Social and Emotional Learning Market by Offering (Solution, Services), Solution (Social & Emotional Learning Platform, Social & Emotional Learning Assessment Tool), Service, End User, Core Competency, Type & Regions - Global Forecast to 2028

Social And Emotional Learning (SEL) Market Analysis & Report Summary, Global Size

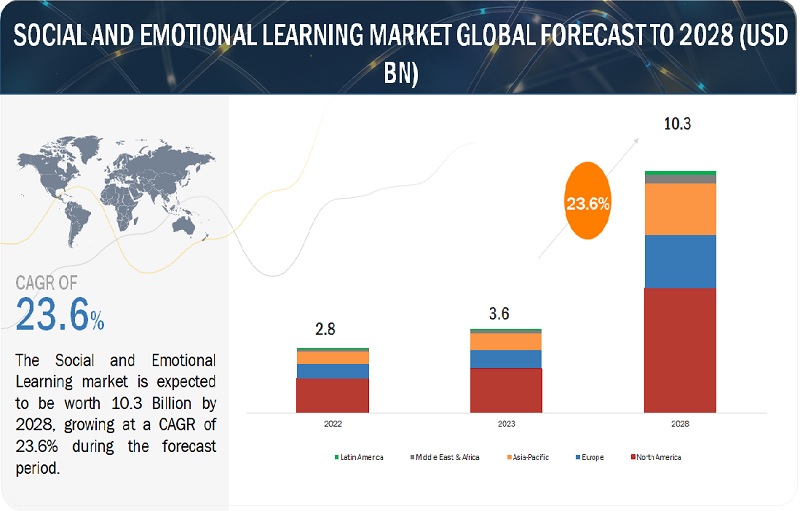

The global Social and Emotional Learning Market size is projected to reach US$3.6bn in 2023. The market size is expected to show an annual growth rate (CAGR 2023-2028) of 23.6%, resulting in a market volume of US$10.3bn by 2028. There has been a significant rise in the demand for SEL in K-12 schools over the past few years. Policymakers worldwide are taking the initiative to promote SEL, and educators are eager to introduce it into their academic curriculum due to its numerous benefits. The Social and Emotional Learning market has enormous potential for growth in the future, as it is being implemented on a large scale in pre-K, elementary, middle, and high schools.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Social and Emotional Learning Market Dynamics

Driver: Growing implementation of distance education solutions

The demand for social and emotional learning programs has increased due to the rise of distance education solutions. The social and emotional learning market has grown significantly with most courses being offered online. Previously, SEL courses were taught in classrooms with the help of teachers. However, due to the availability of online courses, parents are now also involved in their children’s learning at home, anytime and anywhere.

Restraint: Absence of appropriate infrastructure in emerging economies

Most developing and underdeveloped countries need more infrastructure, which is a significant hurdle in the growth of their education system. The minimum educational infrastructure required includes sufficient space, clean drinking water, access to power, roads, the internet, and proper sanitation facilities. Unfortunately, these countries still rely on outdated telecom infrastructure, which cannot offer fast and reliable connectivity. This lack of high-speed internet makes implementing web-based Social and Emotional Learning platforms that require a stable, high-speed internet connection easier. Additionally, these countries have limited funding for academic curriculums. The government cannot allocate enough resources to introduce new student programs because of poor economic conditions. Consequently, most emerging economies need more support when implementing SEL platforms.

Opportunity: Demand for new learning models with advancements in technologies

The K-12 education system has evolved from traditional classrooms to smart classrooms, incorporating innovative technologies such as cloud computing, analytics, advanced collaboration tools, and the Internet of Things (IoT). With interactive whiteboards and displays, even students in remote areas can be engaged in modern classrooms. Educators can efficiently deliver Social and Emotional Learning (SEL) curricula to multiple students from a central location using collaboration tools like WebEx, Zoom, Google Hangouts, and Skype. Cloud computing is widely used in K-12 schools, and SEL providers use it to deliver curricula. Integrating technologies such as videoconferencing, cloud computing, and analytics into the classroom to develop practical SEL skills is crucial. These collaboration tools highlight the importance of working closely with students. For example, the Fresno Unified School District implemented a digital collaboration platform to enhance social and emotional skills, resulting in a 25% improvement in the academic performance of middle school students.

Challenge: The challenge in transitioning away from traditional learning methods

Teachers worldwide face significant challenges transitioning from traditional education methods to innovative approaches. Chief among these obstacles are constraints related to time and curriculum diversity. Research conducted by the US government indicates that 81% of teachers consider time limitations as the primary hurdle in implementing these new methods. The demands of existing curricula and the necessity to cover core academic subjects often leave limited room for incorporating innovative teaching approaches. Additionally, ensuring curriculum diversity and inclusivity poses another significant challenge. Creating teaching materials that cater to the diverse needs of students from various backgrounds, encompassing differences in religion, caste, economic status, and language, can be complex.

Social and Emotional Learning (SEL) Market Ecosystem

Prominent social emotional learning companies in this market include a well-established, financially stable provider of the Social and Emotional Learning (SEL) market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent social emotional learning companies in this market Committee for Children (US), EVERFI (US), Illuminate Education (US), Nearpod (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings of Kids (US), Rethink ED (US), etc.

By service, the Training and Support segment is expected to grow with the highest CAGR during the forecast period

In-person instruction, remote technical support, and assistance with the Social and Emotional Learning platform are all part of the training and support offerings that aid educators in their SEL journeys. The training offerings include workshops and in-class instruction. Personal instruction conferences, webinars, seminars, and SEL-related self-improvement courses. It introduces recommended practices that promote secure and exciting learning environments for students. Teachers and administrative workers can give worthwhile results in SEL programs with the help of practical SEL training. The training model aids principals and teachers in learning about the SEL program, receiving feedback, and gauging its efficacy. Training and support service providers provide best practices for teaching SEL to students.

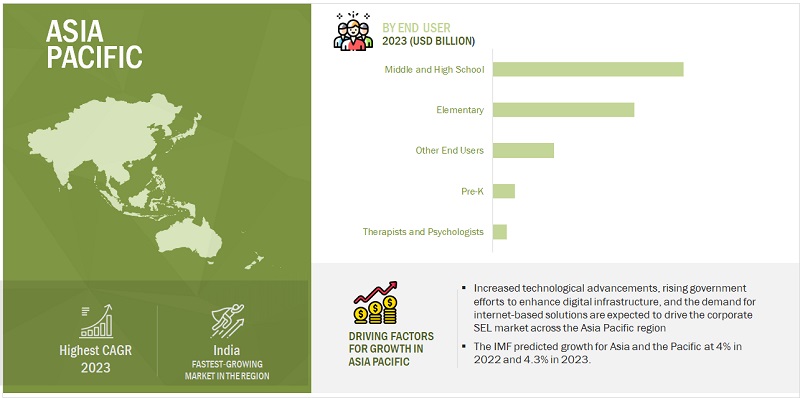

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

Due to its rapid development, Asia Pacific is one of the most lucrative markets for SEL. Social and Emotional Learning solutions are being quickly adopted, making it the fastest-growing market globally. China and Japan, the region’s most technologically advanced nations, dominate the SEL market. The region has the largest student population, and with technological advancements, there is an increasing need for newer teaching methods. The Social and Emotional Learning (SEL) market is driven to adapt to Asia Pacific’s diverse educational needs, including ANZ, Japan, China, South Korea, Southeast Asia, and India. During the projection period, Asia Pacific is expected to have more growth opportunities. The government programs to boost digital infrastructure fuel the region’s adoption of SEL. Consumer IT spending in the Asia Pacific is already declining with the ongoing tight market conditions in the US and Europe. However, enterprise IT spending is expected to remain stable as organizations focus on IT security and digital transformation in the short run.

Global Social Emotional Learning Companies:

The top Social Emotional Learning Companies in the market are Committee for Children (US), EVERFI (US), Illuminate Education (US), Nearpod (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings of Kids (US), Rethink ED (US), etc. These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the SEL market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

SEL Market by Offering (Solution, Services), Solution (Social and Emotional Learning Platform, Social and Emotional Learning Assessment Tool), Service (Consulting, Integration and Deployment, Training and Support), End User (Pre-K, Elementary Schools, Middle and High Schools, Therapists and Psychologists, and Other End Users), Core Competency (Self Awareness, Self Management, Social Awareness, Relationship Skills, Responsible Decision Making), Type (Web-based, Application) |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Top Social Emotional Learning Companies - Worldwide |

Committee for Children (US), EVERFI (US), Illuminate Education (US), Nearpod (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings of Kids (US), Rethink ED (US), etc. |

This research report categorizes the Social and Emotional Learning (SEL) Market based on offerings, solutions, services, end users, core competency, type, and regions.

Based on Offering:

- Solutions

- Services

Based on Solution:

- Social and Emotional Learning Platform

- Social and Emotional Learning Assessment Tool

Based on Service:

- Consulting

- Integration and Deployment

- Training and Support

Based on End User:

- Pre-K

- Elementary Schools

- Middle and High Schools

- Therapists and Psychologists

- Other End Users

Based on Core Competency:

- Self Awareness

- Self Management

- Social Awareness

- Relationship Skills

- Responsible Decision-making

Based on Type:

- Web-based

- Application

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic countries

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East and Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In August 2023, EVERFI from Blackbaud collaborated with Truth Initiative to launch an updated prescription drug safety curriculum for middle and high school students amid the growing youth overdose crisis.

- In June 2023, Panorama Education acquired Mesa Cloud, complementing its platform with graduation support technology and enhancing Panorama’s suite of offerings to improve learning and well-being.

- In June 2023, Newsela acquired Formative to expand its real-time assessment delivery vastly. The acquisition will allow the company to weave Formative assessments and data analysis across its content, which covers social studies, English-language arts, science, and social-emotional learning.

- In March 2023, Rethink Ed announced an expanded partnership with the country’s most extensive public school system, New York City Public Schools (NYCPS), to deliver innovative, evidence-based, specialized support to help students with autism thrive.

- In January 2023, Wings for Kids partnered with the YMCA of Metro Atlanta to provide more than 3,750 children with educational support, social-emotional learning, real-world skills, and workforce development to close the opportunity gap.

Frequently Asked Questions (FAQ):

What is the definition of the Social and Emotional Learning (SEL) market?

According to Collaborative for Academic, Social, and Emotional Learning (CASEL), social and emotional learning can be integral to education and human development. SEL is the process through which all young people and adults acquire and apply the knowledge, skills, and attitudes to develop healthy identities, manage emotions and achieve personal and collective goals, feel and show empathy for others, establish and maintain supportive relationships, and make responsible and caring decisions. SEL advances educational equity and excellence through authentic school-family-community partnerships to develop learning environments and experiences with trusting and collaborative relationships, rigorous and meaningful curriculum and instruction, and ongoing evaluation. SEL can help address various forms of inequity and empower young people and adults to co-create thriving schools and contribute to safe, healthy, and just communities.

What is the market size of the Social and Emotional Learning market?

The Social and Emotional Learning market is projected to grow from USD 3.6 billion in 2023 to USD 10.3 billion by 2028, at a CAGR of 23.6% during the forecast period.

What are the major drivers in the Social and Emotional Learning (SEL) market?

Growing implementation of distance education solutions: Since most of the courses for social and emotional learning programs are offered online through the web, or digitally, an increase in distance education solutions has boosted the social and emotional learning market.

Who are the top social emotional learning companies operating in the market?

The top social emotional learning companies in the market are Committee for Children (US), EVERFI (US), Illuminate Education (US), Nearpod (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings of Kids (US), Rethink ED (US), etc.

What are the opportunities for new market entrants in the SEL market?

Demand for new learning models with technological advancements: The K-12 education system has transformed traditional classrooms into smart classrooms, embracing innovative technologies like cloud computing, analytics, advanced collaboration tools, and the Internet of Things (IoT).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the global SEL market. In the first step, exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total SEL market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

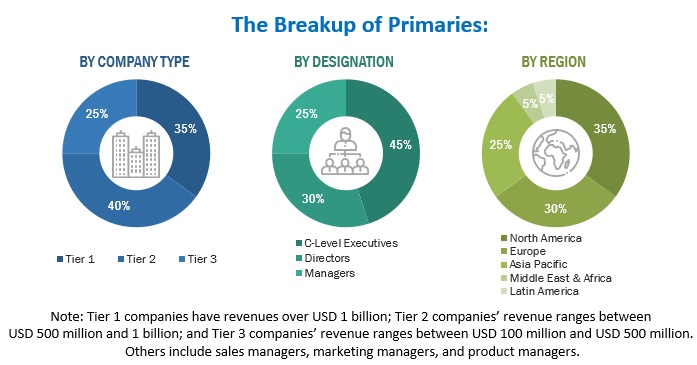

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the SEL market along with the associated service providers, and system integrators working in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

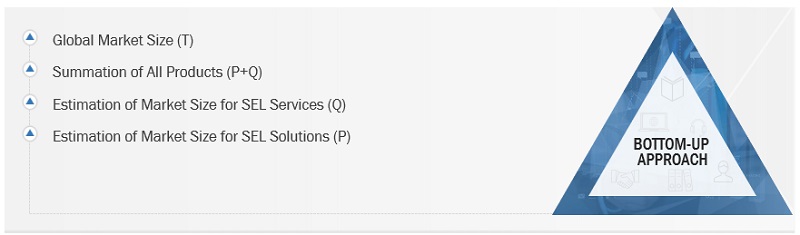

The top-down and bottom-up approaches were used to estimate and forecast the SEL market and other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global SEL market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the SEL market have been identified through extensive secondary research.

- Regarding value, the market size has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

SEL Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

SEL Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Collaborative for Academic, Social, and Emotional Learning (CASEL), social and emotional learning can be integral to education and human development. SEL is the process through which all young people and adults acquire and apply the knowledge, skills, and attitudes to develop healthy identities, manage emotions and achieve personal and collective goals, feel and show empathy for others, establish and maintain supportive relationships, and make responsible and caring decisions. SEL advances educational equity and excellence through authentic school-family-community partnerships to develop learning environments and experiences with trusting and collaborative relationships, rigorous and meaningful curriculum and instruction, and ongoing evaluation. SEL can help address various forms of inequity and empower young people and adults to co-create thriving schools and contribute to safe, healthy, and just communities.

Key Stakeholders

- SEL Providers

- Independent Software Vendors (ISVs)

- SEL Content Developers

- Education Consultants

- System Integrators

- Educationists

- Corporate Trainers

- Compliance Regulatory Authorities

- Government Authorities

- University Bodies

- Professors and Teachers

- Investment Firms

Report Objectives

- To determine, segment, and forecast the global SEL market by offering solutions, services, core competency, type, end user, and regions in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the SEL market

- To study the complete value chain and related industry segments and perform a value chain analysis of the SEL market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total SEL market

- To analyze the industry trends, pricing data, patents, and innovations related to the SEL market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the SEL market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- Track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Social and Emotional Learning Market