Smart Railways Market by Offering (Solutions (Rail Asset Management and Maintenance, Operation and Control, Communication and Networking, Security and Safety, Rail Analytics) and Services (Professional and Managed)) Region - Global Forecast to 2027

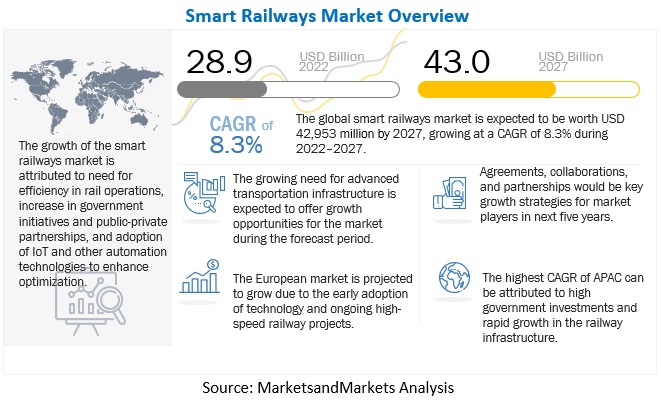

[297 Pages Report] The smart railways market size is expected to grow from USD 28.9 billion in 2022 to USD 43.0 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period. The world is becoming more and more digital, and this transition will affect the railroad business as well. The railroad business, which is regarded as a conservative sector in terms of technology adoption, has recognized the advantages of adapting to digitization. Connectivity, cloud computing, and artificial intelligence (AI) have become three crucial pillars of the railway industry's transition as it starts to adopt digital technology. Therefore, it has become crucial for government organizations to guarantee that the transportation industry is prepared to satisfy the expanding connectivity needs.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Need for efficiency in rail operations

The current rail infrastructure cannot handle the rising demand for rail services; hence the passenger and freight schedules must be optimized in order to maximize throughput. The correct planning, supervision, and servicing of rail assets are necessary for a smooth rail operation. Due to downtime, maintenance schedules lower asset productivity. Due to manual diagnostics' poor success rate, this downtime is further prolonged. Rail authorities place a strong emphasis on condition-based and predictive maintenance strategies in order to increase efficiency and decrease time consumption. These solutions assist in effective asset scheduling and timely asset monitoring, hence reducing downtime. Real-time analytics are used in condition-based and predictive maintenance to reduce the need on manual diagnostics.

Restraint: High initial cost of deployment

The initial cost of implementing smart railway technology is substantial. The costs associated with financing a smart railway project could be a significant barrier limiting market expansion. The implementation of smart railway technologies across regions is hampered by large capital expenditures and rising upfront installation costs. Governments and private firms are constrained in their use of cutting-edge railway technologies and solutions by the constrained existing funds for railroads. Setting up field-level equipment, replacing deteriorating infrastructure, organizing transmission networks between end users, and managing the integration of new and existing systems inside railway premises all need significant upfront investments for smart railway technology. Railway authorities are likewise extremely concerned about high operations and maintenance costs.

Opportunity: Increase in globalization and need for advanced transportation infrastructure

All aspects of railroad traffic are directly impacted by the influence of globalization. Increased speed, security, and dependability are in demand. Therefore, regardless of the distance or the number of intermediate steps required to reach the destination, the future railway transportation ecosystem must provide solutions to satisfy the demand from source to destination with a high degree of efficiency. People's needs are evolving continuously, necessitating the development of more practical travel options. Advanced PIS, advanced vehicle control systems, and other intelligent solutions can offer information on the real-time position of cars, which can be used to monitor schedule adherence and alert passengers on the whereabouts of vehicles while they are in transit. It is anticipated that passenger satisfaction will increase if reliable real-time information regarding the position and status of in-transit vehicles is made available to them.

Challenge: Integration complexities with legacy infrastructure

The deployment of various technological components, such as hardware, software, and networks, for use in smart railway systems must be done seamlessly and in a non-disruptive manner. It may become difficult to integrate various hardware components and smart railway management software services with outdated system architecture. The development of digital infrastructure is challenging without robust pre-existing IT and qualified employees. The IT system can be completely overhauled by railroad operators, but the associated expenditures would take a long time to materialize. Due to protocol problems, legacy systems frequently cannot be integrated with newer generations of smart devices. These systems are unable to communicate effectively with more sophisticated technical systems. Integration difficulties are predicted to impede market expansion in developing regions in the upcoming years because the majority of developing nations continue to rely on their outdated infrastructure.

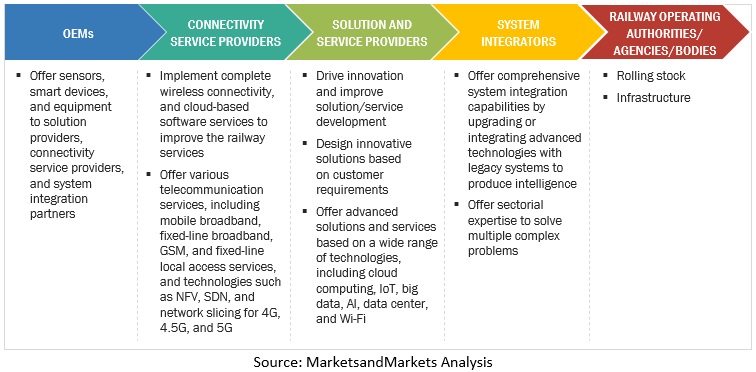

Value Chain Analysis

To know about the assumptions considered for the study, download the pdf brochure

By service, the managed services segment to grow at a higher CAGR during the forecast period

The market for managed services is expected to be driven by the rising demand to outsource the maintenance of smart railway technologies. One of the key reasons anticipated to drive the market's growth for smart railroads is the necessity for organizations to improve resource use. To meet ever-increasing consumer demands, managed services offer continuous upgrades and customized features. As a result, businesses quickly hire Managed Service Providers to handle their tasks.

By solution, the rail communication and networking system segment to hold the largest market size in 2022

The adoption of intelligent communication solutions across numerous railway management systems enhances the ability to make fast decisions regarding situations, including asset deployment, utilization, and maintenance. To guarantee safety, security, and continuous services, efficient railroad operations depend on precise, timely communication among stations, control and dispatch centers, and rolling stock. Therefore, signaling, phone, video, and data traffic must be reliably sent through backbone transmission networks and along railway lines by railway communication systems.

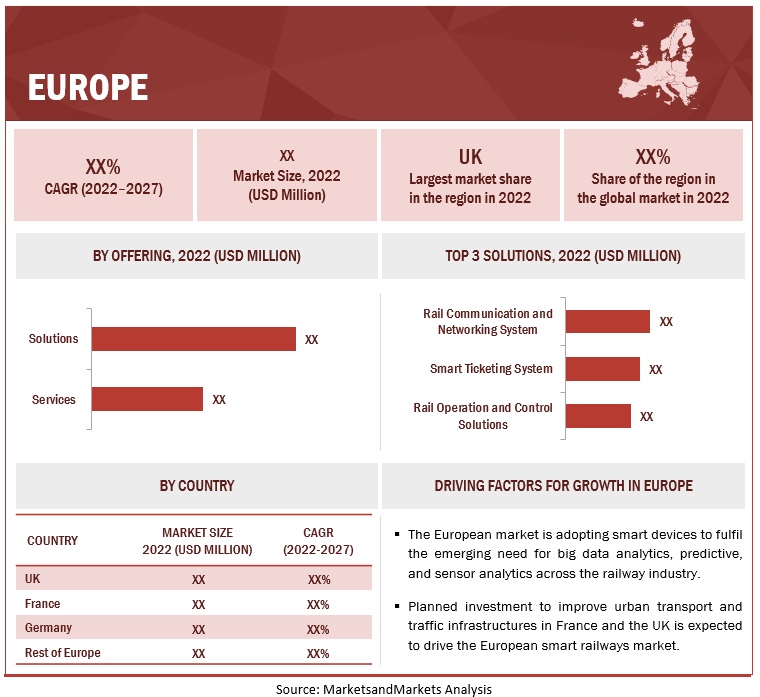

Europe to hold the largest market size during the forecast period

Europe is estimated to have the largest market share in the domain for smart railways over the projected timeframe. The UK, France, and Germany are instances of Western European countries having well-established rail networks. Additionally, a number of railway companies in the region deploy some of the most advanced smart rail systems. The existing rail system is being modernized and upgraded with significant investment from European nations. Large-scale, cross-border trade and passenger transportation in Europe have been encouraged by social and trade agreements among the member states of the European Union (EU). Several European nations are anticipated to embrace new smart railway technology to increase the efficiency of the current infrastructure.

Asia Pacific to hold the highest market growth rate during the forecast period

During the forecast period, the Asia Pacific Smart Railways market is anticipated to expand at a considerable CAGR. The expansion of rail projects and the industry's transition to digitalization are credited to this surge. The markets for smart railways are dominated by China and India in the Asia-Pacific region. For the past several years, the Chinese government has made significant investments in the railroad industry. China's railway budget increased from USD 33.3 billion in 2016 to USD 37.5 billion in 2017. During the foreseeable term, this development is anticipated to hold steady as well. In the upcoming years, the Indian railway industry is anticipated to expand significantly as well.

Key Market Players

The smart railways market is dominated by few established players such as Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), and Honeywell (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market size available for years | 2017–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Billion) |

| Segments covered | By Offering and By Region |

| Geographies covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Thales (France), Advantech (Taiwan), Fujitsu (Japan), Toshiba (Japan), Alcatel-Lucent Enterprise (France), Moxa (Taiwan), EKE-Electronics (Finland), Televic (Belgium), Uptake (US), Eurotech (Italy), Tego (US), KONUX (Germany), Aitek S.p.A (Italy), Assetic (Australia), Machines With Vision (UK), and Delphisonic (US) Passio Technologies (US), Cloud Moyo (US), Chemito (India). |

The research report categorizes the smart railways market based on By Offering and By Region:

By Offering, the smart railways market has the following segments:

-

Solutions

-

Passenger Information System

- Multimedia Information and Entertainment

- Network Connectivity

-

Freight Management System

- Freight Operation Management

- Freight Tracking

-

Security and Safety Solutions

- Video Surveillance and Analytics

- Intrusion Detection

- Access control

- Fire alarm and voice evacuation

- Others (imaging and scanning solutions and security information management solutions)

-

Rail Communication and Networking System

- Ground-To-Train Communication

- Train-To-Train Communication

- Smart Ticketing System

- Rail Analytics System

-

Rail Asset Management and Maintenance Solutions

- Asset Planning and Scheduling

- Workforce Management and Optimization

- Condition-based monitoring

- Predictive maintenance

- Others (incident management, warranty management, and material management)

- Rail Operation and Control Solutions

-

Passenger Information System

-

Services

-

Professional Services

- Consulting

- System Integration and Deployment

- Training, Support, and Maintenance

- Managed Services

-

Professional Services

By Region, the smart railways market has the following segments:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- France

- Germany

- Spain

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- SE Asia

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- South Africa

- Nigeria

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In December 2021, strategic cooperation between Alstom and Hitachi Rail was launched in order to develop a market-leading smart trains business. Both firms are expected to benefit from the partnership's enormous operational efficiencies and be able to provide consumers across the world with an even more comprehensive range of products and services.

- In June 2021, By updating the locomotives in the entire CSX fleet and integrating cutting-edge digital technologies, Wabtec and CSX teamed to accelerate sustainable rail and achieve significant fuel efficiency and emissions savings for CSX's rail operations. The collaboration will support CSX in meeting its goal of reducing greenhouse gas emissions intensity by 37% by 2030..

- In May 2021, The technology firm Padam Mobility, which offers AI-powered platforms and applications for on-demand and paratransit services, has been bought by Siemens Mobility. This acquisition expands Siemens Mobility's multimodal transportation-focused portfolio of intelligent infrastructure..

- In January 2021, Bombardier Transportation has been acquired by Alstom. Alstom's position in the mobility industry would be strengthened by the acquisition, which presents a great opportunity. By giving Alstom access to a vast network of maintenance facilities and a sizable number of operating trains, it increases the company's rolling stock portfolio and significantly strengthens its services division.

- In April 2019, At the IBM IoT Exchange, IBM announced a partnership with Sund & Baelt to help in the development of an AI-powered IoT solution that will assist in extending the lifespan of deteriorating infrastructures, tunnels, motorways, and railroads. With its rich industry- and task-specific functionality, the new industry solution, IBM Maximo for Civil Infrastructure, broadens the IBM Maximo portfolio and enables businesses to manage, oversee, and manage their infrastructure assets.

Frequently Asked Questions (FAQ):

What is the Smart Railways System?

A networked, integrated system that provides a range of services is termed as a smart railway system. Software, hardware, and other technologies that comprise smart railway systems redefine how rail assets and rail network connectivity are employed. Information and communication technology integration with intelligent transportation systems enables this.

How is the global Smart railways market expected to grow in the next five years?

According to MarketsandMarkets, the smart railways market size to grow from USD 28.9 billion in 2022 to USD 43.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 8.3% during the forecast period.

Which region holds the largest market share in the Smart railways market?

Europe is expected to hold the largest market share in the Smart railways market during the forecast period.

Which region has the highest growth rate in the Smart Railways Market?

Asia Pacific is expected to grow at the highest CAGR over 2022- 2027.

Who are the major vendors in the smart railways market?

Major vendors in the smart railways market are Alstom (France), Cisco (US), Huawei (China), Hitachi (Japan), and Siemens (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study consisted of four major activities to estimate the current market size of the smart railways market. Extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the smart railways market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from OECD, International Railway Journal, Railway Gazette International, and the US DoT. The railway spending of various countries was extracted from their respective transportation associations, such as Société Nationale Des Chemins De Fer Français (SNCF), Taiwan Railways Administration (TRA), Passenger Rail Agency of South Africa (PRASA), European Rail Freight Association, and the European Union (EU) Agency for Railways.

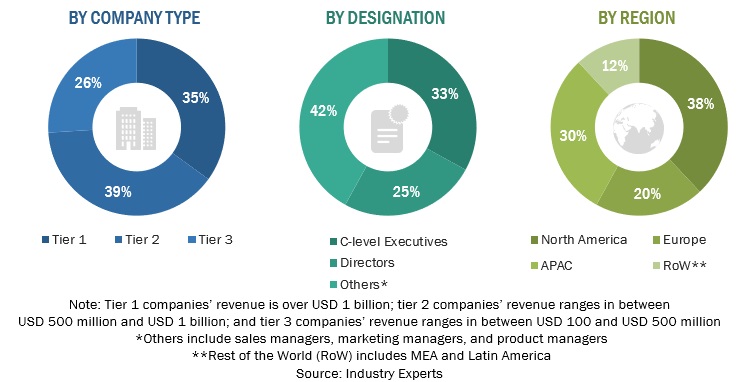

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from smart railways solution vendors, System Integrators, professional and Managed Service Providers (MSPs), industry associations, and independent asset management and railway consultants; and key opinion leaders. Following is the profile breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the smart railways market. These methods were used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using the study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the size of the smart railways market by offering and region

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall smart railways market

- To analyze opportunities in the market for stakeholders by identifying the high growth segments

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as mergers and acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Canada Smart Railways Market, by Offering

- Further breakdown of the UK Market, by Offering

- Further breakdown of the China Market, by Offering

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Railways Market

Gather insights into Energy and Power, Biotechnology, Medical Devices, Semiconductor and Electronics, Automation and Process Control, Telecom and IT, Automotive and Transportation, Engineering Equipment & Devices.

Gather insights into Vendor Evaluations, Project Management Unit, Program Management, Bid Management, Project Monitoring & Auditing.

Gather insights into Passenger Information Systems, Wayside information Systems, Signalling and Train control, Rolling Stock.

Understand the Passenger Information Display System, Public Announcement system, Disaster Warning system, CCTV, Security systems.

Understand the market potential, trends and volume for Passenger information system and CCTV for Railways.