Smart Grid Market by Component (Software, Hardware, Services), Application (Generation, Transmission, Distribution, Consumption/End Use), Communication Technology (Wireline, Wireless), and Region - Global Forecast to 2026

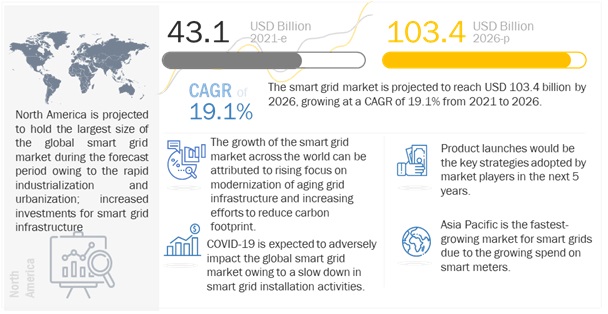

[296 Pages Report] The global smart grid market size was valued at $43.1 billion in 2021 and smart grid industry is projected to reach $103.4 billion by 2026, growing at a CAGR of 19.1% from 2021 to 2026. Modernization of aging grid infrastructure is one the primary factors driving market growth. Moreover, the government across the world is encouraging the investments in smart grids.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Grid Market Dynamics

Driver: Supportive regulatory framework of governments worldwide to promote deployment of smart grids

Governments across the world have imposed several supportive policies and mandates, focusing on implementing smart grids and spreading awareness about energy conservation. These regulations drive the adoption of smart grid technology for industrial, commercial, and residential applications.

The Department of Energy (DOE) was allocated USD 4.5 billion through the American Recovery and Reinvestment Act of 2009 (Recovery Act) funds to modernize electric power grids. Under the Smart Grid Investment Grant (SGIG) program, the DOE and the electricity sector have jointly invested USD 8 billion in 99 cost-shared projects, wherein more than 200 electric utilities and other organizations have participated in modernizing the electric grid infrastructure, strengthening cybersecurity, improving interoperability, and collect an unprecedented level of data on smart grid operations and its benefits.

The Smart Grid Investment Grant (SGIG) program aims to accelerate the modernization of the nation’s electric transmission and distribution systems.

The grid project in Canada focuses on promoting the use of renewable energy sources and implementing IoT and digital communication technologies to integrate new sources of clean energy without compromising the stability and reliability of existing grids. The American Recovery and Reinvestment Act (ARRA), part of the US federal government, allocated USD 3.4 billion under the smart grid investment grant program for utilities and USD 615 million for smart grid demonstration projects. NERC (North American Electric Reliability Corporation) is a regulatory authority established to assess the reliability of the bulk power system in North America. Smart grid technologies are revolutionizing the way electricity is being consumed. Industries are deploying smart grid meters to meet the regulations and mandates imposed by legislative bodies.

In APAC, China, Japan, Australia, and South Korea are expected to boost the growth of the smart grid market, with China as the most prospective leader in smart grid deployment. In 2019, Japan developed a new interface standard, ECHONET Lite, to implement its direct communication interface between the smart meter and home Energy Management Systems (EMS). Japan’s Energy Conversation Act, enacted in 1979 (revised 2010), takes necessary measures for the coherent use of energy by factories, buildings, and machinery equipment. In India, the Ministry of Power launched the India Smart Grid Forum (ISGF) initiative in 2011 to accelerate the development of smart grid infrastructure in the Indian power sector.

Restraints: High installation cost of smart grids

The initial phase of smart grid deployment is capital-intensive. It may restrain the growth of the global smart grid market. The role of the local and national governments is vital in transforming energy infrastructure. Smart grid technology requires huge initial investments to set up the transmission networks that allow two-way communication between the utility and its customers.

Furthermore, effective deployment of a smart grid creates the need for strong coordination across customary organizational boundaries, high flexibility toward significant changes in processes, and rigorous governance. High investments for the successful deployment of smart grids may add an economic burden on the government. Similarly, high operational and maintenance costs after the deployment of smart grid technology is another big concern for utility providers. Developing countries with poor infrastructure, such as China, Brazil, and India, also need huge financial support for building and updating the infrastructure.

Though billions of dollars are being invested in smart cities projects, the challenge to ensure a significant and favorable return on investment (ROI) is still there. Public and private organizations are going to play a major role by offering loans at low-interest rates or offering grants and funds for smart grid projects.

Opportunities: Ongoing smart city projects in developing countries

Smart cities are developed urban areas that create sustainable economic growth and high quality of life by excelling in several fields, such as technology, mobility, environment, living standard, and government regulations. More than 100 smart city projects are going on across the world, presenting a huge opportunity for technology companies, utility service providers, and consulting service providers. In smart cities, key services pertaining to utilities, safety, transportation, and healthcare segments are managed more efficiently and intelligently with proper utilization of resources and the adoption of advanced technologies such as IoT and smart energy meters. Traditional power grid models cannot provide the same level of efficiency to citizens and find it difficult to meet the requirements for energy monitoring, real-time data gathering, and smart billing, which are generated due to modernization.

Smart cities are likely to significantly depend on a robust smart grid platform to create a centrally planned and controlled infrastructure. Favorable conditions such as developed ICT infrastructure and better internet access are likely to result in widespread adoption of smart grids in smart cities. APAC is witnessing rapid urbanization. Developed and developing countries in the region are constantly focusing on adopting smart city technologies. To support smart grid technology, developing countries, such as China, India, and Brazil, are expected to build a new infrastructure, which will enable private and public sectors to create cost-effective, innovative technology solutions.

Challenges: Proper storage and management of complex data generated by smart grid infrastructure

The deployment of smart grid technologies has led to the generation of vast volumes of highly complex data. The data is related to consumer information, utility consumption, transmission logs, etc. It is highly unstructured and needs to be processed to gain vital insights. The continuous generation of data from various nodes of networks is creating challenges for smart grid solution providers to store and manage this data efficiently. The unmanaged data can raise multiple threats, and it might eventually become difficult to gain valuable insights from the data. The respective authorities need to create high-volume data centers, as well as deploy analytical solutions without increasing the cost.

A major challenge for utility providers is to understand the social, economic, and environmental value of the smart grid information and develop a solution that is likely to aggregate the data and correlate the information generated by the smart grid.

Smart utilities are generating huge volumes of data from millions of smart meters, grid sensors, control devices, and networks of other electronic devices. Generating and gathering useful data insights from such vast data for intelligent decision-making is the challenge faced by utility technology providers. The processing of large volumes of data to provide real-time analytics is one of the major functions of smart grid technology. To gain a competitive edge, solution providers need to develop superior data analytical techniques and accurate predictive analysis models. Providing intelligent business solutions to predict equipment failure, natural disasters and their effects, and customer behavior patterns based on the historical data and usage patterns is the most complex challenge faced by utility providers.

Siemens and General Electric are the major providers of big data solutions that address smart grid data-related challenges. There is a need to deploy more solutions and invest more in analytics to manage and store data to be transformed into actionable insights.

Market Trend

To know about the assumptions considered for the study, download the pdf brochure

The software segment were the most extensively demanded segment by type in the global smart grid market in 2020

Smart grid software solutions help ensure effective management of smart grid operations, improve process efficiency, and reduce energy production costs, which, in turn, would likely to accelerate the demand for smart grid software solutions. The smart grid software helps ensure effective management of smart grid operations, improves process efficiency, and reduces energy production costs.

The distribution segment is likely to account for largest share of smart grid

In any power plant, the power is generated at high volts; however, to reduce electricity loss, it is stepped down and connected to lower voltage distribution lines so that distribution companies can supply the power to consumers. Power is distributed through a distribution network that comprises substations, distribution feeders, and transformers. The implementation of smart grids brings intelligence to the distribution process.

The wireless communication technology segment is the fastest growing communication technology in the smart grid market in 2020.

Wireless communication is the most advanced technology at present. It refers to the transfer of information over a distance without the use of electrical conductors or wires. To implement wireless communication in a substation, reliable, secure, and low-latency bi-directional communication infrastructure between the intelligent electronic devices and the control center is required. Compared to wireline technology, wireless technology ensures cost savings and secure data transmission. This technology offers integral support to the utilities by offering high bandwidth, covering a large area, and optimizing complex logistics and production processes.

With increasing modernization of aging grid infrastructure, the Asia Pacific smart grid market is the fastest growing market.

North America held the largest share of 32.0% of the global smart grid market in 2020, and Asia Pacific is expected to be the fastest growing market from 2021 to 2026.

The increasing demand for smart infrastructure and the rising number of smart city projects are the key factors accelerating smart grid market growth in North America. This, in turn, would generate the demand for automation products, including smart grid solutions.

The smart grid market in APAC is expected to grow substantially in the coming years. The market has emerged slowly over the past few years. Increased power consumption in countries such as China, India, and Japan, has raised the need to introduce new measures to generate, distribute, or use electricity efficiently. China, India, Japan, Australia, South Korea, etc., are some major smart grid technology users in the region.

Although the smart grid market has boomed in APAC, compared to North America and Europe, it is far behind in terms of developments in the energy industry. The rising deployment of advanced energy storage systems would augment the growth of the smart grid market in APAC. Smart grids bring benefits to both end users and energy providers; the benefits include efficient management of power distribution, power outages, and demand response (DR) and reduced operation cost. Smart grid technology and infrastructure development are becoming necessary for energy industries in APAC today.

Key Market Players

The smart grid market is dominated by a few globally established players such as Schneider Electric (France), GE (US), Siemens (Germany), ABB (Switzerland), and Itron (US).

Smart Grid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 43.1 Billion |

|

Projected to reach 2026: |

USD 103.4 Billion |

|

CAGR: |

19.1% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

North America |

|

Fastest Growing Market: |

Asia Pacific |

|

Region Covered: |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Segments Covered: |

Component, Application, Communication Technology |

|

Companies Covered: |

GE (US), ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Itron (US), Cisco (US), IBM (US), Oracle (US), Honeywell (US), Eaton (US), Tech Mahindra (India), Tantalus (US), Mitsubishi Electric (Japan), SAP (Germany), Wipro (India), Trilliant Holdings (US), Globema (Poland), Kamstrup (Denmark), Xylem (US), ENEL X (Italy), Esmart Systems (Norway), Esyasoft Technologies (India), Grid4C (US), C3 Energy (US), and NES (US) |

This research report categorizes the smart grid market based by component, application, technology communication, and region.

Based on component, the smart grid market has been segmented as follows:

-

Software

- Advanced Metering Infrastructure

- Smart Grid Distribution Management

- Smart Grid Network Management

- Grid Asset Management

- Substation Automation

- Smart Grid Security

- Billing and Customer Information System.

-

Hardware

- Smart Meters

- Sensors

- Programmable Logic Controller (PLC)

- Others (Networking Hardware and Energy Storage)

-

Services

- Consulting

- Deployment and Integration

- Support and Maintenance

Based on Application, the smart grid market has been segmented as follows:

- Generation

- Transmission

- Distribution

- Consumption

Based on Communication Technology, the smart grid market has been segmented as follows:

- Wireline

- Wireless

Based on the region, the smart grid market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In May 2021, Thailand-based energy company Impact Solar partnered with Hitachi ABB Power Grids for provisioning an energy storage system for the country’s largest private-owned microgrid.

- In January 2021, Schneider Electric acquired DC Systems BV, which is a major supplier of smart systems. This has helped the company in advancing innovations in electrical distribution.

- In September 2020, Siemens Energy, a subsidiary of Siemens, launched its new Unified Power Flow Controller (UPFC) PLUS and expanded the options for grid stabilization. The UPFC PLUS helps system operators stabilize the grid by dynamically controlling the load flow in alternating-current grids.

- in July 2018, GE Power’s Grid Solutions business launched a new Advanced Distribution Management Solution (ADMS) in collaboration with Tata Power Delhi Distribution (Tata Power - DDL), specially designed for India, with advanced features such as monitoring, security, analysis, and planning.

- In May 2018, Itron entered a contract with Jamaica Public Service Company (JPS), an integrated electric utility company and the sole distributor of electricity in Jamaica, to provide Itron’s smart grid solution for Jamaica.

Frequently Asked Questions (FAQ):

What is the major drivers for smart grid market?

The increased awareness about carbon footprint management is one of major drivers for smart grid market. Utilities must follow societal and regulatory obligations, mitigating emissions of greenhouse gases, principally carbon dioxide (CO2), to combat global climate change and its potentially harmful effects on the human body. A carbon footprint is a result of the high amount of carbon dioxide emissions released into the atmosphere.

The US Energy Information Administration (EIA) anticipates that global carbon dioxide (CO2) emissions from energy-related sources will continue to grow in the coming decades. According to EIA’s International Energy Outlook 2019 (IEO2019), global energy-related CO2 emissions will grow 0.6% every year from 2018 to 2050. It also says that the potential growth in energy-related CO2 emissions is not evenly distributed across the world. Relatively, developed economies collectively have no significant growth in emission levels, so all anticipated growth in energy-related CO2 emissions would be among the group of countries outside the Organization for Economic Cooperation and Development (OECD), for example, Brazil, India, and South Africa.

What is the current size of the smart grid market?

The current market size of global smart grid market is estimated to be USD 43.1 billion in 2021.

Which is the fastest-growing region during the forecasted period in smart grid market?

Asia Pacific is the fastest-growing region during the forecasted period. The region is the most populated region in the world and is expected to become the largest smart grid deploying region globally. It comprises many developing countries and requires more increased efficiency of industries for its development. Thus, rise in demand for smart infrastructure is likely to drive the growth of market.

Which is the fastest-growing segment, by component during the forecasted period in smart grid market?

The software segment, by component industry is the fastest-growing segment during the forecasted period. The market for software segment is projected to grow because smart grid software solutions help ensure effective management of smart grid operations, improve process efficiency, and reduce energy production costs, which, in turn, would likely to accelerate the demand for smart grid software solutions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 SMART GRID MARKET, BY COMPONENT

1.3.2 SMART GRID MARKET, BY APPLICATION

1.3.3 SMART GRID MARKET, BY COMMUNICATION TECHNOLOGY

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 SMART GRID MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARIES

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR SMART GRIDS

2.3.3.1 Calculation for demand side

2.3.3.2 Assumptions for demand-side analysis

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 METRICS CONSIDERED TO ASSESS SUPPLY SIDE OF MARKET

FIGURE 8 SMART GRID MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculation

2.3.4.2 Assumptions for supply-side analysis

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 SNAPSHOT OF SMART GRID MARKET

FIGURE 9 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY COMPONENT, IN 2026

FIGURE 10 SMART GRID DISTRIBUTION MANAGEMENT SOFTWARE TO LEAD MARKET IN 2026

FIGURE 11 SMART METERS TO LEAD MARKET, BY HARDWARE, 2026

FIGURE 12 DEPLOYMENT AND INTEGRATION SERVICES TO DOMINATE MARKET IN 2026

FIGURE 13 DISTRIBUTION APPLICATION TO CONTINUE TO HOLD LARGEST SIZE OF MARKET THROUGHOUT FORECAST PERIOD

FIGURE 14 WIRELINE COMMUNICATION TECHNOLOGY TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2026

FIGURE 15 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART GRID MARKET

FIGURE 16 MODERNIZATION OF AGING GRID INFRASTRUCTURE AND IMPLEMENTATION OF SMART METERS TO PROPEL MARKET GROWTH DURING 2021–2026

4.2 SMART GRID MARKET IN NORTH AMERICA, BY COMPONENT AND COUNTRY

FIGURE 17 US HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2020

4.3 SMART GRID MARKET, BY COMPONENT

FIGURE 18 SOFTWARE COMPONENTS HELD LARGEST SHARE OF GLOBAL MARKET IN 2020

4.4 SMART GRID MARKET FOR SOFTWARE, BY TYPE

FIGURE 19 SMART GRID DISTRIBUTION MANAGEMENT SOFTWARE CAPTURED MAJOR MARKET SHARE IN 2020

4.5 SMART GRID MARKET FOR HARDWARE, BY TYPE

FIGURE 20 SMART METERS ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4.6 SMART GRID MARKET FOR SERVICES, BY TYPE

FIGURE 21 DEPLOYMENT AND INTEGRATION SERVICES HELD LARGEST SHARE OF MARKET IN 2020

4.7 SMART GRID MARKET, BY APPLICATION

FIGURE 22 DISTRIBUTION APPLICATION ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4.8 SMART GRID MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 23 WIRELINE COMMUNICATION TECHNOLOGY ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4.9 MARKET, BY REGION

FIGURE 24 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 25 COVID-19 GLOBAL PROPAGATION

FIGURE 26 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 27 RECOVERY ROAD FOR 2020 AND 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 28 REVISED GDP FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 29 SMART GRID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Supportive regulatory framework of governments worldwide to promote deployment of smart grids

FIGURE 30 SHARE OF DIGITAL GRID INFRASTRUCTURE IN GLOBAL ELECTRICITY INVESTMENT (2014–2019)

5.5.1.2 Improved grid reliability and efficient outage response

5.5.1.3 Increased awareness about carbon footprint management

FIGURE 31 GLOBAL ENERGY-RELATED CO2 EMISSIONS (1990–2050)

5.5.1.4 Strong focus on modernization of aging grid infrastructure

FIGURE 32 ICT (INFORMATION AND COMMUNICATION TECHN0LOGY) ELECTRICITY DEMAND

FIGURE 33 ELECTRICITY DEMAND BY NETWORK-ENABLED DEVICES

5.5.2 RESTRAINTS

5.5.2.1 High installation cost of smart grids

5.5.2.2 Low awareness of protocols and interoperability standards

5.5.3 OPPORTUNITIES

5.5.3.1 Creating opportunities for existing utility vendors and emerging players

5.5.3.2 Ongoing smart city projects in developing countries

5.5.3.3 Increasing inclination of automobile companies to manufacture electric vehicles based on V2G technology

FIGURE 34 WORLDWIDE EV SALES, MILLION UNITS, 2017–2020

5.5.3.4 Anticipated shift from on-premises to cloud-based systems

5.5.4 CHALLENGES

5.5.4.1 Proper storage and management of complex data generated by smart grid infrastructure

5.5.4.2 Cybersecurity and vulnerability issues faced by smart grid networks

FIGURE 35 ENTRY POINTS FOR CYBERATTACKS

5.5.4.3 Longer duration of return on investment for utility service providers

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMART GRID MANUFACTURERS

FIGURE 36 REVENUE SHIFT FOR SMART GRID

5.7 MARKET MAP

FIGURE 37 MARKET MAP FOR SMART GRID

TABLE 2 SMART GRID: SUPPLY CHAIN/ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

FIGURE 38 SMART GRID VALUE CHAIN ANALYSIS

5.8.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.8.2 SMART GRID MANUFACTURERS/ASSEMBLERS

5.8.3 DISTRIBUTORS (BUYERS)/END USERS

5.8.4 POST-SALES SERVICE PROVIDERS

5.9 TECHNOLOGY ANALYSIS

5.9.1 SMART GRIDS BASED ON DIFFERENT TECHNOLOGIES

TABLE 3 SMART GRID MARKET: LIST OF FEW TECHNOLOGIES AND THEIR APPLICATIONS

TABLE 4 MAJOR DIFFERENCES BETWEEN CONVENTIONAL POWER GRID AND SMART GRID

5.10 SMART GRID: CODES AND REGULATIONS

TABLE 5 SMART GRID: CODES AND REGULATIONS

5.11 INNOVATION AND PATENT REGISTRATION

TABLE 6 SMART GRID: INNOVATION AND PATENT REGISTRATION

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 39 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 7 SMART GRID MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 CASE STUDY ANALYSIS

5.13.1 STANDALONE/DECENTRALIZED MICROGRID PROVIDED BASIC ENERGY ACCESS TO ALL (INDIA)

5.13.2 TRILLIANT PROVIDED HYDRO ONE WITH SECUREMESH SOLUTION TO HARNESS BENEFITS OF SMART METERING AND DISTRIBUTION

5.13.3 SIEMENS PROVIDED TIA SOLUTIONS OF TESCO FOR WATER MANAGEMENT TO HOBBS

6 SMART GRID MARKET, BY COMPONENT (Page No. - 79)

6.1 INTRODUCTION

FIGURE 40 MARKET SHARE FOR EACH COMPONENT, 2020 (%)

TABLE 8 MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

6.2 SOFTWARE

FIGURE 41 MARKET SHARE FOR EACH SOFTWARE COMPONENT, 2020 (%)

TABLE 9 MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 10 MARKET FOR SOFTWARE, BY REGION, 2019–2026 (USD MILLION)

6.2.1 ADVANCED METERING INFRASTRUCTURE

6.2.1.1 Stringent regulations and mandates by legislative bodies to reduce energy consumption and increase energy efficiency boost demand for AMI

TABLE 11 MARKET FOR ADVANCED METERING INFRASTRUCTURE, BY REGION, 2019–2026 (USD MILLION)

6.2.2 SMART GRID DISTRIBUTION MANAGEMENT

6.2.2.1 High adoption of renewable energy sources and increased number of distributed renewable power generation plants augment need for Smart Grid Distribution Management software

TABLE 12 MARKET FOR SMART GRID DISTRIBUTION MANAGEMENT, BY REGION, 2019–2026 (USD MILLION)

6.2.3 SMART GRID NETWORK MANAGEMENT

6.2.3.1 Increased use of renewable energy and limited capacity of traditional electricity grids to generate renewable energy stimulate demand for Smart Grid Network Management software

TABLE 13 MARKET FOR SMART GRID NETWORK MANAGEMENT, BY REGION, 2019–2026 (USD MILLION)

6.2.4 GRID ASSET MANAGEMENT

6.2.4.1 Strong need to reduce failure and repair costs of grids spurs deployment of Grid Asset Management software

TABLE 14 MARKET FOR GRID ASSET MANAGEMENT, BY REGION, 2019–2026 (USD MILLION)

6.2.5 SUBSTATION AUTOMATION

6.2.5.1 Superior ability of Substation Automation software to recover power at faster rate and prevent blackouts in power systems triggers its adoption by smart grid system manufacturers

TABLE 15 MARKET FOR SUBSTATION AUTOMATION, BY REGION, 2019–2026 (USD MILLION)

6.2.6 SMART GRID SECURITY

6.2.6.1 Heightened threat of cyberattacks on smart grids creates need for Smart Grid Security software

TABLE 16 MARKET FOR SMART GRID SECURITY, BY REGION, 2019–2026 (USD MILLION)

6.2.7 BILLING AND CUSTOMER INFORMATION SYSTEM

6.2.7.1 Elevated demand for efficient billing and information collection capabilities encourages use of Billing and Customer Information System

TABLE 17 MARKET FOR BILLING AND CUSTOMER INFORMATION SYSTEM, BY REGION, 2019–2026 (USD MILLION)

6.3 HARDWARE

FIGURE 42 MARKET SHARE FOR EACH HARDWARE COMPONENT, 2020 (%)

TABLE 18 MARKET FOR HARDWARE COMPONENT, BY TYPE, 2019–2026 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE, BY REGION, 2019–2026 (USD MILLION)

6.3.1 SMART METERS

6.3.1.1 High emphasis on energy savings by using energy-efficient appliances accelerates demand for smart meters

TABLE 20 MARKET FOR SMART METERS, BY REGION, 2019–2026 (USD MILLION)

6.3.2 SENSORS

6.3.2.1 Distinguished ability of sensors to identify risks well in advance promotes their use in smart grids

TABLE 21 MARKET FOR SENSORS, BY REGION, 2019–2026 (USD MILLION)

6.3.3 PROGRAMMABLE LOGIC CONTROLLERS

6.3.3.1 Rugged design of PLCs makes them suitable for repetitive tasks and improved communication bandwidth, enabling their use to make logic-based decisions

TABLE 22 MARKET FOR PROGRAMMABLE LOGIC CONTROLLERS, BY REGION, 2019–2026 (USD MILLION)

6.3.4 OTHERS

TABLE 23 MARKET FOR OTHER HARDWARE COMPONENTS, BY REGION, 2019–2026 (USD MILLION)

6.4 SERVICES

FIGURE 43 MARKET SHARE FOR EACH SERVICE TYPE, 2020 (%)

TABLE 24 MARKET FOR SERVICES, BY SERVICES TYPE, 2019–2026 (USD MILLION)

TABLE 25 MARKET FOR SERVICES, BY REGION, 2019–2026 (USD MILLION)

6.4.1 CONSULTING

6.4.1.1 Need to deliver maximum product assurance drives demand for consulting services

TABLE 26 MARKET FOR CONSULTING SERVICES, BY REGION, 2019–2026 (USD MILLION)

6.4.2 DEPLOYMENT AND INTEGRATION

6.4.2.1 Requirement to streamline operations of smart grid components boosts adoption of deployment and integration services

TABLE 27 MARKET FOR DEPLOYMENT AND INTEGRATION SERVICES, BY REGION, 2019–2026 (USD MILLION)

6.4.3 SUPPORT AND MAINTENANCE

6.4.3.1 Necessity of support and maintenance services to ensure reduced downtime of operations and higher productivity of smart grids

TABLE 28 MARKET FOR SUPPORT AND MAINTENANCE SERVICES, BY REGION, 2019–2026 (USD MILLION)

7 SMART GRID MARKET, BY APPLICATION (Page No. - 99)

7.1 INTRODUCTION

FIGURE 44 SMART GRID MARKET, BY APPLICATION, 2020 (%)

TABLE 29 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 GENERATION

7.2.1 SMART GRIDS HELP POWER GENERATION RESOURCES TO OPTIMIZE ENERGY PRODUCTION

TABLE 30 MARKET FOR GENERATION APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.3 TRANSMISSION

7.3.1 EFFICIENT AUTOMATED TRANSMISSION NETWORK CARRIES POWER FROM BULK GENERATION FACILITIES TO POWER DISTRIBUTION SYSTEMS

TABLE 31 MARKET FOR TRANSMISSION APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.4 DISTRIBUTION

7.4.1 DISTRIBUTION SUBSTATIONS ARE LIKELY TO WITNESS HIGH DEMAND FROM NORTH AMERICA

TABLE 32 MARKET FOR DISTRIBUTION APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.5 CONSUMPTION

7.5.1 UNIVERSAL ACCEPTANCE OF ELECTRICAL APPLIANCES HAS LED TO INCREASING POWER CONSUMPTION

TABLE 33 MARKET FOR CONSUMPTION APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8 SMART GRID MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 105)

8.1 INTRODUCTION

FIGURE 45 SMART GRID MARKET, BY COMMUNICATION TECHNOLOGY, 2020 (%)

TABLE 34 MARKET, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

8.2 WIRELINE COMMUNICATION TECHNOLOGY

8.2.1 INCREASED NEED FOR EFFECTIVE COMMUNICATION TO DRIVE REQUIREMENT FOR WIRELINE COMMUNICATION TECHNOLOGY-BASED SMART GRIDS

TABLE 35 MARKET FOR WIRELINE COMMUNICATION TECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

8.3 WIRELESS COMMUNICATION TECHNOLOGY

8.3.1 REDUCED MAINTENANCE COST AND EASY ACCESSIBILITY OF DATA FROM REMOTE LOCATIONS TO BOOST DEMAND FOR WIRELESS COMMUNICATION TECHNOLOGY-BASED SMART GRIDS

TABLE 36 MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY, BY REGION, 2019–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 109)

9.1 INTRODUCTION

FIGURE 46 SMART GRID MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 47 MARKET SHARE FOR EACH REGION, 2020 (%)

TABLE 37 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 48 NORTH AMERICA: SNAPSHOT, 2020

9.2.1 BY COMPONENT

TABLE 38 MARKET IN NORTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 39 MARKET IN NORTH AMERICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 MARKET IN NORTH AMERICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 MARKET IN NORTH AMERICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.2.2 BY APPLICATION

TABLE 42 MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3 BY COMMUNICATION TECHNOLOGY

TABLE 43 MARKET IN NORTH AMERICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 44 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4.1 US

9.2.4.1.1 Heavy investments in digitalization of electricity infrastructure and data analytics by power industry propel smart grid market growth in United States

9.2.4.1.2 By component

TABLE 45 MARKET IN US, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 46 MARKET IN US FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 MARKET IN US FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 MARKET IN US FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.2.4.1.3 By application

TABLE 49 MARKET IN US, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4.1.4 By communication technology

TABLE 50 MARKET IN US, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.4.2 Canada

9.2.4.2.1 High investments by government in utility-led projects to reduce GHG emissions and upgrade electric grid infrastructure stimulate smart grid market growth in Canada

9.2.4.2.2 By component

TABLE 51 MARKET IN CANADA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 52 MARKET IN CANADA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 MARKET IN CANADA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 MARKET IN CANADA FOR SERVICES, BYTYPE, 2019–2026 (USD MILLION)

9.2.4.2.3 By application

TABLE 55 MARKET IN CANADA, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4.2.4 By communication technology

TABLE 56 MARKET IN CANADA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.4.3 Mexico

9.2.4.3.1 Massive rollout plans and government support for smart meters accelerate smart grid market growth

9.2.4.3.2 By component

TABLE 57 MARKET IN MEXICO, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 58 MARKET IN MEXICO FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 MARKET IN MEXICO FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 MARKET IN MEXICO FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.2.4.3.3 By application

TABLE 61 MARKET IN MEXICO, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4.3.4 By communication technology

TABLE 62 MARKET IN MEXICO, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3 EUROPE

FIGURE 49 EUROPE: MARKET SNAPSHOT, 2020

9.3.1 BY COMPONENT

TABLE 63 MARKET IN EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 64 MARKET IN EUROPE FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 MARKET IN EUROPE FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 MARKET IN EUROPE FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.2 BY APPLICATION

TABLE 67 MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 BY COMMUNICATION TECHNOLOGY

TABLE 68 MARKET IN EUROPE, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 69 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4.1 UK

9.3.4.1.1 Smart grid technology to help UK transform into low-carbon economy, meet its carbon reduction targets, and ensure energy security

9.3.4.1.2 By component

TABLE 70 MARKET IN UK, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 71 MARKET IN UK FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 MARKET IN UK FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 MARKET IN UK FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.1.3 By application

TABLE 74 MARKET IN UK, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.1.4 By communication technology

TABLE 75 MARKET IN UK, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.2 Germany

9.3.4.2.1 Smart meter installment has made tracking energy usage easier

9.3.4.2.2 By component

TABLE 76 MARKET IN GERMANY, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 77 MARKET IN GERMANY FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 MARKET IN GERMANY FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 MARKET IN GERMANY FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.2.3 By application

TABLE 80 MARKET IN GERMANY, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.2.4 By communication technology

TABLE 81 MARKET IN GERMANY, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.3 France

9.3.4.3.1 Strong need for efficient grid operations propelling market growth

9.3.4.3.2 By component

TABLE 82 MARKET IN FRANCE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 83 MARKET IN FRANCE FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 MARKET IN FRANCE FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 MARKET IN FRANCE FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.3.3 By application

TABLE 86 MARKET IN FRANCE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.3.4 By communication technology

TABLE 87 MARKET IN FRANCE, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.4 Italy

9.3.4.4.1 Italy is known for its aggressive smart meter rollout

9.3.4.4.2 By component

TABLE 88 MARKET IN ITALY, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 89 MARKET IN ITALY FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 MARKET IN ITALY FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 MARKET IN ITALY FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.4.3 By application

TABLE 92 MARKET IN ITALY, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.4.4 By communication technology

TABLE 93 MARKET IN ITALY, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.5 Russia

9.3.4.5.1 Urgent requirement to improve power transmission networks boosts demand for smart grid technology in Russia

9.3.4.5.2 By component

TABLE 94 MARKET IN RUSSIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 95 MARKET IN RUSSIA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 MARKET IN RUSSIA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 MARKET IN RUSSIA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.5.3 By application

TABLE 98 MARKET IN RUSSIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.5.4 By communication technology

TABLE 99 MARKET IN RUSSIA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.6 Rest of Europe

9.3.4.6.1 By component

TABLE 100 MARKET IN REST OF EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 101 MARKET IN REST OF EUROPE FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 MARKET IN REST OF EUROPE FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 MARKET IN REST OF EUROPE FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.3.4.6.2 By application

TABLE 104 MARKET IN REST OF EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4.6.3 By communication technology

TABLE 105 MARKET IN REST OF EUROPE, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 BY COMPONENT

TABLE 106 MARKET IN ASIA PACIFIC, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 107 MARKET IN ASIA PACIFIC FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 MARKET IN ASIA PACIFIC FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 MARKET IN ASIA PACIFIC FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.2 BY APPLICATION

TABLE 110 MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 BY COMMUNICATION TECHNOLOGY

TABLE 111 MARKET IN ASIA PACIFIC, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 112 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4.1 China

9.4.4.1.1 Increased deployment of solar PV systems fuels smart grid market growth in China

9.4.4.1.2 By component

TABLE 113 MARKET IN CHINA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 114 MARKET IN CHINA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 MARKET IN CHINA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 MARKET IN CHINA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.1.3 By application

TABLE 117 MARKET IN CHINA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.1.4 By communication technology

TABLE 118 MARKET IN CHINA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.2 Japan

9.4.4.2.1 Japan installed smart meters to host Olympic games in 2020

9.4.4.2.2 By component

TABLE 119 MARKET IN JAPAN, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 120 MARKET IN JAPAN FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 MARKET IN JAPAN FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 MARKET IN JAPAN FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.2.3 By application

TABLE 123 MARKET IN JAPAN, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.2.4 By communication technology

TABLE 124 MARKET IN JAPAN, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.3 India

9.4.4.3.1 Government policies for energy access, high adoption of renewable resources, and increased number of smart city projects are pushing India’s smart grid market growth

9.4.4.3.2 By component

TABLE 125 MARKET IN INDIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 126 MARKET IN INDIA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 MARKET IN INDIA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 MARKET IN INDIA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.3.3 By application

TABLE 129 MARKET IN INDIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.3.4 By communication technology

TABLE 130 MARKET IN INDIA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.4 South Korea

9.4.4.4.1 Urgent need to build smart infrastructure for providing consumer, transportation, electricity, and several other services creates demand for smart grid technology

9.4.4.4.2 By component

TABLE 131 MARKET IN SOUTH KOREA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 132 MARKET IN SOUTH KOREA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 MARKET IN SOUTH KOREA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 MARKET IN SOUTH KOREA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.4.3 By application

TABLE 135 MARKET IN SOUTH KOREA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.4.4 By communication technology

TABLE 136 MARKET IN SOUTH KOREA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.5 Australia

9.4.4.5.1 Immediate requirement to increase operational efficiency of utilities sector spurs demand for smart grids

9.4.4.5.2 By component

TABLE 137 MARKET IN AUSTRALIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 138 MARKET IN AUSTRALIA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 MARKET IN AUSTRALIA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 MARKET IN AUSTRALIA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.5.3 By application

TABLE 141 MARKET IN AUSTRALIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.5.4 By communication technology

TABLE 142 MARKET IN AUSTRALIA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.6 Rest of Asia Pacific

9.4.4.6.1 By component

TABLE 143 MARKET IN REST OF ASIA PACIFIC, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 144 MARKET IN REST OF ASIA PACIFIC FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 MARKET IN REST OF ASIA PACIFIC FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 MARKET IN REST OF ASIA PACIFIC FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.4.4.6.2 By application

TABLE 147 MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4.6.3 By communication technology

TABLE 148 MARKET IN REST OF ASIA PACIFIC, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 BY COMPONENT

TABLE 149 MARKET IN MIDDLE EAST AND AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 150 MARKET IN MIDDLE EAST AND AFRICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 MARKET IN MIDDLE EAST AND AFRICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 MARKET IN MIDDLE EAST AND AFRICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.2 BY APPLICATION

TABLE 153 MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3 BY COMMUNICATION TECHNOLOGY

TABLE 154 MARKET IN MIDDLE EAST AND AFRICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 155 SMART GRID MARKET IN MIDDLE EAST AND AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4.1 UAE

9.5.4.1.1 Strong focus of country on using renewable sources to produce energy by 2030 would accelerate demand for smart grid technology

9.5.4.1.2 By component

TABLE 156 MARKET IN UAE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 157 MARKET IN UAE FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 MARKET IN UAE FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 MARKET IN UAE FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.4.1.3 By application

TABLE 160 MARKET IN UAE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4.1.4 By communication technology

TABLE 161 MARKET IN UAE, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4.2 Saudi Arabia

9.5.4.2.1 Rapid development of advanced transmission systems would propel smart grid market growth in Saudi Arabia

9.5.4.2.2 By component

TABLE 162 MARKET IN SAUDI ARABIA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 163 MARKET IN SAUDI ARABIA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 MARKET IN SAUDI ARABIA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 MARKET IN SAUDI ARABIA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.4.2.3 By application

TABLE 166 MARKET IN SAUDI ARABIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4.2.4 By communication technology

TABLE 167 SMART GRID MARKET IN SAUDI ARABIA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4.3 Qatar

9.5.4.3.1 Desperate need to upgrade energy transmission and distribution networks promotes use of smart grid technology in Qatar

9.5.4.3.2 By component

TABLE 168 MARKET IN QATAR, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 169 MARKET IN QATAR FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 MARKET IN QATAR FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 MARKET IN QATAR FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.4.3.3 By application

TABLE 172 MARKET IN QATAR, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4.3.4 By communication technology

TABLE 173 SMART GRID MARKET IN QATAR, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4.4 South Africa

9.5.4.4.1 Immediate need to reduce utility debt drives adoption of smart grid solutions

9.5.4.4.2 By component

TABLE 174 SMART GRID MARKET IN SOUTH AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 175 MARKET IN SOUTH AFRICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 MARKET IN SOUTH AFRICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 MARKET IN SOUTH AFRICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.4.4.3 By application

TABLE 178 MARKET IN SOUTH AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4.4.4 By communication technology

TABLE 179 MARKET IN SOUTH AFRICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4.5 Rest of Middle East and Africa

9.5.4.5.1 By component

TABLE 180 MARKET IN REST OF MIDDLE EAST AND AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 181 MARKET IN REST OF MIDDLE EAST AND AFRICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 MARKET IN REST OF MIDDLE EAST AND AFRICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 SMART GRID MARKET IN REST OF MIDDLE EAST AND AFRICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.5.4.5.2 By application

TABLE 184 MARKET IN REST OF MIDDLE OF EAST AND AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4.5.3 By communication technology

TABLE 185 MARKET IN REST OF MIDDLE EAST AND AFRICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY COMPONENT

TABLE 186 MARKET IN SOUTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 187 MARKET IN SOUTH AMERICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 MARKET IN SOUTH AMERICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 MARKET IN SOUTH AMERICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.6.2 BY APPLICATION

TABLE 190 SMART GRID MARKET IN SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3 BY COMMUNICATION TECHNOLOGY

TABLE 191 MARKET IN SOUTH AMERICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 192 MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4.1 Brazil

9.6.4.1.1 Surging need to improve operational efficiency boosts demand for smart grid systems

9.6.4.1.2 By component

TABLE 193 MARKET IN BRAZIL, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 194 MARKET IN BRAZIL FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 195 MARKET IN BRAZIL FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 MARKET IN BRAZIL FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.6.4.1.3 By application

TABLE 197 MARKET IN BRAZIL, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.4.1.4 By communication technology

TABLE 198 SMART GRID MARKET IN BRAZIL, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.4.2 Argentina

9.6.4.2.1 Escalating requirement to produce energy using renewable energy sources creates opportunities for smart grid market

9.6.4.2.2 By component

TABLE 199 MARKET IN ARGENTINA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 200 MARKET IN ARGENTINA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 MARKET IN ARGENTINA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 MARKET IN ARGENTINA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.6.4.2.3 By application

TABLE 203 MARKET IN ARGENTINA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.4.2.4 By communication technology

TABLE 204 MARKET IN ARGENTINA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.4.3 Rest of South America

9.6.4.3.1 By component

TABLE 205 SMART GRID MARKET IN REST OF SOUTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 206 MARKET IN REST OF SOUTH AMERICA FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 MARKET IN REST OF SOUTH AMERICA FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 208 MARKET IN REST OF SOUTH AMERICA FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

9.6.4.3.2 By application

TABLE 209 MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.4.3.3 By communication technology

TABLE 210 MARKET IN REST OF SOUTH AMERICA, BY COMMUNICATION TECHNOLOGY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 190)

10.1 KEY PLAYER STRATEGIES

TABLE 211 OVERVIEW OF TOP PLAYERS, JANUARY 2017– MARCH 2021

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 212 SMART GRID MARKET: DEGREE OF COMPETITIVE

FIGURE 50 SMART GRID MARKET SHARE ANALYSIS, 2020

10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 51 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 52 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

TABLE 213 COMPANY FOOTPRINT

TABLE 214 BY COMPONENT FOOTPRINT

TABLE 215 BY APPLICATION FOOTPRINT

TABLE 216 BY REGION FOOTPRINT

10.5 COMPETITIVE SCENARIO

TABLE 217 MARKET: PRODUCT LAUNCHES, JANUARY 2017–SEPTEMBER 2021

TABLE 218 MARKET: DEALS, JANUARY 2017–DECEMBER 2020

TABLE 219 MARKET: OTHER DEVELOPMENTS, JULY 2017–SEPTEMBER 2021

11 COMPANY PROFILES (Page No. - 203)

(Business and financial overview, Products/services/solutions offered, Recent developments & MnM View)*

11.1 KEY PLAYERS

11.1.1 GE

TABLE 220 GE: BUSINESS OVERVIEW

FIGURE 53 GE: COMPANY SNAPSHOT

TABLE 221 GE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 222 GE: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 223 GE: DEALS

TABLE 224 GE: OTHERS

11.1.2 ABB

TABLE 225 ABB: BUSINESS OVERVIEW

FIGURE 54 ABB: COMPANY SNAPSHOT

TABLE 226 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 227 ABB: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 228 ABB: DEALS

TABLE 229 ABB: OTHERS

11.1.3 SIEMENS

TABLE 230 SIEMENS: BUSINESS OVERVIEW

FIGURE 55 SIEMENS: COMPANY SNAPSHOT

TABLE 231 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 232 SIEMENS: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 233 SIEMENS: DEALS

TABLE 234 SIEMENS: OTHERS

11.1.4 SCHNEIDER ELECTRIC

TABLE 235 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 236 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 237 SCHNEIDER ELECTRIC: DEALS

TABLE 238 SCHNEIDER ELECTRIC: OTHERS

11.1.5 ITRON

TABLE 239 ITRON: BUSINESS OVERVIEW

FIGURE 57 ITRON: COMPANY SNAPSHOT

TABLE 240 ITRON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 241 ITRON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 242 ITRON: DEALS

TABLE 243 ITRON: OTHERS

11.1.6 CISCO

TABLE 244 CISCO: BUSINESS OVERVIEW

FIGURE 58 CISCO: COMPANY SNAPSHOT

TABLE 245 CISCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 246 CISCO: DEALS

11.1.7 IBM

TABLE 247 IBM: BUSINESS OVERVIEW

FIGURE 59 IBM: COMPANY SNAPSHOT

TABLE 248 IBM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 249 IBM: DEALS

TABLE 250 IBM: OTHERS

11.1.8 ORACLE

TABLE 251 ORACLE: BUSINESS OVERVIEW

FIGURE 60 ORACLE: COMPANY SNAPSHOT

TABLE 252 ORACLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 253 ORACLE: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 254 ORACLE: DEALS

11.1.9 HONEYWELL

TABLE 255 HONEYWELL: BUSINESS OVERVIEW

FIGURE 61 HONEYWELL: COMPANY SNAPSHOT

TABLE 256 HONEYWELL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 257 HONEYWELL: DEALS

TABLE 258 HONEYWELL: OTHERS

11.1.10 EATON

TABLE 259 EATON: BUSINESS OVERVIEW

FIGURE 62 EATON: COMPANY SNAPSHOT

TABLE 260 EATON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 261 EATON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 262 EATON: DEALS

TABLE 263 EATON: OTHERS

11.1.11 TECH MAHINDRA

TABLE 264 TECH MAHINDRA: BUSINESS OVERVIEW

FIGURE 63 TECH MAHINDRA: COMPANY SNAPSHOT

TABLE 265 TECH MAHINDRA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 266 TECH MAHINDRA: DEALS

11.1.12 TANTALUS

TABLE 267 TANTALUS: BUSINESS OVERVIEW

FIGURE 64 TANTALUS: COMPANY SNAPSHOT

TABLE 268 TANTALUS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 269 TANTALUS: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 270 TANTALUS: DEALS

11.1.13 MITSUBISHI ELECTRIC

TABLE 271 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 65 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 272 MITSUBISHI ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 273 MITSUBISHI ELECTRIC: DEALS

11.1.14 SAP

TABLE 274 SAP: BUSINESS OVERVIEW

FIGURE 66 SAP: COMPANY SNAPSHOT

TABLE 275 SAP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 276 SAP: DEALS

11.1.15 WIPRO

TABLE 277 WIPRO: BUSINESS OVERVIEW

FIGURE 67 WIPRO: COMPANY SNAPSHOT

TABLE 278 WIPRO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.16 TRILLIANT HOLDINGS

TABLE 279 TRILLIANT HOLDINGS: BUSINESS OVERVIEW

TABLE 280 TRILLIANT HOLDINGS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 281 TRILLIANT HOLDINGS: DEALS

11.1.17 GLOBEMA

TABLE 282 GLOBEMA: BUSINESS OVERVIEW

TABLE 283 GLOBEMA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 284 GLOBEMA: OTHERS

11.1.18 KAMSTRUP

TABLE 285 KAMSTRUP: BUSINESS OVERVIEW

FIGURE 68 KAMSTRUP: COMPANY SNAPSHOT

TABLE 286 KAMSTRUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 287 KAMSTRUP: DEALS

TABLE 288 KAMSTRUP: OTHERS

11.1.19 XYLEM

TABLE 289 XYLEM: BUSINESS OVERVIEW

FIGURE 69 XYLEM: COMPANY SNAPSHOT

TABLE 290 XYLEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

*Details on Business and financial overview, Products/services/solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 ENEL X

11.2.2 ESMART SYSTEMS

11.2.3 ESYASOFT TECHNOLOGIES

11.2.4 GRID4C

11.2.5 C3 ENERGY

11.2.6 NES (NETWORKED ENERGY SERVICES)

12 APPENDIX (Page No. - 288)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

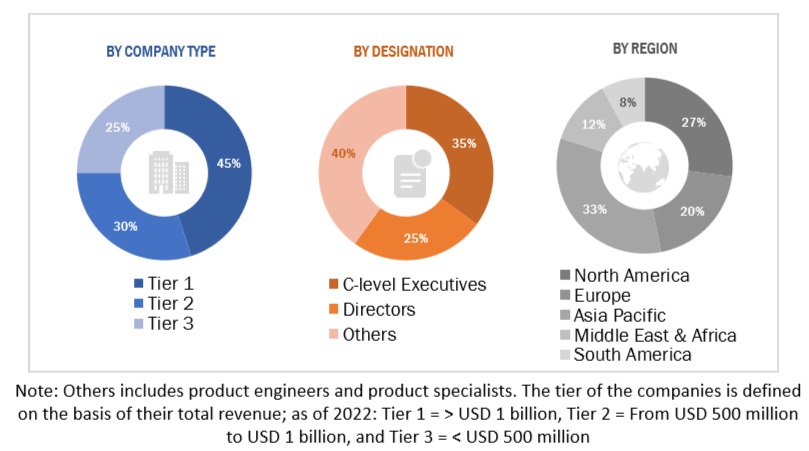

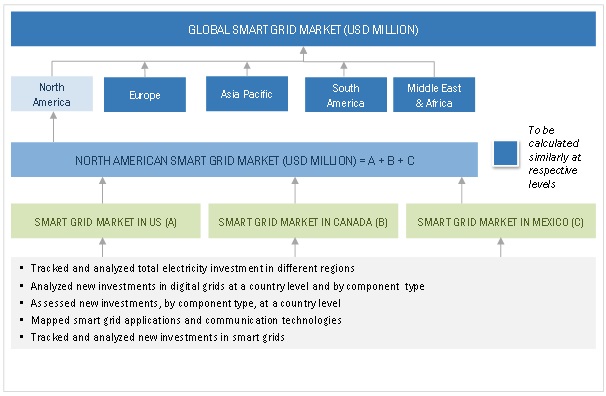

This study involved major activities in estimating the current size of the smart grid market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global smart grid market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The smart grid market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by residential, commercial, and industrial end-users. Moreover, the demand is also driven by the rising demand of increased efficiency. The supply side is characterized by rising demand for contracts from the industrial, commercial, and residential sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the smart grid market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the smart grid market by component, application, communication technology, and region, in terms of value

- To estimate and forecast the global market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the smart grid value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the smart grid market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Grid Market

Which market segment is expected to shape the future of the Smart Grid Market?

Smart Grid Market report includes Market Estimates, CAGRs and Forecasts, Rising demand in the Emerging Markets, Opportunity analysis in market for key stakeholders by identification of high growth segments, Trend analysis and study of drivers and restraints that will affect the global landscaps, Key playing fields and burning issues in sector, Market share, contracts & developments, strategies, product innovations of key companies/players and Competition mapping

Smart Grid Market was published in Oct 2021, and it covers the market trends and growth factors with respect to Smart Grid Market. It also covered the Market estimations of Smart Grid in terms of Value by Component/Application/ Communication Technology at regional and country level for the period 2019-2026. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis.