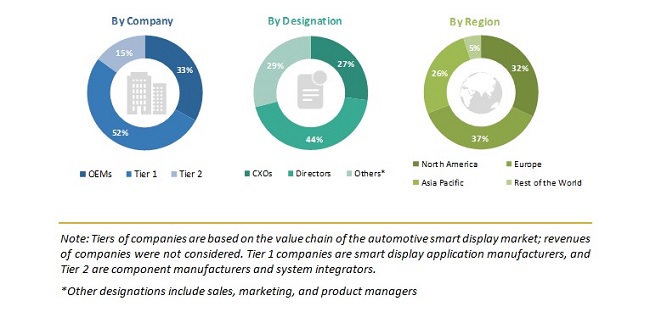

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global automotive smart display market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (OEMs/vehicle manufacturers) and supply side (display manufacturers, module manufacturers, software providers, and system integrators) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 27% of the experts involved in primary interviews were from the demand side, and 73% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the remainder of this report.

Breakdown of Primaries

To know about the assumptions considered for the study, download the pdf brochure

Note: Tiers of companies are based on the value chain of the automotive smart display market; revenues of companies were not considered. Tier 1 companies are smart display application manufacturers, and Tier 2 are component manufacturers and system integrators.

*Other designations include sales, marketing, and product managers

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global automotive smart display market. In these approaches, the vehicle production statistics for each vehicle type (passenger vehicles, light commercial vehicles, and heavy commercial vehicles) at a country level were considered.

Automotive smart display market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive smart display market: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters affecting the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and project (2020–2025) the automotive smart display market, by volume (thousand units) and value (USD million)

- To define, describe, and forecast the market based on application, display size, display technology, autonomous driving, electric vehicle, vehicle class, vehicle type, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze and forecast the market size, by volume, based on display technology (LCD, TFT-LCD, OLED, and others)

- To analyze and forecast market size, by volume and value, based on display size (<5”, 5”-10”, and >10”)

- To analyze and forecast the market size, by volume and value, based on application (digital instrument cluster, center stack, HUD, and rear seat entertainment)

- To analyze and forecast the market size, by value, based on autonomous driving (semi-autonomous and autonomous)

- To analyze and forecast the market size, by volume and value, based on vehicle type (passenger car, light commercial vehicle (LCV), and heavy commercial vehicle (HCV))

- To analyze and forecast the market size of passenger cars by volume and value, based on vehicle class (economy, mid-segment, and luxury)

- To analyze and forecast the market size, by volume and value, based on electric vehicle (BEV, FCEV, HEV, and PHEV)

- To forecast the market size, by volume and value, with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the market and its stakeholders

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and expansions, in the automotive smart display market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive smart display market, by the electric vehicle at the country level

- Automotive smart display market, by vehicle type at country level (for countries not covered in the report)

- Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Automotive Smart Display Market